This Week's Newsletter - Case Study on NEAR, Main News of the Week, $DEAI Moon or Dust & Zoom on AI Agents

Weekly Alpha

This edition is available as an AI-generated Podcast. ⭡

Nothing in this edition is an ad, a collaboration or a partnership.

GM Frens,

I hope your day is as exciting as the innovations in the crypto world 🌐

The crypto market is alive with optimism, and among the narratives stirring excitement, AI in crypto is rapidly emerging as a game-changer.

We dove into this narrative just one month ago, exploring how artificial intelligence is reshaping the blockchain space, but we haven’t seen all yet.

As Bitcoin edges closer to $100K, creating ripples of bullish sentiment across the ecosystem, the spotlight is shifting to new frontiers like AI-driven blockchain integration—a paradigm shift that could redefine decentralization, scalability, and accessibility.

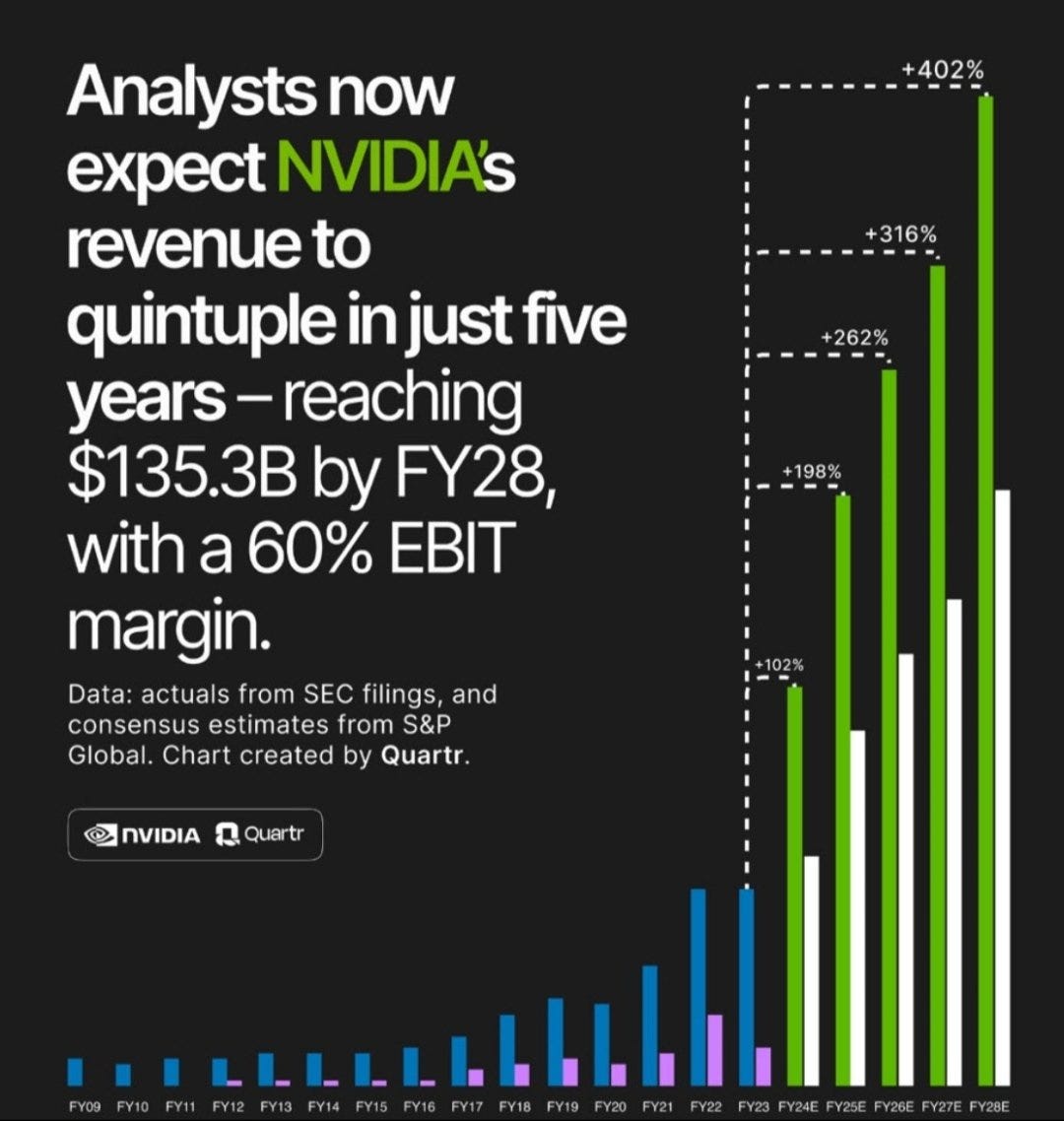

In the meantime, Nvidia has reported record Q3 revenue of $35.1 billion, surpassing expectations by 6%, fueled by strong demand for AI computing technologies.

CEO Jensen Huang highlighted the company’s focus on "agentic AI," systems capable of autonomous decision-making, as a key driver of future growth. Nvidia is positioning itself as a leader in this field by offering cutting-edge GPUs and tools for enterprises to develop and deploy autonomous AI solutions.

Centralized AI, dominated by tech giants, has long raised concerns about monopolies, lack of transparency, and censorship. But blockchain offers a radical alternative: decentralized AI, where data ownership, model training, and operational tasks are distributed and community-driven. AI agents take this concept a step further, enabling autonomous entities that interact with their environments, execute tasks, and collaborate—all in a decentralized and trustless manner.

📊 Looking at the broader trends, VCs are pouring significant investments into AI-focused crypto projects, recognizing this convergence as one of the most critical innovations.

Yet, this isn’t without challenges. The hype around AI in crypto is palpable, but true success lies in balancing innovation with scalability, transparency, and utility. Investors need to carefully evaluate the ecosystem, focusing on projects with tangible use cases, strong teams, and sustainable frameworks to navigate the volatility and risks inherent in this space.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.

Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

So, what’s next? In this week’s issue, we’re narrowing our lens to focus on AI Agents and how they’re transforming decentralized networks. Here's what you can expect:

A Case Study on NEAR Protocol and its contributions to this growing space.

Main News of the Week.

Moon or Dust on $DEAI, a new format where we are exploring whether emerging projects are worth the hype or destined to fade.

Zoom on AI Agents, unpacking how they’re opening up groundbreaking opportunities for collaboration and innovation.

Let’s break down the AI narrative in detail and see what it means for the future of crypto.

1/ Case Study: NEAR Protocol – Pioneering the Intersection of Blockchain and AI

The Genesis and Operation of NEAR

NEAR Protocol emerged as a response to the challenges blockchain users faced during Ethereum's 2017 cycle: high costs, slow transactions, complexity, and ecological impact. Founders Eric and Ilia envisioned a decentralized web powered by a more efficient and user-friendly blockchain.

NEAR employs a dynamic sharding architecture, splitting transactions across sub-networks to boost speed and reduce costs—akin to upgrading from a congested single-lane road to a multi-lane highway.

Key Development Milestones

2019: The NEAR Foundation was established to oversee the blockchain’s development, funding, and ecosystem partnerships.

2020: The mainnet launch opened NEAR to public use.

2021: NEAR achieved carbon neutrality, attracting eco-conscious projects.

Aurora: A layer 2 solution launched in 2021, compatible with Ethereum, enabling developers to leverage NEAR with reduced transaction fees.

Shift Toward Artificial Intelligence

In 2023, NEAR embraced AI :

NEAR Task: Launched in November 2023, this AI marketplace allows users to hire AI agents for various tasks, with blockchain-enhanced data privacy. Unlike centralized AI systems like ChatGPT, NEAR’s solution ensures user data remains secure.

AI Computing Power: By pooling resources across its blockchain, NEAR could surpass traditional AI systems in computational performance.

AI Incubator: Established in 2024, it fosters decentralized AI app development, supporting cutting-edge projects.

Open Source AI Models: NEAR aims to create a 1.4 trillion-parameter open-source AI model, positioning itself as a leader in the AI-Web3 convergence.

AI Fund: A dedicated fund injects capital into AI-focused projects within NEAR’s ecosystem, driving innovation and adoption.

NEAR Token Utility

The NEAR token serves several purposes:

Transaction Fees: Used for payments across the blockchain.

Staking: Secures the network via a Proof-of-Stake mechanism.

Governance: Token holders vote on community proposals.

Economic Framework

Supply: 1.22 billion NEAR tokens in circulation with an annual 5% inflation rate.

Burn Mechanism: 70% of transaction fees are burned, reducing inflation as network usage grows.

Market Position: NEAR’s market cap currently stands at over $6.6 billion, with significant growth potential as adoption increases.

Technical Analysis

Following the Luna crash and FTX collapse, NEAR entered a period of accumulation.

October 2023: A breakout triggered momentum, followed by a consolidation phase in August 2024.

Resistance Levels: Key thresholds at $5-6; breaking through could lead to rapid price appreciation.

AI Narrative: Growing focus on AI could propel NEAR's token value further.

Conclusion: A Blockchain Transformed by AI Ambition

NEAR has evolved from a blockchain solution to a pioneering platform integrating AI within Web3. Its dynamic team, growing ecosystem, and focus on innovation position it as a key player in the crypto and AI spaces.

Near Protocol has unveiled plans to develop a 1.4 trillion-parameter AI model, 3.5 times larger than Meta's Llama, through a crowdsourced initiative on its new Near AI Research hub—an announcement that’s extremely bullish for the ecosystem. Participants can contribute to training smaller models, with top contributors advancing to larger ones, while funding will come from token sales and privacy preserved via encrypted Trusted Execution Environments.h

With robust fundamentals and increasing adoption, NEAR is a project to watch as it reshapes the future of decentralized technology and artificial intelligence.👀

2/ Crypto and Defi News :

⛓ Chainlink introduces the ‘Chainlink Runtime Environment’ framework

News: Chainlink has introduced the “Chainlink Runtime Environment” (CRE), a unified framework aimed at bridging traditional financial systems, such as COBOL and Java Runtime Environment (JRE), with blockchain technology and smart contracts. CRE seeks to streamline the connection between legacy financial architectures, like those powering ATMs and online banking, and decentralized systems, reducing integration complexity.

This framework builds on Chainlink's recent innovations, including its Blockchain Privacy Manager and the Chainlink Cross-Chain Interoperability Protocol (CCIP), which enhance transaction privacy and cross-chain functionality. Chainlink’s collaboration with SWIFT and UBS earlier this year demonstrated the system’s capacity to facilitate tokenized fund settlements without cryptocurrencies, further underscoring its potential to onboard traditional finance onto blockchain ecosystems.

Thought: This development strengthens Chainlink’s position as a pivotal enabler of Web3 adoption, particularly for legacy financial institutions. By addressing integration and privacy challenges, Chainlink is creating a pathway for traditional finance to access blockchain benefits without overhauling existing systems. For the DeFi ecosystem, this integration promises to attract significant liquidity and institutional use cases, fostering a new era of on-chain financial operations. It’s a step further to mass adoption 😎

☝ Coinbase Launches COIN50 Index to Track Digital Assets

Coinbase has introduced the COIN50 Index, a benchmark tracking 50 key digital assets listed on the platform, aimed at institutional and advanced retail traders. Announced on Nov. 12, the index primarily focuses on six cryptocurrencies—Bitcoin, Ethereum, Solana, Dogecoin, XRP, and Cardano—which collectively account for 91% of its weight. Derivative products tied to the new index will not be available to users in the United States, United Kingdom, or Canada.

This is Coinbase’s latest foray into crypto indices, following the discontinued Coinbase Index Fund in 2018. The COIN50 will compete with similar offerings like the Nasdaq Crypto Index and S&P Cryptocurrency Indices, which aim to provide institutional-grade benchmarks for tracking digital asset markets.

Thought: Coinbase’s launch of the COIN50 Index signals a major step toward increasing institutional participation in crypto markets. By providing a transparent benchmark for key assets, Coinbase equips advanced traders and institutional investors with tools to measure market performance effectively. This move highlights a critical shift: crypto is no longer solely the domain of innovators and enthusiasts—it’s becoming a foundational component of global financial systems.

For institutional players, tools like the COIN50 bring clarity and structure to an otherwise volatile market. For DeFi participants, these benchmarks could unlock new opportunities for liquidity and product innovation, laying the groundwork for crypto’s future in both traditional finance and decentralized ecosystems

🐶 MemeCoin Market Hits New All-Time High Of $120 Billion

The memecoin market reached an all-time high of $120 billion this week, signaling a resurgence in speculative tokens. This rise coincided with a broader bullish trend in the crypto market following Donald Trump’s U.S. presidential election victory and the Federal Reserve’s interest rate cuts in November. Established coins like Dogecoin surged 150%, reaching over $0.4, while Shiba Inu recorded 35% gains, partly fueled by renewed activity on its Layer 2 Shibarium network. Emerging meme coins like Pepe Unchained and Crypto All-Stars are capturing attention with promises of 100x potential, leading the market to record-breaking growth despite slight pullbacks after initial gains.

Thought: The staggering growth of the meme coin market highlights its unique ability to capture retail and speculative interest, especially during broader market rallies. These gains often symbolize the heightened sentiment in crypto, but they also underscore risks tied to speculation. For investors, this phase presents opportunities to ride the hype but necessitates caution in discerning between sustainable projects and fleeting trends. With Dogecoin and Shiba Inu strengthening their ecosystems, the meme coin narrative could further solidify its role in shaping crypto adoption. However, the volatility underscores the need for diversification and strategic planning in this high-risk sector.

💰 Polish presidential candidate pledges support for strategic Bitcoin reserve

Polish presidential candidate Sławomir Mentzen has pledged to establish a Bitcoin reserve if elected in 2025, echoing similar promises made by U.S. President-elect Donald Trump. Mentzen emphasized that Poland could become a crypto-friendly nation under his leadership, advancing policies like a strategic Bitcoin reserve. This proposal aligns with global moves by countries like El Salvador, which uses Bitcoin as legal tender, and Bhutan, which mines and holds significant BTC reserves. Poland’s presidential elections are slated for May 2025, with Mentzen gaining popularity among libertarian voters.

Thought: A Bitcoin reserve for countries could be a mass adoption crypto revolution. Think about this: sovereign nations treating Bitcoin as a strategic asset, akin to gold, could redefine how we view global finance. If Poland or other countries actively accumulate BTC, it’s not just bullish—it’s transformative. It signals a shift from fiat reliance to decentralized, trustless systems. For Bitcoin holders, this would mean massive demand and potentially explosive price action. If this trend grows, we’re looking at the birth of a new global financial standard, powered by crypto. This isn’t just a market trend—it could be history in the making.

Have a look at my post on X about it 👀

🗣 Coinbase CEO to meet with Trump to discuss personnel appointments

News: Coinbase CEO Brian Armstrong will meet privately with President-elect Donald Trump to discuss personnel appointments for his administration, according to a report by The Wall Street Journal on Nov. 18. This follows Armstrong's earlier statements that Coinbase is ready to work with either a Harris or Trump administration to advance crypto regulations.

Trump has promised a "Bitcoin and crypto presidential advisory council" to create clear industry guidance within his first 100 days in office and has openly criticized SEC Chair Gary Gensler, vowing to replace him. Armstrong, who has actively supported pro-crypto candidates through PAC contributions, publicly backed Trump's proposed "Department of Government Efficiency" initiative. It remains unclear if Armstrong or anyone from Coinbase will hold an official position in the upcoming administration.

Thought: This meeting is a pivotal moment for crypto. If Armstrong can shape policy or secure appointments favorable to the industry, it could lead to regulatory clarity and a more conducive environment for innovation in the U.S. A pro-crypto stance at the federal level could revitalize institutional interest and attract global investments. But here's the key question: Will this collaboration truly benefit the broader crypto community, or just favor major players like Coinbase? Either way, this signals a deeper integration of crypto into national policymaking, and the potential for systemic change is huge.

3/ 🌕 Moon or Dust: Deep Dive into DEAI and Zero1 Labs

Zero1 Labs and io.net just announced a partnership. By combining Zero1’s advanced AI ecosystem with io.net’s high-performance GPU computing, this collaboration boosts AI training, deployment, and scalability for developers building DeAI applications.

Key highlights include the integration of io.net’s GPU capabilities into Zero1’s Keymaker Platform, fostering innovation through hackathons and bounties, and fast-tracking DeAI projects with cutting-edge infrastructure and support. This is a bullish milestone for DeAI, as it blends blockchain with powerful AI tools to drive privacy, accessibility, and innovation in the decentralized space.

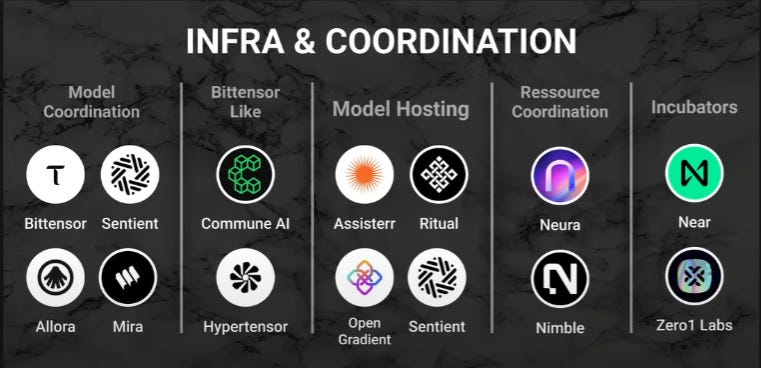

That is why this week, we’re dissecting Zero1 Labs, an ambitious decentralized AI ecosystem, and its native token $DEAI.

With claims of being a simpler alternative to Bittensor and offering a comprehensive infrastructure for AI innovation, does DEAI have the foundation to moon or is it at risk of going to dust? Let’s unpack the details.

🌟 What Could Make DEAI touch the Moon?

1. Comprehensive AI Ecosystem:

Zero1 Labs isn’t just another blockchain project. It offers:

Cypher Blockchain: A Proof of Stake network optimized for AI with Fully Homomorphic Encryption (FHE) for data privacy and Arbitrum Nitro + Celestia for scalable, low-cost transactions.

Keymaker: A toolkit and marketplace for decentralized AI applications, doubling as a launchpad.

ZCP (Zero Construct Program): An incubator providing funding, mentorship, and resources for promising AI projects, ensuring a pipeline of innovative applications.

ZEF (Zero Economic Framework): A rewards program that incentivizes popular AI models and apps, fostering ecosystem growth.

2. DEAI Token Utility:

The DEAI token serves multiple purposes within the ecosystem:

Gas fees on Cypher.

Staking for network security and rewards.

Governance, allowing holders to vote on proposals.

Early access to incubated projects and potential airdrops, enhancing its value proposition.

3. Promising Tokenomics Adjustments: Initial concerns around inflation have been addressed with extended vesting schedules, reducing sell pressure. Coupled with a starting market cap under $20M, early investors could see exponential gains if adoption grows.

4. Developer Accessibility: Zero1 Labs positions itself as a more accessible entry point for AI developers compared to competitors like Bittensor, which could drive faster adoption.

🛑 What Could Push DEAI to Dust?

Immature Technology: Despite its potential, the project is still in its infancy. Critical components, like full documentation and key features, remain underdeveloped or unavailable, raising execution risks.

Communication Concerns: The team has faced criticism for opaque and inconsistent communication, including unclear inflation metrics. The anonymity of the founder and other core members only heightens skepticism.

Overambitious Goals with Limited Resources: While its vision is bold, the current team size and capabilities appear insufficient to deliver on all promises. Balancing innovation with practicality remains a key challenge.

Fierce Competition: Zero1 Labs operates in a competitive space with established projects like Bittensor and new entrants backed by significant funding. Breaking through will require flawless execution and strong differentiation.

Tokenomics Complexity: Although adjustments have been made, the tokenomics are still intricate, with lingering questions about inflation rates and long-term sustainability.

📊 DEAI Tokenomics Overview

Total Supply: 1 billion tokens.

Initial Allocation: Public sale (7.5%), private investors (5%), advisors (5%), team (15%), ecosystem growth (15%), staking rewards (37.5%).

Recent Changes: Extended vesting schedules to limit inflationary pressure.

Ecosystem Role: Central to staking, governance, and project incubation rewards.

🔮 Verdict: Moon or Dust?

Moon Case:

DEAI has all the elements of a potential breakout project: a clear use case in decentralized AI, strong token utility, and a low market cap for significant upside. Its comprehensive ecosystem and rewards mechanism for innovation could attract developers and users alike. This token also depends largely on the hype around AI.

Dust Case:

Execution risks, competition, and opaque communication are significant red flags. The project’s success hinges on delivering on its promises, building trust, and carving a niche in the crowded decentralized AI market.

Final Take:

DEAI is a high-risk, high-reward opportunity. While it could revolutionize the decentralized AI space, it’s still early days, and caution is warranted. Allocate only what you’re willing to lose, and keep a close eye on its development.

4/ 🌟 Future Trends: AI Agents in Crypto – A New Frontier? 🤖

AI agents are poised to transform the crypto ecosystem. From decentralized finance to gaming and content creation, these autonomous actors are emerging as a revolutionary trend. Let’s explore their potential, infrastructure, and challenges to understand if they’re the next big thing—or just hype.

🧠 What Are AI Agents?

AI agents are autonomous programs capable of executing tasks across various domains. These agents are becoming integral to crypto, providing advanced capabilities like:

Trading & Portfolio Management: AI agents can analyze markets, identify investment opportunities, and execute trades.

Content Creation: From memes to virtual influencers, they offer innovative ways for crypto projects to engage with audiences.

Gaming & Metaverse Integration: AI agents can enhance gaming experiences by acting as intelligent NPCs, enriching virtual worlds.

⚙️ Why Are AI Agents Gaining Momentum?

Mainstream Adoption Signals: Coinbase’s Based Agent platform now allows users to create AI agents with ease, showcasing growing institutional interest.

Use Cases:

DeFi: Automating yield optimization and payments.

Gaming: Creating lifelike in-game characters.

Marketing: Enabling AI-driven social media campaigns.

🚀 Projects Driving the AI Agent Revolution

While many projects are entering the AI agent space, a few of them stand out for their innovation and unique approaches: Virtual Protocol, the Artificial Superintelligence Alliance (FET), and Spectral. Here’s an in-depth look at how these initiatives are shaping the future of crypto and AI agents.

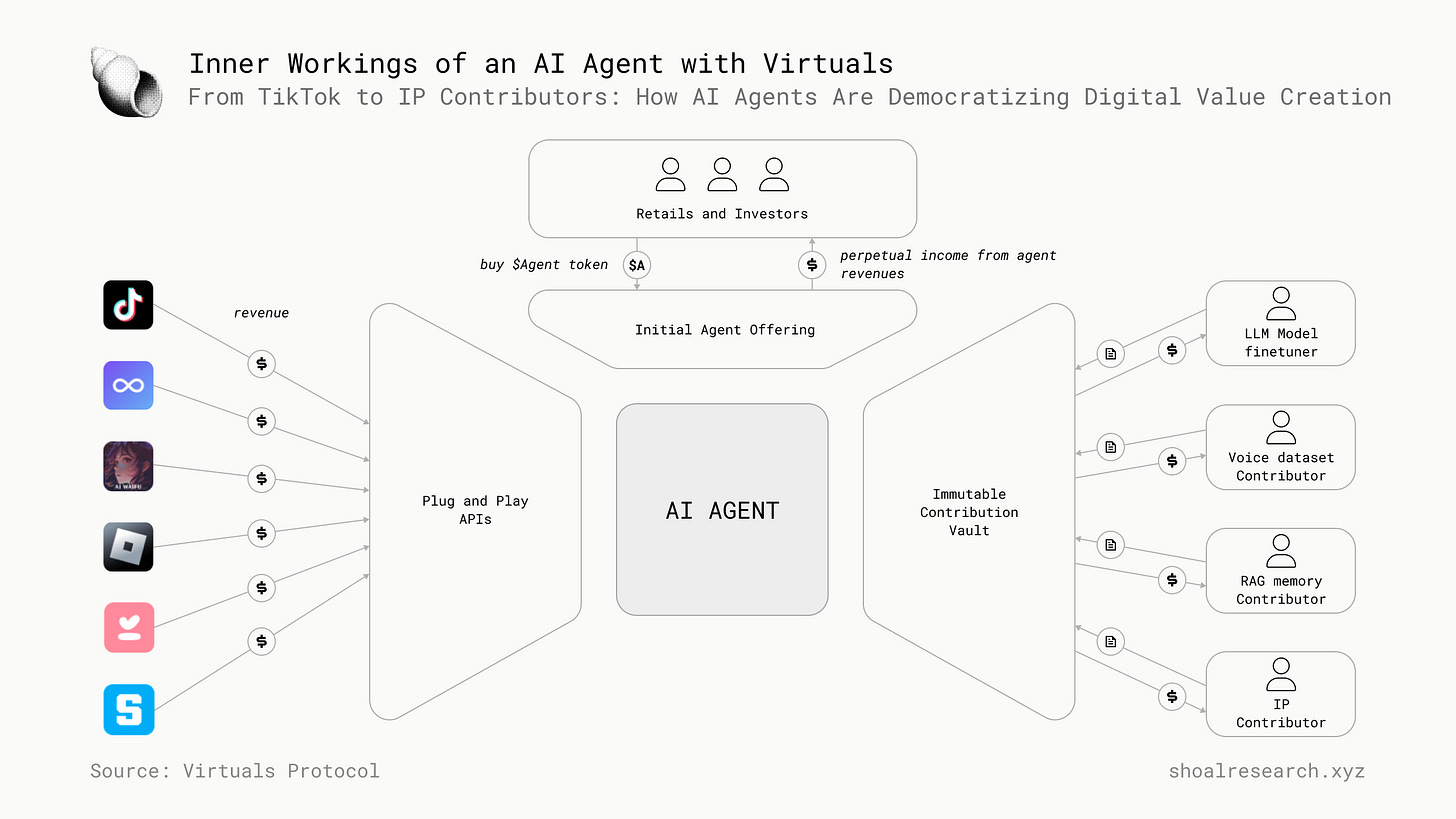

1️⃣ Virtual Protocol: Building the Foundation for AI Agents

Virtual Protocol is a decentralized platform for creating, owning, and trading AI agents. It acts as both an infrastructure hub and an open marketplace for developers and users to interact with agents securely and transparently.

Key Features:

Agent Creation Tools: Developers can create and customize agents for diverse applications, from automated trading bots to immersive NPCs in metaverses.

Ownership Validation: Agents are tied to NFTs, ensuring clear ownership and enabling secure leasing or sales.

Marketplace for Monetization: Virtual Protocol allows for the trading of AI agents, enabling developers to monetize their work while ensuring royalties through smart contracts.

Why It Matters

Virtual Protocol provides the essential infrastructure to scale the adoption of AI agents, enabling more developers to participate and innovate. By decentralizing ownership and trading, it ensures trust and transparency while lowering barriers to entry.

2️⃣ Fetch.ai (FET): Decentralized AI Through the Artificial Superintelligence Alliance.

Fetch.ai (FET) leads the Artificial Superintelligence Alliance (ASI), working alongside SingularityNET, Ocean Protocol, and, most recently, Injective.

This partnership combines Fetch.ai's AI-driven tools with Injective's DeFi expertise to enhance trading strategies, liquidity management, and asset allocation—further solidifying the alliance’s vision of integrating AI with blockchain technology.

Key Features

Autonomous Economic Agents (AEAs): AI-driven entities that manage tasks like resource optimization, contract negotiation, and transactions autonomously. AEAs powered by Fetch.ai’s blockchain are transforming industries from logistics to decentralized finance.

Decentralized Machine Learning: With Federated Learning, AI models train collaboratively while preserving privacy, democratizing access to AI innovations.

Optimized Blockchain: Fetch.ai’s high-performance blockchain incorporates Proof of Stake (PoS), sharding for scalability, and integrated oracles to ensure real-time data access.

Vision and Challenges

Fetch.ai aims to advance Artificial General Intelligence (AGI) and Artificial Superintelligence (ASI) within a decentralized framework. It faces challenges such as ensuring scalability, securing autonomous systems, and addressing ethical concerns in AI deployment.

Why It Matters

Fetch.ai is redefining what’s possible by enabling AI to operate autonomously within decentralized ecosystems. The addition of Injective to the ASI alliance strengthens its position, combining AI innovation with cutting-edge DeFi capabilities to unlock new efficiencies and opportunities across multiple industries.

3️⃣ Spectral: Innovating On-Chain AI Intelligence

Spectral focuses on bringing AI intelligence directly on-chain, allowing agents to operate with full transparency and autonomy. Unlike projects that rely heavily on off-chain computations, Spectral emphasizes decentralization by embedding intelligence into the blockchain itself.

Key Features:

AI Models On-Chain: Spectral allows developers to deploy lightweight AI models directly on blockchain networks, minimizing reliance on centralized servers.

Data Integration: The platform enables agents to access and analyze on-chain data in real-time, such as transaction history, market movements, and smart contract activity.

Incentive Mechanisms: Spectral rewards agents that contribute meaningfully to the ecosystem, such as those optimizing DeFi protocols or creating innovative dApps.

Why It Matters:

Spectral’s approach to on-chain intelligence addresses concerns about data transparency and centralization. By integrating AI directly into blockchain operations, it ensures that agents act within transparent, immutable frameworks. This is particularly valuable in sectors like DeFi, where trust and accountability are critical.

⚠️ Challenges and Risks

Technical Complexity: Developing performant and secure agents requires significant expertise and resources.

Scalability Issues: Managing millions of autonomous agents and their interactions may stress existing infrastructure.

Security Threats: Malicious AI agents or protocol vulnerabilities could disrupt ecosystems.

Regulatory Uncertainty: The legal status of autonomous agents remains unclear, potentially hindering adoption.

Volatility: Crypto market instability could affect the viability of agent-based projects.

🔮 Final Thoughts

AI agents represent a groundbreaking frontier in crypto innovation. Their potential spans across DeFi, gaming, and beyond, promising new ways to interact and transact within the blockchain ecosystem. However, challenges like technical scalability, security, and regulation cannot be ignored.

Will AI agents revolutionize crypto or remain a niche trend? 🙋♂️

Their trajectory will depend on how well developers address these challenges—and how the community adopts these groundbreaking tools.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.

nice !