This Week's Alpha - Newcomers in Liquid Staking Derivatives, News & Catalysts for DeFi, On-chain analysis, And More

Your Alphas curated to save you time

GM frens.

We’re seeing narratives that we anticipated being played out.

Market is still green, a lot of profit is at our fingertips.

But remember, follow your plan, don’t FOMO, and keep a good risk management.

Today you will find:

TA Predictions

Newcomers in Liquid Staking Narrative

Upcoming Narratives

Bullish News & Catalysts for DeFi products

AI Bullish Events

On-chain Analysis

Best On-chain tools

Dune Dashboards

Wallets to track

Projects to research

L1, DAG, L2, Perp DEX, Options…

And much more!

Your alpha, gathered in the following categories:

1/ Predictions & TA

2/ Narratives

3/ Events

4/ On-chain

5/ Data & Numbers

6/ Projects

BONUS

Find your alpha! 👇

1/ Predictions & TA

Arbitrum will be forced to launch a token

We’ve been hearing about a token for Arbitrum for months now.

TheDeFISaint has a few thoughts on Arbi’s token.

Breakout but no pullback

Interesting commentary on the price action by CryptoCred.

A few Wauwda’s indicators & thoughts

8 reasons to be confident about a short term reversal

Technical Analysis is not my main expertise, but these are some interesting indicators.

The Hash Ribbon Indicator printed a buy signal on the weekly

The previous times it happened, it was pretty bullish. But indicators are not to be taken alone. This is why a lot of them are combined here.

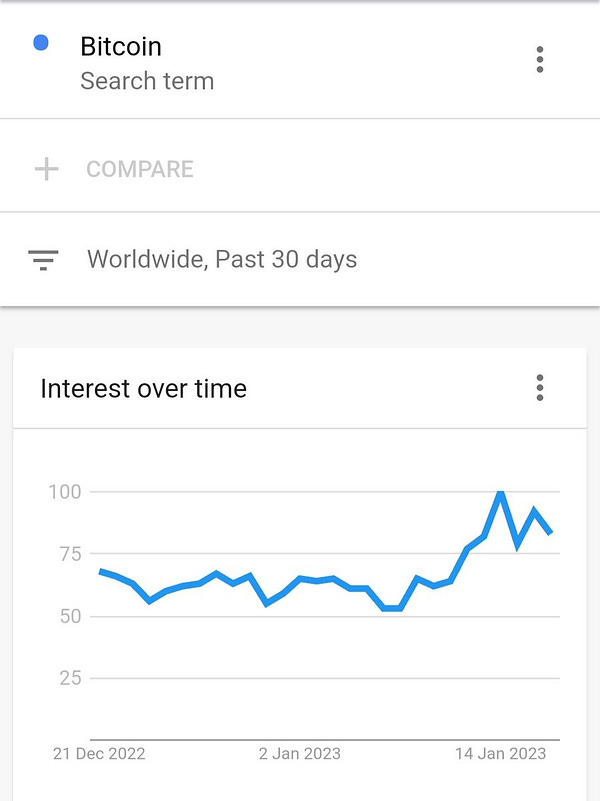

Interest is slowly coming back

Bitcoin Dominance increasing

Another bullish metric, provided by CryptoHub210.

Remember we can’t know for sure what will happen, we can just try to analyze indicators & metrics and predict what can likely happen.

A lot of things can turn the situation around:

Another black swan event

Macro & TradFi

Geopolitical issues

…

Stablecoin supplies remain flat/down

According to tedtalksmacro we’re yet to see if this move was just short liqs or if it will sustain.

Stablecoin supplies are not increasing, meaning no new liquidity is actually being injected into the market.

Still, the current stablecoin supplies are big enough to pump the market for now.

2/ Narratives

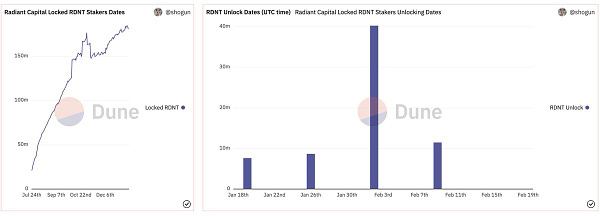

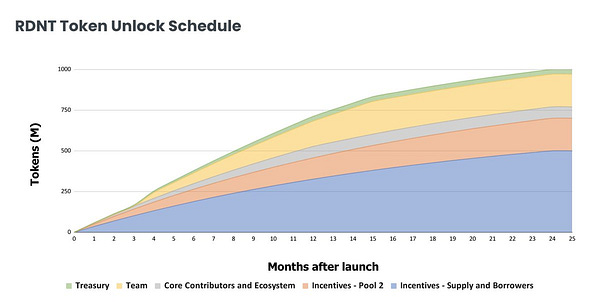

2.1/ Liquid Staking Derivatives

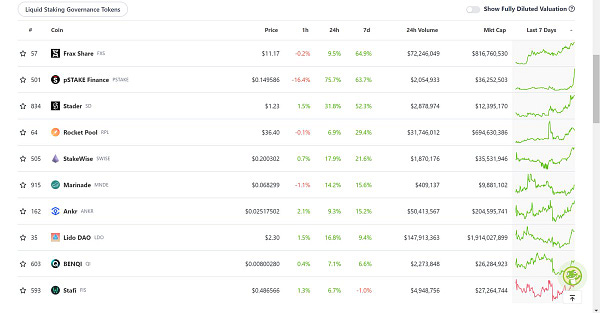

How tokens performed

Which LSD tokens performed the best?

Stader & StakeWise are up by a lot but still low caps.

Data provided by TheDeFISaint.

Liquid Staking Alpha

Good data on the biggest Liquid Staking protocols, provided by ThorHartvigsen.

+ Catalysts below that could have an effect to prices.

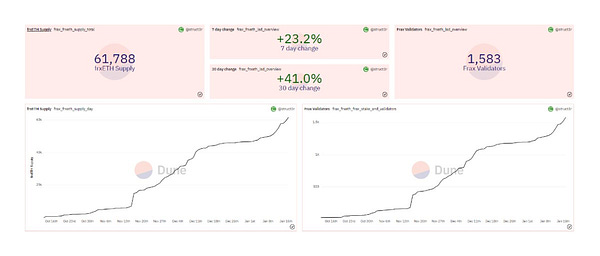

Frax’ $ETH Supply going parabolic

Data provided by Flowslikeosmo.

It seems like FXS is still undervalued even after a +100% on the monthly.

Room for competition

It seems that Rocket Pool & Lido are losing LSD share to competition.

Newcomers like Coinbase are taking market share.

Alpha provided by DefiIgnas

Lowcap LSD: Bifrost

A Lowcap in the LSD Narrative, found by Crypt0_Andrew

NFA. Already did 2X since the call.

2.2/ Others

Weekly Narratives

Find the second edition of the weekly narratives, written by 0xkyle__

There are a few narratives that already played out (might not be finished) like Solana & Aptos, and narratives to keep an eye on like the release of stablecoins from Curve, Aave & Redacted.

Find the analysis in the article.

Crypto Narratives Alpha Series

DeFi Prediction Markets is an underrated crypto thesis for 2023 according to ViktorDefi.

DeFi Prediction Markets are speculative marketplaces that allow users to make and trade predictions on future events.

It can be any real-world event ranging from sports to elections to a company's product sales.

Find projects building in this narrative.

How to play narratives the safe way

Tips provided by thedefivillain.

If you want to take more risks for more rewards, buy lower caps in the narrative, newcomers & tokens lagging.

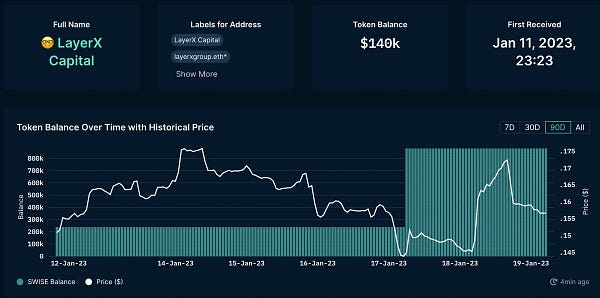

If we take the LSD Narrative, that would be SD for the lower cap, BNC for the “newcomer” (not yet tagged as a LSD token on CMC), SWISE for the token lagging. NFA

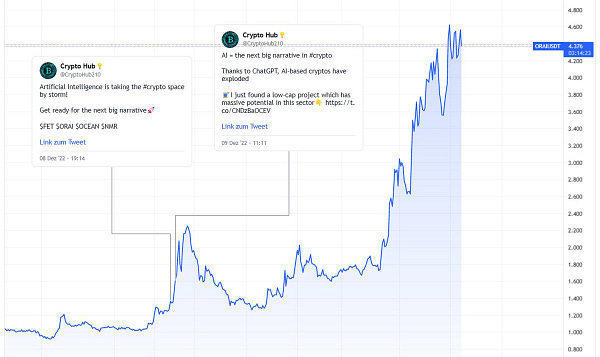

How CryptoHub identified the AI narrative

3 signals that helped them to recognize the narrative early.

Metaverse Narrative

Metaverse tokens have been underperforming for a while now.

I don’t see this narrative as an obvious one, but some catalysts are here.

Meta has not backed down and is still deep in building a Metaverse.

New VR integrations and headsets for big companies.

Doesn’t seem absurd that tokens that have underperformed for a while but have strong fundamentals may be the first to pump when the market recovers.

Alpha provided by CryptoHub210

Strong Narratives to keep an eye on for the next bull run

cyrilXBT believes these narratives could remain strong for the next bull run.

I believe L1 & L2 will obviously be strong narratives.

RealYield & Arbitrum are two narratives that started in Bear Market.

RealYield will remain strong.

About Arbitrum, it depends on how goes the airdrop and how the competition evolves. I wouldn’t be a maxi but I believe it remains one of the best L2 and the best ecosystem for innovation.NFT narrative hasn’t played out yet in this Bear Market so it’s promising.

Liquid Staking should remain strong at least until March. We will then have to see how the narrative evolve with the Shanghai Upgrade.

3/ Events

Latest Developments in DeFi

As always, the weekly alpha from TheDeFinvestor.

Some thoughts I got from it:

Fantom providing funding to ecosystem projects is obviously bullish. Fantom has been quiet for a while but it seems that there is renewal of the ambitions for this ecosystem.

Vela open beta launch date being postponed might have a short-term effect on a potential “sell the news” price action that was anticipated and would be postponed as well.

If Shibarium, Shiba’s L2, is a success, it would be bullish for Shiba and for a memecoin season.

Polygon zkEVM Mainnet launch soon

Co-founder of Polygon, sandeepnailwal, announces that they have a date for Polygon zkEVM mainnet launch.

Obol raised $12.5M

Obol’s goal is to advance the decentralization of Ethereum's validator ecosystem by building a sustainable protocol and ecosystem for distributed validators.

Obol is working on DVT, a middleware component that acts as an additive layer in the technology stack of any Liquid Staking Protocol.

Obol’s technology is already being tested by Lido.

Treasure’s new Game Builders Program

This is bullish for games on Treasure and the whole ecosystem.

Program supported by Arbitrum.

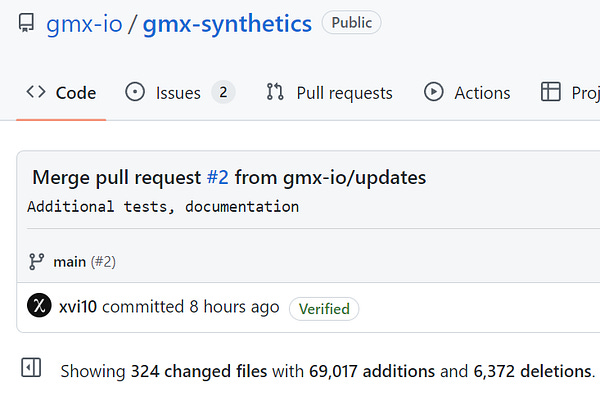

GMX Synthetics soon?

Synthetic assets are crypto-assets that derive their value from some other asset (the underlying asset).

The use of an Oracle is needed to have a reliable price feed for the underlying asset.

It means GMX Synthetics will allow to trade a lot more assets like oil, stocks, currencies etc.

Alpha provided by sliux

TraderJoe’s Tokenomics Revamp

A lot is happening for Joe lately.

They’re expanding to multichain, and rethinking their tokenomics.

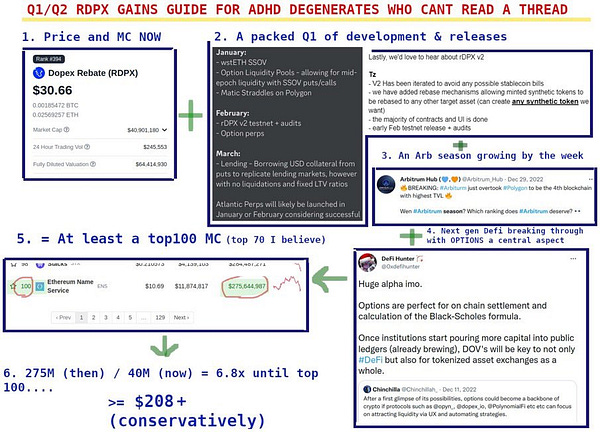

Dopex Launching Atlantic Perps

Alpha provided by Cryptopleb4

Atlantic Perp Protection is live.

jGLP & jUSDC vaults

Launch is postponed to January 27th.

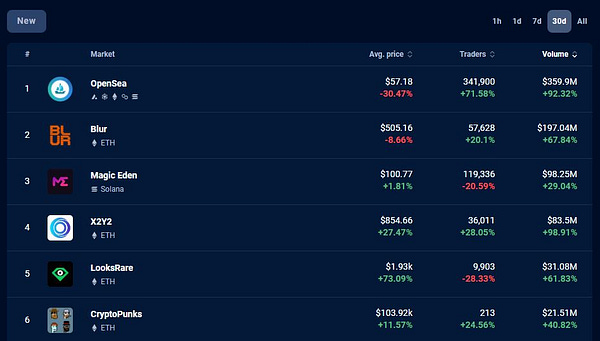

Buffer Finance released their NFT collection: Optopi

A recap of the first few days of Optopi on Opensea, provided by Lysis1501.

Optopi can be used as a profile picture representing Buffer fam and offers key utility to traders trading over the Buffer Platform.

Big events for AI to come

Alpha provided by SmokeAwayyy.

Elon Musk commented “Big year for AI”.

Upcoming Catalysts for Q1

An alpha packed tweet by permanentgainz.

Read everything carefully and draw your own conclusions.

4/ On-chain

On-chain analysis on a group of wallet holding SHIB

A great analysis provided by Bubblemaps on a group of wallets holding 10% of SHIB supply.

Is this a cause for concern? You will find out thanks to their on-chain analysis coupled with their innovative visual tool.

Best on-chain analytics tools & tracking whales

Most blockchains we use are public. Everything is written into the blockchain and transactions are public.

This is a revolution in the world of finance, so let's use this to our advantage.

An alpha provided by TheDeFinvestor to find the best on-chain analytics tools & track wallets.

Token Analyzooor, smart money alpha

A dune dashboard made by defi_mochi to analyze tokens & find on-chain data about accumulation & smart money.

Master this kind of tools and you’ll find your own alpha.

An example of this tool being used by CryptoYusaku

Cryptoyusaku used it for SD as an example.

Insider trading?

RPL got listed on Binance, which led to a 31% increase.

lookonchain found 3 addresses that bought before the listing & sold just after the pump.

Might be interesting wallets to track, if they are still being used.

LayerX Capital accumulating SWISE

Still a small holding, but SWISE is a low cap.

Alpha provided by BenGiove.

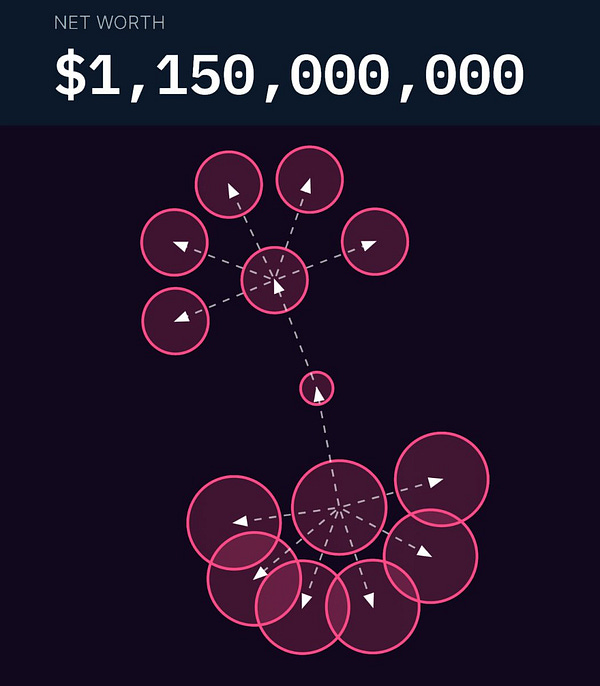

Top 11 wallets to track on DeBank

To gain an edge and anticipate moves, you should track what whales are doing.

CJCJCJCJ_ helps us with his top wallets to track on DeBank, and some key things he found.

Huge alpha here.

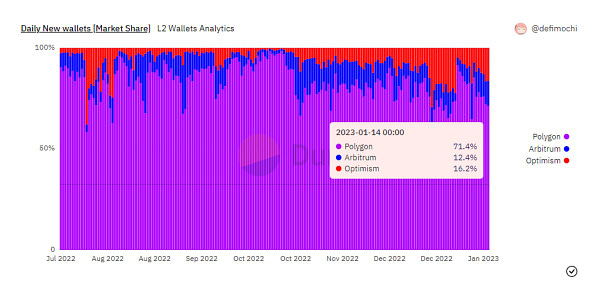

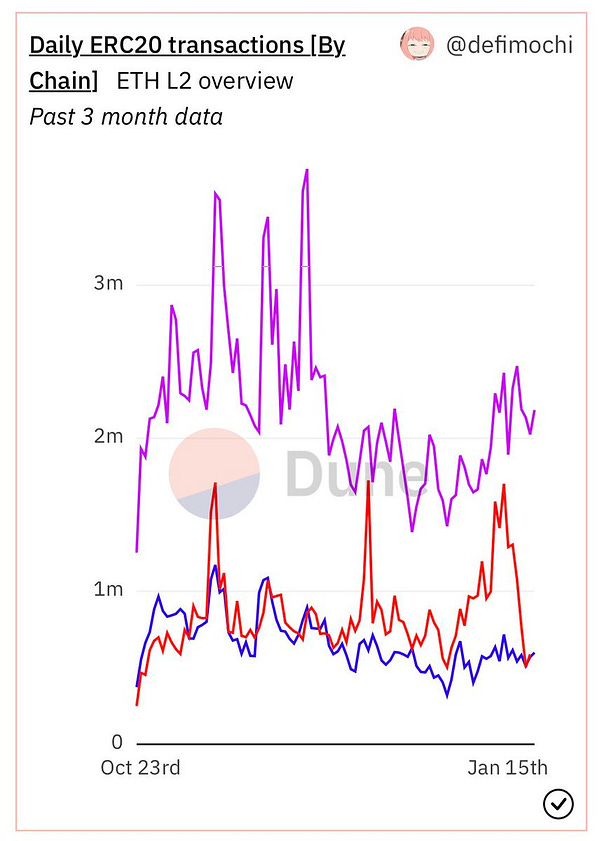

Daily New Wallets (Market Share)

Optimism is gaining market share over Arbitrum (on daily new wallets) after a period dominated by the latter. However this was before the end of Optimism’s quests.

Alpha provided by Flowslikeosmo

Data provided by defi_mochi

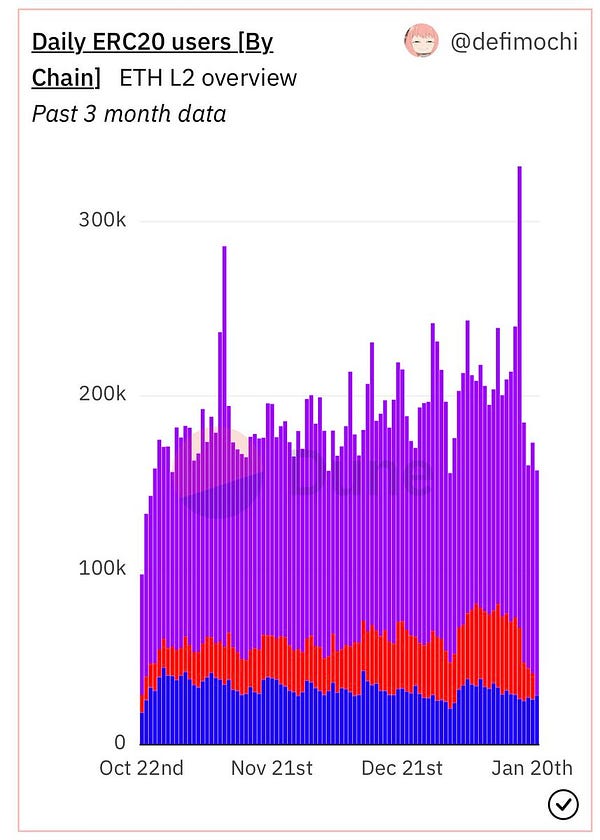

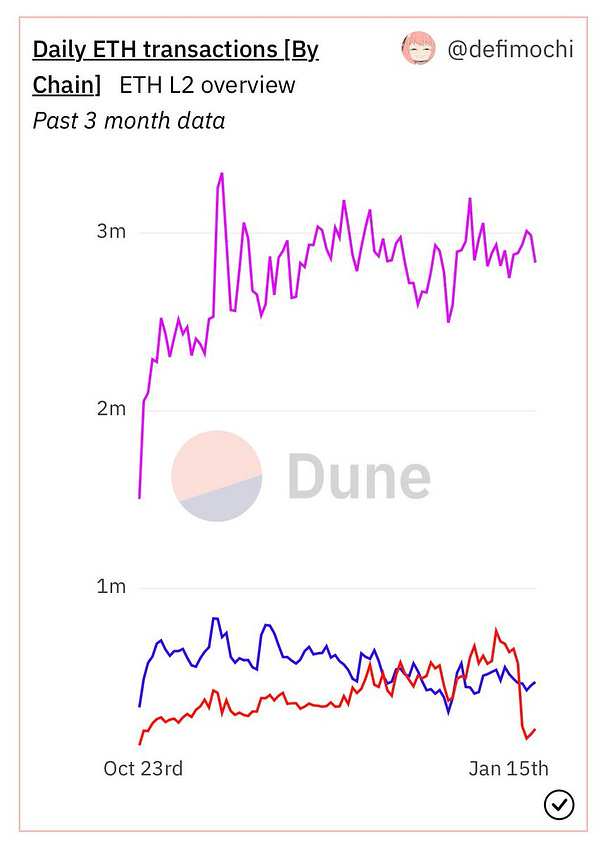

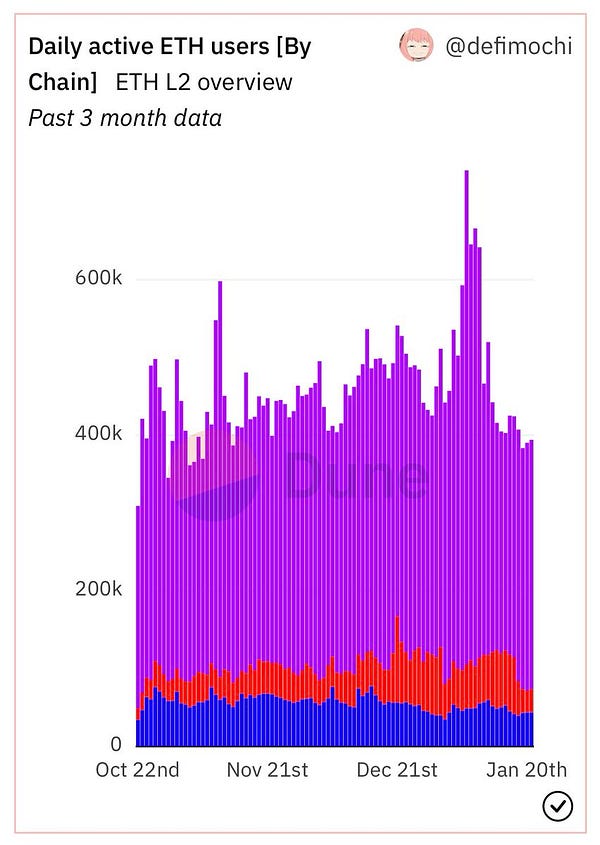

Daily transactions & users dropping on Optimism

Now that Optimism’s quests are over, Optimism’s daily transactions & users are down.

It triggered a thinking process for unhappyben about the return of the quests on Arbitrum.

Data provided by defi_mochi.

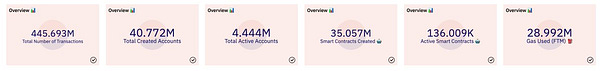

A Dune Dashboard on the Fantom Blockchain Ecosystem

A dashboard provided by HenryBitmodeth.

BTC Daily Active Addresses

Seems like BTC adoption & use are still doing good.

Data by Flowslikeosmo.

CANTO +58%

Canto is up by a lot after a huge inflow of stablecoins.

Data provided by Flowslikeosmo.

Inflow that has been mentioned by Dynamo_Patrick 10 days ago:

5/ Data & Numbers

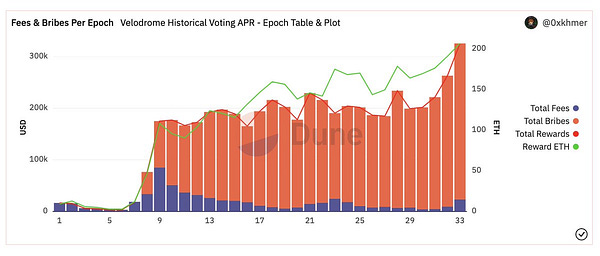

Velodrome record

$325,000+ in bribes & fees.

Bullish for Velodrome.

Over $3.3M Fees for GMX

Another week over $3.3M Fees for GMX.

+ new APR.

Data provided by AlphaverseDeFi.

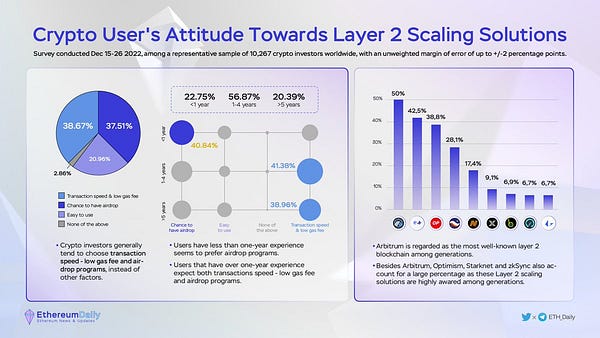

User’s Attitude Towards L2

Which is the most well-known Layer2?

Why would a user choose to use an L2 over another?

Data by ETH_Daily.

Current Yields on some of the top protocols on Arbitrum

Alpha provided by SteveFig22.

frxETH/ETH LP vAPR

~11.5% vAPR yield on Convex on an ETH pair.

Alpha provided by DeFi_Dad.

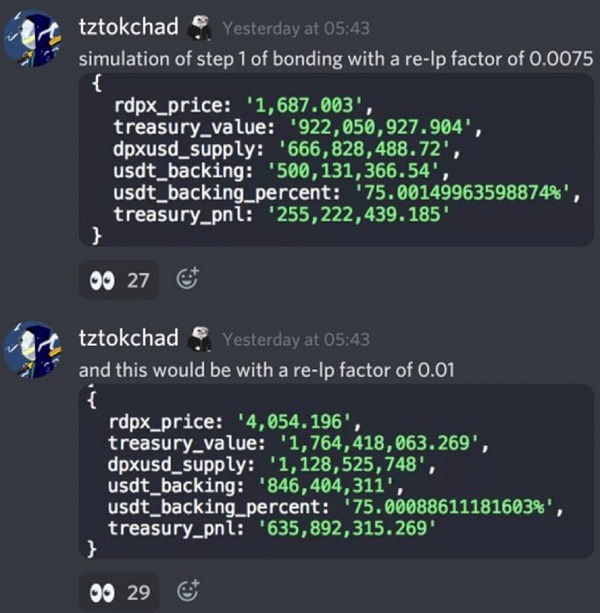

Current rDPX price is FUD?

Catalysts, data, memes, everything to explain that rDPX is undervalued.

Alpha by CryptoAndAliens.

Good volume & good APY on GainsNetwork

Bullish?

Data provided by Gemhunter9000.

6/ Projects

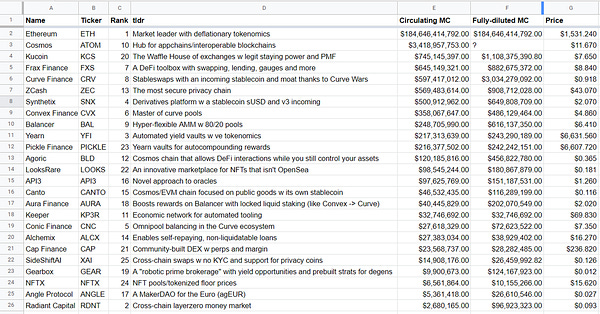

TL;DR on Cochran’s list

Cochran released a list of projects for 2023.

Here is a TL;DR on this list made by redphonecrypto.

Opinion on the list

0xGeeGee is not a fan of Cochran’s list.

Thoughts on missing narratives, and “weird” picks.

Is Cochran dumping on his followers?

Weird coincidences and omissions found by Pickle_cRypto.

Optimism ecosystem & hidden gems

zec_jay looked into Optimism ecosystem and found hidden gems.

X2Y2’s potential

The recipe for 100x and why X2Y2 is a good candidate according to CryptoKaduna.

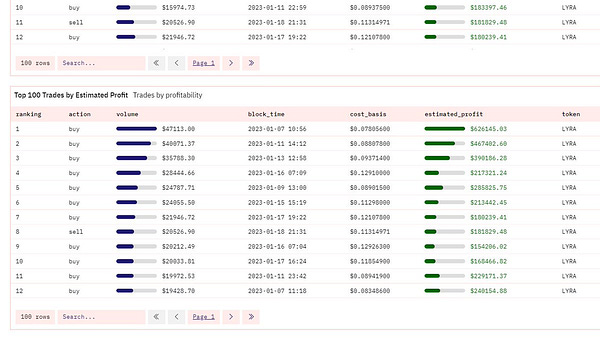

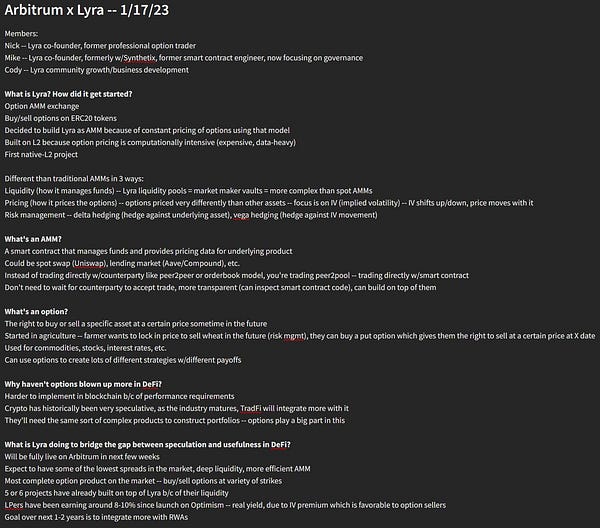

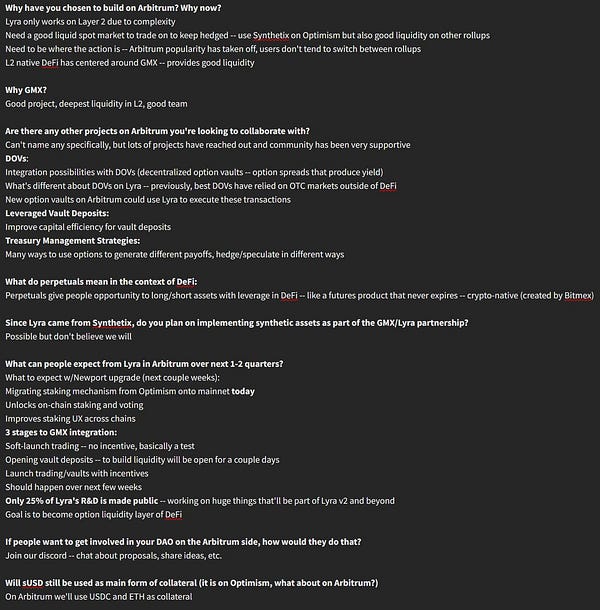

Lyra Alpha

Presentation and notes on Lyra.

Provided by VALh0lla.

Perp DEX on Metis

The only place to long/short METIS, and a perp DEX on METIS, a growing L2.

Already up by a lot, but still a really low cap. NFA

Alpha provided by Govanisher.

AZERO bullish arguments

Is Azero undervalued?

CryptoGirlNova has bullish arguments.

A project supported by the Japanese Government

Astar is a project recognized and supported by the Japanese Government.

It’s already a mid-high cap but still under-known.

Alpha provided by CryptoGirlNova.

Food for your researches

Some interesting projects on the Arbitrum Ecosystem according to wauwda.

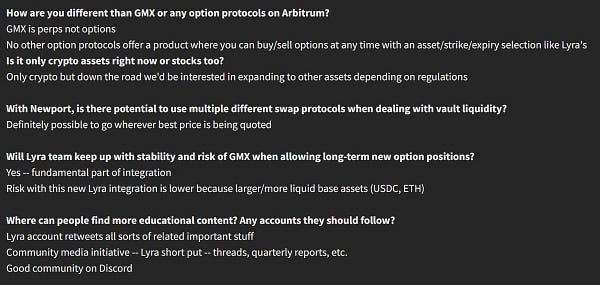

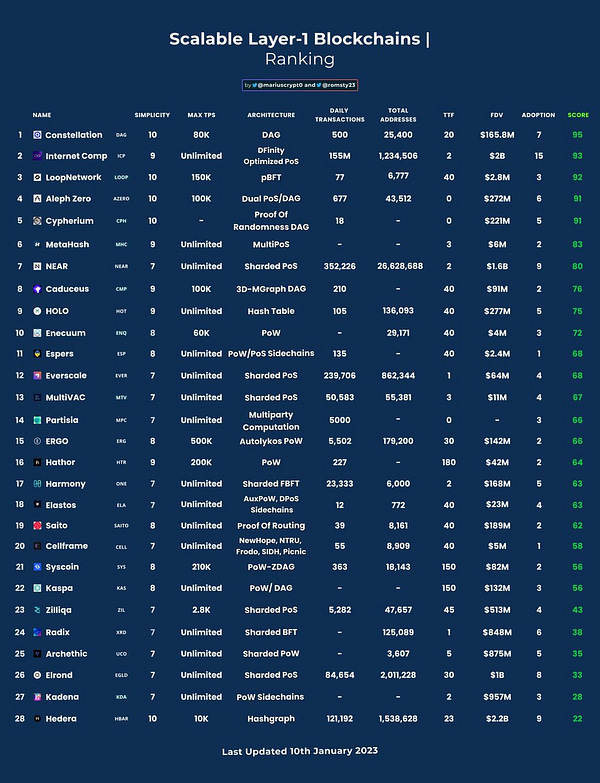

DAG tokens

DAG tokens are potential 100x according to MariusCrypt0.

Don’t know what a DAG is? Find your answer here.

A few alts Louis has his eyes on

A few alts LouisCooper_ is waiting for an entry on.

Some projects to DYOR.

Bullish Arguments for STG

Find bullish Arguments on STG, by ZoomerOracle.

A thread on 28 L1s

Find a thread written by CharlieXDeFi on every L1s from MariusCrypt0’s ranking.

Weekly news & projects launching

Find new projects daily thanks to C4dotgg.

Be careful and DYOR.

BONUS

A place to be taken on Solana

There is no clear leader on Solana DeFi. There might be a spot available for people willing to build.

Alpha provided by bennybitcoins.

New opportunities always arise

Some advices by TheDeFinvestor on how to take position in this market.

I believe however that taking positions on tokens that made multiple Xs can work on undervalued low marketcap that still have room to grow and are in a favorable narrative. Depends on your risk tolerance.

A good question to ask recruiters

To find out if a company has clear expectations.

Crypto jobs may not be clearly bounded or defined, so you must know what suits you.

By CryptoJobsList.

A friendly reminder

Not every investment has to be made on a revolutionary protocol.

A reminder by LouisCooper_

Thoughts on not being an ON/OFF investor

1_Point_618 is not an ON/OFF investor. Are you?

MrBeast following AZERO

MrBeast has been following AZERO for a while, might be something, might be nothing.

Info provided by AstralTrading.

He’s apparently invested through a VC.

Info provided by ScruFFuR.

The Current ZK Ecosystem

How big is the zk ecosystem?

Info provided by CryptoBlooom.

0xFlips the Bottom Callooooor

The bottom Calloooor.

How early are MushroomHead people?

People at FungiAlpha are on all fronts.

I recommend you have a look at what they’re building.

Find a great Community, Gem calls, Threads, AMA with interesting projects, soon a Newsletter, and much more!

That’s it for today frens!

That was a long issue.

Thank you for sticking around, your future self will thank you.

Don’t forget to follow the people who wrote these threads. They are big brains sharing their knowledge. You can also follow me on Twitter @CryptoShiro_.

If you liked this edition and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Find this edition on Twitter: