GM frens. Welcome to all new readers, we’re soon to be 100! Thank you guys, this is just the beginning, crypto is here to stay and we are too!

If you missed the latest airdrops edition, you can find it here:

Let’s start right away with the best content and alphas from Crypto Twitter in the past few days!

In today's edition of the selection of the best crypto threads (12/04 - 12/07), we'll have:

Data on fundraising in crypto

A comparison of @optimismFND & @arbitrum

A macro views for Tradfi & Crypto before CPI & FOMC

And much more! 👇

In a bear market we can expect way less fundraising as it's scarier for investors, and the return on investment less certain.

It can be a signal to keep an eye on for a market bottom. But how bad are the numbers compared to the past bull market?

A thread by @DefiIgnas

I might be a big fan of Arbitrum, I keep in mind that it does not matter since the best practice is to go where the money is flowing.

Optimism is also a great L2 and learning about its features and its biggest protocols is of great importance.

A comparison by @Slappjakke

Don't ignore macro.

Markets are moving with macro events. Crypto is great but the total capitalization is small, and we tend to forget how “insignificant” crypto is compared to the traditional finance and the world economy.

@_FabianHD provides us with great views on CPI/FOMC, how it could affect crypto, liquidity, and how he invests in consequence.

@ColdBloodShill pulled a x40 in 4 weeks.

Learn with this thread about his thought processes, trading approach and discipline.

You probably know already @LouisCooper_, he provides real value and finds gems for his community.

A master thread of all his deep dives on protocols 👇

This is a massive thread with 30 projects researched.

DYOR and find your gem here.

We've talked many times of @DefiLlama, you know this is a powerful tool. But do you know how to use it to its full potential, to find yields for example?

7 features of DefiLlama’s yield tool illustrated in video by @Dynamo_Patrick

Arbitrum being the place where things are currently happening, there is a lot of opportunity, but also risks due to bad/scam projects.

Preserving your capital by avoiding these pitfalls will allow you to invest more sustainably in arbitrum's gems.

A thread by @Crypt0_Andrew

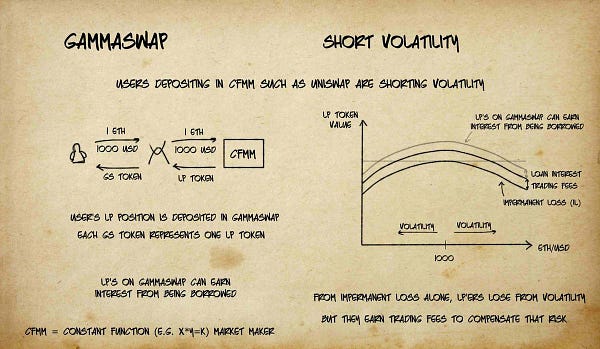

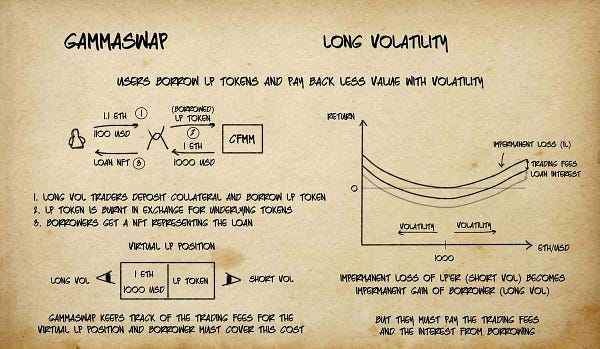

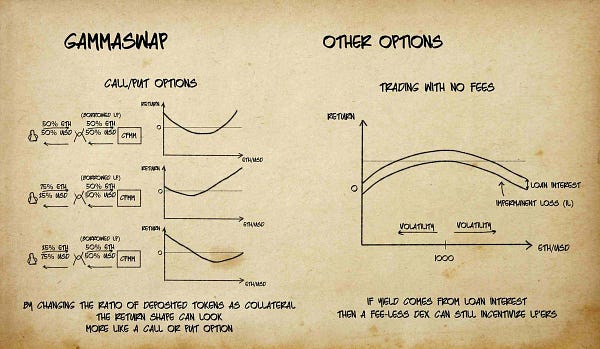

Pure alpha on an innovative upcoming protocol, @GammaSwapLabs, that might allow new ways of trading.

A very well-illustrated thread by @ologai

Another resource to read to protect yourself from scams.

How to spot scam project on presale, by @CryptoGirlNova

People tend to overlook Avalanche, but it is still one of the leading L1s, still strongly building. Surviving to a cycle reinforces its status.

@TheDeFinvestor presents a list of quality upcoming projects on Avalanche.

BONUS:

@rektdiomedes's Macro Investments for 2023.

These are not crypto investments but still really interesting. Diversifying your assets is recommended.

To go further: Projects

This category is for people looking for projects to research.

If you did not have enough content with the previous threads, you’ll learn more about new projects here.

Low-cap projects to not pass up

6 promising Arbitrum projects searching for builders, and why it matters

The most addicting project on Arbitrum: $BFR

Top high cap picks

Fantom could be the ultimate Layer1 solution

Updates on Synthetix and yield

100x potential projects to keep an eye on

4 groundbreaking projects on Arbitrum

Why Umami is the project to keep an eye on for December

TideWeb3, a protocol for acquisition and retention of users in Web3

AmpliFiDefi, the perpetual yield protocol

Spice Finance, an aggregated NFT lending liquidity

KromatikaFi, a multi-chain DEX aggregator

DEXes on Arbitrum

Arbitrum Yield Season

(be careful to understand where the yield comes from and if it is sustainable or not)

That’s it for today frens!

A lot of threads today. You should choose wisely which subjects are interesting to you and which projects seems innovative, but don't forget that a little curiosity can lead you to discover new trends or potential gems!

Don’t forget to follow the people who wrote these threads. They are big brains sharing their knowledge. You can also follow me on Twitter @CryptoShiro_.

If you liked this edition and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Goat