This Week's Newsletter - Case Study on AAVE, Uniswap vs Sushiswap, Main News of the Week, $LINK, & Zoom on RWA

Weekly Alpha

GM Frens,

I’m back!

And so is the Market!

I'm excited to introduce a brand-new weekly format for this Newsletter. 🎉

Each edition will now feature:

Case Study: We’ll dive deep into a project or protocol, exploring its journey and how it’s impacting the DeFi space.

Battle of DeFi Projects: We’ll compare two top DeFi projects to help you better understand their strengths, weaknesses, and which one might be right for you.

News of the last week: Stay up-to-date with the latest and most important DeFi news and updates, handpicked from around the web.

Token Valuation Model: We’ll provide a deep dive into the economic fundamentals of key tokens, analyzing how factors like utility, supply dynamics, and network growth influence their long-term value, helping investors make informed decisions.

Future top narrative: An exploration of emerging trends in crypto or DeFi, with predictions on future developments.

But you know me, the format is evolutive. In this Market the most important skill is adaptability.

I'll adapt the topics according to your feedback and what's hottest on the market.

The goal is to give you an edge in terms of knowledge and investment opportunity.

This format will not totally replace the previous formats. I will also post some Standalone Articles, and you can expect Project & Narrative Alpha, with some degen plays, as I used to post!

I hope this new format will make your experience more engaging and help you stay informed in this fast-moving space. Let’s dive in!

I'd especially like to thank the premium subscribers for their support, I've read your messages, your support is deeply appreciated!

I'm back with the newsletter format, but I wasn’t gone anywhere, I've been here all along, always in the trenches.

Never stopped posting on X & Telegram.

The Weekly Alpha & Weekly Airdrop Alpha that I used to post here as a Newsletter are on my Telegram Channel now!

I’m posting daily Live Alpha on my Telegram Channel ☟

My Linktree to have access to all my Content & Alpha on Twitter (X), Instagram, Telegram, and More: https://linktr.ee/cryptoshiro

1/ Case Study: How Aave Changed the DeFi Lending Landscape

We’re starting with some OG protocols that you can’t ignore. You must know their history and how they changed DeFi. But I know most of you are not beginners here, we’ll delve deeper on new protocols and new narratives starting next week!

Background

Aave, a decentralized lending protocol, launched in January 2020 with a mission to provide users with a non-custodial way to lend and borrow crypto assets. In contrast to traditional finance, Aave allows users to earn interest on their deposits or borrow assets without needing an intermediary like a bank.

The Challenge

Before Aave, DeFi lending protocols struggled with issues like high collateral requirements and limited asset support. These challenges made it difficult for users to access sufficient liquidity or manage risk effectively.

The Solution

Aave introduced several groundbreaking features that solved these problems:

Flash Loans: This feature allows users to borrow instantly without collateral, as long as the loan is repaid within the same transaction. This innovation created new use cases, such as arbitrage and collateral swapping, which weren't previously possible in DeFi.

Collateral Diversity: Aave supports a wide range of crypto assets, allowing users to diversify their portfolios and reduce risk by using various tokens as collateral.

Staking and Safety Module: Aave introduced a staking mechanism that lets users stake AAVE tokens to ensure the safety of the protocol. In return, stakers earn rewards and help protect the platform from bad debt.

The Impact

Since its launch, Aave has grown exponentially, with over $20 billion in total value locked (TVL) at its peak.

The platform also popularized flash loans, leading to new decentralized finance strategies. Additionally, Aave's governance token, $AAVE, has become one of the most valuable DeFi tokens in the market.

Key Takeaways

Aave's flash loans democratized advanced DeFi strategies, enabling arbitrage and liquidation without upfront capital.

The wide range of supported assets attracted more users by offering greater flexibility in risk management.

By involving its community through governance and staking, Aave strengthened user loyalty and trust.

Conclusion

Aave’s innovative approach to DeFi lending made it one of the largest protocols in the space.

Its introduction of features like flash loans and staking has not only transformed DeFi lending but also opened up new possibilities for developers and traders alike.

2/ Battle of Projects: Uniswap vs. SushiSwap

Background

Uniswap: Launched in 2018, Uniswap is a decentralized exchange that popularized the automated market maker (AMM) model, letting users trade tokens using liquidity pools.

SushiSwap: Forked from Uniswap in 2020, SushiSwap quickly gained attention by offering additional incentives for liquidity providers and focusing on community ownership.

Liquidity & Volume

Uniswap: Uniswap has over $1 billion in daily trading volume, making it the largest DEX by liquidity and activity.

& its TVL remain huge all year round.

SushiSwap: While smaller, with around $200 million in daily volume, SushiSwap still attracts users due to its reward structure.

However its TVL seems to be more volatile.

🏆 Winner: Uniswap – In terms of liquidity and volume, Uniswap still dominates, offering users greater access to liquidity and tighter spreads on trades.

Fees & Rewards

Uniswap: Traders pay a 0.3% fee on swaps, which goes directly to liquidity providers.

SushiSwap: Similar 0.3% fee, but 0.05% is distributed to SUSHI stakers, adding an extra income stream for long-term users..

🏆 Winner: SushiSwap – With staking rewards, SushiSwap offers more ways to earn beyond just liquidity provision.

Governance

Uniswap: Controlled by $UNI token holders, governance moves slowly due to its large community.

SushiSwap: Also community-driven, but with more decentralized control, allowing faster decisions.

🏆 Winner: SushiSwap – SushiSwap’s governance is more agile and community-focused.

Ecosystem & Features

Uniswap: Focuses mainly on token swaps, with innovations like concentrated liquidity in Uniswap V3.

SushiSwap: Expands beyond a DEX into lending (Kashi), yield farming (Onsen), and cross-chain capabilities.

🏆 Winner: SushiSwap – SushiSwap offers more diverse DeFi services, creating a broader ecosystem beyond token swaps.

Final Verdict: Uniswap or SushiSwap?

Both Uniswap and SushiSwap have their strengths. If you’re looking for deep liquidity and the most efficient trades, Uniswap is the clear winner. However, if you value community involvement, extra rewards, and a full suite of DeFi products, SushiSwap stands out as a more holistic platform.

Which one suits you depends on whether you prioritize simplicity and volume (Uniswap) or features and rewards (SushiSwap). It also of course depends on which token you want to buy and where is its liquidity, on which chain.

3/ Crypto and Defi News

🚀 Uniswap, one of the leading DEXs, has launched its own Layer2 network, Unichain : This new infrastructure promises faster transaction times, lower fees, and enhanced interoperability between blockchains. Unichain is seen as a bold move to compete with other Layer-2 solutions like Optimism and Arbitrum.

Thought: Layer2 is becoming a key battleground in DeFi. If you’re trading on Uniswap or investing in it, this could be a game-changer in terms of user experience and cost efficiency. Keep an eye on how Unichain performs in comparison to other Layer2s. It might shift liquidity away from competitors if it delivers on its promise. It’s also a loss for Ethereum that will stop catching Fees that go through Unichain, knowing that Uniswap is one of the biggest project on the Network, Ethereum will lose hundreds of Millions in fees. (~$470M this year)

💡 Scroll Lists on Binance: Scroll, the Ethereum Layer 2 solution, launched its token via a Binance Launchpool. It raised many concerns regarding the OG Community that used the protocols since Testnet, and may receive a smaller share of the supply because of the Launchpool, if any share at all.

It also raised concerns about the need for a Centralized Party to launch a token, questioning whether this could compromise Scroll’s decentralization principles. Despite this, Scroll’s co-founder, Ye Zhang, emphasized that partnering with Binance is a strategic decision aimed at expanding in emerging markets, without sacrificing core values.

Thought: Centralized platforms can be a double-edged sword—yes, they bring liquidity, but over-reliance on them can harm the decentralized nature of projects. If you're involved in Scroll or similar L2s, think about diversifying exposure across different exchanges or platforms to mitigate centralization risks. Also if you farmed the Scroll Airdrop, maybe keep interacting after the launch of the token, just in case they do something similar as LayerZero & their second airdrop.

💎 Ethereum's Staking Reaches Record High : Ethereum staking has hit an all-time high of 50 million ETH after the Shanghai upgrade. This surge comes as validators now have a more seamless withdrawal system, which has boosted confidence in staking long-term.

Thought: This shows a lot of faith in Ethereum’s long-term potential. With more people locking up their ETH for staking, you can expect the network to become more secure and less prone to volatility. If you’re already an ETH holder or DeFi participant, this is a good signal for both security and stability in the network. But as we saw before, Ethereum is having trouble to reduce its inflation and collect fees with the increase in the number of L2s and Appchains like Unichain.

👀 Trump's Crypto Platform Proposes Aave Integration for Governance : World Liberty Financial, a crypto platform with ties to Trump, has announced plans to integrate Aave’s governance mechanism. This would allow users to vote on platform decisions, marking a significant step toward decentralized governance in the politically charged crypto space.

Thought: Aave’s governance model is solid, and seeing it integrated into other platforms is a good sign for DeFi. However, when politics and crypto mix, the outcome can be unpredictable. If you're participating in governance or staking, my advice is to keep an eye on how such platforms manage their voting processes—especially when real-world political forces get involved

☀ Avalanche continues to gain momentum with its Web3 gaming initiative Off the Grid : The game has attracted significant attention for its deep integration of blockchain assets, offering in-game rewards that can be utilized across the DeFi ecosystem. With strong partnerships, Off the Grid has quickly positioned itself as one of the most promising Web3 games of 2024.

Thought: Off the Grid's success showcases the potential of merging gaming with DeFi. By allowing players to own, trade, and earn real-world value from in-game assets, Avalanche is unlocking a new audience for DeFi applications. This could lead to broader adoption, bridging the gap between gaming and decentralized finance, driving more users and liquidity to the Avalanche ecosystem.

4/ Token Valuation Model: Chainlink ($LINK)

🌐 Chainlink is the leading decentralized oracle network, providing crucial off-chain data to smart contracts on multiple blockchains. Chainlink's value is derived from its role as the “middleware” of decentralized finance (DeFi) and the broader crypto ecosystem. As a utility token, LINK is used to pay node operators for fetching and validating data, securing decentralized oracles, and staking for network integrity.

This valuation model will analyze how Chainlink’s revenue streams, token utility, and network growth contribute to LINK’s long-term value.

Revenue Generation

Oracle Fees : Chainlink generates value through the fees that smart contract developers pay for oracle services. These fees are used to compensate node operators who provide reliable data to on-chain contracts. The more DeFi protocols and blockchain applications using Chainlink oracles, the higher the demand for LINK as fees are paid in LINK tokens.

Fee Structure: Fees vary depending on the complexity and frequency of data requests. For example, a price feed for DeFi protocols like Aave or Synthetix might have different pricing compared to a custom oracle request.

Growth Potential: As Chainlink integrates with more blockchains and Layer-2s, the volume of oracle requests is expected to rise, increasing fee generation and demand for LINK.

Utility of LINK

Node Operator Staking & Security : LINK’s utility isn’t just about paying for data; it also plays a crucial role in securing the network. Node operators need to hold and stake LINK as collateral to guarantee the quality and reliability of the data they provide. Misbehavior or delivering faulty data can result in the loss of staked LINK, ensuring high-quality service. As the Chainlink network grows and more data is requested, the demand for LINK to be staked by node operators increases.

Staking Mechanism: Chainlink 2.0 upgrade introduced a more robust staking system, requiring node operators to lock up more LINK tokens to ensure data accuracy and security.

Network Impact: This staking feature strengthens the tokenomics by reducing circulating supply, as more LINK gets locked in staking contracts.

Tokenomics

LINK Supply & Circulation : $LINK has a fixed supply of 1 billion tokens, with about 55% currently in circulation. As more developers use Chainlink’s services, demand for LINK will grow, putting pressure on the available circulating supply. Coupled with staking mechanisms that lock up tokens, this creates a natural scarcity effect over time.

Deflationary Pressure: As staking increases and more oracles are used across DeFi and blockchain ecosystems, a portion of the token supply will be locked, leading to deflationary pressures that could push the price higher.

Revenue to Token Holders : While LINK holders don’t directly earn a share of Chainlink’s revenues (oracle fees), increased demand for Chainlink’s services indirectly increases the value of LINK. As more node operators and developers need LINK to secure their roles, the token’s utility and scarcity grow, potentially driving price appreciation.

Growth Catalysts

Enterprise Adoption : One of Chainlink’s key growth drivers is its ongoing enterprise adoption. Major companies are increasingly recognizing the value of decentralized oracles for secure data feeds. Chainlink has already integrated with giants like Google Cloud, AccuWeather, and SWIFT, expanding its utility far beyond DeFi.

Real-World Data: Chainlink’s Proof of Reserves, weather data oracles, and integration with traditional financial systems position it as a vital player in bringing real-world data on-chain, increasing demand for LINK tokens.

Cross-Chain Integration : With the rise of cross-chain ecosystems, Chainlink is poised to become the go-to oracle provider across multiple blockchains and Layer-2s. The Cross-Chain Interoperability Protocol (CCIP) allow Chainlink to facilitate secure messaging and token transfers between blockchains, creating a new layer of utility for LINK and opening up vast new markets.

Key Metrics for Valuation

Total Value Secured (TVS): Chainlink currently secures more than $200 billion in value across DeFi, a key metric that reflects the network’s importance and growing demand for oracles.

Number of Active Node Operators: Monitoring how many node operators are staking LINK is essential, as higher staking reduces circulating supply and increases security.

Oracle Requests: The number of data feeds requested across various blockchains and smart contracts indicates Chainlink’s usage and the demand for LINK.

Enterprise Partnerships: New enterprise partnerships signal broader adoption, which is a strong indicator of future demand for Chainlink services and LINK.

Conclusion: Why LINK’s Value Proposition is Strong

Chainlink’s pivotal role in DeFi, enterprise adoption, and cross-chain applications positions LINK as a critical asset for the growing blockchain ecosystem. Its value accrues from its utility as a payment token, staking asset, and the security it provides to decentralized oracles. With innovations like Chainlink 2.0 and the CCIP, Chainlink’s growth trajectory remains robust.

Final Take: For investors, LINK offers exposure to a key piece of blockchain infrastructure, with strong demand drivers tied to DeFi growth, cross-chain solutions, and enterprise integration. Long-term value will likely be driven by increased staking and the continued expansion of oracle use cases.

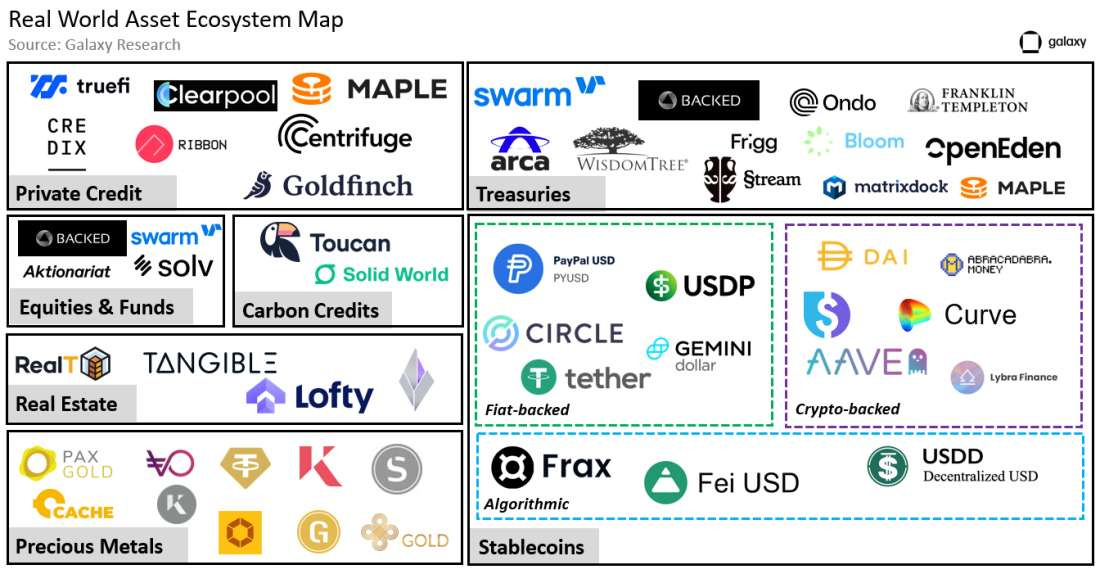

5/ Future top Narrative : Tokenized Real World Assets (RWAs) as the Next Big Wave

As 2024 unfolds, Real World Assets (RWAs) are emerging as a significant trend in the crypto space. By tokenizing physical assets like real estate, stocks, and commodities on the blockchain, RWAs could bridge the gap between traditional finance and decentralized finance (DeFi), unlocking immense value in the process.

What Are Real World Assets (RWAs)?

RWAs are tangible assets represented as tokens on a blockchain. This allows these traditionally illiquid assets—like real estate or commodities—to be traded, lent, or borrowed in DeFi ecosystems. Tokenization introduces liquidity and fractional ownership, making high-value assets accessible to a broader range of investors.

Why RWAs Are the Next Frontier in DeFi ?

Unlocking Liquidity: Illiquid assets like property or private equity can now be traded 24/7 through decentralized platforms, bypassing traditional intermediaries.

Fractional Ownership: Investors can own smaller pieces of high-value assets, opening up new opportunities to diversify their portfolios.

Global Accessibility: RWAs remove geographical barriers, allowing global investors to access assets from anywhere.

DeFi Integration: Tokenized RWAs can be collateralized for loans, staked for rewards, or traded in DeFi protocols, adding utility to traditional assets.

Real-World Applications of RWAs

The RWA trend is no longer a distant possibility; it’s happening right now. Several projects and protocols are leading the charge in bringing RWAs to the blockchain.

RealT: Tokenizes U.S. real estate, allowing investors to purchase fractional shares and earn rental income.

Centrifuge: Brings real-world assets like invoices and real estate into DeFi, unlocking liquidity for businesses.

Goldfinch: Tokenizes loans in emerging markets, offering stable returns while improving access to credit.

Challenges and Considerations

Despite the enormous potential of RWAs, the road ahead is not without challenges.

Regulatory Uncertainty: Governments are still determining how to regulate tokenized assets, which can affect the adoption of RWAs.

Asset Verification: Ensuring the legitimacy of the underlying assets is crucial for trust and security.

Liquidity Fragmentation: Too much fractional ownership could hinder liquidity if buyers or sellers are scarce for smaller portions of assets.

Looking Ahead: RWAs and the Broader DeFi Ecosystem

RWAs are just the beginning of bringing traditional finance onto the blockchain. We’re likely to see more DeFi protocols offering services like asset-backed stablecoins, collateralized lending, and yield farming based on tokenized real-world assets. This could also attract institutional investors, who may prefer the stability of RWAs over the volatility of crypto-native assets.

Conclusion

Real World Assets are primed to play a transformative role in the future of DeFi and the broader blockchain ecosystem. As tokenization gains momentum, it will unlock new markets, democratize access to traditionally inaccessible assets, and potentially bring trillions of dollars worth of real-world value into the decentralized world.

While challenges remain, the potential for RWAs to redefine how we think about ownership, liquidity, and value cannot be overstated. As we move further into 2024, keep an eye on this trend—it might just be the catalyst that pushes DeFi into the mainstream.

If you want to learn more about Commodity RWA, you can see My Thread on LandX.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this new format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.

Great to see you back on Substack. 🙏