This Week's Newsletter - Case Study on RENDER, Akash Network vs. ANKR, Main News of the Week, $TAO, & Zoom on AI

Weekly Alpha

Nothing in this edition is an ad, a collaboration or a partnership.

GM Frens,

Another Week, Another Issue!

This week let’s talk about the elephant in the room—AI.

It’s been all over the news lately, reshaping industries left and right. Companies like OpenAI, Microsoft, and Nvidia have shown us what AI can do, and we’ve all seen those insane growth charts. But what does this mean for crypto?

Well, that’s where things get really interesting. The AI narrative is becoming a dominant force, and as we can see from the charts, it’s not just hype—it’s already making waves in the crypto world. Let’s break down what this all means.

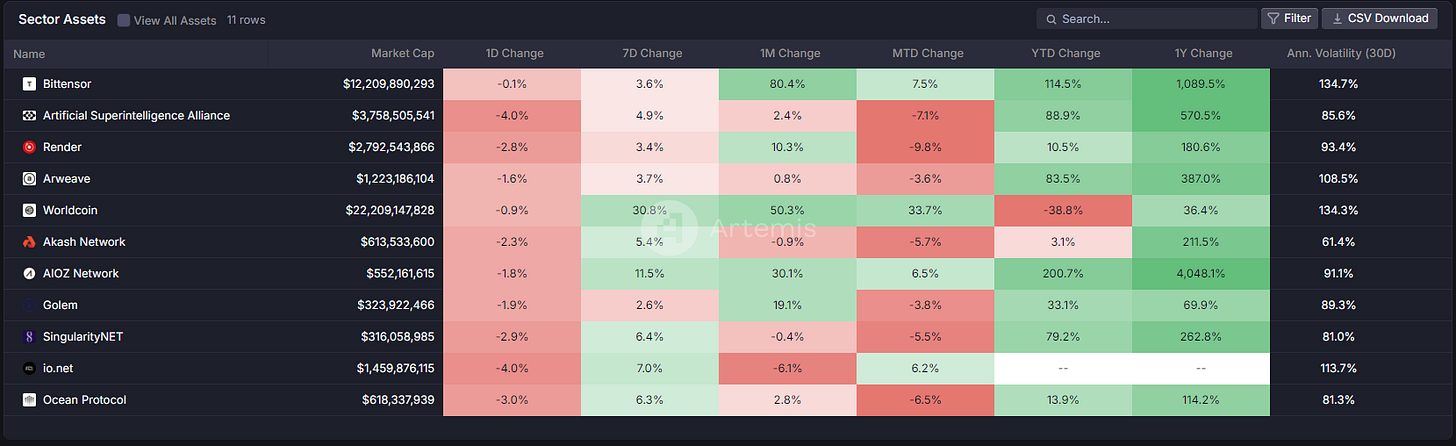

First up, take a look at the sector performance chart. AI is not just holding its own—it’s leading the charge. You can see Bittensor up a staggering 80.4% for the month, followed by Worldcoin with a 50.3% jump. These numbers aren’t just big—they're sending a clear message: AI-related crypto projects are thriving right now. And if you ask me, this is just the beginning.

Why? Because AI in crypto is a perfect match. Think about it—AI is amazing at processing insane amounts of data, predicting market trends, and even spotting fraud in real-time. It’s like having a supercomputer that works 24/7, crunching numbers faster than any human could dream of. That’s why projects like Render and Golem are also performing well—they’re capitalizing on AI’s ability to optimize complex tasks like decentralized rendering and cloud computing.

But what’s even more exciting is how AI and blockchain are starting to intersect in ways that go beyond just trading or data analysis. We’re talking about a future where AI makes us question what’s real and what’s generated. With AI generating content that’s nearly indistinguishable from human work, we’re going to need something like blockchain to validate who’s who and what’s real.

Look at the sector performance bar chart. AI-related projects have outperformed most other crypto sectors, including pillars like DeFi and Bitcoin. The highest performer on the list? AI, clocking in at an impressive 40.7% growth for the month.

To me, this is a clear sign that AI is going to be a driving force in how blockchain evolves from here on out.

And then there’s the second graphic showing asset performance. Notice how AI-based assets like Bittensor, Render, and Worldcoin are fast growing, not just over a month but over the year. Bittensor, for example, is up 1,089.5% year-on-year!

When you see numbers like that, it’s hard to ignore the role AI is playing in shaping the future of digital assets.

So, here’s my take: AI isn’t just a trend—it’s going to redefine how we think about blockchain, crypto, and even ownership in the digital world. With AI’s ability to automate processes and analyze vast datasets in real-time, it’s making blockchain more efficient, secure, and scalable. But more importantly, it’s laying the groundwork for a future where blockchain becomes essential for proving authenticity in a world where AI-generated content is everywhere.

What we’re seeing now is the early stages of a much bigger trend. And if you’re like me, you’ll want to be paying attention to how AI continues to reshape the crypto landscape, because it’s already making a massive impact—and the charts don’t lie.

While we’re seeing some green across the board, with the market ticking upwards, Bitcoin is still bigger than all of the Altcoins combined, and has become the 6th biggest monetary asset worldwide.

Despite that, all eyes are on the AI narrative that continues to lead the charge as the most exciting development in the crypto ecosystem lately.

Before we dive in this Week’s Newsletter

I must remind you that I still curate CT Content on X. Find new projects early. Don’t miss anything.

Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel ☟

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This week, we’re diving into the hottest topics:

A case study on Render Network and how it’s shaking up decentralized cloud rendering

AKASH vs ANKR—a head-to-head comparison

Key updates in this week’s news

Spotlighting TAO

And, of course, a deeper look into AI’s growing impact on the blockchain

Let’s jump right in!

1/ Case Study: How Render Network Is Transforming AI Workloads with Decentralized GPU Rendering

Background

Render Network, a decentralized GPU rendering protocol, launched with the goal of leveraging unused GPU power to render graphics, animations, and now, to support AI workloads. By allowing users to rent out their idle GPU resources, Render Network enables AI developers, artists, and researchers to access affordable, high-performance computing power without relying on centralized cloud providers.

GPU computation and rendering refer to the use of Graphics Processing Units (GPUs) to perform complex calculations and generate images. While GPUs were originally designed for graphics rendering, their parallel processing capabilities make them highly efficient for a range of computational tasks, not just graphics-related operations.

In contrast to traditional cloud computing services, Render Network operates on a decentralized model, providing cost-efficient and scalable GPU power across a distributed network of contributors.

The Challenge

Before Render Network, AI developers and content creators faced several challenges in accessing affordable, scalable GPU power. These challenges included:

High Costs: Renting GPU resources from centralized cloud providers (like AWS or Google Cloud) can be prohibitively expensive, especially for independent developers and smaller teams working on AI models and complex visual tasks.

Scalability: Centralized GPU services are limited by fixed infrastructures, which may not scale efficiently or handle peak workloads for rendering-intensive projects.

Centralized Control: Large cloud providers control access to GPU resources, leading to bottlenecks, service outages, and dependency on single points of failure.

The Solution

Render Network addressed these challenges by creating a decentralized GPU rendering platform, allowing users to tap into a global network of GPUs. Its impact on AI workloads has been significant, providing developers with a more accessible, flexible, and affordable way to power their models. Here’s how Render tackled these problems:

Decentralized GPU Pooling: Render allows anyone with idle GPUs to contribute their computing power to the network. In return, these contributors are rewarded in RNDR tokens. This decentralized structure democratizes access to high-performance GPUs, creating a more scalable and distributed marketplace for computing resources.

Cost Efficiency: By utilizing underused GPU resources from individuals and small enterprises, Render can offer significantly lower costs than centralized cloud providers. This is especially important for AI developers working with limited budgets but needing high computing power.

AI and Machine Learning Optimization: Render has expanded its platform to support AI tasks such as model training, data processing, and rendering AI-generated content. This opens up new opportunities for AI developers who require flexible GPU power for running complex models or iterative simulations.

The Impact

Since its launch, Render Network has revolutionized access to GPU computing power, particularly benefiting the AI and creative industries. Its decentralized model has seen widespread adoption, and several key impacts stand out:

Lowered Entry Barriers: AI developers, who previously struggled with the high cost of cloud services, now have an affordable and scalable alternative in Render Network. This enables smaller players to compete with larger, resource-rich organizations.

AI Workloads on Render: The network has been used for a variety of AI-based tasks, such as training machine learning models and AI-generated art, showcasing its versatility beyond traditional rendering.

$RNDR Token Utility: The $RNDR token not only powers transactions within the network but also incentivizes GPU owners to contribute, creating a symbiotic ecosystem where both providers and consumers of GPU power benefit.

Key Takeaways

Decentralized GPU Access: Render Network’s decentralized model democratizes access to high-performance GPUs, providing a cost-effective alternative to traditional cloud services.

AI-Friendly: The platform is optimized for AI workloads, supporting machine learning tasks, neural networks, and complex data processing without the prohibitive costs of centralized GPU providers.

Tokenized Incentives: By rewarding contributors with $RNDR tokens, Render encourages global participation, building a scalable ecosystem of GPU power readily available for AI tasks.

Conclusion

Render Network’s innovative approach to decentralizing GPU power has opened up new possibilities in AI development. By making scalable, cost-efficient computing resources available to everyone, the platform has helped remove significant barriers to entry for AI developers and creative professionals alike.

As Render Network continues to grow, it’s likely to become a vital infrastructure layer for AI workloads, rendering tasks, and the broader development of AI-driven applications.

2/ Battle of Projects: ANKR vs. Akash Network

Introduction: Decentralized Cloud Computing Showdown

☁️ In the race to decentralize cloud infrastructure, ANKR and Akash Network are emerging as two powerful contenders.

We’re talking computing again. You may not know exactly what’s Cloud Computing.

Cloud computing is a technology that delivers computing services—such as servers, storage, databases, networking, software, and analytics—over the internet ("the cloud"). Instead of owning and maintaining physical data centers or servers, users can rent computing resources from a cloud provider, such as AWS (Amazon Web Services).

ANKR & Akash aim to challenge traditional cloud providers like AWS, but they take different approaches to achieve scalable, decentralized compute power. Let’s dive into how these two projects stack up against each other in terms of technology, tokenomics, and growth potential.

Technology & Infrastructure

ANKR, Web3 Infrastructure Provider : 🔗 ANKR operates as a decentralized infrastructure provider for Web3, offering a comprehensive suite of services such as node hosting, staking, and APIs. By supporting major blockchain networks (Ethereum, Binance Smart Chain, Polkadot, etc.), ANKR enables developers to easily run nodes and access blockchain data without needing to manage their own hardware.

Core Offering: Ready-made node infrastructure, liquid staking, and multi-chain development tools.

Network: ANKR provides access to over 50 different blockchains and a growing set of RPC (remote procedure call) services for developers.

Akash Network, Decentralized Cloud Marketplace : 🌍 Akash Network takes a decentralized marketplace approach, offering compute resources by allowing users to buy and sell unused cloud computing power. Rather than building cloud infrastructure from scratch, Akash leverages idle server capacity from data centers, enabling cheaper and more efficient cloud computing for developers and enterprises.

Core Offering: A decentralized cloud exchange, enabling anyone to rent or provide cloud services.

Network: Built on Cosmos SDK, it supports interoperable cloud services that are faster and cheaper than centralized competitors.

Tech Showdown:

While ANKR focuses on providing blockchain-specific infrastructure like node hosting and staking, Akash Network offers broader cloud compute services for general applications, targeting both Web3 and traditional industries.

🏆ANKR wins for blockchain developers, but Akash shines with its cost-efficient cloud solutions for multiple industries.

Tokenomics

The $ANKR token powers the platform, functioning as a payment mechanism for services like node hosting, staking, and API requests. It’s also used as a reward in the ANKR liquid staking ecosystem, incentivizing users to provide liquidity for staked assets. With partnerships across numerous blockchains, ANKR has diverse utility within the Web3 infrastructure space.

One of the latest added value to the token is the use within the Neura Ecosystem, an AI Blockchain developed by Ankr

Neura provides a fusion of cloud computing, AI, and Web3 technologies to transform the way AI companies are able to deploy, train models, and operate – on the blockchain.

Use Cases: Payment for services, staking, and governance participation.

100% of the Supply is already in Circulation

$AKT is the native token of Akash Network, used for settling transactions within its cloud marketplace. Providers are paid in AKT, and renters use AKT to access compute power. It’s also utilized for staking and securing the network, with holders participating in governance decisions.

Use Cases: Payment for compute services, staking, and governance.

AKT still has a monthly inflation.

Tokenomics Showdown:

Both token have a high utility in their ecosystem.

As there is no inflation built into the ANKR token, and 100% of the supply is released already, there is no scary unlocks incoming.

However unlocks are not necessary a bearish thing, and can bootstrap liquidity within the ecosystem. But if we need to pick one:

🏆 ANKR edges out AKT because of its non-existing token emission & inflation.

Adoption & Ecosystem Growth

ANKR Adoption :

🚀 ANKR has quickly become a top choice for developers seeking node services, boasting partnerships with Binance, Polygon, and major DeFi projects. Its integration with Liquid Staking has boosted adoption, allowing users to earn staking rewards on ETH, BNB, and other assets while keeping their assets liquid. ANKR's ecosystem touches over 50 blockchains, making it a broad, multi-chain player in the Web3 infrastructure space. With now its brand new Neura Blockchain positioning well into AI, Revolutionizing AI Startup Launch.Akash Network Adoption :

📡 Akash is gaining traction as a decentralized alternative to AWS, targeting cloud service buyers and sellers. It has integrated with platforms like Kava and has forged partnerships with major Cosmos-based projects. Though still smaller than centralized competitors, Akash is positioning itself as a lower-cost, decentralized option for cloud computing. With the rise of AI and Web3 applications, the demand for decentralized compute power could soar, positioning Akash well for future growth.

Adoption Showdown:

While ANKR has a more established presence in Web3, Akash has massive potential as decentralized cloud computing becomes more critical for both traditional and blockchain applications.

🏆In terms of overall adoption, ANKR wins for now, but Akash’s unique positioning in the cloud space gives it huge upside potential.

Growth Potential & Catalyst

ANKR’s Catalysts :

📈 ANKR’s growth is driven by the increasing demand for node infrastructure as blockchain networks expand and DeFi protocols scale. Its liquid staking services add another revenue stream, allowing users to maximize returns while participating in proof-of-stake ecosystems. Partnerships with major chains and an expansion into AI and decentralized data will continue driving demand for ANKR’s services.Akash’s Catalysts :

⚡ Akash has tremendous growth potential as more industries recognize the benefits of decentralized cloud computing. With its cost-effective, decentralized marketplace, Akash is well-positioned to capitalize on the growing demand for AI computing power and cross-chain Web3 applications. Additionally, the Akash Network is expanding into new chains via the Cosmos ecosystem and the upcoming Inter-Blockchain Communication (IBC) protocol.

Growth Showdown:

ANKR has established itself within the blockchain community and has the multi-chain infrastructure to support rapid scaling. However, Akash’s entry into the massive cloud computing market offers far greater upside potential if the trend toward decentralization continues.

🏆Akash wins for long-term growth potential, while ANKR is a more immediate play in the Web3 space.

Conclusion: Who Wins?

In the battle of ANKR vs. Akash Network, the winner depends on what you're looking for:

For Web3 developers and multi-chain infrastructure: ANKR offers a proven and reliable solution with broad partnerships and strong growth in node hosting and staking services.

For decentralized cloud computing and long-term upside: Akash Network stands out, offering unique opportunities in the broader tech ecosystem beyond blockchain, particularly with the rise of AI and cross-chain applications.

🥇 Both projects are crucial to the decentralized future, but Akash may have the larger growth horizon given its broader industry reach. However with Neura, Ankr could have a game-changer product.

3/ Crypto & DeFi News :

🚗Tesla Transfers All Its Bitcoin : Tesla has reportedly transferred 11500 BTC (~$760M) to new wallets. However they seem to not having sold any BTC.

Thought: Markets like to interpret movements, especially from players like Tesla who have been holding BTC for a very long time. The fact that Tesla has transferred all its bitcoin may be due to a number of reasons, perhaps to deposit as a collateral for a loan, or they may just really be planning to sell.

Tesla & Elon Musk are still closely connected to the Crypto Space so their actions are still interesting to follow. Maybe Tesla will accept Bitcoin again as a way of payment in the future?

🥖🍕 France and Italy Plan to Raise Flat Tax : Both France and Italy are moving forward with plans to increase their flat tax, 32% and 42% respectively, on capital gains and cryptocurrency transactions. These hikes aim to generate more revenue from wealthier citizens and crypto traders, as both countries attempt to manage their national debt.

Thought: The increase in Flat Tax in these two European countries follows the current trend of higher taxation of capital issues in all European countries. This may have consequences for investors, who may defer declarations of gains, but also engage in tax optimization, especially in our highly mobile ecosystem. In any case, personally, I think that this kind of dissuasive/anti-crypto policy will have the impact of formally reducing the amount of money raised on crypto-currencies.

💎Vitalik Buterin Proposes Lowering Ethereum Validator Threshold to 1 ETH

Ethereum co-founder Vitalik Buterin has put forward a proposal to lower the validator threshold from 32 ETH to just 1 ETH. The move aims to reduce entry barriers for individual stakers and increase decentralization on the network. With more validators able to join, Ethereum could see a wider distribution of nodes, which would enhance network security and encourage more participation.

Thought: This statement by Vitalik Buterin is really important, in a context of doubt surrounding ethereum's decentralization. These changes will increase scalability, and could put the spotlight back on Ethereum with regard to the various L2s.

This could further democratize staking on Ethereum, attracting a wave of new validators and strengthening network security. If you hold ETH, these updates could also have an impact on staking rewards and network participation, which is definitely worth keeping an eye on 👀

🐵ApeCoin Announces Layer 3 Blockchain: ApeCoin has revealed its Layer 3 solution, ApeChain, built on Arbitrum Orbit in collaboration with LayerZero. This new blockchain will utilize $APE as the GAS token, thanks to the LayerZero Omnichain Fungible Token standard. The announcement has created a buzz in the community, with ApeChain quickly becoming a hub for memecoin trading. Projects like Ape Express, similar to Pump.fun, are already surfacing in the ecosystem.

Thought: The momentum behind memecoins is undeniable, and ApeChain's launch seems to be riding that wave. Memecoins are currently experiencing a resurgence, fueled by communities looking to engage in fast-paced, high-risk trades. The success of ApeChain could further solidify the relevance of memecoins in the market, where traders are keen on speculative opportunities.

🌍Worldcoin Launches Layer 2: World, previously known as Worldcoin, has introduced World Chain, a Layer 2 network built on Ethereum’s OP Stack. The network focuses on verified human users via World ID, granting them prioritized access to block space and free gas allocations while excluding bots. With over 15 million users having verified their identity through iris scans, World Chain aims to drive crypto adoption with a human-centered approach.

Thought: This launch taps into the rising demand for human verification in decentralized networks, particularly to combat bot-driven activity. The emphasis on verified users and free gas allocations could attract more real-world use cases for crypto, making World Chain an intriguing contender in the Layer 2 ecosystem. If successful, this human-focused model might inspire other projects to adopt similar verification mechanisms, potentially leading to more secure and user-friendly decentralized spaces.

4/ Token Valuation Model: Bittensor ($TAO)

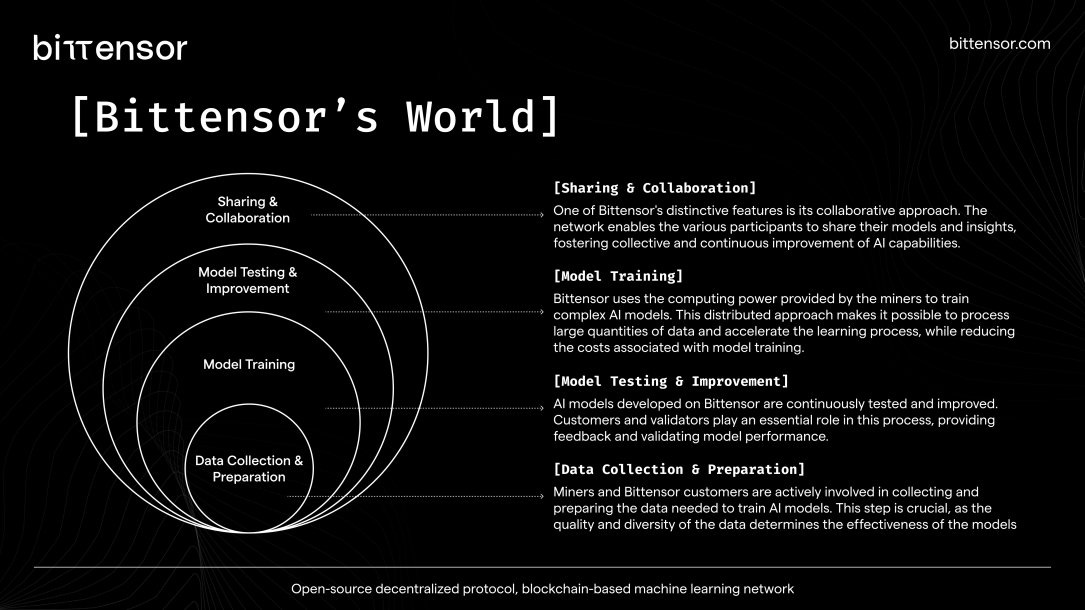

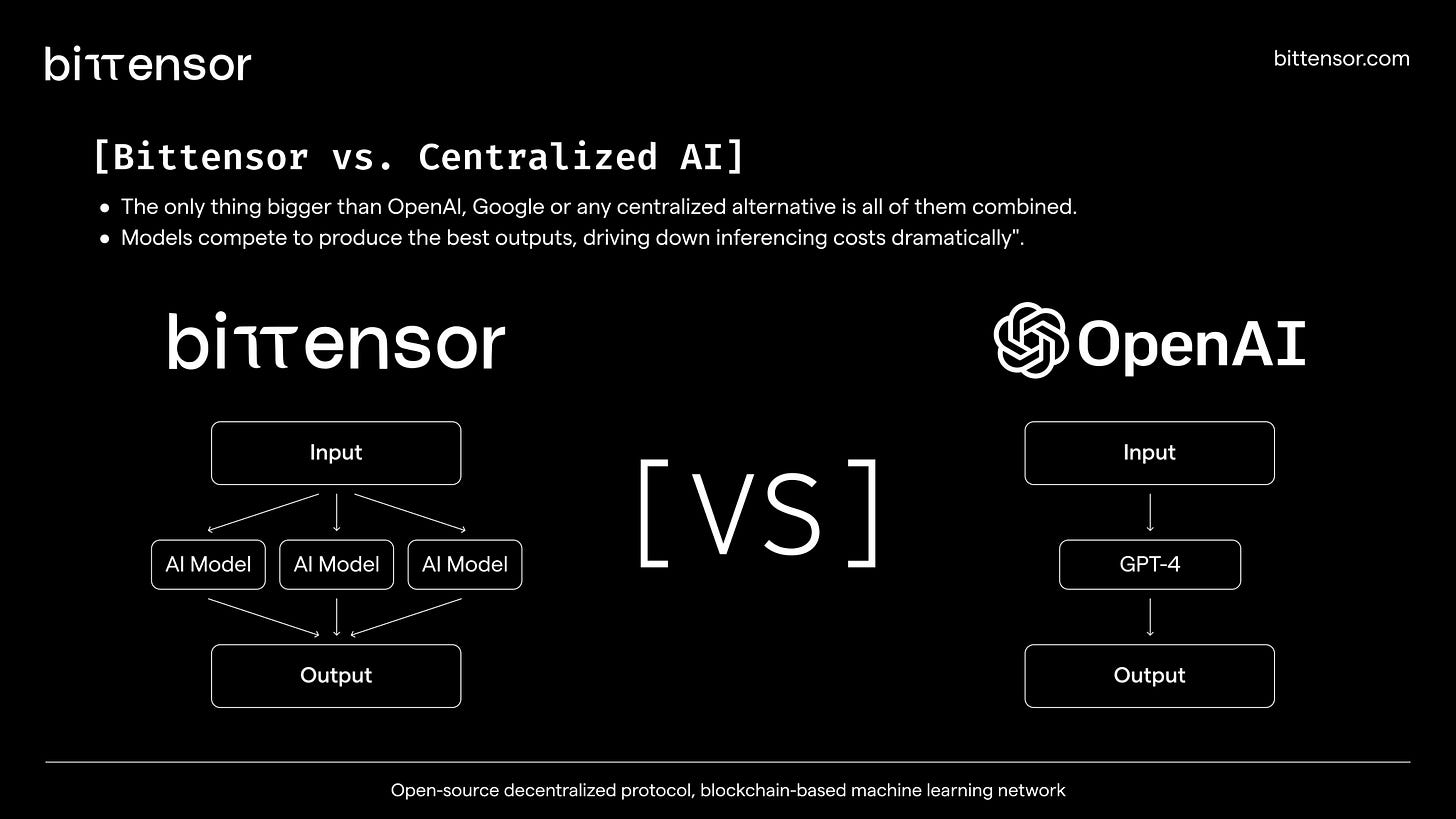

🌐 Bittensor ($TAO) is a decentralized protocol designed to build a global, decentralized AI network. It enables participants to contribute machine learning models and, in return, be rewarded with TAO tokens. Bittensor's value lies in creating an open-source marketplace for AI models, providing infrastructure for decentralized neural networks. As a utility token, TAO is used to incentivize and pay AI model contributors, facilitating the development and distribution of AI knowledge across its network.

On October 17th, 2024, Bittensor took a massive leap forward by integrating Ethereum Virtual Machine (EVM) compatibility into its ecosystem. This new feature allows developers and users to deploy and interact with Ethereum smart contracts directly on Bittensor’s blockchain, opening the door for a range of new decentralized applications (dApps), cross-chain interoperability, and seamless integration with existing Ethereum tools like Metamask.

This is a game changer for the Bittensor ($TAO) ecosystem. EVM compatibility means developers can now utilize the vast Ethereum developer toolkit and user base, while leveraging Bittensor's unique, decentralized machine-learning infrastructure. The move also significantly increases the potential use cases for $TAO tokens, as Ethereum’s decentralized finance (DeFi) services, staking, and other smart contract functionalities can be mirrored or built upon Bittensor’s network.

I'm personally bullish on Bittensor’s expansion with EVM support. This integration not only positions Bittensor to absorb a portion of the Ethereum market but also enhances its appeal to institutional and retail investors.

This newfound utility is why we are diving deep into $TAO's token valuation model today 👇

Revenue Generation

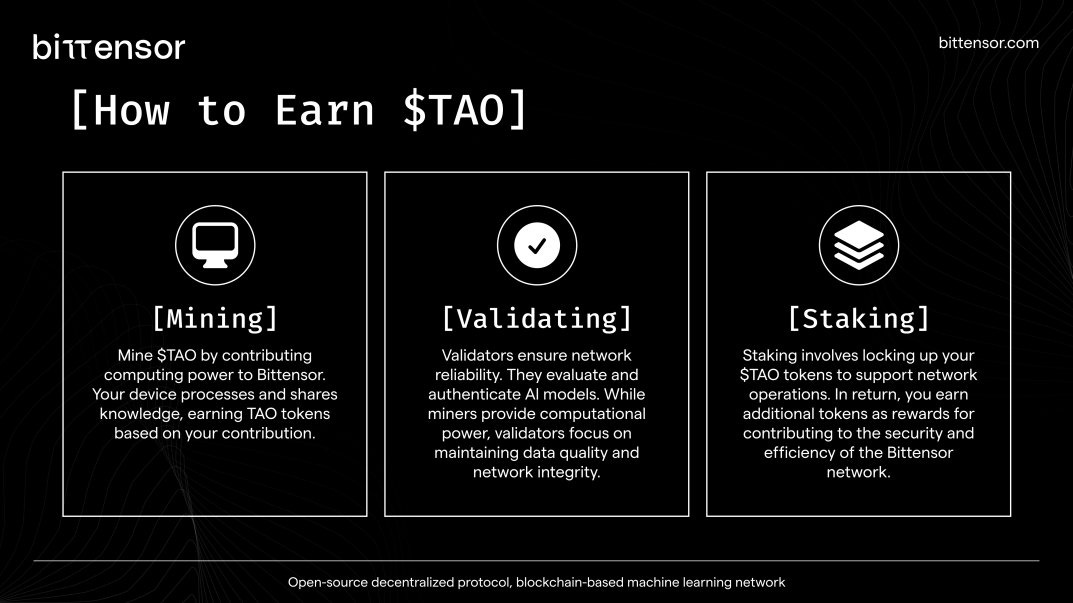

AI Model Training Rewards: Bittensor’s primary revenue driver comes from its decentralized AI marketplace, where users are rewarded in TAO tokens for contributing high-quality machine learning models. The more effective the model is at producing valuable predictions or performing tasks, the more TAO tokens the contributor earns.

Fee Structure: Users or projects that request AI model output pay in TAO tokens. The demand for better AI models drives up competition, which leads to a dynamic marketplace for AI research. This constant demand for high-quality data models enhances the value of TAO tokens.

Growth Potential: As AI continues to expand across industries—from autonomous driving to personalized healthcare—Bittensor’s decentralized marketplace for AI models will grow in utility. The more widespread the adoption of decentralized AI, the higher the demand for TAO tokens to pay contributors.

Utility of TAO

AI Contributor Incentives: TAO tokens serve as the backbone of Bittensor’s decentralized network, used to reward individuals and entities that contribute computational resources or AI models. The network uses these models for a variety of AI tasks, including prediction, language generation, and data processing.

Consensus Mechanism: Bittensor's consensus is based on Proof of Intelligence (PoI), where nodes are ranked based on their contribution to the network's intelligence. The more valuable and useful the AI model, the higher the node ranks, leading to greater TAO rewards. This ensures that TAO is directly tied to the performance and accuracy of AI models on the network.

Staking and Security: Participants can also stake TAO tokens to secure the network, ensuring that only reputable and high-performing models are rewarded. This staking mechanism increases the security of the protocol while reducing circulating supply.

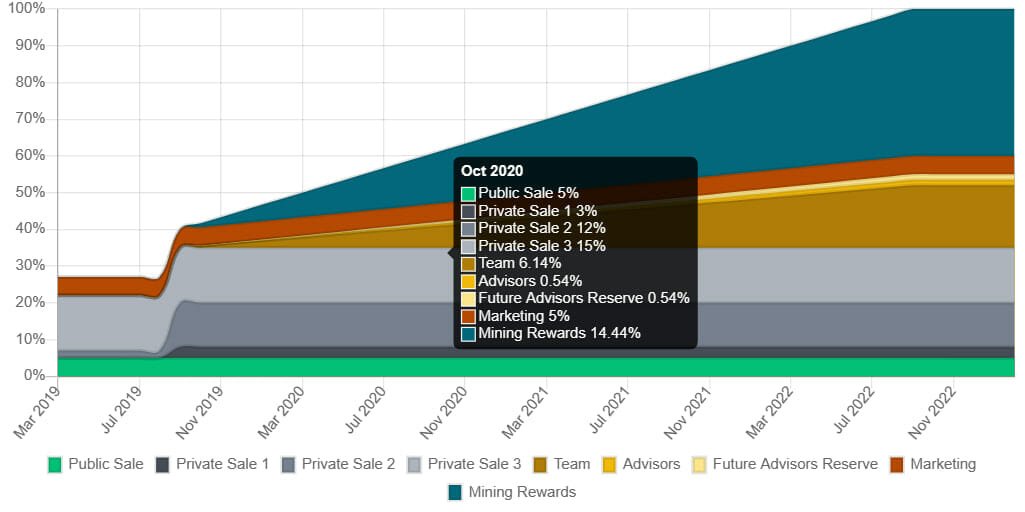

Tokenomics

TAO Supply & Circulation: TAO has a deflationary supply model, with a maximum supply of 21 million tokens. As more developers contribute to Bittensor’s AI network, the demand for TAO tokens increases. TAO’s deflationary nature is further reinforced through its staking mechanism, which locks tokens away from circulation.

Deflationary Pressure: As AI contributors and node operators stake their TAO tokens to participate in Bittensor’s network, the circulating supply reduces, creating upward pressure on the token’s price. Combined with limited supply, this could lead to long-term token scarcity.

Revenue to Token Holders: TAO holders indirectly benefit from the network’s growth and increased usage, as more developers and organizations use TAO tokens to access or contribute to AI models. Although there’s no direct revenue-sharing model for holders, token scarcity and increased demand for TAO will likely drive price appreciation over time.

Growth Catalysts

AI Adoption: The increasing global demand for AI and machine learning is a significant growth driver for Bittensor. As more industries—such as finance, healthcare, and logistics—integrate AI into their operations, decentralized networks like Bittensor will become valuable in providing scalable, low-cost AI infrastructure.

Decentralized AI Models: Traditional AI development is expensive and centralized, with large corporations controlling much of the data. Bittensor flips this model by allowing anyone to contribute and monetize their AI models, democratizing access to AI infrastructure.

Partnerships and Integrations: As Bittensor expands its AI model marketplace, partnerships with major AI-focused projects or enterprises will drive further adoption of TAO tokens. Projects that require sophisticated AI but lack the resources to build models in-house can leverage Bittensor’s decentralized platform, further fueling the need for TAO.

Cross-Industry Utility: From blockchain-based projects to traditional industries, AI applications are vast. Bittensor’s flexibility in serving various sectors creates a potential for exponential growth in TAO demand.

Key Metrics for Valuation

Total Model Contributions: Tracking the number of high-quality AI models contributed to the network will show the growing utility of Bittensor’s platform and increasing demand for TAO tokens.

TAO Staking Levels: Monitoring the amount of TAO being staked helps assess token scarcity and the security of the network. Higher staking rates reduce circulating supply and contribute to price stability or appreciation.

Adoption by AI-Heavy Industries: Industries like healthcare, finance, and robotics will play a key role in TAO's valuation as Bittensor positions itself as a go-to network for decentralized AI model development.

Network Participation Growth: The number of developers and enterprises using the Bittensor network directly impacts TAO demand. A higher participation rate suggests that the platform is becoming more integral to the decentralized AI economy.

Conclusion: Why TAO’s Value Proposition is Strong

Bittensor is pioneering a new model for decentralized AI infrastructure, where the value of the TAO token is intrinsically linked to the quality of machine learning models and the growth of AI applications.

As more industries adopt AI, the need for decentralized, cost-effective solutions like Bittensor will increase, driving up demand for TAO tokens 📈

Final Take: For investors, TAO offers exposure to the rapidly growing AI sector through a decentralized model, If you have faith in this narrative, you must have TAO 0.00%↑ in your bag.

With a deflationary supply and increasing demand driven by AI contributions and staking, TAO’s long-term value is likely to be sustained by a combination of scarcity and utility.

5/ The Future of Crypto: AI as a Transformative Force

As 2024 unfolds, the AI Narrative is emerging as one of the most promising trends in the blockchain space, as we saw in the introduction of this newsletter.

By combining decentralized networks with artificial intelligence, AI has the potential to revolutionize various industries, including finance, marketing, and autonomous systems.

In the context of blockchain, this a step further, by leveraging decentralized platforms to build and run AI models. These models can autonomously perform tasks such as decision-making, content creation, data processing, and optimizing complex operations across various industries. The key innovation here is the decentralization of AI, which distributes control and ownership, allowing anyone to contribute to and benefit from these AI systems.

Why AI is already the Next Big Thing

Decentralized AI Networks: Traditional AI models rely on centralized entities for data storage, model training, and governance. In contrast, Blockchain AI projects distribute these tasks across a decentralized network of nodes, removing intermediaries and reducing vulnerabilities from single points of failure. This enables a permissionless, transparent, and collaborative environment for AI development.

Incentivized Collaboration: Blockchain provides a powerful mechanism for incentivizing participation. Contributors to AI networks, whether they are providing data, training models, or sharing computational resources, are rewarded with crypto tokens. This incentivized structure encourages global collaboration and innovation in AI development.

Cost-Efficient and Scalable: Running large-scale AI models in traditional settings can be costly and require massive computational resources. The narrative AI, supported by decentralized cloud platforms like Akash Network, optimizes the cost of running AI workloads by tapping into a distributed network of computers. This allows AI to scale efficiently and at a lower cost compared to centralized systems.

Autonomous Agents and Machine Learning: Projects like Fetch.ai enable the creation of autonomous agents that use machine learning to optimize processes such as data sharing, transportation logistics, and financial operations. These agents can communicate and transact with each other autonomously, paving the way for machine-to-machine (M2M) economies.

Challenges Ahead

While the potential for AI in the blockchain space is immense, there are still several challenges that need to be addressed.

Data Availability and Quality: AI models require large datasets to train effectively, and ensuring a reliable flow of decentralized data is a challenge. Additionally, the quality of data shared across decentralized platforms needs to be verified to prevent biases and inaccuracies in AI outcomes.

Interoperability: One of the key goals for AI projects is to create systems that are interoperable across different blockchain platforms. While this can unlock new possibilities, achieving seamless communication between various decentralized networks and traditional systems remains an ongoing technical challenge.

Scalability of AI Models: While decentralized platforms can provide computational power for AI models, large-scale AI systems are resource-intensive. Scaling AI models to meet global demand will require further development in optimizing decentralized computation and storage resources.

Regulatory and Ethical Concerns: As with all AI technologies, AI faces ethical challenges, particularly around data privacy, decision-making transparency, and the potential for misuse in creating biased or harmful content. Additionally, navigating global regulatory frameworks for both AI and blockchain technologies will be crucial for broader adoption.

The Future of AI in Crypto

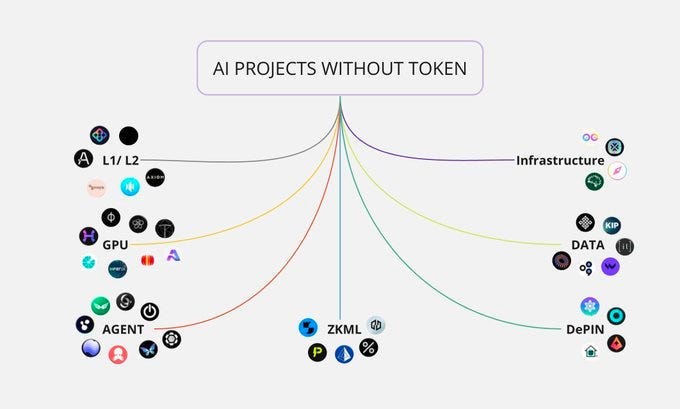

AI is just beginning to tap into its full potential, several projects haven't even released their tokens yet..👀

As decentralized AI networks mature, we’re likely to see their integration into a wide range of industries—from finance and autonomous systems to marketing and gaming. Decentralized AI protocols like Bittensor and Fetch.ai are enabling collaboration on a global scale, creating open and permissionless AI ecosystems where participants are rewarded for contributing data, models, and computational resources.

Looking ahead, we can expect more DeFi applications integrating AI, where AI agents autonomously manage lending protocols, optimize liquidity pools, and automate trading strategies. Additionally, AI-powered oracles from platforms like Near Protocol will likely play a critical role in providing real-time data for smart contracts, enhancing their decision-making capabilities.

Conclusion

The AI Narrative in the crypto space represents a paradigm shift in both AI and blockchain technology. By decentralizing the development, training, and deployment of AI models, many projects are unlocking a future where artificial intelligence is accessible, scalable, and autonomous. As 2024 progresses, the fusion of AI and decentralized networks is set to drive innovation across industries, transforming how we approach automation, decision-making, and intelligent systems.

👀 If you want to check out a new gem for this narrative, you can check Morphware AI. I should write about it soon, and I called it here!

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.