This Week's Newsletter - Case Study on Off The Grid, Main News of the Week, $APE & Zoom on GameFi

Weekly Alpha

Nothing in this edition is an ad, a collaboration or a partnership.

GM Frens,

Happy Halloween! 🎃

Hope you’re all doing well!

As we dive into another week, let’s shift our focus to a topic that’s been stirring up quite a debate lately—blockchain gaming and tokenization.

The gaming industry has always been a playground for innovation, but when it comes to integrating tokens and blockchain technology, the reception from players has been far from enthusiastic. Many gamers see it as a threat to the essence of what makes games fun: skill, strategy, and enjoyment, rather than who has the deepest pockets. The fear that this shift will turn their favorite games into "pay-to-win" experiences is real, and it’s hard to blame them for their skepticism. Microtransactions have already sparked backlash, and for many, tokens just seem like the next step in an already controversial direction.

Yet, despite this resistance, there’s undeniable potential for growth and transformation. Blockchain has the power to reshape how in-game assets are owned, traded, and valued. We're not just talking about cosmetics or skins, but an entirely new ecosystem where players have actual ownership of the items they earn. This opens up a whole new world of possibilities, from creating real economic incentives for playing to allowing players to truly control their in-game assets.

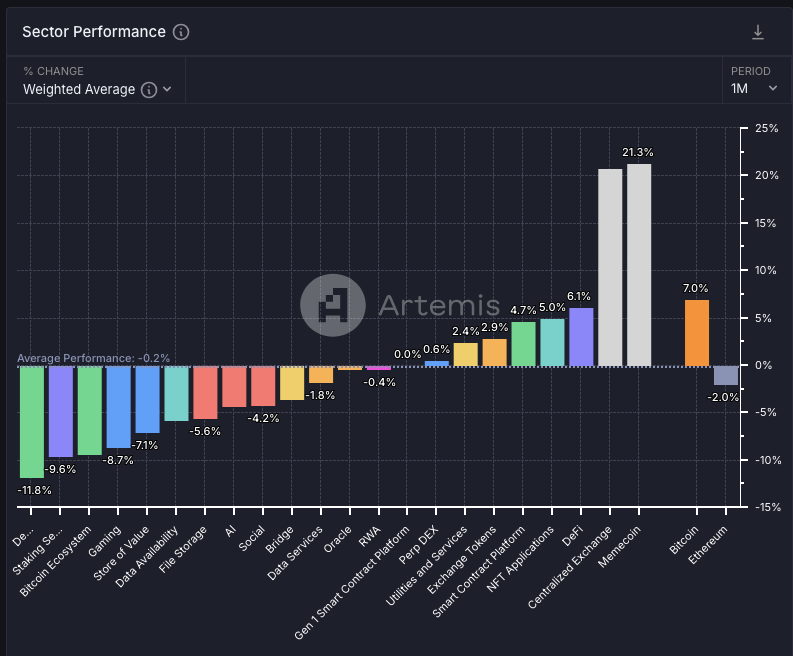

📉 However, the performance of gaming tokens over the past month paints a more cautious picture. According to the data, the gaming sector has seen a -8.7% decline. This places it in line with other underperforming sectors like Social (-4.2%) and Data Availability (-7.1%) and only slightly better than sectors like DeFi (-11,8%) and Bitcoin Ecosystem (-9,6%). This tells us that despite the potential for innovation and ownership, gaming tokens are feeling the broader market pressure—just like many other parts of the crypto ecosystem.

If we dive deeper into specific projects within the gaming sector, we see some interesting trends. Immutable, a key player in blockchain gaming, has suffered a -17.9% monthly drop, while Ronin is down -15.4%, reflecting significant pullbacks even in established projects. However, there are a few shining examples within this space. ApeCoin has surged an impressive 33.8% this month, while Beam is up 17.1%—showing that despite overall bearish conditions, some tokens are still managing to carve out substantial gains.

The third chart breaks down sector performance, and it becomes clear that while many tokens are struggling, only a few are thriving.

The key question, though, is whether the gaming community is ready for this shift—and whether the projects leading the charge can overcome these challenges. Some are paving the way by providing the infrastructure necessary to make blockchain gaming scalable, accessible, and user-friendly. Unlike the games themselves, it’s these underlying technologies that could hold the most promise, as they focus on empowering developers to build engaging and rewarding experiences.

Avalanche, one of the fastest and most scalable blockchains, is also emerging as a critical player in this evolving landscape. It’s quickly becoming the go-to choice for developers looking to build gaming experiences that can handle large-scale user bases without the high costs or congestion issues that have plagued other networks like Ethereum. With projects like "Off the Grid" gaining traction, Avalanche is proving that it has what it takes to become a cornerstone of the future of blockchain gaming.

🤔 So, where does all this leave us?

The narrative around gaming and blockchain is still in its early stages. And while gaming tokens are currently struggling with adoption and market conditions, the long-term potential remains strong. The real test will be whether gamers are willing to embrace these changes—and whether the technology can deliver on its promises without compromising the integrity of games.

In this issue, we’ll dig deeper into the current state of gaming tokens, examining the hurdles they face, the potential they offer, and the key projects to watch. From the resistance among players to the promise of platforms like Avalanche, we’ll cover everything you need to know to stay ahead of this rapidly evolving space.

Before we dive in this Week’s Newsletter

I must remind you that I still curate CT Content on X. Find new projects early. Don’t miss anything.

Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel ☟

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This week, we’re diving into the hottest topics:

A case study on Off The Grid and how it’s shaking up the ecosystem

Key updates in this week’s news

Spotlighting APECOIN

And, of course, a deep dive into GameFi and promising projects

Let’s jump right in! 🏊🏻♂️

1/ Case Study: Off The Grid (OTG) on Avalanche – Reshaping Web3 Gaming with AAA Immersion and Blockchain Mechanics

Off The Grid (OTG), an ambitious AAA battle royale game by Gunzilla Games, is poised to bring high-quality graphics, immersive gameplay, and blockchain integration to the Web3 gaming ecosystem. Set in a dystopian cyberpunk world, OTG uses Avalanche, known for its high transaction speed, scalability, and security, as its blockchain backbone.

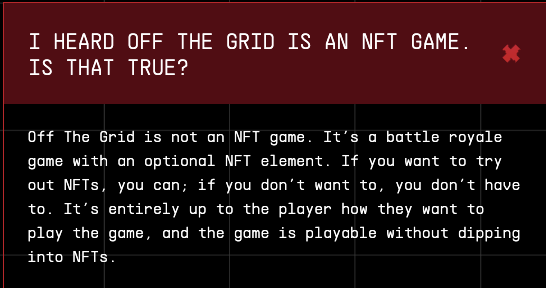

By leveraging Avalanche, OTG aims to enhance player-driven economies, NFT-based ownership, and sustainable token management while addressing common challenges in Web3 gaming: player resistance to tokenization, speculative markets, and the "Pay-to-Win" perception often associated with blockchain-based games.

Why are we talking about this project in particular here?

Off The Grid was among the top played games on Twitch about a week ago, and reached the #1 Free-To-Play game on the Epic Games Store for a few days.

Which were a first for a Web3 game!

Core Innovations and Approach

Decentralized Economy on Avalanche

OTG utilizes Avalanche to power its decentralized economy, which allows players to buy, sell, and trade in-game assets, such as weapons, skins, and territories, all stored as NFTs. Avalanche’s low fees and fast transaction times provide an efficient infrastructure for OTG’s in-game marketplace. However, the platform faces the broader challenge of overcoming traditional gamers’ resistance to blockchain integration, specifically around the fear of Pay-to-Win mechanics and excessive microtransactions.

Avalanche’s efficiency allows OTG to offer a player-driven economy with minimal fees, so gamers can trade without incurring significant costs, making in-game purchases optional rather than obligatory for progression.

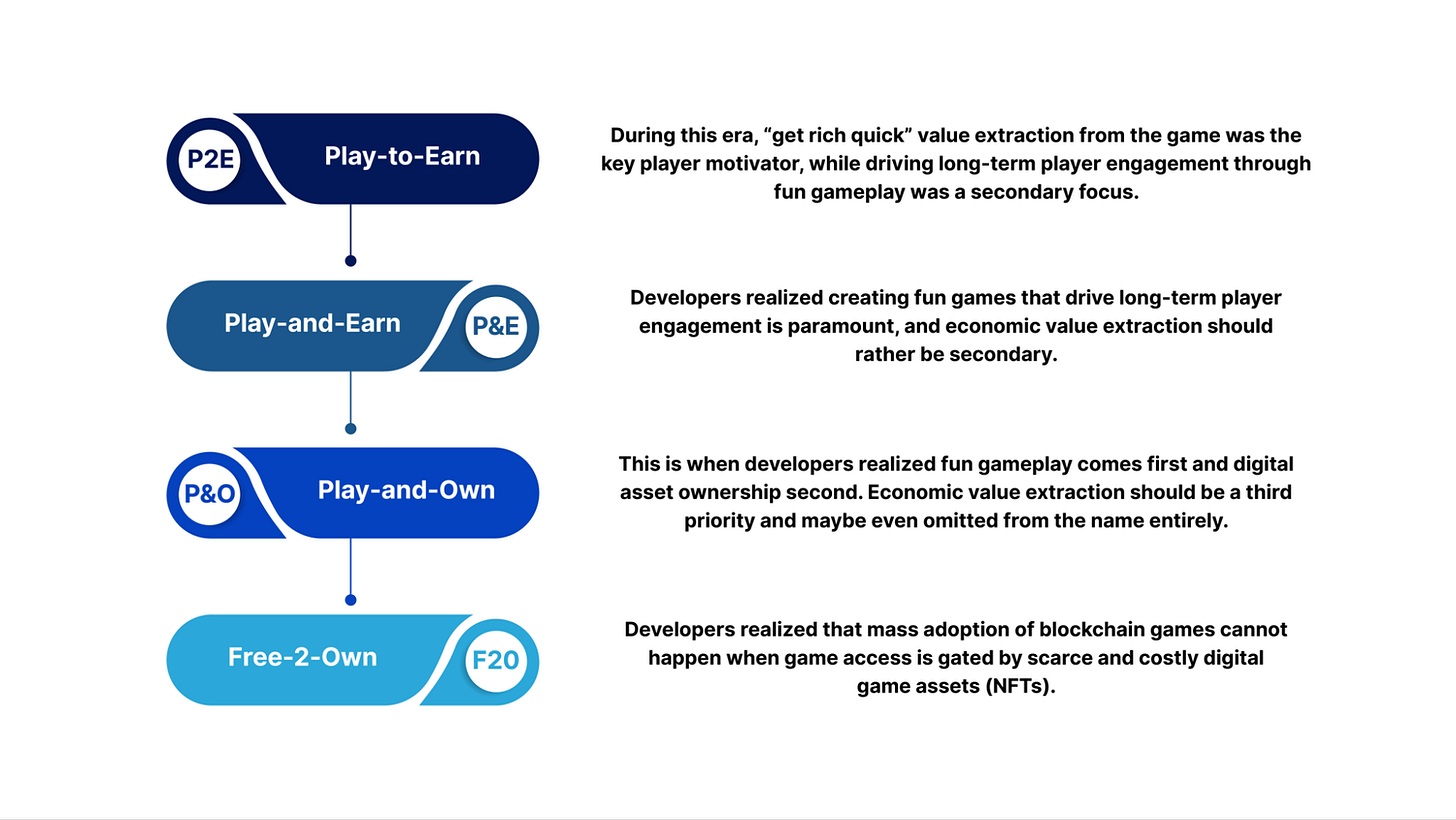

Tackling "Play-to-Earn" with an Immersive Model

While OTG introduces token-based rewards, it intentionally moves away from a Play-to-Earn model, focusing instead on Play-and-Own. On Avalanche, OTG can ensure that NFTs and tokens primarily serve as ways for players to enhance their in-game experience rather than avenues for speculative profits, thus avoiding the risk of gameplay being reduced to a financial transaction.

Players earn tokens primarily through skilled gameplay and achievements rather than farming, aligning the rewards system with player dedication and engagement. By prioritizing these values, OTG addresses the potential risk of deterring players who value the entertainment aspect over the financial one.

Real Utility Over Speculation

A key risk in Web3 gaming is excessive token speculation, often overshadowing the actual game experience. Avalanche’s token standards and secure environment enable OTG to structure its marketplace and token release mechanisms in ways that prioritize utility. OTG aims for a balanced economy where NFTs, tokens, and assets hold real in-game value, enhancing the gaming experience rather than serving as speculative assets.

Avalanche’s capabilities help OTG control token issuance and manage vesting periods, avoiding large sell-offs that could devalue tokens and discourage player confidence.

Challenges and Constraints

Overcoming Pay-to-Win Concerns

OTG’s blockchain-driven economy faces challenges around Pay-to-Win concerns, especially from gamers skeptical of tokenized assets. Leveraging Avalanche’s scalable and low-cost network, OTG implements a fair economy where NFT purchases remain optional and do not directly impact competitive gameplay.

While OTG offers purchasable, customizable items, all skill-based elements remain unaffected by NFTs or tokens, ensuring a fair playing field and addressing the “Pay-to-Win” apprehensions among players.

Mitigating Microtransaction Overuse

With Avalanche’s low transaction fees, OTG minimizes the need for microtransactions to sustain its ecosystem. By focusing on cosmetic and optional enhancements, OTG ensures players can fully experience the game without recurring fees. This approach reassures players who are wary of microtransactions becoming a necessity.

Maintaining Stability Against Token Speculation

Avalanche’s robust infrastructure supports OTG’s strategies to maintain token stability, helping mitigate speculative pressures. The platform’s security and structure allow OTG to cap token supplies and stagger token releases, ensuring that prices remain stable and accessible to long-term players, rather than fluctuating due to speculative short-term holders.

Avalanche and OTG Key Metrics

Marketplace Stats: Within OTG’s Avalanche-based marketplace, approximately 70% of NFTs sold during launch were affordable, with transaction times under a second, underscoring Avalanche’s efficiency. Notably, assets with functional in-game value maintained higher demand, suggesting players are seeking utility over pure speculation.

Token Stability: Avalanche’s ability to process thousands of transactions per second supports OTG’s token stability strategies, creating a secure environment with minimal fees, which keeps the in-game economy sustainable and reliable for both gamers and developers.

Impact on the Web3 Gaming Ecosystem

Avalanche is paving the way for AAA Games in Web3

OTG’s success as a AAA game within the Web3 space is a significant proof of concept. It showcases that blockchain-based games can be developed at a high quality, comparable to mainstream gaming, thus expanding Web3’s appeal beyond crypto enthusiasts to hardcore gamers.

Fostering Economic Ownership in Gaming

By giving players genuine economic control over in-game assets, OTG highlights the ownership potential of Web3 gaming. This shift could inspire other developers to prioritize player-owned economies, creating fairer and more transparent monetization models that benefit players as much as developers.

Bridging Traditional and Web3 Gaming Audiences

OTG’s accessible AAA gameplay acts as a gateway for traditional gamers into the Web3 space. As OTG continues to grow, it could help drive broader adoption by normalizing the blockchain aspects of gaming, making it a model for future hybrid games that aim to bridge these communities.

Conclusion

Off The Grid (OTG) on Avalanche combines blockchain's strengths with the immersive qualities of AAA gaming to deliver a high-quality, player-driven experience.

Avalanche’s infrastructure allows OTG to maintain a decentralized, stable economy while tackling the broader challenges of Web3 gaming: avoiding Pay-to-Win pitfalls, reducing microtransactions, and prioritizing gameplay quality.

We must acknowledge that the hype was short-lived, and the game has already lost many players. This isn't due to it being a Web3 game but likely because the marketing is less aggressive now, and the game is still in early access and under development.

Yet OTG still showed a potential good outcome for Web3 Gaming is possible and that blockchain gaming can merge seamlessly with traditional gaming without compromising on player enjoyment, helping establish a sustainable model for the future of Web3 gaming.

2/ Crypto and Defi News :

🏦 ECB Report on Bitcoin Criticized by Industry Leaders

The recent European Central Bank (ECB) report has attracted criticism, especially from Bitcoin advocates who argue that the ECB’s claim that Bitcoin encourages wealth inequality lacks nuance. The ECB paper suggested Bitcoin serves early adopters disproportionately at the expense of new investors and hinted at regulatory actions that could include restrictions or even a potential ban. Industry leaders countered, asserting that Bitcoin was created in response to inflation and central bank policies, providing a decentralized hedge against fiat currency devaluation.

Thought: This debate signals a growing concern among traditional financial institutions about Bitcoin’s role as a decentralized asset, especially as it gains traction amid economic uncertainty. The ECB’s strong stance may drive further discussion around cryptocurrency regulation, potentially encouraging capital movement to jurisdictions with more favorable crypto policies. As such, Bitcoin’s appeal as a “safe haven” asset against inflation could gain additional momentum, spurred by such high-profile opposition.

🏝 Monero's Privacy in Question by Japanese Authorities

Japanese law enforcement recently succeeded in tracing transactions on Monero, a privacy-focused cryptocurrency, marking a milestone in crypto crime enforcement. The investigation led to the arrests of 18 people who allegedly laundered money through Monero by utilizing stolen credit card data. This case suggests that despite Monero’s focus on privacy, authorities equipped with the right tools are finding ways to pierce its anonymity layers.

Thought: The news about Monero’s transactions being traceable by Japanese authorities brings up a key reality about privacy coins—while they can enhance anonymity, no system is foolproof. Often, privacy can be compromised during on- and off-ramps, such as when moving funds from Monero to fiat currencies. For those investing in or transacting with privacy coins, it’s a reminder to consider how you’re managing your funds end-to-end. While Monero remains a leading privacy option, knowing the full transaction flow is essential for protecting anonymity.

💎 MakerDAO’s Rebranding to Sky Falls Flat

MakerDAO recently rebranded to "Sky," an unexpected move that hasn't been well received by the crypto community, and it coincides with a recent drop in Maker’s MKR token price. This rebranding seems to have created confusion rather than excitement, raising questions about the strategic direction and identity of the organization at a time when stablecoin options are plentiful.

Thought: Rebranding is always a delicate process, especially in crypto, where the user community is highly invested in both the brand and the values behind it. MakerDAO’s switch to "Sky" doesn’t seem to have resonated well with its users or the market, as seen in MKR's price drop. For stablecoin holders looking for a decentralized option, this move has actually increased appeal toward alternatives like Liquity (LUSD), which some see as more stable. It’s a good reminder that changes in identity and direction can impact both brand perception and token stability, so staying informed can help in choosing stable, reliable assets.

🚀 Pump Fun’s Rapid Success on Solana

The platform Pump Fun on Solana has seen remarkable early success, driven by high user engagement and substantial revenue generation. This success speaks to the growing appeal of Solana as a base for emerging platforms, which are proving to be both profitable and scalable. Pump Fun’s rapid monetization and appeal are being compared to established players on Solana’s blockchain.

Thought: Pump Fun’s meteoric rise highlights Solana’s growing ecosystem strength and its ability to support profitable and high-traffic applications. This success taps into the current meme coin craze, as platforms like Pump Fun harness community engagement to create viral growth. For those following Solana, this type of growth shows a profitable trend toward engaging, community-driven platforms with high transaction volume. But while the hype is high, keep an eye on sustainability—short-term profit doesn’t always equate to long-term stability.

💸 Potential Impact of Microsoft’s Investment in Bitcoin

Rumors of Microsoft potentially following in MicroStrategy’s footsteps with a Bitcoin investment have stirred excitement among investors. While still unconfirmed, such a move would signal a major endorsement of Bitcoin from one of the world's largest tech companies, potentially catalyzing similar investments from other corporations.

Thought: A potential Microsoft investment in Bitcoin would be huge, potentially driving more companies to follow suit, similar to MicroStrategy’s influential investments. With the weight of Microsoft’s reputation, Bitcoin could see increased institutional interest as a hedge against inflation. For investors, this underlines Bitcoin’s potential as a value store that’s catching the interest of major corporations. However, regulatory pressure remains a potential barrier, so any moves by Microsoft will likely be gradual and strategically phased.

3/ Token Valuation Model: ApeCoin ($APE) – Understanding Value Drivers in the Bored Ape Ecosystem

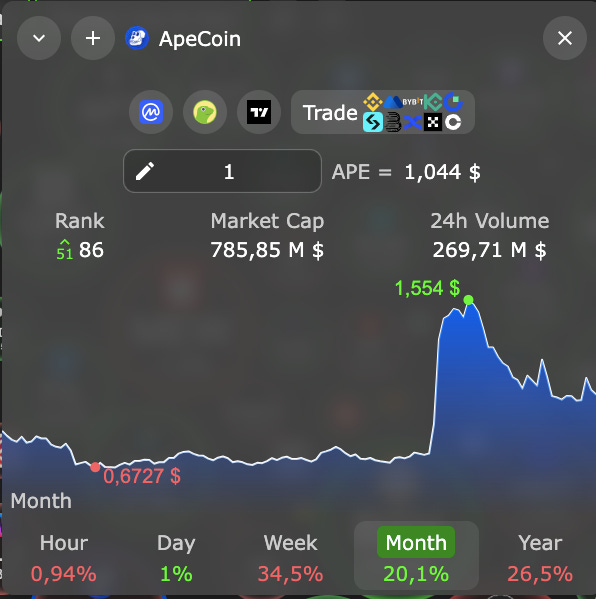

🌐 ApeCoin ($APE), the utility and governance token of the Bored Ape Yacht Club (BAYC) ecosystem, is seeing significant transformation with the recent launch of ApeChain the 21st October 2024.

Built as a layer 3 blockchain leveraging Arbitrum Nitro technology, ApeChain operates within the Arbitrum Orbit networks, bringing advanced scalability and cost efficiencies to the $APE ecosystem. This long-anticipated release enhances $APE’s functionality, particularly with an innovative fee-burn mechanism that introduces deflationary pressure.

ApeChain’s new Timeboost upgrade allows users to pay a priority fee for expedited transactions, with 50% of these fees directed to the DAO and the other half burned, reducing $APE’s circulating supply.

Thus, as transaction volume on ApeChain grows, $APE’s scarcity increases, adding potential upward pressure on its value. Since launch, LayerZero has integrated with ApeChain to facilitate bridging functionalities, and applications like Dookey Dash and the recent Top Trader (a virtual trading simulator) are now live, showcasing the expanding utility of $APE within the Yuga Labs ecosystem.

With rising interest in ApeChain and amid a backdrop of growing open interest in Bitcoin, the potential for ApeChain to renew enthusiasm for $APE is notable. However, after a challenging two years, the sustainability of this momentum remains to be seen. Our model explores the impact of ApeChain's deflationary mechanisms, ecosystem integrations, and expanding use cases on $APE's valuation trajectory, highlighting its evolving role within Web3 gaming and decentralized applications.

This newfound utility is why we are diving deep into Apecoin's token valuation model today 👇

Core Innovations and Approach

Network and Ecosystem Value

User Growth: Valuing $APE is tied closely to the growth and engagement of BAYC holders, Otherdeed NFT holders, and players within Yuga Labs' ecosystem. With exclusive events, metaverse experiences, and ecosystem rewards, increased utility translates into demand for $APE.

Projected Growth in Demand for Metaverse & NFTs: Yuga Labs' Otherside metaverse is a major value driver for $APE, with continued development and adoption driving token demand as users spend on in-world assets and interactions. Modeling $APE’s value involves estimating how much adoption Otherside and related ecosystem assets might capture within the $1 trillion global gaming industry.

Token Utility and Circulation

In-Game Currency: $APE functions as a transactional currency within Otherside, BAYC events, and the wider Yuga ecosystem. Projects or events that offer exclusivity through $APE spending add value. Based on transaction volume within the Otherside metaverse and demand at BAYC community events, the circulation velocity of $APE could provide estimates of long-term value.

Governance: Governance rights, although hard to quantify directly, contribute indirectly by reinforcing community loyalty. Increased governance participation (through APE staking, proposals, and community votes) enhances its perception as a community-driven asset, which is crucial to its valuation stability.

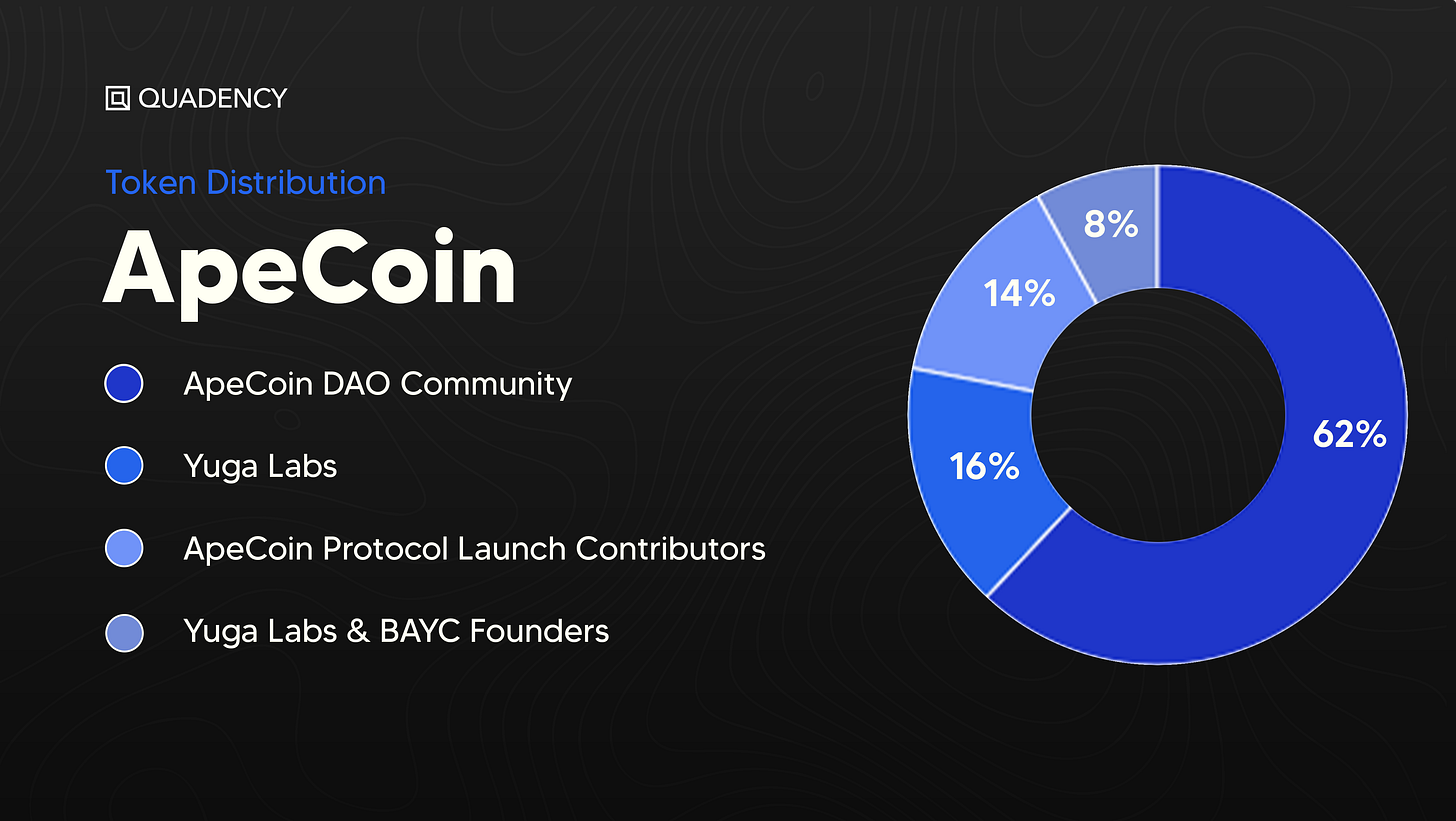

Supply & Tokenomics

Total Supply: $APE’s capped supply of 1 billion tokens supports scarcity-driven value; however, a structured vesting schedule for early holders and continuous release to the community through staking and rewards needs monitoring to assess market pressure.

Vesting & Unlock Schedule: Yuga Labs has a multi-year vesting schedule that gradually releases tokens to the founders, Yuga Labs, and early investors. Token unlock events can affect valuation by increasing circulating supply, often causing short-term sell pressure. An effective model considers these events to mitigate valuation fluctuations due to oversupply risks.

Market Demand and Liquidity

Liquidity & Exchange Listings: $APE benefits from high liquidity and broad exchange listings on platforms like Binance, Coinbase, and Uniswap. This broad access reduces slippage and transaction costs, making it easier for both retail and institutional investors to access $APE.

Speculative Demand: As a highly visible token within the NFT and gaming markets, $APE’s valuation is partially tied to market sentiment around Web3, NFT speculation, and Yuga Labs developments. Consequently, valuation should account for cyclical demand influenced by macro trends.

Risks & Considerations

NFT Market Sentiment: Given its roots in BAYC, $APE's valuation is vulnerable to market perception around NFTs. A drop in NFT market interest could reduce $APE’s appeal despite metaverse growth.

Token Unlocks: Scheduled token unlocks present short-term volatility. Investors might anticipate sell-offs during vesting periods, temporarily impacting $APE's price.

Metaverse Adoption Uncertainty: Otherside’s success is still speculative. If adoption underperforms, $APE may face demand shortfalls, impacting valuation forecasts.

Conclusion

⏳ With the launch of ApeChain, $APE is poised to strengthen its role as the utility token within Yuga Labs’ extensive Web3 ecosystem.

By powering transactions, enhancing user incentives, and expanding $APE’s utility within a seamless, scalable network, ApeChain promises new value streams for $APE holders and the broader BAYC community.

Combining these developments with $APE’s existing utility in the Otherside metaverse, governance functionality, and high liquidity, our valuation model suggests that $APE is positioned as a key player in the evolution of tokenized gaming and NFT experiences.

4/ Future Trends in Gaming Narrative: Opportunities, Challenges, & Promising Projects

🎮 Introduction to the Gaming Narrative

The Gaming Narrative – also known as GameFi – represents the fusion of video games, decentralized finance (DeFi), and blockchain technology. This innovative model allows for the creation of in-game economic ecosystems where players can earn tokens or non-fungible tokens (NFTs) through gameplay, creating a new, immersive "play-to-earn" (P2E) experience.

Here’s how narrative gaming stands out:

Blockchain-backed ownership: Players gain true ownership of digital assets through blockchain technology, ensuring traceability and authenticity. This mitigates fraud and enhances the security of virtual assets.

In-game assets as NFTs: Virtual items, such as skins, gear, or characters, can exist as NFTs, creating a market where players can trade these assets or use them as currency.

Economic incentives: Narrative gaming introduces financial rewards to incentivize participation, blending traditional gaming with real-world value creation. Players can earn while they play, blurring the line between entertainment and earning.

However, while Gamefi has generated considerable hype, its long-term sustainability faces scrutiny and challenges, particularly in gaining mainstream acceptance and balancing gameplay quality with economic incentives.

Criticisms of the Current Model

As promising as the concept sounds, narrative gaming has met resistance from gamers, who are skeptical of the introduction of token-based economies in traditional gaming experiences. Here are the primary criticisms:

Gamer Resistance

Perception of "Pay-to-Win" (P2W): Many players view tokenization as a potential gateway to a "pay-to-win" model, where wealth trumps skill. This can create frustration among traditional gamers who value skill and fair competition.

Fear of Exploitative Microtransactions: With tokenized economies, there’s a concern that games might introduce more microtransactions, turning games into platforms for monetization at the expense of genuine player experience.

Tokenization Questions

Economic Viability: Does the tokenization of games truly add value? Are players willing to pay more for completed games or resell unlocked assets? Additionally, will game publishers embrace secondary markets that may cut into their profits?

Speculation and Hype

Limited Real Adoption: Despite the hype, the actual trading volume of game tokens remains low. Much of the investment in narrative gaming is driven by speculative enthusiasm rather than true user engagement.

Venture Capital's Role: The current GameFi trend, heavily funded by venture capital, is driven by the expectation of rapid gains, exemplified by the success of projects like Axie Infinity. However, this profit-oriented mindset may not align with creating sustainable, enjoyable games.

Opportunities and Promising Projects

The future of narrative gaming may lie in focusing less on individual games and more on infrastructure and tools that can enable and enhance the ecosystem.

Below, we’ll explore some of the promising projects and platforms in this sector and their unique strengths and weaknesses.

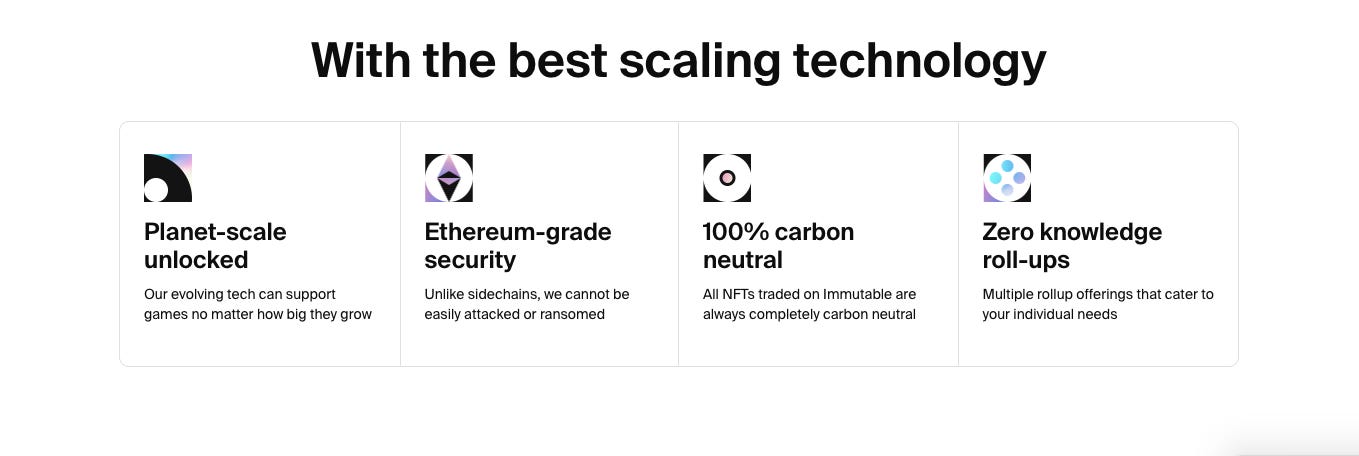

🥇 IMX (Immutable X): The Established Leader

Description: Immutable X (IMX) is a Layer 2 scaling solution for Ethereum, designed to improve transaction speed and scalability for NFT and gaming applications.

Strengths:

Adoption by Major Games: IMX has gained traction among notable games like "Off the Grid," a battle royale game built on the Avalanche blockchain.

Market Resilience: IMX has shown resilience against market downturns, performing better than many tokens in the gaming sector.

Potential for Growth: Unlike other tokens launched in 2021, IMX has yet to reach its all-time high (ATH), leaving room for further growth.

Weaknesses:

Selling Pressure from Vesting: Vesting periods for investors add selling pressure on the IMX token, potentially limiting short-term gains.

Dependence on Ethereum: IMX’s success is tied to Ethereum’s growth and scalability, as it operates as a Layer 2 solution on Ethereum’s blockchain.

⚔️ Ronin: The Legacy of Axie Infinity

Description: Ronin is an Ethereum sidechain developed by Sky Mavis, the team behind Axie Infinity. It’s tailored specifically to host blockchain-based games.

Strengths:

Strong Brand and Experience: Ronin benefits from the reputation and experience of Sky Mavis, which has successfully built a widely recognized GameFi title.

Solid Funding: Sky Mavis has secured substantial funding, providing Ronin with the resources needed to expand and attract new games.

Weaknesses:

Game Quality: Games currently available on Ronin are considered low-quality by many, limiting the platform's appeal to players.

Investor Interest: Since the market’s last low in August 2023, Ronin’s performance has lagged behind competitors like IMX, suggesting waning investor interest.

💡 BEAM: The Open-Source Solution on Avalanche

Description: BEAM is an open-source project on the Avalanche blockchain, developed to facilitate the integration of blockchain technology in gaming. It’s managed by the Merit Circle DAO.

Strengths:

Token Performance: BEAM saw notable growth during this year.

Active Community Support: Managed by the Merit Circle DAO, BEAM benefits from decentralized governance and a dedicated community.

Supportive Ecosystem: BEAM’s home on Avalanche provides a dynamic environment focused on narrative gaming.

Weaknesses:

Competition: BEAM faces significant competition from other gaming infrastructure projects, requiring constant innovation.

Market Speculation: BEAM’s success heavily depends on the arrival of popular games, making it vulnerable to market speculation and shifts in GameFi interest.

Key Factors and Future Directions

While IMX, Ronin, and BEAM each represent compelling projects, they come with different risk profiles and growth potentials. Here’s a comparative summary:

IMX stands as the established leader with significant adoption but faces short-term selling pressures from token vesting.

Ronin benefits from the brand recognition of Sky Mavis but must prove itself by attracting high-quality games to the platform.

BEAM is a promising open-source project on Avalanche, but its future depends on its ability to differentiate from competitors and attract flagship games.

The Gamefi industry is evolving rapidly, and the success of these projects will depend on factors such as gamer adoption, the quality of developed games, and overall trends in the cryptocurrency market.

Conclusion: Reimagining GameFi for the Future

To succeed, GameFi needs to transcend speculation and directly address gamers' concerns:

Rethinking Play-to-Earn: The current play-to-earn model may not be sustainable, as it risks compromising gameplay quality by prioritizing profit over experience.

Seamless Blockchain Integration: Blockchain technology should enhance, not detract from, gameplay. Integrating blockchain features in a way that feels natural and invisible to players will be key to gaining widespread adoption.

Opportunities for Infrastructure: Rather than focusing on individual games, investors may find more resilient opportunities in infrastructure projects like IMX and BEAM, which provide foundational support for GameFi and can evolve with the ecosystem.

Despite its challenges, the potential of GameFi remains promising.

By focusing on infrastructure and addressing player concerns, the industry could reshape itself into a viable, long-term segment within both gaming and blockchain ecosystems. Projects that successfully combine high-quality gameplay with transparent, fair economic incentives will likely lead the way in making GameFi a mainstream success.

Of course we’re only thinking long term here. A short run is definitely possible this cycle and the simplicity of the Narrative could lead to tremendous gains as it did the previous cycle. Don’t get caught bag holding!

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.

excellent report on cryptogaming/ GameFi!

the crypto gaming vertical has been an underperformer for years!

a combination of stale game play, P2W mechanics, parasitic tokenomics, & not enough blockchain abstraction can explain a lot of the underperformance of cryptogaming.

check our RNG Gaming on Solana, its a telegram gaming bot where ppl play Russian roulette for fun and high stakes