This Week's Newsletter - Case Study on Babylon, Main News of the Week, $KAS & Zoom on BTCfi

Weekly Alpha

Nothing in this edition is an ad, a collaboration or a partnership.

GM Frens,

Hope you’re all doing as well as the market ! 💹

We dive into another week, packed with hot news, and the focus today is on BTC 👀

With Trump’s victory, $BTC reached its ATH, which brings even more debates on Bitcoin’s potential as a decentralized, alternative reserve currency.

Let's quickly go back to basics.

Crypto Advocates argue that Bitcoin’s decentralized nature, free from control by any single authority like the U.S. Federal Reserve, offers a solution to the risks of corruption and mismanagement that often plague centralized financial systems.

Its fixed supply of 21 million coins also presents a contrast to the dollar, which can be printed at will, making Bitcoin a potential hedge against inflation and a store of value. Additionally, the peer-to-peer structure of Bitcoin transactions reduces dependency on intermediaries, which could lower transaction costs and improve financial access in underserved regions. Its resistance to surveillance and censorship, also appeals to those seeking financial autonomy and privacy.

Despite these arguments, Bitcoin faces notable challenges as a mainstream currency. Its fixed supply limits the monetary flexibility needed during economic crises, when central banks traditionally adjust money supply to stabilize economies. Bitcoin’s price volatility further complicates its use in everyday transactions, as its value can fluctuate rapidly, creating uncertainty for businesses and consumers. Furthermore, the dollar’s status as a global reserve currency gives the U.S. significant geopolitical influence, which is unlikely to relinquish in favor of an asset it cannot control.

The Bitcoin ecosystem has seen a decline of 7,9% over the past month. Meanwhile, $BTC is still at + 19,3%, showing that BTC ecosystem can be uncorrelated to BTC performance.

The current environment reflects a complex interplay of factors, with Bitcoin facing both short-term challenges and longer-term institutional interest, positioning it as a sought-after store of value despite recent price fluctuations.

On their part, Altcoins have struggled to keep pace, underperforming Bitcoin as investor sentiment leans more conservative. This shift in market dynamics is driven partly by institutional investors who are increasingly drawn to Bitcoin over altcoins due to its perception as a “safer” option amidst uncertain market conditions. The increased accumulation of Bitcoin by institutions like MicroStrategy further supports this narrative, reinforcing Bitcoin’s dominance as a preferred asset. For altcoins, this trend has meant greater difficulty in recovering during market corrections, emphasizing the need for a careful approach when considering exposure to smaller assets.

In the Ethereum ecosystem, innovation continues to thrive. Solutions like Starknet, a layer-2 scaling project, are achieving new highs in transaction capacity, highlighting the potential of Ethereum’s scalability upgrades. The emergence of “blob” storage techniques is another promising development that could drive Ether (ETH) burn rates higher, potentially influencing its supply dynamics positively as layer-2 usage increases. Vitalik Buterin’s recent writings about Ethereum’s future touch on ambitious goals like quantum resistance and account abstraction, showing Ethereum’s commitment to advancing its technological base to meet the demands of tomorrow.

Overall the data highlights that the broader institutional adoption of Bitcoin remains on an upward trajectory. While the Bitcoin ecosystem has experienced short-term losses, institutional interest in Bitcoin as a digital reserve asset suggests a long-term confidence in its value proposition. With companies and financial institutions increasingly adopting Bitcoin, the digital asset is gaining traction as a serious alternative to traditional stores of value.

Amidst these fluctuations, U.S. elections has added a layer of complexity, increasing volatility across the crypto market, even if crypto has become a key argument within the campaign for both candidates.

Given this climate, investors would do well to stay informed, carefully evaluating developments in Bitcoin and Ethereum, as these assets remain pivotal within the broader digital asset space.

In navigating these shifts, a balanced, well-researched strategy will be key to managing the uncertainties that lie ahead in the crypto market.

But if you ask me, sentiment is super bullish as we’re entering the next phase of the Bull Market. NFA.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.

Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel ☟

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This week, we’re diving into the hottest topics:

A case study on Babylon, the future of BTC stacking.

Key updates in this week’s news.

Spotlighting $KAS, a BTC competitor.

And, of course, a deep dive into BTCFi.

Let’s jump right in! 🏊🏻♂️

1/ Case Study: Babylon – Expanding Bitcoin’s Utility in Decentralized Finance

Babylon is introducing a new paradigm in decentralized finance (DeFi) by enabling Bitcoin holders to stake their BTC in a way that secures emerging Proof of Stake (PoS) networks without sacrificing custody or decentralization. By creating its own blockchain, Babylon allows Bitcoin to directly participate in the DeFi ecosystem, transforming BTC into a more dynamic asset for earning yield and enhancing network security.

Key Highlights

Blockchain Developed by Babylon: A dedicated blockchain, built with the Cosmos SDK, provides a robust infrastructure that allows seamless integration and interoperability across multiple chains, ensuring scalability and user experience.

$1.3 Billion TVL on TestNet: Babylon’s TestNet phase demonstrated rapid traction, with over 1,000 BTC staked within the first hour, highlighting high user confidence and demand.

Airdrop and Staking Rewards: Babylon incentivizes early adopters through a points-based system and potential airdrop rewards, creating a community-driven engagement model for BTC holders.

The Innovation: Bringing Bitcoin to Staking

Babylon’s core innovation is its ability to leverage Bitcoin’s proof-of-work security within PoS ecosystems. By building a unique blockchain layer, Babylon enables BTC to act as a securing asset for PoS chains in a trustless and decentralized manner. This approach preserves Bitcoin’s security principles while introducing it to the growing world of DeFi and staking.

How It Works:

Shared Security Model: Babylon’s blockchain links Bitcoin’s proof-of-work with PoS chains, using a mechanism that allows validators to “borrow” security from BTC stakers.

Slashing Mechanism: Babylon employs a robust validator slashing protocol that penalizes malicious actors, enhancing security without the need for centralized intermediaries.

Staking Mechanics

Babylon allows BTC holders to stake their assets securely through smart contracts while still keeping full custody. Babylon’s blockchain infrastructure uses time-stamping to streamline the staking process and reduce unstaking wait times significantly.

Key Features of Babylon Staking:

Time-Stamping: Reduces typical unstaking delays, giving users quicker access to their funds without the long lock-up periods found in many traditional staking protocols.

Liquid Staking Options: Partnerships with platforms like Ankr enable BTC holders to stake while retaining liquidity. This allows for a “dual-earning” model, where users can leverage their staked BTC in DeFi applications, amplifying their yield.

Airdrop and Rewards Program

To attract early adopters, Babylon has introduced a points-based system that rewards users based on their staking activity. Points earned through staking will be eligible for potential airdrops, incentivizing participation and helping users benefit from Babylon’s growth.

Details on Babylon’s Airdrop Program:

Points Accumulation: Users earn points for staking BTC, which may be converted into future token airdrops.

Early Adoption Incentives: Babylon’s approach to community engagement creates strong incentives for BTC holders to join early, participate actively, and benefit from network growth.

Technical Architecture

Babylon’s blockchain leverages the Cosmos SDK, providing interoperability with over 90 blockchains. This modular approach allows Babylon to scale efficiently while interacting with various ecosystems beyond Bitcoin, including other PoS blockchains.

Key Technical Attributes:

Cosmos SDK: Enables Babylon to connect seamlessly with existing blockchain networks, ensuring scalability and cross-chain operability.

Chain Abstraction: Babylon abstracts the underlying blockchain complexity, allowing users to access DeFi features with Bitcoin without needing to understand the specific mechanics of each chain.

Adoption and Community Response

Babylon’s phased rollout has demonstrated significant community interest and demand for Bitcoin staking. Each phase has seen impressive participation, underscoring both the appeal of Babylon’s model and the community’s trust in its unique approach.

Phase 1 Mainnet Launch: On August 22, Babylon officially launched Phase 1 of its mainnet, allowing users to stake their Bitcoin through verified finality providers. Due to high demand, Babylon capped the first staking round (Phase 1 - Cap 1) at 1,000 BTC, and this limit was filled in just one hour. This rapid uptake illustrates the strong demand and trust within the community, as BTC holders rush to capture Babylon’s attractive staking rewards.

Phase 1 - Cap 2: Following the initial cap, Babylon lifted staking restrictions temporarily, providing participants with a 1.5-hour window (approximately 10 Bitcoin block confirmations) to stake without limits. During this brief period, 22,891 BTC was staked, underscoring the community’s eagerness to participate in Babylon’s staking model and demonstrating the scale of interest in a protocol that connects Bitcoin’s security to DeFi.

Phase 2 - Testing New Infrastructure: The next phase will test Babylon’s blockchain infrastructure designed to inherit Bitcoin’s security through its proprietary Timestamping Protocol. This system allows Babylon to sync with PoS chains, enabling these chains to access Bitcoin’s security directly. Phase 2 will be a key milestone, establishing Babylon’s cross-chain functionality and laying the groundwork for broader security applications.

Phase 3 - Security Marketplace: The final phase of Babylon’s roadmap will establish a decentralized security marketplace, where staked Bitcoin can secure multiple PoS blockchains at once. This means BTC holders will be able to earn rewards from several chains simultaneously, positioning Bitcoin as a dynamic, yield-generating asset within DeFi. Babylon’s marketplace will allow PoS chains to enhance their security while BTC holders benefit from multi-chain rewards, potentially creating a new standard for cross-chain security.

Community Metrics:

Mainnet Launch Demand: Phase 1 - Cap 1 saw the 1,000 BTC staking cap filled in just one hour.

Phase 1 - Cap 2 Participation: 22,891 BTC was staked in just 1.5 hours, reflecting strong interest and community engagement.

TestNet Success: $1.3 billion in TVL on TestNet reflects high levels of trust and adoption.

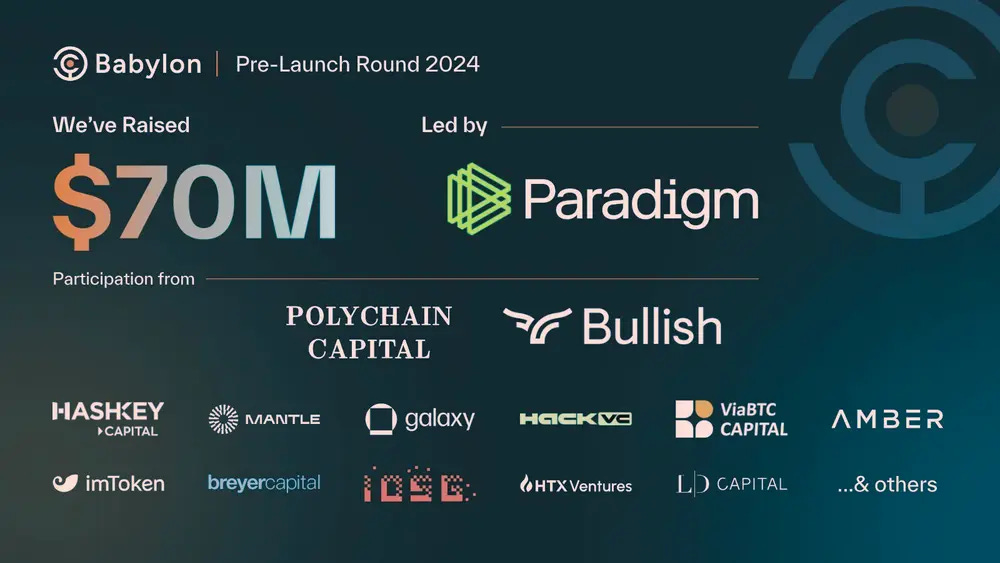

VC Backing: Babylon is supported by major investors, including Paradigm and Binance Labs, who bring resources and credibility to support its scaling efforts.

Risks and Challenges

While Babylon’s early adoption metrics are promising, several challenges lie ahead for its growth and sustainability. Here are some key obstacles Babylon faces:

Earning Trust from the Bitcoin Community: Despite Babylon’s alignment with Satoshi’s concept of shared security, many in the Bitcoin community—particularly maximalists—are skeptical of Proof of Stake. Convincing these users to lock up their BTC on Babylon may take time, as BTC holders traditionally value decentralization and minimal trust in third-party protocols.

Behavioral Differences: BTC holders typically don’t move their coins as frequently as Ethereum users, who are active in DeFi. This difference in behavior may affect Babylon’s growth trajectory, especially when targeting BTC holders who are new to staking and DeFi.

Growing Competition: Ethereum’s restaking solutions, like those from Eigenlayer, are also targeting Bitcoin holders by offering yield on Bitcoin derivatives. This could draw liquidity away from Babylon, as some users may prefer earning yield on BTC through familiar Ethereum-based solutions.

Market Fragmentation Risks: As restaking solutions and cross-chain staking platforms increase, Babylon faces the challenge of standing out in a saturated market. With Bitcoin holders’ inherent reluctance toward altcoin projects, Babylon must prove it offers unique value and security benefits.

Technical Hurdles: Babylon’s mainnet is still in its early stages, and technical challenges remain, such as bridging Bitcoin and ensuring data availability. Overcoming these issues will be crucial to maintaining momentum as the platform matures.

Post-Airdrop Activity: While the airdrop program has driven initial interest, Babylon must sustain this engagement once the airdrop concludes. The question remains whether Babylon can maintain its growth without relying heavily on incentives

Strategic Roadmap and Future Plans

Looking ahead, Babylon plans to enhance its cross-chain capabilities and further integrate with DeFi protocols. By expanding liquidity options and supporting new ecosystems, Babylon aims to become a go-to platform for BTC holders interested in staking without compromising on security or control.

Roadmap Highlights:

Extended Interoperability: Babylon’s future includes expanding its integrations to support popular networks like Polygon and Arbitrum.

Enhanced Staking Solutions: Babylon will continue developing user-centric features like liquid staking and simplified unstaking, optimizing the platform for widespread adoption.

Conclusion

Babylon’s unique blockchain and staking model bring a new era of utility to Bitcoin. With a strong technical foundation, user-focused incentives, and seamless cross-chain integrations, Babylon is pioneering a space where BTC holders can securely earn yield and contribute to the security of PoS ecosystems.

However, with competition from Ethereum-based solutions, technical challenges, and skepticism from the Bitcoin community, Babylon will need to navigate these hurdles to maintain its growth. For Bitcoin investors looking to actively participate in DeFi while maintaining control, Babylon offers a promising, though challenging, path forward.

2/ Crypto and DeFi News :

🚀 Trump’s Win Boosts Markets; Bitcoin Hits Record High of $75,000

Donald Trump has won the U.S. presidential election, securing over 270 electoral votes and giving the Republican Party control of both the White House and Congress. His victory, marked by a decisive lead in key swing states like Florida, signals a return to Trump’s previous policies and potentially introduces a fresh perspective on both domestic and foreign issues. The markets responded positively, with the Nasdaq and S&P 500 rising and Bitcoin reaching a new all-time high of $75,000. This reaction likely reflects investor optimism about a pro-crypto administration. Additionally, Trump’s “America First” economic policy could have a substantial impact on European trade and China.

Thought:Trump's election is reshaping expectations across sectors. With both the presidency and Congress, he has the legislative power to enact policies that may further boost crypto and traditional financial markets. Investors seem to welcome his stance on cryptocurrency, as Bitcoin’s record high suggests a belief in a favorable regulatory climate ahead. However, Trump’s foreign policy promises, such as the Ukraine resolution, may be more challenging to achieve quickly, signaling potential shifts in global alliances. For Europe, Trump’s trade policies could reduce access to the U.S. market, adding economic strain, while China's position may grow more complex with a potential increase in U.S. tariffs. All eyes will be on how these changes evolve and what they mean for global trade and financial stability.

🗡 Altcoin Market Faces a Potential "Grand Finale of Reckoning"

Crypto analyst Benjamin Cowen warned of a potential final sell-off for altcoins, signaling a pattern seen in previous cycles where altcoins hit bottom before staging a recovery. He expects this to play out by December or early January 2025, referencing the last “altcoin reckoning” in 2019, which preceded the 2020-2021 bull run. Cowen also highlighted that altcoin/Bitcoin pairs have been in decline for years, indicating that this cycle mirrors past altcoin cycles

Thought: This one could be a real shake-up for altcoins, especially since it’s being compared to the last big crash of 2019. If Bitcoin dominance keeps rising, it’s likely that most altcoins will struggle to find their footing in the short term. But if this “reckoning” does clear out weaker projects, we might see a stronger and more valuable altcoin market heading into 2025. It’s rough for holders right now, but if history repeats, it could lead to a healthier market down the line.

💸 Nvidia Becomes World’s Most Valuable Company, Surpassing Apple

Nvidia recently surpassed Apple as the world’s most valuable company, achieving a market cap of $3.43 trillion. This achievement follows a nearly 3% stock increase and Nvidia’s strong positioning in the AI market. The company’s value has nearly tripled over the past year, supported by growing demand for its GPUs and AI technology. Apple’s recent slump in performance contributed to Nvidia’s rise (CompaniesMarketCap).

Thought: Nvidia’s surge is a massive validation for AI and GPU-driven tech. AI is driving so much growth right now that even Apple, a staple at the top, has been overtaken. Nvidia’s focus on accelerated computing and generative AI has clearly resonated with investors, and it makes sense that they’re becoming the front-runner. The AI boom isn’t slowing down, and Nvidia’s success will likely push other tech giants to increase their investment in AI—ultimately good for both AI advancement and the crypto sector that often relies on GPU technology.

💎 OpenAI Explores Transition to a For-Profit Structure

OpenAI, the developer of ChatGPT, is reportedly in talks with California and Delaware regulators to restructure as a for-profit entity. This shift could make the company more attractive to investors, though it faces regulatory hurdles. The move raises questions about whether OpenAI will maintain its founding mission of developing beneficial AI products amid increased pressure to commercialize. Previously structured as a capped-profit entity, OpenAI may find itself at odds with nonprofit goals and investor expectations

Thought: OpenAI’s for-profit restructuring is big news, especially in tech circles. Their original goal was to keep AI safe and beneficial, but turning a profit has to be balanced with those intentions. It’s a move that could bring in more funds and drive faster innovation, but there’s always a risk that the mission could get diluted. Other tech companies might follow OpenAI’s lead if this transition proves successful, and it could lead to a lot more AI competition. It’s exciting but definitely has some people watching closely to see how it unfolds.

🐹 Hamster Kombat’s User Base Drops 86% While Paws Mini App Surges

Hamster Kombat, once a top mini-game on Telegram with around 300 million users, has suffered an 86% decline to 41 million active monthly users. Contributing factors include political backlash and competition, particularly from the recently launched Paws app, which rapidly gained over 20 million users in its first eight days. This shift was also reflected in Hamster Kombat’s token, HMSTR, which dropped by 70% since its peak on September 26

Thought: Hamster Kombat’s sharp decline shows just how fickle the GameFi and mini-app market can be. Users are quick to move on if something new and shiny comes along—like Paws did here. This kind of volatility highlights the intense competition in the GameFi space, where new players can disrupt established ones almost overnight. It’s a good reminder that projects in this space need continuous updates and real user value to keep their momentum going.

3/ Kaspa (KAS) : Token Valuation Model

Kaspa positions itself as a “peer-to-peer electronic payment system” staying true to Satoshi Nakamoto’s vision while solving Bitcoin’s scalability limitations. Leveraging advanced technology like GHOSTDAG and planned upgrades, Kaspa aims to offer faster and more efficient transactions without compromising on decentralization and security.

Valuation Parameters and Key Metrics

To evaluate Kaspa’s potential value, we will consider multiple metrics, including technology, scalability, supply structure, adoption challenges, and future upgrades.

A. Technological Innovation

GHOSTDAG Protocol: Unlike Bitcoin’s linear blockchain, Kaspa employs a Directed Acyclic Graph (DAG) structure, enabling parallel block processing and increased speed. With Kaspa producing one block per second (compared to Bitcoin’s 10 minutes), transaction throughput is significantly higher.

Orphan-less Blocks: The DAG structure eliminates orphan blocks, which occur in Bitcoin when miners validate blocks simultaneously, improving efficiency.

MEV Resistance: Kaspa’s DAG architecture protects against Miner Extractable Value (MEV) exploitation, reducing transaction manipulation risks and promoting fairer network participation.

Scalability and Decentralization Potential

Crescendo Upgrade (2025): Projected to increase block speed to 10 blocks per second, bringing Kaspa’s transaction capacity to 3,000–4,000 TPS—rivaling Visa and Solana.

DAGKnight (2025–2026): Aiming to reach 100 blocks per second, this upgrade would further enhance scalability, positioning Kaspa as one of the most efficient PoW networks.

Pruning System (Mining in Logarithmic Space): Unlike Bitcoin’s full blockchain storage requirement, Kaspa’s pruning mechanism keeps essential data only, enabling nodes to sync in 20–60 minutes and lowering storage requirements, encouraging decentralization.

Supply and Tokenomics

Supply Distribution: 86% of KAS supply is already in circulation, which is beneficial for decentralization and reduces inflationary pressures. However, questions remain on miner incentives as emissions phase out by 2037.

Proof-of-Work Sustainability: While PoW aligns with Bitcoin’s ethos, environmental concerns could impact Kaspa’s appeal, particularly in an increasingly eco-conscious industry.

Kaspa Ecosystem Growth and Adoption Challenges

A. Ecosystem Expansion

KRC-20 Token Standard: Similar to Ethereum’s ERC-20, KRC-20 enables the creation and exchange of tokens on the Kaspa network. The rapid adoption (over 6,000 tokens created within 24 hours of launch) signals strong community interest.

Smart Contracts and ZK-Rollups: Kaspa is exploring smart contract functionality, potentially via ZK-Rollups, which would enhance its DeFi and dApp potential, expanding its use cases.

Kaspa Ecosystem Foundation: An independent, community-funded entity supporting development, adding a layer of legitimacy and resource allocation to the project.

B. Challenges to Widespread Adoption

Exchange Listings: Limited presence on major exchanges like Binance and Coinbase limits liquidity and accessibility for mainstream users.

Use Case Development: While technically advanced, Kaspa needs concrete use cases to differentiate itself and prove its utility beyond fast transactions.

Node Count: Kaspa’s network currently has only 273 public nodes, significantly fewer than Bitcoin (4,400) and Ethereum. To improve decentralization, Kaspa must simplify node operation and grow its network of active participants.

Growth Scenarios and Potential Valuation

We can assess Kaspa’s valuation through three growth scenarios: Conservative, Moderate, and Optimistic, based on market adoption, technological progress, and ecosystem development.

A. Conservative Scenario

Assumptions: Slow adoption, limited exchange listings, and no significant additional use cases beyond transactions. Crescendo and DAGKnight upgrades face delays.

Expected Market Cap: $500 million to $1 billion, as a niche payment solution with limited mainstream traction.

B. Moderate Scenario

Assumptions: Moderate adoption, with gradual exchange listings and some DeFi integration through smart contracts. Crescendo is implemented by 2025, bringing substantial network improvements.

Expected Market Cap: $1–3 billion, reflecting Kaspa’s appeal as a fast and efficient Bitcoin alternative with moderate adoption in the DeFi ecosystem.

C. Optimistic Scenario

Assumptions: Widespread adoption, with listings on major exchanges and successful implementation of smart contracts and ZK-Rollups, making Kaspa a central figure in BTC alternatives. DAGKnight upgrade accelerates Kaspa’s transaction capabilities to a highly competitive level.

Expected Market Cap: $5–10 billion or higher, as Kaspa could rival leading scalable networks like Solana or newer PoW blockchains.

Competitive Positioning vs. Bitcoin

Kaspa’s ambition to surpass Bitcoin in scalability and efficiency is bold, yet it faces stiff competition and the challenge of convincing the market that it’s a viable alternative. Bitcoin's established network effects, brand, and liquidity give it a considerable edge, but Kaspa’s technical superiority and future roadmap position it as a formidable competitor if it can overcome adoption and liquidity barriers.

Conclusion: A Potential Disruptor with High Reward and High Risk

Kaspa represents a promising, technologically advanced alternative to Bitcoin. Its innovative DAG structure, ambitious scalability upgrades, and dedicated community make it a project worth watching. However, the path to mainstream adoption is fraught with challenges, from securing exchange listings to building out a robust ecosystem of use cases.

While its current valuation may not reflect its potential, Kaspa’s long-term value will depend on its ability to execute its roadmap, achieve broader adoption, and maintain a secure, decentralized network. If successful, Kaspa could redefine what’s possible in PoW blockchain technology and become a compelling option for those seeking the next generation of digital gold.

4/ Future Trends in BTCFi: Opportunities, Challenges, and Institutional Impact

Introduction to BTCFi

BTCFi is an emerging sector that combines Bitcoin (BTC) with decentralized finance (DeFi) elements, enabling holders to put their Bitcoin to work beyond simple holding or trading. At its core, BTCFi aims to provide financial products, such as lending, staking, and liquidity provision, to Bitcoin holders. This innovation is creating new ways for Bitcoin holders to generate yield and interact with decentralized protocols.

Key characteristics of BTCFi include:

Restaking and Staking: BTCFi allows Bitcoin holders to "stake" or "restake" their assets on DeFi platforms. This involves locking up Bitcoin as collateral or in yield-generating mechanisms that reward holders with additional BTC or other tokens.

Cross-Chain Bridging: Some BTCFi projects bridge Bitcoin with other blockchain networks, such as Ethereum or Layer 2 solutions, to leverage the broader DeFi ecosystem while using Bitcoin as collateral.

Decentralized Lending: BTCFi protocols offer lending solutions, allowing Bitcoin holders to borrow against their assets without liquidating their BTC, adding liquidity to the market.

BTCFi is still a young concept, but it offers a new way to bring utility and liquidity to Bitcoin, which has traditionally been seen solely as a "store of value" asset. However, BTCFi faces unique challenges and risks, especially as it intersects with the inherently decentralized, permissionless nature of Bitcoin.

Current Limitations of BTCFi

While BTCFi has significant potential, several key limitations prevent it from reaching widespread adoption:

Security Concerns

Risks of Cross-Chain Bridges: Bridging Bitcoin to other networks can introduce security vulnerabilities. Bridges are often targeted by hackers, and if a bridge is compromised, users’ BTC can be at risk.

Smart Contract Risk: BTCFi protocols that rely on smart contracts expose Bitcoin holders to the risks associated with smart contract bugs and exploits. Given the value stored in BTC, any flaw in the smart contracts could lead to substantial losses.

Complexity and Accessibility

User Experience: BTCFi is still complex for the average Bitcoin holder to navigate, especially when compared to traditional Bitcoin wallets or exchanges.

Liquidity Challenges: The BTCFi ecosystem is still limited in liquidity, meaning that BTCFi products often have higher slippage and fewer trading pairs, which can limit their effectiveness and profitability for users.

Regulatory Scrutiny

Regulatory Uncertainty: BTCFi, as a combination of Bitcoin and DeFi, attracts additional regulatory attention. Governments are increasingly interested in regulating Bitcoin and DeFi separately, but BTCFi presents unique challenges for policymakers.

Custodial and Compliance Concerns: Custody of BTC in a decentralized protocol raises questions about compliance, taxation, and reporting, especially as regulatory agencies become more stringent.

Opportunities and Promising BTCFi Projects

As the BTCFi ecosystem evolves, some platforms are emerging as early leaders.

Let’s look at some of the most promising projects (Outside of Babylon, that we already studied):

Stacks (STX): Bringing Smart Contracts to Bitcoin

Description: Stacks is a Layer 1 blockchain designed to enable smart contracts on Bitcoin, unlocking DeFi functionalities for BTC without altering the Bitcoin blockchain.

Strengths:

Native BTC Integration: Stacks uses Bitcoin as its base layer, providing DeFi capabilities without moving BTC off the main chain.

Strong Developer Ecosystem: Stacks has built a robust community of developers creating applications like decentralized exchanges (DEXs), lending protocols, and NFTs specifically for BTC holders.

Weaknesses:

Market Penetration: While promising, Stacks has yet to achieve widespread adoption among Bitcoin holders.

Dependence on Bitcoin’s Scalability: Stacks relies on Bitcoin’s base layer, meaning it can face scalability issues if Bitcoin experiences congestion.

BadgerDAO: DeFi for Bitcoin on Ethereum

Description: BadgerDAO is a DeFi platform on Ethereum that provides tools and infrastructure for BTC holders to access DeFi opportunities, including yield farming and lending.

Strengths:

Cross-Chain Integration: BadgerDAO bridges Bitcoin with Ethereum, making it accessible within the broader Ethereum DeFi ecosystem.

Community Governance: BadgerDAO is a decentralized, community-driven project, which ensures that its development aligns with users' interests.

Weaknesses:

Bridge Risk: BadgerDAO depends on bridges to bring Bitcoin onto Ethereum, which poses potential security risks.

Regulatory Exposure: As a cross-chain solution, BadgerDAO faces scrutiny from regulators, which may impact its operations or functionality in certain jurisdictions.

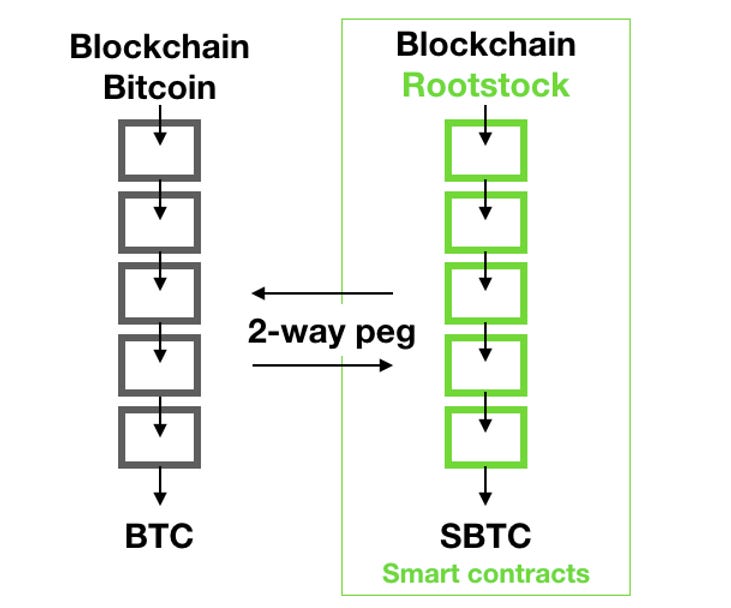

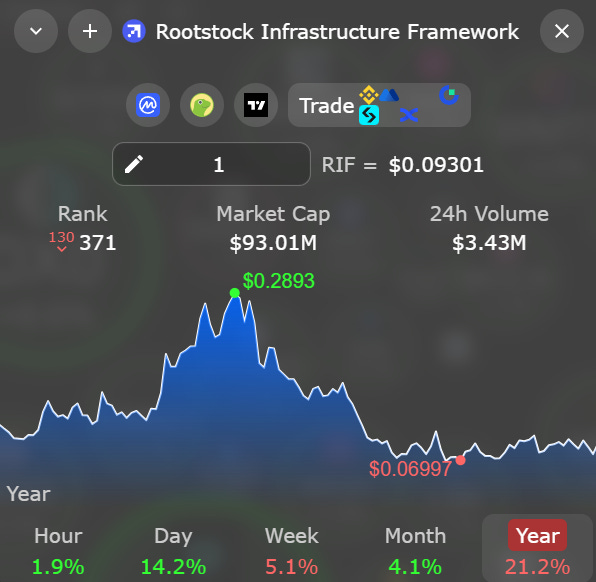

Sovereign Finance: Bitcoin-Native DeFi on Rootstock

Description: Sovereign Finance is a DeFi platform on Rootstock (RSK), a Bitcoin sidechain. Sovereign enables Bitcoin holders to participate in lending, borrowing, and trading without leaving the Bitcoin network.

Strengths:

Bitcoin Security Model: Sovereign operates on RSK, a Bitcoin sidechain, which means it benefits from Bitcoin’s security.

Decentralized Lending: Sovereign offers lending and borrowing services directly to Bitcoin holders, creating new financial opportunities.

Weaknesses:

Limited Ecosystem: Sovereign’s reach is currently limited, as it only serves BTC holders and operates on a less popular sidechain.

Low Liquidity: Since BTCFi is still in its early stages, Sovereign’s liquidity is relatively low, which can limit the efficacy of its services.

Institutional Influence and Impact on BTC ( and so BTCfi): The Case of MicroStrategy

MicroStrategy, a publicly traded company, has become one of the most influential institutional investors in Bitcoin, with a bold strategy that has significant implications for the BTCFi ecosystem and Bitcoin’s price volatility. Below is a detailed summary of MicroStrategy's approach and its impact on BTCFi:

MicroStrategy’s Bold Shift to Bitcoin

Background: Founded in 1998, MicroStrategy initially gained prominence during the dot-com boom but faced significant setbacks due to an accounting error. This experience marked CEO Michael Saylor, who later turned to Bitcoin as an alternative asset after initially dismissing it. In 2020, he led MicroStrategy in a massive acquisition of Bitcoin, betting on its potential as a hedge against inflation and a store of value.

Leveraging Complex Financial Strategies

Debt-Financed Bitcoin Purchases: MicroStrategy has financed its BTC acquisitions through sophisticated mechanisms, including debt and convertible bond issuance. This allows it to raise capital while offering investors exposure to Bitcoin’s price appreciation via MicroStrategy stock, effectively creating a leveraged bet on BTC.

MicroStrategy as an Indirect Investment Vehicle for Bitcoin

Public Appeal: MicroStrategy stock now serves as a proxy for Bitcoin exposure, attracting investors who seek BTC exposure without the challenges of directly holding cryptocurrency. This has driven up the stock price, further entrenching the company’s BTC-focused strategy.

Risks and Potential Consequences

Bitcoin Price Dependence: The sustainability of MicroStrategy's approach hinges on Bitcoin’s price trajectory. A significant BTC downturn could strain MicroStrategy’s solvency, potentially forcing asset sales and exerting additional selling pressure on the Bitcoin market.

The 2121 Plan: In October 2024, Michael Saylor announced the ambitious "2121 Plan," which aims to raise $42 billion to acquire more Bitcoin. While this highlights Saylor's confidence, it intensifies the risks, as MicroStrategy's future is inextricably tied to Bitcoin's price.

Conclusion: BTCFi’s Future and Institutional Impact

BTCFi has the potential to revolutionize Bitcoin's role by introducing DeFi elements that bring utility and yield to Bitcoin holders. However, as seen in the case of MicroStrategy, institutional influence plays a significant role in BTCFi’s growth and volatility.

BTCFi offers unique opportunities for BTC holders to generate yield, but its future will depend on a combination of technical innovation, increased accessibility, and institutional dynamics. The success of BTCFi will ultimately rely on balancing decentralized principles with sustainable financial practices, and it may need to adapt quickly to the growing presence and influence of institutions like MicroStrategy.

Whether this institutional interest will drive BTCFi forward or lead to increased market risks remains to be seen, but it undeniably places Bitcoin at a critical juncture in the Defi landscape.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.