This Week's Newsletter - Case Study on Base, Main News of the Week, $STRK & Zoom on ETH L2

Weekly Alpha

This edition is available as an AI-generated Podcast. Try it, you’ll be surprised! ⭡

Nothing in this edition is an ad, a collaboration or a partnership.

GM Frens,

I hope your day is as filled as your bags 👜

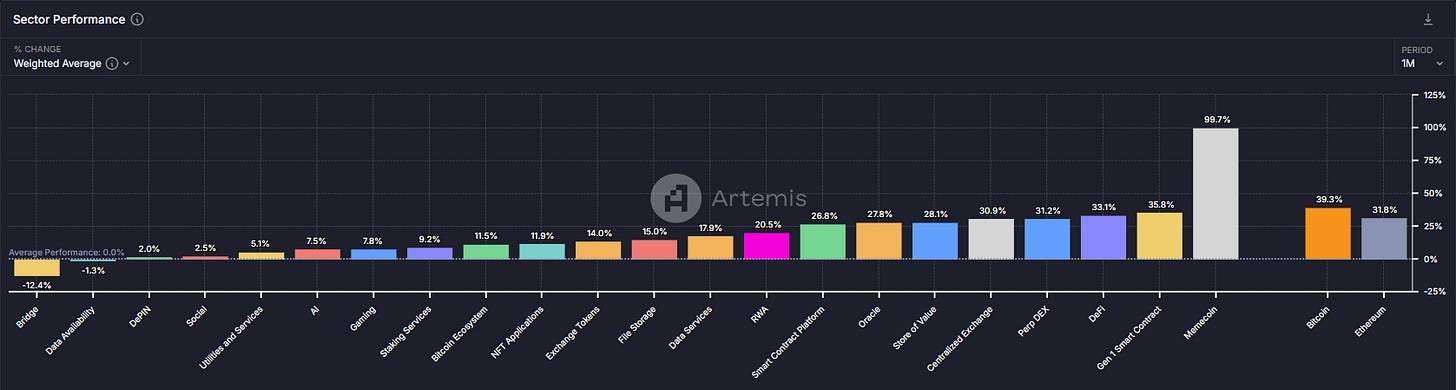

Is it already Altcoin season ?

We’re in a Bull Run, at least for Bitcoin.

But Ethereum is starting to catch up, capturing attention with impressive growth—even outperforming Bitcoin a few days ago.

$ETH just surpassed the Bank of America in Market Cap, highlighting the momentum building around Ethereum.

In this emerging landscape, Ethereum finds itself uniquely positioned, navigating a middle ground between Bitcoin and Solana. While Bitcoin is increasingly the darling of institutions and governments, and Solana attracts retail users and developers with its high-speed network, Ethereum stands out as the primary choice for scalable, decentralized applications. But it also faces a challenging balancing act: maintaining its own identity while competing with Solana’s developer-friendly appeal and Bitcoin’s institutional allure.

Layer 2 (L2) solutions are the focal point of Ethereum's growth story, despite some concerns that they might fragment the ecosystem. These L2s—such as rollups like StarkNet, Optimism, and Arbitrum—are essential in scaling Ethereum, making transactions faster and cheaper by bundling them before settling on the main blockchain. StarkNet, for example, recently demonstrated its potential by reaching an impressive 857 transactions per second in a stress test. This proves not only the scalability but also the resilience of Ethereum’s L2 architecture, setting a new benchmark for what’s possible on the network.

One particularly promising development is the move toward decentralizing sequencers. StarkNet, for instance, plans to decentralize its sequencers using a variation of Tendermint, adding a layer of censorship resistance and network security.

Sequencers play an essential role in optimizing and ordering transactions on Layer2s.

Tendermint basically is a way to use a consensus that helps validators (network participants) to agree on transactions quickly.

Vitalik Buterin himself has voiced his expectations here, emphasizing that by 2025, only Layer 2 solutions that meet rigorous security standards (at least "Stage One" security) will be acknowledged as robust by the Ethereum community.

📊 And if we look at recent performance metrics, Ethereum’s strength in the past month is clear, almost as shining as Bitcoin, showing that investor confidence is shifting.

This growth isn’t just about numbers; it underscores the rising adoption and potential of Ethereum’s Layer 2s, as well as fresh developments in the “blob” market. As rollup data storage demand increases, rollups must burn Ether to secure transactions, introducing a potentially deflationary effect that could positively influence ETH’s price long-term.

Institutional interest in Ethereum ETFs still lags behind Bitcoin ETFs, leaving considerable room for growth and further adoption.

The Layer 2 landscape, meanwhile, faces its own challenges. Fragmented liquidity and some lackluster token launches have stirred some skepticism. Nevertheless, excitement around Layer 2 rollups and their capacity to enhance Ethereum’s infrastructure remains high.

So, where does this leave us? As Ethereum heads deeper into the bull cycle, the ecosystem’s focus is shifting toward enhancing scalability, decentralization, and security, all while fostering greater adoption. Layer 2 solutions are at the forefront of this journey, helping Ethereum not only keep pace but also set the standard in blockchain innovation.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.

Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel ☟

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

In this week’s issue, we’re diving deep into the state of Ethereum’s Layer 2 landscape, exploring:

A case study on Base and its role in Layer 2 adoption.

Main news of the week.

A spotlight on $STARKNET.

Insights on Ethereum, with a focus on his Layer 2 solutions, the challenges they face, and what this means for the broader crypto landscape.

Let’s dive in and explore how Ethereum is setting the pace in this new phase of growth!

1/ Case Study: Base – A Deeper Analysis of Performance, Strategy, and Future Potential

Base’s Rapid Growth and Standout Metrics in the Layer 2 Landscape

Base has seen swift growth among layer 2 blockchains, achieving a Total Value Locked (TVL) of $2.5 billion within a year, positioning itself close to Arbitrum. This growth underscores Base’s scalable infrastructure and its capacity to meet demand.

Beyond TVL, Base also captures 55% to 60% of weekly active addresses in the Layer2 space, indicating a strong user base. Platforms like Grow the Pie rank Base at the top for transaction volume and active addresses, reinforcing its competitive edge.

Innovative Business Model: “Dropshipping” Blockspace to Drive Profits

Base’s economic model charges elevated transaction fees while utilizing cost-efficient Ethereum storage through data blobs. This approach has allowed Base to generate significant revenue, peaking at $3-4 million per day. Current profits remain robust at $500,000 to $1 million daily, highlighting the model’s sustainability.

Coinbase: An Influential Backer Fueling Base’s Ascent

Coinbase’s backing has been instrumental to Base’s rise. Resurgent trading volumes, nearing 2021 levels, amplify Coinbase’s ecosystem influence, enhancing Base’s reach. Coinbase’s regulatory efforts, including CEO Brian Armstrong’s policy advocacy, lend credibility to Base as a compliant Layer 2 option.

Base’s Vision: Enabling Innovation, User Empowerment, and Economic Freedom

Base’s mission, driven by Coinbase, is rooted in innovation and accessibility, aiming to:

Facilitate institutional adoption by bridging traditional finance with blockchain.

Enable users to engage in decentralized apps and new economic models.

Expand crypto payments, fostering financial inclusivity.

These pillars support a cohesive vision for democratized blockchain use.

Onboarding Strategies: Building a Base Ecosystem

To attract users, Base employs several strategies:

Base Names establish unique on-chain identities.

Coinbase Wallet Integration offers a smooth entry point.

Strategic Partnerships, like with the NBA’s Golden State Warriors, broaden reach.

Global Outreach through events in Latin America and Africa.

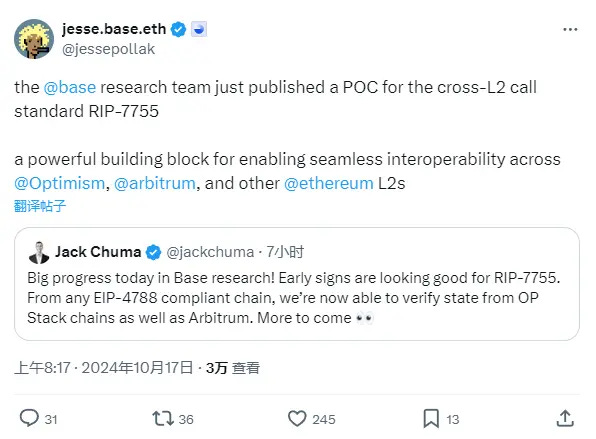

Technological Advancements and Focus on Decentralization

Base’s technical focus includes:

Fraud-proof mechanisms to enhance transparency.

Decentralization through additional verification methods.

Interoperability improvements like RIP 7755 for seamless layer 2 interactions.

Streamlined User Experience: Smart Wallet and Magic Spend

Base enhances usability through:

Smart Wallets with biometric security for ease of use.

Magic Spend for direct spending from Coinbase balances, facilitating crypto adoption.

These tools reduce onboarding friction, appealing to new users.

Fostering AI Innovation and Autonomous Agents on Base

Base fosters AI by supporting:

Based Agents, a tool for AI-powered interactions.

AI Projects like Virtuals, showcasing the platform’s flexibility.

Farcaster, a decentralized social network, ideal for autonomous agent interactions.

These initiatives align Base with blockchain and AI integration.

DeFi Opportunities: A Thriving Ecosystem

Base has seen significant DeFi growth:

cbETH drives liquidity and user interest.

Stablecoin Dominance led by USDC highlights DeFi potential.

DeFi protocols like Aerodrome and Moonwell offer lending and investment options.

Caution and Considerations: Recognizing Challenges Ahead

Despite its strengths, Base faces challenges:

The speculative nature of AI-driven initiatives.

Coinbase’s influence, which could impact long-term decentralization.

Conclusion: A Promising Platform with Robust Foundations

Base’s trajectory has established it as a major player in the crypto space, with impressive performance metrics, a forward-looking economic model, and a vision driven by Coinbase’s expertise. Its commitment to onboarding, technological advancement, and DeFi expansion underscores its potential to redefine layer 2’s role in the ecosystem. While there are challenges, such as AI speculation and questions around decentralization, Base’s achievements and Coinbase’s support position it as a platform with significant potential in the evolving blockchain landscape.

2/ Crypto and Defi News :

💸 New record: Bitcoin surpasses $1.8 trillion market cap

Bitcoin has broken new records, with its price surpassing $93,000 and market cap reaching an unprecedented $1.8 trillion. This milestone has driven the entire crypto market to a total valuation of $2.71 trillion. Analysts attribute this to increased interest from institutional investors and positive sentiment around crypto, influenced by President-elect Donald Trump’s pro-crypto stance. This surge also means that every Bitcoin investment over the past 15 years is now profitable, as Bitcoin’s value continues to climb with an overall circulating supply of 19.8 million BTC. Key analysts believe this is only the beginning of a prolonged bull market, with some even urging holders to stay patient, forecasting more upside.

Thought: Bitcoin’s new all-time high and a market cap surpassing $1.8 trillion are powerful signals of momentum in the crypto market. As Bitcoin’s valuation climbs, the entire crypto market cap is also approaching previous record highs, indicating renewed enthusiasm and confidence. With institutional investors increasingly supporting Bitcoin and influential leaders hinting at favorable crypto policies, we’re in a phase of optimism that many believe could extend this bull run even further.

There’s a notable rise in public interest around cryptocurrency topics, evidenced by growing online research and discussions, even if there is still a long way from the levels seen at previous market peaks. This broad curiosity and engagement could foster an even wider adoption, drawing more eyes and investment into the space. Combined with Bitcoin’s established role as the pioneer digital asset, these developments could sustain bullish market conditions in the coming months, potentially setting new highs across the board.

🏗 Tether expands into oil trading with $45M transaction

Tether, the issuer of the USDT stablecoin, has entered the commodities market with a $45 million crude oil transaction. Completed in October 2024, the deal involved the transport of 670,000 barrels of Middle Eastern crude oil, facilitated by Tether’s Trade Finance business. This marks Tether’s first foray into commodity trading and highlights its goal to integrate blockchain technology into traditional trade finance, which has historically been reliant on slower, more costly payment methods. The company’s move comes amid its broader strategy to diversify its business, including investments in renewable energy, AI, and Bitcoin mining.

Thought: Tether's entrance into the oil trading market is a significant step that could disrupt traditional trade finance. By leveraging blockchain and its stablecoin, USDT, Tether can provide faster, more efficient payment solutions, a welcome change for industries that rely on slower, bank-dependent systems. This deal represents more than just a commodity transaction—it’s a signal that stablecoins are becoming increasingly integral to global finance. Moreover, Tether’s move to expand into other sectors like energy and AI shows its ambition to diversify, making stablecoins not only a tool for crypto traders but also for businesses across various industries. This could lead to a future where stablecoins are as common in global trade as traditional currencies.

💎 BlackRock’s Bitcoin ETF flips gold fund

BlackRock’s Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has surpassed $33 billion in assets, overtaking the asset manager’s gold ETF, iShares Gold Trust (IAU), which has been trading since 2005. The Bitcoin ETF achieved this milestone just 10 months after its launch in January 2024, marking a significant shift in investor preference. The surge in inflows to IBIT was particularly notable following Donald Trump's U.S. presidential election win, which many see as a favorable event for the cryptocurrency industry. Bitcoin’s price has also seen consecutive all-time highs, further driving ETF interest.

Thought: The rapid rise of BlackRock’s Bitcoin ETF surpassing its gold counterpart is a clear sign of the growing adoption of Bitcoin within the traditional financial sector. This shift, happening in less than a year, shows that institutional investors are increasingly turning to Bitcoin as a credible store of value, a role traditionally held by gold. The surge in Bitcoin’s price, alongside institutional inflows, suggests we are at the cusp of a more extensive integration of cryptocurrencies into the global financial system. With the Bitcoin market continuing to heat up, it’s likely that governments will play a more significant role in regulating and engaging with digital assets in the next 5 to 10 years, potentially leading to a more structured and widespread adoption across both public and private sectors. This is a promising sign for the future of Bitcoin and the crypto ecosystem as a whole.

✈ Near’s crosschain AI Assistant will soon book flights and order takeout for you

At the Redacted conference in Bangkok, Near Protocol unveiled the NEAR.AI Assistant, a cross-chain AI agent designed to simplify various tasks. This AI assistant can already launch memecoins and facilitate product purchases across the web using fiat. In the near future, it will also help users book flights and order takeout on Web2 sites. Additionally, Near introduced a new feature, "Near Intents," that enables cross-chain transactions and asset swaps between Bitcoin, Ethereum, Arbitrum, and other blockchains. The NEAR.AI Assistant's open-source model allows developers to integrate additional features, making it a highly versatile tool for future applications in decentralized finance (DeFi) and beyond.

Thought: I already told you that i am really bullish on the AI Narrative for this cycle.. Near’s AI Assistant marks a significant leap forward by integrating blockchain with AI in such a practical and accessible way. The assistant’s ability to conduct transactions, from launching memecoins to making real-world purchases, is a clear demonstration of how AI can streamline both crypto and traditional sectors. The “Near Intents” feature is particularly interesting, as it allows for cross-chain asset swaps and even AI agents to communicate with each other to complete tasks. This is not only a massive step for blockchain’s scalability but also a glimpse into a future where AI, blockchain, and DeFi are intricately linked.

🆚 Solana’s Economy Outpaces Ethereum’s in October

According to Syncracy Capital’s Nov. 12 report, Solana’s economic activity surpassed Ethereum’s in October 2024 across key metrics, including real economic value (REV), which combines transaction fees and MEV tips. Solana's REV was 111% of Ethereum’s for the month, a sharp rise from just 1% in the prior year. This growth, largely due to a "memecoin mania" with tokens like Goatseus Maximus (GOAT) and SPX6900 (SPX), has driven increased network volume, fees, and TVL, reaching a two-year high.

While some view memecoin activity as a speculative trend, Syncracy sees it as a stress test that Solana has handled well. The network’s ecosystem is expanding to include DePIN projects such as Helium and Render, and the anticipated 2025 Firedancer upgrade aims to support its continued growth.

Thought: This news marks a clear milestone for Solana, illustrating the network’s ascent as a serious competitor to Ethereum on multiple fronts. While some may view the surge in activity from memecoins as temporary, it's worth noting that similar speculative phases helped Ethereum refine its infrastructure and test resilience in DeFi’s early days. For Solana, these tests could be crucial in proving its capability as a robust and scalable platform. I’ve previously mentioned my bullish stance on AI in crypto, and Solana’s recent success in DePIN projects reflects the diverse, innovative use cases possible within this ecosystem. With continued advancements like the Firedancer upgrade, we may anticipate more significant developments on Solana’s network, potentially driving the blockchain into further competitive alignment with Ethereum in the coming years.

3/ Token Valuation Model for StarkNet ($STRK)

Project Overview and Key Value Drivers

StarkNet is a layer 2 scaling solution for Ethereum, leveraging Zero-Knowledge Proofs (ZK-proofs) to provide faster, more cost-effective transactions with improved security. As a layer 2, it offloads transaction processing from Ethereum’s main chain and communicates transaction proofs to Ethereum for verification, enhancing throughput and reducing fees. StarkNet's scalability, low transaction costs, and quantum resistance through STARKs (a type of ZK-proof) make it a promising long-term solution.

Key Value Drivers:

Increased Scalability: StarkNet can process high transaction volumes independently of Ethereum’s main chain, effectively reducing congestion.

Lower Transaction Fees: Transactions on StarkNet are processed off-chain, allowing for significant fee reductions for users.

Enhanced Security: Using STARK proofs, StarkNet provides quantum-resistant validation, which is a strategic advantage over other ZK-proofs.

Cross-chain Interoperability: While designed for Ethereum, StarkNet's compatibility with other blockchains could facilitate cross-chain transfers, expanding its ecosystem potential.

Economic Model and Token Utility

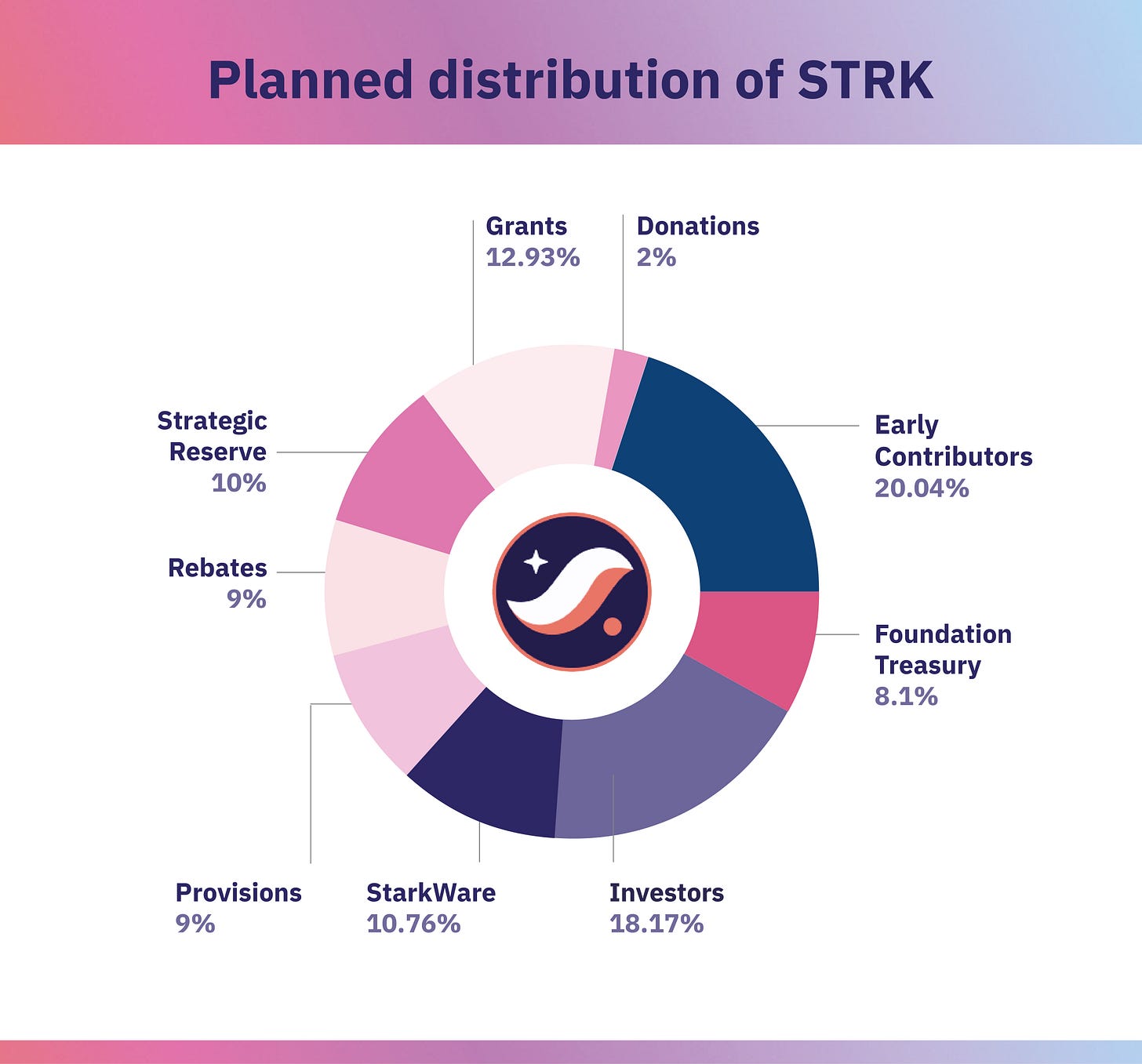

StarkNet launched its STRK token in February 2023, drawing strong initial interest due to the network’s ambitious roadmap. Despite this early enthusiasm, STRK’s value has since dropped significantly, reflecting both market volatility and StarkNet’s challenges in establishing itself within the Layer2 ecosystem.

While this decline raises some concerns, it also represents a market adjustment as StarkNet continues to advance its core technology. The upcoming staking feature and network upgrades scheduled for 2024-2025 could positively impact STRK’s value by increasing its utility and potentially driving demand.

The StarkNet token (STRK) serves multiple functions within the ecosystem:

Gas Fees: STRK is used to pay for transactions and execution costs on StarkNet, sustaining demand as transaction volumes grow.

Staking and Security: Users may stake STRK to enhance network security and earn staking rewards.

Governance: STRK holders are granted voting rights on critical protocol upgrades and governance decisions.

By assigning STRK a dual purpose in transactional utility and governance, StarkNet incentivizes user participation while providing a mechanism for economic growth within the network.

Comparative Market Analysis and Token Valuation Metrics

Transaction Volume and Market Demand

Based on StarkNet's current performance:

Transaction Volume: Given StarkNet's ability to process high volumes, projected transaction growth is around 20-25% year-on-year with increased adoption.

Addressable Market: StarkNet’s addressable market is primarily Ethereum users, although cross-chain interoperability could expand this significantly. As Ethereum transactions increase, demand for affordable, scalable solutions like StarkNet will likely surge.

Fee Revenue Potential

With projected low transaction fees, fee revenue will depend heavily on StarkNet’s ability to attract high transaction volumes and user adoption rates. If StarkNet captures just 5% of Ethereum’s current daily transaction volume, it could potentially achieve annualized fee revenues of $150 million to $200 million by 2025.

Future Developments and Their Impact on Token Valuation

StarkNet's upcoming upgrades introduce key features that could positively impact STRK token valuation by enhancing network utility, security, and user engagement.

StarkNet Staking (Q4 2024) : The addition of staking for STRK will incentivize users to hold and lock up tokens to earn rewards, reducing circulating supply. This feature could increase demand for STRK, potentially supporting higher prices as users look to participate in staking rewards.

Version 0.13.4 (February 2025) : Planned enhancements like L2 gas optimization, improved error handling, and a transition to Cairo-native development are set to make StarkNet more efficient and attractive for developers. These improvements could drive adoption, which would likely increase STRK utility as the network’s ecosystem expands.

Version 0.14.0 (April 2025) : With updates like 2-second block times, a mempool and fee market, and a more decentralized sequencer, StarkNet will become faster and more scalable. These changes are expected to support higher transaction volumes and further adoption, potentially driving greater demand for STRK as a utility token within the ecosystem.

These developments reflect StarkNet’s commitment to growth and scalability, likely boosting the demand and value of STRK as the network’s usability and adoption expand.

Valuation Model: Revenue and Token Flow Forecast

Revenue Model (2024-2026)

2024: Estimated revenue from fees at $100 million with current adoption rates.

2025: Increased network adoption could push annual revenue to $175 million.

2026: Projected annual revenue could exceed $250 million.

Token Circulation and Inflation Rate

StarkNet has a controlled token supply, with an anticipated inflation rate of 5% annually. New token issuance will support staking incentives and ecosystem growth.

P/E and P/S Ratios for STRK Valuation

Given a target P/E ratio of 20x by 2026 and P/S ratio of 10x, STRK’s fully diluted valuation could reach $2.5 billion - $3 billion if revenue targets and user growth are met.

Investment Case and Potential Risks

Investment Case: StarkNet’s distinctive approach, leveraging quantum-resistant STARK proofs, offers unique scalability and security advantages. With Ethereum's growing congestion and fees, StarkNet is well-positioned to capture market share, especially as demand for affordable transaction options grows. Upcoming features create compelling use cases that may draw developers and DeFi projects seeking a scalable and cost-efficient solution.

Risks:

Competitive Layer 2 Solutions: Competitors like Arbitrum, Optimism, and zkSync present strong alternatives, which could limit StarkNet’s market capture if these solutions continue to innovate quickly.

Regulatory Challenges: Increased regulatory scrutiny of the DeFi and blockchain sectors could impact StarkNet’s growth trajectory.

Market Saturation: The market for layer 2 solutions is becoming crowded, which may place pressure on transaction fees, reducing revenue potential.

Conclusion: Strong Long-Term Outlook for STRK

StarkNet’s pioneering STARK technology, focus on scalability, and Ethereum alignment position it as a high-potential Layer2 solution. With a robust roadmap of innovative features, StarkNet is set to become a critical part of Ethereum’s scaling ecosystem.

Based on current projections, $STRK’s valuation could surpass $2.5 billion by 2026, contingent on user growth, adoption of upcoming features, and the continued expansion of Ethereum’s ecosystem. Of course it’s also dependant on Market Cycle & BTC Performance.

As such, $STRK represents a promising long-term investment with strong fundamentals and innovative technology, particularly for those seeking exposure to the scaling layer of Ethereum.

As we saw before with Base, Layer2 can emerge and grow very fast.

But they can also get replaced very fast by better & newer technologies. And their token tend to have a hard time finding a real utility and appeal to investors. Keep that in mind.

4/ Ethereum’s Journey to Scalability: The Role and Evolution of Layer 2 Solutions

Introduction to Ethereum and the Emergence of Layer 2 Solutions

Since 2015, Ethereum has established itself as the premier platform for decentralized applications (dApps) and smart contracts. Unlike Bitcoin, which primarily serves as a decentralized store of value, Ethereum was designed to be a programmable blockchain, enabling developers to build a wide array of applications ranging from decentralized finance (DeFi) to non-fungible tokens (NFTs) and beyond. This versatility has attracted a vibrant community of developers, investors, and users, propelling Ethereum to the forefront of the blockchain ecosystem.

However, Ethereum’s rapid growth has exposed significant limitations, particularly in terms of scalability and transaction costs. With a base layer capacity of approximately 15 transactions per second (TPS), Ethereum struggled to keep up during peak demand periods, such as the DeFi boom of 2020-2021. To address these challenges, Ethereum has increasingly relied on Layer 2 (L2) solutions—secondary frameworks built atop the Ethereum mainnet—to enhance scalability and reduce transaction fees while maintaining the security and decentralization inherent to Ethereum.

Definition and Role of Layer 2 Solutions

Layer 2 solutions are blockchain protocols constructed "on top" of existing Layer 1 (L1) blockchains like Ethereum. Their primary purpose is to improve scalability and reduce transaction costs without compromising the security and decentralization provided by the underlying Layer 1. By offloading transaction processing and data storage to Layer 2s, Ethereum can handle a significantly higher volume of transactions, making it more accessible to a broader user base.

Key characteristics of Layer 2 solutions include:

Scalability: Layer 2s can process thousands of transactions per second, vastly outperforming the base Ethereum layer.

Cost Reduction: By handling transactions off-chain, Layer 2s minimize gas fees, making Ethereum more economically viable for everyday use.

Security Inheritance: Most Layer 2 solutions derive their security from Ethereum’s robust consensus mechanism, ensuring that transactions remain secure and tamper-proof.

In essence, Layer 2s act as an extension of Ethereum, providing the necessary infrastructure to support its expanding ecosystem without overburdening the mainnet.

Vitalik Buterin’s Vision for Ethereum: The Roadmap to a Scalable, Decentralized Future

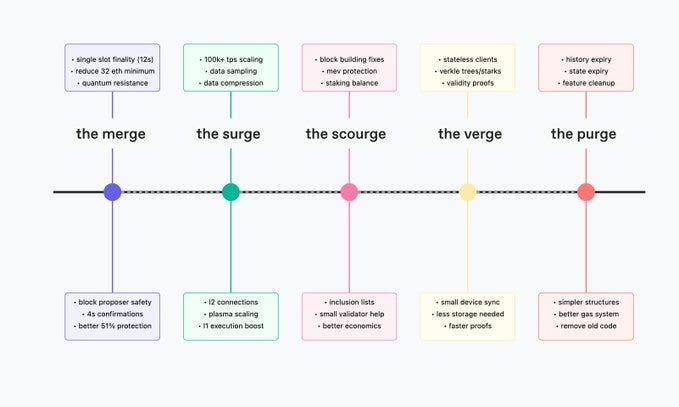

Ethereum’s journey is packed with exciting changes, and Vitalik Buterin’s recent updates reveal what’s next. Three major phases—The Merge, The Scourge, and The Surge—focus on boosting Ethereum’s scalability, decentralization, and transaction efficiency.

The Merge: Upgrading Proof of Stake

The Merge aims to enhance Ethereum’s existing Proof of Stake (PoS) system, targeting stability, performance, and decentralization. Here are the two main goals:

Transaction Confirmation: Currently, Ethereum takes 12 seconds to confirm a transaction. Buterin wants to cut this to 8 or even 4 seconds, making it harder for bots to “front-run” users by paying higher fees. Options include coding a shorter confirmation time or using a “preconfirmation” system.

Transaction Finality: Transaction finality—when a transaction becomes irreversible—now takes around 15 minutes on Ethereum. Buterin’s goal is “single slot finality” (SSF), bringing finality down to 12 seconds, the length of one block. Options range from validator-proof aggregation protocols to creating a random validator committee for finalization.

The Scourge: Tackling Centralization

The Scourge targets potential centralization threats, ensuring Ethereum remains open and decentralized.

Block Construction: Today, specialized companies handle most block construction on Ethereum, optimizing for Maximum Extractable Value (MEV) but risking censorship. Solutions include encrypting the mempool (pending transactions list) to limit MEV or creating “inclusion lists” to ensure certain transactions are included in blocks.

Staking Decentralization: About 30% of Ethereum’s ETH supply is staked. Large-scale staking risks centralization as users turn to liquid staking services. Buterin proposes a decentralized, neutral liquid staking token, adjusting ETH emissions based on the number of stakers, and lowering the staking requirement to make solo staking more accessible.

The Surge: Scaling with Layer 2

The Surge is all about Ethereum’s scalability, aiming for 100,000 transactions per second (TPS) via Layer 2 (L2) networks. Layer 2s are independent networks that rely on Ethereum’s security for fast transaction processing.

Data Storage: EIP-4844 introduced “blobs” as temporary storage for Layer 2 data, but storage remains limited. A promising solution is data availability sampling (DAS), which distributes data across the network for efficiency. Combined with data compression, DAS could push Ethereum’s TPS over 58,000.

Interoperability: Improving Layer 2 interoperability makes transfers and use easier for users. Developments like Layer 2-specific addresses and unified standards (ERC-7683, RIP-775) are in progress.

Security: Most Layer 2 solutions currently rely on trust in their development teams. Buterin’s vision is to make Layer 2s trustless through cryptographic proof systems, like fraud and validity proofs, to ensure secure transactions.

Layer 1 Upgrades

While Layer 2 is key to scaling, Layer 1 also needs strengthening. Simple upgrades like boosting validator performance and optimizing Ethereum’s code to make transactions lighter and more energy-efficient are on the horizon.

Vitalik Buterin’s roadmap is ambitious, pushing Ethereum’s decentralization, speed, and security to the next level. It’s a balancing act, but Ethereum’s dedication to open, decentralized innovation remains unwavering. As the ecosystem evolves, these enhancements will make Ethereum stronger, more scalable, and ready for the future.

Critiques and Challenges of Ethereum and Layer 2 Solutions

Despite Layer 2 solutions significantly enhancing Ethereum, the network still faces critiques that could impact its long-term success.

Scalability Issues : Ethereum’s high fees and slower speeds, especially during busy periods, remain pain points. Rollups have helped alleviate these by processing transactions off-chain, but data storage costs on the mainnet are still high, even after introducing Proto-Danksharding (EIP-4844), which only temporarily stores blobs.

Maximum Extractable Value (MEV) : As Layer 2 networks grow, they capture more MEV—profits from reordering transactions—which affects Ethereum’s validators’ revenue. This shift could alter Ethereum’s economic landscape, especially as centralized L2s take a significant share of MEV.

Decentralization Concerns : Many Layer 2 solutions rely on centralized sequencers for transaction ordering, raising decentralization and censorship concerns. These centralized entities could lead to single points of failure, challenging Ethereum’s security and decentralization goals.

Ethereum’s Modular Security Vision :Ethereum’s modular approach provides security layers tailored to use cases. Layer 1 serves as a secure foundation for high-value transactions, while Layer 2s handle high-speed, lower-stakes transactions. This design echoes traditional finance by differentiating between high and low-security needs.

Interoperability and Innovation : Layer 2s foster innovation and work toward interoperability, which enhances user experience. Projects like Optimism’s Superchain and protocols such as RIP-7755 and RC-7683 are advancing communication between Layer 2s, making Ethereum’s ecosystem more interconnected.

Addressing Challenges and Moving Forward

Scalability and Costs :Updates like Proto-Danksharding and potential data compression techniques aim to cut costs and boost transaction speeds to over 100,000 TPS, rivaling Visa-level performance.

Improving Decentralization : Ethereum is exploring decentralized sequencer models for Layer 2s to distribute validation across more nodes, strengthening Ethereum’s decentralized security.

Enhancing Interoperability : Interoperability protocols like RIP-7755 work to unify user experiences across Layer 2s, mitigating the current fragmentation.

Capturing Value :To keep value within the mainnet, Ethereum may encourage more engagement with Layer 2 transactions, ensuring Ethereum remains economically sustainable.

DeFi Growth and Adoption : The DeFi ecosystem is supported by Layer 2 solutions, which allow for complex trading and lending strategies. The ongoing synergy between Layer 1 and Layer 2 solutions is vital to sustaining Ethereum’s utility.

Ethereum’s path forward requires addressing these issues to maintain its competitive edge against high-performance blockchains while balancing security, decentralization, and innovation

Conclusion

Ethereum’s future as a cornerstone of decentralized finance and blockchain depends on overcoming inherent challenges. Key to its success is the development of Layer 2 solutions, which are essential for creating a scalable, secure, and decentralized platform for a global financial system.

For developers, investors, and users, Ethereum offers both opportunities and risks. By leveraging its ecosystem and advancements in Layer 2, stakeholders can benefit from Ethereum’s growth. However, ongoing monitoring of decentralization, interoperability, and competition is crucial to its future.

In conclusion, Ethereum’s commitment to scalability and innovation ensures its leadership in decentralized finance. Balancing security, decentralization, and scalability will define its long-term.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.