This Week's Newsletter - Case Study on Sui, Main News of the Week, $QUIL Moon or Dust & Zoom on DePIN through Glow

Weekly Alpha

This edition is available as an AI-generated Podcast. ⭡

Nothing in this edition is an ad, a collaboration or a partnership.

GM Frens,

Feel free to tell me in DM or Comments what you think will be the next big narrative 🌟

Bitcoin, the market’s locomotive, continues to shine. Over the past week, it reached an impressive $99,500, even surpassing $100,000 on select platforms—a milestone reinforcing its status as the cornerstone of the crypto ecosystem. However, its dominance has slightly dropped to 58%, signaling a shift in market dynamics as liquidity begins to flow into altcoins 👇

Speaking of altcoins, they’ve shown renewed vigor this week. While these are promising signs, we’re still short of a full-fledged alt season—however the metric tracking Altcoins over Bitcoin rose at 65%, not far from the 75% threshold typically needed.

Today, we’ll be talking about DePIN, a narrative that hasn’t outperformed the market yet, but has the potential to do so.

DePIN stands for Decentralized Physical Infrastructure Network. It refers to a system where physical infrastructure—such as telecommunications or transportation networks for example—is operated and maintained in a decentralized manner, leveraging blockchain technology to coordinate, incentivize, and secure the network.

DePIN networks aim to revolutionize infrastructure by shifting from centralized control to decentralized, blockchain-enabled solutions. DePINs can deploy infrastructure faster and at lower costs while empowering individuals and communities rather than monopolistic corporations. This approach also aligns perfectly with other growing trends, such as AI and the increasing demand for computational resources.

The current momentum for DePINs is underpinned by several factors:

The convergence of DePINs with the AI narrative, with projects like Aethir, Render, and Akash supplying critical GPU power to AI ventures.

The explosive demand for computational resources, particularly GPUs, driven by AI’s rapid growth.

The increasing adoption of DePIN infrastructure by major projects, boosting visibility and credibility in the market.

Strong node sales performance from initiatives like Rivalz and XR One, showcasing the community’s appetite for decentralized infrastructure solutions.

At its core, DePIN represents a shift in how we think about infrastructure. These networks break away from monopolies, empower communities, and align with crypto’s foundational principles of decentralization and trustlessness. Their role as a bridge between the AI and blockchain narratives adds another layer of growth potential, making DePINs a key trend to watch in 2024.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.

Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This week’s newsletter brings everything into focus:

A Case Study on Sui, exploring if it could be “Solana’s killer”.

Main News of the Week, capturing the market's most impactful moments.

A Moon or Dust spotlight on $QUIL, where we assess if it’s a star in the making.

A Deep Dive into DePIN, with a closer look at Glow.

Let’s explore what this means for the ecosystem—and what opportunities lie ahead.

1/ Case Study: Sui Network – Could It Be the "Solana Killer"?

Sui Network is gaining momentum in the blockchain industry with high-profile partnerships and growing institutional interest. On Nov. 22, 2024, Sui announced a strategic collaboration with global asset manager Franklin Templeton. The partnership focuses on supporting ecosystem builders and piloting innovative blockchain technologies on Sui’s layer-1 network. This move reflects Franklin Templeton’s increasing presence in the crypto space, as seen in its tokenized money market fund initiatives on Aptos and Base earlier this year.

Combined with the launch of Grayscale SUI Trust and multiple stablecoins like USDC on its network, Sui is solidifying its reputation as a major player in decentralized finance and real-world asset tokenization. These developments position Sui as a serious contender to Solana, with its rapid transaction speed and emphasis on low-latency applications. Let’s delve deeper into why Sui could emerge as the next "Solana killer."

Origins and Context

The story of Sui begins with the failure of Facebook's Libra/Diem project. Despite the regulatory hurdles that led to its downfall, Facebook's substantial investment in blockchain technologies laid a solid foundation. Diem’s open-source technology became the springboard for new ventures, including Sui.

Mysten Labs, the driving force behind Sui, was founded in 2021 by former Facebook engineers, including Evan Chang. With their deep technical expertise and $300 million raised even during the bear market, Mysten Labs has become a beacon of confidence for investors. This financial backing provides the necessary resources for long-term development and innovation.

Technical Innovations of Sui

1. Parallel Transaction Processing

Unlike traditional blockchains like Ethereum and Bitcoin, which process transactions sequentially, Sui separates data processing from consensus. Its dual system, Narwhal and Tusk, enables parallel transaction processing, significantly improving speed and scalability.

2. Move Programming Language

Move, a language originally designed for Diem, focuses on security and efficiency. It allows developers to easily verify smart contracts, reducing risks of vulnerabilities and coding errors. This is a crucial feature for fostering trust among developers and users alike.

3. ZkLogin for User Accessibility

Sui integrates Zk (Zero Knowledge) Login, which simplifies the onboarding process for users. By allowing access to decentralized applications (dApps) through accounts like Google or Twitch, Sui removes barriers for blockchain newcomers, making adoption more seamless.

4. Unmatched Scalability and Speed

Sui’s infrastructure supports 273,000 transactions per second (TPS) under optimal conditions, surpassing even Solana’s 120,000 TPS. This capability positions Sui as an ideal platform for high-demand applications, such as gaming, micropayments, and decentralized finance (DeFi)

Key Advantages of Sui

1. Scalability for Mass Adoption

Sui’s ability to handle a high volume of transactions is vital for mainstream applications like video games and global payment systems. Scalability ensures the network remains efficient as demand grows.

2. Low Latency

Instant confirmation of transactions makes Sui suitable for applications requiring real-time interactions, such as high-frequency trading and interactive gaming.

3. Developer Accessibility

The Move programming language is easier to learn than Solana’s Rust, lowering the barrier for developers to build on Sui. This is critical for expanding its ecosystem and attracting talent.

4. Institutional Backing

Support from major players like Binance Labs and Coinbase Ventures has fueled confidence in Sui’s growth trajectory. These partnerships provide resources and credibility, accelerating adoption.

Sui vs. Solana: The Rivalry

While both blockchains target similar use cases, Sui’s superior speed, developer accessibility, and stability give it a unique edge. However, Solana’s established ecosystem and network effects cannot be overlooked.

The Role of the SUI Token

Core Functions

Governance: Token holders vote on network decisions.

Transaction Fees: Gas fees reward validators and secure the network.

Staking: Users stake SUI to earn rewards while helping secure the network.

Tokenomics and Supply Concerns

Only 27% of SUI tokens are currently in circulation, with the rest to be released gradually. While this creates opportunities for long-term growth, the token unlocks could lead to sell pressure, affecting the price.

Sui has introduced a burn mechanism to reduce token supply over time, potentially counteracting inflationary effects from token releases.

Ecosystem Growth and Partnerships

Sui’s ecosystem is rapidly evolving, with a focus on fostering partnerships and enhancing adoption:

DeFi and TVL Growth: Sui’s total value locked (TVL) recently surpassed $1B and is already at $1.6B since, reflecting rising confidence in its DeFi ecosystem.

Key Partnerships:

Circle: Integration of USDC enhances Sui’s utility for global payments.

Red Bull Racing: Leveraging Web3 to create unique fan experiences.

Harden: Blockchain-based loyalty programs.

These collaborations demonstrate Sui’s versatility and ability to penetrate diverse industries.

What to Watch For

Revenue Growth: Monitoring transaction fees is vital to gauge the network’s sustainability. If fees do not grow in line with adoption, Sui’s long-term viability could be questioned.

Token Unlocks: Future token releases could impact the price of SUI. Managing these unlocks effectively will be key to avoiding excessive volatility.

Developer Activity: Attracting and retaining developers is essential for maintaining a thriving ecosystem. The success of dApps built on Sui will serve as a measure of its attractiveness.

Competition: Sui faces stiff competition not only from Solana but also from other Layer-1s like Ethereum and Aptos. Continuous innovation and ecosystem growth will be crucial for staying ahead.

Conclusion: Can Sui Truly Rival Solana ❔

Sui Network has positioned itself as a technologically advanced blockchain with unparalleled speed, scalability, and accessibility. Its focus on developer-friendliness, combined with its ability to onboard new users seamlessly, makes it a strong contender in the Layer1 space.

While challenges such as token unlocks and intense competition remain, Sui’s robust foundation, innovative architecture, and growing institutional support suggest significant upside potential. If it continues on its current trajectory, Sui could indeed become the “Solana killer”, or more likely a healthy competition.

2/ Crypto & DeFi News :

🦄 Uniswap sees record monthly volume on L2 as DeFi demand flows back

Uniswap recorded a massive $38B in trading volume across Ethereum Layer 2 (L2) networks in November, breaking its previous record by $4B. Major contributors included Arbitrum ($19.5B) and Base ($13B). This surge aligns with a broader "DeFi renaissance," driven by rising on-chain yields, increased demand for stablecoins, and ETH outperforming BTC in recent weeks. Uniswap remains a top DeFi protocol, raking in over $90 million in monthly fees, and its UNI token has surged 42% over the last week.

Thought: This record-setting performance highlights DeFi's resurgence and Ethereum's ecosystem strength. L2 networks are clearly proving their value, lowering costs and driving activity back on-chain. Uniswap's dominance and the UNI token's gains reflect growing confidence in decentralized protocols. If this "DeFi renaissance" gains further momentum, it could signal Ethereum’s ecosystem entering a phase of sustained outperformance against BTC and other networks. Is this the beginning of DeFi’s golden era? The numbers certainly make a strong case.

🇸🇷 Suriname the next Bitcoin Nation?

Maya Parbhoe, a Surinamese presidential candidate, has pledged to turn Suriname into a Bitcoin-powered nation, rivaling El Salvador's efforts. Her plans include making Bitcoin legal tender, replacing the Suriname dollar with sats, and dismantling the central bank. She believes Bitcoin could eradicate corruption and create a transparent governance model. Her journey is deeply personal, rooted in a tragic history of systemic corruption and her father’s unsolved murder. Inspired by figures like Nayib Bukele and Samson Mow, Parbhoe's campaign is gaining traction within the Bitcoin community as a vision for transformation.

Thought: If Parbhoe succeeds, her policies could make Suriname a beacon for Bitcoin adoption, reinforcing its use as a tool for transparency and economic empowerment. A Bitcoin-based economy means direct accountability in government spending and a shift away from inflation-prone fiat systems. This is more than a financial revolution—it’s a stand against corruption and centralized control, potentially inspiring other nations to follow suit. Could Bitcoin be the global equalizer for small nations? The next few years may redefine the political and financial landscape.

🏁 Bitcoin startups get dedicated crowdfunding platform

A new crowdfunding platform, Timestamp, has been launched in the U.S., dedicated exclusively to Bitcoin-focused startups. It allows both accredited and non-accredited investors to fund projects and receive equity ownership, ensuring regulatory compliance. Timestamp offers startups an alternative to venture capital funding, charging a 7% success fee while providing a global investor network. Though currently restricted to fiat investments, Bitcoin payment options are expected by 2025. Since Bitcoin's Ordinals protocol launch and the approval of Bitcoin spot ETFs, innovation in Bitcoin projects has surged, supported by growing institutional interest.

Thought: A Bitcoin-focused crowdfunding platform like Timestamp is a significant development for the ecosystem. It could democratize access to early-stage Bitcoin projects, fostering innovation while reducing reliance on traditional venture capital. This approach not only supports decentralized funding but also helps build Bitcoin-centric infrastructure for long-term growth. If Bitcoin payments are integrated, it could further align the funding process with the ethos of Bitcoin itself—permissionless and global. Are we witnessing the evolution of a more self-sustaining Bitcoin economy?

💵 Tether mints an additional $3B in USDT stablecoins

Tether minted $3B more USDT tokens on November 23, with $2B on Ethereum and $1B on Tron, coinciding with Bitcoin's rise toward $100,000. Since November 8, Tether has added $13B USDT, reflecting surging demand during a historic market rally. Stablecoins like USDT are critical for liquidity, serving as fiat on-ramps and off-ramps for crypto traders. Cantor Fitzgerald, which oversees Tether's US Treasury reserves, recently acquired a 5% stake in the company for over $600 million, further spotlighting institutional interest in stablecoins.

Thought: The massive minting of USDT signals bullish momentum in crypto markets and highlights Tether's role as a cornerstone of trading liquidity. This activity isn't just about supporting retail traders—it reflects deeper institutional alignment, especially with Cantor Fitzgerald's involvement. As Bitcoin edges closer to $100,000 and speculation about a Bitcoin "arms race" among nation-states grows, stablecoins like USDT may become indispensable for high-frequency trading and global market efficiency. The question now is whether this exponential growth is sustainable under increasing regulatory scrutiny or a sign of a more centralized financial pivot within decentralized markets. Are we ready for this evolving balance?

💰 Solana breaks all-time high on Coinbase, 2 years after FTX catastrophe

Solana (SOL) hit a new all-time high of $264.31 on November 22, according to Coinbase data. This milestone comes two years after the collapse of FTX, which sent SOL to a low of $10 in December 2022. Driving this resurgence are filings for Solana-focused spot ETFs from Bitwise, VanEck, and others, as well as a 500% surge in DeFi total value locked (TVL) on Solana this year, now at $8.8B. Additionally, regulatory shifts and broader altcoin momentum, fueled by Gary Gensler’s planned resignation and Trump’s election, have lifted the market to a $3.42 trillion total capitalization.

Thought: Solana's recovery is nothing short of remarkable—a climb from $10 to record-breaking highs in just two years showcases its resilience and market potential. The surge in DeFi activity underscores Solana's technical strengths, particularly in efficiency and scalability. But the ETF filings could be the real game-changer, offering institutional access and amplifying liquidity. As Solana demonstrates that it's not just surviving but thriving post-FTX, it might lead the charge in solidifying altcoins as central players in the next crypto bull run. Could Solana be the banner bearer for the "altcoin season" revolution?

3/ 🌑 Moon or Dust: Quilibrium ($QUIL) – A Decentralized Internet Dream

Quilibrium is a Layer 1 blockchain with the ambitious mission of decentralizing the internet. It offers a censorship-resistant, privacy-first infrastructure for developers and users, powered by a shared and obfuscated hypergraph network and the innovative Proof of Meaningful Work consensus mechanism. Quilibrium debuted as a fair launch, embodying decentralization and equitable access.

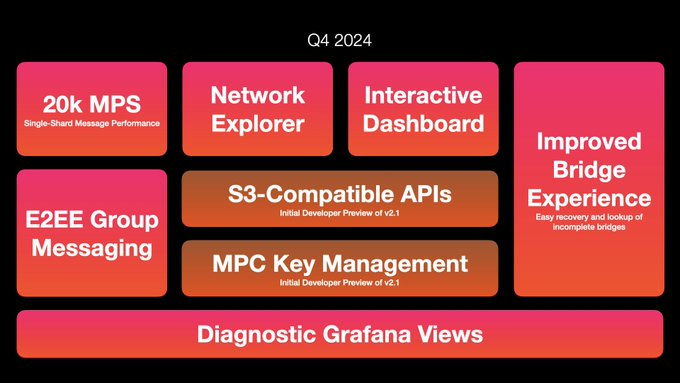

With the Version 2.0 release on October 13, 2024, Quilibrium has opened its doors to native token trading, dApp development, and a host of new functionalities. The next steps on its Q4 2024 roadmap highlight further network upgrades and developer tools, making now a pivotal moment for the project.

Note: For now, $QUIL is only available as wQUIL (a wrapped version) on the Ethereum blockchain, which allows trading but limits direct interaction with the native Quilibrium network until future updates.

🚀 Why It Could Moon

1. Fair Launch: True Decentralization

No Pre-Sales or VC Funding: Quilibrium launched without any private token sales or external investments. Everyone had equal access to $QUIL from the start.

Community Ownership: Quilibrium Inc. holds less than 1% of the total token supply, ensuring power remains distributed within the community.

2. Milestone Achievements in Version 2.0.

Native $QUIL Trading: Native tokens could soon be traded, providing liquidity and accessibility to a broader audience.

dApp Development Enabled: Developers can build decentralized applications, fully utilizing Quilibrium’s hypergraph framework.

Bridge Access Restored: Miners now have access to their rewards, stimulating network activity and liquidity.

3. Strong Roadmap for Q4 2024 and beyond

Q4 2024:

Enhanced Network Stability: Improvements in message passing and node incentives.

Developer Tools: Features like S3-compatible APIs, MPC key management, and an interactive node dashboard.

Network Explorer Preview: Simplified access to blockchain data for users and developers.

Q1 2025:

V2.1 General Release: Unlocking app development, content hosting, and decentralized wallets.

Q Compute Language: A simplified way for developers to convert Golang applications into decentralized solutions.

Partner Announcements: Major collaborations and flagship app launches.

Bridges: Two-way bridging between $wQUIL, $QUIL, and other networks.

Q2-Q3 2025:

Advanced network primitives for AI/ML, including CUDA and streaming services.

4. Revolutionary Technology

Hypergraph Network: Enables sophisticated data relationships, surpassing traditional blockchain capabilities.

Proof of Meaningful Work: Reduces energy waste by tying mining rewards to useful computational tasks.

5. Broad Use Cases & Adoption Potential

Applications range from decentralized cloud computing to censorship-resistant social media, secure messaging, and AI/ML integrations.

The growing 50,000-node network and active community of 5,000+ members show strong early traction.

6. Potential for Major Exchange Listings

Native token trading opens the door to liquidity on top-tier exchanges, increasing visibility and adoption.

🌪️ Why It Could Be Dust

1. Token Dump Risk

Miners who accumulated QUIL during the bridge’s downtime may sell their holdings to cover costs, causing downward price pressure.

Early adopters may prioritize short-term profits, undermining long-term network stability.

2. Execution Challenges

The Q4 2024 roadmap is ambitious, with many features dependent on timely implementation and adoption.

Past delays in delivering V2.0 has raised questions about the team’s ability to meet future deadlines.

3. High Technical Complexity

The hypergraph network and Proof of Meaningful Work require specialized knowledge. Adoption may lag without sufficient developer support or accessible tooling.

4. Competitive Landscape

Quilibrium faces rivals, all offering decentralized solutions for internet infrastructure. Differentiation will require significant technological and ecosystem advantages.

5. Limited Proven Use Cases

While Quilibrium’s vision is compelling, real-world applications and developer traction are still in their infancy.

🌟 Final Verdict

Spearheaded by Cassandra Heart, the project’s mission to create a decentralized internet resonates with growing user demand for privacy and autonomy.

Quilibrium’s fair launch and advanced technology provide a strong foundation for decentralization and innovation. With the release of Version 2.0 and a robust roadmap for 2024-2025, the project has significant upside potential. However, challenges like token sell-offs, delayed execution, and intense competition cannot be ignored.

Moon Potential

High: Successful execution of the roadmap, dApp development, and exchange listings could push $QUIL into the spotlight.

Dust Risk

Substantial: Execution failures, weak adoption, or competitive pressures could limit long-term success.

👉 Bottom Line

Quilibrium is a high-risk, high-reward project that embodies the ethos of decentralization. For speculative investors, it offers a unique opportunity to back an ambitious vision for a private, censorship-resistant internet. Monitoring the rollout of roadmap features and ecosystem growth will be key to assessing its long-term viability.

4/ Future Trends in the DePIN Narrative: Unlocking the Next Wave of Decentralized Innovation

The concept of Decentralized Physical Infrastructure Networks (DePIN) is rapidly gaining traction, representing a transformative shift in how infrastructure is created, maintained, and monetized. From decentralized storage solutions to GPU networks, DePIN combines blockchain technology with physical infrastructure to foster decentralization, efficiency, and community-driven innovation. Here's an analysis of future trends shaping this exciting narrative.

Rather than zoom in on the DePIN narrative in general, which would take forever, I've chosen to talk about this narrative through a very specific project that demonstrates all the innovations that can be brought about by this narrative and that can really transform the ecosystem.

DePIN narrative is very connected to the AI narrative, which you know I am very bullish on 👀

We already spoke about Render in this newsletter a few weeks ago, so we are going to talk about another very interesting DePIN project, named Glow.

📈 Market Growth and Diversification

Explosive Growth in Adoption

The DePIN market is expected to expand exponentially as more sectors integrate decentralized infrastructure models.

With more than 1,300 projects and millions of devices globally, DePIN's footprint spans industries such as telecommunications, energy, and artificial intelligence.

Emerging Sectors

Energy: DePINs powering solar grids and EV charging stations could revolutionize sustainable energy deployment.

Healthcare: Decentralized data storage and processing for sensitive medical records.

AI & ML: GPU-focused DePINs like Akash Network and IONet will drive decentralized compute solutions, addressing AI’s insatiable demand for power.

🌐 Real-World Application: The Case of Glow.

The rise of Decentralized Physical Infrastructure Networks (DePIN) has unlocked transformative possibilities, and Glow, an Ethereum-based protocol, is at the forefront of this narrative. Glow’s focus on decentralized solar energy showcases how blockchain technology can reshape the global energy landscape while addressing critical environmental challenges.

🌞 Glow’s Impact: Scaling Solar Energy in India

Glow recently secured $30 million in funding from notable venture capital firms like Framework Ventures and Union Square Ventures, alongside others including Protocol Labs and Hack VC. These funds are set to:

Expand Solar Infrastructure: Glow’s solar grid in India will provide clean energy for 34,000 households, marking a significant step in renewable energy adoption.

Reduce Carbon Emissions: Existing solar farms in Glow’s network are projected to eliminate over 85,000 tons of CO2 emissions during their lifespan.

From Rooftops to Mega Projects

What began as a rooftop solar project in the U.S. has now evolved into a global network, with several multimillion-dollar solar farms established across India. Glow’s rapid expansion underscores the scalability and economic viability of the DePIN model.

📈 Economic Model and Rewards

Glow incentivizes participants using a dual-reward system:

GLW Tokens: Solar farms receive tokens proportional to their electricity output.

Stablecoin Rewards: Additional rewards are earned for carbon credits, prioritizing regions with the highest potential for offsetting carbon emissions.

This incentive structure fosters participation and aligns economic rewards with environmental impact, targeting regions like Rajasthan, where Glow’s recent expansion has further boosted revenue to $5 million.

We don’t have any date for the token release yet 👀

🌍 Leader in DePIN Revenue

According to DePIN.Ninja, Glow has surpassed competitors like Helium, achieving over $4 million in revenue since its beta launch in 2023. This makes it the most profitable DePIN network to date, with its Rajasthan expansion playing a key role in reaching this milestone.

🚀 Glow and the Broader DePIN Vision

Glow embodies the potential of DePIN to revolutionize physical infrastructure. By leveraging blockchain, it allows individuals to collectively own, maintain, and profit from renewable energy systems. This approach is not only economically scalable but also drives sustainable development in high-impact areas.

As Michael Anderson, co-founder of Framework Ventures, aptly put it:

“We think DePIN can be a powerful tool for rolling out physical infrastructure across the world.

The Future of DePIN Energy

Glow’s success paves the way for other energy-focused DePIN protocols, which facilitates peer-to-peer energy trading. These projects demonstrate how decentralized models can:

Accelerate clean energy adoption in regions with limited traditional infrastructure.

Empower local communities through financial incentives and shared ownership.

Address global climate goals by scaling renewable energy solutions.

🌟 Glow’s Role in the DePIN Ecosystem

Glow is not just a DePIN success story—it is a blueprint for how blockchain can drive meaningful, scalable, and sustainable change in the energy sector. With its innovative token rewards, focus on environmental impact, and rapid growth, Glow has set the standard for DePIN projects aiming to balance economic profitability with environmental responsibility.

As Glow expands further, it solidifies the DePIN narrative as a cornerstone of decentralized innovation in the 2020s, proving that a community-driven model can outpace traditional infrastructure development while fostering global sustainability.

🌟 The Promise of DePIN

DePIN represents a paradigm shift in infrastructure development, democratizing access and empowering communities through blockchain-based incentives. While technical and regulatory challenges remain, the narrative’s potential to disrupt industries like AI, energy, and telecommunications is undeniable.

2024 and Beyond: Key Drivers

Expansion of GPU Networks: Vital for AI and ML applications.

Energy DePINs: Crucial for sustainable infrastructure.

Mainstream Partnerships: Bridging DePINs with traditional sectors will unlock untapped potential.

The next decade could witness DePINs evolving into a foundational layer of the global economy, shaping a future where infrastructure is not only decentralized but also efficient, inclusive, and resilient.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.