This Week's Newsletter - Case Study on Helium, Main News of the Week, Zoom on Solana's Ecosystem

Weekly Alpha

This edition is available as an AI-generated Podcast. ⭡

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM Frens,

This week, we’re turning our attention to Solana.

Solana has been one of the biggest winners of the previous cycle, and is still highly relevant in the current one, further strengthening its ecosystem.

You know the drill already, Solana is a blockchain making waves with its speed, scalability, and ecosystem growth, driving innovation across DeFi, NFTs, and more.

One area where Solana shines is its ability to support high-velocity trading environments. With ultra-low fees and lightning-fast transaction speeds, the platform has become a fertile ground for a variety of assets, from traditional tokens to highly speculative trends like memecoins.

Memecoins have found a thriving playground on Solana. These assets often ignite bursts of activity, driving up daily transactions, trading volumes, and active addresses.

While their speculative nature raises questions about sustainability, the economic activity and liquidity they generate can't be overlooked. Memecoins provide exposure to new users, offering an accessible entry point into the broader Solana ecosystem.

However, this trend comes with challenges. The rapid rise (and fall) of speculative assets can create volatility, overshadowing Solana's long-term innovations. Striking a balance between supporting market trends and maintaining ecosystem stability will be key to its sustained growth.

Beyond trading, technical advancements like the adoption of TypeScript and the introduction of Fire Dancer underline Solana’s focus on scalability and developer-friendly infrastructure. These innovations make the network even more appealing to developers building the next generation of decentralized applications.

Consistent growth in active addresses, transaction volume, and ecosystem diversity highlights Solana’s position as a blockchain leader. In fact, Solana's DEX trading volume now rivals Ethereum's, cementing its reputation as a high-performance blockchain.

As Solana's infrastructure matures, its influence extends beyond DeFi and trading. Projects like Helium, leveraging Solana for decentralized connectivity, showcase its potential to disrupt traditional industries. Combined with its growing ecosystem and developer-first approach, Solana is evolving into a blockchain that can support a wide variety of use cases.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

And have a look at my Latest Post on X:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

In this week’s newsletter, we’ll explore:

A case study on Helium, a project leveraging Solana’s infrastructure.

Main News of the Week to keep you updated.

A closer look at Solana’s evolution—from its technical strengths to its growing ecosystem, and how it could lead the charge in the next market cycle.

Let’s dive into the details and explore why Solana is quickly becoming one of the most exciting blockchains in crypto. 🌟

Today's Newsletter is brought to you by Mantle:

💎 Unlock $ENA & $EIGEN Rewards on Mantle’s Rewards Station

Mantle is revolutionizing staking rewards with its Rewards Station, now offering 4M $ENA and 570K $EIGEN in rewards. This builds on the success of previous campaigns, which distributed billions of Ethena shards, $COOK tokens, and $MNT, making Mantle a standout in DeFi yield opportunities.

What Is the Rewards Station?

The Rewards Station is Mantle’s premier event, allowing $MNT holders to lock tokens and earn Mantle Power (MP), which determines their share of the prize pools.

Event Duration:

$ENA Pool: Dec. 6 – Mar. 6.

$EIGEN Pool: Dec. 11 – Mar. 11.

Rewards:

Up to 64% APY for $ENA (300-day lock).

$EIGEN pool rewards 570K $EIGEN (~$2.8M).

How to Participate:

Hold $MNT in a supported wallet on Mantle L2 (e.g., Bybit Web3 Wallet or MetaMask).

Connect to rewards.mantle.xyz.

Lock $MNT and allocate MP to the pool of your choice.

Why $ENA and $EIGEN Are Worth Your Attention

Both pools offer unique opportunities:

$ENA Pool: Offers the highest yield, starting at ~18.35% APR with no lock-up and up to 64% APY for 300-day locks. Rewards are tied to Ethena, an ecosystem focused on stablecoins and decentralized collateral.

$EIGEN Pool: Perfect for those bullish on Web3 scalability. Eigen focuses on decentralized data infrastructure, making it an ideal choice for long-term believers in Mantle’s growth.

Previous Rewards Station Highlights

Mantle has consistently rewarded its community with high-value campaigns:

Ethena Shards: 2.8B distributed pre-TGE.

$COOK: 4% of supply distributed during Meme Lab.

$MNT: Millions distributed across campaigns.

The new $ENA and $EIGEN pools continue this tradition with competitive yields and meaningful ecosystem alignment.

Tips to Maximize Your Rewards

1️⃣ Long-term Staking for Maximum APY: Lock $MNT for 300 days to maximize MP and claim the highest rewards from the $ENA Pool.

2️⃣ Diversify Pools: For Web3 believers, allocate MP to the $EIGEN Pool to earn exposure to Eigen’s growing ecosystem.

3️⃣ Act Early: Join the events early for lower competition and higher reward shares.

4️⃣ Delta-Neutral Strategies: For risk-averse users, pair $MNT staking with shorting strategies (e.g., via Hyperliquid) to generate balanced returns.

Get Started Today

Lock your $MNT and allocate MP across pools

With $ENA and $EIGEN rewards available, Mantle offers one of the best staking opportunities in DeFi right now.

1/ Helium Case Study: Revolutionizing IoT Connectivity

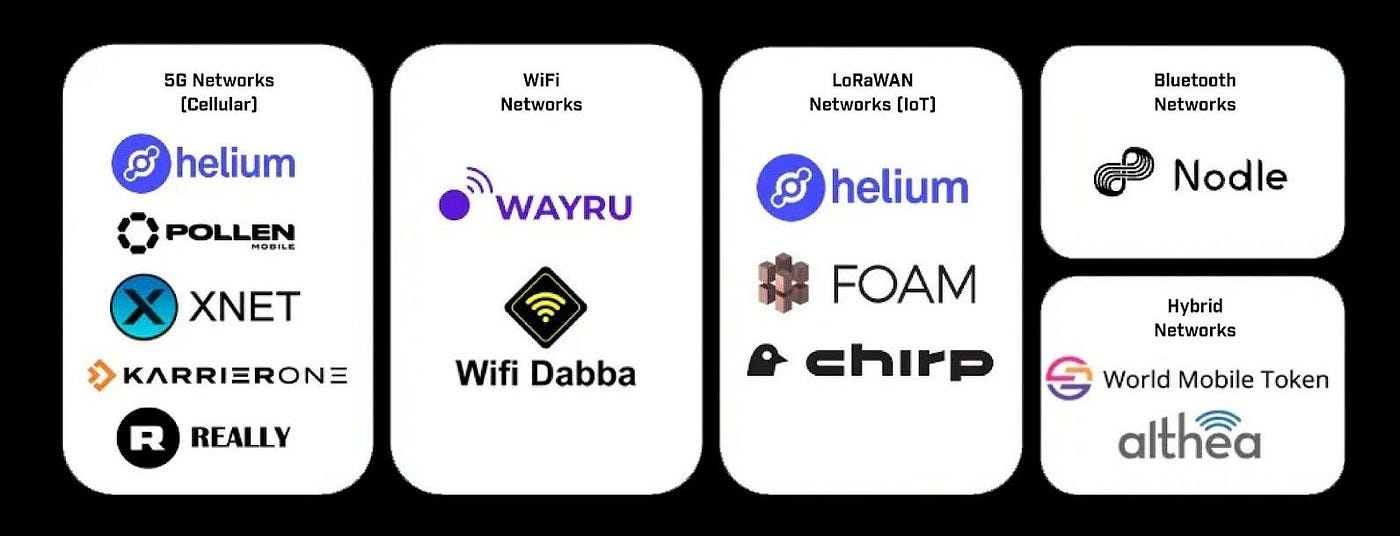

Helium, a blockchain-powered network, has positioned itself as a transformative force in the Internet of Things (IoT) space. By leveraging decentralized infrastructure and innovative incentive models, Helium addresses connectivity challenges while offering substantial rewards to contributors. With its proprietary Proof of Coverage (PoC) consensus mechanism and an ecosystem focused on incentivizing high-quality network participation, Helium is redefining IoT network paradigms.

This case study examines the network's architecture, real-world applications, strategic growth, competitive positioning, and a detailed analysis of its Q3 2024 performance.

Helium's Unique Operating Model

1. Hotspots and Rewards: Building a Decentralized Network

Helium enables users to establish wireless coverage through "hotspots," which serve as decentralized access points. These hotspots facilitate IoT connectivity and mobile traffic, rewarding operators in Helium tokens (HNT). The model encourages network expansion by providing financial incentives aligned with coverage quality.

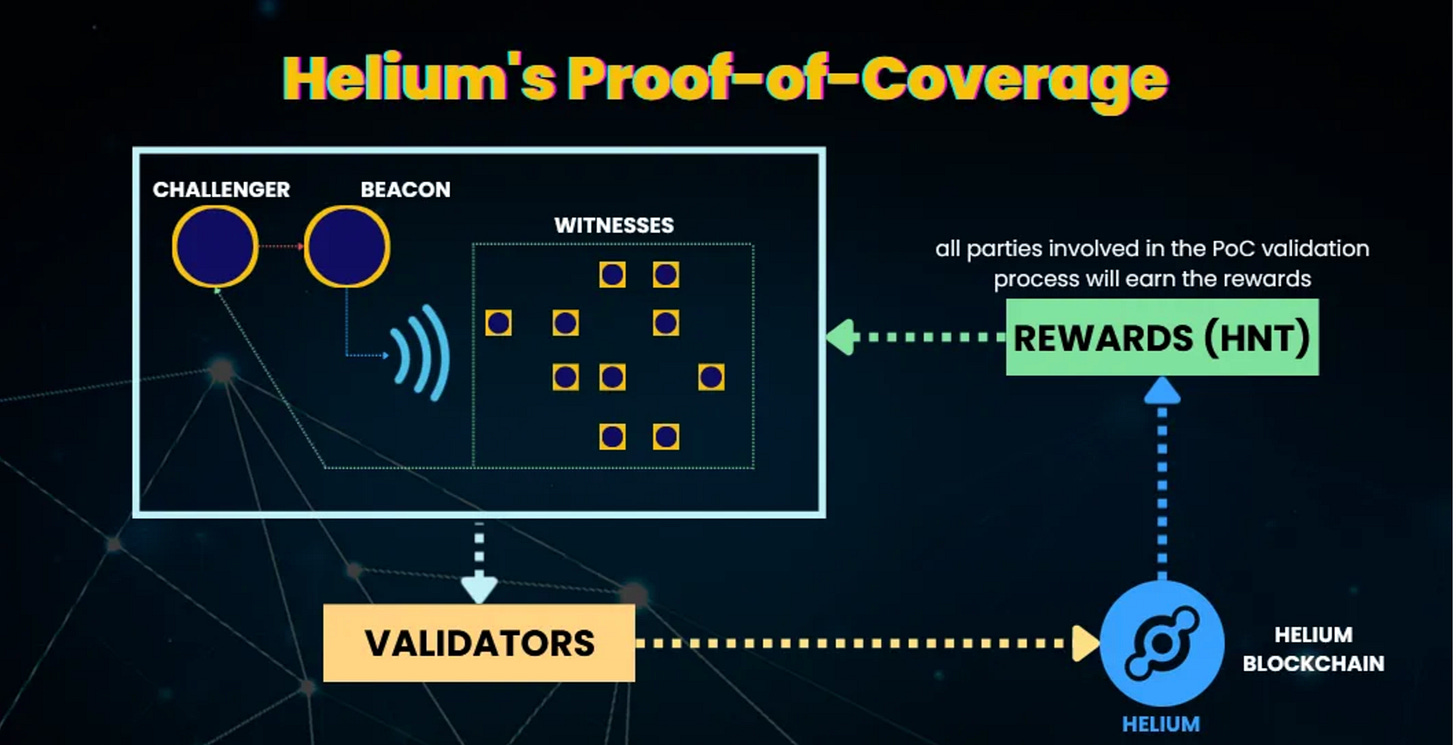

2. Proof of Coverage (PoC): Guaranteeing Network Integrity

The PoC mechanism validates the active contribution of hotspots to the network, ensuring data integrity and reliability. By utilizing this system, Helium promotes a self-sustaining ecosystem where participants' efforts directly translate into rewards.

3. Incentive-Driven Ecosystem

Helium's structure ensures that those who provide consistent and reliable coverage receive higher compensation in HNT tokens. This meritocratic system incentivizes optimal network deployment and maintenance.

Real-World Applications: Expanding Beyond Smart Cities

Initially focused on urban IoT networks, Helium has broadened its scope to cater to diverse industries:

Supply Chain and Logistics: Enabling real-time tracking of goods and fleet management.

Healthcare: Supporting remote patient monitoring and medical device connectivity.

Environmental Monitoring: Facilitating data collection from remote sensors for climate research and natural disaster management.

Architecture and Smart Buildings: Enhancing automation and IoT connectivity in modern structures.

These applications highlight Helium’s potential to address global challenges, making it an indispensable tool for industries reliant on IoT networks.

Strategic Partnerships and Adoption

Helium has accelerated adoption through collaborations with enterprises and industry players. Such partnerships expand its footprint across sectors, ensuring sustainable growth while driving IoT innovation.

Impact on IoT Ecosystem and Broader Industry Trends

Democratizing Connectivity

Helium's decentralized model challenges traditional telecom monopolies by putting control in the hands of users. This not only reduces costs but also empowers communities to build and maintain their own connectivity networks.

Bridging the Digital Divide

By providing affordable IoT and mobile connectivity, Helium has the potential to connect underserved and remote areas. Its infrastructure can support smart farming, wildlife tracking, and other initiatives critical for rural development.

Driving Industry Standards

Helium’s success could influence the IoT industry to adopt decentralized solutions, fostering competition and innovation. Its Proof of Coverage model may serve as a blueprint for other blockchain-based networks aiming to provide real-world utility.

Analyzing Q3 2024 Performance

1. Key Metrics and Growth

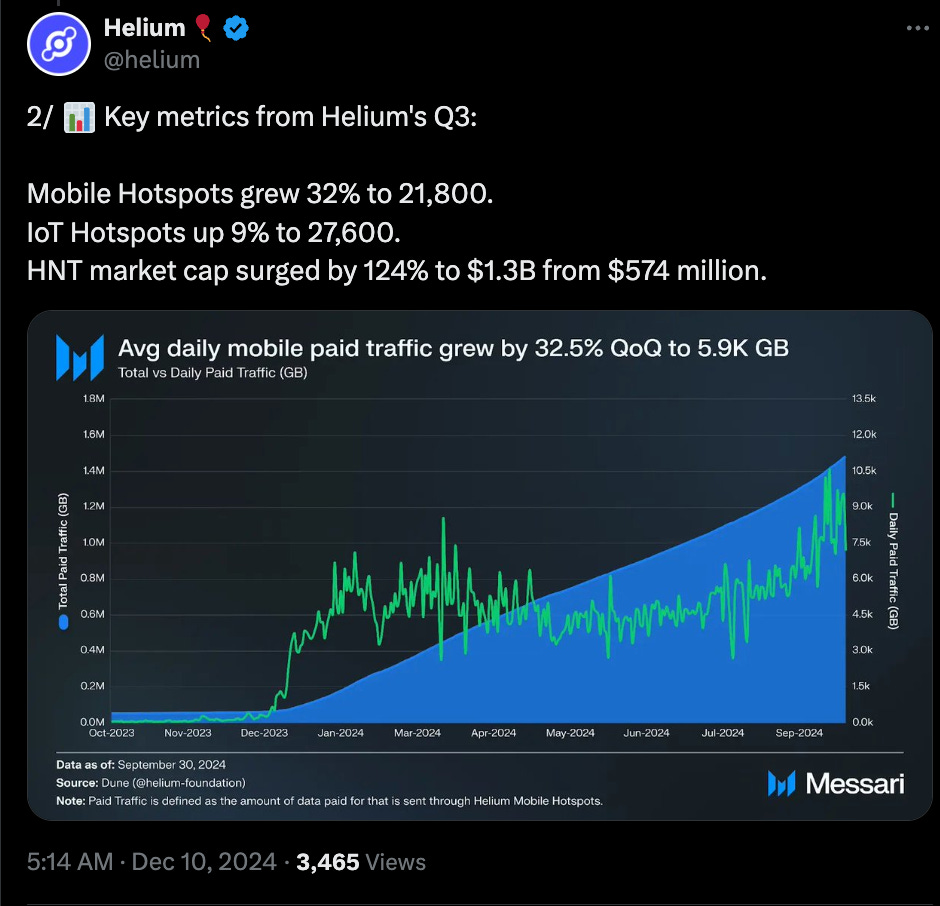

According to Helium's Q3 2024 report by Messari:

Data Offloaded: The network achieved 88,000 GB of carrier data offloading, representing a staggering 10,202% quarter-over-quarter increase.

Subscriber Base: Helium Mobile reached 116,000+ subscribers, reflecting the growing demand for decentralized connectivity solutions.

Hotspot Deployment: The network expanded to 49,000 hotspots, underpinning its role in driving IoT and mobile networks.

The exponential growth in offloaded data underscores Helium's capability to meet increasing connectivity demands while scaling effectively.

2. Traffic and Market Metrics

Mobile Hotspot Growth: A 32% increase in mobile hotspots raised their number to 21,800, while IoT hotspots grew by 9% to 27,600.

Market Capitalization: HNT's market cap surged 124%, reaching $1.3 billion from $574 million.

Traffic Expansion: Average daily mobile paid traffic grew by 32.5%, reaching 5.9 GB/day.

These metrics reveal robust adoption and network activity, positioning Helium as a key player in decentralized IoT solutions.

3. Insights from the Data

Helium's Q3 data reflects several important trends:

Rapid Scalability: The network's ability to scale offloading capacity aligns with growing industry demand.

Increased Utility: Expanding hotspots and subscriber growth illustrate the increasing utility of Helium's offerings in real-world scenarios.

Market Confidence: Thet significant market cap increase reflects investor confidence in Helium's long-term viability and growth potential.

Conclusion

Helium is emerging as a game-changer in decentralized IoT connectivity, backed by its unique PoC model, innovative incentive structures, and a rapidly growing network. Its Q3 2024 performance underscores the scalability and viability of its ecosystem, marking it as a project with immense potential. With increasing adoption across industries, strategic partnerships, and robust market performance, Helium is poised to redefine the future of IoT networks.

Compared to other blockchain giants like Ethereum and Polkadot for exemple, Helium focuses on a niche market—decentralized IoT connectivity offering unparalleled efficiency in connecting low-power devices.

This specialization allows Helium to dominate its segment while complementing broader blockchain ecosystems.However, the volatile nature of cryptocurrency markets and competition from established players necessitate careful monitoring. Investors and participants must remain informed about developments within the Helium ecosystem to leverage its full potential effectively.

2/ Crypto and DeFi News :

👎🏻 Microsoft shareholders vote ‘no’ on Bitcoin reserve

Microsoft shareholders rejected a proposal to allocate a portion of the company’s profits to Bitcoin reserves during the annual meeting on Dec. 10. The proposal, brought by the National Center for Public Policy Research (NCPPR), suggested using Bitcoin to diversify profits and hedge against inflation. While proponents cited examples like BlackRock’s Bitcoin ETF and MicroStrategy’s holdings, Microsoft’s board opposed the idea, emphasizing Bitcoin’s volatility and the company’s existing treasury management strategies. Shareholders ultimately aligned with the board's recommendation, voting against the resolution.

Thought: Microsoft’s decision to reject Bitcoin as a treasury asset mirrors its cautious stance in prior technology waves, such as its underestimation of Apple’s iPhone in 2007. Back then, Microsoft’s CEO Steve Ballmer dismissed the iPhone due to its high price and lack of a physical keyboard, favoring Windows Mobile’s business-centric devices. This skepticism cost Microsoft significant ground in the mobile market.

Similarly, rejecting Bitcoin highlights the tension between safeguarding stability and embracing innovation. While Bitcoin's volatility is a valid concern, it also represents a transformative financial asset gaining traction among corporations like MicroStrategy and BlackRock. By adhering to traditional treasury strategies, Microsoft risks sidelining itself in a growing crypto-financial wave that could redefine asset diversification and long-term value creation. This decision could later be viewed as a missed opportunity to position itself at the forefront of financial innovation.

My post on BTC holdings by traded companies.

🇺🇸 NY regulator approves Ripple’s RLUSD stablecoin

Ripple’s RLUSD stablecoin has received approval from the New York Department of Financial Services (NYDFS), as confirmed by CEO Brad Garlinghouse on Dec. 10. RLUSD, designed to compete with USDT and USDC, will be pegged 1:1 to the U.S. dollar and backed by USD deposits, short-term U.S. Treasury bonds, and other cash equivalents. Ripple has been testing RLUSD on the XRP Ledger and Ethereum mainnets since August and has partnered with exchanges such as Bitstamp, Uphold, and Bullish. Ripple projects RLUSD could achieve a $2 trillion market cap by 2028, focusing on institutional adoption.

Thought: NYDFS approval of RLUSD marks a pivotal moment for Ripple as it ventures into the highly competitive stablecoin market. With institutional backing as its target, Ripple's approach underscores the importance of regulatory compliance to foster trust and adoption. The RLUSD stablecoin could strengthen Ripple's ecosystem and complement its XRP token, creating a diversified offering for both DeFi and traditional financial markets. However, achieving market share in a space dominated by USDT and USDC will depend on Ripple’s ability to showcase RLUSD’s stability, utility, and integration within existing systems. This move could signal a broader shift toward institutional-grade digital assets.

💻 Quantum computing could be a threat to Satoshi Nakamoto’s 1 million Bitcoin

Advancements in quantum computing have reignited concerns about the vulnerability of Satoshi Nakamoto's 1 million BTC, stored in early Bitcoin transaction formats (P2PK) that expose public keys on the blockchain. Unlike the more secure P2PKH format used today, these coins could theoretically be targeted by quantum computers capable of deriving private keys from exposed public keys. Suggestions to freeze Satoshi's holdings to prevent exploitation have sparked debates within the crypto community. While freezing would require a Bitcoin Improvement Proposal (BIP) and consensus-driven network changes, critics argue it undermines Bitcoin’s core principles of decentralization and immutability. Proponents see it as a necessary step to safeguard the network’s integrity against future quantum threats.

Thought: The quantum threat to Satoshi’s BTC encapsulates a critical challenge: balancing Bitcoin’s foundational values with emerging risks. Freezing these holdings would represent an unprecedented intervention, potentially eroding trust in Bitcoin’s immutability and decentralization. However, the sheer scale of Satoshi's holdings—combined with their exposure—presents a unique systemic risk, as a quantum breach could destabilize the broader market. While this scenario remains theoretical for now, it highlights the urgency of advancing quantum-resistant cryptographic standards within Bitcoin's protocol. Any decision will need to carefully weigh Bitcoin’s ethos against the practical need to protect its future from technological disruptions.

However, it seems like the latest advancements in quantum computing, Google’s Willow, only has 105 qubits, while Bitcoin’s encryption would require millions of error-corrected qubits.

Short-term: The threat to Bitcoin from quantum computing is negligible due to technological limitations.

Long-term: Preparing for quantum-resistant cryptography is critical but will require careful implementation to preserve Bitcoin’s core values.

I’m not a quantum nor a Bitcoin Security Expert, so here is a bit more about Quantum Computing and Willow.

🐂 Maverick Protocol aims to bring ‘MemeFi’ to Base

Maverick Protocol launched goose.run, a MemeFi platform on Base, Coinbase’s Ethereum Layer-2 network, aiming to enhance DeFi for memecoins. Goose.run allows users to lend and borrow against memecoins, a feature unavailable on most platforms, and facilitates liquidity bootstrapping for new tokens. Bob Baxley, a contributor, highlighted Base's untapped potential for memecoin platforms. Goose.run also plans to incorporate video broadcasting to gamify memecoin trading. With Base surpassing $4 billion in total value locked (TVL), Goose.run positions itself to capitalize on the growing interest in memecoins, which now command over $128 billion in market cap.

Thought: Goose.run’s launch reflects the evolution of memecoins into a legitimate financial niche, intertwining them with innovative DeFi mechanisms. By enabling lending and borrowing for memecoins, the platform could attract speculative traders while increasing network activity. The gamification approach, including livestreaming, might help bridge the gap between meme culture and financial utility, much like platforms on Solana have achieved. However, success will hinge on mitigating risks like harmful content, which recently impacted Solana's Pump.fun. If successful, goose.run could further solidify Base’s position as a leading Layer-2 network and elevate memecoins beyond speculative assets to dynamic financial instruments.

🇨🇳 CZ says it’s inevitable for China to build a BTC reserve

Former Binance CEO Changpeng Zhao (CZ) stated that it is "inevitable" for China to establish a strategic Bitcoin reserve, although he acknowledged the unpredictability of the Chinese government's crypto policies due to its lack of transparency. Speaking at the Bitcoin MENA conference, CZ speculated that smaller nations might first adopt Bitcoin reserves, but larger powers like China could act swiftly when the time comes. CZ remarked that Bitcoin’s status as a "hard asset" would likely compel the Chinese government to eventually accumulate it, though he suspects they would act covertly before any public announcement.

Thought: CZ’s prediction underscores Bitcoin’s evolving role from a decentralized asset to a potential instrument of national strategy. While smaller countries may adopt BTC reserves to hedge against fiat volatility, China’s involvement could signal a seismic shift in Bitcoin’s geopolitical significance. Given China's previous restrictions on crypto, a sudden pivot to accumulation could reflect broader recognition of Bitcoin’s scarcity and utility. However, the lack of transparency in China’s financial policy leaves room for uncertainty, potentially making any accumulation a stealth operation. Should this scenario unfold, it may drive Bitcoin’s valuation significantly, raising questions about equitable access and the broader implications of state-driven hoarding of decentralized assets.

To see my post about BTC holdings by countries.

3/ Solana: A Leader in the Crypto Space

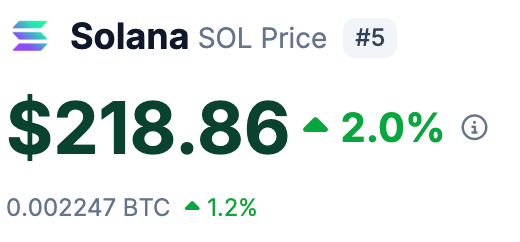

Solana is already one of the leading players in the blockchain ecosystem. Despite skepticism and lingering criticism, recent trends and data suggest that this blockchain is significantly undervalued and poised for explosive growth in the near future.

A Growing Market Presence

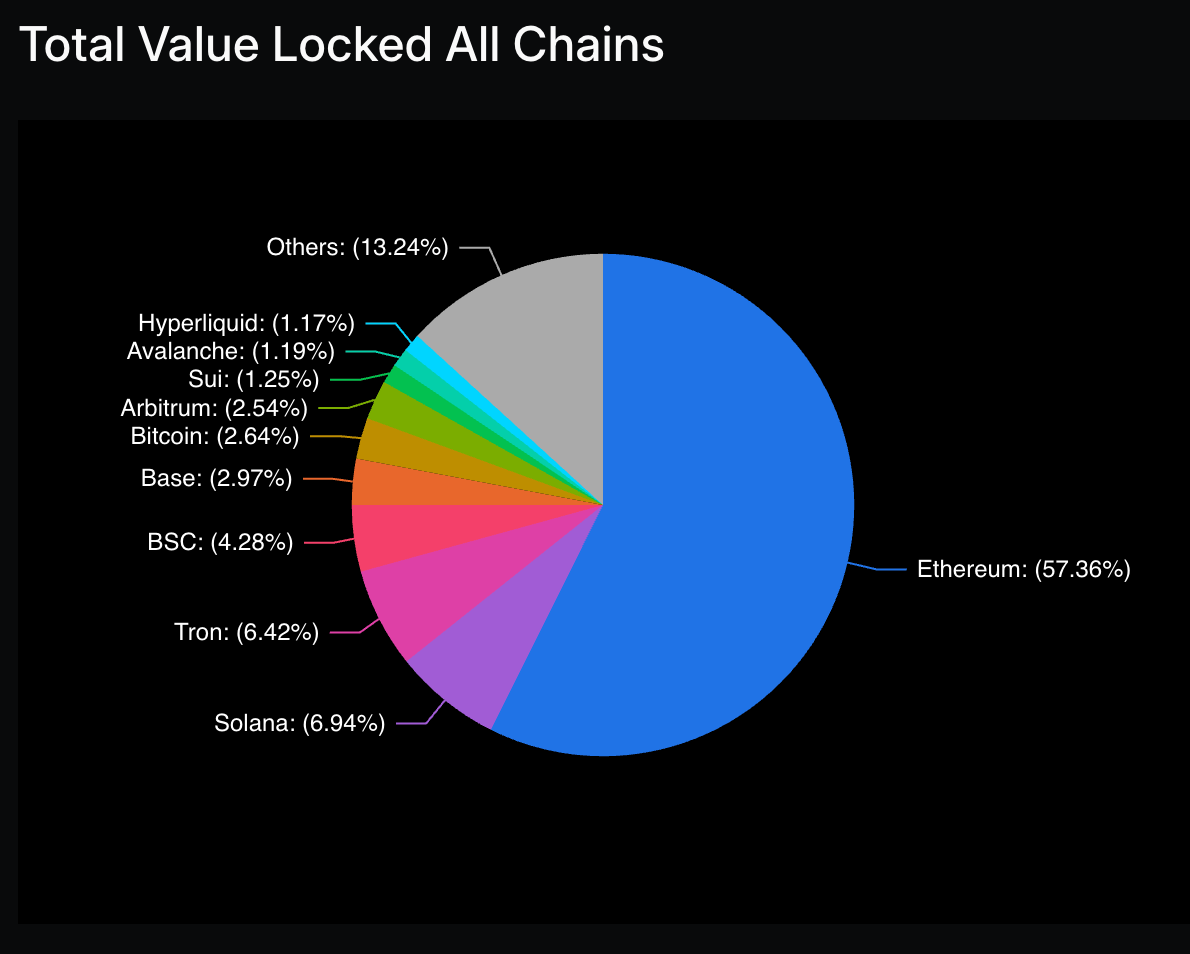

Solana’s dominance in the DeFi space is hard to ignore:

DEX Volume: Solana commands over 30% of total decentralized exchange (DEX) trading volume this month, even surpassing Ethereum. This highlights its appeal to users and developers alike.

Fee Revenue: Solana generates significant fee revenue, ranking among the most profitable blockchains in the market.

Sustained Growth: Solana continues to see growth in critical metrics like active addresses and transaction counts.

A Thriving Ecosystem

Solana’s ecosystem stands out as mature and diverse, especially when compared to other blockchains like Cardano:

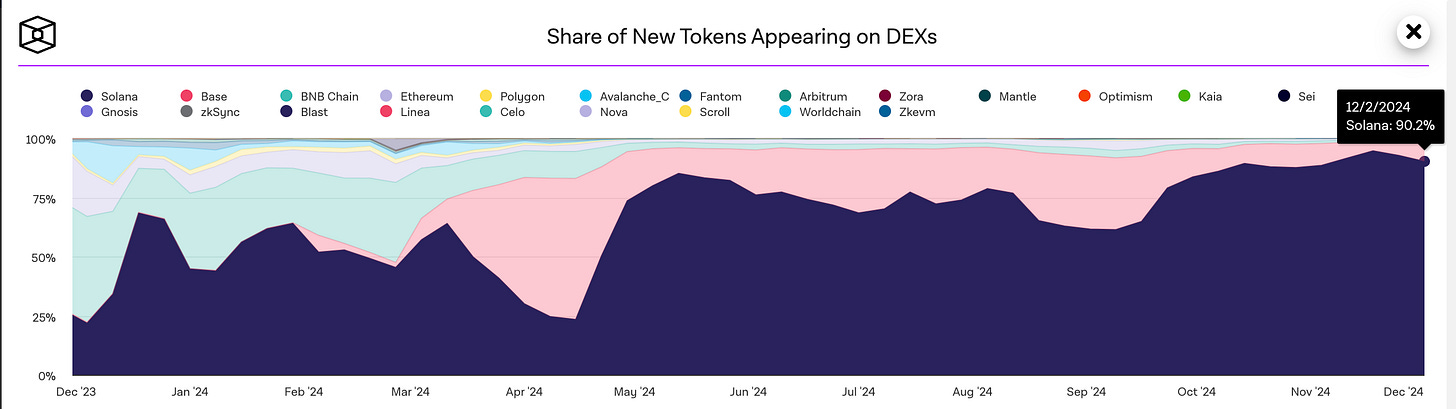

High-Value Altcoins: Solana hosts a larger number of projects with high market capitalizations, reflecting its vibrant and advanced ecosystem, and also has the biggest share of new tokens appearing on DEX’s.

Native Stablecoin: Solana benefits from having USDC as a native stablecoin, an essential component for DeFi adoption and real-world blockchain integration. In contrast, Cardano lacks a comparable stablecoin, limiting its reach in the DeFi sector.

Altcoin Boom on Solana

Solana’s ecosystem is primed for a significant altcoin resurgence, mirroring past success stories like Binance Smart Chain in 2020-2021.

Historical Precedent: The performance of altcoins on Binance Smart Chain during its rise suggests a similar trajectory for Solana.

Promising Projects: Key projects such as Jupiter, Helium, Raydium, Render showcase the potential of Solana’s ecosystem.

Key Growth Factors: Solana is attracting a steady influx of skilled developers, building innovative products, and growing its user base, all of which contribute to its accelerating momentum.

The Numbers Don’t Lie

Solana’s financial and operational performance underscores its strength:

Revenue Growth: Solana generates over $1 million in daily revenue, which is 35–40% of Ethereum’s earnings despite having a significantly lower Total Value Locked (TVL) and market cap.

Mass Adoption: All key indicators are trending upwards, from active addresses to transaction volume.

The Breakout Potential

Many analysts see Solana as a breakout candidate ready to exit its current price range and reach new highs. While meme coins on Solana have drawn criticism, their trading volume still contributes to the chain’s growth. If the focus shifts toward more mature decentralized applications (dApps), Solana’s perception as a serious blockchain could skyrocket even further.

Why Solana Matters Now

Solana’s valuation relative to its market dominance, ecosystem strength, and revenue generation presents a compelling investment thesis. Whether as a long-term player or a high-risk, high-reward bet, Solana stands out as one of the most promising blockchains in the space today.

Spotlight on Solana Ecosystem Projects

Raydium (RAY) :

Raydium is the leading decentralized exchange (DEX) within the Solana ecosystem, renowned for its efficiency, low transaction fees, and integration with Serum's order book. This unique setup enables high-speed trading and liquidity sharing, solidifying Raydium as the backbone for most DeFi activities on Solana.

Key Features and Strengths

Liquidity Dominance: Raydium holds 75% of the liquidity on Solana, positioning it as the central hub for DeFi on the network.

Capital Efficiency: Despite a lower TVL (Total Value Locked) than competitors like Uniswap, Raydium generates proportionally higher trading volumes, reflecting its optimized economic model.

Profit from Trends: As an infrastructure layer, Raydium benefits from trends like memecoin trading without relying on any specific token for its success.

Tokenomics

The native token, $RAY, plays a central role in the ecosystem:

Used for transaction fees, staking, liquidity provisioning, and governance.

With 100% of tokens already unlocked, it eliminates concerns about large sell-offs by early investors, reducing dilution risks for token holders.

What is the Fee Switch?

The fee switch lets DeFi protocols share a portion of their revenue with token holders, turning governance tokens into yield-generating assets. This aligns token value with protocol performance, incentivizing long-term holding and engagement.

While not widely adopted yet due to regulatory concerns, it’s a game-changer for protocols looking to boost token utility and attract investors.

What About the Fee Switch?

Raydium already has a partial fee-sharing model:

84% of fees go to liquidity providers.

4% goes to the treasury.

12% is used for RAY token buybacks.

Introducing a full fee switch could directly link RAY’s value to Raydium’s growth, making it more attractive to holders.

Why the Fee Switch Matters for Raydium

The fee switch mechanism could address a core challenge in DeFi: the lack of tangible value for governance tokens. By redistributing a portion of fees to RAY stakers, Raydium could:

Create Yield for RAY Holders: Adding a direct financial incentive for staking or holding RAY would transform it into a yield-generating asset.

Incentivize Long-Term Participation: A fee switch would reward long-term holders, reducing speculative behavior and fostering a more stable community.

Align Interests: Linking token value to protocol success strengthens the alignment between Raydium’s growth and its community’s loyalty.

By the Numbers

Raydium generated $558 million in fees in 2024, largely driven by its dominance as the go-to DEX for memecoin trading. Let’s consider a scenario where Raydium implements a 20% fee switch:

$111.6 million would be distributed to RAY stakers.

Assuming 30% of RAY tokens (about $1.57 billion market cap) are staked, the annualized yield for stakers could reach 26%.

This would make staking RAY one of the most lucrative opportunities in DeFi, potentially attracting significant new capital to the ecosystem.

Risks

Dependence on Solana: Raydium’s success is closely tied to Solana’s growth and stability, making it vulnerable to any network issues.

Volatile Markets: Sudden shifts in market trends or liquidity can impact both the protocol and token value.

Raydium’s dominance on Solana and robust infrastructure already make it a top player in DeFi. However, implementing a fee switch could elevate it to the next level by transforming $RAY into a yield-generating asset. This would not only attract long-term holders but also cement Raydium’s position as a pioneer in innovative tokenomics, driving sustained growth for the protocol and its community.

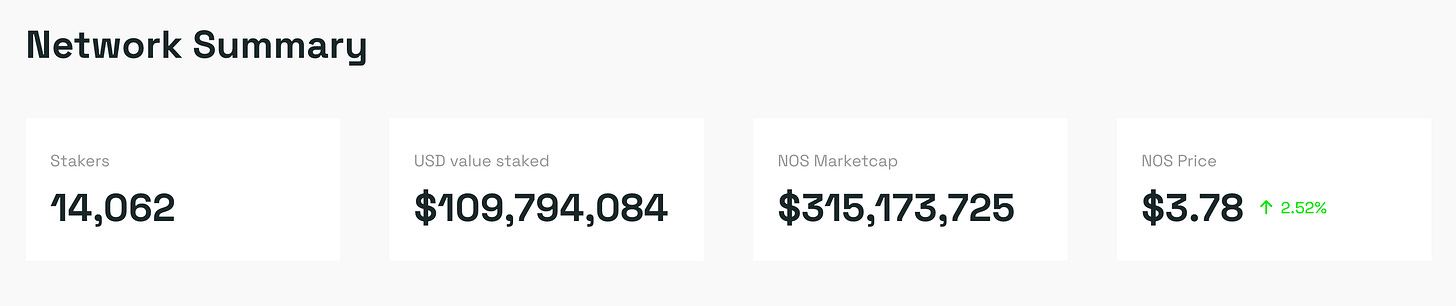

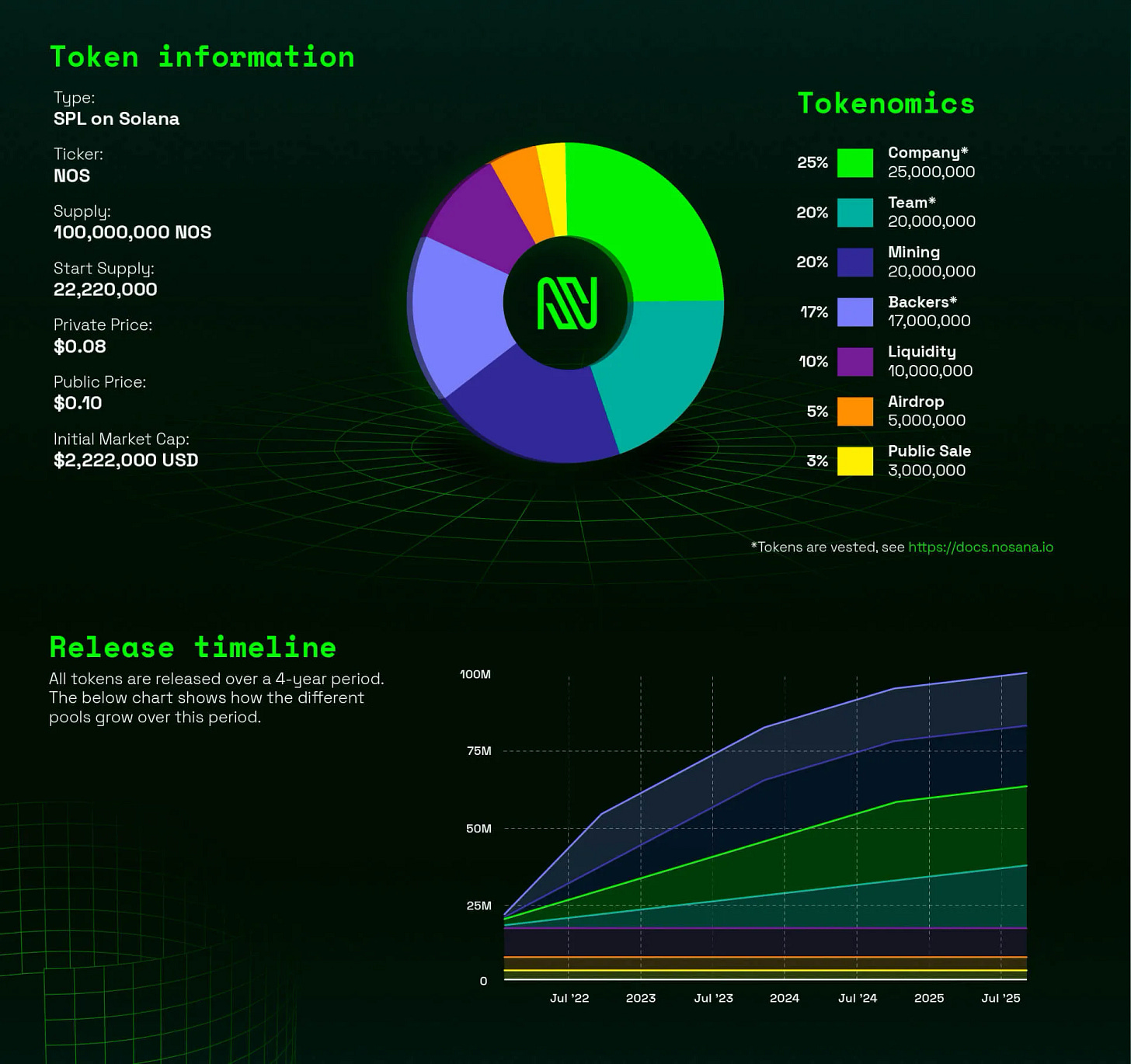

Nosana (NOS) :

Nosana is revolutionizing decentralized cloud computing by providing accessible and cost-efficient GPU power for AI applications. Positioned uniquely within the Solana ecosystem, it addresses key challenges in AI development.

Key Features and Strengths:

GPU Optimization: Nosana optimizes GPU clusters, offering similar performance to high-end GPUs but at a fraction of the cost.

AI Demand: Focused on AI inference, a rapidly growing sector, Nosana aligns its services with one of the most lucrative markets in tech today.

Token Usage: With a significant portion of tokens staked (35%), the tokenomics are designed to reduce selling pressure.

Tokenomics:

The $NOS token fuels transactions and incentivizes participants.

A majority of the supply is already in circulation, which mitigates concerns about future inflation.

Potential:

While still in development, with its mainnet expected in early 2025, Nosana has drawn comparisons to Render Network. Its lower market cap suggests significant upside potential, although it remains a speculative play until its product is fully operational.

Shadow Token (SHDW) :

Shadow Token redefines decentralized storage by leveraging mobile devices, aligning with Solana's "mobile-first" approach. Its innovative strategy taps into the underutilized storage capacity of billions of smartphones worldwide.

Key Features and Strengths:

Decentralized Storage: SHDW offers an alternative to centralized solutions, ensuring secure and private data storage.

Monetization of Idle Resources: Users can earn rewards by renting out unused phone storage, turning everyday devices into network assets.

Cost-Effective: With storage costs significantly lower than Filecoin, Shadow Token positions itself as a competitive player in decentralized storage.

Tokenomics:

A favorable economic model redistributes up to 75% of storage revenue to node operators and stakers.

The project employs buybacks to reduce circulating supply and support token value.

Growth Prospects:

Shadow Token is expanding rapidly, with its low market cap offering substantial room for growth. Its unique focus on mobile devices could drive mass adoption, particularly in emerging markets.

Risks:

Competition from established players like Filecoin.

The need for broader ecosystem adoption to realize its full potential.

Shadow Token represents an exciting innovation within the decentralized storage space, blending accessibility and affordability with cutting-edge technology.

Conclusion

Solana’s ecosystem projects like Raydium, Nosana, and Shadow Token highlight the diverse opportunities within this rapidly growing blockchain. Each token presents a unique investment case, catering to DeFi, AI, or storage sectors.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.