This Week's Newsletter - Case Study on Pendle, Main News of the Week, Moon or Dust on $ATR & Zoom on RWA through Story Protocol

Weekly Alpha

This edition is available as an AI-generated Podcast. ⭡

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM Frens,

Last week, Bitcoin reached a historic all-time high of over $107k, solidifying its dominance as the broader market continues to evolve.

We're now far from $107k, having dropped significantly.

The Federal Reserve's decision to implement smaller-than-expected rate cuts has disappointed markets, which had been anticipating a more aggressive approach to reducing rates to the 2–3% range.

Instead, projections indicate that long-term rates may stabilize closer to 3%, suggesting the central bank is prioritizing inflation control over market expectations. This approach has introduced uncertainty into the economic outlook, signaling potential rate hikes if inflation resurges, particularly in a political environment that leans toward stimulative fiscal policies.

Today, we’ll discuss RWAs, which are emerging as a critical bridge between traditional finance and decentralized technology, offering a glimpse into the future of a multi-trillion-dollar industry.

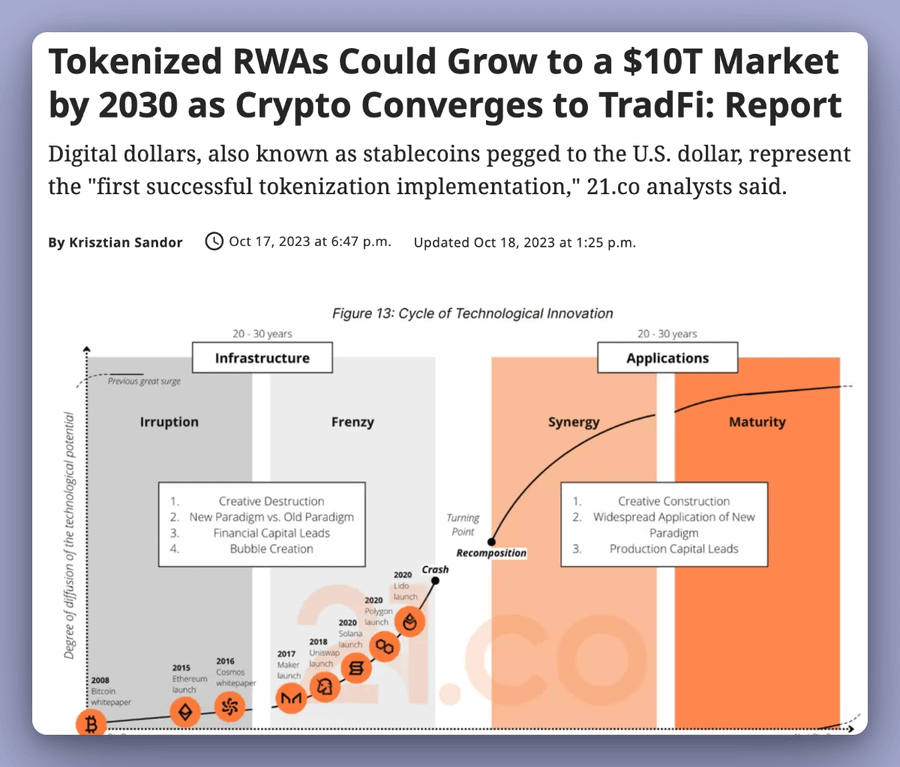

RWAs involve the tokenization of tangible assets such as gold, real estate, and government bonds onto blockchain networks. By digitizing these assets, they become more accessible, liquid, and transparent, unlocking new possibilities for both investors and institutions. The integration of blockchain with traditional assets addresses longstanding inefficiencies in finance, such as high fees, slow settlement times, and opaque structures.

This is not merely a theoretical shift—global giants like BlackRock are already exploring tokenized solutions.

Tokenized bonds, gold, and other commodities are becoming real use cases, setting the stage for blockchain adoption at an institutional scale. The RWA sector is projected to grow beyond $10 trillion by 2030, highlighting the massive potential of this narrative.

However, the journey isn’t without challenges. The Web3 space still lacks a variety of standout projects effectively capitalizing on this trend.

Many RWA projects struggle with tokenomics that fail to incentivize participation or offer long-term value, slowing down adoption despite the sector’s promising future. Ethereum has established itself as the go-to blockchain for RWAs, but competition may intensify as newer chains optimize for scalability and institutional use cases.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

In this week’s newsletter, we’ll explore:

A Case Study on Pendle, where tokenized yields redefine how users interact with DeFi protocols.

The Main News of the Week, delivering the key updates shaping the market.

An analysis of $ATR in Moon or Dust, evaluating its potential as an emerging RWA project.

A deep dive into Story Protocol, a project revolutionizing the way RWAs integrate into Web3 ecosystems.

Let’s unpack this narrative and explore why RWAs are not just the future of Web3—they’re the future of global finance.

Today's Newsletter is brought to you by Mantle:

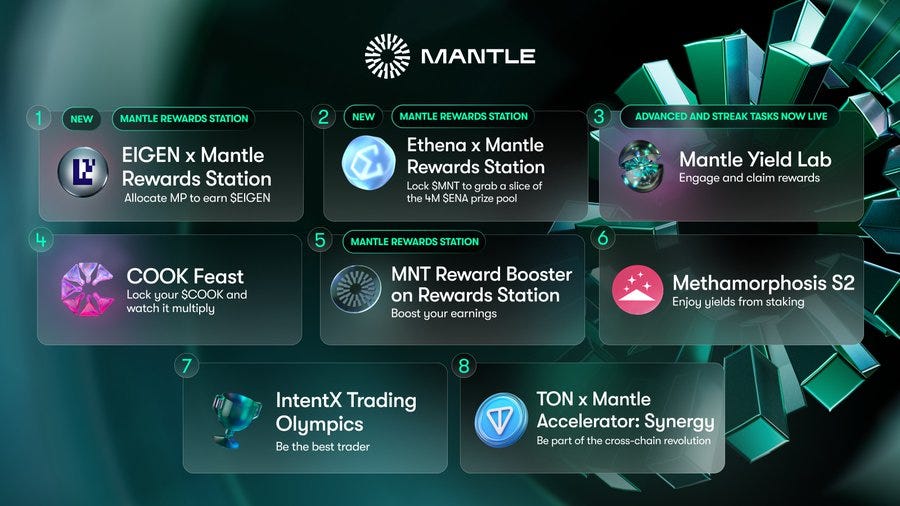

Mantle’s 2024: A Year of Breakthroughs and DeFi Innovation 🚀

As we close out 2024, Mantle continues to solidify its position as a sustainable ecosystem and R&D hub, delivering exceptional growth across TVL, staking opportunities, and ecosystem innovation.

Here’s what stands out as we head into 2025 👇

1️⃣ $MNT: The Bull Run Catalyst 📈

$MNT has had a stellar Q4 performance:

+100% in the last 30 days

Current market cap: $3.8B

With Mantle’s ecosystem maturing and growing demand for DeFi products like $ENA, $EIGEN, and $mETH, $MNT is positioned for a strong 2025.

2️⃣ Reward Opportunities: $ENA & $EIGEN Campaigns 🏆

Mantle’s Rewards Station remains a top destination for stakers:

• Ethena Pool:

4M $ENA rewards available.

APYs up to 64% for 300-day locks.

Focused on decentralized stablecoin growth through the Ethena ecosystem.

• Eigen Pool:

Earn a share of 570K $EIGEN rewards.

Aimed at supporting Eigen’s scalable, decentralized data infrastructure.

Perfect for those bullish on Web3’s backbone technologies.

With flexible and long-term lock options, Mantle offers some of the best yields in DeFi today.

3️⃣ End-of-Year Stats: A Snapshot of Mantle’s Growth 📊

• mETH Protocol:

500K ETH staked, driving a TVL of $92.2M.

4th largest ETH Liquid Staking Protocol by TVL.

• cmETH:

Over $500M in TVL, enhancing Mantle’s liquid restaking ecosystem.

• FBTC:

Surpassed $1B in TVL, enabling omnichain Bitcoin adoption.

This synergy of protocols amplifies liquidity and deepens Mantle’s impact across the DeFi landscape.

Ontop of that, the latest update showing Mantle’s Growth is the collaboration with SuccinctLabs to become the largest ZK rollup, significantly reducing finality.

4️⃣ My Mantle Thesis for 2025 🔮

Looking ahead, here’s why Mantle could lead the next DeFi wave:

Expansion of liquid staking solutions like $mETH will drive TVL growth.

Rewards Station will continue to attract both retail and institutional stakers.

Mantle’s focus on research and sustainability makes it an ideal environment for builders and long-term investors alike.

The balance between innovation and sustainable rewards positions Mantle for exponential growth in the coming year.

As we wrap up 2024, Mantle isn’t just building—it’s redefining what a DeFi ecosystem can achieve. If you’re seeking yield, innovation, or a long-term thesis for your portfolio, Mantle is the place to look.

Get Started Today

Lock your $MNT and allocate MP across pools

With $ENA and $EIGEN rewards available, Mantle offers one of the best staking opportunities in DeFi right now.

1/ Case Study: Pendle – Revolutionizing DeFi and Real-World Asset (RWA) Integration

If you’ve been following me for a while, and reading this Newsletter, you might remember when I first talked about Pendle back in Early 2023.

We’re close to a 100x now, and Pendle has been through a great journey, and still has a lot to offer.

But if you still don’t know what Pendle is, here is an introduction.

Introduction to Pendle

Pendle is a DeFi protocol that enables the tokenization of future yields, giving users the ability to split yield-bearing assets into two components:

Principal Token (PT): Represents the base value of the asset (without yield).

Yield Token (YT): Represents the future yield generated by the asset over a specific period.

By decoupling the principal from the yield, Pendle provides a powerful tool for yield optimization while bridging the gap between traditional finance (TradFi) and Decentralized Finance (DeFi) through Real-World Assets (RWA).

The Importance of Yield Tokenization for RWA

Pendle’s ability to tokenize future yields is transformative for the integration of Real-World Assets into DeFi.

Digital Representation:

Tokenization creates a digital representation of real-world yields, such as income from real estate, loans, or dividends from stocks.Example: Yields from U.S. Treasury bonds or mortgage-backed securities can be represented as Yield Tokens on Pendle.

Fractionalization:

Tokenized yields can be fractionalized, enabling smaller investors to access high-value RWA that were previously out of reach.This opens new opportunities for global retail participation.

Increased Liquidity:

Traditionally illiquid RWAs, such as real estate yields or private loans, become tradable as tokens. This improves liquidity and enables efficient price discovery within DeFi markets.

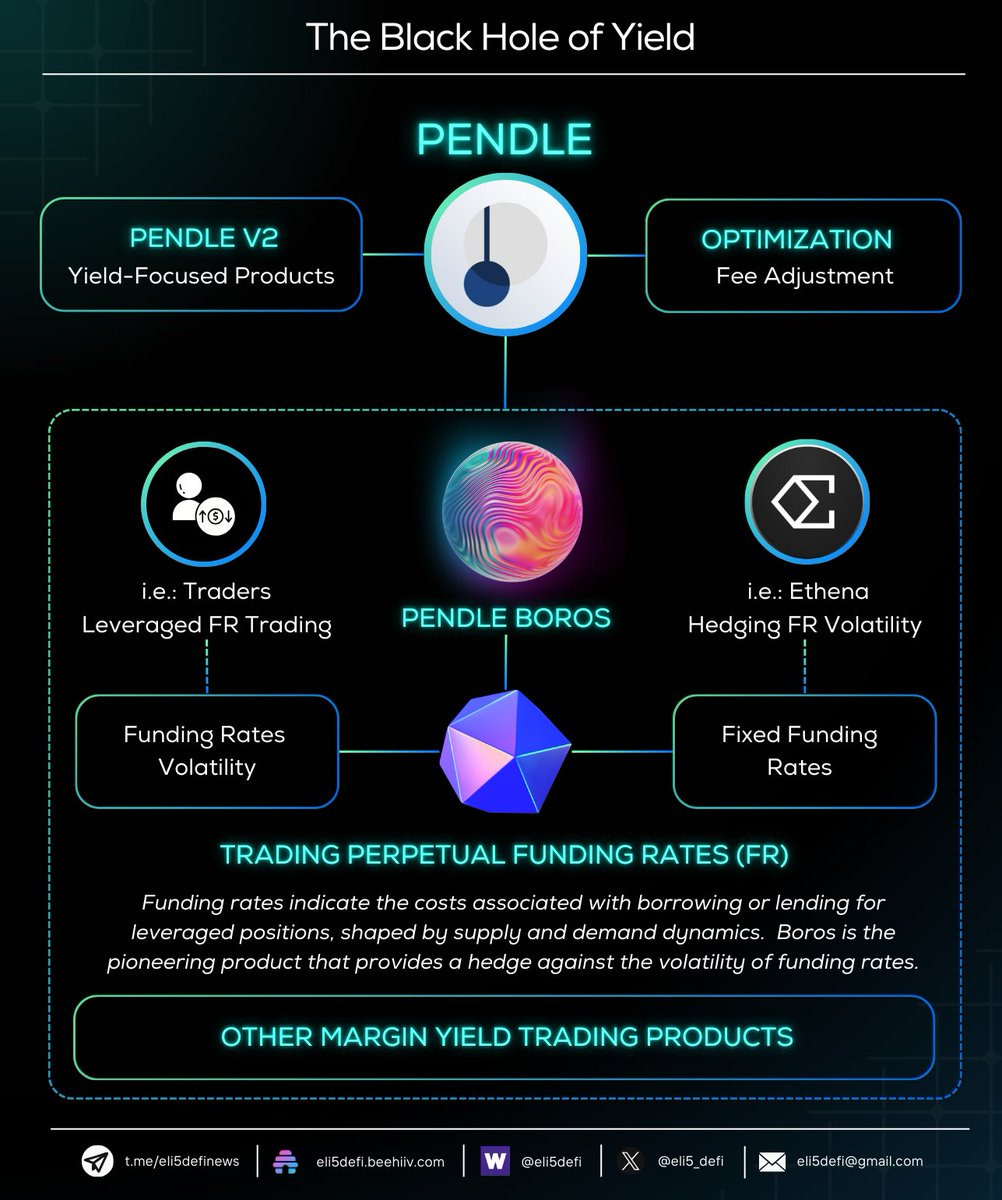

Boros: Bridging RWA Yields and DeFi

Pendle’s Boros product further expands the protocol’s RWA focus by tokenizing funding rates—a crucial aspect of derivatives trading.

What Are Funding Rates?

Funding rates are periodic payments exchanged between long and short positions on perpetual contracts. They ensure the market price remains close to the underlying asset price.

Boros and Tokenized Funding Rates

Boros enables users to tokenize funding rates, providing a new form of RWA by capturing income generated from trading activity on centralized platforms.

This allows participants to speculate on or hedge against fluctuations in funding rates.

DeFi Protocol Risk Management:

Boros serves as a tool for protocols using delta-neutral strategies—where assets are hedged to minimize exposure to price volatility.

Example: A DeFi protocol that generates stable yields via delta-neutral strategies can use Boros to hedge against adverse changes in funding rates, securing stable returns in bearish markets.

Unlocking RWA Potential:

By tokenizing off-chain financial activities, such as derivatives funding rates, Boros creates a bridge between traditional financial yields and DeFi ecosystems.

Practical Use Cases of RWAs in Pendle and Boros

Investing in Tokenized RWAs:

Pendle allows users to invest in RWAs like tokenized Bitcoin (e.g., wrapped BTC) or U.S. Treasury bonds, offering exposure to traditional assets via DeFi infrastructure.

Investors gain the flexibility and transparency inherent in DeFi protocols.

Advanced Yield Strategies:

Users can implement complex yield strategies combining multiple assets.

Example: An investor can structure a position that captures yields from both Bitcoin and stablecoins, optimizing returns based on their risk profile.

Creation of Financial Products:

Tokenization of yields opens the door for hybrid financial products, combining features of RWAs and crypto assetsExample: Structured products with fixed yields backed by tokenized RWAs, similar to bonds or fixed-income securities.

Risk Hedging for Institutions:

Institutions and protocols exposed to funding rate volatility can use Boros to hedge their positions, mitigating risk and ensuring predictable yields.

Growth Potential for Pendle

Pendle’s approach to yield tokenization and RWAs positions it as a leader in the growing RWA narrative within DeFi.

Key drivers of Pendle’s growth include:

New Investment Opportunities:

By making RWAs accessible and liquid, Pendle opens doors for institutional and retail capital to flow into DeFi.

Enhanced Risk Management:

Protocols and investors can use Pendle’s tools to hedge against market volatility, ensuring stable and predictable yields.

Integration with Traditional Finance:

Tokenized yields on RWAs bridge the gap between TradFi and DeFi, unlocking new products and user bases.

Innovation in DeFi:

The ability to separate yield from principal enables innovative strategies and products, such as fixed-income solutions, hedging tools, and derivatives.

Conclusion

Pendle’s innovative model of yield tokenization is a game-changer for both DeFi and Real-World Asset integration. By enabling fractionalized, liquid, and tradeable yield tokens, Pendle transforms how users interact with RWAs and traditional financial instruments.

The introduction of Boros further strengthens Pendle’s position by unlocking funding rate tokenization, a critical new avenue for risk management and yield optimization.

With the potential to attract institutional capital, improve liquidity, and create advanced financial products, Pendle is paving the way for a new era of DeFi—one where RWAs seamlessly integrate with crypto ecosystems.

The future of Pendle will depend on adoption, regulatory evolution, and security, but its value proposition positions it as a key player in transforming global finance.

2/ Crypto and DeFi News :

🛹 Bitcoin ETFs flip gold funds in AUM

Bitcoin exchange-traded funds (ETFs) in the United States collectively surpassed gold ETFs in assets under management (AUM) for the first time on December 16. Total net assets in Bitcoin ETFs, including spot and derivatives-based funds, reached $129 billion, surpassing the $128 billion held by gold ETFs. BlackRock’s iShares Bitcoin Trust leads the BTC ETF market, holding nearly $60 billion in AUM. This milestone underscores the growing institutional adoption of Bitcoin as a digital asset alternative to gold, often considered a hedge against inflation and economic uncertainty.

Thought: The surpassing of gold ETFs by Bitcoin ETFs in AUM marks a pivotal moment in the financial markets, signaling a shift in perception about Bitcoin as a store of value. While gold has long been a staple for traditional investors during periods of uncertainty, Bitcoin's rapid rise in ETF dominance reflects growing confidence in its potential as "digital gold." This trend highlights the increasing alignment of Bitcoin with institutional strategies, such as the "debasement trade," driven by concerns over geopolitical instability and fiscal deficits. However, Bitcoin's volatility and regulatory hurdles remain critical challenges for its long-term positioning as a competitor to gold.

🇺🇸 Ethena Labs partners with Trump’s World Liberty Financial

Ethena Labs has entered into a strategic partnership with Donald Trump-backed World Liberty Financial, announced on December 18. This collaboration integrates Ethena’s synthetic stablecoin, sUSDe, into World Liberty Financial’s ecosystem, allowing users to earn dual rewards in sUSDe and the WLF token when they deposit USDe on the platform. A proposal to formally onboard sUSDe as collateral for World Liberty Financial was also submitted, leveraging its successful risk assessments on other platforms like Aave Core.

The move follows World Liberty Financial's purchase of $500,000 worth of ENA tokens and aligns with Ethena’s strategy to expand stablecoin liquidity and utilization.

Thought: This partnership highlights a broader trend of DeFi protocols aligning with institutional ventures to deepen market adoption. For Ethena, this collaboration not only enhances sUSDe’s utility but also creates a pathway to integrate DeFi mechanisms into emerging financial networks. However, World Liberty Financial’s uneven performance since its launch—coupled with its reliance on external backing—raises questions about its ability to compete with more established players in the ecosystem. For Ethena, the success of this partnership will hinge on how effectively it can attract users to its dual rewards system and foster liquidity growth.

🐧 Pudgy Penguins’ PENGU token down more than 50% after launch

The Pudgy Penguins’ native token, PENGU, dropped over 50% within hours of its December 17 airdrop debut. Initially launching with a market capitalization of approximately $2.8 billion, the token has fallen to under $2 billion, according to CoinGecko data. About half of PENGU’s nearly 89 billion tokens were airdropped to the community, with 26% specifically allocated to NFT holders.

PENGU, trading on Solana, currently lacks a defined use case but is anticipated to contribute to governance within the Pudgy Penguins ecosystem. Holders of the project’s flagship Pudgy Penguins NFTs or related assets like Lil’ Pudgys and Pudgy Rods can claim PENGU by verifying ownership on Ethereum.

The project also boasts significant commercial success, selling 1.5 million branded toys at retailers like Walmart and maintaining high-value NFT prices. However, PENGU's steep decline following its launch suggests challenges in sustaining momentum beyond initial hype.

Thought: The drop in PENGU’s value after its launch underlines the risks tied to speculative airdrops, especially when utility or governance mechanisms are not clearly outlined. While Pudgy Penguins’ success in retail and NFT markets signals brand strength, the token's volatility raises questions about its long-term integration into the project’s ecosystem. To stabilize PENGU’s value, clearly defined tokenomics and functional use cases will be essential for maintaining investor and community interest.

💵 Tether USDT trading continues across Europe despite Coinbase delisting

Tether’s USDT trading remains active across major European cryptocurrency exchanges, including Binance, Crypto.com, and Kraken, despite Coinbase delisting the stablecoin for European users on December 13. This decision by Coinbase aligns with the approaching December 30 deadline for the full implementation of the Markets in Crypto-Assets Regulation (MiCA). The regulation’s stablecoin framework, applicable since June, introduces strict compliance measures for stablecoins in Europe.

Exchanges like KuCoin, MEXC, and Bitget have also retained USDT listings, while OKX, which previously delisted USDT in March 2024 to focus on euro-based pairs, still offers the token as of December 17. OKX and Bitpanda declined to confirm whether further delisting actions are planned.

Coinbase’s decision stems from its interpretation of USDT as potentially noncompliant under MiCA, though European regulators have not issued clear guidance on this matter. Other exchanges have yet to vocalize similar concerns, suggesting a split in approaches to regulatory compliance.

Thought: The varied responses to USDT amid MiCA implementation reveal a fragmented regulatory landscape for stablecoins in Europe. While Coinbase has chosen caution by delisting, others continue to support USDT, potentially assessing lower regulatory risk. This divergence highlights the need for clearer guidance from European authorities to avoid market confusion. Stablecoin projects and exchanges must proactively adapt to meet MiCA’s requirements to maintain user trust and operational continuity in the region.

📉 Bitcoin's price slips to $95K following a Federal Reserve rate cut and Powell's updated 2025 inflation projections.

Bitcoin’s price dropped by ~10% to $95K following a 25 basis point rate cut announced by the Federal Reserve and a revised hawkish inflation outlook for 2025. The rate cut aligned with market expectations, but Fed Chair Jerome Powell's post-cut remarks dampened bullish sentiments by signaling only two additional rate cuts in 2025 and raising the 2025 inflation forecast from 2.1% to 2.5%.

This cautious tone reflects economic uncertainties linked to the incoming Trump administration’s anticipated policies, including increased tariffs and fiscal deficit expansion. Powell emphasized the Federal Reserve’s readiness to recalibrate policies to maintain economic stability, despite concerns over persistent inflation and rising long-term interest rates.

The broader crypto market reacted sharply, with Ethereum falling to $3,300. Analysts observed a significant clearing of leveraged positions, with both long and short traders affected by the abrupt price moves.

Thought: The Federal Reserve’s hawkish tone despite a rate cut reflects a delicate balancing act. By signaling only two additional rate cuts in 2025 and revising inflation expectations upward, the Fed acknowledges persistent inflationary pressures, likely exacerbated by anticipated fiscal policies under the incoming Trump administration. This shift has alarmed markets, as rising long-term interest rate projections (from 2.9% to 3%) suggest tighter financial conditions over time.

For Bitcoin, the immediate reaction reflects its sensitivity to macroeconomic cues. The asset’s decline alongside equities highlights its continued correlation with broader risk markets. Persistent inflation fears could attract long-term interest in Bitcoin as a hedge, but the current focus on rising rates undermines its appeal in the short term. Additionally, compared to the European Central Bank’s (ECB) more dovish outlook, the Fed’s stance reinforces the dollar’s strength, potentially adding further pressure to Bitcoin prices in the near term.

The divergence in global monetary policies could create a mixed environment for crypto. While Bitcoin may find support as a hedge in uncertain conditions, prolonged tight financial conditions in the U.S. could dampen speculative flows into the crypto space.

3/ Moon or Dust: Artrade ($ATR)

🌟 Concept Overview

Artrade is the first global platform dedicated to art tokenization, offering a marketplace where users can buy, sell, and fractionalize tokenized artworks. The platform bridges art and blockchain, enabling shared ownership of valuable pieces like a Picasso sketch valued at $200,000, purchased by 159 co-owners through fractional tokens. With over 6,000 active users, the marketplace also caters to luxury collectibles, with fast sales underscoring strong market interest.

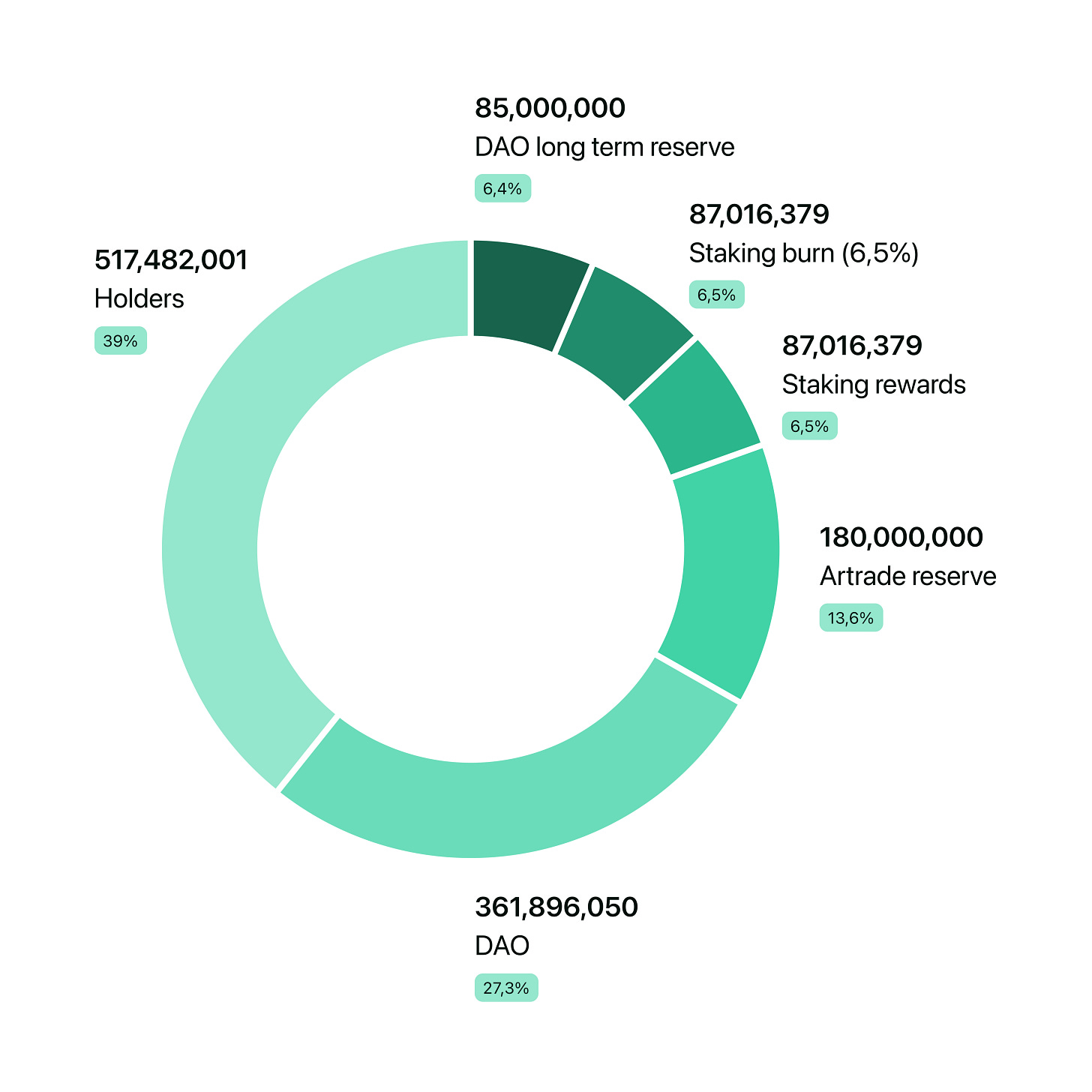

🔍 The Token: ATR

ATR is Artrade's utility token, central to the ecosystem. It powers auctions, purchases, and access to platform features, while also offering staking incentives and governance rights.

Market Cap: $80.5M with 1.25B ATR tokens in circulation, fully distributed, eliminating the risk of future unlocks.

Staking Rewards:

15% APY for Supporters.

25% APY for Ambassadors.

Benefits include up to 30% discounts on purchases, platform revenue sharing, and DAO governance.

Deflationary Model: Over 87M ATR tokens burned, reducing supply to support long-term price stability. And ATR tokens keep being burned 👇

📊 Technical Analysis

ATR has demonstrated bullish momentum, but its low market cap makes it highly volatile.

Current Price:

Historical Performance: A strong rally in March 2024 followed by correction and consolidation above key accumulation zones.

Key Resistance Levels:

First target at $0.08 (previous peak).

Breaking $0.10 could unlock targets at $0.20 and $0.27.

ATR vs. BTC: ATR outperformed Bitcoin in late 2024, showcasing relative strength. However, further bullish confirmation requires overcoming critical resistance on the ATR/BTC chart.

🚀 Why ATR Could "Moon"

Real-World Asset (RWA) Momentum: RWA tokens are among the top-performing narratives in 2024, and ATR is well-positioned within this space.

Established Use Case: A functional platform with clear utility for ATR and demonstrated user interest through successful tokenization projects.

Blockchain Strength: Leveraging Solana's high-speed, scalable infrastructure and listing across multiple exchanges for accessibility.

Future Developments: Promising roadmap includes:

NFC chip integration for physical assets.

Improved user experience.

Strategic partnerships to expand the ecosystem.

⚠️ Why ATR Could Be "Dust"

Volatility Risk: ATR’s low cap makes it prone to sharp price fluctuations, posing significant risks for short-term traders.

Adoption Challenges: While the 6,000-user base shows traction, scaling to a broader market will be critical for sustained growth.

Solana Dependence: Relying on Solana’s performance makes ATR susceptible to issues within the Solana ecosystem.

Competitive Landscape: Other RWA tokenization platforms could emerge, increasing competition.

🧐 Final Verdict

Moon Potential: High, driven by the booming RWA narrative, Artrade’s early mover advantage, and the growing interest in art tokenization.

They have invested in marketing strategies such as this space on CoinMarketCap, which could attract more people to discover this project 👇

Dust Risk: Significant, given market volatility, adoption hurdles, and Solana’s reliability.

ATR represents a promising bet on the intersection of art and blockchain. With the right execution and continued RWA narrative momentum, ATR could deliver outsized returns. However, it’s a high-risk, high-reward scenario—ideal for investors willing to navigate volatility while managing their exposure prudently.

🤔 Will $ATR paint the future of art investing, or fade into obscurity?

3/ Real World Assets (RWA): The Future of Asset Tokenization

In previous editions of the newsletter, we explored the rise of Real World Assets (RWA)—a booming trend in 2024. We could have covered projects like ONDO and Mantra today, both trailblazers in bridging traditional finance with blockchain technology.

But we’ll dive today into a project at the intersection of RWA and AI : Story Protocol, a promising venture with no token yet but immense potential.

What are Real World Assets (RWA)?

RWAs refer to physical or tangible assets—like real estate, commodities, or intellectual property—that are digitized and tokenized on the blockchain. Tokenization makes these assets more accessible, liquid, and programmable, revolutionizing markets traditionally hindered by inefficiencies and high barriers to entry.

While most RWA projects focus on assets like real estate or bonds, Story Protocol brings a fresh perspective by addressing intellectual property, a $5 trillion global market.

Introducing Story Protocol

Introducing Story Protocol

Story Protocol aims to transform the way intellectual property (IP) is managed and monetized online. By leveraging blockchain technology, Story is building the foundation for a new era of IP management—one that's decentralized, transparent, and efficient.

Latest Innovation: AI Agents on Blockchain

Story Protocol just unveiled a revolutionary framework called Agent Transaction Control Protocol for Intellectual Property (ATCP/IP), allowing AI agents to trade IP autonomously on-chain.

This breakthrough addresses a critical limitation of current AI agents, enabling them to securely exchange valuable assets such as training data, creative styles, and investment strategies.

Core Features:

Legally binding smart contracts executed both on- and off-chain.

Secure IP management to prevent unauthorized scraping of AI-generated data.

Partnerships with major AI entities like ai16z DAO's Eliza and Zerebo’s ZerePy.

Integration with Virtuals Protocol's GAME and Crossmint’s GOAT.

This innovation positions Story Protocol as a pioneer in the AI-agent crypto economy, echoing Ethereum co-founder Vitalik Buterin’s vision of an "information finance" future, where AI agents manage prediction markets with unmatched efficiency.

Why Intellectual Property (IP)?

Intellectual property includes copyrights, trademarks, and patents that protect creators’ rights and ensure they benefit from their creations. However, the current system is outdated, slow, and prohibitively expensive.

Challenges: Paper-based processes, inaccessible systems for small creators, and complexity in managing AI-generated content.

Story's Solution: Tokenize IP on the blockchain to make it liquid, modular, and programmable.

Through Programmable IP Licenses (PILs), creators can set usage terms, automate royalties, and enable interoperability across platforms.

How Does It Work?

Story Protocol is built on a custom blockchain, Story Network, optimized for IP management. Key features include:

Tokenized IP: IP assets registered as NFTs with unique smart contract accounts.

Licensing Automation: Smart contracts for licensing, royalty distribution, and dispute resolution.

Plug-and-Play: APIs allow creators to use the system without needing blockchain expertise.

Creative Collaboration: Modular IP lets creators combine assets seamlessly across platforms.

Applications and Ecosystem

The project is already in TestNet with several promising applications:

Story also supports developers through its Story Academy, fostering innovation and ecosystem growth.

Risks and Challenges

While Story Protocol has immense potential, its success depends on:

Adoption: Establishing itself as the go-to IP standard amid competition.

Tokenomics: Clarity on the token's role and value post-launch.

Execution: Delivering on its vision with a robust ecosystem and killer applications.

Additionally, gaining traction with large studios and government regulation could pose hurdles.

Conclusion

Story Protocol embodies the promise of RWA, bringing intellectual property into the blockchain era. With strong funding, a visionary team, and a massive addressable market, it’s a project worth watching—especially for those eyeing a potential airdrop or token release in 2025.

This is one of the boldest takes on Real World Asset tokenization, with the potential to reshape how we perceive and monetize creativity in the digital age.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.