This Week's Newsletter - Case study on Hyperliquid, Main News of the Week, & Zoom on DeFi Renaissance through Ethena & Usual

Weekly Alpha

This edition is available as an AI-generated Podcast. ⭡

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM Frens,

Merry Christmas, Happy Holidays!

As we wrap up 2024, I want to take a moment to thank each of you for your incredible support and engagement throughout the year. It’s been a journey of growth, learning, and resilience, and your continued presence has made it all worthwhile.

This is our final edition of the year, and as we close out an extraordinary 2024, we’re setting our sights on 2025 with optimism—a year brimming with potential, innovation, and renewed momentum in the crypto space.

TL;DR: I’m bullish on 2025 and on you 🫡

Last week, we dove into Real-World Assets (RWAs) and their transformative role within blockchain. Today, we’re shifting focus to the DeFi Renaissance, a powerful resurgence that’s redefining how we interact with financial systems through resilience, transparency, and groundbreaking innovation.

You couldn’t have missed the massive token launch by Hyperliquid, one of the most talked-about events in the ecosystem. Their $8 billion airdrop, distributing 310 million $HYPE tokens to their community, wasn’t just a milestone—it was a statement. By allocating 70% of tokens to the community, Hyperliquid exemplifies what it means to prioritize decentralization. It’s this monumental event that makes Hyperliquid the perfect focus for this week’s case study, where we’ll break down their strategy, impact, and implications for the broader DeFi space.

Bitcoin’s recent correction suggests the beginning of a potential range-bound phase—a dynamic that has historically benefited altcoins. As Bitcoin stabilizes, attention has shifted toward altcoins, which are gaining traction as the year comes to a close.

In the U.S., enthusiasm for crypto is growing, fueled by election discussions and Donald Trump. This has the potential to bring a wave of retail investors directly into altcoins. Year-end ETF spot Bitcoin sales have added to the downward pressure.

Yet, the broader crypto market remains resilient. Companies like MicroStrategy continue to bolster Bitcoin’s long-term outlook, recently acquiring 5,200 BTC at an average price of $106,000—a testament to institutional conviction.

Despite an 85% drop in Total Value Locked (TVL) during the bear market, DeFi has proven remarkably resilient. Ethereum, the backbone of DeFi, has faced scalability challenges, but the rise of Layer2 solutions like Arbitrum and Optimism has significantly reduced costs and enhanced throughput.

Established protocols like Uniswap and Aave remain dominant, but new players are driving fresh competition in staking, aggregation, and liquidity provision. Meanwhile, as we’ve seen 2 weeks ago, Solana’s high-speed & low-cost ecosystem continues to strengthen its position in DeFi.

As we prepare for 2025, the DeFi narrative is poised to grow stronger. Advances in tokenization, innovative stablecoins, and intersections with AI and gaming are creating exciting opportunities.

The energy seen in altcoins as 2024 ends could carry forward into the new year, making DeFi one of the most promising sectors in the crypto space.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

And have a look at my Latest Post on X:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

In this week’s newsletter, we’ll explore:

A Case Study on Hyperliquid, analyzing their historic token launch and its impact on the DeFi landscape.

The Main News of the Week, highlighting key trends and developments.

A deep dive into the DeFi Renaissance, unpacking its resilience, key innovations, and outlook for 2025, with a focus on protocols like USUAL and Ethena, which are shaping the next chapter of decentralized finance.

Cheers, and see you in 2025! 🥂

Case Study: Hyperliquid ($HYPE)

Introduction: The Power of Airdrops

The $HYPE airdrop marked a watershed moment in the crypto landscape. Valued at $1 billion at its Token Generation Event, the airdrop created an instant buzz among traders and DeFi enthusiasts, further reinforced by its swift success within minutes. Hyperliquid has allocated an additional $12 billion worth of $HYPE (38.88% of the total supply) for future distributions, emphasizing its long-term commitment to incentivizing adoption and engagement.

The airdrop not only rewarded early adopters but also set the stage for future ecosystem development. By adopting a points farming program—akin to its earlier strategy in October—Hyperliquid has continued to attract user participation, subtly hinting that current usage could translate into future rewards. This strategic use of airdrops, not just as a launch mechanism but as an ongoing engagement tool, positions Hyperliquid uniquely in a competitive market.

Importance of the Concept

Hyperliquid's innovative approach addresses a long-standing gap in DeFi: the need for high-frequency trading (HFT) on a transparent, on-chain order book.

Unlike competitors such as dYdX, which operate off-chain order books, Hyperliquid offers a fully composable, on-chain alternative that eliminates inefficiencies like front-running and payment for order flow (PFOF).

These advantages make it an attractive option for retail traders, institutions, and builders looking for secure and efficient trading solutions.

Key Features

Tailored Infrastructure:

HyperBFT Consensus: Optimized for low-latency and high-throughput trading, ensuring performance tailored to HFT demands.

Gasless Trading: Reduces friction for traders, particularly for transactions that don’t contribute to state bloat, enhancing user experience.

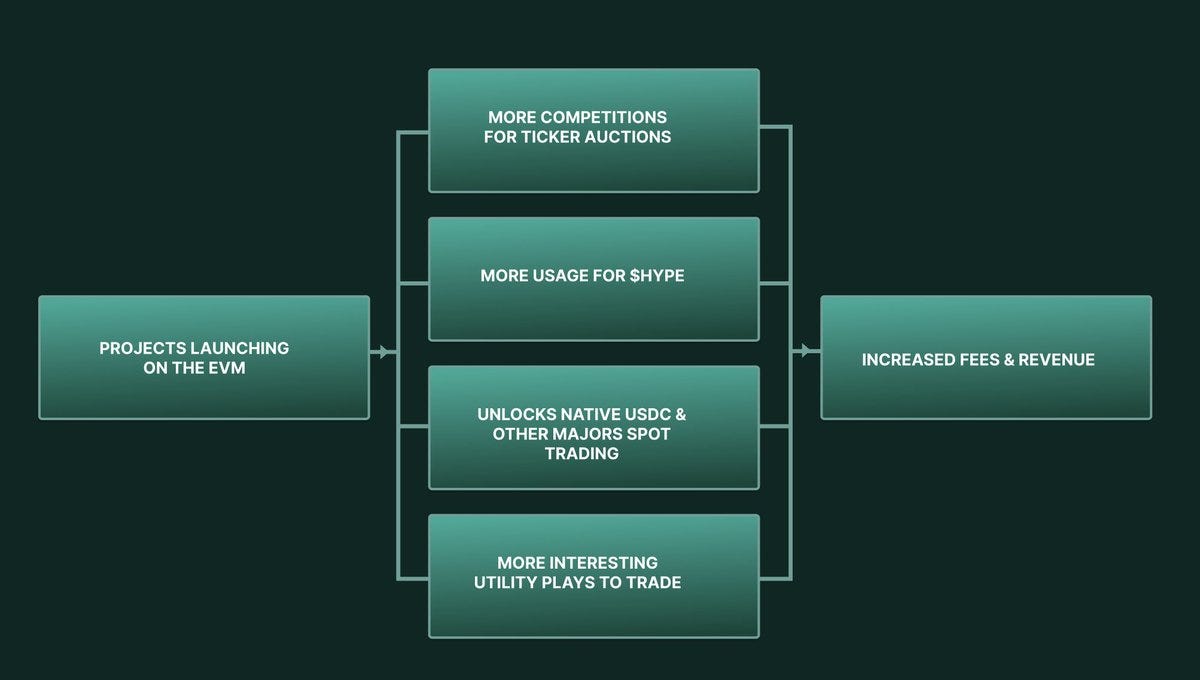

EVM Compatibility:

The upcoming EVM layer promises to open doors for interoperability, making it easier for developers to migrate existing projects or create new protocols on Hyperliquid.

Composability:

Hyperliquid’s native perpetual DEX and spot markets seamlessly integrate with DeFi protocols for lending, options, and hedging, fostering a fertile environment for innovative applications.

Practical Use Cases

Traders:

They have access to a gasless, high-speed order book for perpetual futures and spot trading, minimizing slippage and trading costs.

The points program provides additional incentives, making Hyperliquid a compelling platform for active trading strategies.

Builders:

Hyperliquid’s infrastructure enables the creation of diverse DeFi applications, from decentralized lending platforms to advanced options protocols, leveraging its transparent and high-performance order book.

Institutional Investors:

Transparency and the absence of front-running mechanisms offer institutions a secure and efficient trading environment, addressing long-standing trust issues in centralized finance.

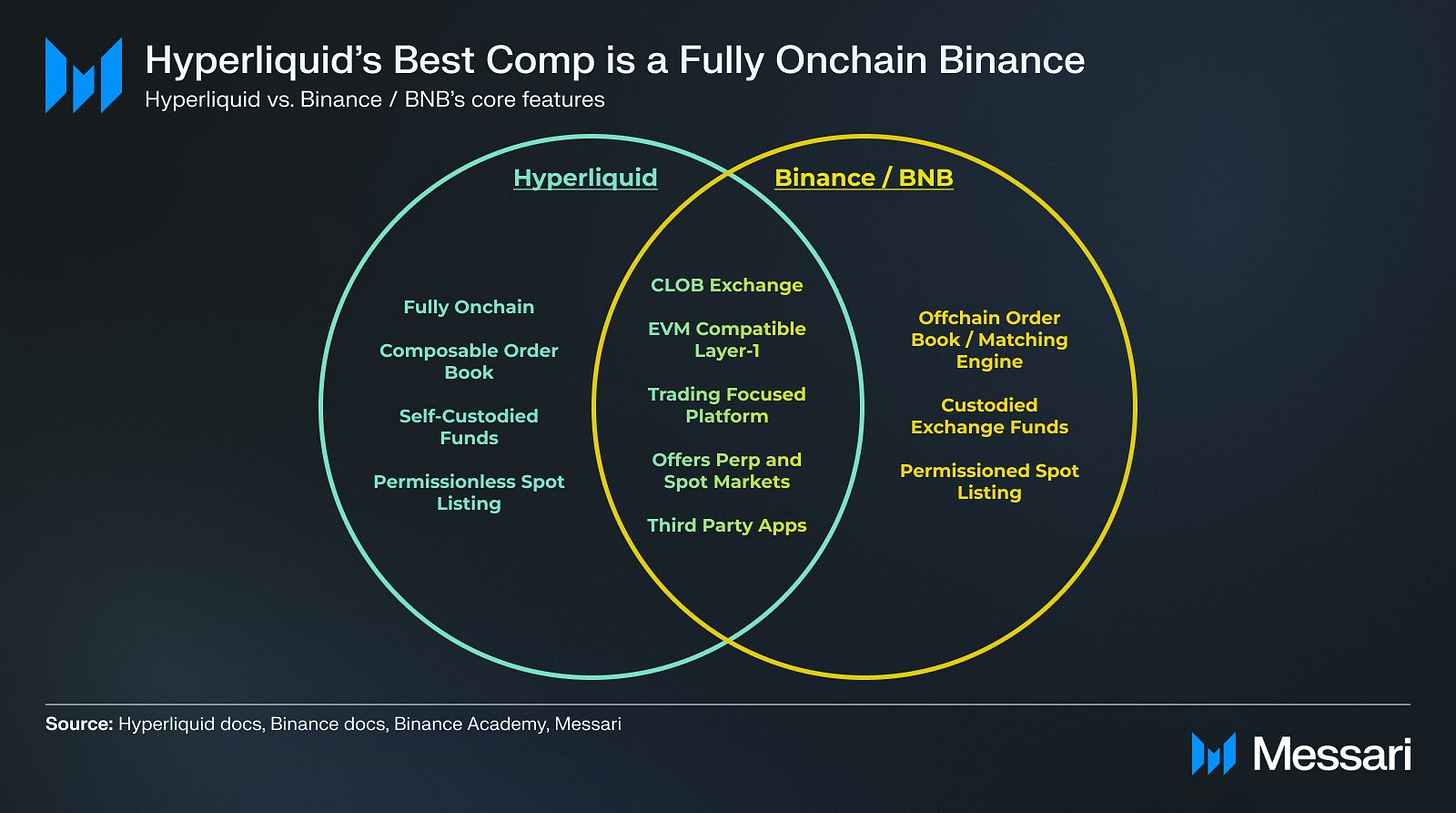

Comparison to Centralized Exchanges (CEXs)

While Hyperliquid represents a decentralized, on-chain alternative, centralized exchanges like Binance dominate the trading landscape with their own set of advantages and trade-offs:

Liquidity Depth:

Binance and other major CEXs offer unparalleled liquidity across thousands of trading pairs, making it easier for traders to execute large orders with minimal slippage.

Hyperliquid’s composable ecosystem aims to build competitive liquidity pools, but it may take time to rival the scale of CEXs.

User Experience:

CEXs provide an intuitive user experience with advanced trading tools, APIs, and fiat on/off ramps.

Hyperliquid counters with gasless trading and tailored infrastructure, though it requires users to be familiar with DeFi wallets and on-chain interactions.

Transparency and Trust:

Hyperliquid’s on-chain order book ensures full transparency, addressing issues like front-running and PFOF.

Conversely, CEXs operate under opaque mechanisms, occasionally facing criticisms over wash trading and mismanagement of user funds.

Decentralization:

Hyperliquid’s decentralized framework mitigates risks associated with CEX custody, such as hacks or account freezes.

However, CEXs like Binance offer customer support and insurance funds, catering to risk-averse traders.

Ultimately, Hyperliquid offers a robust alternative for users prioritizing transparency, composability, and decentralization. While it lacks some conveniences of CEXs, its innovative infrastructure and targeted incentives position it as a key player for the future of DeFi trading.

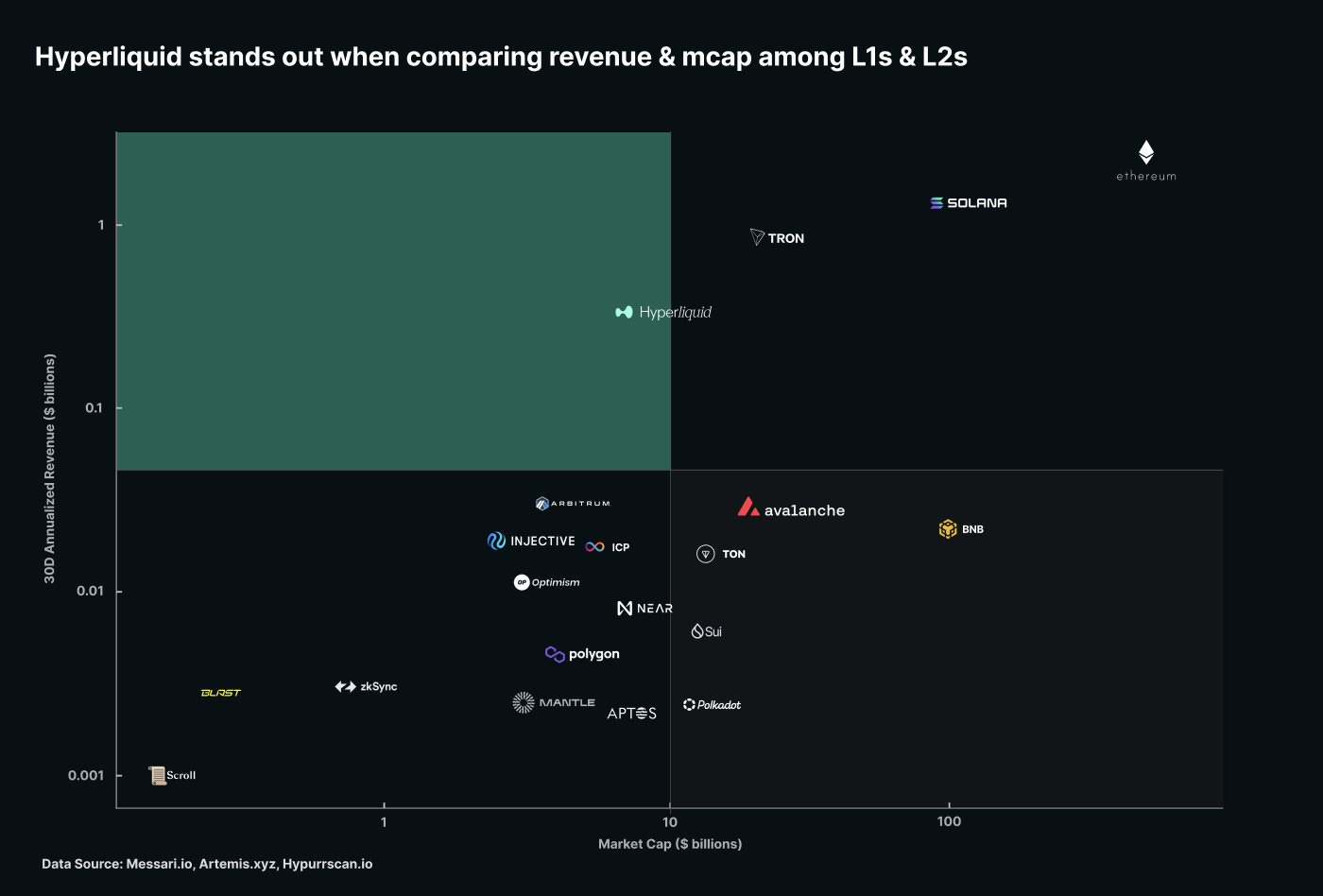

Growth Potential :

Revenue Scenarios:

Base Case: With activity levels comparable to Base L2, Hyperliquid could generate $59M in monthly revenue.

Bull Case: Doubling auction volumes and EVM activity could drive revenues up to $102M monthly.

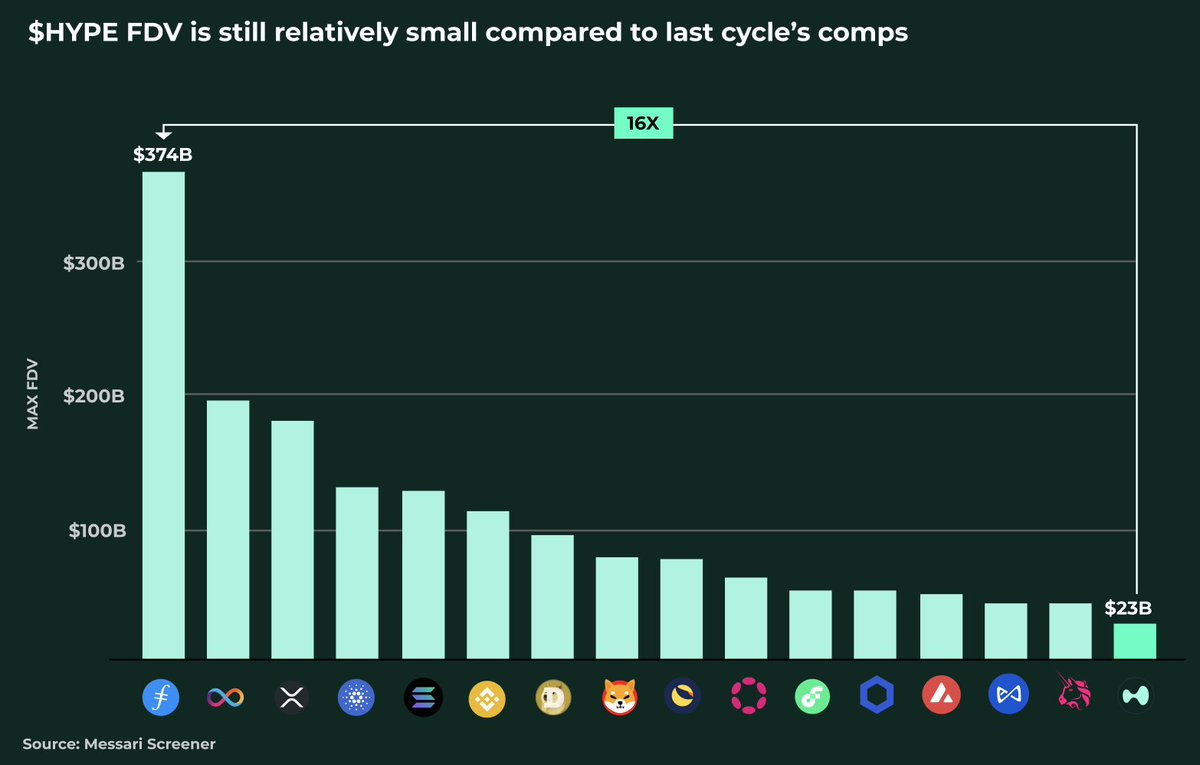

Capital Inflows:

With 60,000 holders and limited exchange listings, Hyperliquid has already demonstrated significant traction. Capturing even a fraction of Solana or Ethereum’s market cap could bring in capital inflows exceeding $10B, further solidifying its position in the market.

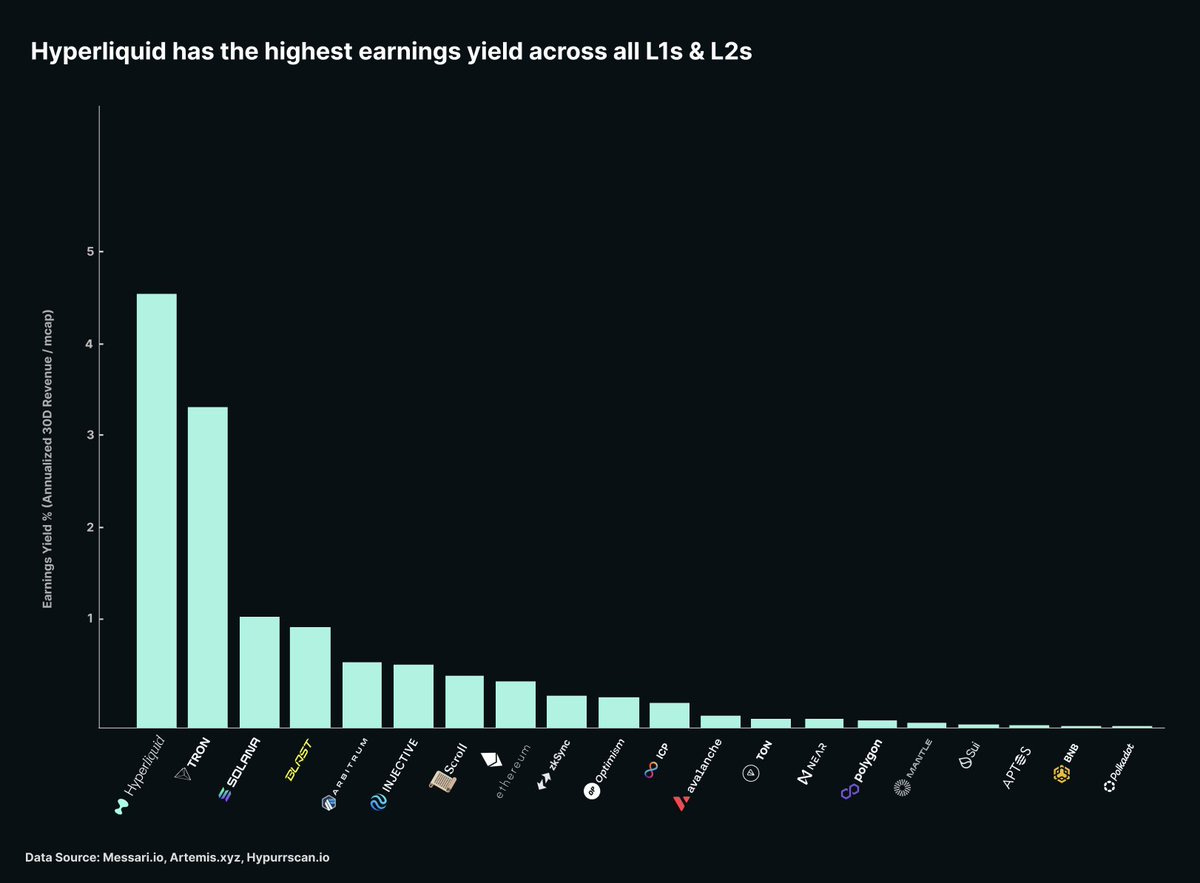

The Role of $HYPE :

$HYPE is the native utility token of the Hyperliquid ecosystem and serves as the backbone for its operational and governance functions.

Utility:

$HYPE facilitates fee discounts for traders, incentivizing frequent use of the platform.

It is also essential for accessing premium features, such as priority execution or advanced analytics tools.

Staking Rewards:

Token holders can stake $HYPE to secure the network and earn rewards in return, creating a symbiotic relationship between platform usage and token value.

Governance:

$HYPE holders can vote on key proposals, such as updates to trading incentives, fee structures, and network upgrades. This ensures community-driven development and aligns long-term incentives.

Supply Dynamics:

With a significant portion of $HYPE reserved for future incentives, the token’s value is tied to the platform’s growth. As adoption scales, increased demand for $HYPE is expected to reduce circulating supply, driving potential price appreciation.

$HYPE’s tokenomics align closely with Hyperliquid’s broader vision of fostering a sustainable, user-centric ecosystem. The deflationary mechanics combined with real utility provide a strong foundation for long-term value appreciation.

Risks

Validator Decentralization:

Transitioning from four centralized validators to a decentralized network of over 60 introduces risks related to performance stability and trust.

Ecosystem Quality:

The success of the EVM layer depends on attracting high-quality projects. A surge in low-quality or derivative applications could undermine user trust and long-term viability.

Regulatory Challenges:

As with any disruptive innovation, regulatory scrutiny is inevitable. However, decentralization and geofencing measures may mitigate some of these risks.

Market Correlation:

$HYPE’s valuation is closely tied to broader market conditions and the team’s ability to execute its roadmap effectively.

Recent Controversy

Hyperliquid is facing scrutiny after suspicious activity led to $60 million in USDC withdrawals in a single day. Concerns center on potential North Korean involvement, linked to the notorious Lazarus Group, known for high-profile crypto heists like the $620 million Ronin hack in 2022.

While some users are alarmed by the possibility of security vulnerabilities, others point to existing safeguards, such as Circle's ability to freeze addresses and Arbitrum's rollback mechanism. However, critics have highlighted slow response times in previous cases, raising doubts about the platform's operational security.

The incident underscores the growing need for robust security measures and faster response protocols in the decentralized finance space to counter increasingly sophisticated cyber threats.

Basically, the risk seems low, but it still showed that FUD goes fast and crypto is highly volatile, with a 20%+ drawdown in a day because of the controversy.

Conclusion

Hyperliquid stands out as a pioneering effort to revolutionize DeFi through its fully on-chain, composable L1 tailored for HFT. By addressing long-standing inefficiencies in traditional trading systems, the project not only offers a robust alternative to CEXs but also sets a new standard for transparency and composability in DeFi.

The $HYPE airdrop and points program have already demonstrated Hyperliquid’s ability to generate interest and adoption. With its innovative infrastructure, strategic roadmap, and focus on ecosystem growth, Hyperliquid is well-positioned to become a leader in the crypto space. While challenges remain, the project’s potential to transform DeFi and establish itself as a cornerstone of the crypto ecosystem is both promising and undeniable.

2/ Crypto and DeFi News :

🇷🇺 Russia is free to use Bitcoin in foreign trade

Russian Finance Minister Anton Siluanov stated that Russia is legally authorized to use Bitcoin and digital financial assets (DFAs) in foreign trade transactions. This development aligns with Russia's legislation, which permits the use of DFAs and Bitcoin under an experimental legal regime introduced in September 2024.

According to Siluanov, the country can pay for goods with Bitcoin, particularly mined domestically, within this regulatory framework. Russia has already begun leveraging these tools and plans to scale their usage further. This move comes after Russia legalized crypto mining earlier this year, facilitating the use of Bitcoin in international trade as an alternative to the US dollar. Siluanov emphasized the role of DFAs in modernizing global settlement systems, describing them as the future of trade.

Thought: Russia's adoption of Bitcoin and DFAs in foreign trade highlights a strategic pivot away from the US dollar, driven by geopolitical and economic pressures. This move reflects an effort to reduce dependency on traditional financial systems, which have become increasingly restrictive due to sanctions and global tensions.

By integrating DFAs and Bitcoin into its trade infrastructure, Russia aims to bolster its economic sovereignty while also testing innovative financial tools in a controlled setting. However, the effectiveness of this strategy will depend on the broader global acceptance of Bitcoin in trade and the country's ability to navigate regulatory and operational challenges. The scaling of such transactions could set a precedent for other nations exploring alternative financial frameworks

🇰🇷 Over 30% of South Koreans invest in crypto assets

South Korea's crypto investor base reached 15.6 million by November, accounting for over 30% of the population. This data, sourced from major exchanges such as Upbit, Bithumb, and Korbit, highlights a growing interest in digital assets among South Koreans, supported by the nation’s new Virtual Asset User Protection Act, which mandates the safeguarding of user crypto assets by service providers.

The rise in crypto adoption coincided with the U.S. presidential election results, as former President Donald Trump’s victory was perceived to signal a potential shift in global crypto policies. South Korean media suggested that Trump’s win encouraged optimism about favorable crypto regulations, contributing to a surge in local investors. The total crypto holdings in South Korea amounted to 102.6 trillion won ($70.3 billion), with trading volumes rivaling those of the country's stock market.

Thought: South Korea's surging crypto adoption reflects the nation's evolving financial landscape, where cryptocurrencies are becoming a significant investment vehicle. The new regulatory framework strengthens investor confidence by ensuring asset protection, fostering a more mature and secure crypto market.

The external influence of global political events, such as Trump’s election, underscores the interconnectedness of the crypto ecosystem. A favorable regulatory environment in major economies could bolster adoption in other regions. However, the rapid growth of crypto investment also raises questions about market volatility, regulatory readiness, and potential risks to traditional financial systems in South Korea. Balancing innovation with oversight will be crucial for sustained growth.

To see my post on Crypto Users over the world.

🤑 Memecoins take top spot for crypto investor interest in 2024

In 2024, memecoins dominated crypto investor interest, with nearly one-third of all attention directed at these speculative tokens, according to CoinGecko. A report covering site traffic trends from January 1 to December 21 revealed that memecoins alone accounted for 15% of total interest, up by over six points from 2023. Additional trends, such as Solana-based memecoins and on memecoins on Base, contributed to the category's momentum, taking 8% and just over 2% of interest, respectively.

The broader memecoin market saw a valuation of $113.2 billion, spearheaded by Dogecoin ($49.3 billion) and Shiba Inu ($13.8 billion). While often speculative and prone to volatility, these tokens experienced significant gains amid a crypto rally, including Bitcoin’s 123% year-to-date growth. Other sub-narratives, including AI-related tokens, also maintained traction, capturing nearly 13% of investor focus.

Thought: The resurgence of memecoins reflects retail investors’ appetite for speculative opportunities, underscoring the growing influence of niche narratives in the crypto space. The heightened interest in Solana-based memecoins signals the blockchain’s emerging role in capturing market share, while Coinbase’s Base blockchain indicates institutional players are fostering ecosystems for speculative assets.

However, the reliance on hype over fundamentals raises sustainability concerns. As memecoins grow in popularity, regulatory scrutiny and market risks might intensify, potentially curbing speculative fervor. Meanwhile, the concurrent interest in AI tokens demonstrates a diversification of narratives, suggesting that technological innovation continues to drive optimism alongside speculative trends.

🥞 PancakeSwap closes record $310B year

PancakeSwap achieved a record $310 billion in trading volume for 2024, reflecting a 179% year-over-year increase driven by the growth of DeFi, Layer2 blockchain adoption, and user-focused upgrades. Significant contributions came from Arbitrum and Base, which experienced trading volume increases of 3,656% and 3,539% year-over-year, respectively.

Cross-chain activity surged as PancakeSwap recorded a 251% growth on Ethereum and 155% on the BNB Chain. Upgrades such as PancakeSwapX, offering zero-fee trading and gasless swaps, streamlined user experience, further attracting DeFi users. The overall DeFi ecosystem grew substantially in 2024, with total value locked (TVL) more than doubling from $54 billion to $121 billion, according to DefiLlama.

PancakeSwap is now the second-largest DEX by daily trading volume, behind Uniswap, demonstrating its pivotal role in driving DeFi adoption.

Thought: PancakeSwap's $310 billion milestone underscores the rapid maturation of DeFi ecosystems and the increasing role of L2 solutions like Arbitrum and Base in supporting scalable, low-cost transactions. The platform's emphasis on user-centric innovations, such as simplified onboarding through gasless swaps, highlights a key shift toward making DeFi more accessible to mainstream users.

This record growth also signals a competitive edge for decentralized exchanges as they continue to encroach on centralized exchange dominance. However, with regulatory uncertainty surrounding DeFi platforms, sustaining this momentum will require ongoing technical and governance advancements.

💎 Aave mulls Chainlink integration to return MEV fees to users

Aave is considering integrating Chainlink’s Smart Value Recapture (SVR), a new oracle service aimed at redistributing maximum extractable value (MEV) profits back to protocol users. According to a governance forum proposal released on December 23, SVR allows Aave to recapture approximately 40% of MEV profits generated during liquidations and return these earnings to the Aave ecosystem.

MEV arises from reordering or backrunning transactions, often creating profits for builders at users' expense. Aave liquidations currently provide third-party liquidators with collateral bonuses, inadvertently enabling MEV opportunities. By integrating SVR, Aave intends to redirect these liquidation profits through an MEV-Share auction, benefiting its DAO and users.

The initiative aligns with broader Ethereum network trends where private transactions are increasingly used to mitigate harmful MEVs. This development reflects ongoing efforts to protect user funds and improve ecosystem fairness.

Thought: Aave's proposed integration of Chainlink's SVR represents a significant step toward addressing MEV-related inefficiencies in DeFi. By recapturing MEV profits and channeling them back to users, Aave strengthens its value proposition while advancing the narrative of user-centric DeFi innovation.

This move could set a precedent for other protocols grappling with MEV challenges, as it not only addresses economic inefficiencies but also highlights the role of oracles in improving on-chain fairness. If successfully implemented, the integration could position Aave as a pioneer in MEV mitigation, further solidifying its standing in the DeFi ecosystem. However, it remains essential to monitor governance consensus and the potential technical complexities of implementing such solutions.

3/ DeFi Renaissance : The Dawn of a New Era in DeFi

Last week’s edition was focused on Real-World Assets (RWAs) and their transformative impact on decentralized finance.

Today, we continue this narrative by delving into the broader DeFi renaissance, exploring how protocols like Usual and Ethena are shaping the future. This continuity underscores the central role of RWAs and innovative stablecoins in driving the next wave of adoption.

DeFi: From Speculation to Real Utility

The DeFi ecosystem has undergone profound evolution since its inception, experiencing cycles of growth, skepticism, and innovation. What sets the current phase apart is the sheer resilience of the industry. As traditional finance grapples with inefficiencies, DeFi is stepping in with solutions that are composable, scalable, and user-centric. The narrative is no longer limited to speculative trading; it’s about reshaping how global finance operates.

Real-World Assets are at the forefront of this transformation, offering stability and utility that was previously absent. Tokenized assets such as U.S. Treasury Bills, real estate, and even commodities are now seamlessly integrated into blockchain platforms. This trend has opened up yield-generating opportunities that appeal to both retail users and institutional investors. By offering transparency and reducing the reliance on intermediaries, DeFi is creating a financial model built on trust and efficiency.

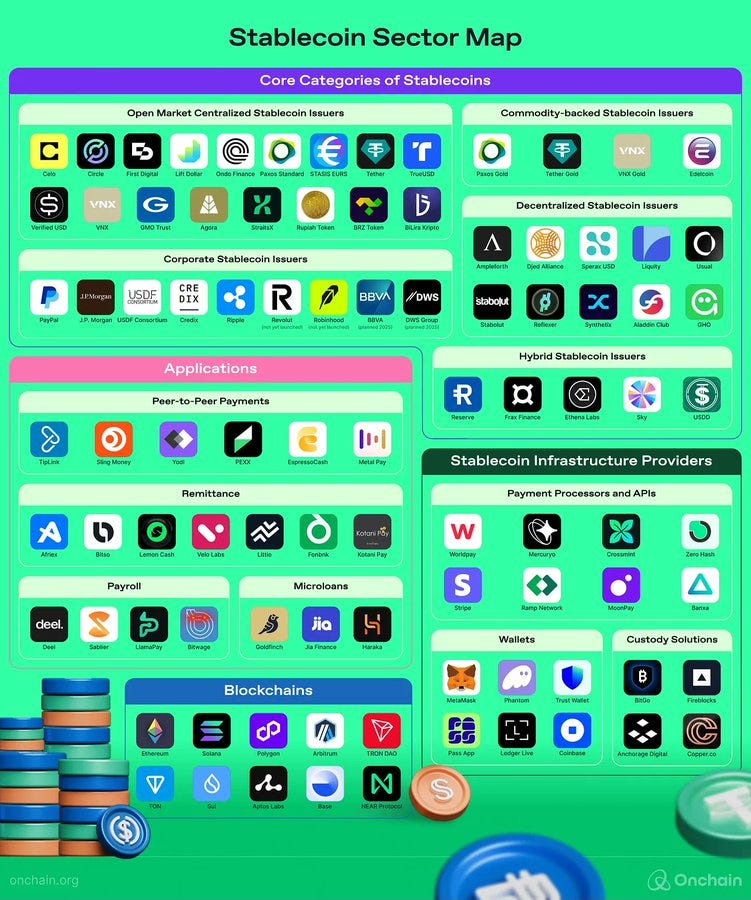

A Focus on Decentralized Stablecoins

The evolution of stablecoins has been equally pivotal. Where centralized giants like USDT and USDC once reigned supreme, new entrants are revolutionizing the landscape. Projects like Usual and Ethena are demonstrating how decentralized, yield-bearing stablecoins can challenge incumbents. These protocols not only offer transparency but also unlock novel use cases through composability.

Scaling DeFi Through Layer2 Innovations

Additionally, the rise of Layer2 solutions is addressing long-standing challenges of scalability and transaction costs. Platforms like Arbitrum, Optimism, and Base are enabling DeFi protocols to operate at scale, with faster transaction times and lower fees. This accessibility is critical as DeFi aims to onboard millions of users globally.

Why Usual and Ethena?

In previous editions, we explored DeFi OGs like Uniswap and Aave—innovators that laid the foundation for today’s ecosystem. However, the narrative is evolving. While these giants remain pivotal, newer projects like Usual and Ethena represent the next wave of innovation. These protocols focus on integrating Real-World Assets and addressing global financial needs, aligning with the emerging priorities of scalability, inclusivity, and sustainability. Furthermore, their innovative approaches make them particularly relevant as the DeFi Renaissance unfolds.

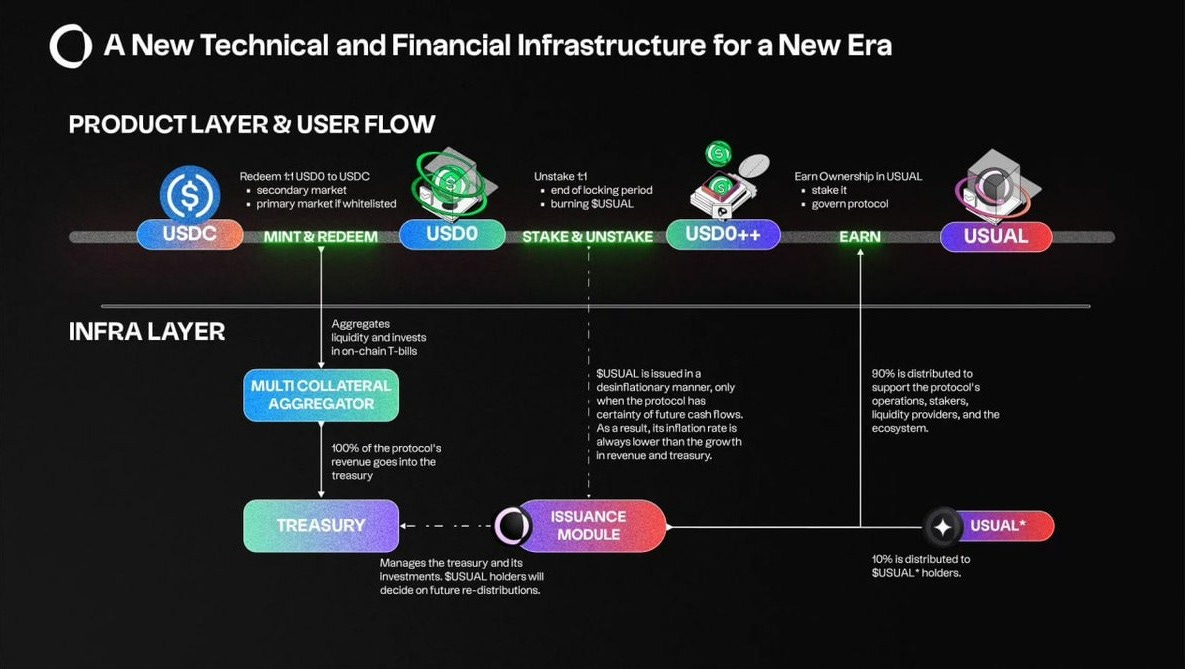

Usual — RWA Meets Composability

Usual is leading the charge in integrating Real-World Assets into decentralized finance. By aggregating tokenized assets from industry leaders like BlackRock and Mountain Protocol, Usual has created a stablecoin ecosystem that prioritizes transparency and sustainability.

Key Features:

$USD0: A stablecoin pegged 1:1 to the U.S. dollar and backed by Treasury Bills. It combines the stability of fiat with blockchain’s efficiency.

$USD0++: An innovative staking model that allows holders of $USD0 to earn yield without additional complexity.

$USUAL: The governance token at the heart of the protocol, giving users a say in its future development while sharing in its revenue streams.

$USUALx: A staked version of $USUAL designed for compounding rewards.

Usual stands out due to its focus on user-centric innovations. By simplifying access to yield and governance while ensuring transparency in operations, the protocol has gained significant traction:

$1B Total Value Locked (TVL) added in just 30 days.

A rapidly expanding user base of over 8,000 holders.

Strategic partnerships that enhance cross-protocol composability.

Additionally, Usual’s collaborations, particularly with Ethena, highlight its ambition to integrate into a broader ecosystem. These partnerships enhance liquidity and drive synergies, further solidifying Usual as a cornerstone of the decentralized stablecoin sector.

Ethena: A Pioneer in Decentralized Stablecoins

Ethena is transforming the stablecoin space with USDe, a synthetic dollar built on Ethereum. It offers a scalable, censorship-resistant alternative to traditional stablecoins, designed for DeFi applications.

Collateralization and Minting : Ethena users deposit collateral such as Ethereum or derivatives like stETH, forming the foundation of USDe’s value. They can mint USDe while maintaining over-collateralization to safeguard against volatility.

Delta Hedging for Stability : Ethena uses Delta hedging by shorting Ethereum derivatives equal to the collateral’s value. This strategy neutralizes volatility, keeping USDe pegged to the U.S. dollar and providing stability for users.

Arbitrage Mechanisms : The protocol incentivizes arbitrage to maintain the peg. If USDe trades above $1, users mint and sell it for profit, bringing the price down. If it trades below $1, users buy it cheaply and redeem it, driving the price back up.

What Sets Ethena Apart :

USDe: A Decentralized Synthetic Dollar : USDe is pegged 1:1 to the U.S. dollar. Unlike centralized stablecoins like USDT, USDe achieves stability through on-chain mechanisms, eliminating reliance on traditional systems.

Income-Generating Stability : USDe functions as an "Internet Bond." By staking Ethereum or derivatives, users earn yields from Ethereum staking and funding rates. This dual-yield structure appeals to both retail and institutional investors.

Transparency and Decentralization : All transactions and positions are verifiable on-chain, enhancing security and reducing counterparty risks. USDe stands apart from centralized stablecoins like USDC, which depend on off-chain reserves.

Deep DeFi Integration : USDe integrates with leading DeFi platforms like MakerDAO, Curve Finance, and Aave, enabling borrowing, lending, and yield farming.

Risk Management : Ethena’s Delta hedging strategy stabilizes USDe, supported by over-collateralization and a strong risk framework, ensuring resilience during market turbulence.

Stablecoins are vital to DeFi growth, and Ethena’s innovative approach positions USDe as a key player. Combining decentralization, transparency, and income generation, USDe provides a powerful alternative to traditional and DeFi-native stablecoin.

Ethena aims to democratize access to decentralized finance, enabling seamless transactions, savings, and earnings. Its commitment to transparency and accessibility aligns with DeFi principles, positioning Ethena as a transformative force in global finance.

Catalysts to Watch: World Liberty Financial

World Liberty Financial is a project that merges traditional financial principles with the innovation of decentralized finance. With backing from high-profile players and a vision rooted in transparency, this initiative is gaining traction as a potential game-changer.

It’s mainly popular for being founded by Trump.

Key Developments:

Diverse Portfolio Strategy: Recent data shows World Liberty Financial acquiring significant amounts of altcoins, signaling a strategy focused on diversification and high-growth assets. Their holdings include ETH, AAVE, LINK, and more.

Partnerships with Ethena: A strategic partnership with Ethena underscores World Liberty Financial’s commitment to aligning with innovative protocols in the DeFi space. This collaboration is expected to enhance liquidity and create synergies that benefit both ecosystems.

$76M Portfolio: With a robust portfolio valued at over $76 million, the initiative is well-capitalized to scale its operations and drive adoption.

Why It’s Worth Watching:

A Bridge Between Worlds: By combining DeFi protocols with traditional financial mechanics, World Liberty Financial could attract a broader audience to blockchain technology.

Scaling TVL: The initiative’s success could catalyze the DeFi ecosystem, potentially pushing its TVL significantly higher in the coming years.

Institutional Interest: With its alignment to regulatory frameworks and focus on auditability, the project could draw institutional capital into DeFi.

World Liberty Financial represents the kind of macro catalyst that has the potential to transform the DeFi landscape. By aligning its principles with decentralized ideals, it serves as a bridge for institutional and retail participants alike, creating new pathways for adoption and growth.

Insights and Predictions for 2025

DeFi’s Total Value Locked (TVL) is poised to grow significantly, driven by the adoption of RWAs and innovative stablecoins.

RWA-focused protocols like Maker, Usual, and Ethena will continue to gain prominence.

Layer2 solutions will dominate in optimizing transaction speeds and costs, fostering widespread accessibility.

Solana’s high-speed network and the introduction of Firedancer will carve out new niches in the blockchain ecosystem.

Asset tokenization and the integration of AI into DeFi protocols will accelerate mainstream adoption.

These insights reflect my analysis and perspective. While I believe these trends are likely, the crypto space is unpredictable, and outcomes may differ.

DeFi is no longer a niche experiment—it’s becoming a cornerstone of global finance. From RWAs to decentralized governance, the ecosystem is evolving into a robust, inclusive, and transparent financial model. As we move into this new era, let’s build the tools and systems that will define the future of finance.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.

Merry Christmas! 🎄⛄ Thanks for all the in depth content this year. Fingers crossed for a great 2025!

Great content, is $USUAL still a better choice than $FXS with its new proposal?