This Week's Newsletter - Case Study on Bio Protocol, Main News of the Week, & Zoom on DeSci

Weekly Alpha

This edition is available as an AI-generated Podcast. ⭡

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

Happy New Year! 🎉

Welcome to the first newsletter of the year.

This year promises to be a landmark for crypto innovation, and I’m thrilled to continue sharing the most impactful narratives with you.

2025 is already making waves, with trends like AI Agents, DeFAI or DeSci leading the charge. Among these, DeSci stands out as one of the most transformative narratives, poised to reshape scientific research and innovation.

This week, we’re kicking off with a deep dive into Bio Protocol ($BIO) and its historic launch on Binance, an event that’s already making waves. As the first-ever DeSci project to be listed on a major exchange, $BIO is more than just another token—it’s a bold statement about the future of decentralized science. Its listing marks a pivotal moment, not only for $BIO but for the entire DeSci movement, signaling the arrival of this narrative on the global stage.

Bio Protocol has positioned itself as a trailblazer, revolutionizing research funding and accessibility. By decentralizing the way science is funded and practiced, $BIO removes traditional barriers, allowing the global community to directly support innovation. Binance’s endorsement further cements its place as a flagship project, providing $BIO with a platform to amplify its mission.

With the launch of Bio Protocol on Binance, DeSci’s market cap surged from a modest $1.2 billion to $2.5 billion.

DeSci, short for Decentralized Science, offers a new frontier for crypto by addressing inefficiencies in traditional research systems. Using blockchain technology, it democratizes funding, enhances transparency, and fosters global collaboration. Projects like $BIO represent the potential of DeSci to redefine how science is practiced, breaking free from centralization and creating opportunities for innovation.

Ethereum remains a stronghold for DeSci projects, hosting nearly half of all initiatives launched in prior cycles. However, Solana is quickly catching up, with 40% of projects launched after 2023 choosing its infrastructure for its speed and efficiency.

This is just the beginning. With only a handful of BioDAOs currently in existence, the scarcity of early projects creates an incredible opportunity for those paying attention. The market cap of these inaugural BioDAOs is minuscule compared to the potential ahead, making this a space primed for growth.

As we look to the year ahead, DeSci is positioned to shine. The listing of $BIO on Binance has already sparked a surge of interest, and this momentum is likely to carry over into other projects in the sector.

The combination of innovation, influential support, and untapped potential makes 2025 the perfect time to explore the next wave of DeSci breakthroughs.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

In this week’s newsletter, we’ll explore:

Case Study: The historic launch of Bio Protocol ($BIO) on Binance.

Main News of the Week: Key updates from across the crypto space.

Zoom on DeSci: Why this narrative could define 2025.

Today's Newsletter is brought to you by Mantle:

Mantle: Reflecting on 2024 & Gearing Up for 2025 🚀

2024 in Review

Mantle has solidified itself as a Financial Hub of Web3, achieving significant milestones:

$2.4B TVL on Mantle Network

$1.8B TVL on mETH Protocol, now the 4th largest in liquid staking and 6th largest in liquid restaking

$1.3B TVL on Ignition FBTC, revolutionizing wrapped Bitcoin liquidity

$140M TVL on Mantle Rewards Station, distributing rewards for assets like $ENA, $EIGEN, and $COOK

Ontop of that, Mantle expanded partnerships with top-tier DeFi protocols like Pendle, Ethena, and Compound.

Breaking Down mETH Protocol's Rise:

Launched just a year ago, the mETH Protocol has taken the liquid staking world by storm:

$1.6B in TVL with 441K $mETH supply.

$cmETH TVL reached $700M, with high yields across Mantle and Ethereum ecosystems.

Its rapid growth can be attributed to Mantle's strong backing, integration with DeFi blue chips, and relentless innovation to empower its holders.

Ignition FBTC:

In just six months, Ignition FBTC became the most adopted wrapped Bitcoin, with $1.3B in TVL and integrations across six blockchains.

FBTC addresses longstanding issues of BTC liquidity fragmentation, bringing a secure, decentralized, and liquid solution to BTCFi.

Why is $MNT Rallying? 📈

The continued price momentum of $MNT reflects investor confidence in Mantle's ecosystem. Catalysts include:

Non-dilutive rewards from the Mantle Rewards Station.

Expanding integrations with projects like Aave, Ethena, and Pendle.

The best yield for your $ETH & $BTC.

Initiatives to onboard new users via a good use of the treasury (TON Accelerator x Mantle).

The Mantle Thesis for 2025:

With a > $4B treasury, Mantle is primed to scale its ecosystem further:

Expanding institutional adoption for products like mETH and Ignition FBTC.

Transitioning Mantle Network to ZK-validity rollup via Succinct Labs.

Cross-chain growth for $cmETH, the highest-yielding ETH derivative on Pendle.

A greater focus on AI-powered blockchain technologies.

Why Mantle Stands Out:

Mantle’s success in 2024 is a testament to its commitment to scaling Web3 infrastructure while addressing real user needs. From its multi-chain integrations and liquidity solutions to its regional growth efforts and grassroots funding programs, Mantle is proving to be a transformative force in the blockchain space.

As we step into 2025, all signs point to even greater growth. Mantle's holistic approach—spanning DeFi, staking, wrapped Bitcoin, and institutional-grade innovations—places it at the forefront of the next wave of blockchain adoption.

1/ Case Study: BIO Protocol – Pioneering the Decentralized Science (DeSci) Revolution

Introduction

BIO Protocol has positioned itself as a game-changer in the decentralized science (DeSci) movement. Described as "a new home for decentralized biotechnology," it seeks to accelerate the flow of capital into on-chain scientific research, breaking barriers imposed by traditional funding mechanisms.

Its launch has sparked a new narrative in crypto, dubbed by many as the "DeSci season", with BIO Protocol’s token debut on Binance propelling the DeSci market cap to new heights.

This case study delves into its potential, ecosystem, and the wave of opportunities it’s creating across the crypto and biotech landscapes.

What is BIO Protocol?

BIO Protocol operates as the financial layer for DeSci, fostering innovation through:

Incubating BioDAOs: It identifies and funds promising decentralized autonomous organizations (DAOs) focused on niche scientific research.

Liquidity Provision: Provides the necessary liquidity to create network effects for BioDAOs, enabling sustained development.

Cross-Chain Capabilities: Initially launched on Ethereum, the protocol will soon bridge to Solana and Base to enhance accessibility.

BIO Protocol hosts several prominent BioDAOs under its umbrella, including VitaDAO (longevity research) and PsyDAO (psychedelic therapy).

A New Era for DeSci

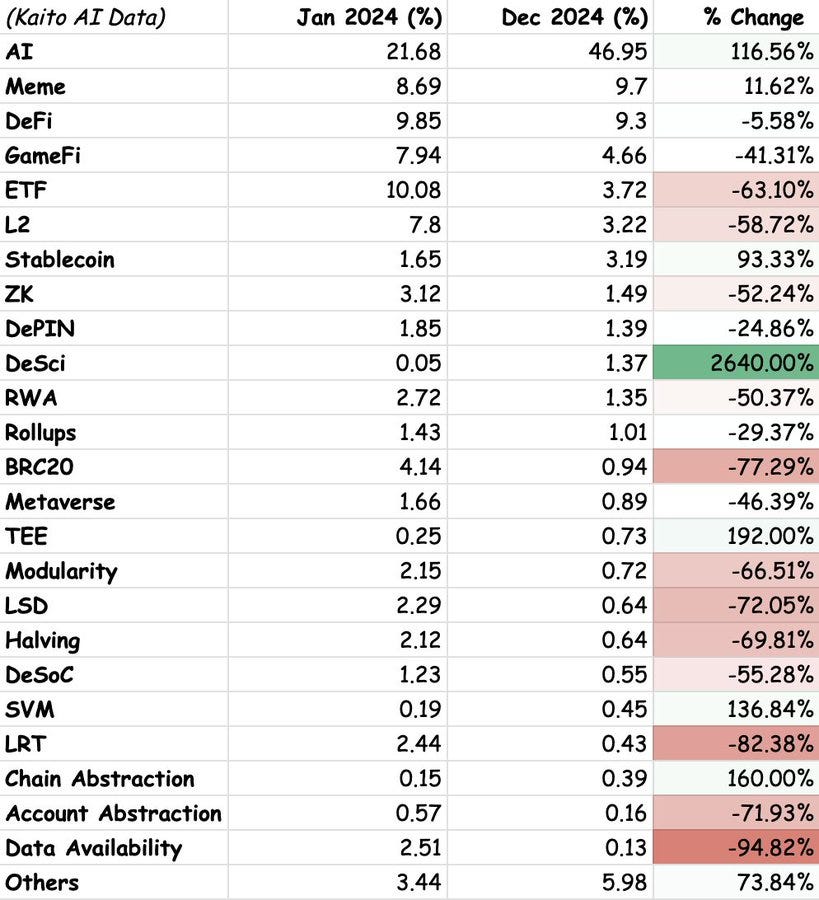

The launch of BIO Protocol has been likened to "rocket fuel" for the DeSci movement. In 2024 alone, DeSci’s market share grew by a staggering 2,640%, driven largely by BIO Protocol’s momentum.

Key Catalysts:

Tokenomics:

Genesis Allocation: 3% of tokens were distributed via Binance Launchpool.

Ecosystem Incentives: 25% allocated to fuel BioDAO growth and incentivize participation.

Community Airdrop: 6% set aside to reward early supporters.

Binance Labs Investment: Solidified BIO Protocol’s legitimacy, with Binance CEO CZ highlighting DeSci as a core area of focus alongside blockchain and AI.

Early Success Stories:

PsyDAO received $14.6 million worth of BIO tokens, more than double its market cap pre-launch.

Other BioDAOs like ValleyDAO, CryoDAO, and AthenaDAO are set to unlock significant rewards, creating a strong foundation for long-term growth.

BIO Protocol’s Ecosystem

The protocol acts as a Y Combinator of on-chain science, incubating and funding startups that tackle underfunded scientific challenges.

Examples of Supported Research Areas:

Longevity: VitaDAO explores anti-aging therapies.

Cryopreservation: CryoDAO focuses on preserving biological materials.

Rare Diseases: EndRare unites families and patient communities to combat over 10,000 rare diseases.

Long COVID Research: LongCovidLabs accelerates a cure for millions affected globally.

DeSci: The Next Big Crypto Narrative

BIO Protocol combines elements from multiple crypto narratives:

AI Integration: Recently onboarded AI expert Shawn to optimize research processes.

Tokenization of Real-World Assets: Intellectual property (IP) from research is tokenized and community-owned, offering unprecedented access to scientific breakthroughs.

Decentralized Funding: Empowers researchers by overcoming traditional funding bottlenecks, dubbed the "valley of death" in science funding.

A Unique Investment Opportunity:

BIO Protocol offers exposure to the entire DeSci ecosystem through its token, akin to a decentralized science index fund. Token holders can also vote on proposals to establish new BioDAOs.

Ripple Effects: Boosting the DeSci Ecosystem

The launch of BIO Protocol has spurred interest in other DeSci projects, many of which stand to benefit from the newfound attention:

Drugs DAO: Previously shared at a $5M market cap, soared to $62M.

Osai Don DAO: Focused on transparent funding for personalized medicine research.

Neuron (Cerebrum DAO): Demonstrating steady gains with its focus on neuroscience.

HairDAO: Tackling hair loss prevention and reversal.

Technical Analysis and Market Outlook

Current Valuation:

Token price is currently lower than the token’s pre-launch price at $0.95.

With the current Market being in a downside, and the hype around DeSci starting to coming back down after the Binance Launchpool, it was expected.

However if you believe DeSci has a future, it could be a potential entry point, given the token’s broad exposure to the burgeoning DeSci sector.

Market Potential:

Total DeSci market cap recently doubled to $2.5 billion but remains a fraction of other crypto sectors, highlighting significant upside potential.

BIO Protocol’s curated ecosystem positions it as a leader capable of attracting institutional capital and retail interest alike.

January 2025 Roadmap for BioProtocol

BioProtocol’s January roadmap highlights key steps to further its mission in decentralized science (DeSci):

Onboarding 10+ New DAOs

Expanding its ecosystem by integrating over 10 new DAOs to drive collaboration and decentralization.Rust + EVM Launchpad Contracts

Releasing smart contracts compatible with Rust and Ethereum, ensuring seamless multi-chain project deployment.BIO Bridges to Solana and Base

Facilitating cross-chain liquidity and accessibility by bridging the BIO token to Solana and Base ecosystems.Pioneering Projects

Kickstarting transformative initiatives like LongCovidLabs and EndRareDiseases to address pressing global health challenges.DeFi Liquidity Pairings

Launching BIO and BioDAO liquidity pools to foster sustainable funding and incentivize participation.DeScAI Agents MVP

Introducing AI-driven DeScAI agents in partnership with VitaDAO, optimizing research and data workflows.QuantumBioDAO TGE

Hosting the Token Generation Event for QuantumBioDAO, marking a significant milestone for quantum-driven research.Launchpad Audit

Conducting a full audit to ensure the security and reliability of the platform for developers and users alike.

As outlined in the accompanying timeline, BioProtocol’s roadmap reflects its broader goal of creating a decentralized, equitable ecosystem for funding and conducting scientific research. With initiatives spanning AI-driven tools, DeFi integrations, and health-focused DAOs, BioProtocol is poised to lead the next wave of innovation in DeSci.

By committing to these milestones, BioProtocol signals its dedication to reshaping the way we approach science, funding, and innovation.

Conclusion: A Blueprint for the Future of Science

BIO Protocol is more than just a DeSci project—it’s a movement redefining how science is funded and conducted. By democratizing access to capital and enabling community ownership of groundbreaking research, it addresses systemic flaws in the traditional scientific funding model.

The protocol’s ambitious vision, strong tokenomics, and early ecosystem success make it a cornerstone of the DeSci revolution. For investors and researchers alike, BIO Protocol represents a unique opportunity to be part of the next big crypto narrative.

2/ Crypto and DeFi News

🔗 Ripple partners with Chainlink to boost RLUSD stablecoin in DeFi markets

Ripple has partnered with Chainlink to enhance the adoption of its RLUSD stablecoin across DeFi markets. Announced on January 7, the collaboration integrates Chainlink’s decentralized price feeds for RLUSD transactions on both Ethereum and the XRP Ledger. The move aims to provide tamper-proof, real-time market data, ensuring cost-effective and secure interactions for DeFi applications.

RLUSD, pegged 1:1 to the US dollar, is designed for use in payments, trading, and lending. By leveraging Chainlink's oracles, Ripple seeks to mitigate risks such as data manipulation or inaccuracies, paving the way for RLUSD to become more accessible for developers building DeFi solutions.

This partnership highlights Ripple’s ongoing focus on blockchain-based finance, with stablecoins like RLUSD bridging traditional finance and decentralized ecosystems. Chainlink’s involvement further reinforces its role in providing robust infrastructure to the growing tokenized asset sector.

Thought: The Ripple-Chainlink collaboration reflects the growing importance of stablecoins in the DeFi ecosystem, especially as a medium for secure, real-time transactions. RLUSD’s integration with Chainlink not only strengthens its utility but also underscores the demand for reliable data in decentralized markets.

This development positions Ripple to compete more effectively in DeFi, particularly against other stablecoin-backed initiatives. As stablecoins continue to drive blockchain adoption, partnerships like this could become a blueprint for enhancing interoperability and security in DeFi ecosystems.

🌋 Solana 24-hour DEX volume beats Ethereum & Base combined

Solana has surpassed Ethereum and Base in 24-hour DEX trading volume, recording nearly $3.8 billion on January 6, compared to Ethereum's $1.7 billion and Base's $1.2 billion, as per DefiLlama data. This milestone highlights Solana’s expanding influence in DeFi, driven by a surge in retail trader activity, particularly around memecoins and AI agent tokens.

Solana’s 2024 growth is reflected in its total value locked (TVL), which has grown fivefold from $1.4 billion to over $9.5 billion, outpacing Ethereum. Its leading DEX, Raydium, reported significant volume increases, jumping from $180 million daily in January to over $3 billion by year-end. Memecoins have been a significant driver, accounting for 65% of Raydium's monthly trading volume in November.

Additionally, platforms like Pump.fun are boosting activity, with the memecoin-focused protocol generating $250 million in trading volume over the past month.

Thought: The surge in Solana's DEX volume signals the growing appeal of alternative ecosystems to Ethereum for DeFi activity.

Solana's focus on low transaction fees and fast processing times is resonating with retail traders, particularly in speculative niches like memecoins. As Solana continues to strengthen its ecosystem, it may challenge Ethereum's dominance further, particularly in catering to high-volume, low-cost trading use cases. However, sustaining this momentum may depend on its ability to diversify beyond speculative trading and enhance institutional adoption.

👻Crypto wallet Phantom confirms it won’t launch a token amid airdrop rumors

Crypto wallet Phantom has denied rumors of launching a token, despite speculation following the announcement of its upcoming social discovery feature. In a January 3 post on X, Phantom clarified, "We do not have any plans to launch a token." The feature, unveiled on December 19, will allow users to create profiles, add friends, and manage privacy settings.

The rumors stemmed from speculation that Phantom users might earn tokens through interactions on the platform, such as gaining followers. Phantom emphasized its focus on enhancing the user experience without introducing a token.

Additionally, Phantom announced its support for the Sui blockchain, set to integrate in early 2025. This marks the fourth blockchain Phantom supports, alongside Bitcoin, Ethereum, and Solana. Phantom has also grown significantly, reporting 7 million monthly active users as of April 2024.

However, the wallet faced challenges, including an emergency update for iPhone users in November due to application resets, with one user reportedly losing $600,000.

Thought: Phantom’s decision to clarify token rumors reflects its commitment to user experience over speculative hype, a stance that could strengthen trust among its growing user base.

The integration of Sui blockchain highlights its expansion efforts, diversifying its ecosystem. However, challenges like security updates underline the critical need for consistent improvements to maintain its position as a leading non-custodial wallet. By focusing on core features and ecosystem growth, Phantom is positioning itself for long-term success without relying on token incentives.

🕹️ Illuvium partners with Virtuals, bringing autonomous AI NPCs to its games

Illuvium has partnered with the Virtuals Protocol to introduce autonomous AI-powered NPCs across its gaming ecosystem. Using Virtuals’ G.A.M.E AI framework, NPCs in Illuvium's games—Overworld, Arena, and Zero—will adapt quests, dialogue, and challenges dynamically based on player interactions. This innovation aims to create "infinite stories" by enabling NPCs to react to player actions in unique ways, such as altering quests or environments based on behavior.

Illuvium co-founder Kieran Warwick emphasized safeguards to ensure these NPCs maintain narrative and gameplay integrity, including strict behavioral guidelines and real-time monitoring. The feature will initially roll out in Overworld, Illuvium’s exploration game, and later expand to the other titles.

Virtuals Protocol co-founder Ether Mage noted that this partnership marks a milestone, as their vision to integrate AI with AAA gaming franchises becomes a reality. Virtuals' AI agents can also transcend individual games, remembering interactions across platforms to enrich the gaming experience.

Thought: This partnership between Illuvium and Virtuals sets a new benchmark for blockchain gaming by making AI-driven NPCs integral to the player experience. Adaptive gameplay through autonomous agents allows for unparalleled engagement, with NPCs creating unique interactions based on player choices.

This innovation strengthens Illuvium’s reputation as a pioneer in Web3 gaming and showcases how blockchain platforms can leverage AI to enhance content quality and interactivity. The broader implications for interconnected, personalized gaming could redefine how blockchain games compete with traditional AAA titles.

💵 Tether USDT’s market cap dropped

Tether’s USDT market cap has seen a 2.8% decline since December 19, 2024, dropping from a peak of $141 billion to its current level. Daily trading volumes have also plummeted by 64%, going from $154 billion to $55 billion during this period. Matrixport attributes this decline to a "seasonal holiday lull" rather than bearish market sentiment, indicating that bullish momentum might resume as trading activity picks up in the new year. Increased stablecoin activity is often a precursor to fresh capital inflow into the crypto markets.

The USDT decline has sparked rumors linking it to MiCA regulations, which were supposed to lead to delistings of USDT from European exchanges by December 30, 2024. However, major exchanges like Binance have dismissed such rumors, continuing to support USDT trading.

Thought: The drop in USDT’s market cap is less likely to signal long-term bearish sentiment and more indicative of seasonal trading patterns. Stablecoins like Tether are crucial liquidity sources, and reduced activity during the holiday season is expected. This dip might be a temporary consolidation phase before renewed bullish momentum, especially if institutional and retail participants increase activity in early 2025.

The fears surrounding MiCA regulations highlight lingering uncertainties about stablecoin compliance within the European Union. However, the lack of enforcement actions and continued support from exchanges suggest that regulatory clarity is evolving slowly. If USDT remains widely used despite regulatory pressures, it will reinforce its dominance as a cornerstone of crypto liquidity, mitigating risks tied to potential delistings.

3/ Decentralized Science (DeSci): Redefining the Research Paradigm

Decentralized Science (DeSci) is an emerging field leveraging blockchain and Web3 technologies to revolutionize the way scientific research is funded, conducted, and shared. By addressing long-standing challenges such as limited funding, lack of transparency, and centralized control, DeSci is poised to democratize access to science and drive global innovation.

Decentralized Science (DeSci) is becoming one of the most explosive trends in crypto, with a staggering 2,640% growth (or roughly 266x) in 2024, surpassing sectors like AI and meme coins. Yet, lots of crypto enthusiasts remain unaware of DeSci.

Currently, the spotlight is on meme coins and AI, but undervalued gems like DeSci could be the next big wave.

Vitalik Buterin himself is a strong advocate for DeSci, viewing it as a real-world use case compared to meme coins. As the bull market gains traction, utility projects like DeSci are poised to take center stage. Industry leaders like Brian Armstrong and CZ have publicly supported DeSci: Armstrong highlighted ResearchHub and ResearchCoin back in 2022, which skyrocketed from a $22M market cap three months ago to $135M now. Meanwhile, CZ was early to emphasized using crypto to accelerate research funding

DeSci is more than a trend—it represents real use cases and is rapidly growing in importance.

Let’s dive deeper into what makes DeSci the rising star of 2025 👇

State of DeSci in 2024

The momentum behind DeSci has grown significantly in recent years:

Q1 2024 recorded the highest number of project launches since the last cycle's peak. While the pace slowed in Q2 and Q3, a surge in Q4 highlights renewed interest and innovation.

Market Snapshot: The total market cap of DeSci stands at $2.6 billion—only 0.065% of crypto’s overall market cap, emphasizing its untapped potential.

Ethereum & Solana Dominance: Ethereum leads with 49% of active DeSci projects launched before 2023 still operational, while Solana rapidly gains traction.

New Entrants: Half of the top 10 DeSci projects were launched in 2024, indicating significant opportunities for innovative ventures to capture market interest.

Despite its nascent stage, DeSci spans diverse categories, including infrastructure, funding, data collection, publishing, memes, and research methods. Notably, the rise of memes like pumpdotscience showcases the blending of cultural and scientific narratives.

Why DeSci Matters

DeSci seeks to transform the research landscape through:

Decentralized Funding:

Tokenized and NFT-based funding models open research to global participation, breaking traditional funding barriers.

Transparency and Integrity:

Blockchain ensures data authenticity, enabling researchers to publish verifiable results directly on-chain.

Global Collaboration:

DeSci eliminates geographical and institutional barriers, fostering a truly collaborative research environment.

Ownership and Monetization:

Researchers can tokenize intellectual property as NFTs, creating new revenue streams and retaining control over their work.

Democratized Access:

DeSci promotes inclusivity, allowing broader participation in scientific discovery.

This ecosystem map illustrates the diverse and rapidly growing DeSci landscape:

Challenges and Risks in DeSci Adoption

While DeSci offers immense promise, the road ahead is fraught with challenges that demand careful navigation.

1. Funding and Sustainability:

DeSci projects often rely on community-driven funding models, DAOs, or tokenomics to sustain operations. While this decentralization empowers participants, it can also lead to financial instability. Market downturns or shifts in investor sentiment can jeopardize long-term project viability. Unlike traditional science institutions, DeSci lacks the extensive safety net of government grants or endowments.

2. Adoption Barriers:

The intersection of blockchain and science is still nascent, and mainstream adoption remains a hurdle. Convincing traditional researchers and institutions to embrace decentralized systems often involves overcoming skepticism about blockchain's legitimacy and usability. Furthermore, the complexity of Web3 tools and onboarding processes can alienate non-crypto-native participants, impeding widespread integration.

3. Regulatory Uncertainty:

The regulatory landscape for blockchain and cryptocurrency is in constant flux. This uncertainty poses a significant risk for DeSci projects, which operate at the intersection of two heavily scrutinized domains: science and blockchain. Projects must navigate a maze of compliance requirements, from intellectual property laws to data privacy regulations, all while maintaining decentralization—a challenging balancing act.

4. Quality Assurance and Credibility:

Scientific research thrives on rigor, peer review, and credibility. DeSci's decentralized model, while democratizing access, can sometimes dilute quality control. Ensuring that research on decentralized platforms meets the same standards as traditional journals is essential to gaining the trust of the scientific community. Without robust vetting mechanisms, there is a risk of misinformation or subpar research proliferating.

5. Coordination and Governance:

DeSci projects often operate as DAOs, with decentralized governance structures. While this model empowers community members, it can also lead to inefficiencies, conflicts, and delays in decision-making. Achieving consensus among a diverse group of stakeholders is a persistent challenge that can slow down progress and innovation.

OriginTrail: Building a Verifiable Web for AI and Science

OriginTrail is at the forefront of addressing AI and scientific challenges by creating a "Verifiable Web.

OriginTrail stands out as one of the most robust infrastructure projects within the DeSci space. Initially designed as a supply chain protocol, OriginTrail has evolved into the "world’s first Decentralized Knowledge Graph."

This evolution enables it to support DeSci initiatives by organizing and verifying scientific data on the blockchain.

One of OriginTrail's key innovations is its focus on data interoperability. Scientific research often involves diverse datasets that are difficult to integrate. OriginTrail solves this by creating a unified framework where data from different sources can interact seamlessly. This capability is particularly valuable for interdisciplinary research, where collaboration across fields is essential.

The project also prioritizes data integrity. Using blockchain, OriginTrail ensures that all scientific data is immutable and traceable, addressing one of the most critical issues in research today: reproducibility.

By providing a transparent and verifiable record of experiments, OriginTrail builds trust among researchers, funders, and the public.

OriginTrail’s partnerships further cement its importance. Collaborations with organizations like BSI (British Standards Institution) and the World Economic Forum highlight its potential to become a global standard for decentralized data management. With a market cap exceeding $320 million, OriginTrail is not just a DeSci leader but a cornerstone for Web3's integration into real-world applications."

Key features include:

Decentralized Knowledge Graph (DKG):

Combines blockchain with knowledge graphs to structure and verify data, reducing biases and ensuring AI reliability.

Architecture:

Blockchain for data security.

DKG for accessible global datasets.

AI integrations, like ChatGPT, to utilize verified data.

Adoption:

Over 15 million knowledge assets on the platform.

70 million TRAC tokens locked.

Token Economics:

TRAC is used for staking, publishing data, and purchasing assets.

Current price: ~$0,80, with potential for significant growth.

Research Hub: Redefining Scientific Collaboration

ResearchHub is often described as the "GitHub for science," and for good reason. This platform is designed to revolutionize how research is conducted, shared, and funded. By integrating blockchain technology, ResearchHub incentivizes open access and collaboration through its native token, $RSC. Researchers earn tokens by contributing to the platform, whether by uploading papers, reviewing submissions, or participating in discussions.

One of the platform’s standout features is its ability to streamline peer review, a process traditionally plagued by inefficiency and opacity. ResearchHub uses smart contracts to ensure that reviewers are compensated fairly and promptly, reducing bottlenecks in the publication pipeline. Moreover, the platform supports community-driven funding initiatives, allowing users to crowdfund specific research projects. This decentralized approach not only democratizes funding but also ensures that niche but critical research areas receive attention.

The growth of ResearchHub has been nothing short of phenomenal. Backed by Coinbase founder Brian Armstrong, $RSC has grown from a market cap of $22 million to $135 million within a year. This rapid growth highlights the increasing interest in DeSci and its ability to attract both researchers and crypto enthusiasts alike.

Research Hub (RSC) exemplifies DeSci’s potential to disrupt traditional publishing:

Key Advantages:

Rewards contributors with RSC tokens for publishing, reviewing, and collaborating.

Governance and funding driven by the community.

Backed by Industry Leaders:

Brian Armstrong (Coinbase) and other influential figures actively support the project.

Market Potential:

Current market cap: $122 million.

Expected listing on major exchanges, including Coinbase.

Strategic Insights

Underestimated Potential:

DeSci’s market cap remains minuscule compared to its transformative potential. With proper adoption, it could redefine the $2 trillion global scientific research market.

Alignment with Industry Trends:

Emerging narratives like AI, prediction markets, and memecoins intersect with DeSci, creating synergistic growth opportunities.

Key Drivers of Growth:

Support from influencers like Vitalik Buterin and Brian Armstrong.

Integration with leading platforms (e.g., Ethereum, Solana).

Expansion into mainstream scientific use cases.

The Road Ahead

Despite these challenges, DeSci represents a paradigm shift in how science is funded, conducted, and shared. It empowers researchers, decentralizes access to knowledge, and aligns incentives through tokenized economies. By breaking down the silos of traditional academia, DeSci has the potential to accelerate innovation on a global scale.

DeSci is a real-world use case that transcends the speculative nature of meme coins. In an era where trust in institutions is waning, DeSci offers a transparent, community-driven alternative. The involvement of leading voices like Brian Armstrong and CZ only adds to its credibility.

The DeSci revolution is just beginning. For those seeking to stay ahead of the curve, now is the time to explore, research, and invest in this transformative sector. Whether through funding groundbreaking research, participating in DAOs, or simply spreading awareness, there are countless ways to contribute to the movement.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.