This Week's Newsletter - Case Study on HeyAnon, Main News of the Week, & Zoom on DeFAI

Weekly Alpha

This edition is available as an AI-generated Podcast. ⭡

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

With Trump’s official inauguration just days away on January 20th, the crypto world is bracing for what’s next.

Political shifts like this often bring major ripple effects, and all eyes are on how his administration will impact the market. Will he fulfill promises that could drive innovation and adoption? The anticipation is palpable, and the stakes are high.

With the most recent dips in the Market, instead of the up only Q1 that was expected, many have reconsidered their conviction of the inauguration being a sell the news event.

Will the market pump on the 20th? That’s what I’m starting to think, we’ll see.

Meanwhile, there’s a new meta for 2025: DeFAI. Yep, DeFi meets AI. If you’ve been following along, we’ve covered the DeFi Renaissance and the rise of AI agents.

Now, imagine combining the intelligence of AI with the infrastructure of DeFi—that’s DeFAI. It’s all about making DeFi simpler, smarter, and accessible to more people, potentially unlocking the next wave of growth for the industry.

DeFi has always been at the heart of blockchain innovation, enabling lending, borrowing, trading, and more—all without intermediaries. But let’s be honest: it’s not exactly user-friendly. This complexity has always been a barrier to mass adoption. DeFAI aims to change that by simplifying DeFi through AI-driven automation, making smarter decisions faster and reducing the learning curve for users.

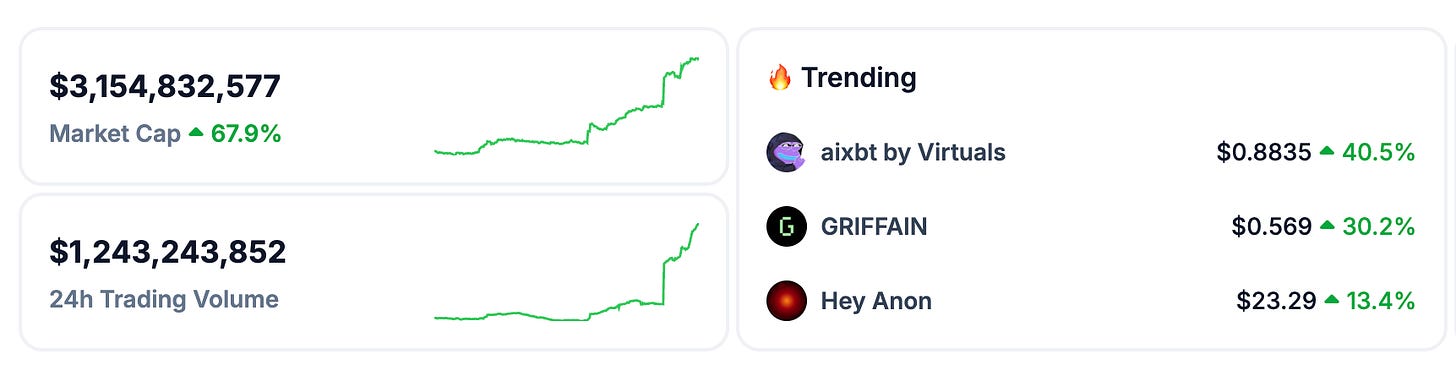

The numbers are already promising. Earlier this month, CoinGecko introduced a new DeFAI category, and it’s gaining traction. The market cap for DeFAI sits at $3.1 billion, which might seem substantial, but when you consider its potential, it’s just the beginning.

Why is this so important? Because DeFAI isn’t just about adding AI to DeFi; it’s about making decentralized finance accessible to millions who’ve been intimidated by its complexity. Projects like Hey Anon are already pushing boundaries, showing how AI can streamline portfolio management, automate trading strategies, and optimize yield farming—all while preserving DeFi’s core principles of decentralization.

Of course, no innovation comes without risks. DeFAI still faces challenges like ensuring AI reliability and avoiding costly mistakes, but every new frontier has its hurdles. What’s clear is the immense potential for DeFAI to redefine how we think about and interact with decentralized finance.

If DeFi was the foundation of blockchain’s first big wave, DeFAI could be the catalyst that finally bridges the gap between crypto enthusiasts and the mainstream. With its ability to abstract complexity and provide practical, impactful solutions, DeFAI is poised to lead the charge in 2025.

This year isn’t just about watching trends; it’s about being part of them. And DeFAI is one you won’t want to miss.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

And just in case you missed the Kaito Hype, have a look at my post about it:

I’m also posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

In this week’s newsletter, we’ll explore:

Case Study: The innovative rise of Hey Anon

Main News of the Week

Zoom on DeFAI: How the fusion of DeFi and AI is shaping up to be the breakout Narrative of 2025.

Today's Newsletter is brought to you by Mantle:

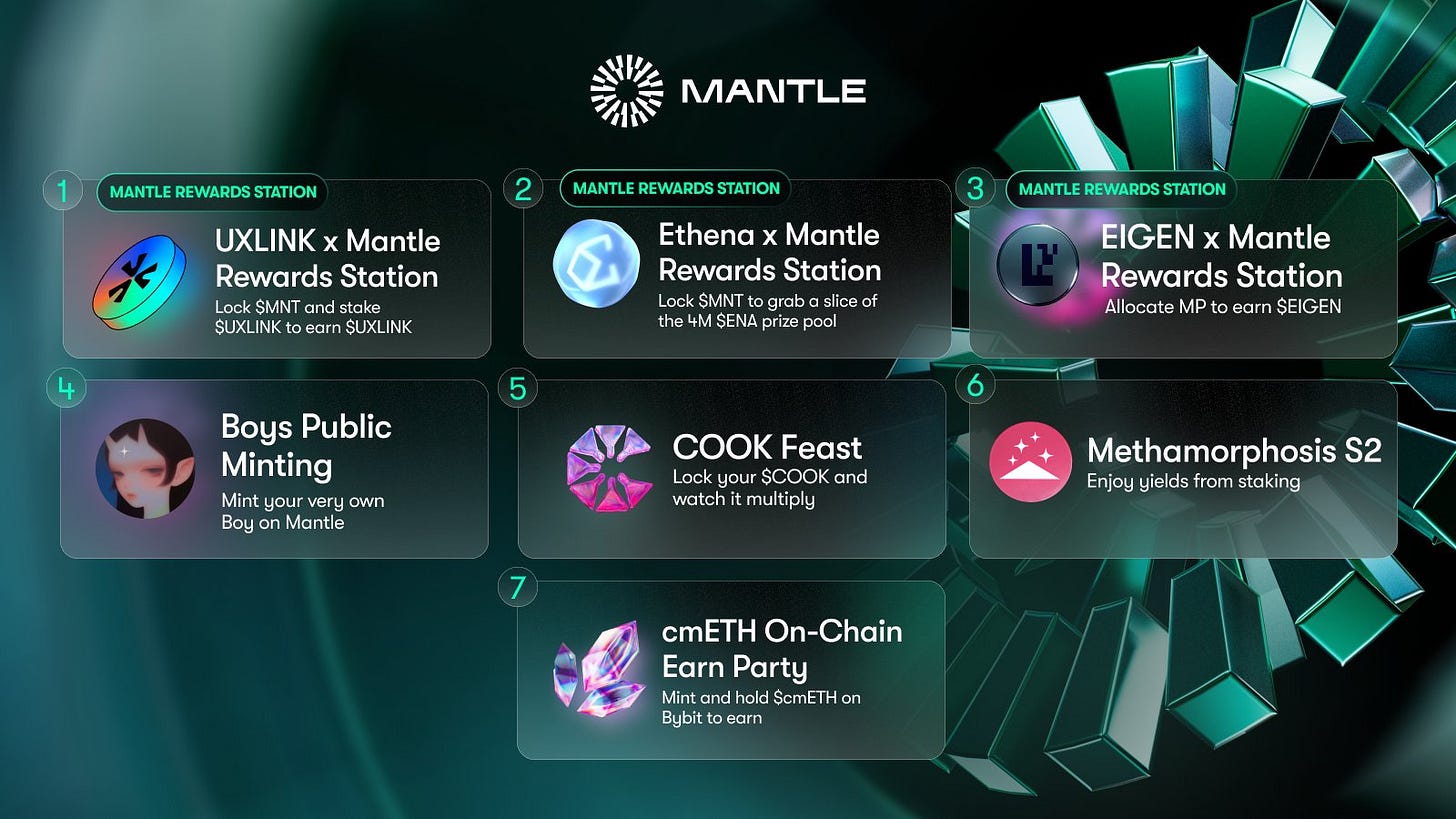

Mantle Rewards Station: Your Gateway to Rewards

The Mantle Rewards Station continues to gain momentum as one of the most active hubs for earning rewards. With over 126M $MNT locked (~$139.9M USD) and more than 35,718 participants, the station has cemented itself as the go-to platform for locking tokens, allocating resources, and maximizing rewards.

But that’s not all. Mantle has consistently delivered innovative campaigns to its growing community, with multiple active and upcoming opportunities to earn tokens across various projects.

Highlighted Campaigns

1️⃣ UXLINK Season 2 Airdrop

Rewards Pool: 1,000,000 $UXLINK tokens.

Deadline: January 20th.

The UXLINK campaign brings exciting opportunities to engage in the Mantle ecosystem while earning a share of significant rewards. With the clock ticking, this is your chance to lock in your participation and make the most of this collaboration!

2️⃣ EIGEN Campaign

Rewards Pool: Earn rewards by engaging with Eigen’s innovative decentralized solutions.

Deadline: March 11th.

Eigen has partnered with Mantle Rewards Station to incentivize users diving into its next-generation DeFi opportunities.

3️⃣ Ethena Campaign

Rewards Pool: Participate and explore Ethena’s financial innovations.

Deadline: March 6th.

This campaign offers rewards for users aligning with Ethena’s mission of creating secure, innovative financial solutions.

Ongoing Campaigns: Don’t Miss Out

4️⃣ cmETH On-Chain Earn Party with Bybit

Details: Earn an extra 3% APR on ETH by minting and holding $cmETH.

Deadline: February 28th.

This campaign has already seen significant participation, making it one of the top ways for Mantle users to grow their ETH holdings while contributing to the ecosystem.

5️⃣ COOK Feast

Deadline: February 16th.

As $COOK continues to grow within the Mantle ecosystem, this campaign offers users an additional opportunity to earn rewards through active engagement.

6️⃣ Methamorphosis Season 2

Deadline: February 16th.

The second season of Methamorphosis has been met with strong interest, driving participants to explore more about the Mantle ecosystem while earning significant rewards.

Recently Completed Campaigns

Mantle Yield Lab Campaign: Rewards for participants in this program will be distributed by the end of January 2025, ensuring contributors to the Yield Lab see the benefits of their engagement.

Why Participate?

High ROI: From staking to campaign engagement, users unlock value through token rewards, APR bonuses, and innovative project interactions.

Diverse Campaigns: With opportunities like UXLINK, cmETH, COOK, and more, there’s something for everyone, whether you’re a DeFi enthusiast, NFT collector, or ETH holder.

Trusted Ecosystem: Mantle Network continues to rank among the top-performing Alt-DA Ethereum L2s, backed by growing market metrics and community trust.

Don’t miss out—head over to the Mantle Rewards Station today and explore all the live and upcoming campaigns. Whether it’s $UXLINK, $cmETH, or $COOK, the rewards are waiting for you!

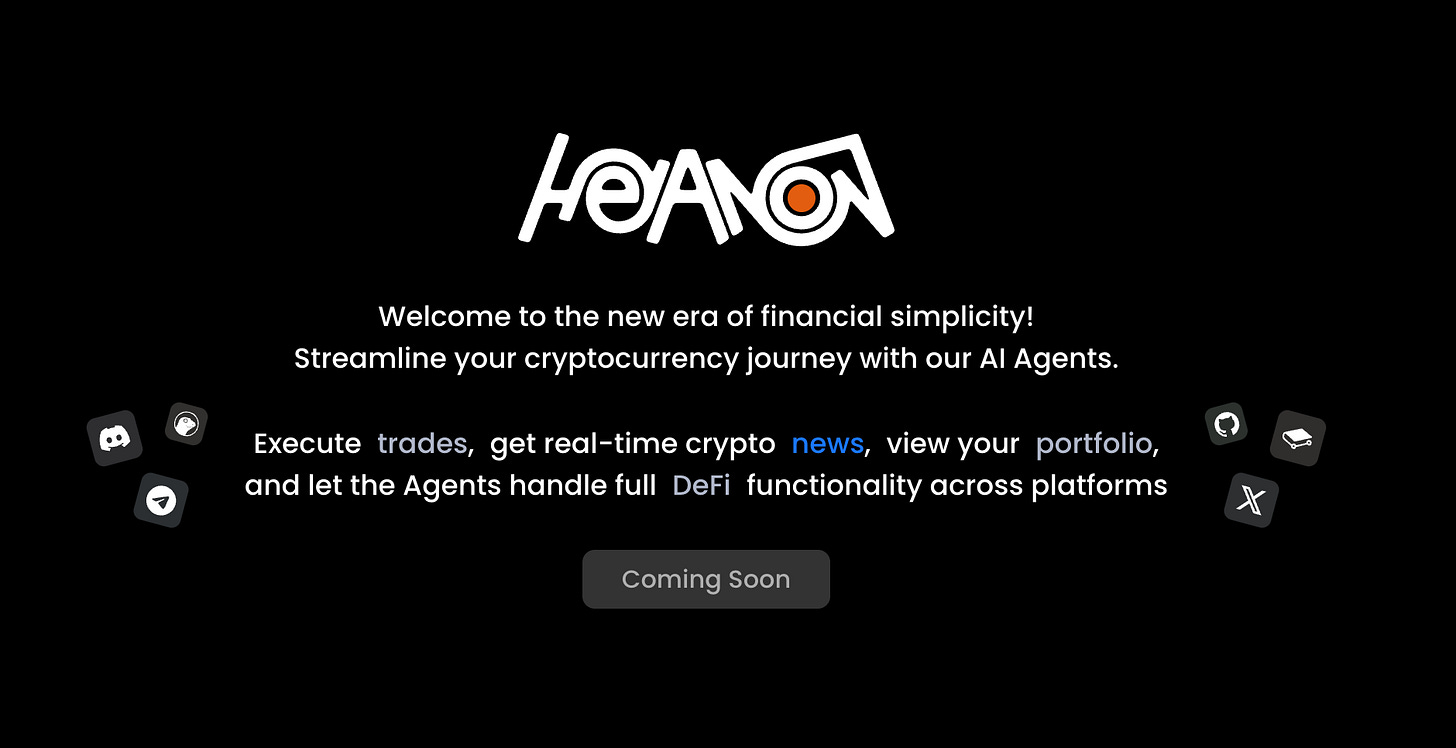

1/ Case Study: Hey Anon ($ANON)

Overview

Hey Anon, spearheaded by Daniele Sesta, is carving out a pioneering role in the DeFi-AI (DeFAI) landscape.

By seamlessly merging artificial intelligence with decentralized finance, Hey Anon seeks to simplify intricate on-chain interactions, enhancing accessibility, efficiency, and security in DeFi.

The project revolves around two key components:

Gemma: An AI research assistant that transforms massive amounts of on-chain and social data into actionable insights.

AUTOMATE: A TypeScript framework designed for seamless and secure integration of DeFi protocols within the Hey Anon ecosystem.

Vision and Mission

Hey Anon’s mission is to establish itself as the universal smart layer for blockchain. By enabling multi-step transactions, governance, and data analysis, the project aims to ensure safety and transparency in on-chain operations.

AUTOMATE plays a pivotal role, enforcing schema-based, typed interactions to mitigate errors and enhance security for developers and users alike. This approach reflects the project’s commitment to reliability and precision in an evolving DeFi landscape.

Key Features

Gemma: AI-Powered Insights

Gemma functions as an advanced research assistant, leveraging AI to convert complex data streams into actionable strategies for DeFi participants. Its key benefits include:

Enhanced Decision-Making: Provides reliable, data-driven insights to navigate the volatile DeFi market.

Comprehensive Data Analysis: Analyzes vast amounts of on-chain and social data, uncovering hidden trends and opportunities.

User-Friendly Accessibility: Democratizes access to high-level research, empowering both retail and institutional users.

AUTOMATE: DeFAI Development Framework

AUTOMATE simplifies DeFi protocol integration with features designed to address critical pain points:

Deterministic Logic: Ensures all on-chain calls are validated against strict schemas, minimizing unpredictability.

Predictable Execution: Guarantees secure transaction execution, rejecting incomplete or erroneous data.

Security-First Design: Reduces the risk of misconfigurations in complex operations like bridging, staking, and swapping. This makes AUTOMATE ideal for managing large treasuries and DAOs.

Ecosystem and Partnerships

Hey Anon has formed robust partnerships with several major blockchain networks, emphasizing its commitment to interoperability:

L2 Chains: Arbitrum, Base, Scroll, Metis, OP, ZkSync Era,…

L1 Chains: Avalanche, BNB Chain, IoTa EVM, Kava EVM, Sonic,…

Future expansions include integration with Solana, further broadening its multi-chain capabilities. This positions Hey Anon as a truly interoperable DeFAI ecosystem.

Growth Strategy: Grants Program

To fuel ecosystem growth, Hey Anon has implemented a DAO-driven grants initiative comprising:

2% of $ANON tokens

$1 million USDC

The grants program incentivizes developers to integrate new protocols using AUTOMATE. Grant sizes range from $6.9k to $420k, depending on the complexity and impact of integrations. Partner chains also offer fast-track rewards, accelerating the onboarding of critical protocols.

Challenges and Criticism

Founder Reputation: Daniele Sesta’s controversial history with projects like Wonderland and Abracadabra raises questions about trust and accountability.

Market Skepticism: Critics argue that AI tools could have been integrated into existing DeFi protocols rather than creating a separate ecosystem and token.

Competition: Hey Anon faces rivals like Griffin, Orbit, and Newer, all exploring similar intersections of AI and DeFi.

Trust and Security: Concerns persist about the security of AI agents managing funds and the transparency of their operations.

Strategic Importance

Hey Anon tackles core issues in DeFi with innovative solutions:

Simplifying Complexity:

By automating multi-step processes, the project reduces barriers to entry for DeFi participants.

Enhancing Security:

Strict deterministic tooling minimizes risks associated with user error and protocol misconfigurations.

Driving Ecosystem Growth:

Developer incentives and strategic partnerships foster rapid integration of new protocols, expanding Hey Anon’s ecosystem.

Conclusion

Hey Anon is making ambitious strides in the DeFAI sector, merging AI with DeFi to streamline on-chain operations. With tools like Gemma and AUTOMATE, it offers unparalleled capabilities for users and developers alike. The project’s strategic partnerships and robust grants program further position it as a key player in the evolving blockchain space.

However, its success will hinge on overcoming challenges related to founder reputation, market skepticism, and competition. By maintaining transparency, delivering on its promises, and fostering a secure and scalable ecosystem, Hey Anon has the potential to define the future of DeFAI, becoming the universal smart layer for blockchain.

2/ Crypto & DeFi News

💵 Bitcoin strategic reserve bill introduced in Oklahoma

Representative Cody Maynard introduced House Bill 1203, the Strategic Bitcoin Reserve Act, to the Oklahoma House of Representatives on January 15, 2025. This bill aims to allow state pension funds and savings accounts to allocate a portion of their assets to Bitcoin as a hedge against inflation. Maynard emphasized that Bitcoin offers financial freedom and protects against the devaluation of purchasing power due to inflationary pressures.

Oklahoma joins a growing number of states pursuing similar initiatives. Texas, Pennsylvania, North Dakota, and New Hampshire have introduced their own Bitcoin reserve proposals, with some expanding the scope to include other digital assets. These legislative efforts reflect increasing institutional acceptance of Bitcoin as a hedge against macroeconomic risks.

Thought: The introduction of Bitcoin reserve acts in multiple U.S. states signals growing recognition of the asset’s role as a hedge against inflation and economic uncertainty. For Oklahoma, this move could diversify its state assets and potentially safeguard the purchasing power of pension funds in the face of currency devaluation. However, adopting such measures also introduces volatility risk, requiring careful management and oversight.

If successful, Oklahoma’s approach could inspire broader adoption across states, reinforcing Bitcoin’s position as a store of value. However, it also raises questions about the state’s readiness to handle the operational and regulatory complexities associated with holding and managing Bitcoin reserves.

Ultimately, the outcomes of these legislative proposals may serve as case studies for integrating Bitcoin into public asset management strategies.

🏎️ XRP rally to $3 holds, overtaking Bitcoin searches on Google Trends

XRP surged past the $3 mark for the first time since 2018, climbing 41% in just 15 days. This rally places the altcoin just 12.9% below its all-time high of $3.40, with expectations of entering a price discovery phase soon. Interestingly, Google Trends data revealed that global searches for XRP overtook Bitcoin (BTC) on January 15, 2025, marking the third time in a year that XRP has led BTC in search interest.

Additionally, XRP's rise appears largely fueled by spot trading rather than derivatives markets, according to order flow analysts. The altcoin's strong fundamentals and growing holder base—an increase of 58,000 accounts in 2025—underscore the "XRP army's" bullish sentiment. Recent technical milestones, including the XRP/BTC chart breaking an 8-year descending resistance, further bolster confidence in the asset's strength against Bitcoin.

Analysts speculate that XRP may outperform Ethereum (ETH) if the current momentum continues. Positive regulatory outlooks and XRP's distinct use case have amplified investor enthusiasm, with some market participants questioning the need to hold ETH over XRP.

Thought: XRP's current rally reflects a combination of robust community support, strong spot-driven demand, and favorable technical and regulatory factors. The overtaking of Bitcoin in Google Trends highlights growing mainstream interest in XRP, potentially signaling a shift in retail investor focus within the crypto market.

However, such rapid surges can often lead to overbought conditions, suggesting that a consolidation period might occur before attempting to breach its previous all-time high. If XRP maintains its momentum and benefits from regulatory clarity under the new U.S. administration, it could potentially solidify its position as a top-tier asset and challenge Ethereum in terms of market cap dominance.

While promising, the broader crypto market's volatility underscores the importance of balanced portfolio management for those betting on XRP's continued rise.

💦 Hyperliquid’s $7.5B airdrop marks shift from centralized token listings

Hyperliquid’s HYPE token launch has redefined on-chain token distribution, bypassing centralized exchanges and venture capital involvement. Launched directly on its own layer-1 blockchain, the protocol orchestrated the largest airdrop in crypto history, worth over $7.5 billion as of January 8, 2025. The token, which debuted at $3.22 on November 29, 2024, has surged over 600%, reaching $22.67.

Hyperliquid distributed 31% of its total 1 billion HYPE tokens during its genesis event, with the remaining allocated for community rewards (38.8%), a foundation treasury (6%), and grants (0.3%). Unlike tokens launched on platforms like Binance—where over 80% of listed assets lose value within six months—the HYPE token demonstrated resilience, largely due to its decentralized and community-focused approach.

Hyperliquid’s blockchain, which supports up to 200,000 transactions per second, uses HYPE as its staking and gas token. The ecosystem also features compatibility with Ethereum Virtual Machine (EVM) through its HyperEVM layer.

Thought: Hyperliquid's decentralized token launch signifies a pivotal shift in crypto project fundraising and distribution. By excluding venture capitalists and central exchanges, it aligns with the core values of decentralization, allowing grassroots communities to shape tokenomics and price discovery.

This approach addresses long-standing critiques of centralized exchange listings, such as early investor dilution and rapid post-launch depreciation. The success of the HYPE token highlights the growing demand for fair-launch mechanisms, particularly among retail participants disillusioned with the inequities of traditional fundraising methods.

Hyperliquid’s rapid price appreciation and massive airdrop underline the potential of community-driven projects to reshape the crypto landscape. If the model proves sustainable, it could inspire broader adoption of decentralized distribution frameworks, reducing dependency on centralized exchanges and fostering greater trust in blockchain ecosystems.

🤖 President Biden signs executive order to promote AI infrastructure

President Joe Biden signed an executive order on January 14, 2025, to incentivize private sector companies to build artificial intelligence (AI) infrastructure. The order directs the Department of Defense and the Department of Energy to lease federal land for AI infrastructure projects, aiming to enhance economic competitiveness, national security, AI safety, and clean energy integration. Additionally, projects must utilize a significant share of U.S.-manufactured semiconductors, with government oversight ensuring the national security implications of AI models developed on-site.

This marks Biden’s 157th executive order during his presidency and comes shortly before the end of his term on January 20. The move aligns with previous initiatives to bolster technological leadership, including his 2022 executive order on digital asset regulation. The latest order complements Biden’s recent proposal to restrict semiconductor exports to foreign nations, despite criticism from industry leaders over potential competitive disadvantages.

Thought: This executive order underscores the growing prioritization of AI as a strategic asset for national security and economic resilience. By fostering public-private collaboration, the initiative could catalyze advancements in AI technologies while securing critical supply chains, particularly in semiconductors. However, balancing innovation with national security oversight may present challenges, particularly regarding compliance and global competitiveness.

The directive aligns with broader trends in U.S. technology policy, emphasizing domestic production and regulatory frameworks for emerging technologies like AI and blockchain. Biden’s initiative could lay the groundwork for a sustained national focus on AI infrastructure under future administrations, influencing global standards and partnerships in the rapidly evolving AI ecosystem.

🚀 AI agents’ market cap surges 222% in Q4 2024, driven by Solana

The market capitalization of AI agents surged by 222% in Q4 2024, rising from $4.8 billion to $15.5 billion. This rapid growth was largely driven by Solana, which captured 56.48% of the market share, equating to $8.44 billion. Solana also dominated social media engagement, holding 64.34% of mindshare in the AI agents sector. The launch of the Goatseus Maximus (GOAT) token on Solana in October played a pivotal role in the category’s growth, alongside broader crypto market strength in Q4 2024.

Other blockchains like Base also saw significant contributions, with projects such as Aixbt and Virtuals Protocol gaining traction and holding 40.57% market dominance. Tokens like Virtuals Protocol (VIRTUAL) and ai16z (AI16Z) surged by 8% and 20%, respectively, in early January 2025.

The overall crypto market cap rose 45.7% in Q4 2024, hitting $3.91 trillion, with Bitcoin reaching an all-time high of $108,135 and Ethereum layer-2 networks witnessing record transaction volumes.

Thought: The surge in AI agents' market capitalization underscores the transformative role artificial intelligence is playing in blockchain ecosystems. Solana’s dominance highlights its appeal as a scalable, high-performance blockchain, particularly for emerging use cases like AI-driven DeFi applications. This growth demonstrates a broader trend of blockchain evolving beyond traditional finance into cutting-edge technologies, offering new opportunities for automation and efficiency.

However, the concentration of market activity on Solana and Base raises questions about resilience and ecosystem diversification. The rapid adoption of AI agents also points to the importance of fostering interoperability among blockchains to ensure the decentralized ethos of Web3.

As AI agents integrate further into DeFi, their potential to automate trading and decision-making could redefine user experiences, although this would likely require robust governance to mitigate risks associated with algorithmic decision-making.

3/ DeFAI: The Fusion of DeFi and AI - A New Era in Decentralized Finance

On the last Newsletter of 2024, we talked about DeFi Renaissance, but maybe the DeFi renaissance is not the one we expected 👀👇

Decentralized Finance Artificial Intelligence (DeFAI) represents the convergence of DeFi and AI technologies, aiming to revolutionize financial services by streamlining user interaction with DeFi protocols. This fusion simplifies decision-making, automates transactions, and optimizes yield strategies. The primary objective is to democratize DeFi access, making it more intuitive, secure, and efficient for a broader audience, including non-technical users and institutional investors.

Key Features

Automated Market Analysis: AI-driven agents process real-time market data, identifying profitable opportunities, market inefficiencies, and arbitrage possibilities across decentralized exchanges (DEXs). These systems leverage big data and predictive modeling to enhance decision-making accuracy.

Smart Transaction Execution: AI-powered automation executes complex transactions seamlessly, reducing latency, slippage, and human error. Smart contract integrations ensure secure and efficient execution of multi-step operations.

Portfolio Optimization: Intelligent agents tailor asset allocations based on user-defined risk profiles, market trends, and macroeconomic indicators. Dynamic portfolio rebalancing ensures maximum yield with minimal exposure to volatility.

Predictive Analytics: Machine learning models forecast market movements, token price fluctuations, and liquidity changes, assisting users in making proactive investment decisions. This feature empowers both retail and institutional investors with data-backed strategies.

Risk Mitigation and Compliance: AI monitors smart contracts for vulnerabilities, flags suspicious activities, and ensures compliance with evolving regulations through automated reporting and risk alerts.

Practical Applications of DeFAI

1. Simplified User Interface: DeFAI platforms harness natural language processing (NLP) to bridge the gap between complex DeFi tools and user-friendly interfaces. Users can input commands like "Swap 9 ETH for USDT and stake it in the highest-yield pool." This significantly lowers the barrier to entry, facilitating mainstream adoption.

2. Automated Trading Agents: DeFAI agents continuously scan market conditions, exploiting arbitrage, liquidity mining, and yield farming opportunities across multiple DEXs. These agents operate on pre-configured strategies, dynamically adjusting to market volatility without human intervention.

3. Advanced Technical Analysis: Machine learning algorithms analyze vast datasets, including on-chain data, social sentiment, and historical price actions, to generate accurate predictive signals. Platforms like Quant XBT offer AI-driven insights that enhance users' trading accuracy through data-backed strategies.

4. Optimized Portfolio Management: AI agents manage portfolios by automatically rebalancing assets according to real-time market trends, risk appetite, and macroeconomic indicators. AI-driven models can pivot portfolios to safer assets during market downturns or allocate more capital to growth assets during bullish trends.

5. Risk Management Tools: DeFAI integrates automated risk assessment models that evaluate smart contract vulnerabilities, market volatility, and liquidation risks. Tools like anomaly detection and threat analysis help safeguard user funds and provide early alerts for market anomalies.

6. Cross-Protocol Liquidity Optimization: AI facilitates seamless liquidity aggregation across multiple blockchains and DeFi protocols, reducing fragmentation and slippage. This optimizes yield farming and liquidity provision strategies by automatically routing funds to the most profitable pools.

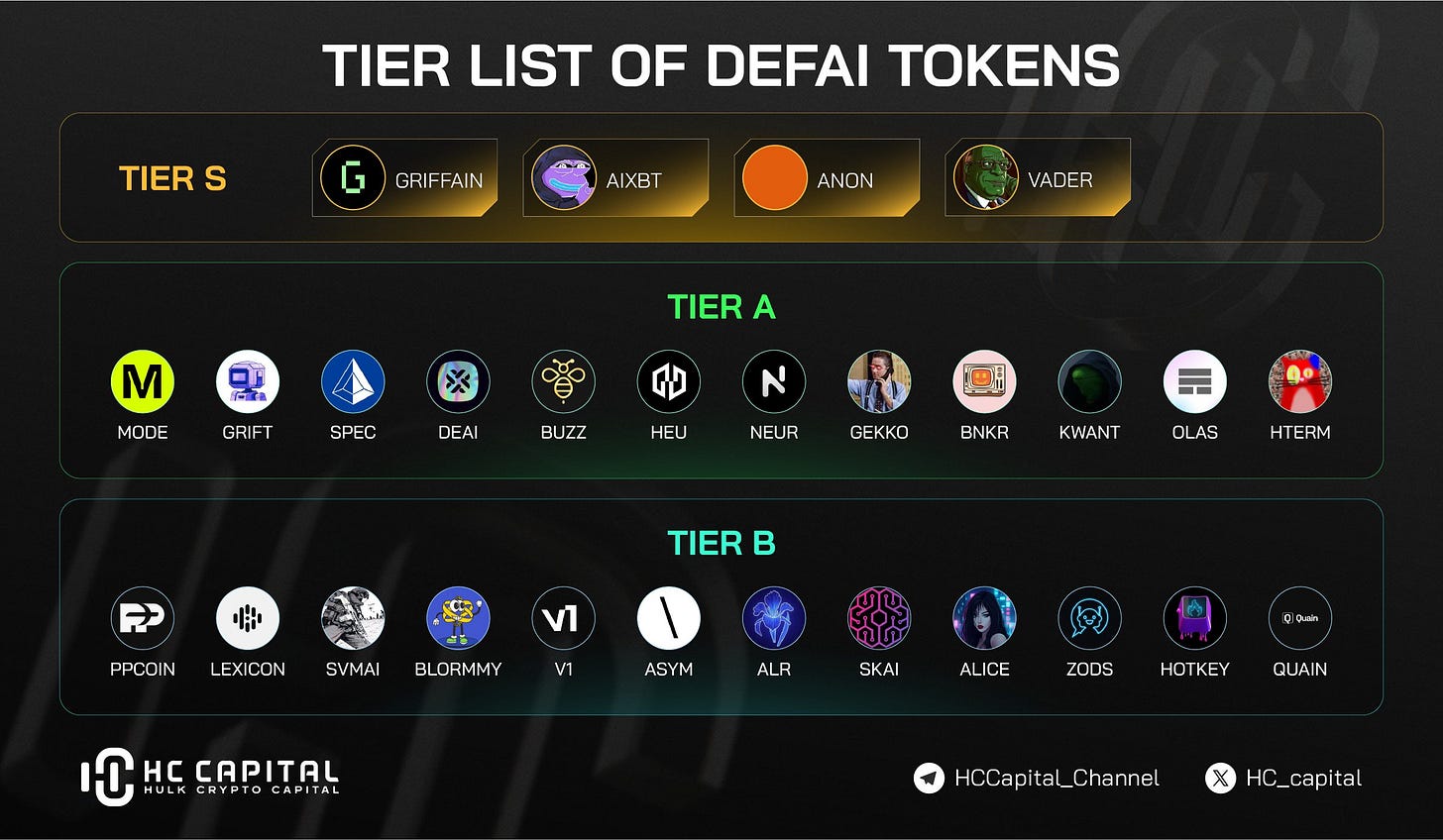

Key DeFAI Projects and Market Insights

Market Leaders

Griffain: A pioneer in DeFi abstraction, Griffain enables users to automate on-chain actions such as memecoin creation, liquidity provision, and cross-chain swaps using natural language commands. Its customizable AI agents simplify complex DeFi operations.

Hey Anon: Refer to the case study.

Promising Projects:

Orbit (Grift): A cross-chain DeFi platform that streamlines user interactions across over 117 blockchains and 200+ protocols through AI-enhanced interfaces, improving cross-chain liquidity and asset management.

Neur: An open-source Solana co-pilot emphasizing transparency and community-driven development. Neur's AI systems help users execute DeFi strategies with precision.

Quant XBT: A leader in AI-based market analytics, offering actionable insights to traders and investors through machine learning models that analyze market sentiment and price actions.

Emerging Infrastructure:

Mode Network: A Layer-2 scaling solution tailored for DeFAI applications, providing cost-effective and scalable infrastructure for AI-powered staking, yield farming, and trading.

Cookie.fun: A real-time data aggregator that feeds critical market intelligence to DeFAI agents, enhancing decision-making efficiency across DeFi protocols.

Challenges and Opportunities

1. Security Risks: DeFAI agents often require extensive permissions, including access to user wallets and smart contract interactions, increasing exposure to cyber threats. Implementing advanced security frameworks, multi-signature wallets, and zero-knowledge proofs can mitigate these risks.

2. Inherent DeFi Risks: DeFAI inherits systemic vulnerabilities from DeFi, such as smart contract bugs, liquidity shortages, and flash loan exploits. Continuous code audits and AI-driven anomaly detection are critical to safeguarding assets.

3. Mass Adoption: Onboarding non-technical users remains challenging. Simplified UX/UI, gamified learning modules, and AI-guided tutorials can facilitate mainstream adoption.

4. Real-World Asset Tokenization (RWA): Integrating tokenized real-world assets (RWAs) into DeFAI platforms can diversify portfolios and create new revenue streams. Projects are exploring tokenization frameworks to merge traditional finance with DeFi.

5. Regulatory Landscape: As DeFAI expands, regulatory scrutiny will increase. Projects must navigate compliance while preserving decentralization. AI-driven compliance tools can automate reporting and help adapt to regulatory changes.

Market Outlook and Strategic Positioning

With a current market cap of $3.1B, and more holders each days, the DeFAI sector is gaining momentum. Growth drivers include:

Enhanced Accessibility: AI simplifies complex DeFi processes, attracting retail and institutional investors.

Scalable Automation: AI automates repetitive DeFi tasks, enhancing efficiency and reducing operational risks.

Innovation Synergy: The blend of AI's predictive capabilities with DeFi's openness fuels continuous financial innovation.

Conclusion

DeFAI marks a transformative leap for decentralized finance by integrating AI's intelligence with DeFi's transparency.

It simplifies user access, automates complex processes, and introduces predictive insights. While security and regulatory challenges persist, the sector's innovation trajectory suggests immense growth potential. Early adopters stand to benefit as DeFAI continues to shape the future of finance.

The DeFAI revolution has begun—now is the time to engage and innovate.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.