This Week's Newsletter - Case Study on Morphware, Main News of the Week, & Zoom on Memecoins through $TRUMP

Weekly Alpha

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

January 20th marked a historic moment in global politics and the crypto world alike, as Donald Trump was officially inaugurated as the 47th President of the United States.

Beyond the political theater, this event carries immense implications for cryptocurrency markets. Just days before the inauguration, Bitcoin shattered its previous all-time high, soaring past the $109,000 mark. For now, it’s holding strong around this monumental level, but the real question is: how will Trump’s presidency shape the future of digital assets? With crypto firmly in the spotlight, market participants and policymakers alike are bracing for what could be a transformative chapter in the industry’s evolution.

Of course, no discussion of the current crypto landscape would be complete without acknowledging the unprecedented memecoin frenzy gripping the market. At the heart of it all is $TRUMP, a token inspired by the President himself, launched just days before his swearing-in ceremony. The coin has taken the crypto world by storm, skyrocketing into the top rankings with billions in market cap almost overnight. Unlike many memecoins, which are often dismissed as fleeting hype, $TRUMP has sparked intense discussions about its cultural significance, speculative appeal, and potential to shape the future of this quirky sector of the crypto economy. Whether it’s a calculated move or simply a phenomenon born of Trump’s polarizing influence, the $TRUMP token is a stark reminder of how intertwined culture, politics, and crypto have become in 2025.

Trump’s arrival in the Oval Office has shifted global attention to Bitcoin and the broader blockchain space. Will his administration deliver on promises to embrace crypto-friendly policies and encourage innovation, or will regulatory challenges continue to cast a shadow over the sector? Either way, there’s no doubt that Bitcoin’s performance and blockchain’s role in the economy will be scrutinized like never before. The industry is poised at a crossroads where politics and technology are more entangled than ever, creating both opportunities and uncertainties.

Meanwhile, Google searches for 'What is Crypto' have surged to a 5-year all-time high, signaling a potential wave of new retail interest—early signs of the next market cycle?

Amid this backdrop of memecoins and macro-level shifts, innovation in the crypto space continues to charge ahead. Platforms like Morphware ($XMW) are leading the way by unlocking the untapped potential of decentralized GPU compute power. By offering cutting-edge AI capabilities, eco-friendly Bitcoin mining, and cost-effective cloud computing solutions, Morphware represents the kind of transformative innovation that keeps this industry evolving, even in times of heightened market volatility and speculation.

It’s a powerful reminder that while memes and price charts dominate headlines, real technological advancements are the bedrock of the crypto ecosystem.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Case Study on Morphware ($XMW): How this platform is revolutionizing decentralized compute power and bridging AI with blockchain.

Main News of the Week.

Zoom on Memecoins: From $TRUMP’s explosive debut to the broader memecoin mania sweeping the space.

Today's Newsletter is brought to you by Mantle:

Kaito x Mantle Partnership: Engage and Earn

Kaito, the AI-powered Web3 information platform, is transforming how users interact with Mantle. Through its Yapper Leaderboard, Kaito incentivizes meaningful engagement by rewarding users for high-quality, relevant posts.

Why Kaito?

Allows anyone to earn by posting ("Yapping") on X.

Focuses on quality over quantity—posts must be engaging, insightful, and relevant to Mantle.

As one of the few projects with its own leaderboard, Mantle demonstrates its strong community presence and growth potential.

What’s in it for you?

Rewards for Yapping about Mantle.

Potential Kaito airdrop for active participants.

Build your Web3 presence while contributing to one of the most innovative ecosystems in crypto.

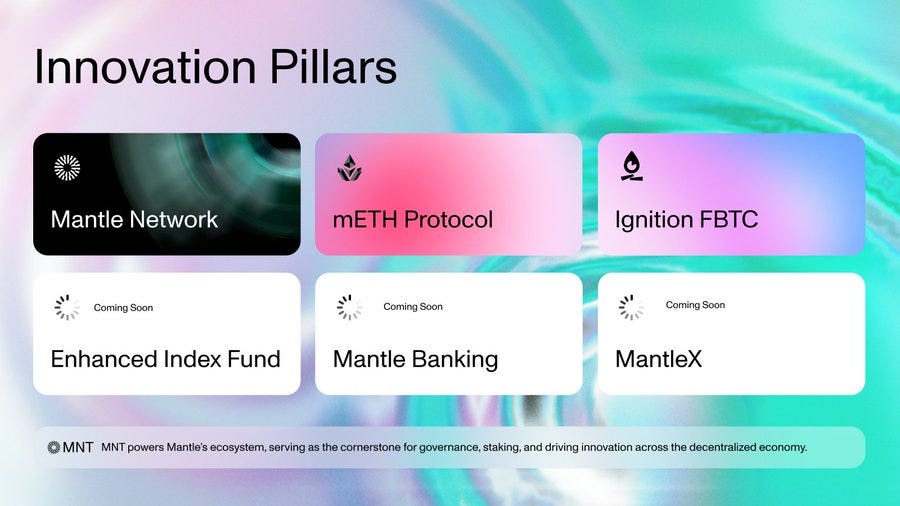

Mantle’s Product Innovations: Leading the Future of DeFi

Mantle isn’t just about community engagement—it’s setting a new standard in DeFi with three game-changing products:

1. Enhanced Index Fund

Launching in Q1 2025, this institutional-grade fund is a bridge between crypto and traditional finance (TradFi).

Target: $1 billion in Assets Under Management (AUM).

Composition: Includes BTC, ETH, SOL, and yield-bearing assets like mETH, bbSOL, and sUSDe.

Key Features:

Systematic rebalancing for optimized returns.

Tokenized representation for seamless on-chain integration.

Enhanced yield through on-chain staking opportunities.

This fund aims to attract institutional investors while boosting liquidity across the Mantle ecosystem, aligning with its vision to make passive yield accessible and efficient.

2. Mantle Banking

Mantle Banking redefines financial services by delivering fully blockchain-based solutions for:

Payments

Lending

Wealth management

What makes it revolutionary?

Seamlessly bridges the gap between fiat and crypto.

Built entirely on-chain, combining simplicity with decentralization and efficiency.

Aims to provide a Revolut-like experience for everyday users, tailored for the Web3 era.

3. MantleX: Where AI Meets Blockchain

MantleX is an AI-augmented platform designed to manage advanced AI agents for various tasks across the Mantle ecosystem, such as:

Treasury management

Community engagement

On-chain research

With AI poised to revolutionize blockchain applications in 2025, MantleX positions itself at the forefront of this evolution, merging DeFi with cutting-edge AI advancements.

Mantle Treasury: Powering the Vision

Backing all these developments is the Mantle Treasury, the largest community-owned treasury in crypto:

$4 billion in AUM, including $1 billion in USD and ETH reserves.

Generated $67 million YTD income in 2024.

Supports ecosystem growth through the $200 million Mantle EcoFund, which has invested in over 500 projects.

The Treasury ensures Mantle’s financial stability while driving innovation and sustainability across its ecosystem.

Why This Matters

Mantle’s announcements highlight its mission to bridge TradFi and DeFi, integrate AI, and empower its community. Whether you're a Yapper, investor, or just a DeFi enthusiast, there’s something for everyone:

For Yappers: Kaito’s leaderboard rewards meaningful engagement.

For Investors: The Enhanced Index Fund offers secure, yield-enhanced exposure to crypto.

For Users: Mantle Banking makes managing crypto as easy as traditional banking.

Mantle’s roadmap for 2025 is ambitious, with six innovation pillars driving its vision for a decentralized, interconnected financial ecosystem.

1/ Case Study: Morphware's Penetrative Pricing Model

Introduction

I already spoke about Morphware $XMW multiples times on my telegram channel, and on my X account. Now it’s time that we dive deeper here 👇

Morphware mines BTC leveraging hydro-renewable energy from one of the largest hydroelectric plants in the world, in Paraguay.

Morphware introduces a disruptive approach to the computational market through its penetrative pricing model, designed to offer unmatched cost efficiency for large-scale model training while ensuring profitability that surpasses traditional cryptocurrency mining.

Unlike competitors such as AWS and Google Cloud, which rely on tiered pricing and premium services, Morphware offers a straightforward and cost-effective alternative that democratizes access to computational resources without hidden fees or long-term commitments. This innovative pricing strategy positions Morphware as a formidable competitor to cloud service providers and redefines the economic landscape of computational resource utilization.

Morphware is positioned at the crossroads of several narratives, and with the explosion of AI Agent narratives, Morphware could benefit from this craze, as well as from the Bitcoin craze.

Strategic Pricing Model for Competitive Advantage

Undercutting Market Prices

Morphware aims to attract a broad user base by setting service prices significantly lower than existing cloud services and specialized AI training platforms. This strategy makes large-scale AI model training accessible to a wider range of users, including independent researchers, startups, and academic institutions.

Optimizing Operational Costs

Morphware strategically operates in Paraguay, leveraging its abundant and cost-effective renewable energy sources, along with favorable regulatory policies and tax incentives, to minimize operational expenses.

Paraguay's supportive regulatory environment for crypto mining and AI-driven businesses allows Morphware to benefit from lower taxation and simplified compliance requirements. Combined with the use of consumer-grade GPUs and ASICs, which are more cost-efficient than enterprise-grade counterparts, Morphware achieves a lower cost base, allowing it to adopt a penetrative pricing model without compromising profitability.

Ensuring Profitability Beyond Crypto Mining

Dynamic Resource Allocation

Morphware dynamically allocates computational resources between AI model training and cryptocurrency mining based on real-time profitability metrics. This ensures optimal utilization of assets and maximizes revenue generation. For instance, during periods of high demand for AI training, Morphware has successfully redirected resources from mining to support intensive model training tasks, leading to increased client satisfaction and revenue diversification.

Value Proposition for AI Development

The pricing model covers operational costs and generates profits by offering value-added services for AI development, such as bespoke computational solutions, premium access to AI training tools, and collaborative opportunities for model development and deployment.

Long-term Customer Engagement

Morphware builds a loyal user base by offering competitively priced services initially and gradually introducing additional paid features and services, increasing profitability over time.

Impact on the Computational Market

Morphware's penetrative pricing model challenges the computational market's status quo. By offering competitively priced AI training services while maintaining profitability, Morphware sets a new benchmark for cost efficiency in the industry, driving down prices and encouraging innovation in AI development.

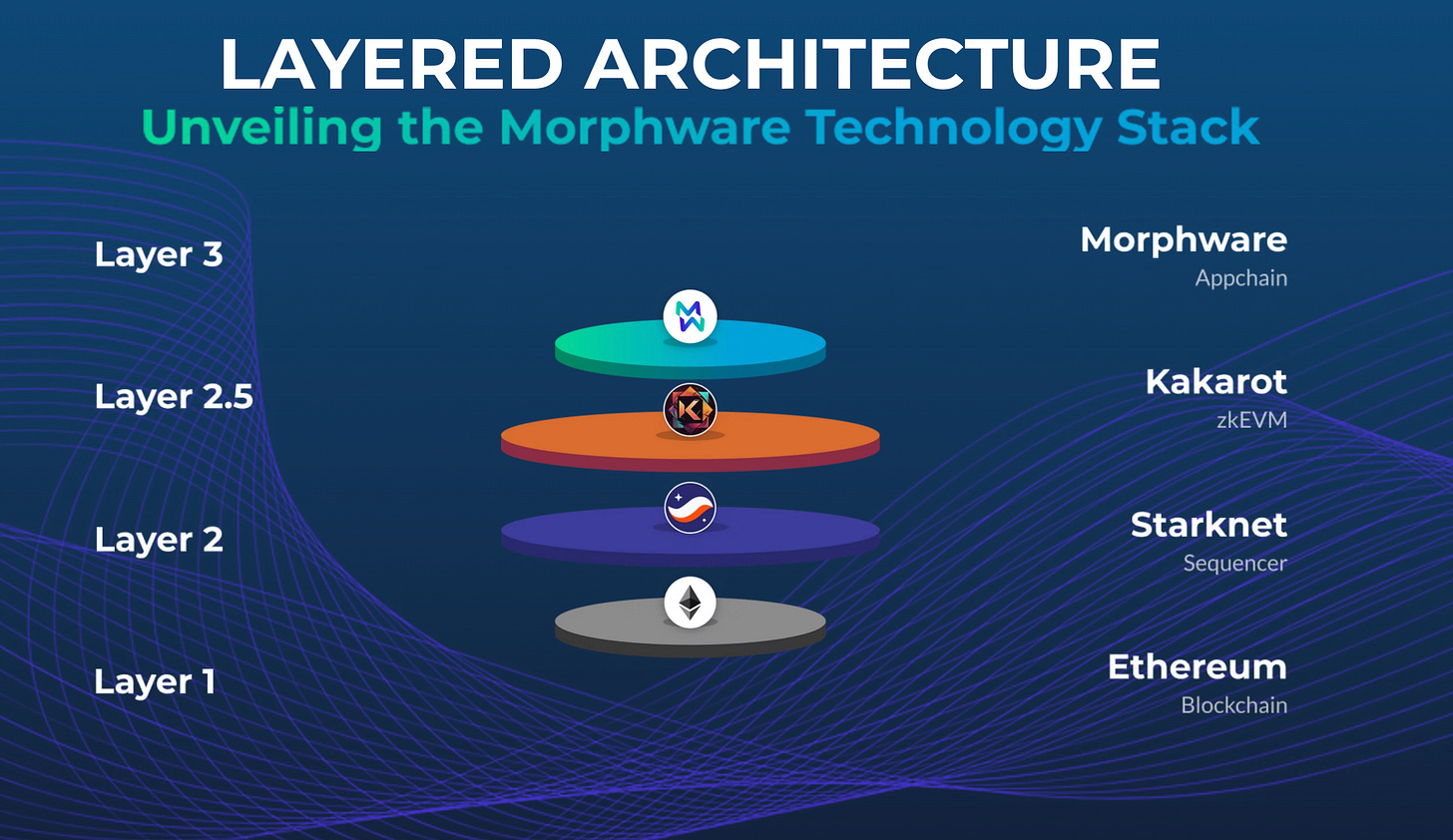

Technical Architecture

Morphware's infrastructure relies on state-of-the-art hardware and software optimizations, including:

NVIDIA H200 GPUs: Providing 141GB of memory and improved bandwidth, enabling superior parallel processing for AI and blockchain workloads.

Multi-Chain Compatibility: Supporting various blockchain networks to expand accessibility and use cases.

Decentralized Cloud Solutions: Offering an alternative to centralized cloud providers with improved security and fault tolerance.

Tokenomics Overview

Total Tokens: 1,232,922,769 XMW

Allocation:

Team & Advisors: 15% (6-month cliff, 18-month monthly vesting)

Seed Investors: 8% (unlocked)

Strategic: 1% (monthly vesting over 1 year)

InfoSec Team: 1% (monthly vesting over 1 year)

Treasury Shelf: 25%

Liquidity: 50%

Initial Token Generation Event (TGE)

58% of tokens has been released at TGE to foster an active and engaged community. This percentage surpasses the industry average for early-stage projects, which typically range between 30-50%, providing early adopters with higher liquidity and immediate participation opportunities.

It’s also to be noted that the share of the token for the team is quite low (15%), and the share for early investors is even lower (10%). Meaning that 75% of the supply is aimed to support the project and for the community.

Performance Metrics

Market Cap Growth: $XMW experienced a 300% increase within the last quarter, reflecting growing investor confidence.

Daily Trading Volume: Averaging $5 million across major exchanges, indicating strong liquidity.

Mining Profitability: Competitive returns due to low energy costs and optimized hardware usage.

User Adoption: Over 50,000 active users and growing participation in staking and governance activities.

Conclusion : Growth Potential & Challenges

Scalability: Expansion into AI-driven workloads and DeFi applications.

Regulatory Compliance: Navigating evolving regulations in decentralized infrastructure.

Adoption Hurdles: Educating the market on the advantages of decentralized cloud computing.

Network Competition: Competing with established providers like Akash Network and Render.

User Education: Bridging the knowledge gap for non-technical users entering the decentralized computing space.

Morphware is redefining the landscape of computational resources by combining technological innovation with sustainability and decentralized governance.

With a strategic roadmap prioritizing scalability and environmental responsibility, Morphware aims to democratize access to computational power and foster groundbreaking advancements in machine learning and cryptocurrency mining.

The roadmap includes key milestones such as expanding data center capacity, integrating new AI optimization techniques, and forging strategic partnerships to further enhance ecosystem growth.

Morphware Recap

• $XMW is not listed on any CEX (planned for Q1)

• They're not giving tokens to CEX to get listed, CEX will accumulate $XMW to list it on their platform

• Still has a 5% trading tax (used to bootstrap the mining operations & create a treasury)

• Only listed on 1 DEX (Uniswap) and yet already getting a ton of traction

• $XMW still hasn't released its own blockchain (will soon)

• But you're not too early as they've already built mining infrastructures, already operating

• Competitors like Riot Platforms (RIOT Stock) are capitalized at over $4B Mcap

• Or Core Scientific valued at $3B - one of the worlds largest btc miners

• Mining Facility is expanding rapidly

• Their second data center is almost 100 000m2, bigger than Musk's AI Training data center

• $XMW is ~$60M Mcap

• Price has been ranging for a while, smart money are accumulating

2/ Crypto and DeFi News

🇺🇸 US asset managers file for TRUMP, DOGE ETFs

Osprey Funds and REX Shares have filed proposals with the U.S. Securities and Exchange Commission (SEC) to launch ETFs for memecoins like Dogecoin (DOGE), Official Trump (TRUMP), and Bonk (BONK), as well as Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP.

The proposed ETFs would invest at least 80% of their assets in the respective cryptocurrencies and derivatives. Notably, the TRUMP ETF would feature the Trump-affiliated token, which briefly reached an $80 billion fully diluted valuation after its Jan. 18 launch, causing network congestion on Solana. Over 200,000 users joined Moonshot, the platform facilitating TRUMP purchases.

This move reflects optimism for a more crypto-friendly regulatory stance under President Trump, with issuers preparing a range of altcoin ETFs.

Thought: The filing of memecoin-focused ETFs, particularly one featuring TRUMP, underscores the increasing intersection of politics and cryptocurrency, blending speculative investments with cultural and political branding. This development signifies a broader shift in market sentiment, where retail and institutional interest is expanding into niche digital assets like memecoins.

If approved, these ETFs could bring more legitimacy and accessibility to cryptocurrencies, potentially driving market participation. However, the speculative nature of such assets also raises concerns about volatility and investor protection.

The SEC's response to these proposals will set a crucial precedent, shaping the regulatory landscape for crypto ETFs and their role in the financial ecosystem.

🚀 Trump announces $500B AI infrastructure venture ‘Stargate’

President Donald Trump announced “Stargate,” a $500 billion private-sector initiative to build AI data centers across the United States. Led by OpenAI, SoftBank, and Oracle, the project also lists Microsoft and Nvidia as key technology partners. SoftBank has committed $100 billion for immediate deployment, with the remaining $400 billion to be invested over four years.

Stargate aims to support AI innovation, create over 100,000 jobs, and maintain the U.S.'s leadership in artificial intelligence. Initial construction has started in Texas, with additional sites under evaluation. The project will advance AI-driven applications like healthcare data management and strengthen national security. OpenAI sees Stargate as a milestone in achieving artificial general intelligence and eventually artificial superintelligence.

Thought: The Stargate initiative highlights a transformative investment in AI infrastructure, reflecting the growing importance of technology as a strategic national asset. This venture aligns with broader trends of governments fostering innovation to maintain geopolitical competitiveness. By leveraging private-public partnerships, Stargate could accelerate advancements in AI, particularly in areas like healthcare and defense, while positioning the U.S. as a global leader.

For industries relying on AI applications, and especially crypto, this project may catalyze growth and open new frontiers for innovation. However, questions about equitable access, ethical concerns, and regulatory oversight will likely intensify as such ambitious projects unfold..

⭕️ Circle acquires Hashnote, USYC onchain money fund

Circle Internet Financial, the issuer of USDC, has acquired Hashnote, the issuer of the tokenized real-world asset fund US Yield Coin (USYC). The move aims to position USYC as a leading yield-bearing collateral option on crypto exchanges, custodians, and prime brokers. Hashnote’s USYC, with $1.25 billion in total value locked, is currently the largest tokenized money fund by market capitalization.

Through this acquisition, Circle will integrate USYC with USDC to provide seamless interoperability between the tokenized money market fund and its stablecoin. Additionally, Circle is collaborating with DRW, a major institutional crypto trader, to enhance liquidity and settlement for USDC and USYC, improving collateral management.

As demand for tokenized real-world assets (RWAs) grows, this strategic acquisition could strengthen Circle’s position in the $30-trillion RWA market globally. Other tokenized T-bill funds like BlackRock’s BUIDL and Franklin’s FOBXX will serve as competitors in this space.

Thought: Circle’s acquisition of Hashnote and its USYC token marks a pivotal moment in the evolution of stablecoins and tokenized real-world assets (RWAs), expanding USDC’s utility into the realm of yield generation. By integrating USYC with USDC, Circle is positioning itself as a leader in RWA tokenization, leveraging Hashnote’s $1.25 billion TVL in tokenized money funds, including U.S. Treasury bills, to attract institutional investors. The partnership with DRW enhances liquidity and settlement services, catering to the growing demand for efficient collateral management among custodians and crypto exchanges.

This move not only strengthens Circle’s competitive edge over Tether but also underscores the broader institutionalization of decentralized finance, reflecting the increasing alignment of traditional finance and blockchain innovations

🐶 Musk’s DOGE agency launches official website with Dogecoin logo

Elon Musk’s Department of Government Efficiency (DOGE) officially launched its website on January 21, prominently displaying Dogecoin’s logo. This development led to an 11% surge in Dogecoin’s price, which climbed to $0.38. The DOGE agency, focused on reducing government spending and optimizing regulations, has garnered widespread attention due to its shared acronym and logo with the popular cryptocurrency. Speculation from retail investors suggests potential ties between Musk’s government initiative and Dogecoin’s adoption. Dogecoin has gained prominence in the past months, including surpassing Porsche’s market cap in November 2024, fueled by Musk’s vocal support and ongoing developments around potential exchange-traded products (ETPs). However, the DOGE initiative faces challenges, with National Security Counselors alleging that the agency violated the Federal Advisory Committee Act (FACA) by failing to meet transparency requirements, such as public accessibility to meetings and recorded minutes. Despite these legal questions, Dogecoin remains a central point of attention in the growing intersection of cryptocurrencies and politics.

Thought: The DOGE agency’s public alignment with Dogecoin branding underscores a new era where government-backed initiatives and cryptocurrency culture increasingly overlap. This affiliation elevates Dogecoin’s cultural and economic relevance, moving it from a niche memecoin to a potential symbol of innovation and efficiency. Musk’s influence continues to boost Dogecoin’s speculative appeal, driving retail and institutional interest. However, the legal challenges surrounding the agency could raise questions about its operational structure and commitment to transparency, which might affect its ability to achieve long-term goals.

For Dogecoin, while the immediate rally highlights market enthusiasm, its sustained growth will likely depend on how this symbolic association translates into practical use cases or government adoption.

💪 Ethereum Foundation to set aside 50K ETH to support DeFi apps

The Ethereum Foundation has announced it will allocate 50,000 ETH—worth approximately $165 million—to support Ethereum's decentralized finance (DeFi) ecosystem. This move follows months of criticism suggesting the foundation has been neglecting DeFi development.

Ethereum co-founder Vitalik Buterin stated on Jan. 20 that the foundation will implement structural changes to better support app developers and enhance transparency. The allocated funds will be secured in a three-of-five multisig wallet on Safe, with an initial test transaction already conducted on Aave. However, finalizing the wallet setup may take a few days, according to Ethereum’s Hsiao-Wei Wang.

This allocation represents 18.5% of the Ethereum Foundation’s total holdings, which have declined by 56% from 617,000 ETH in 2020 to 269,000 ETH today, according to Arkham Intelligence. Critics, such as Infinix founder Kain Warwick, have previously accused the foundation of lacking DeFi focus, while some have raised concerns about the selling pressure from the foundation's ETH liquidations to cover operational costs.

Thought: The Ethereum Foundation's decision to allocate a significant portion of its holdings to DeFi signals a strategic shift aimed at reinforcing Ethereum’s dominance in the sector. This move could serve to restore community trust and reinvigorate developer engagement, potentially fostering innovation in DeFi protocols.

However, the foundation's treasury depletion raises concerns about long-term sustainability. While the staking rewards strategy could help mitigate selling pressure, Ethereum’s broader challenges—such as regulatory competition and market sentiment—remain critical factors.

If effectively managed, this initiative could set a precedent for other blockchain foundations, demonstrating a proactive approach to ecosystem growth. However, whether it will be enough to counter Ethereum’s recent underperformance and competition from rival chains remains to be seen.

3/ The $TRUMP and $MELANIA Memecoins: Hype, Risks, and Market Impact

Memecoins: A Quick Overview

Memecoins are cryptocurrencies that derive value primarily from internet culture, community-driven hype, and celebrity influence rather than utility. Unlike traditional cryptos, memecoins often lack strong fundamentals, making them highly speculative. However, their virality and potential for quick gains attract a significant number of investors seeking rapid profits.

The rise of memecoins has led to the emergence of several high-market cap tokens, as illustrated. As of January 2025, the top 10 memecoins by market capitalization include household names such as Dogecoin ($50B) and Shiba Inu ($11B), alongside newer entrants like $TRUMP ($7B) and Fartcoin ($1.7B). Dogecoin remains the oldest and most capitalized memecoin, holding a dominant position in the market. However, the rise of $TRUMP was unexpected and extremely rapid, raising speculation about a potential flippening in the future. This evolution showcases how memecoins can capture significant market attention and investor interest despite their speculative nature.

Trump's Past Crypto Ventures

Trump has been involved in several crypto-related ventures prior to the launch of his memecoin:

NFT Collections: Trump launched multiple NFT collectible card series, including a "Mugshot" edition in December 2023. These sales generated around $35 million for Trump and his campaign, with an additional $7.2 million earned through licensing deals. However, the market became oversaturated with repeated releases, leading to disappointment among early investors.

World Liberty Financial: Trump's sons, Donald Trump Jr. and Eric Trump, launched this crypto trading company with the goal of raising $300 million. However, they only secured less than half the target, and the project faced scrutiny over potential conflicts of interest between Trump's business ventures and political aspirations. We already spoke about it a few newsletters ago.

Other Business Ventures: Over the years, Trump has been involved in various business initiatives outside of crypto, including physical collectibles, sneakers, Bibles, guitars, watches, steaks, vodka, and the Trump University. Many of these ventures failed due to poor sales or marketing, with Trump University facing legal action for fraud.

The Launch of $TRUMP: An Unprecedented Move

Before we dive into the $TRUMP token, let’s talk about the recent news that affected its performance. The Official Trump memecoin experienced a lot of volatility after launch, especially when Donald Trump admitted he didn’t know much about it during a press conference announcing a $500B AI investment.

When asked about its success, he casually remarked, “I don’t know much about it other than I launched it,” and downplayed its multi-billion-dollar valuation as “peanuts.” Since its launch on Jan. 18, $TRUMP surged to an all-time high of $73.43 before crashing over 43%. Some noted that Trump “nuked his own memecoin” with his comments, while others speculate his lack of involvement explains his silence since launch.

However, we all know Trump’s ego and his preference for anything associated with his name to perform exceptionally.

So if that’s peanuts for him right now, he may mention $TRUMP again to propel it into the ranks of the top 3 memecoins.

Unlike other political-themed memecoins with humorous undertones, $TRUMP appears to have been created solely as a way for supporters to back the former president.

Key highlights of the $TRUMP launch:

Promotion: Trump actively promoted the coin on his official social media accounts.

Accessibility: Users could purchase $TRUMP via credit card on a dedicated website.

Rapid Growth: Within hours, $TRUMP became the 206th largest cryptocurrency globally, and is now firmly established in the top 30.

Market Cap: The coin reached a staggering $9 billion market capitalization overnight, with projections from leading crypto analytics firms suggesting a potential $30 billion.

The Market Reaction

The launch of $TRUMP sent shockwaves through the crypto market, with trading volumes reaching an all-time high of $3 billion within the first 24 hours and a 25% increase in Solana-based DeFi activity. The unprecedented liquidity drain caused by $TRUMP's surge has led to extreme volatility across the broader crypto market, impacting investor sentiment and market stability.

Solana Surge: As $TRUMP is based on Solana, the network saw a 16% price jump.

Other Gains: Platforms like Radium and Jupiter experienced growth due to the trading frenzy.

Speculative Frenzy: The event highlighted the market's ongoing hunger for high-risk, high-reward assets.

The $MELANIA Coin: A Follow-Up Surprise

The very next day, Melania Trump launched her own memecoin, $MELANIA, leading to market chaos. While $TRUMP was met with a degree of acceptance, $MELANIA faced criticism for being a blatant cash grab. The immediate result:

Price Crash: $TRUMP’s price plummeted by 50% following the $MELANIA launch.

Recovery: $TRUMP stabilized around a $12 billion market cap, with $MELANIA at $1.8 billion.

The Positives: Opportunities Amidst the Madness

Despite skepticism, the $TRUMP memecoin phenomenon presents some potential upsides, though it's important to note that these are speculative and may not materialize as expected:

Mass Adoption: It introduces a new demographic to crypto investing.

Solana's Ecosystem Boost: Capital inflows into Solana projects could trigger further growth.

Regulatory Precedent: If a former president can launch a memecoin, regulatory scrutiny on the broader crypto space may lessen.

Pro-Crypto Sentiment: Trump's pro-crypto policies could gain momentum.

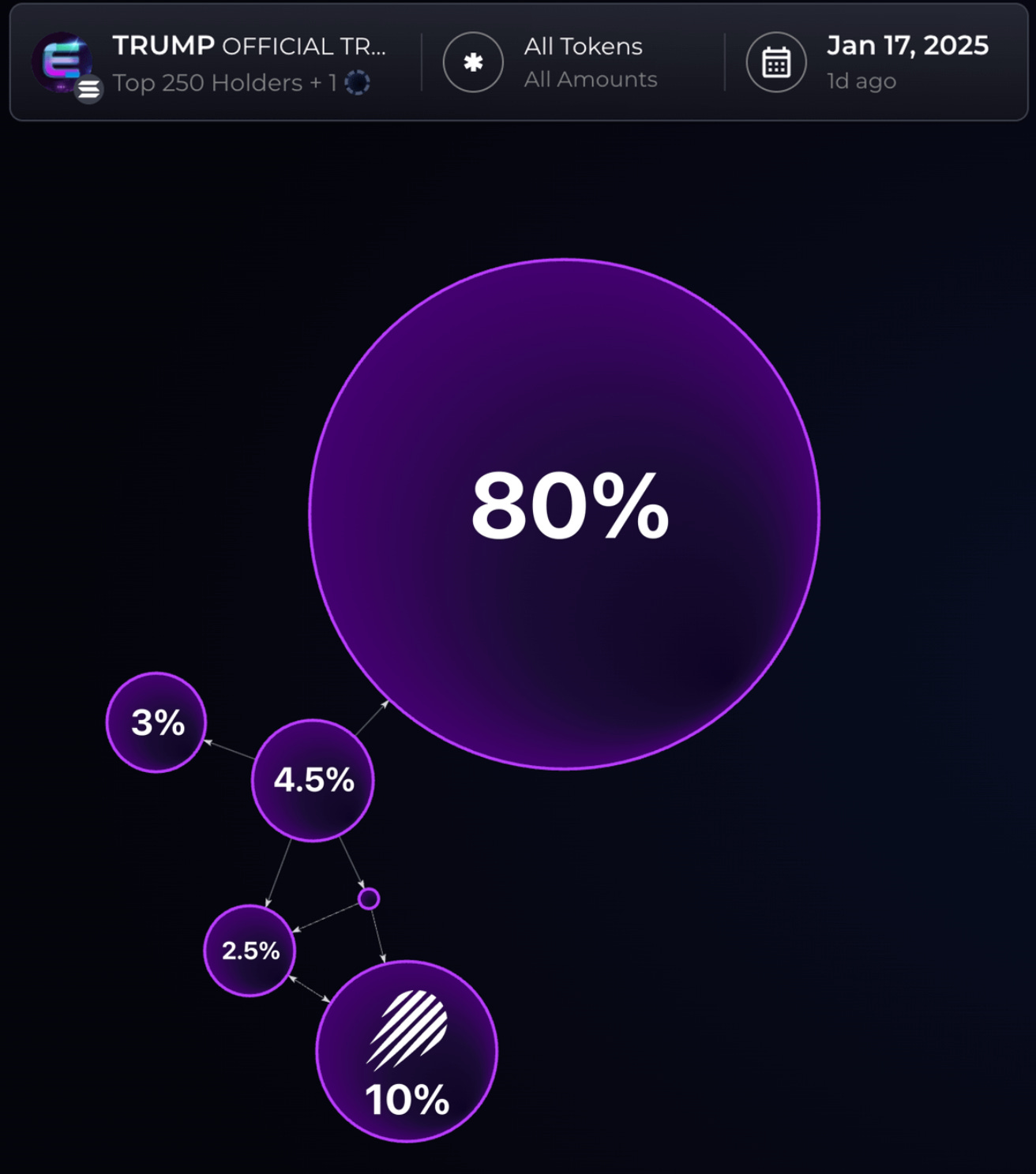

The Red Flags: Risks and Uncertainties

While excitement is high, significant concerns remain, as evidenced by historical examples such as $DOGE and $SHIBA, which faced liquidity challenges and extreme volatility during their peak hype cycles:

Liquidity Drain: Funds are being pulled from more established projects.

Tokenomics Issues: With only 20% of $TRUMP's supply in circulation, future unlocks could tank the price.

Reputational Damage: Political opponents might use the coin's volatility against Trump and the crypto industry.

Cycle Top Indicator: Many experts believe the hype signals an overheated market.

Chain Wars: Ethereum vs. Solana

$TRUMP’s launch initially bolstered Solana's dominance, but the $MELANIA launch congested the network, leading to service disruptions. This reignited debates about Ethereum’s reliability and scalability advantages over Solana.

Fartcoin and the Broader Meme Market

The success of $TRUMP has also reignited interest in other memecoins, such as Fartcoin. Initially fueled by an AI-driven marketing campaign, Fartcoin experienced renewed momentum. Known for its humor-centric branding and viral social media campaigns, it has gained a cult following. However, as with all memecoins, it remains highly speculative and prone to wild price swings, with major price fluctuations often linked to influencer endorsements and social media trends.

Final Thoughts: Should You Invest?

Despite the recent crash, Trump and Melania’s memecoins have attracted new retail investors to crypto. Their launch has driven speculative demand and market liquidity, with many newcomers entering through the Moonshot platform. Lee suggests celebrity-backed tokens could reshape market trends by bringing fresh capital and pushing blockchain further into the mainstream.

While the $TRUMP and $MELANIA memecoins provide opportunities for speculative gains, they carry significant risks. Investors should:

Understand the Tokenomics: High insider holdings could impact price stability.

Take Profits Early: Memecoins are notorious for volatile boom-bust cycles.

Be Wary of Celebrity Influence: Market moves driven by public figures often lack long-term sustainability.

In conclusion, the $TRUMP memecoin launch represents a historic moment for the crypto space, blending politics and speculation like never before. However, investors should tread cautiously, recognizing the speculative nature of memecoins and the potential for significant losses.

I would be quite confident that Trump would not let his token die, out of ego, but that would depend on how involved he really is in crypto and in the launch of this token.

NFA & DYOR 🫡

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.