This Week's Newsletter - Case Study on IO.NET, Main News of the Week, & Zoom on Ethereum

Weekly Alpha

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

This week, the crypto market took a wild ride. As the FOMC meeting loomed, investors braced for impact, expecting a hawkish Federal Reserve to send prices tumbling. Instead, they got a surprise rally, flipping the script on everyone.

However the bullish price action of BTC and the Market didn’t last long.

Over the past two days, the cryptocurrency market has experienced a notable decline, primarily due to recent tariff announcements by President Donald Trump. On February 1, 2025, the administration imposed significant tariffs: 25% on imports from Mexico and Canada, and 10% on goods from China. These tariffs are set to take effect immediately.

The imposition of these tariffs has heightened economic uncertainty, leading investors to adopt a risk-averse stance. This shift in sentiment has adversely affected various asset classes, including cryptocurrencies.

Bitcoin is currently trading just below $100,000.

Nevertheless, over $200 million in Ethereum purchases have been traced to wallets linked to World Liberty Financial, showing a strong interest by Trump’s surrounding.

This active buying has fueled speculation about the rationale behind such a significant investment at a time when many were expecting a prolonged period of uncertainty. Whether this move signals a strategic bet on Ethereum’s future role in finance or something else entirely, it has undeniably contributed to renewed confidence in the asset. The question now is whether other institutional players will follow suit.

Decentralized AI is emerging as a major force alongside Ethereum’s resurgence. China's DeepSeek AI recently launched its V3 model, competing with OpenAI and Anthropic, potentially at a fraction of the cost, challenging AI valuations and fueling debates on accessibility. This, after Trump’s $500B AI plan, signals China’s growing influence in a once U.S.-led sector.

Demand for decentralized compute power is surging, with projects like Io.net providing distributed GPU networks. AI-driven automation is also transforming crypto, with Ethereum and Solana integrating AI solutions into DeFi.

With Ethereum accumulation, decentralized AI advancements, and emerging agent-based systems driving the next phase of innovation, the market is entering a period of rapid transformation. As institutional capital flows into Ethereum and AI-powered blockchain solutions gain traction, the next few months could mark the beginning of a new wave of adoption.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into :

Case Study on IO.NET: AI Agents & the Need for Decentralized Compute – How IO.NET is addressing the rising demand for GPU power in the AI era.

Main News of the Week.

Zoom on Ethereum: Ethereum’s Institutional Evolution – The Etherealize Initiative and its impact on the future of ETH adoption.

Today's Newsletter is brought to you by The Thing from PrivateAI :

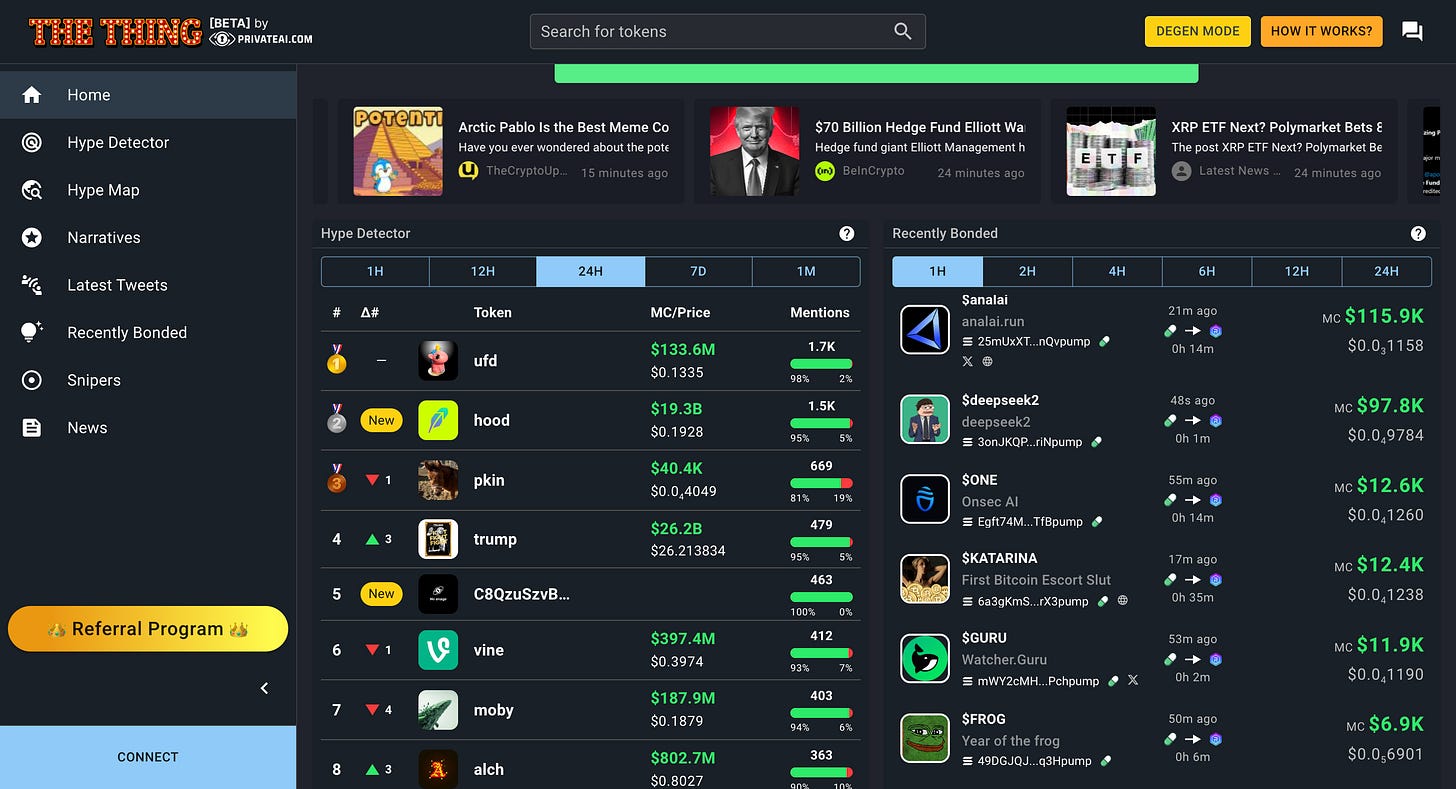

The Thing by $PGPT: Redefining AI-Powered Crypto Analytics

The Thing by $PGPT is transforming how traders navigate the crypto markets by integrating AI-powered insights, real-time data tracking, and exclusive premium features for token holders.

Powered by PrivateAI, The Thing leverages:

AI-driven sentiment analysis to detect trends before they explode.

Real-time tracking of crypto conversations across social platforms.

Positive and negative sentiment detection for any token.

90,000+ social channels monitored, including Telegram, X, and Discord.

On-chain + off-chain intelligence to detect early-stage opportunities and scams.

Let’s break down why this matters 👇

Exclusive Features for $PGPT Holders

Holding $PGPT isn’t just about speculation—it unlocks premium access to The Thing’s most powerful tools:

Hype Charts & Sentiment Graphs to track token momentum.

Whale Move Alerts for real-time insights into major buys and sells.

Pre-Sale Alerts & Pump/Dump Radar to get ahead of market moves.

Sentiment-based Copy Trading Bots for automated strategies.

To access these premium features, users must stake 100 $PGPT (currently only ~$10) per month, with tokens burned in the process—increasing scarcity and long-term demand.

The Thing’s Product Innovations: Next-Level AI for Traders

1. Call-to-Price Action & Influencer Reputation Tracking

Maps influencer networks and detects coordinated shilling.

Identifies which KOLs actually move prices.

2. Real-Time Token Launch Tracker & Sniping Detection

Tracks newly minted and bonded tokens.

Detects sniper bots to avoid bad trades.

3. AI-Driven Scam Detection & Rug Pull Alerts

Flags high-risk projects before they collapse.

Integrates on-chain + social sentiment for advanced warnings.

4. Shorting Memecoins via DEXTools Collaboration

Spot overhyped tokens early.

Execute shorts directly within The Thing.

5. AI-Powered Sentiment Tracking

Hype Chart & Hype Detector provide a real-time overview of token sentiment with interactive charts.

Tracks crypto conversations in real time, analyzing positive vs. negative sentiment across multiple tokens to detect rising trends.

$PGPT Tokenomics & Market Impact

The Thing isn’t just an analytics platform—it’s built to drive demand for $PGPT through:

Access-Based Model: Exclusive tools require staking/burning $PGPT.

Decreasing Supply: More users = more $PGPT burned, increasing scarcity.

Multi-Chain Expansion: $PGPT (BNB Chain) will also be burned and locked on Solana.

Currently, $PGPT is available on MEXC & Bitget.

Early Discoveries: How The Thing Identifies Winners

The Thing by $PGPT has already helped traders catch some of the biggest pumps early:

$PYTHIA: $1M → $30M

$AUDIT: $3M → $23M

$SNAI: $5M → $120M

They constantly share insights on new token discoveries on X—users can follow their account to stay updated on the next potential winners.

HYPE Detector: Never Miss a Moonshot Again

Now live on thething.privateai.com, the HYPE Detector scans:

4 million tokens in real-time

2.8 million tweets and calls from 540K+ traders and influencers

Each token mention processed by AI in under 300ms

It tracks early social momentum, so traders can identify tokens gaining traction before they take off.

Why This Matters

The Thing by $PGPT is not just another analytics tool—it’s a trader’s edge in an AI-driven market.

For traders: Gain real-time insights and predictive analytics for smarter decision-making.

For $PGPT holders: Enjoy exclusive premium features while benefiting from token demand and burns.

For institutions & whales: Monitor sentiment shifts and execute high-precision strategies.

As AI and blockchain continue to merge, The Thing by $PGPT is set to become the go-to intelligence layer for crypto traders.

1/ Case Study: IO.NET and the Future of AI Agents

Introduction

IO.NET is a decentralized physical infrastructure network (DePIN) designed to aggregate and optimize GPU usage for AI workloads. Acting as an "Airbnb for GPUs", it enables users to rent out their idle GPU power while providing enterprises with cost-efficient, high-performance computing resources.

With AI workloads rapidly increasing and traditional cloud solutions struggling to keep up with demand, IO.NET presents a scalable, cost-effective alternative that could play a crucial role in the future of AI agents and decentralized AI applications.

The AI Compute Problem & IO.NET's Solution

The demand for computational power in AI is growing exponentially, doubling approximately every three months. However, this demand is met with several critical challenges:

Cloud computing limitations: Traditional providers like AWS and Google Cloud are expensive and often struggle to scale dynamically.

Underutilized hardware: Millions of GPUs remain idle in personal computers, gaming rigs, and underused data centers.

High latency & inefficiency: AI workloads require real-time optimization, a challenge for conventional centralized cloud services.

IO.NET addresses these issues by:

Aggregating idle GPU power from independent data centers, crypto miners, and gaming rigs.

Providing scalable, decentralized infrastructure that adapts to AI training and inference needs.

Offering a cost-effective alternative to centralized cloud providers, reducing costs by up to 90%.

Ensuring low-latency compute through geo-distributed GPU clustering, essential for real-time AI agent interactions.

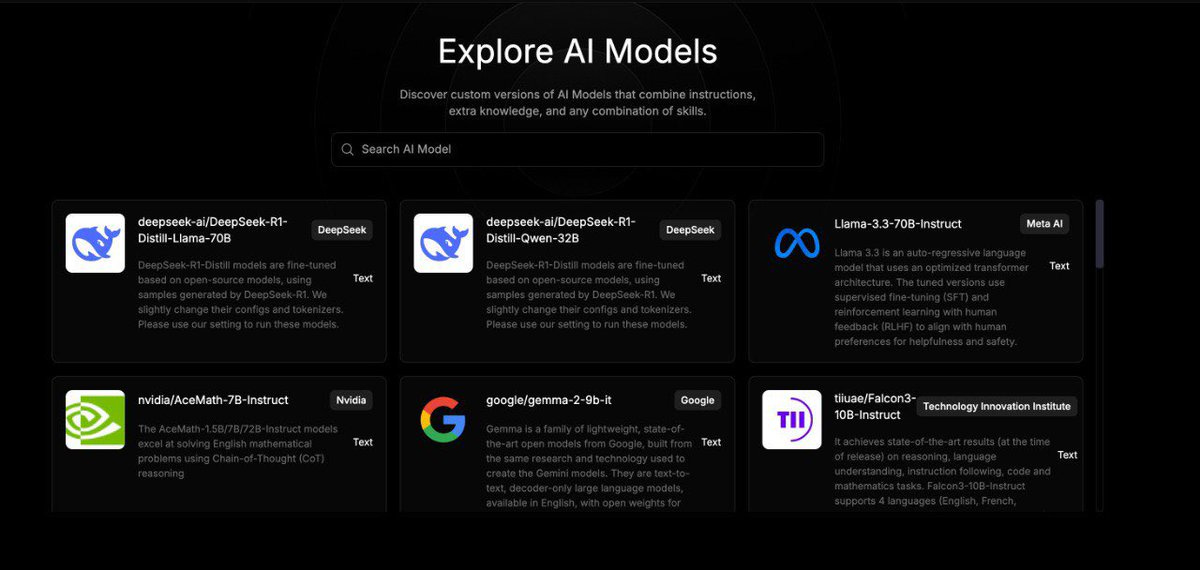

DeepSeek & IO.NET: A Powerful Synergy

DeepSeek, an emerging open-source AI model, stands out for its efficiency in training and inference. However, running and refining such models still requires significant GPU power.

IO.NET provides the perfect infrastructure to enhance DeepSeek’s potential by:

Cost-Effective Training: Traditional cloud AI training is costly. DeepSeek models can leverage IO.NET's decentralized GPU network to train at a fraction of the price.

Scalability & Flexibility: AI developers using DeepSeek can dynamically scale their compute needs without being locked into centralized providers.

Decentralized AI Evolution: Open-source AI models like DeepSeek can flourish when paired with an open, accessible compute network like IO.NET, promoting broader adoption and innovation.

AI Agents & the Need for Decentralized Compute

AI agents are transforming various industries, from automated DeFi strategies to autonomous content creation and social engagement. However, these multi-agent systems introduce new challenges:

Model complexity: As AI agents interact dynamically, the computational demands increase exponentially.

Real-time optimization: Autonomous decision-making requires low-latency inference.

Scalability in multi-agent ecosystems: Gaming, DeFi, and Web3 applications require on-demand, high-throughput computing power.

IO.NET provides:

High throughput & low latency: Essential for real-time AI agent interactions.

Fault-tolerant infrastructure: Ensures stability in large-scale AI applications.

Decentralized resource pooling: Reducing reliance on centralized cloud providers, ensuring cost-effectiveness and resilience.

Partnerships & Ecosystem Expansion

IO.NET is already collaborating with key players in the AI and Web3 space, including:

Leonardo.AI: Expanding access to GPU-powered AI creativity.

Filecoin: Enhancing decentralized storage solutions for AI workloads.

AgentFi: Facilitating next-gen AI agent interactions.

Render Network: Complementing decentralized compute for 3D rendering and AI tasks.

Additionally, IO.NET is expanding its presence in the Crypto AI and Agent sector with in-house products and integrations with emerging AI tools.

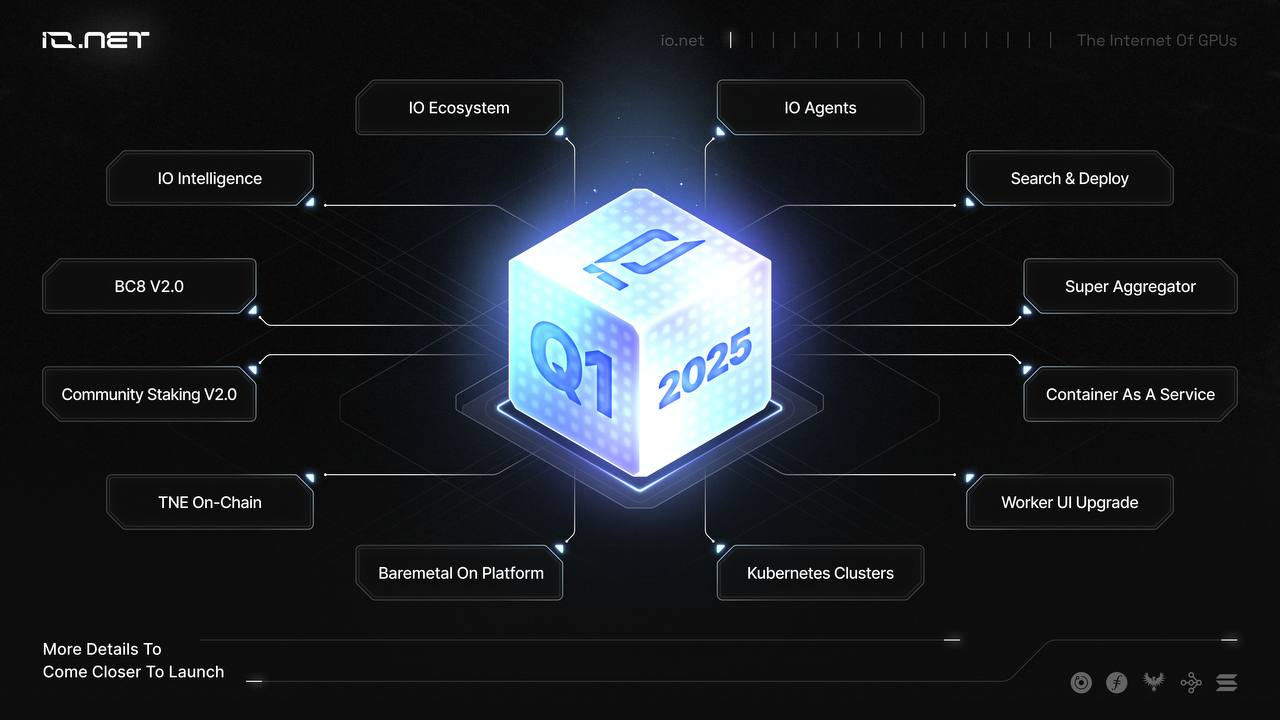

IO.NET Q1 2025 Roadmap

As part of its Q1 roadmap, IO.NET is expanding into the Crypto AI and autonomous agent ecosystem with proprietary solutions. Moving beyond its role as the top compute provider in Web3, IO.NET is committed to making LLM models such as LLaMA and DeepSeek more accessible. It also aims to empower developers and the community by providing tools that facilitate the creation and deployment of AI-driven applications on the IO Compute Network.

Real-World Impact

IO.NET’s strategic direction aligns with the rising need for decentralized AI and scalable GPU computing. By leveraging IO.NET’s decentralized infrastructure, projects like DeepSeek could access affordable, high-performance GPU power without dependence on centralized cloud services.

Furthermore, IO.NET’s distributed GPU network plays a key role in enhancing AI-driven automation, allowing developers to efficiently build, launch, and scale AI agents. Through deep integration with state-of-the-art models and specialized infrastructure tailored for AI workloads, IO.NET is cementing its position as a leader in the decentralized AI movement.

Future Outlook: The Rise of AI Agents and Decentralized Compute

The convergence of AI, DeFi, and decentralized infrastructure marks a new era of innovation. As AI agents evolve from simple automation tools to fully autonomous decision-makers, compute power will become the primary bottleneck. IO.NET’s decentralized approach ensures:

Greater accessibility to AI resources for developers and businesses.

Lower costs & improved efficiency compared to traditional cloud solutions.

A truly decentralized AI ecosystem, reducing reliance on centralized tech giants.

With DeepSeek becoming a leader in open-source AI models and IO.NET revolutionizing decentralized computing, the next wave of AI innovation is set to be more inclusive, scalable, and efficient than ever before.

Conclusion

IO.NET is not just a compute provider—it is the backbone of the decentralized AI revolution. By seamlessly integrating with AI frameworks, agent ecosystems, and open-source models like DeepSeek, IO.NET is paving the way for a more decentralized, accessible, and cost-effective AI future.

As we move toward, projects leveraging decentralized compute will gain a significant edge, ensuring that AI development remains open, scalable, and unstoppable.

2/ Crypto & DeFi News

🆚 As Solana sips from Ethereum's glass, its dominance in the DEX arena increases.

Solana has rapidly expanded its presence in the decentralized exchange (DEX) market, capturing nearly 50% of the total volume in recent weeks. The surge is largely driven by the memecoin launchpad Pump.fun, which has generated more trading activity than the entire Ethereum network at times. In late December, Solana’s DEX market share briefly peaked at 89.7%, highlighting its growing dominance. Analysts attribute this rise to Solana’s low transaction costs, fast processing speeds, and developer-friendly ecosystem. The Jupiter DEX, which handles nearly 70% of Solana’s DEX volume, has been instrumental in optimizing slippage and real-time pricing. Despite its rise, Ethereum and its layer-2 networks still lead in liquidity and larger trade sizes, indicating continued preference among institutional traders

Thought: Solana’s dominance in DEX trading signals a major shift in the DeFi landscape, particularly among retail traders looking for speed and low fees. However, its reliance on memecoin speculation raises questions about sustainability, as liquidity remains concentrated in short-term hype cycles. Ethereum’s deep liquidity and institutional adoption still position it as the backbone of DeFi, while its Layer2 solutions could challenge Solana’s cost advantages in the long run.

Whether Solana can convert its momentum into a more stable DeFi ecosystem with lasting utility will determine its ability to compete with Ethereum beyond speculative trading.

🇺🇸 Texas Lt. Governor announces ‘Bitcoin Reserve’ as priority bill for 2025

Texas Lieutenant Governor Dan Patrick has announced that establishing a Bitcoin Reserve will be a key legislative priority for the state in 2025. This initiative follows similar efforts in states like Arizona and Utah, where strategic Bitcoin reserve bills have advanced. Texas lawmakers, including Senator Charles Schwertner and Representative Giovanni Capriglione, have proposed legislation to create the reserve, with provisions allowing certain fees and taxes to be paid in BTC. Supporters argue that such reserves modernize financial systems, act as an inflation hedge, and enhance economic freedom. Texas, with its vast economy and a strong presence of Bitcoin miners due to its affordable energy and crypto-friendly policies, is positioning itself as a leader in Bitcoin adoption. If passed, the legislation could reinforce Texas’ role in shaping the future of digital asset integration.

Thought: Texas’ push for a Bitcoin Reserve is a major development for state-level crypto adoption and could set a new precedent for other states or even national policies. With its strong mining industry, regulatory flexibility, and economic scale, Texas is in a prime position to incorporate Bitcoin into its financial framework. However, the success of such a reserve will depend on its design—whether it serves primarily as an investment vehicle, a financial safeguard, or a broader economic tool.

Regulatory scrutiny and Bitcoin’s volatility remain key challenges, but if implemented effectively, Texas could accelerate Bitcoin’s role in mainstream finance and influence broader adoption across the United States.

📱 Crypto mobile wallets hit 36M record high amid growing retail adoption

The number of mobile cryptocurrency wallets has reached a record 36 million in Q4 2024, marking a surge in retail adoption as more passive holders transition into active users. According to Coinbase’s Jan. 29 report, mobile wallets play a crucial role in increasing engagement with DeFi and blockchain-based applications. While global crypto holders total around 560 million, industry experts predict this number could triple within two years.

Stablecoins have also emerged as crypto’s “killer app,” with total supply rising over 18% in Q4 and approaching $200 billion. Stablecoin trading volume surged threefold in 2024 to $30 trillion, driven by Bitcoin’s rally past $100,000. Inflows to exchanges hit a record $9.7 billion in November, signaling increasing investor appetite. Additionally, stablecoins are gaining traction in East Asia, where they are replacing fiat currencies in inflation-prone economies due to lower costs and accessibility. This shift highlights stablecoins' growing importance in remittances, digital capital markets, and financial inclusion

Thought: The record growth in mobile wallets signals a new phase of crypto adoption, where users are not just holding assets but actively engaging with blockchain applications. This trend strengthens the foundation for DeFi and broader on-chain activity. Meanwhile, the rapid expansion of stablecoins underscores their role as a bridge between traditional finance and crypto, with their use in payments, remittances, and trading increasing exponentially. If regulatory clarity improves, stablecoins could redefine global finance by challenging fiat dominance, especially in emerging markets.

The shift in East Asia further confirms that crypto adoption is not just about speculation—it is becoming a necessity for those in economies struggling with currency devaluation. The coming years could see stablecoins playing an even bigger role in reshaping global money flows and financial access.

💵 Tether’s stablecoin to be integrated into Bitcoin Lightning

Tether’s USDT stablecoin is set to be integrated into Bitcoin’s Lightning Network through the Taproot Assets protocol, expanding Bitcoin’s functionality to support tokenized assets. The integration, developed by Lightning Labs, was announced by Tether CEO Paolo Ardoino and Lightning Labs CEO Elizabeth Stark at the Plan B conference in El Salvador. This move will allow merchants accepting Bitcoin via Lightning to also support USDT transactions using the same infrastructure. Tether, which processed $10 trillion in transactions in 2024 and operates across over 10 blockchains, remains the largest stablecoin with a market cap of $139.4 billion, nearly triple USDC’s $53.1 billion. Lightning Labs believes this expansion will not only facilitate cross-border transactions and serve as a hedge for users in inflationary economies but could also support AI-driven transactions and autonomous vehicle payments.

Tether’s decision follows its recent relocation to El Salvador, the first country to adopt Bitcoin as legal tender. While the nation’s Bitcoin adoption has faced challenges—such as limited use of the Lightning-supported Chivo Wallet—this integration could provide a stronger foundation for stablecoin usage in Bitcoin’s growing ecosystem.

Thought: This integration marks a significant step in Bitcoin’s evolution as a transactional network rather than just a store of value. By bringing stablecoins like USDT to Lightning, Bitcoin’s network gains a new level of utility, particularly in emerging markets where volatility discourages direct BTC payments. Merchants now have a more stable alternative while retaining Lightning’s speed and efficiency. Additionally, this move could strengthen Bitcoin’s position against competing ecosystems, such as Solana or Ethereum, where stablecoins already play a crucial role in DeFi and payments.

However, for mass adoption, UX and liquidity management challenges must be addressed. If this integration is executed seamlessly, it could reinforce Bitcoin’s relevance in payments and potentially drive further adoption beyond speculative use cases.

Will this move finally make Bitcoin a viable alternative for stablecoin-driven commerce, or will limitations in scalability and merchant adoption hinder its impact?

🍣 Sushi acquires Shipyard to address DEX performance issues

Sushi Labs has acquired Shipyard Software to enhance the performance of SushiSwap, its decentralized exchange (DEX). The acquisition aims to tackle key challenges such as impermanent loss, liquidity optimization, and cross-chain trading efficiency. Shipyard’s products include Blade, an automated market maker (AMM) that uses a request-for-quote (RFQ) system to mitigate impermanent loss, and Kubo, a liquidity aggregation tool for decentralized perpetual futures (perps) exchanges. Sushi plans to integrate Kubo as a new branded perps product.

This move comes as SushiSwap struggles with a prolonged decline in total value locked (TVL), which has dropped from its $8 billion peak in 2021 to around $230 million today. SushiSwap currently ranks 13th among DEXs, far behind Uniswap ($5.6B TVL) and Raydium ($2.7B TVL). The platform also faces growing competition from Solana-based DEXs and newer entrants like Hyperliquid. Meanwhile, the broader DeFi market is witnessing a resurgence, with TVL surpassing $119 billion, doubling year-over-year, driven by liquid restaking tokens (LRTs) and Bitcoin-native layer-2 networks. Despite this growth, DeFi TVL still lags its $170 billion peak from 2021.

Thought: Sushi’s acquisition of Shipyard Software highlights its attempt to remain competitive in an evolving DEX landscape. By integrating advanced liquidity management tools and mitigating impermanent loss, Sushi aims to offer traders and liquidity providers a more efficient trading experience. However, with SushiSwap’s TVL significantly lagging behind competitors, this acquisition alone may not be enough to reclaim its former dominance. The rise of Solana-based DEXs and hyper-efficient trading platforms like Hyperliquid suggests that simply improving trade execution might not be sufficient—Sushi will likely need to innovate beyond traditional AMMs. Meanwhile, DeFi’s overall TVL growth signals renewed interest, with LRTs and Bitcoin-native L2s driving liquidity expansion.

If Sushi can effectively leverage these trends while integrating Shipyard’s technology, it may improve its standing in the DEX ecosystem. However, the challenge remains: can Sushi recapture lost market share, or is it destined to remain a second-tier player in an increasingly competitive DeFi landscape?

3/ Ethereum’s Institutional Evolution

Introduction

Ethereum isn’t just a blockchain—it’s the foundation of decentralized finance, the pioneer of smart contracts, and the leading platform for Web3 innovation. With Etherealize, Ethereum aims to transcend its crypto-native roots and become the backbone of institutional finance, creating a bridge between traditional markets and blockchain technology.

We’ll dive deep into how Ethereum is evolving, its deflationary mechanisms, validator updates, and its position in the competitive crypto landscape. We'll also explore the challenges Ethereum faces as it seeks to scale and secure its future as the preferred blockchain for institutions worldwide.

Ethereum’s Current Standing: An Unmatched Leader

Security and Decentralization

Ethereum boasts over 1M active validators, making it the most decentralized and secure blockchain for smart contracts. Its Proof-of-Stake system, implemented through the Merge in 2022, has not only reduced energy consumption by over 99% but also solidified Ethereum’s position as the go-to platform for secure and sustainable decentralized applications (dApps).

The DeFi Ecosystem

Dominance: Ethereum supports over 75% of the entire DeFi ecosystem, with projects like Aave, Uniswap, and Curve relying on its robust infrastructure.

TVL Leadership: As of Q1 2025, Ethereum accounts for over $40 billion in total value locked (TVL), significantly outpacing competitors like Solana and Binance Smart Chain.

Innovative Use Cases: Beyond trading and lending, Ethereum powers real-world applications, from on-chain gaming economies to decentralized identity solutions.

Deflationary Dynamics

The introduction of EIP-1559 in August 2021 transformed Ethereum’s monetary policy. By burning a portion of transaction fees, Ethereum introduced a deflationary mechanism that strengthens its value proposition.

Stats to Watch: Since the Merge, over 1.2 million ETH have been burned, reducing supply and increasing scarcity.

Institutional Appeal: Ethereum’s deflationary nature positions it as a digital asset akin to “programmable gold,” appealing to institutions seeking inflation-resistant investments.

The Etherealize Initiative: Bridging Institutions and Blockchain

Etherealize is a recently launched initiative aimed at accelerating institutional adoption of the Ethereum ecosystem. Led by Wall Street veteran Vivek Raman, the project seeks to bridge the gap between traditional finance and blockchain technology.

The Ethereum Foundation and co-founder Vitalik Buterin are key contributors to Etherealize, providing partial funding and support for the initiative.

This initiative focuses on three pillars: Education, Product Development, and Integration with Traditional Finance.

Key Features and Innovations

Asset Tokenization

Traditional assets like real estate, equities, and bonds can be tokenized and traded on Ethereum, unlocking liquidity and enabling fractional ownership.

Projected Impact: The World Economic Forum estimates the tokenized asset market could reach $24 trillion by 2027.

Enhanced Analytics

Etherealize will provide institutions with advanced dashboards for monitoring and managing their on-chain assets. This includes real-time data on ETH staking yields, transaction flows, and DeFi lending opportunities.

Institutional Staking Protocols

Ethereum plans to introduce bespoke staking options for institutions, allowing them to stake ETH with enhanced security measures and tailored yield strategies.

The $ETH Value Proposition

Etherealize positions $ETH as more than a cryptocurrency—it’s the foundational asset for decentralized finance:

As the backbone for Layer2 transactions.

As collateral for institutional-grade lending.

As a yield-generating asset through staking.

Validator Changes: Scaling for the Future

Ethereum’s validator network is undergoing significant changes to ensure scalability, efficiency, and institutional participation.

New Validator Rules

The Ethereum Pectra upgrade, scheduled for early 2025, is a significant development aimed at enhancing the network's scalability, security, and user experience.

Validator Stake Flexibility: The upgrade increases the maximum effective balance per validator from 32 ETH to 2048 ETH, allowing larger staking operations to consolidate their holdings and reduce the number of validators they manage. The minimum requirement to become a validator remains at 32 ETH.

Ethereum is becoming more flexible to accommodate both small and large stakeholders.

Layer1 and Layer2 Integration

Ethereum’s roadmap includes enhancements to both Layer1 (main blockchain) and Layer2 (scaling solutions):

Data Sharding: Ethereum’s next upgrades will include “blobs” of transaction data, enabling Layer2 rollups to process significantly more transactions at lower costs. A step towards Data Sharding.

Pectra Upgrade: Expected by Q4 2025, Pectra will increase Layer2 throughput, reducing costs and making Ethereum competitive with high-speed chains like Solana.

Why Ethereum Stands Out

Security: No other blockchain offers Ethereum’s combination of decentralization and security.

Interoperability: Ethereum’s ecosystem of Layer 2s ensures seamless integration with other blockchains and protocols.

Deflationary Edge: Unlike its competitors, Ethereum’s deflationary tokenomics make $ETH increasingly scarce and valuable.

Adoption Drivers and Institutional Momentum

Ethereum’s institutional push comes at a pivotal moment:

Regulatory Progress: The U.S. and EU are finalizing crypto regulations that favor secure, decentralized blockchains like Ethereum.

Market Sentiment: Institutions are increasingly diversifying into digital assets, with Ethereum leading the charge.

Institutional Use Cases

DeFi Yield Strategies: Institutions can earn yield through Ethereum’s DeFi protocols, which offer higher returns than traditional finance.

On-Chain Settlements: Ethereum enables real-time settlements for cross-border payments, reducing costs and increasing transparency.

Carbon Markets: Ethereum’s energy-efficient Proof-of-Stake model is being leveraged for carbon credit tokenization and trading.

Challenges on the Road Ahead

Despite its strengths, Ethereum faces significant hurdles:

Scalability Pressure: Competing with high-speed chains requires rapid Layer 2 adoption and consistent Layer 1 improvements.

Education Gap: Institutions need clear guidance on blockchain adoption and use cases.

Regulatory Uncertainty: Governments are still defining rules for crypto assets, which could slow adoption.

Ethereum’s Response

Accelerating rollup adoption with incentives for Layer2 developers.

Building partnerships with financial leaders to showcase Ethereum’s capabilities in regulated environments.

Increasing investments in ecosystem development to support institutional onboarding.

Conclusion

With unmatched security, groundbreaking upgrades like Pectra, and a strategic focus on asset tokenization, Ethereum is laying the foundation for a multi-trillion-dollar financial system powered by blockchain.

And for institutions, Etherealize is more than an invitation—it’s a call to build the financial infrastructure of tomorrow on the most trusted blockchain today.

Ethereum isn’t just competing in the crypto space; it’s redefining global finance, one upgrade and one institution at a time.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.