This Week's Newsletter - Case Study on Venice.AI, Main News of the Week, & Zoom on Base through Aerodrome

Weekly Alpha

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

Another eventful week in Crypto.

This week the memecoin market took a massive hit, and Solana went down with it. After weeks of dominance, the narrative collapsed under its own weight.

We also just learned about a massive ByBit hack, with $1.46 billion in stolen funds. Probably the biggest hack ever.

It has obviously impacted the market, which was once again in a short-lived uptrend. However the dips over the Market hasn’t been so bad in comparison with the magnitude of the hack. We could have expected a chain reaction of strong sell-offs leading to liquidations, but it didn’t happen. Bullish?

Yet for now it still poses a significant risk to the market, even though ByBit appears to be handling the situation well.

But let’s get back to the memecoin implosion. It all started with $LIBRA. Argentina’s President Javier Milei promoted the token, and retail aped in hard, believing it was a legitimate government-backed initiative. What followed was the biggest rug of the year—insiders dumped $107M, leaving investors wrecked. The damage control efforts were laughable. One of the token creators claimed the funds would be used to "support Argentinian companies." Another insisted on reinvesting profits back into the token, as if that would fix anything.

None of it mattered. The trust was gone, and the market turned against memecoins (for now).

It wasn’t just $LIBRA. The broader memecoin ecosystem started feeling the pressure. The same teams that launched $MELANIA and $LIBRA had been running coordinated pump-and-dump cycles. Even politicians got involved—Trump launched $TRUMP, Melania had $MELANIA, and the Central African Republic’s president dropped $CAR. The patterns were identical: huge pumps, insiders selling, brutal crashes. And then there was Solana.

Solana had been the home of this memecoin frenzy, and when things collapsed, it took a hit too. Critics argued that Solana culture actively enabled the degeneracy—top influencers celebrated Pump.fun and trading bots that extracted insane fees from retail. Even major Solana projects like Jupiter and Meteora worked with the $LIBRA team pre-launch. That wasn’t a good look.

But we can argue that Solana is not only Memecoins and high speculation/casino.

Solana has strong fundamentals in DePIN and AI.

But the damage is still done. The perception that Solana is a playground for extraction is setting in and could stick for a while.

So what’s the next narrative?

We’ve covered the Solana and Ethereum ecosystems in past editions of this newsletter, but today, let’s shift our focus to a Layer2 that’s been making waves: Base.

Unlike Solana’s memecoin mania, Base has been pushing narratives that feel more sustainable: RWAs, DeFi, and AI, and we heard a lot about Venice.AI recently.

Venice is an open-source, decentralized AI platform that launched its token, $VVV, alongside its API. The idea is simple: no centralized control, no data logging, no censorship. It integrates models like Llama 3 and Nous, giving users access to powerful AI without the restrictions of corporate platforms.

Coinbase listed Venice at launch, while not listing Virtuals and other Base AI Agent tokens for months now. Which may suggest the involvement of the coinbase team in Venice, a project that was not at the forefront of the narrative at all before Coinbase listed it.

But all in all, Base is still in the spotlight. And at the heart of the chain? Aerodrome, the biggest DEX on Base.

Liquidity is flowing in fast, and the protocol is positioning itself as the heart of Base’s DeFi ecosystem. While Solana reels from the fallout of its own excesses, Base is capturing attention by doing the opposite—building.

We also saw new narratives and strong ecosystems emerge.

It’s the end of the “short the new token launch” trend for now.

As we’ve seen bullish launches with $BERA, $IP, $KAITO, and even $QUAI in some extent.

And of course the Sonic Ecosystem seeing a surge of interest.

Memecoins aren’t dead, but the golden era of them dominating the market narrative might be over for now. And as the hype cycle shifts, the real question is: what’s next?

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into :

Case Study on Venice AI: Exploring how Venice AI is positioning itself as a key player in decentralized AI, leveraging its open-source ecosystem to drive adoption and innovation.

Main News of the Week.

Zoom on MetaDex & Aerodrome : Breaking down MetaDex and Aerodrome’s fundamentals and potential in the evolving DeFi landscape.

Today's Newsletter is brought to you by Mantle

$MNT has taken a hit after the ByBit situation, obviously. Yet significantly lower that it could have been, showing strength.

Depending on how the situation unravel, it might be an opportunity.

mETH Protocol is safe and unaffected.

And Mantle Ecosystem is not going anywhere.

Here are the latest news:

Introducing the $cmETH Fixed Yield Vault: Earn an Additional 2% Fixed Yield

Looking for a fuss-free yield strategy? Earn an additional fixed yield of 2% on top of underlying Ethereum staking rewards (~3% APY) when you deposit into their $cmETH Fixed Yield Vault.

For many institutional and retail users, earning fixed $ETH returns is a more attractive option. To meet this demand, the cmETH Fixed Yield Vault will run for the next 6 months, offering a stable yet rewarding alternative—fixed annual yields on top of Ethereum staking rewards. Fixed yield rewards will be distributed in $wETH linearly, and users can claim their accumulated rewards at any time, as long as the amount is greater than zero.

How This May Impact You

Restaking protocol rewards across EigenLayer, Karak, Symbiotic, and Veda (including potential AVS and tech partner rewards).

Future Powder rewards (when Season 3 launches) for $COOK tokens.

Flexibility to put your $cmETH across L2 dApps for enhanced yield opportunities.

If you prefer to maximize exposure to future protocol rewards and maintain flexibility with your $cmETH, this vault may not be the best fit.

Season 2: Methamorphosis & COOK Feast Wrap-Up

Methamorphosis Season 2 & COOK Feast have officially ended, paving the way for Season 3.

mETH Protocol is now live on Guild, further expanding its ecosystem reach.

The $COOK supply distribution for Season 2 was structured to boost engagement and early adoption of $cmETH.

60% of the total $COOK token supply is allocated to community incentives, with 4% dedicated to Season 2 participants.

There will be no vesting period for this tranche of $COOK rewards.

Claiming Rewards

$COOK claims will open in March, with further details released through official channels.

$cmETH restaking rewards from Season 2 will be automatically accrued across EigenLayer, Symbiotic, Karak, and Veda.

Rewards from Symbiotic, Karak, and Veda are subject to their respective TGE timelines.

Users on Safe Wallet via Mantle L2 must authorize an EOA address to claim restaking rewards on Ethereum L1.

COOK Feast Rewards: If you locked $COOK for COOK Power, you can still claim rewards in March. Rewards are based on a time-weighted COOK Power formula.

With Season 3 already planned, Mantle is gearing up for further engagement campaigns and ecosystem expansions. A major new product launch is also on the horizon, adding another layer of growth for the Mantle ecosystem.

mETH & cmETH: Driving Institutional-Grade Staking Solutions

$mETH remains a top ETH liquid staking token, accruing ETH staking rewards and maintaining instant redeemability.

$cmETH optimizes restaking across EigenLayer, Symbiotic, Karak, and Veda, compounding staking yields for maximum capital efficiency.

In under two months, $cmETH has amassed over $600M in TVL, reinforcing its adoption.

Mantle Treasury's strategic restaking of 100K $mETH into EigenLayer resulted in 2.098M $EIGEN tokens being distributed to the community.

With its CeFi & DeFi integrations expanding, Mantle’s ecosystem is positioning itself as a leader in institutional-grade staking and restaking solutions.

Stay tuned for more updates as the landscape evolves.

Learn more about Mantle & its 2025 Roadmap with my thread on X

1/ Case Study: Venice & Crypto's Escalating AI Ambitions

The Expansion of Venice.AI

While Wall Street investors grappled with less certain American AI supremacy, Crypto hosted its own bit of AI news with a new decentralized AI platform, Venice.

First launched in May 2024, Venice offers open, censorship-free generative AI. Unlike mainstream AI services that log every request and potentially share user data, Venice operates through a decentralized network of GPU providers, ensuring privacy and security.

Since its launch in May 2024, Venice.AI has seen rapid growth:

400,000 registered users

50,000 daily active users (DAU)

15,000 inference requests per hour

Venice’s mission is to provide permissionless access to private and uncensored machine intelligence, setting it apart from centralized AI platforms. The platform gained significant attention with the airdrop of its $VVV token and the release of its API. Notably, this came just as DeepSeek, a major Chinese open-source AI project integrated into Venice, tightened its global access.

What is Venice.AI?

Venice.AI is a chat-based platform for decentralized, private access to generative AI, supporting text, image, and code generation. Founded by Erik Voorhees, known for ShapeShift, Venice integrates models such as Nous, Llama 3, Playground 2.5, and DeepSeek. It does not store conversation histories and routes encrypted queries through decentralized GPU providers.

Critics argue that decentralized inference networks (DePIN & DeVIN) make it harder to guarantee document deletion. However, Venice mitigates these concerns by ensuring that user data is never logged or stored centrally. The platform relies on browser local storage for chat history, keeping interactions entirely private.

Features of Venice.AI

Venice.AI is more than just an image generation tool or a ChatGPT 2.0.

Using Venice.AI for UX Research

It has had a profound impact on UX research by analyzing user data, identifying patterns, and making predictions about user behavior. This has allowed designers to make more informed decisions, improving the overall user experience. Clients have noticed the difference, and the ability to switch between various LLMs seamlessly enhances flexibility.

The AI presents results in a clear and concise manner, making it accessible even to non-data scientists.

Writing Code with Venice.AI

Venice has also become a valuable tool for writing simple code. Designers with limited coding experience can generate code snippets to integrate into their projects, saving time and allowing more focus on design.

For coders, Qwen stands out as an excellent model for programming tasks.

Model Selection

Venice supports various AI models, including DeepSeek, Llama 3.3, and Qwen 2.5 Coder. With DeepSeek recently restricting new sign-ups to Chinese phone numbers, Venice provides a workaround by integrating it into its decentralized AI framework.

Tiered Access

Venice offers three access tiers:

Free: 15 text and 5 image prompts daily without an account.

Private: 20 daily prompts with the potential to earn points, which may relate to the Venice Incentive Fund.

Pro: $18/month or $149/year for unlimited prompts, high-res outputs, access to DeepSeek, and API integration.

The Pro tier includes AI character creation and third-party API integrations, positioning Venice as a competitive AI development platform.

Image Generation and Real-World Cases

One of Venice’s standout features is its powerful image generation. Real-world applications include:

Product Line Visuals: Used to generate high-quality images for social media campaigns, leading to increased engagement and success.

Website Redesigns: Generated realistic scenarios of users interacting with interfaces, streamlining the design process.

The $VVV Token

$VVV is Venice’s native token, designed to shift API usage from a pay-per-request model to a stake-based system. Stakers gain proportional access to Venice’s inference capacity, ensuring continued AI access without direct payment.

Tokenomics & Distribution

Total Supply: 100M VVV

Airdrop: 50% distributed to Venice users and AI-focused projects.

Company Allocation: 35%, with gradual unlocking.

Venice Incentive Fund: 10% for rewards and growth.

Liquidity Development: 5%.

Annual Inflation: 14M new tokens (14% rate), distributed to stakers and Venice.

Staking and Crypto Rewards

Venice also offers a staking feature, allowing users to earn rewards by staking their tokens. These tokens can be used to unlock premium features, fostering community engagement.

Controversies & Market Performance

Upon launch, $VVV hit a $1B valuation, with Coinbase listing it on day one.

However, issues soon emerged:

A single entity allegedly claimed over 1M $VVV using 100 wallets.

Reports surfaced of the Venice team selling $10.2M in tokens, contributing to price drops.

Market cap fell from $500M to $80M, with the price dropping from $19 to $2.9.

The Benefits of Using Venice.AI

Some of the main benefits include:

Time-Saving: Generates images, analyzes user data, and writes code faster than traditional methods.

Ease of Use: Designed to be intuitive even for those without AI expertise.

Cost-Effective: Unlike many AI tools, Venice is free to use, making it highly accessible.

Limitations to Consider

However, there are some challenges:

Steep Learning Curve: While easy to use, mastering its full capabilities takes time.

Limited Model Offerings: Some models are restricted, though this may improve with the Pro account.

Token Inflation: High token inflation may impact long-term value.

Long-Term Potential

Despite early controversy, Venice’s strong use cases keep it relevant:

Privacy-first, censorship-resistant AI

Decentralized GPU compute network

Open-source model integrations (Llama 3.3, DeepSeek, Nous Theta)

Stake-based API for cost-effective AI inference

Conclusion

Venice exemplifies how crypto and AI can merge to create decentralized, censorship-free applications.

And yet, its launch and the controversies surrounding it make it seem like a VC coin pump-and-dump, manipulated by Coinbase.

Some solid rebounds have occurred, but they have not been sufficient to recover the launch price after the massive dump that followed.

I’d say the tech is solid, but the tokenomics and apparent manipulation pose a major risk. It was certainly not the biggest or most popular AI Agent token to be listed on Coinbase first.

In the long term, by enabling private AI inference and shifting from traditional monetization models, Venice has the potential to drive AI-agent development on Base. Keeping in mind the risks associated with a potential manipulation from teams & VCs.

2/ Crypto & DeFi News

ByBit Hack

As mentioned before, ByBit got hacked for $1.46B.

Kaito Launch & InfoFi Narrative

Kaito AI, an AI-driven crypto intelligence platform, recently launched its native token, KAITO, on February 20, 2025. The launch included an airdrop on the Base network and subsequent listings on major exchanges such as Binance and OKX.

I’ve been mentioning Kaito a lot lately on X and Telegram. It has finally launched, potentially igniting a long-term InfoFi narrative.

The lower-than-expected airdrop disappointed many, yet the price quickly bounced at launch and started pumping higher than the listing price.

And that’s another big launch on Base!

Learn more about the Tokenomics.

Mantra Finance Secures Dubai VASP License to Expand DeFi and RWA Offerings

We talked about Mantra two weeks ago.

Mantra Finance has obtained a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA), enabling it to expand its DeFi and real-world asset (RWA) tokenization services across the UAE and MENA region. Announced on Feb. 19, the license allows Mantra to operate as a digital asset exchange and offer broker-dealer, management, and investment services.

Dubai has positioned itself as a leading global crypto hub with structured regulatory frameworks. Mantra CEO John Patrick Mullin praised VARA’s leadership in digital asset regulations, stating that clear rules accelerate institutional adoption. The license will allow Mantra to scale its regulated financial products and deepen institutional engagement in RWAs.

Mantra’s focus is on institutional investors, with partnerships already established with major UAE entities, including Damac, Libre, MAG, Novus Aviation, and Zand. While retail investors are not the primary target, Mantra plans to ensure broader accessibility in the future while maintaining compliance and investor protection.

Thoughts

Mantra Finance’s VARA license underscores Dubai’s growing status as a regulated crypto hub. The move aligns with the broader trend of institutional engagement in RWAs, which has gained momentum following the success of crypto ETFs. With regulatory clarity now in place, Mantra’s ability to tokenize multi-billion-dollar assets could significantly advance on-chain finance in the region.

For DeFi, this is another step toward bridging traditional finance with blockchain-based services. While RWAs are seen as the next major sector for institutional adoption, scalability and regulatory compliance remain key challenges. If Mantra successfully executes its vision, it could set a precedent for other DeFi firms looking to operate in regulated environments while maintaining the ethos of decentralization

Tether co-founder launches rival stablecoin that offers yield

Tether co-founder Reeve Collins is launching a decentralized stablecoin that will compete with the original dollar-pegged token he helped create, increasing competition in the stablecoin market. Pi Protocol (not related to Pi Network of course) is a decentralized project launching on Ethereum and Solana later this year. Pi Protocol will use smart contracts to allow users to mint the USP stablecoin by exchanging yield-bearing USI tokens. The stablecoin will reportedly be backed by bonds and other real-world assets, though specific details about its fiat peg were not disclosed.

Collins was one of the original developers of Tether (USDT) before selling the project to Bitfinex operators in 2015. Since then, USDT has grown from under $1 billion in circulation to over $142 billion, dominating the stablecoin market.

Pi Protocol enters a highly competitive space that includes Tether’s USDT, Circle’s USD Coin (USDC), Ethena’s USDe, and MakerDAO’s Dai (DAI). The stablecoin market has surpassed $225 billion in total circulation, according to DefiLlama. USDT remains the largest stable asset, holding more than 63% of the market, but newer entrants are gaining traction. Ethena’s USDe recently overtook DAI to become the third-largest stablecoin by market capitalization.

Stablecoins have become critical to the crypto market, providing liquidity and enabling transactions. They are also widely used for cross-border remittances, offering a cost-effective alternative to traditional payments. A recent ARK Invest report highlighted this trend, showing that stablecoin transaction volumes hit $15.6 trillion in 2024, surpassing Visa and Mastercard.

Thoughts

The launch of Pi Protocol’s USP stablecoin highlights the shifting landscape of stable assets, where yield-generation is emerging as a key feature. While USDT dominates, projects like USP and USDe appeal to a yield-focused audience, potentially drawing both retail and institutional investors. However, yield-bearing stablecoins backed by real-world assets may face heightened regulatory scrutiny, especially in jurisdictions that could classify them as securities.

If Pi Protocol succeeds, it could mark a shift in stablecoins from simple fiat-backed assets to more complex financial instruments blending traditional finance with DeFi. This evolution may drive innovation in lending, liquidity, and remittances but could also attract regulatory oversight. The growing competition among Tether, Circle, and new protocols like Pi may redefine stablecoins' role in crypto, potentially accelerating their adoption as mainstream financial tools.

Ether reserves on exchanges hit 9-year low as supply shrinks

Ether reserves on centralized exchanges have dropped to their lowest level in nearly nine years, signaling potential bullish momentum for ETH. According to CryptoQuant, total ETH reserves on exchanges fell to 18.95 million on Feb. 18, a level last seen in July 2016 when ETH traded around $14.

The reduction in available ETH on exchanges is often linked to a “supply shock,” where strong demand meets declining supply, potentially driving prices higher. However, ETH has struggled year-to-date, falling 19%, and is down 3.67% over the past year, per TradingView data.

Investors appear to be moving ETH into cold storage, a trend often interpreted as a bullish signal. Nicolai Sondergaard, a research analyst at Nansen, noted that a similar pattern is observed with BTC, possibly indicating a shift toward self-custody rather than short-term trading. Bitget COO Vugar Usi Zade reinforced this sentiment, stating that reduced exchange supply historically correlates with lower sell pressure and price stability.

Despite this trend, ETH faces key resistance at $2,750 and $2,800. A breakout beyond $2,800 could trigger the liquidation of over $822 million in leveraged short positions, according to CoinGlass data.

Another potential catalyst for ETH price growth is the introduction of staking-enabled Ethereum ETFs. Marcin Kazmierczak, co-founder of Redstone, suggested that such a product could further constrain Ethereum’s liquid supply, reinforcing its status as a prime investment asset.

Thoughts

The declining ETH reserves on exchanges reinforce the long-term bullish case for Ethereum, particularly as self-custody increases and liquid supply shrinks. This shift aligns with broader crypto trends, where investors are favoring security over short-term speculation. However, while lower exchange supply historically reduces selling pressure, it does not guarantee an immediate price rally. The market still needs a catalyst, such as stronger institutional demand or macroeconomic shifts, to propel ETH past resistance levels.

The potential for staking-enabled ETFs could be one such trigger, significantly impacting ETH’s circulating supply and incentivizing long-term holding. If these products gain regulatory approval, Ethereum’s appeal as a yield-generating asset could expand, driving more institutional participation. However, regulatory uncertainty remains a factor, and while supply-side constraints are supportive, demand dynamics will ultimately dictate price action. ETH’s ability to break past key resistance levels will be a crucial indicator of whether this supply shock translates into a sustained rally.

Hyperliquid rolls out HyperEVM, unveils bug bounty rewards

Hyperliquid has launched HyperEVM, a general-purpose Ethereum Virtual Machine (EVM) integrated into its layer-1 blockchain, alongside a bug bounty program offering up to $1 million in USDC for security vulnerabilities. Unlike standalone EVM chains, HyperEVM is secured by Hyperliquid’s consensus mechanism, allowing direct interaction with native components and enabling seamless token usage across the ecosystem.

The platform’s native HYPE token is fully fungible with the EVM’s gas token, facilitating minimal-fee trading on Hyperliquid’s order book and interoperability with applications built on HyperEVM. To enhance security, the bug bounty program offers tiered rewards based on the severity of identified vulnerabilities, with the most critical bugs earning nearly $1 million in USDC.

Despite the launch, HYPE’s price remained steady at around $26, with a market capitalization of $8.6 billion and a 24-hour trading volume exceeding $200 million, according to CoinGecko. However, Hyperliquid’s total value locked (TVL) has surged, reaching $677 million in February—marking a 300% increase since December 2024.

The project previously gained significant traction in the DeFi space after executing a $7 billion airdrop, distributing 28% of its total token supply to early users.

Thoughts

Hyperliquid’s launch of HyperEVM strengthens its position as a high-performance DeFi platform, but its impact on adoption will depend on developer engagement and real-world use cases. The decision to integrate EVM functionality directly into the layer-1 rather than as a separate chain could enhance liquidity and efficiency, making it easier for developers to build applications with native interoperability.

The bug bounty program is a proactive step in ensuring security, particularly as new EVM implementations can introduce vulnerabilities. With rewards up to $1 million, Hyperliquid is signaling a serious commitment to platform integrity. However, the market’s muted reaction, as seen in HYPE’s price stability, suggests that investors are waiting for tangible results—such as increased developer adoption or major protocol integrations—before assigning additional value to the network’s expansion.

Hyperliquid’s TVL surge signals strong user participation, but sustainability remains a question. Much of its momentum has stemmed from its high-profile airdrop, and long-term growth will require more than incentives. If HyperEVM can drive new applications and maintain deep liquidity, Hyperliquid could establish itself as a major player in DeFi. However, competition remains fierce, and its ability to differentiate from other layer1s will be key to its success.

3/ Zoom on Base growth: MetaDex and Aerodrome

Overview

We’ve already talked about Base and Aerodrome in another edition of this newsletter, but today we’ll dive deeper into what makes Aerodrome so special 👇

Aerodrome implemented the MetaDEX model, which is one of the reasons for its success.

But what exactly is the MetaDEX, and why is it crucial to understanding Base's rapid growth?

What is the MetaDEX?

The MetaDEX is a decentralized exchange model that powers Aerodrome, the central trading and liquidity hubs on Base and the broader Superchain ecosystem.

It’s inherited from Velodrome, a successful DEX on Optimism.

Unlike traditional DEXs, the MetaDEX integrates and enhances key features from Curve, Convex, and Uniswap, offering an optimized system for liquidity provision and trading.

By refining these models, it provides:

Efficient liquidity pools that maximize capital efficiency and reduce slippage.

An advanced incentive system that enables protocols to build deep liquidity for their tokens.

A governance-driven emissions model that ensures rewards flow to the most valuable liquidity pools.

Why Are We Talking About MetaDEX Today?

The success of Base as a growing DeFi ecosystem is closely tied to its liquidity infrastructure, and the MetaDEX is at the heart of that. By enabling protocols to bootstrap liquidity in a highly efficient manner, it has played a key role in Base’s expansion.

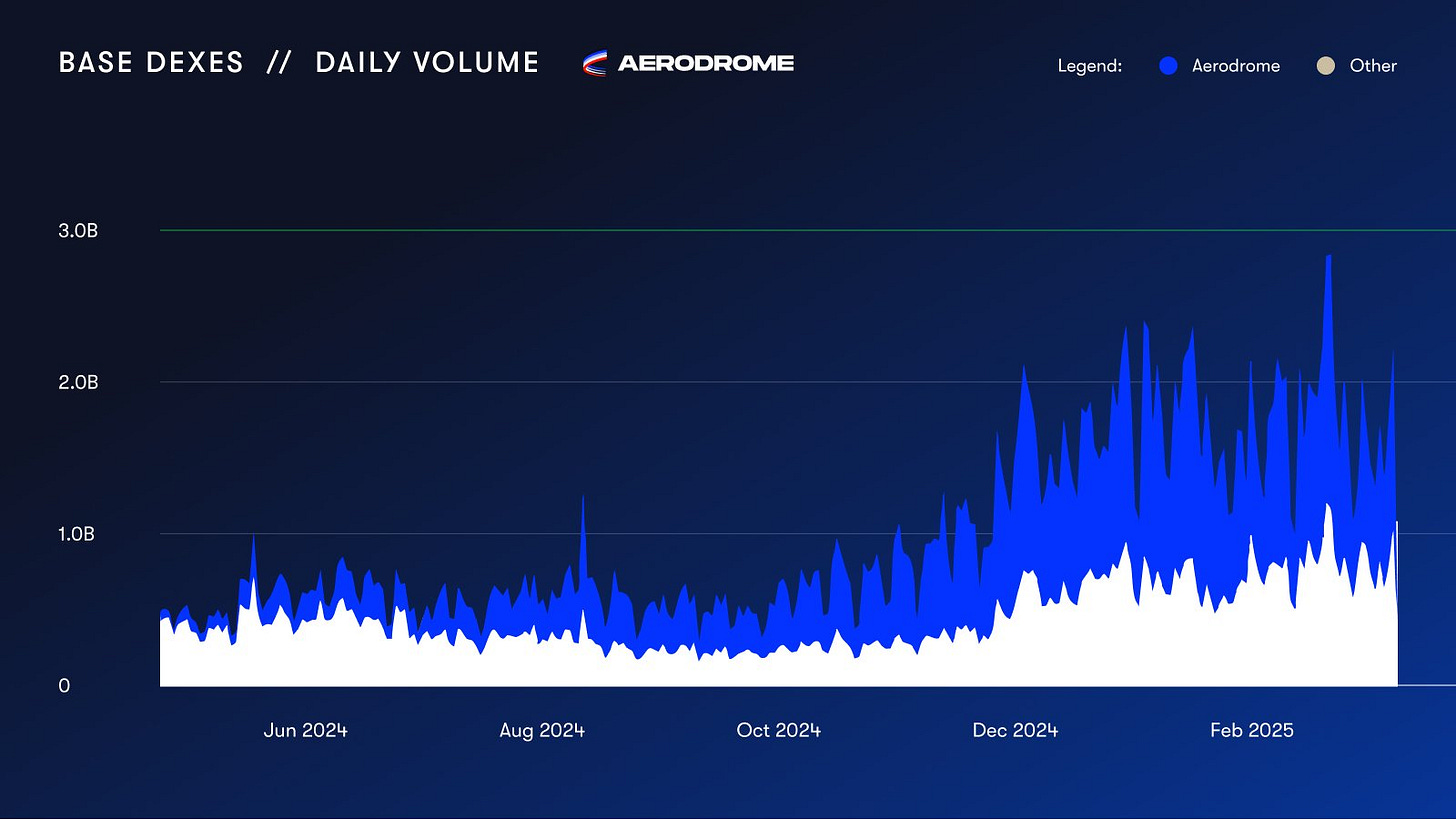

The Role of Aerodrome in Base’s Growth

Aerodrome serve as the primary liquidity engine on Base.

Aerodrome: Base’s Liquidity Powerhouse

Aerodrome is well established in the Top 5 of the biggest DEX, even thought it’s just available on Base and is more than just a decentralized exchange. It’s the foundation of Base’s liquidity infrastructure, facilitating deep, capital-efficient markets that enhance the entire ecosystem.

The protocol has established itself as the primary liquidity hub by offering:

Optimized ve(3,3) mechanics: Inspired by Curve and Velodrome, Aerodrome uses vote-escrowed (ve) tokenomics, where users lock AERO tokens to gain governance power and direct liquidity emissions.

Superior capital efficiency: By leveraging stable and volatile liquidity pools, Aerodrome enables deep liquidity while minimizing slippage for traders.

A fair, permissionless reward system: Weekly emissions of AERO are decided by veAERO holders, ensuring liquidity flows to the most utilized pools.

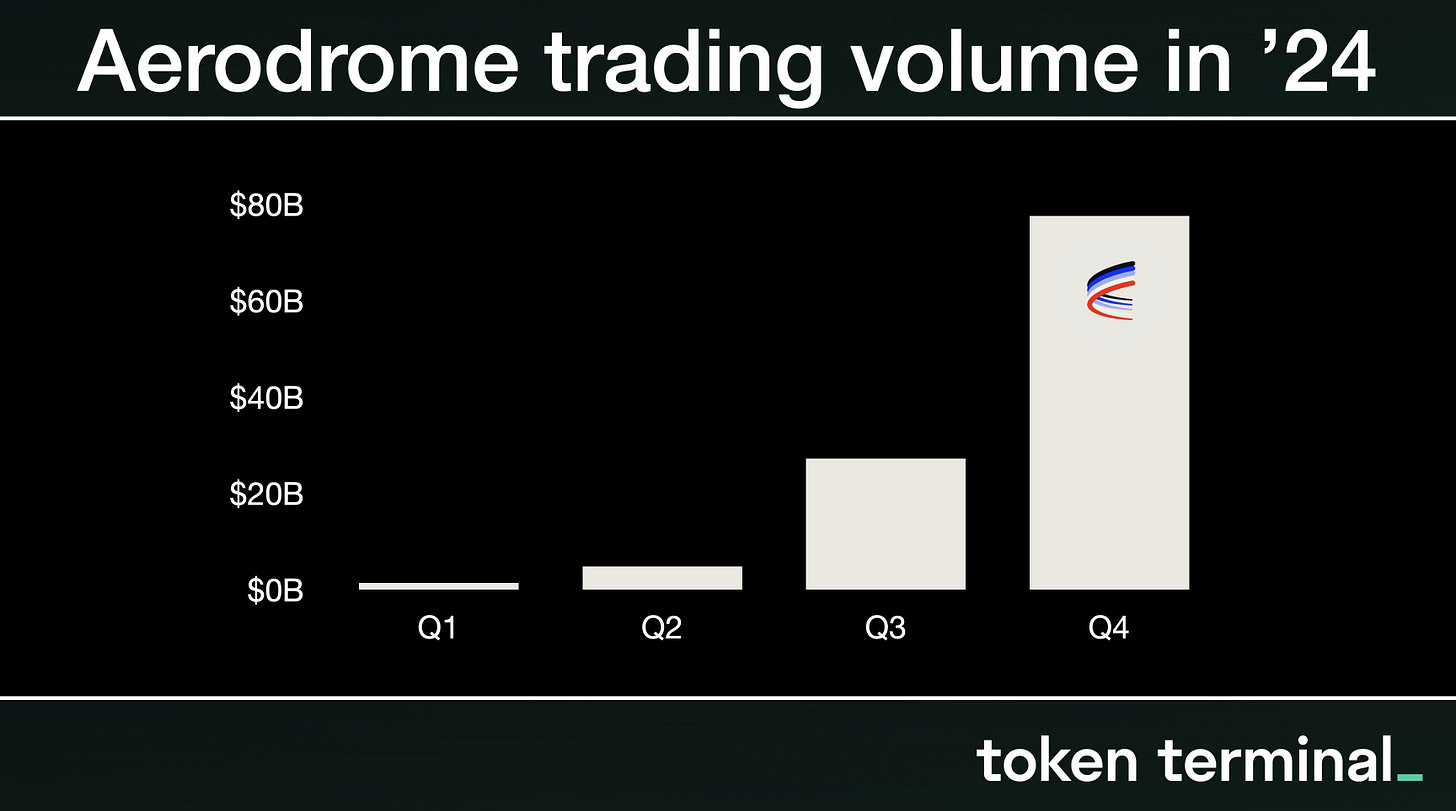

And the numbers speak for themselves:

$600M+ in rewards distributed to Base users.

$111B+ in trading volume processed (2024)

$1B in TVL, making it the largest DEX on Base.

60% of Base’s DEX volumes and 4% of global DEX volumes.

Its secret? The ve(3,3) model, where users lock AERO tokens for governance power, directing emissions and ensuring liquidity flows to where it’s most valuable. This is the core engine of Base’s DeFi success.

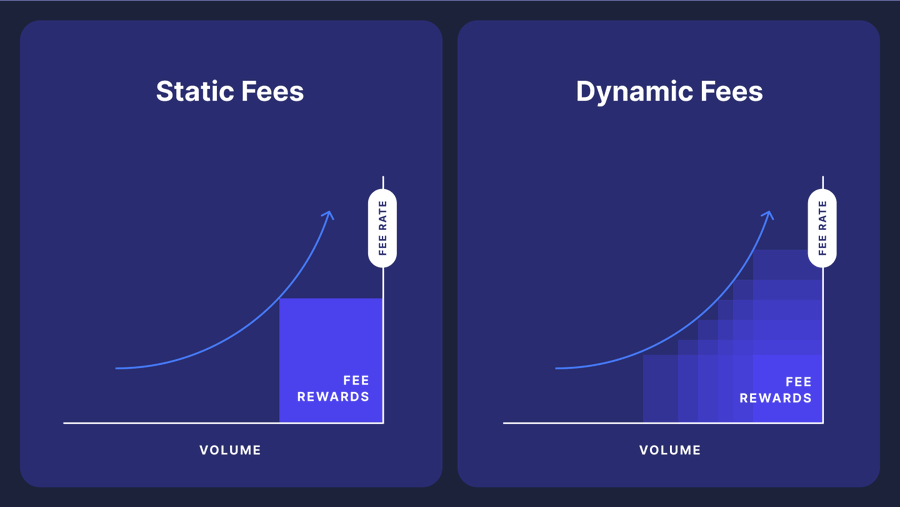

Slipstream V2: The Future of AMMs

Aerodrome is leveling up with Slipstream V2, a game-changing upgrade that introduces dynamic fees—a first for AMMs.

Volatile markets → Higher fees, capturing more value from price swings.

Stable markets → Lower fees, driving more volume and efficiency.

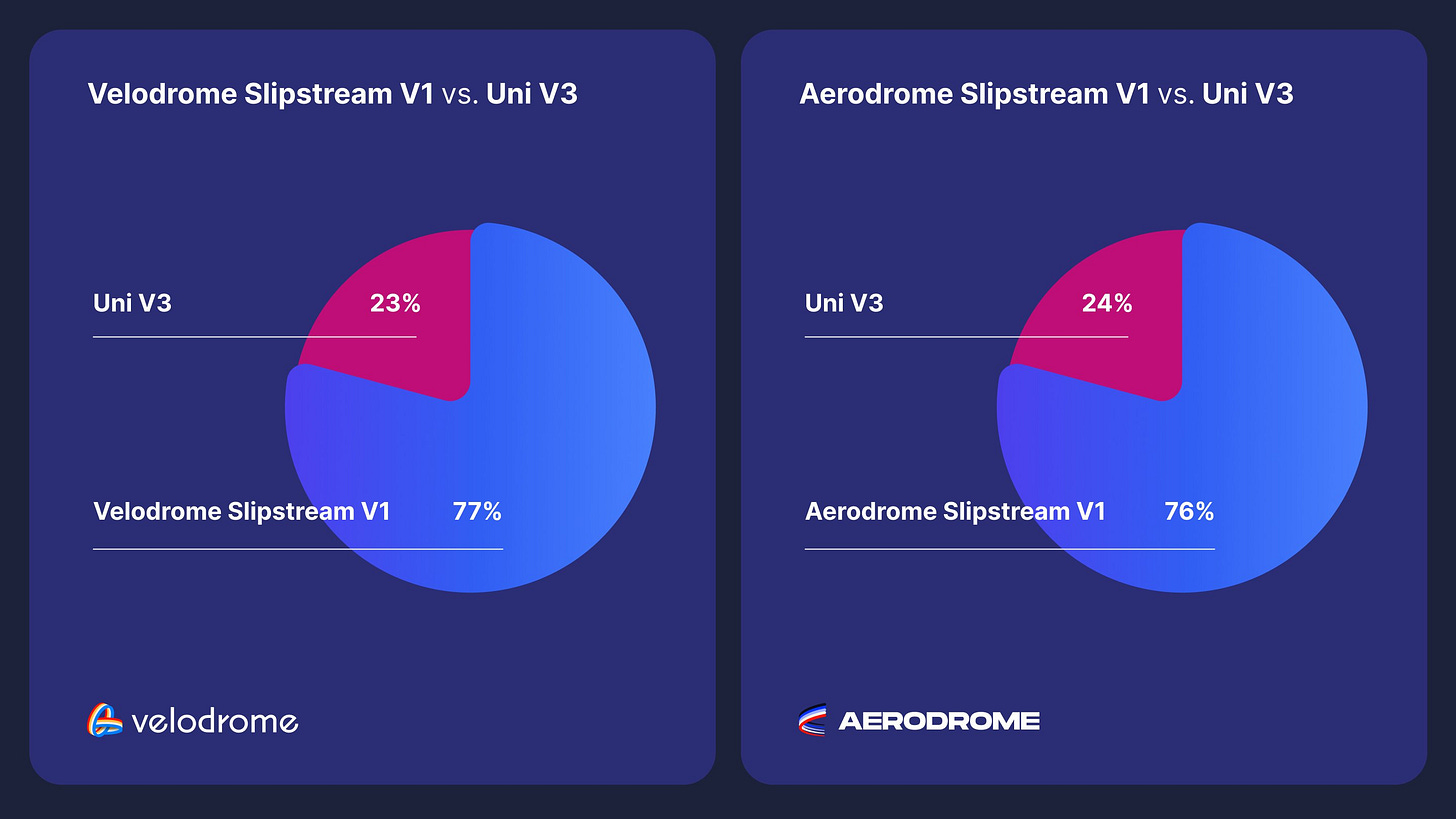

Slipstream V1 already outperformed Uniswap V3 with:

More concentrated liquidity, ensuring rewards go to the active tick.

Better incentives, with steady, predictable rewards.

Greater flexibility, with custom tick spacing and fee mapping.

V2 takes this to another level, ensuring maximum capital efficiency in all market conditions. This isn’t just an upgrade—it’s a paradigm shift for AMMs.

Velodrome: The Predecessor and Catalyst

Aerodrome was developed by the same team that developed Velodrome, a pioneer and a bluechip on Optimism.

Velodrome was the first major implementation of the MetaDEX model. With its vote-escrowed tokenomics and liquidity incentives, Velodrome became a core piece of Optimism’s DeFi infrastructure, demonstrating the viability of the MetaDEX model.

Battle-tested mechanics: Velodrome proved that the ve(3,3) model could efficiently distribute liquidity incentives while aligning incentives across stakeholders.

Cross-chain expansion: The success of Velodrome set the stage for Aerodrome on Base, allowing the model to be fine-tuned for a different ecosystem.

Interoperability with Base: As Base and Optimism share the OP Stack, liquidity and governance synergies between Aerodrome and Velodrome create a more cohesive DeFi landscape.

Governance and Incentive Model of the MetaDEX

At the heart of both Aerodrome and Velodrome is their governance-driven emissions model, which aligns incentives between liquidity providers, token projects, and governance participants.

veAERO and veVELO holders control emissions: Over 19,500 veAERO holders vote weekly on which liquidity pools receive AERO emissions, ensuring efficient liquidity allocation.

Reward distribution to voters: Unlike many DEX models, MetaDEX protocols distribute 100% of trading fees and additional incentives to ve token holders, reinforcing long-term participation.

Protocol-owned liquidity: By incentivizing deep, protocol-owned liquidity, both Aerodrome and Velodrome reduce reliance on mercenary capital and ensure sustainable market depth.

The MetaDEX’s Impact on the Broader Base Ecosystem

The MetaDEX model, spearheaded by Aerodrome and supported by Velodrome’s foundational work, has had far-reaching effects across Base:

A launchpad for new protocols: Emerging projects can establish liquidity pools, attract users, and seamlessly integrate into Base’s DeFi network.

Composability with other DeFi applications: The deep liquidity provided by the MetaDEX enhances lending protocols, yield aggregators, and trading strategies.

Sustainable incentives without external funding: Unlike many DeFi projects that rely on private funding rounds, the MetaDEX is entirely community-driven, funded through governance incentives (veAERO and veVELO rewards).

The MetaDEX and the Future of DeFi

The digital era is defined by one fundamental truth: if something can be distilled into code, it will be. Code, being weightless and globally accessible, demands less infrastructure and fewer intermediaries. This is the essence of DeFi: it eliminates traditional financial intermediaries and captures the full value of code by transforming complex systems into trustless, efficient, and transparent operations.

The MetaDEX model ensures a permissionless flow of value, distributing rewards based on real utility and long-term engagement. By removing intermediaries and fostering transparent governance, it creates a positive-sum economic system that benefits all participants.

Why Aerodrome, Velodrome, and MetaDEX Matter More Than Ever

As DeFi continues to evolve, sustainable liquidity models will be crucial for the next generation of financial applications. Aerodrome and Velodrome, built on the MetaDEX framework, represent a major leap forward, demonstrating how DeFi can efficiently allocate capital, reward participation, and drive real economic activity.

We talked about Slipstream V2 but the roadmap of Aerodrome is filled with others exiting changes :

With Base’s continued growth and adoption, Aerodrome is positioned to remain the cornerstone of its DeFi economy, while Velodrome continues to strengthen Optimism’s DeFi stack. Together, they set the standard for liquidity infrastructure on Superchain and beyond.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.