This Week's Newsletter - Case Study on KaitoAI, Main News of the Week, & Zoom on SocialFi

Weekly Alpha

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

The market is at a crossroads. Uncertainty is everywhere, and the Fear and Greed Index has swung into fear territory.

Bitcoin broke below key support levels, while Ethereum is at lows not seen since December 2023. The 1.8 billion-dollar outflows from Bitcoin ETFs signal that early investors are taking profits, and risk appetite is fading fast. Meanwhile, liquidations are piling up, and the CME gap looms below. Are we headed for a deeper flush, or is this just another shakeout before the next leg up?

There are always multiple factors behind a crypto market drop. While specific events can be attributed later in retrospect, it’s usually a mix of macroeconomic forces, market manipulation, and key technical levels.

This time, the drop is linked to tariffs.

Trade Tariffs: President Trump's announcement of new tariffs—10% on imports from China and 25% on those from Mexico and Canada—has introduced uncertainty.

One thing is clear: macro forces are in play. Nvidia’s earnings could have given the stock market a much-needed boost, preventing an even deeper drop, but the broader sentiment remains fragile. The SEC is shifting its stance, closing investigations into Coinbase and Gemini, and loosening its grip on parts of the industry. Regulatory clarity is long overdue, and any signs of relief could spark a new wave of institutional confidence.

Amid the uncertainty, one sector is making a lot of noise: SocialFi. And it’s all thanks to Kaito AI.

Kaito just reignited the SocialFi and the InfoFi narrative, pushing the idea that Web3-native social platforms will be the next big thing. No more platforms profiting off your engagement—Kaito flips the script, rewarding users directly for interactions, content creation, and community building.

This week, we’re diving into SocialFi with The Arena and Hub—two platforms that rides the Kaito wave. Both are betting big on decentralized social networks where users actually own and monetize their content. Could this be the breakout moment for SocialFi?

And we’re going even deeper on Kaito AI, the project behind this narrative explosion. With a decentralized AI-driven approach, Kaito is rethinking how crypto intelligence works, combining on-chain and off-chain data into one ecosystem. If AI is set to transform crypto, Kaito is trying to be at the center of it.

The market may be struggling, but narratives don’t stop moving. SocialFi is back in the conversation, AI keeps evolving, and regulatory shifts could change the game.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Also, you might have missed my latest post on Sonic Ecosystem:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into

Case Study on Kaito AI: Exploring how Kaito AI is reshaping the SocialFi narrative, leveraging AI-driven insights to revolutionize engagement and monetization in the crypto space.

Main News of the Week.

Zoom on SocialFi through The Arena & Hub: Breaking down how The Arena and Hub are pushing the boundaries of SocialFi, redefining user incentives, and creating new opportunities in decentralized social networks.

Today's Newsletter is brought to you by Mantle

You’re likely aware of the Bybit hack that occurred last Friday, February 21.

As always, I prioritize honesty with my community, which is why I’m selective about my partnerships.

Following the incident, I’ve been in touch with the Mantle team to ensure everything was fine and users safe. $MNT has shown impressive resilience, holding strong through the situation.

Bybit has handled the matter efficiently and is already making significant progress in repaying its debts. This was nowhere near an FTX-level event, it could even be forgotten already in a few weeks.

Mantle continues to stand firm, build, and remain unaffected.

And we saw the power of Blockchain.

When the Bybit exploit struck on Feb. 21, 2025, the industry saw blockchain's resilience in action: transaction data, visible on public ledgers, allowed stakeholders to track stolen funds within minutes. Blockchain’s immutable, public nature drives hyper accountability, pushing ecosystem players to act decisively.

Funds remained secure and fully backed for users on both Bybit and Mantle

Mantle is positioned at the forefront of this evolution, leveraging a strong network of partners, robust security practices, and cutting-edge infrastructure.

Mantle keeps building, and here are the Latest News ↓

Introducing the $cmETH Fixed Yield Vault: Earn an Additional 2% Fixed Yield

Looking for a fuss-free yield strategy? Earn an additional fixed yield of 2% on top of underlying Ethereum staking rewards (~3% APY) when you deposit into their $cmETH Fixed Yield Vault.

For many institutional and retail users, earning fixed $ETH returns is a more attractive option. To meet this demand, the cmETH Fixed Yield Vault will run for the next 6 months, offering a stable yet rewarding alternative—fixed annual yields on top of Ethereum staking rewards. Fixed yield rewards will be distributed in $wETH linearly, and users can claim their accumulated rewards at any time, as long as the amount is greater than zero.

How This May Impact You

Restaking protocol rewards across EigenLayer, Karak, Symbiotic, and Veda (including potential AVS and tech partner rewards).

Future Powder rewards (when Season 3 launches) for $COOK tokens.

Flexibility to put your $cmETH across L2 dApps for enhanced yield opportunities.

If you prefer to maximize exposure to future protocol rewards and maintain flexibility with your $cmETH, this vault may not be the best fit.

Season 2: Methamorphosis & COOK Feast Wrap-Up

Methamorphosis Season 2 & COOK Feast have officially ended, paving the way for Season 3.

mETH Protocol is now live on Guild, further expanding its ecosystem reach.

The $COOK supply distribution for Season 2 was structured to boost engagement and early adoption of $cmETH.

60% of the total $COOK token supply is allocated to community incentives, with 4% dedicated to Season 2 participants.

There will be no vesting period for this tranche of $COOK rewards.

Claiming Rewards

$COOK claims will open in March, with further details released through official channels.

$cmETH restaking rewards from Season 2 will be automatically accrued across EigenLayer, Symbiotic, Karak, and Veda.

Rewards from Symbiotic, Karak, and Veda are subject to their respective TGE timelines.

Users on Safe Wallet via Mantle L2 must authorize an EOA address to claim restaking rewards on Ethereum L1.

COOK Feast Rewards: If you locked $COOK for COOK Power, you can still claim rewards in March. Rewards are based on a time-weighted COOK Power formula.

With Season 3 already planned, Mantle is gearing up for further engagement campaigns and ecosystem expansions. A major new product launch is also on the horizon, adding another layer of growth for the Mantle ecosystem.

mETH & cmETH: Driving Institutional-Grade Staking Solutions

$mETH remains a top ETH liquid staking token, accruing ETH staking rewards and maintaining instant redeemability.

$cmETH optimizes restaking across EigenLayer, Symbiotic, Karak, and Veda, compounding staking yields for maximum capital efficiency.

In under two months, $cmETH has amassed over $600M in TVL, reinforcing its adoption.

Mantle Treasury's strategic restaking of 100K $mETH into EigenLayer resulted in 2.098M $EIGEN tokens being distributed to the community.

With its CeFi & DeFi integrations expanding, Mantle’s ecosystem is positioning itself as a leader in institutional-grade staking and restaking solutions.

Stay tuned for more updates as the landscape evolves.

Learn more about Mantle & its 2025 Roadmap with my thread on X

1/ Kaito AI: The Attention Economy Meets AI-Driven Crypto Research

Introduction

I already talked about Kaito a while ago on my X account.

The intersection of artificial intelligence, blockchain, and the attention economy is one of the most compelling narratives shaping the future of crypto. In a market driven by narratives, sentiment, and social influence, Kaito AI is positioning itself as a tool that not only delivers insights but also monetizes attention through AI-powered research.

Crypto has evolved beyond just trading—it’s about information asymmetry, influence, and social finance. The projects that win are often those that control attention.

The real question is: can Kaito AI become the go-to platform for distilling meaningful insights from the chaos of social-driven markets?

The Problem Kaito AI Solves

Crypto research is broken. Not because there isn’t enough data—but because there’s too much of it, and it’s scattered across fragmented, noisy platforms. The ability to filter signal from noise is now the most valuable edge in the industry.

Social platforms (X, Discord, Telegram) drive narratives and hype cycles.

On-chain data confirms movements but lacks context.

News and research reports are slow and often outdated by the time they reach the public.

The problem is clear: attention is the currency of crypto, but it’s inefficiently allocated. Kaito AI aims to fix this by acting as a Bloomberg Terminal for the attention economy, ensuring that traders and investors access the most relevant insights first.

In a world where a single influencer tweet can shift a token’s valuation, the ability to quantify and analyze social finance trends in real time is invaluable. Kaito AI steps in as an AI-powered intelligence layer that tracks where attention is flowing before the market reacts.

Key Features & Innovations

AI-Powered Search & Narrative Tracking

Instead of manually piecing together insights from X threads, Discord chats, and scattered research reports, Kaito AI’s Natural Language Processing (NLP) models do the work for you.

Want to know why a specific token is trending? Kaito AI provides context, not just sentiment scores.

Need a summary of key updates from an ecosystem? Instead of doom-scrolling, you get a structured, AI-generated digest.

Looking for emerging narratives before they hit mainstream? The algorithm tracks rising discussions across social media and forums.

The ability to surface under-the-radar narratives before they explode is where Kaito AI truly stands out. The reality is, many of crypto’s biggest trends—whether it was DeFi Summer, GameFi, or AI tokens—started in niche conversations before going mainstream.

Social Sentiment Meets On-Chain Movements

Most research tools either focus on on-chain analytics (wallet tracking, liquidity shifts) or off-chain discussions (social media, Telegram groups). Kaito AI combines both.

Why does this matter? Because narratives are formed off-chain, but they materialize on-chain.

If a project starts gaining significant social traction, but wallets tied to insiders are selling, that’s a red flag.

If an emerging sector (like RWA tokens) gains attention, and smart money starts accumulating, that’s an opportunity.

Kaito AI isn’t just showing sentiment scores—it’s providing actionable research based on the convergence of attention and capital flows.

Real-Time Trend Detection & Attention Metrics

We all know that crypto is attention-driven. But how do you measure it?

Kaito AI’s trend detection algorithms track not just mentions, but:

Engagement intensity: How deep are the conversations?

Influencer involvement: Are key players talking about it, or is it just bot activity?

Sustained vs. flash-in-the-pan interest: Is this a real trend or just short-term noise?

Traders already know that being early to narratives is one of the best alpha strategies. Kaito AI automates this process, making it easier to identify high-conviction opportunities.

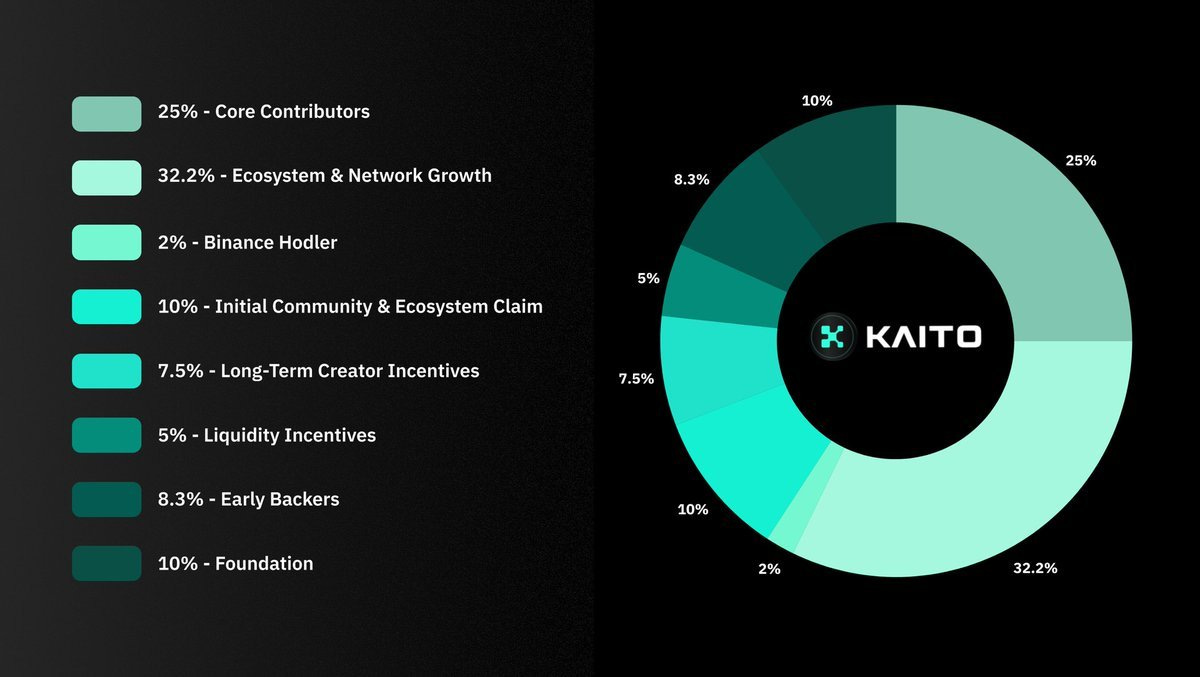

The Tokenomics of $KAITO

$KAITO was launched on Base, we talked about Base ecosystem & $KAITO Launch last week.

Unlike many projects that allocate 15-30% to VCs, Kaito has kept its allocation low, demonstrating a commitment to a more community-centric approach.

Airdrop Mechanism

Kaito AI has allocated nearly 20% of its total supply to airdrops and incentives.

The first airdrop distributed 10% of the total supply to early users, Genesis NFT holders, and ecosystem partners.

Yap Points were used to determine eligibility, minimizing bot farming.

The team ensured that locked tokens from investors/foundation/team cannot be staked to prevent market manipulation.

$KAITO isn’t just a speculative asset—it has a fundamental role in the platform’s economy 👇

Utility: $KAITO holders actively participate in shaping the network by influencing the distribution of attention within the AI-powered InfoFi ecosystem.

Staking Rewards

Incentive Mechanism: Researchers and content contributors could be rewarded in $KAITO once more, driving user-generated research.

Community Governance: $KAITO enables decentralized decision-making, allowing token holders to propose, vote on, and implement key protocol and algorithm changes. This governance mechanism ensures that the network evolves in alignment with its community’s interests, fostering a transparent and efficient AI-powered InfoFi ecosystem.

$KAITO's current valuation is robust, and the launch has been impressive.

From the beginning, its price trajectory has demonstrated consistent growth, maintaining an upward trend line and gathering strong momentum, despite a generally declining market. This isn't a fleeting surge; $KAITO is developing resilient strength, with buyers actively supporting it at various price points.

The real test? Adoption. If traders, institutions, and researchers find the insights valuable, $KAITO could evolve into a necessity rather than a speculative token. However, if engagement slows, the token’s demand could stagnate, limiting its price appreciation.

Challenges and Market Concerns

Insider Token Allocation

43.3% of $KAITO supply is held by insiders, including 35% for the team and 8.3% for early investors.

This raised concerns over potential sell-offs post-airdrop, reminiscent of previous cases where early adopters dumped their tokens.

Managing Airdrop Expectations

Some users who contributed to the platform expressed dissatisfaction with their airdrop rewards.

The strategy focused on merit-based distribution rather than mass giveaways.

Long-Term Token Viability

Many airdropped projects see high volatility, with initial price spikes followed by sharp declines.

Kaito AI aims to sustain demand through staking, governance, and real utility within the InfoFi ecosystem.

Yapper Launchpad

Community-Driven Decision Making

Kaito AI’s Yapper Launchpad empowers the community to decide which pre-TGE projects gain visibility, ensuring that the most promising projects receive attention and research coverage.

Basically it’s a game of attention, and a project gains attention when it has a dashboard on Kaito.

Staked Voting with sKAITO

The introduction of sKAITO enhances the voting system by rewarding long-term holders with greater influence. Voting power scales with the amount staked, holding duration, and engagement, incentivizing deeper participation.

Transparent and Impactful Selection

Every vote is publicly visible, acting as a signal for projects regardless of whether they launch. This transparency strengthens credibility and helps the market identify high-potential projects early.

Strengthening Pre-TGE Research

By focusing on pre-TGE projects, Yapper Launchpad addresses information asymmetry, creating a consensus layer for early-stage opportunities. This ensures that valuable projects gain traction through informed community input.

My Take on $KAITO

Let’s be real—crypto is an attention economy, and narrative trading is one of the most profitable strategies. The projects that capture and monetize attention effectively tend to win.

Kaito AI has a strong value proposition because it provides a structured way to analyze where attention is flowing, why it’s happening, and what the market implications are. The integration of AI-driven research with SocialFi mechanics makes it one of the more compelling AI projects in the space.

But execution is everything. If Kaito AI delivers a seamless, must-have research experience, it could become an indispensable tool for traders, funds, and analysts. If not, it risks being just another AI-driven hype cycle that fades away.

Staking $KAITO isn’t just about governance—it also comes with perks like voting power and social badges. The longer you stake, the more influence you have, which keeps the ecosystem driven by committed holders. On top of that, tiered badges (Gold, Silver, Blue) reward long-term stakers with status and future benefits. I like this approach because it makes staking more than just a passive move—it’s a way to stay involved and get recognized in the community.

Conclusion

Kaito AI is addressing one of the most valuable yet underdeveloped sectors in crypto: attention analytics and AI-driven research. The ability to track narratives, social finance trends, and on-chain validation in real time could be a game-changer.

If they execute well, Kaito AI could redefine how traders and analysts navigate crypto’s attention economy.

If adoption is slow or execution falters, it could struggle against more established analytics platforms.

In a space where information asymmetry is the ultimate edge, Kaito AI is one of the few projects actively working to make research more efficient.

The big question is: Will traders and institutions embrace it? Right now, it’s a high-potential bet—but only time will tell if it becomes an industry staple.

What do you think? Is Kaito AI set to dominate the AI-driven research space, or is it just another SocialFi experiment?

2/ Crypto & DeFi News

💪 GameStop buying Bitcoin would shake the market

GameStop Corp. (GME) received a letter from Strive Asset Management, urging it to invest its $4.6 billion cash reserves in Bitcoin. CEO Ryan Cohen confirmed the proposal from Strive's CEO, Matt Cole, for GameStop to buy Bitcoin and fund more purchases through market offerings.

John Haar of Swan Bitcoin commented that this "Leveraged Bitcoin Equity" (LBE) strategy would surprise traditional investors skeptical of GME and Bitcoin. GameStop, a key player in the 2020–2021 meme stock surge, saw a peak rise of 11,500%, impacting Wall Street short sellers.

Cole suggests issuing new equity and convertible debt to buy more BTC, closing unprofitable stores, and boosting online sales to make GameStop a market leader resistant to inflation. He advises a Bitcoin-only approach to enhance GameStop's image as disciplined. Cohen recently met with Michael Saylor, whose firm has a $44.2 billion Bitcoin position, influencing companies like Metaplanet and Semler Scientific.

Thoughts

If GameStop were to embrace Bitcoin as a treasury asset, it could spark a wave of interest in BTC adoption among retail-focused firms. The proposal mirrors Michael Saylor’s Bitcoin playbook, which turned Strategy into a de facto Bitcoin holding company, dramatically boosting its market value. However, GameStop’s core business model differs significantly, making its ability to sustain a BTC-centric strategy uncertain.

While Bitcoin accumulation could serve as an inflation hedge, leveraging equity to buy BTC introduces significant financial risks, especially in volatile markets. GameStop’s history as a meme stock means it already experiences extreme price swings, and adopting Bitcoin could amplify this volatility. Institutional investors may also be skeptical of such a shift, particularly if the company’s core retail operations remain under pressure.

However, if GameStop were to take this step, it would likely draw retail traders and crypto enthusiasts into its stock, mirroring past speculative frenzies. The broader question remains: would this be a long-term value play or another high-risk bet in line with its meme stock origins? Regardless, any move in this direction would further entrench Bitcoin’s position as a corporate treasury asset, potentially influencing other firms on the sidelines.

👀 Stablecoin competition heats up as MEXC invests $20M in Ethena’s USDe

MEXC has invested $20 million in Ethena’s synthetic dollar stablecoin, USDe, as part of a broader push for stablecoin adoption. The exchange also allocated $16 million to Ethena Labs and launched a $1-million reward pool to boost USDe trading and staking.

USDe, now the third-largest stablecoin with a $5.9 billion market cap, differentiates itself by using a hedging strategy backed by crypto assets. Ethena recently secured $100 million in funding, reportedly through a private sale of its governance token, ENA, with backing from major investors like Franklin Templeton. The project aims to develop a blockchain and token for traditional finance.

Momentum for yield-bearing stablecoins is growing. Ethena currently offers USDe holders a 9% yield, while the SEC recently approved Figure Markets’ YLDS, the first regulated yield-bearing stablecoin, which will offer 3.85%. The stablecoin sector now exceeds $220 billion, with Tether’s USDt maintaining dominance at over $140 billion in circulation.

Thoughts

MEXC’s investment signals growing institutional confidence in synthetic stablecoins, particularly as yield-bearing models gain traction. Ethena’s ability to attract major investors suggests that USDe could challenge traditional stablecoins like USDT and USDC, especially among DeFi users seeking yield.

However, reliance on hedging strategies introduces counterparty risk, making regulatory scrutiny a potential hurdle. The increasing competition in the stablecoin market also raises questions about long-term sustainability—whether projects can maintain attractive yields without compromising stability. If Ethena succeeds in integrating with traditional finance, USDe could become a major player, but it will need to navigate evolving regulatory landscapes and market volatility.

🛬 Leveraged MicroStrategy ETF down 81% since November

The T-REX 2X Long MSTR Daily Target ETF (MSTU) has dropped about 81% since its November peak, per The Kobeissi Letter. In the last three sessions, MSTU fell 40%, while Strategy’s stock (MSTR) decreased 20%. Leveraged ETFs like MSTU are riskier because they rebalance daily and rely on financial derivatives, leading to underperformance in volatile markets. A GSR Markets study found leveraged ETFs can underperform by over 20% during high volatility. Despite the risks, interest in leveraged MSTR ETFs remains strong. REX Shares and Tuttle Capital Management launched MSTU and its inverse counterpart, MSTZ, in September. Defiance's similar ETF saw $22 million in first-day trading volume, possibly a record per Bloomberg's Eric Balchunas. Strategy shifted from business intelligence to Bitcoin investments in 2020 under founder Michael Saylor.

The company has accumulated over $33 billion worth of BTC at an average price of $66,000 per coin, currently holding an unrealized profit exceeding $10 billion. While MSTR had surged 2500% at its peak in November, it is now down 15% year-to-date, primarily due to Bitcoin’s February price correction.

Thoughts

The sharp decline in MSTU highlights the inherent dangers of leveraged ETFs, particularly in volatile markets. These products amplify both gains and losses, but their structural inefficiencies—such as daily rebalancing costs—make them prone to underperformance over time. The recent drawdown serves as a reminder that leveraged ETFs are short-term trading instruments rather than long-term investment vehicles.

Despite MSTU’s losses, strong demand for leveraged exposure to MSTR suggests continued retail enthusiasm for Bitcoin-adjacent stocks. Strategy's massive Bitcoin holdings have turned it into a de-facto BTC hedge fund, and its stock price remains highly correlated with BTC movements. However, as seen in February’s correction, Bitcoin’s volatility directly impacts MSTR, and by extension, leveraged ETFs tied to it.

For investors, the lesson is clear: while leveraged ETFs can offer high returns in bullish conditions, they are exceptionally risky during pullbacks. Given MSTR’s long-term Bitcoin strategy, traders might find traditional exposure to the stock or BTC itself to be a more stable alternative, particularly in uncertain market conditions.

🏆 Uniswap announces end of investigation from the SEC

Uniswap Labs announced that the SEC has ended its investigation into the firm without pursuing enforcement action. The probe, which began under former SEC Chair Gary Gensler, had been ongoing since April 2024.

Calling it a “huge win for DeFi,” Uniswap said the decision reaffirms that its technology operates within legal boundaries. While the SEC has not made an official statement, similar cases against Coinbase, Robinhood Crypto, and OpenSea were also reportedly dropped.

The move aligns with broader shifts in the SEC’s stance on crypto. Recent filings suggest the commission is exploring regulatory changes, with Commissioner Hester Peirce advocating for a new approach once a Senate-confirmed chair is in place. Reports indicate the SEC may pause or withdraw other enforcement cases, including its appeal against Ripple Labs.

Thoughts

The SEC stepping back from Uniswap may signal a shift in crypto regulation. DeFi protocols, long under regulatory uncertainty, might now face less aggressive enforcement. This could boost institutional confidence in DeFi, previously hindered by regulatory risks. Clearer guidelines may lead to increased institutional adoption and liquidity.

Questions remain: Is this a temporary move due to SEC politics or a lasting change? With Project 2025 and a potential new SEC chair, crypto policy might keep evolving, especially if crypto-friendly leadership focuses on innovation over enforcement.

At the same time, regulatory clarity is still lacking. While enforcement actions may be slowing, the lack of formal guidelines for DeFi leaves room for uncertainty. The industry needs proactive engagement with regulators to shape policies that balance compliance with decentralization. Without clear rules, future administrations could easily reverse course and resume enforcement actions.

For now, this is a positive development for DeFi, but the long-term impact depends on whether the SEC follows through with meaningful regulatory reform or simply delays further action.

🚀 Nasdaq files to list Grayscale Polkadot ETF

Nasdaq has filed to list a Grayscale Polkadot ETF, adding to the growing number of altcoin ETFs awaiting SEC approval. If approved, the fund would allow investors to gain exposure to Polkadot’s native token (DOT) through a regulated exchange-traded product.

Grayscale already operates Bitcoin and Ethereum ETFs and has applied for ETFs holding Solana, Litecoin, XRP, Dogecoin, and Cardano. It is also pursuing a diversified crypto ETF with multiple altcoins.

The SEC must review and approve these applications before trading can commence. The regulatory agency has historically been cautious about altcoin ETFs, though recent developments—such as the approval of Bitcoin and Ethereum ETFs—suggest a potential shift in stance.

Bloomberg Intelligence currently estimates that an XRP ETF has a 65% chance of approval, while Solana and Litecoin ETFs have 70% and 90% odds, respectively.

Thoughts

The push for altcoin ETFs is crucial for crypto markets. While Bitcoin and Ethereum ETFs are approved, a Polkadot ETF and others could widen institutional access to various digital assets. For Polkadot, an ETF listing would boost its profile, liquidity, and recognition, potentially giving it a stronger position against Ethereum and Solana. Cardano and Litecoin might also gain from new investments if their ETFs get the green light.

However, the SEC's position on altcoin ETFs is unclear. Bitcoin and Ethereum are seen as commodities, but other cryptocurrencies face regulatory uncertainty. Approval could depend on decentralization, network security, and legal history, like XRP's case with the SEC.

Political factors also play a role. The SEC has been more lenient since Trump’s re-election, hinting at less enforcement and a friendlier crypto stance. If this continues, we might see several altcoin ETFs approved soon, boosting institutional involvement in DeFi and Web3.

Overall, Grayscale’s Polkadot ETF filing is a sign that the industry is pushing for wider acceptance beyond Bitcoin and Ethereum. If approved, it could further legitimize the altcoin market and accelerate adoption—but regulatory uncertainty still looms over the timeline and outcome.

3/ The Rise of SocialFi: The Arena and Hub Leading the Charge

Kaito's success has ignited a fresh surge in SocialFi projects.

Until now, mostly two projects have been making waves in the Narrative, Lens and Farcaster. (If we set aside the FriendTech debacle).

Seems like now SocialFi (Social Finance) could reemerge as a promising trend, combining the power of social networks and decentralized finance (DeFi) to create a new connected world where users control and benefit from their content. As blockchain technology reshapes social interactions, SocialFi platforms are unlocking novel monetization models, empowering users, and fostering decentralized communities.

Today, we'll dive into two ambitious contenders 👇

What is SocialFi?

SocialFi blends social networking with financial incentives by leveraging blockchain technology. Unlike traditional social media platforms controlled by centralized entities, SocialFi applications allow users to own their data, monetize their content, and participate in governance.

Key Features of SocialFi:

Decentralization: Operates on blockchain, eliminating control by a single entity.

Data Ownership: Users have full control over their personal data and interactions.

Monetization: Creators can earn from engagement, interactions, and community participation.

Community Governance: Users influence platform development through DAOs.

Transparency: Transactions are recorded on-chain, ensuring trust and accountability.

With multiple SocialFi projects emerging, two standout platforms are The Arena and Hub, each offering unique approaches to decentralized social networking;

The Arena: Tokenizing Social Influence

What is The Arena?

The Arena is a SocialFi platform built on Avalanche, designed to tokenize social influence by allowing users to buy and sell Tickets—a representation of their relevance on the platform. Unlike traditional social media, where engagement is measured in likes and retweets, The Arena introduces a market-driven system where influence has monetary value.

Each user has their own Ticket, which can be freely traded, and its price fluctuates based on market demand. This means that individuals with high engagement and growing influence can see their Tickets appreciate in value, rewarding them financially for their online presence.

The Arena introduces a new financial layer to social media interactions, allowing users to not only engage with their favorite creators but also invest in their growth, speculate on rising influencers, and participate in an incentivized social economy.

How The Arena Works

Onboarding: Connecting Social Identity to Web3

To start using The Arena, users need to link their X account and connect a Web3 wallet. This ensures that:

Their social activity can be tracked and tokenized.

Earnings, airdrops, and trades can be seamlessly processed on-chain.

They have full ownership over their influence and rewards.

This wallet integration allows The Arena to operate as a trustless, decentralized platform, where transactions are settled transparently and without intermediaries.

Ticket System: The Core of The Arena’s Economy

Each user has a Ticket, which functions similarly to a personal stock. These Tickets can be:

Bought – Users can purchase the Ticket of any individual they believe will increase in influence.

Sold – If a user no longer sees value in holding a particular Ticket, they can sell it for a profit or minimize losses.

Held – Users can choose to hold onto their Tickets, betting on long-term influence appreciation.

The price of a Ticket is determined algorithmically, fluctuating based on supply and demand. As more people buy a Ticket, its price increases. Conversely, if people sell or lose interest in a particular influencer, the Ticket price declines.

This model introduces a gamified social economy, where speculation and engagement drive value creation.

Earning Mechanisms: How Users Make Money

The Arena enables multiple earning opportunities for both content creators and regular users:

Profiting from Your Own Ticket

As a user’s influence grows (measured by their social engagement and activity), demand for their Ticket increases, raising its price.

Early adopters who bought the Ticket at a low price can sell for a profit.

Holding Other Users’ Tickets

Users can invest in emerging influencers, holding onto their Tickets and selling them later at a higher price.

Just like traditional investing, identifying undervalued creators before they gain traction can lead to significant returns.

Tipping System

Users can send AVAX directly to content creators as a form of appreciation or patronage.

Unlike traditional tipping on social platforms, The Arena enables on-chain transactions, ensuring immediate payouts with no middlemen fees.

This multi-faceted approach makes The Arena more than just a social platform—it’s a financialized engagement ecosystem where every interaction has the potential for monetary upside.

Airdrops & Incentive Farming

To further encourage participation and engagement, The Arena distributes weekly airdrops to users based on their activity and influence.

How to Qualify for Airdrops

Users are rewarded for:

Engaging with content – Liking, retweeting, and commenting on posts.

Referring new users – Bringing in fresh participants strengthens the ecosystem.

Trading Tickets – Active participants in the Ticket marketplace are prioritized for larger rewards.

These incentives help sustain platform growth and ensure that the most engaged and strategic users are continuously rewarded.

Who Earns the Most?

Top influencers – Users with the highest Ticket demand receive larger payouts.

High-volume traders – Those who frequently buy and sell Tickets benefit from compounded rewards.

Loyal, active users – Consistently engaging with The Arena increases long-term earnings.

This model gamifies social engagement, making participation financially rewarding in addition to being interactive.

Why The Arena Stands Out

The Arena successfully merges social engagement with DeFi, offering users tangible rewards for their online presence. The platform has seen early adopters capitalize on its growth, creating a strong and loyal community.

Key Metrics:

📈 Market Cap Growth: From $8M → $23M peak, currently at $15M.

🔒 Total Value Locked (TVL): 38,000 AVAX.

📊 Trading Volume: High and consistent Ticket transaction activity.

With a rapidly expanding user base and strong financial incentives, The Arena is positioning itself as a dominant force in SocialFi.

Hub: Reinventing Social Engagement with Web3

What is Hub?

Hub is a Web3-native SocialFi platform that integrates decentralized identity, monetization, and AI-driven community tools. Unlike The Arena, which focuses on trading social influence, Hub prioritizes user reputation and credibility in decentralized interactions.

How Hub Works

Each day, the Hub x account will pose a question aimed at gathering insightful responses that contribute to the ongoing training of the AI Agent. This interactive approach not only enhances the AI's learning but also fosters a vibrant community of engaged and curious minds.

The smartest your answer is and the more IQ point you will earn and IQ points will be converted into $HUB token after TGE.

Decentralized Identity (DID) Creation: Users register a blockchain-based identity that remains portable across platforms.

Reputation System: Activity on the platform contributes to a reputation score, which influences earning potential.

Earning Mechanisms:

Users receive Hub tokens for creating high-quality content.

Participation in governance and community-driven activities increases rewards.

AI-powered content curation boosts visibility for reputable creators.

Airdrop & Incentives Farming:

Users who maintain high engagement and positive reputation scores receive regular token distributions.

Governance participants and community moderators get additional incentives.

Staking Hub tokens within the ecosystem amplifies reward earnings.

Why Hub Stands Out

Hub’s focus on decentralized identity and credibility scoring differentiates it from speculative SocialFi projects. By rewarding meaningful engagement over hype, Hub is creating a more sustainable Web3 social network. As blockchain-based reputation systems gain traction, Hub’s approach could become a standard for decentralized social media.

The Future of SocialFi : The Arena vs. Hub

Which Model Will Prevail?

The Arena thrives on fast-paced social trading, appealing to users who seek speculative gains and want to leverage their influence for financial rewards.

Hub, on the other hand, focuses on sustainable engagement, rewarding users for long-term credibility and meaningful participation.

Both models cater to different types of users:

Traders and influencers might prefer The Arena’s speculative opportunities.

Professionals and thought leaders may lean toward Hub’s reputation-driven ecosystem.

SocialFi’s Next Wave

SocialFi is redefining digital interactions by giving users ownership, rewards, and governance rights. The Arena and Hub showcase two distinct approaches—one built on social influence speculation, the other on reputation-based engagement. As blockchain social networks evolve, investors and users alike should monitor these platforms, assessing their long-term viability and impact.

With SocialFi positioned as a major blockchain growth driver, The Arena and Hub could be at the forefront of this transformation, shaping the next era of decentralized social interactions.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.