Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

The market just pulled a classic bait-and-switch. One moment, Trump announces a strategic crypto reserve, and everything pumps—Bitcoin, Ethereum, alts. Sentiment flips bullish again, and for a brief moment, it feels like the next leg up is finally here. Then, just as quickly, it all comes crashing down. New tariffs hit, and every gain gets wiped out. This kind of volatility isn’t new, but this time, it’s not just another market correction. It’s a battle between macro forces and market momentum, and the stakes are higher than ever.

We've faced these kinds of upheavals before; however, this cycle might be unique. Trump is playing the long game, having just assumed office. His initial actions focus on gaining leverage—using tariffs now to negotiate from a position of strength later. It mirrors his first-term strategy, setting up to replicate it. This time, though, crypto isn’t merely another speculative asset. It has integrated into the system. The White House is holding its first crypto summit. Agencies that long aimed to stifle the industry are now retreating. Endless lawsuits are dissolving. The message is unmistakable: crypto has transitioned from a fringe idea to a crucial component of global finance.

Simultaneously, the Federal Reserve is nearing a pivotal moment. There are $7 trillion poised in money market funds. As soon as the Fed reduces interest rates, that liquidity will rush into risk assets. The shift won't be immediate but will reverberate across all markets. Institutional interest is steadily climbing. While some Bitcoin ETF investors may have taken profits, the existence of such products signifies market maturity. The next phase of adoption isn’t fueled solely by retail speculation—major players are strategically aligning for the future.

But there’s a reality that can’t be ignored : Every win comes at someone else’s expense. The ones who make it aren’t just riding the obvious narratives. They’re getting ahead of the next wave before it fully forms.

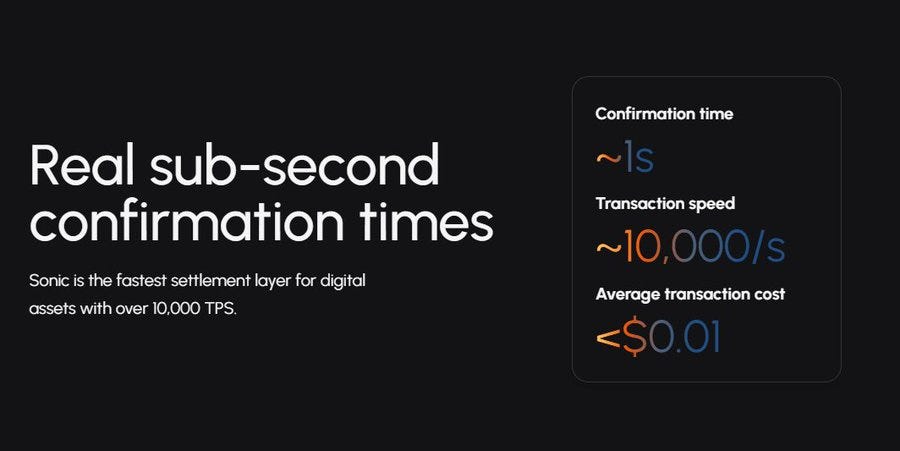

Sonic is back. What was once Fantom has now rebranded and evolved into a next-generation Layer1 blockchain built for speed and scalability. It’s no longer just an iteration of its past—it’s a complete transformation. The network has been rebuilt with a focus on performance, boasting over 10,000 transactions per second with near-instant finality. It’s designed for DeFi, gaming, AI-driven applications, and any high-performance use case that needs more than what Ethereum can currently offer.

But what really sets Sonic apart is the timing. Sonic is positioning itself as the blockchain that can actually support the kind of demand that’s coming. While Solana has led the way in high-speed blockchain infrastructure, Sonic is taking a different approach—one that doesn’t sacrifice decentralization for performance. The architecture is built on a DAG-based consensus model combined with the SonicVM, a system designed to optimize throughput while maintaining security. It’s not just hype; the underlying tech is built for real-world applications.

The market is already starting to take notice. Developers and investors who had moved on are beginning to return. Liquidity is coming back in. And to accelerate adoption, Sonic is rolling out one of the biggest airdrops of the year. With 190 million $S tokens set to be distributed to early adopters, there’s a clear effort to reignite the ecosystem and bring fresh activity onto the network. This isn’t just about rewarding past users—it’s about setting the stage for future growth.

There’s a bigger picture unfolding here. The market is in flux, and the macro landscape is shifting. Trump’s policies, Federal Reserve decisions, and institutional positioning will shape the next phase of this cycle. Some narratives will fade away, while others are only just beginning.

This week, we’re breaking down everything you need to know about Sonic, its transformation, and why it’s shaping up to be one of the most interesting project in crypto. There’s a lot happening under the surface, and those who pay attention now will be the ones best positioned when the next big move happens.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into :

Deep Dive on Sonic: Exploring how Sonic is redefining Layer1 scalability, leveraging cutting-edge technology to drive efficiency, speed, and innovation in the decentralized ecosystem.

Main News of the Week.

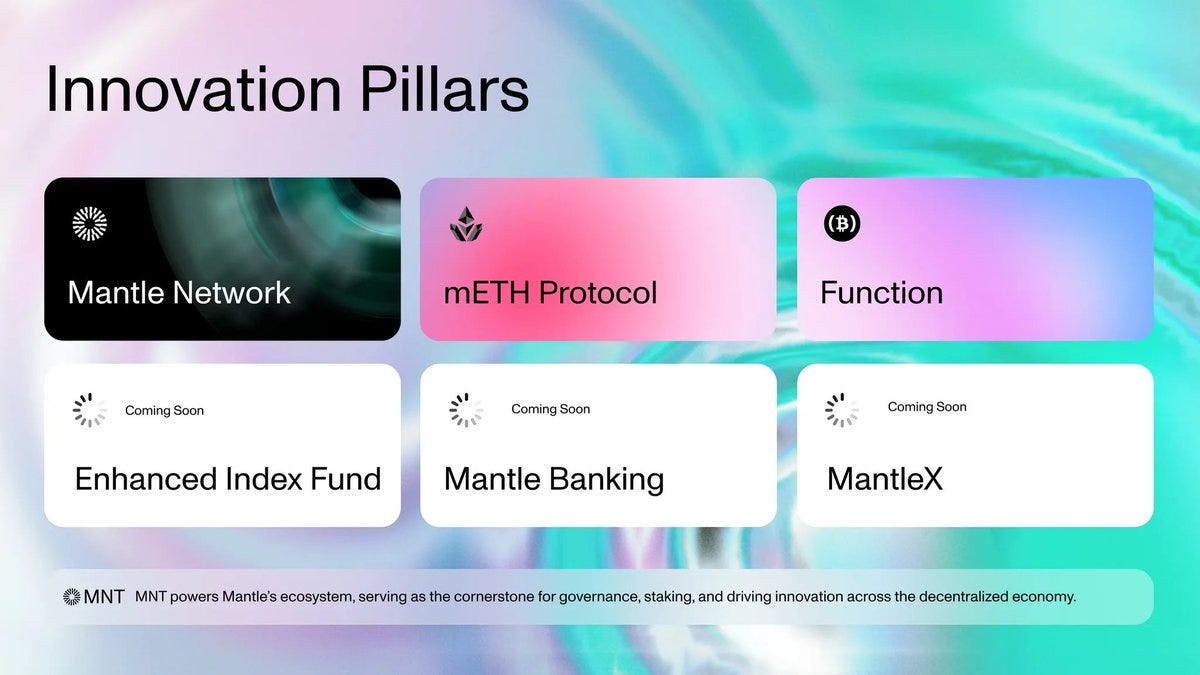

Today's Newsletter is brought to you by Mantle

For years, crypto has struggled to attract a broader audience beyond seasoned traders. Mantle is tackling this head-on with two ambitious initiatives:

Enhanced Index Fund: A simplified way to gain exposure to major crypto assets (BTC, ETH, SOL) while earning staking rewards—all within a single fund.

Mantle Banking: Aiming to create a crypto-first financial ecosystem, this initiative could leverage Bybit’s vast user base and Mantle Network’s DeFi capabilities to offer blockchain-based financial services, eliminating traditional banking fees in the process.

These efforts highlight the increasing overlap between fintech and crypto, echoing how companies like Stripe and Robinhood have expanded into digital assets.

Enhanced Index Fund – A Smarter Approach to Crypto Investing

Navigating the crypto market remains daunting for many investors. While traditional index funds have simplified investing in stocks, their crypto counterparts often fall short due to the preference for direct asset ownership.

Mantle’s Enhanced Index Fund aims to bridge this gap by:

Offering exposure to assets like BTC, ETH, and SOL.

Utilizing yield-generating tokens such as mETH, bbSOL, sUSDe, and AUSD to create passive income streams.

Automating portfolio rebalancing to ensure optimal asset allocation.

This fund provides a streamlined entry point for both retail and institutional investors seeking diversified, yield-bearing crypto exposure.

Mantle Banking – Reshaping Financial Services with Crypto

Digital-first banks, or neobanks, have disrupted traditional banking by offering online-first solutions with reduced fees. The rapid expansion of this sector—growing at an annual rate of 49%—demonstrates the rising demand for alternative financial services.

Why crypto matters for banking:

Stablecoins are revolutionizing global transactions with lower costs and faster speeds.

Crypto platforms provide real-time interest rates that often surpass traditional banking.

Blockchain removes intermediaries, making financial services more efficient and accessible.

Mantle Banking aims to harness these benefits by:

Eliminating costly banking fees.

Integrating DeFi yield-generating strategies.

Offering seamless blockchain-based services, from payments to lending.

While the finer details are still unfolding, Mantle Banking’s potential is amplified by Bybit’s massive user base and Mantle Network’s infrastructure, setting the stage for a comprehensive crypto-native financial ecosystem.

Treasury/Financial Overview

Fintech firms are aggressively stepping into the crypto landscape:

Stripe acquired Bridge.xyz for $2.1 billion to enhance its stablecoin infrastructure.

Robinhood has launched a crypto wallet and expanded its asset listings.

Revolut facilitates crypto transactions and is developing its own stablecoin.

Klarna, which handles $100 billion annually, is integrating crypto solutions.

While fintech firms are making significant inroads into crypto, the reverse hasn’t been as prominent. However, that’s changing:

Utopia Labs (acquired by Coinbase) enables US retail investors to access AAVE yields.

Legend is simplifying the DeFi onboarding process.

Mantle Banking, led by Bybit Co-Founder Yaxi Zhu, is positioning itself as a user-friendly, crypto-first financial ecosystem.

Conclusion: Why This Matters

Traditional finance is built on stability and compliance, fintech is designed to innovate within regulatory frameworks, and crypto pioneers new financial paradigms. Initially, crypto was seen as highly volatile and experimental, but today’s DEXs, lending protocols, and liquid staking solutions have achieved product-market fit, with substantial trading volumes to back them up.

Mantle’s initiatives—Enhanced Index Fund and Mantle Banking—are strategic moves to expand crypto’s reach. They pave the way for broader adoption, acting as a bridge between fintech and DeFi while making crypto-powered financial services more accessible.

As fintech continues embedding itself in the crypto landscape, it’s time for crypto to make its mark on fintech.

1/ Deep Dive: Sonic - The Future of Modular Liquidity

Introduction

Sonic is the evolution of Fantom, an established Layer1 blockchain that has undergone a dramatic transformation to position itself at the forefront of the DeFi space. This evolution stems from the need to address fundamental blockchain challenges such as scalability, security, and efficiency, which have historically hindered the widespread adoption of DeFi.

Originally launched as Fantom Opera, the network gained a reputation for its high throughput, low fees, and robust developer ecosystem. However, as competition intensified with the rise of new-generation Layer2s and modular blockchains, Fantom faced the challenge of remaining relevant. Enter Sonic, a rebranded and technically enhanced version of the Fantom network, designed to push the boundaries of blockchain performance and usability.

A key figure behind this transformation is Andre Cronje, a well-known developer and pioneer in DeFi, who has played a crucial role in shaping Sonic’s roadmap. His expertise, combined with Fantom’s proven track record, has positioned Sonic as a compelling alternative in the Layer1 landscape.

Sonic boasts significant improvements in transaction speeds, validator efficiency, and liquidity incentives, all while maintaining the Ethereum Virtual Machine (EVM) equivalence that ensures seamless onboarding for developers and users. The network operates on a directed acyclic graph (DAG) consensus model and features asynchronous Byzantine fault tolerance (aBFT) to achieve high scalability without compromising security.

With a massive $S token airdrop (190 million tokens) underway, Sonic has captured the attention of DeFi enthusiasts and liquidity providers. This deep dive explores Sonic’s architecture, its expanding DeFi ecosystem, and how it stacks up against competing Layer1 and Layer2 solutions.

Sonic’s Technical Foundation

Network Overview

Sonic’s name speak for itself, it has been architected to achieve over 10,000 transactions per second (TPS) while maintaining ultra-low transaction fees.

It achieves this through several key innovations:

DAG-based Consensus: Unlike traditional blockchain architectures, Sonic utilizes a directed acyclic graph (DAG) model, reducing congestion and improving finality times.

aBFT Consensus: Enhancing security and allowing transactions to be processed asynchronously without compromising network integrity.

Sonic Virtual Machine (SonicVM): An optimized execution environment designed to outperform standard EVM processing while remaining fully compatible with Ethereum-based dApps.

Live Pruning Database Storage: A revolutionary technique that significantly reduces validator storage requirements, making node operation more efficient and cost-effective.

The Sonic Gateway, managed by a 2/4 multisig Safe, serves as the primary bridging mechanism from Ethereum for the network. While this introduces a degree of centralization risk, it ensures operational security and efficiency.

Decentralization and Validator Network

Sonic has a well-balanced validator network with 36 active nodes securing the blockchain. While this is a notable level of decentralization, the reliance on a single node client does pose a potential long-term risk.

The FeeM system is another great aspect of Sonic’s tokenomics.

Sonic's FeeM system is designed to provide developers with a sustainable income by redistributing up to 90% of the network fees generated by their applications back to them. This model mirrors Web2 ad-revenue strategies, aiming to incentivize developers to build high-usage dApps on the Sonic network.

However, this design has implications for validator incentives, which must be carefully managed.

Learn more about the FeeM system.

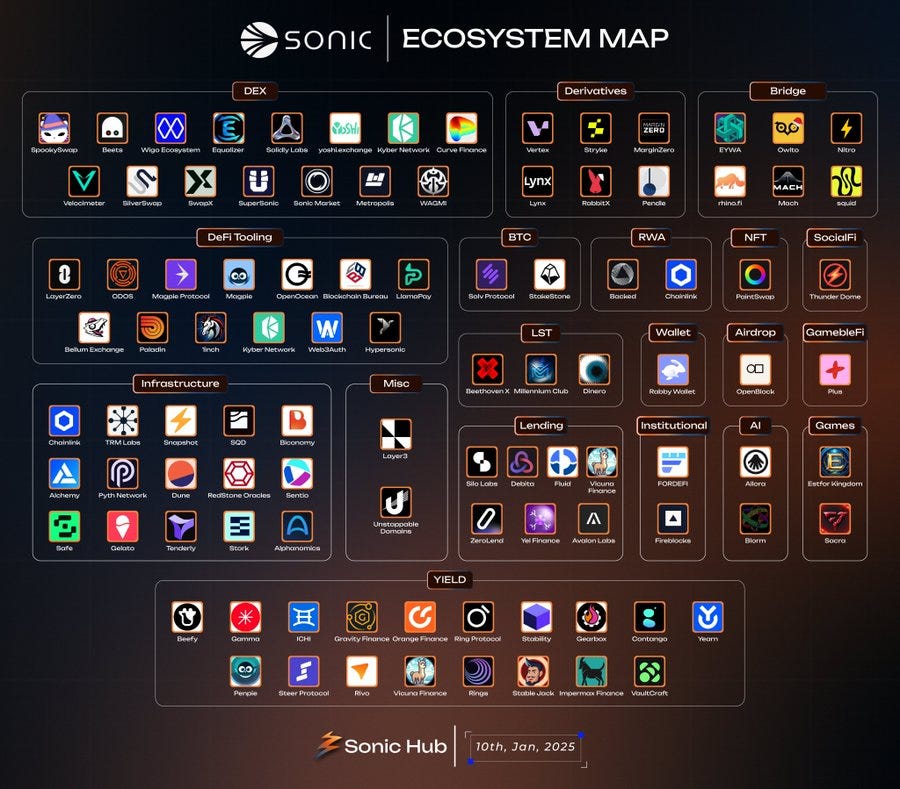

Sonic’s Expanding DeFi Ecosystem

Major DeFi Integrations & Yield Strategies

Sonic’s ecosystem is rapidly growing, with major DeFi protocols integrating to provide users with lending, stablecoin yield farming, liquidity management, and derivatives trading.

If you want to see the last news and parterships on Sonic.

And here to check out the complete ecosystem roundup.

Aave on Sonic: Data-Driven DeFi Lending

Aave V3's deployment on Sonic leverages the network's high-throughput capabilities, aiming to redefine DeFi lending with significantly reduced costs and increased efficiency. Sonic's ability to process 10,000 transactions per second (TPS) and achieve sub-second finality directly translates to lower gas fees and faster transaction confirmations, crucial for time-sensitive lending activities.

Cost Reduction: By operating on Sonic, users can expect a substantial reduction in transaction fees compared to Ethereum's mainnet. This cost-effectiveness is particularly beneficial for frequent lending and borrowing activities, making DeFi more accessible.

Liquidity Incentives:

Sonic has committed $15 million in funding and up to 50 million $S tokens as incentives.

Aave has allocated $800,000 in stablecoins and migration incentives.

These substantial incentives are designed to attract liquidity providers and borrowers, ensuring deep liquidity pools and fostering a robust lending market.

Asset Availability: Initially, Aave on Sonic supports $USDC, $WETH, and $wS. Future asset additions will be driven by Chainlink's expansion of oracle support, ensuring secure and reliable price feeds.

Enhanced Capital Efficiency: The combination of Sonic's speed and Aave's lending protocol enables users to execute arbitrage and leverage strategies with greater precision. This is especially valuable in volatile market conditions where rapid execution is essential.

Interoperability: Seamless bridging of assets from Ethereum and other EVM chains to Sonic facilitates a broader user base and increases the flow of capital into the Sonic ecosystem.

Security: The integration of Chainlink oracles provides secure and reliable price feeds, mitigating the risk of price manipulation and ensuring the stability of lending and borrowing activities.Aave just added Sonic and Users can now borrow, supply, and earn incentives on Aave.

It reached $33M TVL in 24h, it’s already a success 👇

Pendle: Fixed Yield Strategies

We already talked about Pendle a while ago in this Newsletter.

Integration with Rings Protocol:

Pendle's initial pools on Sonic feature integrations with Rings Protocol, offering pools for stkscUSD and stkscETH.

Rings Protocol allows users to mint yield-bearing stablecoins (scUSD/scETH) and stake them in Veda Labs vaults to earn yield from blue-chip protocols like Aave.

This integration creates synergistic opportunities for users to leverage multiple DeFi protocols within the Sonic ecosystem.

Point Amplification:

Pendle allows for amplified points for users of the platform.

For example, stkscUSD has 2x Rings points, 12x Sonic points, and 3x Veda points.

stkscETH has 1.5x Rings points, 8x Sonic points, and 3x Veda points.

Enhanced Trading Strategies:

Pendle's platform facilitates various trading strategies, including yield speculation, hedging, and arbitrage.

Users can trade PTs and YTs to capitalize on market fluctuations and optimize their yield positions.

Liquidity Management & DEXs

ShadowOnSonic: ShadowOnSonic is the first native decentralized exchange deployed on Sonic, built to provide deep liquidity, efficient swaps, and low slippage trading. Unlike traditional DEXs, ShadowOnSonic benefits from Sonic’s modular liquidity layer, allowing for better price execution and improved capital efficiency :

Liquidity Aggregation: Pulls liquidity from various pools within the Sonic network to enhance trading depth.

Lower Fees: Thanks to Sonic’s optimized transaction framework, swap fees are significantly lower compared to Ethereum mainnet DEXs.

Staking & LP Rewards: Users can stake their LP tokens for additional yield generation.

They just received their first FeeM rewards, so this is just the beginning 👇

Wagmi DEX & Metropolis DEX: Alternative trading venues that support dynamic liquidity market-making (DLMM) protocols.

Llamaswap: Facilitating seamless bridging and cross-chain asset transfers within the Sonic ecosystem.

If you want to learn more about the ecosystem opportunities in general.

Stablecoin & Liquidity Dynamics

Stablecoins play a crucial role in Sonic’s financial ecosystem, and liquidity depth is a priority. The network has strong support for:

USDC, DAI, and LSTs (Liquid Staking Tokens) such as stETH and stSOL.

Upcoming incentives to attract Curve and Convex-like protocols to solidify its stablecoin yield strategies.

Rings Protocol, which introduces meta-asset strategies, enhancing stablecoin utility and liquidity.

New protocols are joining every week, further expanding the growing ecosystem of Sonic 🤝

To learn more about the yield farming on Sonic.

And if you want to now more about Defi Strategy in general on Sonic.

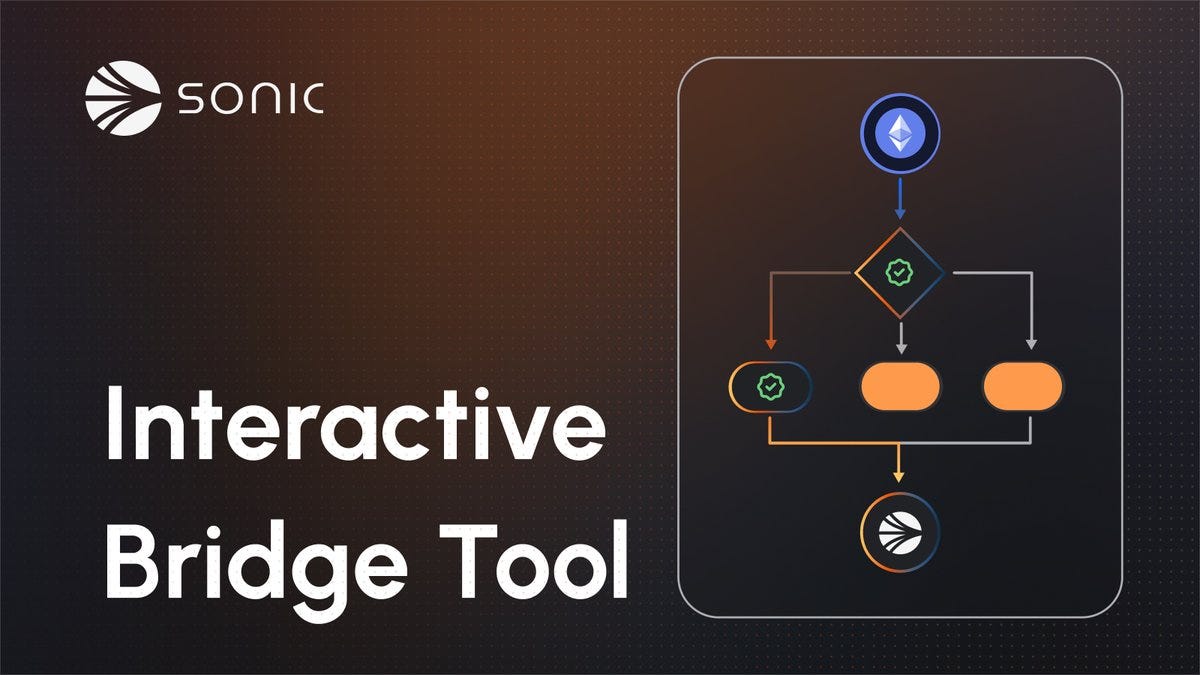

Bridging to Sonic

To move assets to Sonic, you have several options:

Sonic Gateway: The official bridge, managed by Sonic Labs. Connect your EVM wallet, select your assets, and transfer. Note: it's managed by a 2/4 Safe.

Llamaswap: Offers user-friendly bridging, potentially with lower fees.

Centralized Exchanges (CEXs): Use exchanges like Binance, Bybit, etc., for direct withdrawals to your Sonic wallet. Check fees and times.

Third-Party Bridges: Emerging options, but verify their security.

Key Considerations:

Prioritize security: Use trusted platforms.

Compare fees: Find the most cost-effective method.

Check transaction times and wallet compatibility.

Bridging to Sonic enables access to its high-speed, low-fee DeFi ecosystem.

$S Token Airdrop: Incentivizing Growth

Sonic’s massive 190 million $S token airdrop is designed to reward early adopters and attract long-term liquidity to the network.

The airdrop structure includes:

Total Allocation: 200 million $S (with 190M dedicated to users and liquidity providers).

Season-Based Distribution: Spanning one year, with the first six months accounting for 40-60% of the rewards.

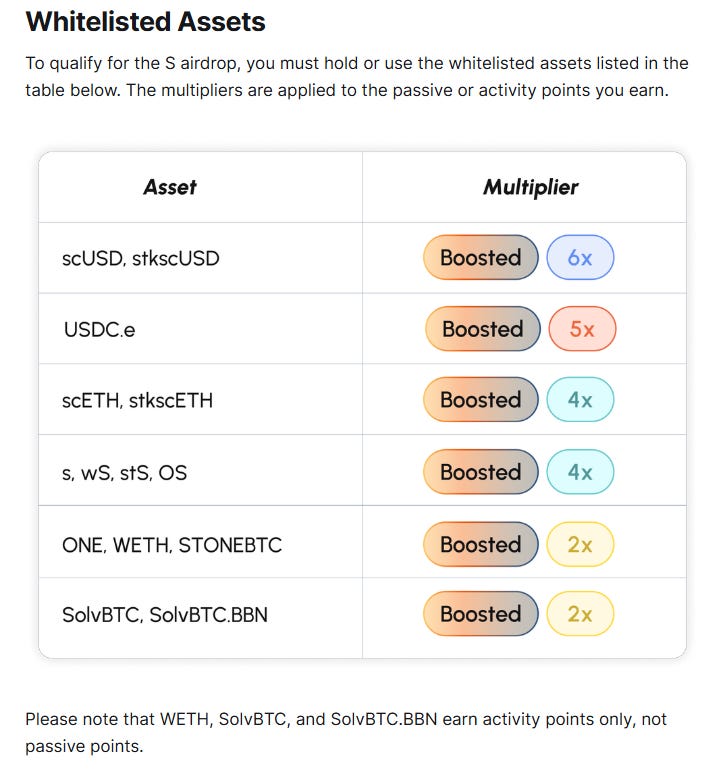

Earning Mechanisms:

Passive Points: Holding whitelisted assets —> They just added 3 new assets for $S Airdrop points.

Activity Points: Using DeFi protocols on Sonic (weighted 2x higher).

App Points: Incentives for developers building on the network.

Vesting Model:

25% liquid $S, 75% vested in NFT format, which can be burned for faster unlocks.

Deflationary Aspects

Sonic introduces multiple burning mechanisms to enhance the deflationary nature of $S:

50% of transaction fees are burned.

Portions of the airdrop are permanently removed from circulation through burns.

Unused ecosystem funds will also be burned periodically.

How Sonic Stacks Up Against Other L1s & L2s

Sonic competes directly with both monolithic Layer1s (Solana, Aptos, Sei) and scalable Layer2s (Arbitrum, Optimism, Base).

Key differentiators include:

10,000 TPS with sub-second finality, far surpassing most Ethereum L2s.

EVM-equivalence, ensuring easy migration for dApps.

Native Aave V3 deployment, a significant advantage in DeFi.

Strong stablecoin yield mechanics.

FeeM mechanism, which reinvests network fees into dApp incentives.

Airdrop already announced with a points mechanism, allowing you to track your potential allocation.

Compared to almost all the chains, Sonic is specifically designed for DeFi power users.

If you want to compare Sonic with others powerful Parallel EVMs ( SEI and Monad).

If you want to compare Sonic with others chains

The $S Token and its Role in Governance

As Sonic prepares for its airdrop, the $S token is set to play a crucial role in the ecosystem. Unlike speculative tokens with no utility, $S is designed to be the backbone of Sonic’s governance and economic model:

Transaction Fee Discounts: Users holding $S tokens will enjoy reduced fees on transactions and swaps within Sonic’s ecosystem.

Liquidity Incentives: Staking $S will provide liquidity providers with additional rewards, ensuring deep market depth on ShadowOnSonic and other DeFi platforms.

Governance Power: $S holders will have a say in key protocol upgrades, funding decisions, and ecosystem expansion initiatives.

By embedding strong utility into the $S token, Sonic ensures long-term engagement and sustainability for its ecosystem.

Sonic Key Metrics & Growth

Sonic has experienced rapid growth since its rebranding:

TVL: Increased from $27.2 million to an ATH of $736 million in two months.

Total Trading Volume: Surged from $2.2 million to $2.761 billion.

Revenue: Generated $4.48 million in protocol fees.

Total Transactions: Exceeded 30.8 million transactions on the network.

Airdrop Participants: Over 200,000 wallets eligible for the first season.

Why Sonic Matters for DeFi’s Future

Sonic’s arrival comes at a pivotal moment in DeFi’s evolution.

With Ethereum’s Layer2 race heating up, Sonic differentiates itself through:

Deep integrations with existing DeFi protocols like Aave, ensuring immediate liquidity and user activity.

A focus on capital efficiency, solving a major problem faced by fragmented liquidity across multiple L2s.

A strong governance and tokenomics model, providing real utility to $S holders rather than speculative hype.

For DeFi users, Sonic offers an ecosystem where transactions are fast and cheap, liquidity is deep, and composability is maximized. There are many ways to interact with the ecosystem.

For developers, it presents an attractive environment to build and innovate, leveraging Ethereum’s security without its prohibitive costs.

I wrote more on X about Sonic here.

Conclusion

Sonic represents a major leap forward in Layer1 blockchain technology, combining the strengths of Fantom with cutting-edge optimizations for scalability, liquidity incentives, and user adoption. With its aggressive airdrop campaign, robust DeFi integrations, and high-performance architecture, Sonic is well-positioned to challenge both L1 and L2 incumbents.

For DeFi users and developers, Sonic presents an exciting opportunity to engage with a next-generation ecosystem that prioritizes speed, efficiency, and yield optimization. As liquidity continues to grow and more protocols deploy, Sonic could emerge as a dominant force in the blockchain space.

As the $S airdrop is getting closer (planned to start around July), excitement around Sonic is at an all-time high. But beyond the airdrop, Sonic’s real strength lies in its ecosystem-driven approach—one that could define the next era of DeFi innovation. Whether you’re a trader, a liquidity provider, or a DeFi builder, Sonic is shaping up to be a network worth watching.

2/ Crypto & DeFi News

🏠 Trump’s White House Crypto Summit

Donald Trump just hosted the first White House Crypto Summit on March 7, with over 25 participants, including members of the Presidential Working Group on Digital Assets. Some of the attendees were Brian Armstrong, Co-founder and CEO of Coinbase, Michael Saylor, Co-founder and Executive Chairman of Strategy, Cameron and Tyler Winklevoss, Founders of Gemini, Zach Witkoff, Co-founder of World Liberty Financial, associated with President Trump's own crypto ventures, and more.

Key Announcements and Discussions:

Establishment of a Strategic Bitcoin Reserve: President Trump signed an executive order creating a "Strategic Bitcoin Reserve," effectively preventing the U.S. government from selling approximately 200,000 bitcoins acquired through criminal and civil asset forfeitures. This move aims to bolster the credibility and legitimacy of Bitcoin by treating it as a strategic asset.

Creation of a Digital Asset Stockpile: The executive order also introduced a "Digital Asset Stockpile" to hold other cryptocurrencies seized by the government. This initiative reflects the administration's commitment to embracing a broad spectrum of digital assets.

Support for Stablecoin Legislation: Treasury Secretary Scott Bessent highlighted the potential of stablecoins to maintain the U.S. dollar's dominance as the global reserve currency. The administration expressed strong support for legislative efforts to provide regulatory clarity for dollar-backed stablecoins, aiming to foster innovation while protecting investors.

Conclusion of Operation Chokepoint 2.0: President Trump declared an end to "Operation Chokepoint 2.0," a previous regulatory initiative perceived as hostile toward the crypto industry. This announcement was met with approval from industry leaders, who felt unfairly targeted by prior enforcement actions.

Thoughts

While the summit marked a positive shift in the administration's stance on cryptocurrencies, and is long term bullish, it didn’t give the market a good-enough reason to be short term bullish.

The Strategic Bitcoin Reserve prevents from selling seized BTC, but does not seem to plan to buy more (for now), apart from a potential "budget-neutral strategies" in the future to acquire more $BTC.

Overall, the summit represents a pivotal moment for the industry. If Trump’s administration follows through with policy announcements favoring crypto innovation, it could mark the beginning of a more favorable regulatory environment in the US. Long term bullish.

🏌️Solana sees $485M outflows in February

Solana experienced $485 million in outflows in February as investors moved toward perceived safer assets amid rising market uncertainty. According to a Binance Research report, capital flowed into Ethereum, Arbitrum, and BNB Chain, while Bitcoin dominance rose to 59.6%.

The decline in Solana-based assets was driven by multiple factors, including macroeconomic concerns, the record-breaking $1.4 billion Bybit hack, and a series of memecoin scams. The most notable was the Libra token, which saw a 94% price collapse after insiders allegedly siphoned over $107 million in liquidity.

As a result, stablecoins and real-world assets (RWAs) hit record highs, with stablecoin market capitalization exceeding $224 billion and onchain RWAs reaching $17.1 billion. Binance Research suggests that given ongoing macroeconomic turbulence, investors may continue shifting toward stable yield-generating assets.

Thoughts

The massive outflows from Solana highlight a key shift in market sentiment: in times of uncertainty, capital flows to assets perceived as safer, whether that means BTC, ETH, or even off-chain alternatives like RWAs.

One major takeaway is that Solana's exposure to speculative assets, particularly memecoins, is a double-edged sword. While the memecoin boom helped drive its explosive on-chain activity, repeated rug pulls and pump-and-dump schemes have eroded investor trust. This issue isn’t unique to Solana, but its association with high-risk speculative tokens has clearly made it more vulnerable to capital flight.

The increasing dominance of RWAs and stablecoins also signals a maturing market where yield stability is gaining importance over speculative trading. If this trend continues, protocols that facilitate tokenized real-world assets could see significant growth, potentially positioning platforms like MakerDAO, Ondo Finance, and Maple Finance as key players in the next cycle.

Looking ahead, Solana needs to rebuild investor confidence by fostering more sustainable DeFi and utility-driven applications —> like Sonic..

While its ecosystem remains one of the most active in crypto, its reliance on speculative trading makes it susceptible to large capital outflows during downturns. If Solana-based DeFi protocols can capture some of the capital rotating into stable yield products, it could help balance its risk exposure and strengthen its position in the broader crypto market.

🥱 Memecoin market crashes 56% since December

Memecoins Performance the past 3 months

The memecoin market has lost 56% of its value since peaking in December, erasing all gains from Trump’s presidential victory. According to CoinMarketCap, total memecoin market capitalization fell from $124 billion on Dec. 5 to $54 billion on March 5.

Analysts attribute the decline to economic uncertainty, insider trading scandals, and influencer-driven pump-and-dump schemes. Anmol Singh, co-founder of Zeta Markets, believes the market will consolidate around major memecoins like Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Bonk (BONK), and the Official Trump (TRUMP) memecoin, while others fade away.

Dogecoin remains dominant, representing 53% of the total memecoin market cap. Despite Tron founder Justin Sun calling memecoins the "future of crypto," he advised investors to focus on well-established tokens rather than newer, riskier launches.

Thoughts

The sharp decline in the memecoin market highlights the risks associated with speculative assets driven primarily by hype. Memecoins have always been highly cyclical, but this cycle was particularly brutal, with excessive influencer involvement and political branding playing a major role in the rise and fall of various tokens.

The survival of certain memecoins will likely depend on liquidity, exchange support, and their ability to maintain cultural relevance. DOGE’s dominance, in particular, is a reminder that longevity and adoption matter more than short-term hype.

For traders, the decline in speculative memecoins could push liquidity into more structured markets like perpetual futures and blue-chip crypto assets. The fact that Justin Sun and others are emphasizing “established” memecoins further reinforces the idea that the era of easy gains from random memecoin launches may be over—at least until the next cycle of speculation kicks off.

🔜 Ethereum Pectra upgrade live on testnet, but mainnet may face delays

We already talked about ETH and the updates coming soon in a precedent edition.

Ethereum’s Pectra upgrade has successfully launched on the Sepolia testnet, but the mainnet activation could face delays due to unresolved issues on the Holesky testnet. The upgrade, which includes 11 Ethereum Improvement Proposals (EIPs), aims to enhance staking, L2 scalability, and network capacity.

The Holesky testnet, which activated Pectra on Feb. 24, failed to finalize due to technical issues. Developers now estimate it will take at least 18 more days to address concerns related to “correlation penalties” and “validator balance drains.” The final mainnet launch date is expected to be discussed at Ethereum’s All Core Developers call on March 6.

Analysts see Pectra as a major step toward the approval of staked Ether ETFs. Iliya Kalchev from Nexo noted that the upgrade enhances staking flexibility, making it easier for institutional products like Grayscale’s ETF proposal to gain traction. With Ethereum facing competition from Solana’s lower fees and faster transactions, Pectra could reinforce Ethereum’s institutional appeal.

Thoughts

Pectra represents a critical step in Ethereum’s evolution, particularly in expanding staking capabilities and maintaining its competitive edge against Solana and other L1s. While delays are common in Ethereum’s upgrade cycle, the success of the testnet phases will be crucial for maintaining investor confidence.

The potential for a staked ETH ETF adds another layer of significance. Institutional demand for staking products has been rising, especially after Trump’s election, which is expected to bring a more favorable regulatory environment for crypto. If Pectra successfully launches and improves staking accessibility, it could accelerate institutional adoption and solidify Ethereum’s position as the primary smart contract platform.

However, persistent delays and technical issues could lead to market uncertainty. If Holesky’s problems take longer than expected to resolve, it might dampen sentiment, at least in the short term. The upcoming All Core Developers call will be key in setting expectations for Ethereum’s next major upgrade.

If you want to see more of ETH Bullish Developments.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.