Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

Hope you’re hanging in there because the market is dishing out mixed signals and macro spice like it’s back in 2022.

Trump’s wasting no time.

His administration just rolled out a sweeping tariff package — a flat 10% on all imports with higher rates targeting specific countries, including 34% on Chinese goods. Call it “America First 2.0,” or just call it what it is: a serious shake-up as $2 trillion have been wiped out from the stock market.

If you want to know everything on Trump's Liberation Day.

The reaction? Pretty textbook. Equities pulled back, yields jumped, the DXY is climbing, and global markets are entering “risk-off” mode again. In crypto, we saw a knee-jerk dip, followed by... well, not much.

No conviction, no bounce, just sideways chop and CT infighting.

Powell delivered a cold dose of reality: inflation’s easing, but rising unemployment, weak job growth, and public sector layoffs are flashing warning signs and amidst this mess, the good news is that BTC is still holding.

We’re in that weird phase again — too late for early, too early for late.

You’ve probably felt it yourself. The timeline’s split between:

Bears calling for the top — citing fading ETF inflows, weak altcoin structures, and macro headwinds.

Bulls saying this is just consolidation — and that BTC to new ATH is still in play.

And in the middle? The rest of us, staring at charts, flipping between fear and greed, and wondering what the hell this cycle even is.

We talked about Sonic and Berachain in recent editions, and I’ll be honest — yield farming on those two is basically all I’m doing onchain right now.

But even in this market, some ecosystems are still building — not chasing hype, but laying foundations.

Which brings us to today’s focus: Sei Network.

Whether you’re sidelined, staking, or still deciding what season it is — Sei deserves your radar.

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on Sei Network: How a U.S.-Based L1 Is Redefining EVM Performance, Policy Strategy & DeFi Growth

Main News of the Week.

Today's Newsletter is brought to you by Mantle

Key Initiative: Mantle Banking + MI4 — bringing DeFi closer to real life

Mantle is launching two big products that could actually make crypto easier and more useful for everyday people.

Let’s be honest — DeFi has a UX problem. Most people don’t want to deal with 5 apps, bridges, gas settings, or swapping back and forth between fiat and crypto. That’s where Mantle Banking and MI4 come in. These are clean, simple tools that aim to fix exactly that.

Product Breakdown

1. Mantle Banking – One app for everything

Mantle Banking is a crypto-native bank account that lets you:

✅ Receive your salary in fiat

✅ Instantly convert it to stablecoins

✅ Spend globally using virtual cards

✅ Save or invest directly into DeFi from the same app

This is the kind of thing we’ve been waiting for — real-world money and onchain yield in one place. It’s simple, smooth, and built directly on Mantle Network.

You don’t need to mess around with bridging or jumping between apps. Just deposit, spend, and earn — all from a single account.

2. MI4 – A tokenized crypto index fund

MI4 (Mantle Index Four) is a tokenized index fund that makes investing in crypto way easier. It’s backed by a $400M anchor from the Mantle Treasury and includes BTC, ETH, SOL, and stablecoins — plus staking yield from things like mETH, bbSOL, and sUSDe.

🔹 No need to pick individual tokens

🔹 Built-in yield strategies

🔹 Fully tradable on Mantle Network

If you’ve ever wanted a simple way to get crypto exposure without managing a complex portfolio, this might be it. And since it's tokenized, you can use it in DeFi just like any other asset.

Ecosystem Momentum

These launches didn’t come out of nowhere — they’re building on serious progress across the Mantle ecosystem:

mETH Protocol has seen strong growth, with 27K+ cmETH in fixed-yield vaults

FunctionBTC (FBTC) just passed $1.2B TVL and is now live on Sonic and Berachain

MantleX is working on tools to help optimize yield and liquidity across the network

And the $4B+ Mantle Treasury is still one of the largest in the industry — backing new products, LP incentives, and development

There’s real momentum here, and everything is starting to connect.

Why It Matters

A lot of DeFi feels like it’s made by crypto people for crypto people. But this feels different.

✅ Mantle Banking could be a better alternative to your regular bank

✅ MI4 gives simple, one-click exposure to the top assets — with built-in yield

✅ The whole thing is supported by real infrastructure and a massive treasury

If the goal is to make crypto actually usable for regular people — not just degens — this feels like a step in the right direction.

1/ Deep Dive: Sei Network

Sei is a high-performance Layer1 blockchain purpose-built for speed, parallelization, and real-world scalability.

Launched in 2023, Sei combines the performance advantages of the Cosmos SDK with full Ethereum compatibility. It introduced one of the first parallelized EVM environments, enabling fast execution (sub-400ms finality) and high throughput (28,000+ TPS in real-world tests). Sei v2 brought optimized consensus, execution, and storage—but even that wasn't enough.

Now, Sei is preparing for its most ambitious evolution yet with the GIGA upgrade. But what sets Sei apart isn’t just technical innovation. It’s the chain’s positioning as a U.S.-based, regulation-aware infrastructure layer designed to attract builders, institutions, and real-world use cases in DeFi, DeSci, and beyond.

From explosive DeFi growth to foundational moves in policy engagement, Sei Network is evolving into a uniquely U.S.-based, high-performance Layer 1 blockchain.

I recently wrote about it on X and wanted to dive deeper today 👇

Strategic Foundations: The Sei Development Foundation

Sei Network recently unveiled the Sei Development Foundation, based in Manhattan.

This move signals a deepening commitment to the U.S. as a hub for blockchain development, at a time when sentiment toward crypto regulation in the U.S. is gradually improving.

The Foundation aims to:

Provide a base for U.S.-centric institutional crypto adoption.

Engage directly with policymakers to create a regulatory framework that supports innovation.

Offer infrastructure, funding, and resources to builders in the Sei ecosystem.

Sei’s Executive Director, Justin Barlow, emphasized this alignment with U.S. leadership, stating: “We are committed to nurturing innovation for the next generation of entrepreneurs by establishing a strong local presence in the U.S.”

This presence is more than PR.

Circle Ventures, the team behind USDC, confirmed that they hold 6.25 million $SEI tokens — their fourth-largest allocation behind Bitcoin and Ethereum. As Circle approaches IPO, their choice to back Sei speaks volumes.

Scaling Infrastructure: GIGA Upgrade (v3)

The centerpiece of Sei’s roadmap is the upcoming GIGA Upgrade, expected in Q2 2025. This initiative is laser-focused on one mission: scaling the Ethereum Virtual Machine (EVM) beyond today’s limits.

Most EVM chains operate under the constraint of ~100 transactions per second. This limit creates friction for developers and prevents applications from scaling to meet Web2-level performance.

GIGA aims to increase throughput 50x, targeting 5 gigagas per second, a novel metric that captures actual computation capacity rather than basic TPS. The upgrade introduces several architectural innovations:

Execution Layer:

Rewritten EVM client optimized for speed.

Transaction-level parallelization with conflict avoidance.

New encoding format for lower gas computation costs.

Consensus Layer:

Asynchronous execution with faster finality.

Multiple proposers to increase decentralization.

Enhanced data propagation layer to reduce latency.

Storage Layer:

Async state root generation for consistent performance.

Optimized database read/writes.

Caching and batch operations for speed.

This GIGA Upgrade builds on Sei v2, which already delivered 390ms block finality and 28,000+ TPS. If Sei achieves its GIGA vision, it will offer the highest throughput EVM-compatible chain to date.

Ecosystem in Motion: DeFi, Trading, & Real Usage

Sei isn’t just focused on architecture — it’s seeing real-world adoption across DeFi and trading.

User Adoption:

2M+ monthly active users.

400K+ daily active wallets.

~4M daily transactions.

Trading Volume:

Top protocols: Vertex, Filament, and Citrex with seasonal trading competitions.

Stablecoins on SEI are growing.

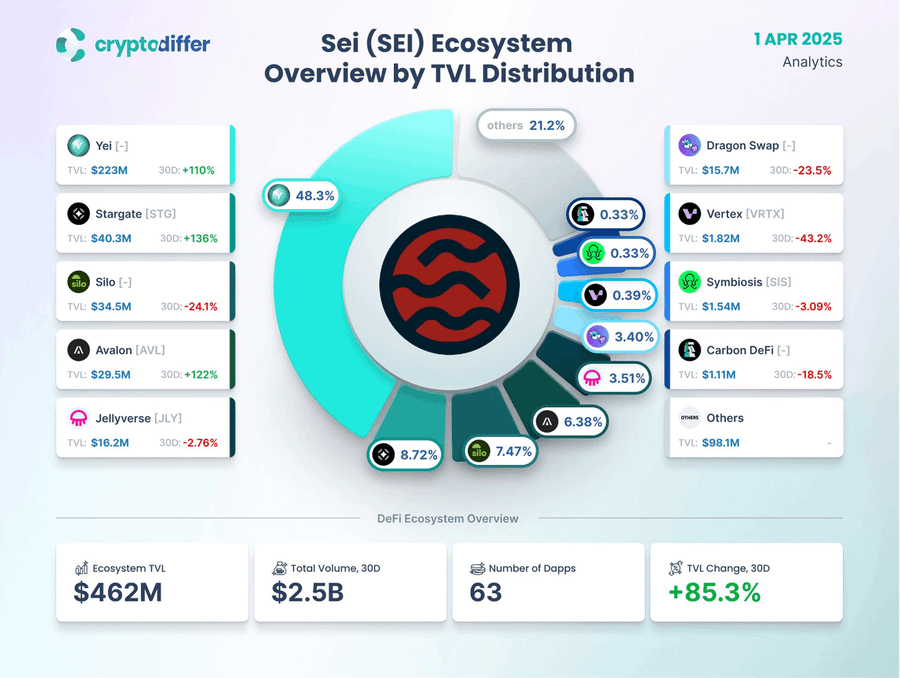

Top Protocols by TVL

Yei Finance – $223M (Lending, airdrops, points).

SailorFi – $61M (DEX).

Stargate – $40M (Bridge).

Avalon, DragonSwap, Silo Stake, TakaraLend, Pit Finance – Diverse DeFi primitives.

Major incentive campaigns on Filament and Citrex have drawn both traders and liquidity providers, while Yei’s ecosystem-centric airdrop model is driving strong organic growth.

Core Engine: Yei Finance & the Rise of DeFi on Sei

While attention has grown around Sei’s speed and scalability, the real story might be how Yei Finance is quietly becoming its DeFi backbone.

Yei Finance launched in June 2024 and now holds over 52% of Sei’s total TVL—around $502M—making it the largest protocol in the ecosystem by far. It plays a central role in fueling on-chain activity through lending, borrowing, and bridging.

That means:

$2.1B in total assets locked across Sei

High-yield support for $SEI, $USDC, $USDT, $WETH

Weekly liquidity incentives (e.g., 1.43M $SEI distributed recently)

Cross-chain bridging from Ethereum, Arbitrum, and Avalanche

Efficient risk controls via E-Mode and Isolation Mode

$1.3M in SEI tokens are up for grabs until April 14 —> Users who deposit 100 $SEI and bridge 25 $USDC qualify for rewards by joining directly in the Binance Web3 Wallet.

With new partners like @compass_wallet and @jlyvrs, plus the upcoming @yeidas_nft drop, Yei isn’t just leading DeFi on Sei—it’s helping shape its identity.

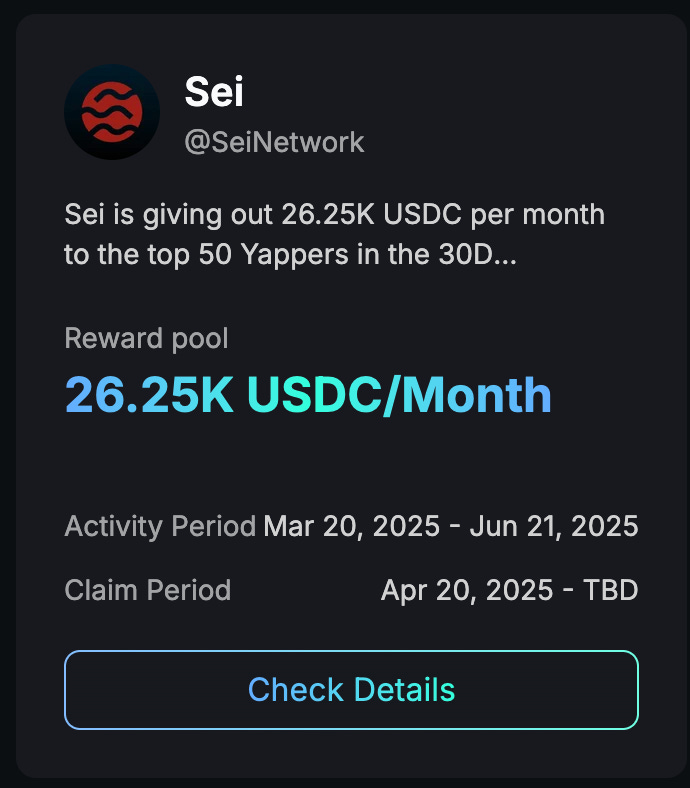

KaitoAI: Mindshare, Metrics, and Incentives

KaitoAI has emerged as one of Sei's most dynamic partners, playing a key role in accelerating on-chain engagement and growing awareness.

They introduced the Sei More Campaign end of March.

By combining AI-driven analytics, content incentives, and a unique leaderboard system, KaitoAI is creating a flywheel of attention around $SEI.

Every week, KaitoAI ranks users (“yappers”) based on their contribution to Sei-related content and analysis. Those who make the top 20 leaderboard receive token rewards, with $26.5K distributed monthly across campaigns.

These gamified incentives are proving highly effective at generating:

High-quality threads and research posts.

Increased visibility on Twitter and Farcaster.

More participation in early-stage Sei projects.

This approach also benefits the ecosystem’s alpha-seekers: as more quality content circulates, more users onboard and explore Sei’s products.

Additionally, KaitoAI’s dashboards are tracking token mindshare across social media, and Sei has consistently shown up as a top gainer, rivaling chains like Sonic and Berachain in attention metrics.

As the market warms up to narrative-driven investing again, this blend of on-chain engagement + social reputation is helping Sei carve out a space among both retail and builders. In many ways, KaitoAI has become the narrative engine that translates Sei’s technical momentum into sticky attention — and attention still drives capital.

Made in the USA: Regulatory Narrative

Most L1s are competing on speed or memetic brand power. Sei is aligning around something else: regulatory readiness + developer performance.

Sei is actively betting that the next phase of crypto adoption will be regulated, institutional, and integrated with existing U.S. financial infrastructure. By building a base in New York and engaging directly with lawmakers (through its podcast, newsletter, and lobbying presence), it’s creating a wedge for builders who want to stay compliant.

World Liberty Financial (WLF) – a politically-connected U.S. fund – has already disclosed buying over $100K in $SEI tokens. While speculative, this signals growing attention from traditional players.

New Frontiers: DeSci & Data Infrastructure

We already talked about DeSci and its potential in a precedent edition of this Newsletter.

Perhaps the most overlooked story in Sei’s ecosystem is its potential in DeSci and data ownership.

Sei could become the first performant, U.S.-based blockchain to specialize in scientific data sovereignty. That means:

Secure storage of medical/genetic data.

Permissioned access + monetization models for researchers.

Integration with decentralized AI models for diagnostics.

Combined with Sei’s technical strengths, this opens up a highly specialized narrative — compliant infrastructure for scientific & health applications.

Creator Economy & Incentives

Beyond finance and science, Sei has quietly become fertile ground for creators and early-stage devs.

Grant programs by the Sei Foundation.

Monthly rewards via KaitoAI’s leaderboard campaigns.

Open incentivization models for both builders and analysts ("yappers").

This focus on early support is helping Sei bootstrap a broad spectrum of contributors — from protocol devs to DeFi influencers to open data nerds.

If you want to see all the recent updates and news.

Conclusion: The Underrated L1?

Sei isn’t the loudest chain on CT, but its fundamentals are strengthening across every axis: user growth, TVL, infra, transactions and institutional relevance.

It’s becoming:

A performance-first, EVM-compatible chain.

A regulatory-aligned, U.S.-based project.

A base layer that’s attracting not just DeFi capital, but talent from health, AI, and data verticals.

If GIGA delivers on its 50x throughput promise, Sei could quietly evolve from fast L1 to foundational Web3 infrastructure — especially in a regulatory cycle that increasingly rewards chains willing to operate within national frameworks.

Still early days. But worth watching closely.

2/ Crypto & DeFi News

🎮 GameStop Turns Bitcoin Maxi — or Just Trying to Stay Relevant?

GameStop has officially completed a $1.48B convertible note raise, with explicit plans to allocate part of that capital to Bitcoin and stablecoins.

The move was telegraphed on March 25 but confirmed this week in an SEC filing. Surprisingly, the markets didn’t care much. GME ticked up 1.34% after the announcement and gave back most of its earlier 12% gain from when the plan was first floated.

This isn’t GameStop’s first dance with crypto. Remember the GME Wallet? Yeah, the one they launched and shut down in less than a year. Still, the firm has ~$4.7B in reserves and clearly feels the pressure to do something bold. Bitcoin is an easy play — it’s flashy, conviction-driven, and just unpredictable enough to spark retail attention without reinventing the wheel.

Thoughts

GameStop's Bitcoin allocation doesn’t feel like a leap of conviction; it feels like a hedge against irrelevance. As the original meme stock that birthed Reddit-fueled rallies, GME’s brand is already entangled with retail speculation.But this BTC move might actually be less about retail and more about following the Saylor blueprint — anchoring a distressed balance sheet to hard money and hoping the market gives them credit for the narrative.

The real test will come if they try to double down, stake their treasury in DeFi, or open up Bitcoin-related product lines.

Until then, this is more of a narrative gimmick than a structural pivot — but one that could open the door to other corporate treasuries waking up and saying, “Wait, GameStop did it. Why can’t we?”

🤖 Did ChatGPT Write Trump’s Tariff Policy?

Trump’s new “reciprocal tariff” policy — announced April 2 — has caused quite the stir, especially after multiple users on X showed that ChatGPT can generate a near-identical formula using a basic prompt. The model calculated tariffs by dividing the U.S. trade deficit by import volume and setting a floor of 10% — which, coincidentally, is the exact logic used in Trump’s policy. Major countries like China, Japan, and the EU are facing tariffs as high as 34%.

The kicker? Not only ChatGPT, but also Gemini, Claude, and Grok returned similar results.

Academics, meme lords, and even Flexport’s CEO reverse-engineered the formula in real time. Then markets puked: BTC dumped 5%, shedding $5,500 in a matter of hours. Why? Because tariffs = inflation = rate hike fears = bad news for risk-on assets.

Thoughts

Whether or not the Trump team used ChatGPT is almost beside the point. What matters is that a generative AI model, trained on internet-scale text, can replicate national policy logic in seconds — and people believe it.

That’s a narrative shift. If AI-generated geopolitics becomes normalized, we're entering a new paradigm where policy decisions are less about nuance and more about math models and populist simplicity. For crypto, it also reinforces just how tightly we’re tethered to macro shocks. Bitcoin didn’t fall because of fundamentals; it fell because AI geopolitics injected a fresh dose of volatility into an already unstable global economy.

TL;DR: AI is no longer just disrupting jobs — it’s disrupting how policy is created and perceived. That’s an edge case today, but it won’t be tomorrow.

🧊 Avalanche’s Stablecoin Boom Isn’t Helping $AVAX — Yet

Avalanche has seen a 70% increase in its stablecoin supply, now sitting at $2.5B as of March 31, 2025. That’s a big number — and normally, more stablecoins = more firepower for DeFi activity. But here’s the weird part: $AVAX is down nearly 60% year-over-year, even with all that extra liquidity in the ecosystem. Analysts suggest that a significant portion of the stablecoins aren’t being deployed in lending, trading, or farming, but are instead just sitting in wallets or treasuries — waiting.

Meanwhile, macro sentiment isn’t helping. Trump’s tariff rollout, paired with global trade fears, has depressed appetite for risk. Even bullish analysts are cautious, with Nansen assigning a “70% chance” of crypto bottoming by June.

Thoughts

There’s a clear mismatch here — the liquidity exists, but the conviction doesn’t. Avalanche is a good case study of the “dry powder” dynamic: tons of idle stablecoins sitting on-chain, but no movement into real economic activity. This isn’t just an AVAX problem — it’s an ecosystem-wide issue across chains like Solana and Arbitrum.

Builders are building, yes, but users are watching from the sidelines. If macro clears and risk appetite returns, Avalanche could see a rapid re-activation of that capital. But for now, the chain’s fundamentals are disconnected from its token price — and that’s a dangerous narrative if not reversed soon. Without killer apps or major incentive realignment, AVAX risks becoming the chain with great liquidity... and no movement.

🏛️ Circle Files for IPO — and Reveals How Much It Pays Coinbase

Circle, issuer of the $USDC stablecoin, officially filed its S-1 to go public on the NYSE under the ticker CRCL.

The IPO is planned for later this month and will give markets their first real glimpse under the hood of a major stablecoin issuer. 2024 revenue was $1.67B, but net income fell 42% to $155.6M. Most eye-catching, though? Circle paid $908M to Coinbase in distribution costs last year — more than half its revenue.

Also interesting: Circle holds $6.2M in Bitcoin, $5.6M in SUI, $3.3M in ETH, and exposure to smaller alts like Sei, Aptos, and Optimism. Nearly all of its revenue comes from yield on stablecoin reserves, mostly in short-term Treasury bills.

Thoughts

Circle’s IPO is less about the stock and more about the signal: stablecoins are entering their institutional era. But the S-1 filing also reveals a lopsided business model — Coinbase is capturing more value than Circle itself from USDC’s success.

That’s a red flag. It also puts pressure on Circle to diversify revenue or renegotiate terms before investors ask tough questions. Still, a successful IPO could serve as a “proof of legitimacy” moment for the entire stablecoin sector, especially as regulation heats up and Tether remains offshore and opaque. Expect heavy media attention, potential congressional cameos, and maybe even some “crypto legitimacy” vibes heading into the second half of the year.

📉 DeFi TVL Falls 27%, But AI and Social Protocols Are Booming

According to DappRadar’s Q1 report, total value locked (TVL) in DeFi dropped 27% to $156B — largely due to the Bybit exploit and broader economic malaise. Ethereum led the losses, falling 37% in TVL, while Sui, Tron, Arbitrum, and Solana all posted double-digit declines. The lone standout? Berachain, which surged to $5.17B in just under two months post-launch.

But not everything’s red: AI and social protocols posted massive user growth. Daily active wallets interacting with AI protocols rose 29%, while social dApps climbed 10%. Meanwhile, NFT volume fell 25%, with OKX eating most of OpenSea’s lunch.

Thoughts

This is the clearest signal yet of a user behavior shift. As speculative capital exits DeFi (or sits idle in stables), actual users are flowing into apps that feel new, interactive, and weird. AI agents are no longer just whitepapers — they’re onboarding users and reshaping UX. SocialFi, though still chaotic, is building sticky engagement loops.

Meanwhile, DeFi looks... boring. Unless protocols innovate beyond yield farming and copy-paste lending, they risk losing mindshare to more expressive, narrative-driven dApps. The good news? DeFi still has the deepest liquidity. The bad news? Liquidity without user demand is just TVL cosplay. The next cycle won’t reward passive capital — it’ll reward ecosystems that actually capture attention.

🌍 Crypto Donations Cross $1B — Real-World Utility Gets Its Moment

Crypto donations topped $1 billion in 2024, and they’re on pace to hit $2.5B in 2025, according to The Giving Block. The latest catalyst? A 7.7 magnitude earthquake that rocked Myanmar and Thailand on March 28, killing over 2,700 people in Myanmar and 18 in Thailand. With infrastructure crippled and traditional banking inaccessible, crypto became a lifeline.

Binance co-founder CZ stepped up, sending 1,000 BNB (~$600K) directly to relief organizations — doubling his initial 500 BNB pledge. He wasn’t alone. Intergovernmental blockchain advisor Anndy Lian donated 44 BNB, while Vitalik Buterin has been a recurring crypto philanthropist, donating over $180K in ETH to biotech causes just months ago.

The speed and borderless nature of blockchain-based giving is proving superior to legacy payment rails in times of crisis. No banks. No wires. Just wallets.

Thoughts

Crypto philanthropy isn’t just a feel-good narrative anymore — it’s becoming infrastructure. What we saw after the Myanmar-Thailand quake is exactly the use case critics said would never scale: real funds, moving instantly, to people in need, in regions where banks were either offline or irrelevant. It’s a living example of crypto fulfilling the original “money for the internet” vision — but through the lens of humanitarian relief.

What’s more, every high-profile donation — especially from names like CZ or Vitalik — isn’t just money in motion. It’s narrative ammo. It’s credibility. It’s the kind of reputational capital that policymakers can’t ignore forever. As crypto matures, governments and NGOs will increasingly recognize blockchain rails as not just viable, but optimal, for emergency response. This isn't just about donations — it's about resilience. And it might end up being one of the few crypto use cases regulators actively support, not fight.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.

Thanks for sharing