There is no collaboration with the projects mentioned in this edition.

GM frens,

Washington just handed crypto one of its biggest win in years 👇

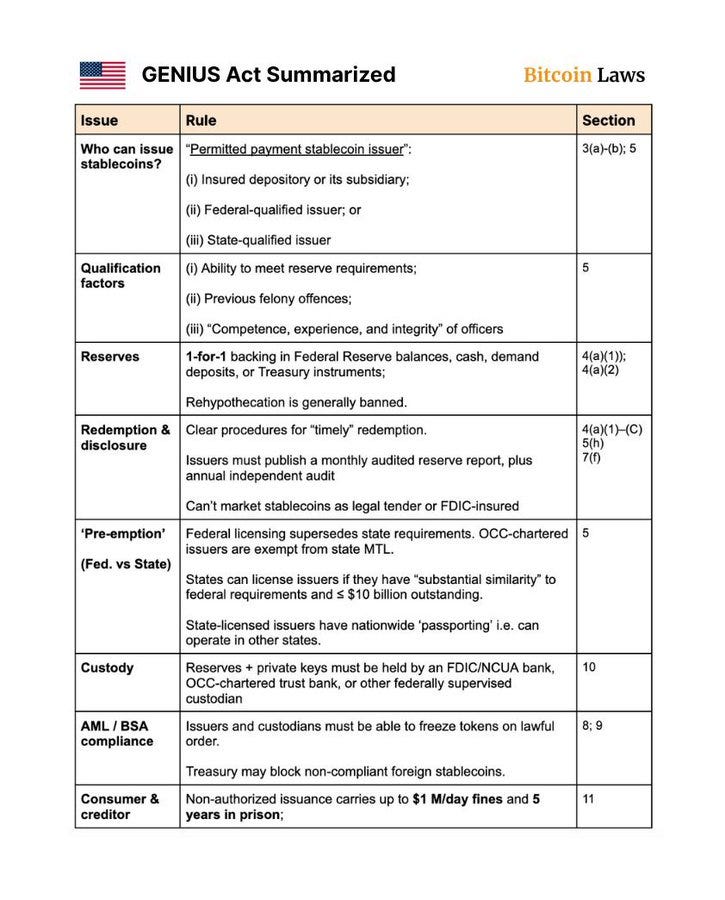

The GENIUS Act just passed the Senate, 68 – 30, with the text left exactly as written. It now needs only one vote in the House, where support looks strong. If that happens before summer, U.S.-dollar stablecoins will finally get clear national rules. Each token will hold the same amount of cash or short-term Treasuries, and issuers will follow the same safety checks banks use. The result is quick payments, almost no fees, and steady new demand for government bonds.

Congress is moving fast because the bond market is under strain. Foreign buyers are shrinking their Treasury holdings, so regulators quietly let banks hold more of that debt with lighter capital rules. The plan is simple: stablecoins will soak up new supply, and banks will carry the rest.

Politics keeps pressure high. Donald Trump praises the bill, saying the United States must “own crypto,” yet he also hints at a possible move against Iran, and each headline from the Gulf rattles traders. Later tonight, Jerome Powell will speak at 8:00 p.m. Rates are expected to stay unchanged, but even a hint of rate cuts later this year could lift markets, while fresh talk about stubborn inflation and high oil prices could keep them flat.

Crypto data still looks strong. BlackRock bought another $500 million in Bitcoin this week (for the clients of their BTC ETF, not them directly), and total ETF inflows keep rising. Bitcoin trading leads the pack even as Ethereum activity cools off. Altcoins remain weak because money is flowing into proven plays like JP Morgan’s new JPM Coin pilot on Base. The bank’s quick shift shows how fast traditional finance can catch up when it has a direct line to regulators.

That is today’s big picture: stablecoin rules coming soon, quiet help for banks, tension in the Middle East, a careful Federal Reserve, and Bitcoin pulling in the big money while smaller coins drift.

That leads us straight to the next wave of real adoption—robots on crypto rails. Wall Street analysts now model 8 million humanoid robots working U.S. factory floors by 2040 and 63 million by 2050, shifting trillions in wages from humans to machines. Worldwide figures push revenue over $5 trillion by mid-century. Robots that dense can’t rely on paperwork and week-long wire transfers. They need:

a tamper-proof ID for every arm and drone

instant micropayments for each weld, scan, or delivery

on-chain logs that insurance auditors can’t dispute

tokenized financing so anyone can co-own a bot and stream yield in real time

Blockchains tick every box: wallets, escrows, immutable data, and 24/7 settlement. A welding arm could stake a bond that gets slashed for defects. A warehouse rover could pay for battery swaps in stable-coins each shift. A swarm of inspection drones could sell live video to investors who funded them. DePIN networks already give machines cheap connectivity and edge compute; what’s missing is a shared brain where robots trade code and settle payments without Amazon or Azure in the middle.

That’s where today’s spotlight lands.

ThinkMesh is building that brain layer—letting robots share skills, prove results, and pay one another on-chain. If DePIN is the body of Web3 machines, ThinkMesh wants to be the nervous system syncing every move.

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!If you missed my Latest Post:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Case Study on ThinkMesh – How distributed robotic cognition and real-world agent performance could reshape on-chain coordination.

Main News of the Week.

UPDATE (07/27/2025):

ThinkMesh turned out to be a scam — with a fake whitepaper, fake results, and a fake team.

The testnet was real, but the goal was never to build the project — only to scam.Fortunately, none of the readers of this newsletter were affected, since there was no public sale, and no one could buy at launch (the launch had high taxes and no official time). They simply did a rug pull — launched the token and then pulled the liquidity.

Only private investors were affected.

That’s the risk with angel investments and private sales.They had carefully planned the scam over several months, with a promising whitepaper and a working testnet.

The Robotics narrative in crypto remains super interesting — but unfortunately, we’ll have to find other projects for it.

1/ 🦾 Case Study – ThinkMesh & the Rise of Distributed Robotic Cognition

Most blockchains talk AI.

ThinkMesh actually builds the coordination layer that lets robots think, learn, and pay on-chain.

Forget chains and apps. This is raw, permissionless substrate for machines to discover, benchmark, and buy intelligence like it’s just another primitive.

Here’s how ThinkMesh might unlock the brain layer of the Machine Economy 👇

🧩 Context – From Centralized Control to Composable Cognition

Robots are still stuck in 2010:

→ Hardcoded logic

→ Vendor-locked firmware

→ Zero memory, zero feedback, zero plug-and-play agents

Which means:

Robots follow rigid instructions written manually. They can’t adapt or learn on the fly.

Their software is proprietary (closed-source) and locked by manufacturers. You can’t easily upgrade or mix different robot brands or components.

Most robots don’t remember past actions, can’t learn from them, and don’t give useful feedback to improve over time.

You can’t just plug in new tools (like sensors, arms, or software modules) and expect it to work instantly. Each addition needs custom coding.

ThinkMesh aims to solve most of these problems.

It’s a middleware (software that connects different systems so they can work together) for distributed robotic cognition—real-time coordination between agents and machines, running live.

⏱ Real-time coordination between agents and machines, running live

ThinkMesh makes it possible for multiple robots or AI agents to work together instantly.

Robots on ThinkMesh go beyond pre-programmed behavior.

They dynamically discover and run the best agents for the job—based on real-world performance, environment, and past experience.

Basically, ThinkMesh is not about just one robot thinking, but a network of robots sharing knowledge and coordinating together.

ThinkMesh helps robots talk to each other, share skills, and coordinate actions in real time — like a hive mind.

⚙️ Architecture – The Protocol Stack of Machine Intelligence

ThinkMesh adds five layers that convert isolated robots into a shared intelligence network:

Identity Layer – Every robot gets a unique, persistent ID (called MeshID) that can't be transferred or deleted (like a soul-bound token). This identity records hardware configuration, tasks it’s attempted, agents it used, success/failure metrics, enabling robots to learn over time, track progress, and build a behavioral memory.

Agent Registry – Modular, versioned agents indexed on-chain.A decentralized "app store" for robots. Agents = small, pluggable AI modules that can handle tasks like welding, planning, diagnostics, language interaction, etc. Robots query this registry to discover and run the right agent based on their context and need.

Execution Runtime – Sandboxed, auditable (ROS2, WASM, containers). A robot can now install, test, and run new agents but in a safe box, with every action recorded and checkable.

Feedback + Reputation – Telemetry → validator checks → scoring. After a robot executes a task, it submits telemetry data (e.g., success/failure, duration, resource usage). This is how agent quality evolves over time—with real data.

Incentive Layer – Agents that perform earn; fraud gets slashed. Token rewards flow to developers of high-performing agents, robot operators who submit logs, validators who verify performance. This turns intelligence into an economic system—self-sustaining and scalable.

Composability meets accountability—on-chain.

🔎 Welding Pilot – Real-World Coordination in Action

Let’s have a look at a welding operation in factories, before and after using ThinkMesh.

3 different factories. 3 different continents. Same KUKA arms. (robotic welding arms from the KUKA brand)

Before: locked firmware, 12.4% variance.

After: ThinkMesh deployed 4 agent modules, rotating every 4h.

→ Quality variance dropped to 7.4%: robots became more consistent across sites.

→ Downtime cut from 41 to 26 mins/shift: better reliability

→ ThinkMesh automatically detected the best-performing welding module and made it available to all other robots globally.

→ The developer of that high-performing agent earned tokens from validator rewards, incentivized for doing good work.

The result? Robots sharing cognition across borders.

💸 Token Flywheel

The ThinkMesh token is a utility + coordination tool.

The token exists for a reason:

Developers earn when their agents succeed.

Validators verify logs, earn fees, and slash bad actors.

Staking required to participate and be discoverable.

Governance manages updates, parameters, and safety committees.

This is proof-of-performance.

🔄 The ThinkMesh Loop – Cognition as Network Effect

📊 Tokenomics

5% for the Team is really decent.

60% for Liquidity + Ecosystem means most of the tokenomics is here to ensure deep liquidity on DEXs, Incentives, Validator Rewards, Grants etc.

The only potential dump will come from the Strategic Seed Round. But there will be vesting of course.

Seems like good tokenomics here, very fair.

🚀 Emerging Use Cases (All Piloted or Sim-Ready)

🏭 Welding Arms (Industrial Automation)

→ Sync best logic across multi-site deployments

→ Agents adapt by material + humidity + region📦 Warehouse Bots (AMRs)

→ Congestion-aware navigation modules

→ Runtime switching for peak load vs low battery🛎️ Service Robots (Hotels / Offices)

→ Language + tone agents by country

→ Fault diagnostics triggered dynamically🏗️ Construction Robots

→ Terrain-adaptive excavation agents

→ Swapped in based on real-time soil feedback🧪 Research Labs

→ Publish experimental modules → see usage logs → get paid when used in field

🔧 In the Pipeline

→ Agents improve as they’re used—no central training needed. This allows agents to evolve through decentralized, field-based learning — no centralized training or retraining pipeline needed.

→ Robots can prove they did the work without exposing factory data. This lets robots prove task execution (for rewards or validation) while keeping internal data (like factory layouts or client info) private.

→ Autonomous contracting between machines. Robots become economic actors—negotiating, paying, and collaborating without human intervention.

→ Deeper ROS2/DDS/PLC stack integrations. ThinkMesh is not a replacement for robotics frameworks like ROS2 or DDS—it complements them.

→ Rolling out from testbeds to live bot networks. This means the protocol starts small but is designed to power global live networks of robots coordinating in the field.

💎 ThinkMesh as the Cognition Layer of DePIN

It doesn’t aim to be intelligence.

It just needs to coordinate it.

Think of TCP/IP—it didn’t invent the web, it made the connection layer work.

ThinkMesh brings that same order to robotic cognition.

→ Open agent markets

→ Live feedback built in

→ Reputation tied to output

→ Interop from day one

→ Composable at the core

If DePIN is the body of Web3 machines, ThinkMesh is the nervous system.

Still early. Still rough.

But when this scales—everything in robotics shifts.

The token is not out yet, but I’ve heard it could be out this month.

It’s still very early, but could be interested. If you want to do your own research:

🔗 Have a look at their website

🔗 X Account

2/ Crypto & DeFi News

💸 Four US Public Firms Pile $844M Into Bitcoin & HYPE — First Nasdaq Play on a DeFi Token

Four publicly traded US firms announced a combined $844M in crypto buys, with most of it headed to Bitcoin — and for the first time ever, a Nasdaq-listed company going straight into a native DeFi token.

🍽️ DDC Enterprise raised $528M (via convertible notes, credit, and equity) to stack 5,000 BTC over three years.

🏦 Fold Holdings secured $250M in equity financing to boost its BTC treasury, potentially adding 2,390 BTC.

🛠️ BitMine turned a stock raise into a $16.3M BTC buy, now holding 154 BTC.

🧬 Eyenovia, the biotech eye-care firm turned crypto maxi, raised $50M to grab 1M+ HYPE tokens and stake them — and rebranded as Hyperion DeFi (HYPD) in the process.

Thoughts

This is the first major rotation from corporate Bitcoin-only treasuries into onchain DeFi assets. Eyenovia’s $HYPD pivot is especially bold — bypassing ETFs and passive strategies for direct token staking, airdrops, and governance rewards.

Hyperliquid (HYPE) clocks $2B+ in monthly volume, and the move could foreshadow a wave of “treasury alpha” plays by other cash-heavy firms.

With ~$778M targeting BTC (~7,300 coins at today’s prices) and $40M headed into staked HYPE, this is real corporate buy pressure hitting the market. First came BTC on balance sheets. Now? Altcoin era, corporate edition.

⚛️ Amazon Locks In 1.9 GW of Nuclear Power to Feed Its AI Hunger

Amazon just inked a 20-year deal with Talen Energy for 1,920 MW of nuclear-generated juice from Pennsylvania’s Susquehanna plant, enough to light up every AWS server farm and AI cluster in the region through 2042. Instead of a direct line, the power flows through PPL Electric’s grid—meaning Amazon pays hefty transmission fees that actually lower costs for other customers. Bonus: the partnership includes R&D on small-modular reactors (SMRs), hinting at an even more distributed nuclear future for Big Tech compute.

Thoughts

AI is an energy monster, and the cloud titans are done playing footsie with “green credits.” Nuclear is back, baby. Microsoft reopened Three Mile Island, Meta just bought 1.1 GW from Constellation, and now Amazon is locking in nearly 2 GW. That’s a clear signal: if you want petaflops, you need gigawatts—and solar plus wind aren’t cutting it for 24/7 uptime.

Politically, the timing is perfect. Trump keeps banging the drum for nuclear to power AI, Bitcoin mining, and HPC. Lawmakers love the “clean base-load” narrative, and utilities love mega-contracts that stabilize their balance sheets. For Amazon, this isn’t ESG theater—it’s vertical integration of its most critical input: electricity. Expect other hyperscalers to copy-paste this playbook, and don’t be shocked when SMR pilots start popping up next to every new data-center campus. The AI arms race just went nuclear—literally.

🪄 Seven Solana ETF Filings Hit SEC Desk, but Fast-Track Approval Looks Unlikely

Seven issuers — Fidelity, 21Shares, Franklin Templeton, Grayscale, Bitwise, Canary Capital, and VanEck — all dropped or updated S-1s for spot Solana ETFs on June 13. Each filing includes language for on-chain staking, a first for any prospective U.S. spot crypto ETF.

Bloomberg’s James Seyffart says don’t pop the champagne yet: he expects “a lot of back-and-forth” with the SEC, pointing to the marathon it took Bitcoin ETFs to clear. While Bloomberg Intelligence pegs 2025 approval odds at 90 %, Seyffart doubts an all-clear is coming next week.

Thoughts

This is the ETF gold rush, round three: BTC got green-lit in 2024, ETH is in the chute, and now Solana’s lining up. But staking is the wild card. The SEC hasn’t blessed it for Ether ETFs, so locking it into SOL filings basically guarantees extra legal chess.

Still, the sheer breadth of issuers — from TradFi giants (Fidelity) to crypto die-hards (Grayscale) — shows how aggressive the hunt for block-space alpha has become. If the SEC eventually signs off on staking for both ETH and SOL, altcoin ETF summer could turn into a full-blown Cambrian explosion of yield-bearing products.

For now? Expect months of comment letters, tweaks, and political theater. But when D.C. finally caves, SOL could rocket — with staking yield in tow — and the ETF floodgates will swing even wider.

More of my thoughts about it 👈

🛒 Walmart & Amazon Eye USD-Backed Stablecoins, Could Skim Billions off Banks

Retail titans Walmart and Amazon are reportedly cooking up their own dollar-pegged stablecoins, aiming to slash payment fees and turbo-charge cross-border sales. A brand-specific coin would let the firms settle transactions in seconds, bypassing legacy rails that shaved an estimated billions off their combined $547 B in 2024 e-commerce revenue. While both companies are mum, insiders told WSJ the plans hinge on the GENIUS Act, the bipartisan stablecoin bill.

Thoughts

If Amazon and Walmart flip the switch, the phrase “crypto mass adoption” finally gets real. Forget cashback points—PrimeCoin and WallyBucks would instantly park stablecoins in tens of millions of wallets, turning checkout pages into de facto crypto on-ramps. Banks stand to lose a juicy fee stream, and Visa/Mastercard should be sweating: one click, one stablecoin, zero interchange.

But regulation is the gating item. The GENIUS Act will force robust collateral rules and AML compliance—music to corporate treasurers’ ears. Once that hurdle’s cleared, expect an arms race: Shopify’s USDC integration is already in the queue, and Wall Street megabanks are sketching their own consortium coin. The takeaway? Stablecoins are about to leave the crypto sandbox and crash the Fortune 500 party. Get your moon boots ready—this time the “utility” narrative is bringing a battering ram.

What could that bring for protocols like Pendle ?

💥 JPMorgan Goes Onchain: Deposit Token Pilot on Base, Meets SEC on Tokenized Capital Markets

Wall Street’s largest bank is sprinting into crypto. JPMorgan just launched a pilot for its new deposit token JPMD—on Base, Coinbase’s L2—and met with the SEC Crypto Task Force to explore how capital markets could migrate to public blockchains. The pilot will test JPMD as an institutional settlement rail, positioning it as a scalable alternative to stablecoins. Behind the scenes, sources say JPMorgan is “accelerating like never before,” trying to catch up to firms like Franklin Appleton, who are already years ahead in real-world asset tokenization.

Thoughts

This is JPMorgan admitting it’s behind—and trying to leapfrog forward fast. A deposit token on a public Ethereum L2 like Base is a huge departure from closed-bank systems. It signals a paradigm shift: TradFi isn’t just flirting with crypto rails—they’re deploying onchain. The meeting with the SEC? Strategic optics. With Trump back in power and JPM’s execs enjoying insider access, they’re laying groundwork for regulatory greenlights.

If successful, JPMD could become a new institutional money rail, beating out bank-issued stablecoins and pushing onchain finance into mainstream capital markets. The play is bold—and the stakes are massive. Don’t let the TradFi suits fool you: they’re building.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and is purely informative.