Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

Update about Last Week Newsletter.

GM frens,

Markets feel unpredictable right now. One day we’re hearing about missile strikes, the next day it’s peace talks.

WTF is happening ? WW3 is cancelled ?

Iran fired six missiles at a U.S. base in Qatar, but they gave a warning before the attack. The missiles were intercepted with no casualties. After that, Donald Trump said he secured a total ceasefire between Iran and Israel. Tehran didn’t fully confirm but said they’re ready to stop strikes if Israel does too.

The market reacted fast. Oil prices dropped from around $80 to $68 in less than a day. That’s a huge move and shows investors now think the risk of more fighting is lower. Cheaper oil also takes pressure off inflation, making it easier for the Fed to consider rate cuts soon.

Just days ago, traders saw no chance of a cut in July. After this weekend, odds for a 0.25% cut jumped above 20% and bond yields already reflect this shift.

While stock markets stayed closed for the weekend, crypto stayed open as always. Crypto traders had to handle both fear and relief in real time. Bitcoin dropped 7% within minutes of the first reports. Ethereum fell almost 20% over two days. Many altcoins also took big hits, showing again how sensitive crypto is to global news, especially on quiet weekends.

By Monday’s US market open, the panic had cooled. The NASDAQ stayed near record highs. Nvidia printed a new all-time high, showing investors still want tech stocks. Bitcoin bounced back fast too, with nearly $400 million flowing into ETFs on Monday.

And just like that, the map turned green again… making crypto feel like the ultimate stress barometer for global markets 😅

There’s also a big shift happening in crypto regulation. Until now, it was hard for banks to hold crypto. They had to lock up more money than they invested, which made it too costly. But now, the Fed is easing those rules and this change makes it way easier for big banks to offer crypto services without the old restrictions.

But it’s not all good news. Bitcoin dominance is still strong, and there’s no real sign of an altcoin season.

Stablecoin growth is flat, which means fresh money isn’t really flowing in. Most altcoins are struggling to gain traction, and investors are staying cautious.

One reason for this caution is token design. Many altcoins are just governance tokens with no real benefits. Investors are now looking for tokens that share revenue, offer buybacks, or give access to real utility. That’s why some attention is shifting toward platforms like Pump.fun and Hyperliquid.

And that brings us to today’s case study.

Pump.fun started as a simple tool for launching meme tokens. It looked like a joke at first, but it quickly became one of the most active apps in all of crypto.

But success brought problems. The platform was hacked, faced lawsuits, and is now accused of draining value from Solana while giving little back.

Still, Pump.fun continues to run and people are still using it.

Today, we’re telling the full story how Pump.fun exploded, what went wrong, and why it still matters. Because whether you love it or hate it, the platform is still here 👇

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!If you missed my Latest Post:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Case Study on Pump.fun – From Meme Machine to Market Mover

X Alpha.

Main News of the Week.

Today's Newsletter is brought to you by Defx:

🔔 Trade in the Dark, Earn in the Open – $50K Campaign + Passive Yield Vaults Now Live

Transparency is crypto’s flex; but it can also be a vulnerability.

Every size, every liquidation level, every alpha leak? It’s all on display.

Defx is changing that: a Dark Pool Perp DEX with encrypted trade intents, hidden liquidation thresholds, and ZK-proofed execution. You stay private and your edge stays yours.

Imagine Hyperliquid, but encrypted.

→ Built on a custom sovereign Layer 1

→ Supports crypto, FX, indices, commodities, and interest rate perps

→ EVM + Solana support

→ Backed by Pantera, CMT, CoinShares, and more 👇

💸 1. Trade-to-Earn – $50K Pro-Rata Rewards Pool

Defx’s 60-day Trade-to-Earn campaign is live.

$50K in USDC split pro-rata by volume

No minimums, no PnL requirements, just trade

Leaderboard updates weekly

Taker volume only (market orders or matched limits)

Volume tiers: $10K @ 75M → $50K @ 175M+ traded

Here’s the alpha:

You can hedge trades on Hyperliquid or Lighter, then farm points and earn cash on both sides. Real yield loop.

Early traders = bigger share. Every fill counts.

🪙 2. Deposit Into the Vaults – Earn Like a Market Maker

Don’t want to trade? Defx vaults are open, and unlike AMM perp DEXs, you’re not exposed to trader PnL.

These are delta-neutral, professionally managed market-making vaults:

Earn from trading fees (50% of all fees)

Capture liquidation rewards + rebates

Get Defx Points and the Vault Operator Discord role

Designed for low volatility, no directional risk

Deposit in USDC, sit back, and earn passively (~30% APY).

TVL is currently capped at $2.5M and early LPs get the best cut.

🎯3. Stack Defx Points While You’re At It

Every action, trading, LPing, referring, earns Defx Points.

4 million Defx Points are up for grabs and they unlock :

Premium tools and fee discounts

Role-based perks in The Syndicate (private Discord)

Future rewards system and leaderboard status

This isn’t a throwaway points campaign. It’s a long-term performance layer, and the earlier you stack, the deeper your edge when rewards unlock.

1/ 🤑 Case Study on Pump.Fun: A Launchpad of Dreams or a Casino of Scams?

We will talk about Pump.Fun today, a project that started off looking like a simple meme site, but quickly turned into one of the most used and talked-about apps in the entire space.

This is the story of how it exploded, what it changed, and why it continues to divide opinions across the ecosystem 👇

🎬 Act I – When Memes Met Frictionless Creation

At the end of 2023, Ethereum became too expensive for everyday users. Transaction fees were so high that many people simply stopped launching or trading tokens. It felt like a space that was no longer made for beginners.

Solana, on the other hand, became the opposite. Cheap, fast, and open to everyone, creating the perfect environment for a new kind of tool.

Pump.Fun arrived at exactly the right time, as the platform allowed users to create a token by filling out a short form with a name, a ticker, and a short description and once submitted, the token would go live almost instantly.

Everything that normally made launching a token difficult was removed. Users didn’t need to code, they didn’t have to manage liquidity pools, and they didn’t need to understand smart contracts. Pump.Fun handled the technical side in the background and made the process feel simple and fun.

This was crypto built for speed and access, where anyone with an idea and a little imagination could launch their own coin and start promoting it right away.

🎭 Act II – The Creator With a Past

Pump.Fun was built by Dylan Kerler, who already had a complicated history in the crypto space.

Back in 2017, at just 16 years old, he launched two ICOs: eBitcoinCash and EthereumCash. Both projects are now widely seen as failed or deceptive. They raised roughly 240 ETH, worth about $75,000 at the time, before quickly collapsing. The tokens lost most of their value within days, and Kerler vanished from public view shortly after.

In 2024, Dylan Kerler returned with something very different: Pump.Fun, a fully functional product that was smooth, fast, and incredibly easy to use.

Every transaction carried a small fee, and with thousands of tokens launching and trading daily, those fees quickly stacked up forming the backbone of the platform’s revenue model.

Some people saw Dylan’s return as a repeat of old patterns, just with better execution. Others believed that this time, he had created something that people actually wanted. Whatever the truth is, the platform grew quickly and became a central part of the Solana memecoin movement.

🧨 Act III – From Meme Machine to Market Mover

As more users joined the platform, the number of tokens created through Pump.Fun grew rapidly. In total, more than 144,000 tokens have graduated from it.

A few tokens became successful enough to inspire a flood of new creators.

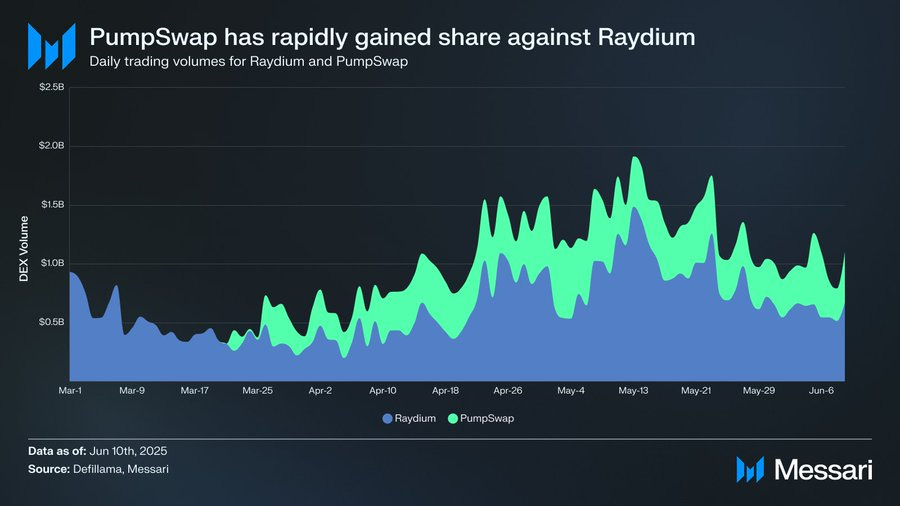

The team launched their own decentralized exchange, called PumpSwap. Before that, most tokens from Pump.Fun were traded on Raydium. By creating their own exchange, the team captured more of the trading volume and redirected the fees back into the platform. In just a few weeks, PumpSwap had taken over a significant share of Solana’s memecoin market.

While the product continued to grow, something else was happening behind the scenes. Large amounts of Solana were being sold from wallets linked to the project. Reports estimated that the team had sold over 740 million dollars worth of SOL since May 2024. That raised new concerns about the platform’s long-term impact on Solana.

🕵️ Act IV – Trouble Hits the Feed

In February 2025, the project faced its biggest public setback. The official Pump.Fun X account was hacked, and a fake token was promoted through the platform’s profile. The post looked official, and many users rushed to buy the token without asking questions.

Just a few minutes later, the token crashed. In total, multiple millions dollars were lost.

The team quickly released a statement saying that they had been hacked and that the attack was linked to phishing tactics involving Jupiter DAO. They denied any connection to the fake token. Still, the damage was already done, and many people were left with doubts about how the situation had been handled.

Soon after the hack, the legal problems began. A law firm called Burwick filed a class-action lawsuit claiming that Pump.Fun was operating as an unregistered securities platform. A second federal case followed a few weeks later, adding more pressure on the team.

X also suspended the accounts of Pump.Fun, its co-founder Alon Cohen, and several other popular memecoin platforms.

That moment caused many creators to pause, and it forced the whole scene to slow down. The energy around memecoins dropped, and the future of Pump.Fun started to look uncertain.

🎢 Act V – Stuck at the Crossroads

It’s now June 2025, and Pump.Fun is still live. The platform continues to run, but the atmosphere around it feels different. The $PUMP token sale, which was originally planned for late June, has already been delayed once. Now that it’s been pushed back again without a confirmed date, many users are starting to lose confidence.

The scale of the raise isn’t helping. Pump.Fun is aiming to raise $1 billion at a $4 billion fully diluted valuation, making it one of the largest token sales in crypto history. The deal is expected to split between public and private investors, with rumors of whitelist access for early users, and a possible airdrop for select wallets.

Details are still vague, but what's clear is that $PUMP is set to replace $SOL as the base trading pair on PumpSwap, mimicking what Virtuals did with their own token. That shift has already sparked controversy, as SOL’s price has dropped 25% since the start of the month and some believe Pump.Fun is one of the main reasons, as the platform continues to take value from the ecosystem without giving much back.

Legal pressure continues to build and in response, the team brings in high-profile lawyers with experience in crypto-related cases. Their X account comes back online after a short suspension, but the silence during those few days highlights just how fragile their visibility really is.

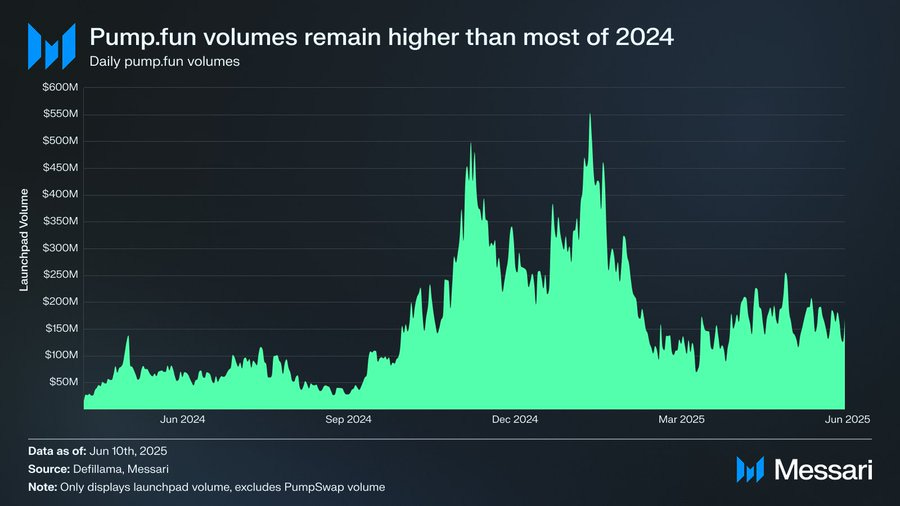

Despite the setbacks, the platform’s numbers remain strong. Pump.Fun has generated more then 750 million dollars in trading fees ( in 1Y).

Users continue to create new tokens every day, and the core product still works the way it was designed… the community hasn’t disappeared.

Meanwhile, new theories about Pump.Fun’s next move are picking up speed. Some people expect the team to launch its own blockchain. Others believe they are building a content platform focused on memecoin culture. There is also speculation that they are working on a full DeFi suite, including tools for staking, lending, and advanced trading.

So far, none of these plans have been confirmed. But the team still controls a large amount of capital, the user base is active, and the platform continues to operate without major issues.

🎰 One More Spin?

Pump.Fun gave crypto users something they hadn’t seen before. It made launching a token as easy as writing a tweet, removed the friction, lowered the cost, and turned memes into real, on-chain products.

At the same time, it created new risks. The platform faced serious legal issues, its team dumped massive amounts of SOL, and the majority of tokens created through it ended in failure.

Even with all that, the platform is still online, people are still launching coins, and the next chapter hasn’t been written yet.

Some people are saying that memecoin season is over, but for now, the experiment continues.. and the players are still at the table.

It’s definitely not the ideal time for PumpFun to launch its token (December would’ve been much better of course), yet their metrics remain strong.

So all eyes are on the PUMP launch and its massive valuation—let’s see how it plays out.

I’m not particularly bullish or bearish, but I think a $1B market cap might actually be a bit low for PUMP. That said, it’s still a massive valuation for a launch and heavily depends on market conditions and sentiment around PumpFun—so I might sit this one out.

2/ X Alpha 🫡

I’m back with some X Alpha, curating the most interesting updates, top CT posts, and surfaced key info worth knowing.

I paused that format on X, but I’ve decided to bring it back, this time, inside the Newsletter. I’ll highlight standout posts and share my thoughts on them.

Unpopular opinion on Crypto : Tbh, it’s a brutal take but kinda hits, feels like most people are just here to survive now, not believe in anything anymore.

Iran Vs Usa : Wild thread, it feels like a half war room briefing, half XRP prophecy. Some dots feel forced but the way it ties geopolitics to crypto actually makes you think.

June is the bottom : Every June we hit the bottom of the Altcoin season index and every time it’s the same setup : dead sentiment, no attention, then boom. A good signal to monitor in my opinion.

Hyperliquid is finish ? : Valid concerns, but this feels like classic capitulation at the top. Coinbase brings heat, sure, but Hyper’s edge was never regulation. It’s speed, exotic markets, and now HIP-3.

Revenue Tier list : Tether and Circle are printing but none of it flows back to users. Hyperliquid and Pump.fun might be smaller, but at least there’s a path for the community to eat too. In this cycle, revenue, fees and distribution matter.

InfoFI’s problem : We talked about Info-Fi in a precedent edition, InfoFi is just showing who’s really here to add value and who’s farming points. Right now it’s all noise and shills, but if the incentives ever change, a lot of these loud accounts will disappear real quick.

AI Agent are becoming billionaire : This actually feels inevitable. AI agents don’t get tired, don’t chase pumps, and don’t overthink. They just farm, flip, and scale 24/7. Can I become one of them ? 😂

$CRCL > $USDC : Kinda wild that Circle is already worth more than the total USDC in existence. Just shows how good TradFi is at extracting value..

$SERV is SERVING : Just sharing some thoughts on $SERV. It’s one of the projects I’ve been following closely and yeah, still holding my bags.

Reasons to be bearish? : Just some hopium for you, it’s hard to deny that it feels like everything’s setting up for a run now. Fed hinting at cuts, Sol ETF buzz, no major macro FUD… we’ll see from now.

3/ Crypto & DeFi News

📊 Bitcoin Now 1/3 of Crypto Portfolios

In 2025, Bitcoin accounts for 30.95% of total crypto portfolios, up from 25.4% in late 2024, making it the single largest asset held by crypto investors. Institutions are piling in post-ETF approval, while retail flows shift toward altcoins, betting on the next ETF narrative.

ETH holdings relative to BTC hit a yearly low in April (0.15) and still lag at 0.27. For every $1 of ETH, investors now hold $4 in BTC. Meanwhile, over 244 companies now list BTC on their balance sheets, up from 124 just weeks ago, with 3.45M BTC locked across public treasuries and ETFs.

Retail? Not as bullish on BTC. Their Bitcoin allocations dropped 37% since November 2024 (now just 11.6%), likely rotated into XRP (up from 1.29% to 2.42%) and stablecoins. Solana's portfolio share has dropped 35% to 1.76%, as capital flows shift toward what the market sees as the more ETF-ready alt.

Thoughts

This bifurcation is the clearest sign yet that we’re in a mature, narrative-driven crypto market. Institutions are consolidating around Bitcoin, not out of speculative mania, but because it’s becoming the index fund of digital assets. ETFs provide regulatory comfort, liquidity, and low-friction exposure, it’s the new treasury gold standard.

Retail, meanwhile, is back in rotation mode. The drop in BTC exposure isn’t bearish, it’s opportunistic. They're front-running narratives like a potential XRP ETF, hunting for asymmetric upside, not security. XRP doubling its portfolio weight shows that ETF speculation is now the retail meta.

If Bitcoin becomes the macro anchor, XRP is trying to be the next narrative rocket. And Solana? It’s losing capital share not due to poor fundamentals, but because it’s perceived as further back in the ETF approval queue. This kind of strategic positioning : "what will the SEC approve next?" is a new era for crypto portfolio construction.

We’re watching portfolio theory evolve in real-time, Bitcoin as ballast, altcoins as options. Welcome to the ETF age.

🇪🇺 MiCA Wins Mindshare as Crypto Picks Europe Over Trump’s America

Despite Donald Trump’s vocal pro-crypto stance, capital flows and user activity are signaling a clear preference for Europe’s MiCA framework. EU trading volume spiked 70% in Q1 2025, coinciding exactly with MiCA’s licensing regime rollout, while U.S. retail activity declined across major platforms like Coinbase and Robinhood.

While trade counts barely moved, EU customers are placing bigger, more deliberate bets. Coinbase retail volume? Down to 18% from 40% in 2021. Robinhood Q1 crypto volume? Off 35%. Meanwhile, France saw a 175% surge in activity, with Germany and the Netherlands quietly building crypto-native infrastructure. The message: capital loves clarity.

Thoughts

MiCA might be boring, but boring wins markets. In 2025, regulation clarity is more valuable than bullish tweets from politicians. Europe built the rails, and capital’s already riding them with big platforms (OKX, Crypto.com, Bybit, Coinbase) snapping up licenses like they're minting L2 tokens in 2021.

While U.S. firms stumble through lawsuits and licensing patchworks, EU players get one license, 27 countries. Stablecoins are regulated. Staking rules are defined. User protections are codified. That kind of certainty doesn't just attract users, it unlocks institutional scale.

France's rise is the proof. Regulation gave it a head start, and now it's a top-volume hub. Even Germany's old-school finance is coming online with crypto settlement via Deutsche Börse. Meanwhile, U.S. retail is asking, “Will my staking product be delisted next month?”

Trump’s backing is helpful optics, but until Congress passes something like the GENIUS Act, America remains stuck in a regulatory mess. If that bill passes, 2026 might be a comeback year. Until then? Europe’s got the flow, and the narrative.

📈 Michael Saylor Sets $21M Bitcoin Target by 2046

At BTC Prague 2025, Strategy founder Michael Saylor tripled down on his long-range Bitcoin thesis: $21 million per BTC by 2046. The number’s symbolic, 21 million coins, 21 years, but the conviction is serious. It’s a sharp jump from his prior $13 million 2045 forecast, driven by what he calls a “geopolitical and adoption pivot nobody predicted.”

He points to the Trump-led White House openly embracing Bitcoin, a flurry of U.S. crypto bills (Genius Act, Digital Asset Market Clarity Act, Bitcoin Act), and state-level adoption surging across the U.S. Strategy itself bought another $1B in BTC last week , bringing its total stash to 592,100 BTC, further proving Saylor’s “one asset” ideology.

Thoughts

Saylor is becoming Bitcoin’s most bullish oracle, and his narrative is evolving with the macro: hyper-financialization meets hyper-politicization. A year ago, he hoped for political neutrality; today, he’s cheering on a state-level Bitcoin strategy, federal reserve speculation, and public market accumulation.

But here’s the real signal: while most corporate treasuries are still wrestling with ETF allocations, Saylor’s Strategy is holding raw BTC, at scale, with no plans to stop. And his message is crystal: you’re not late.

That said, $21M BTC is moon math… If Bitcoin does reach gold parity ($22T cap), it lands near $1.1M per coin. For $21M BTC, you need not just ETF flows but sovereign treasuries, Fed buy-ins, and Bitcoin becoming a global collateral base. It’s a long shot, and to be honest probably just fantasy.

Whether or not BTC ever hits $21M, Saylor is reframing the narrative: Bitcoin isn’t just digital gold, it’s “the apex monetary network.” And if that meme catches on globally, who knows what 2046 looks like.

🚀 OKX Eyes US IPO

OKX is reportedly considering a U.S. IPO just months after relaunching domestic operations in April. Sources say the exchange is exploring a local stock exchange listing as the next big step. While no official comment has been made, the move follows the successful debut of Circle (CRCL), which skyrocketed nearly 250% post-listing, peaking at $248.9.

But the pivot west comes as OKX faces pressure in Asia, including a looming ban in Thailand, where the SEC is moving to block five offshore platforms (OKX included) from operating locally. Meanwhile, U.S. exchanges like Coinbase are seeing fresh stock rallies (+30% in a week).

Thoughts

OKX’s IPO chatter confirms what insiders already know: the stock market is now the crypto bull market. With U.S. listings like Circle and Coinbase showing strong post-listing performance, it’s no surprise the next big exchange wants a piece. This isn’t about capital, it’s about legitimacy, regulatory optics, and unlocking institutional money.

Timing is critical. Circle’s pump is about narrative: “stablecoins are infrastructure.” OKX can pitch itself as “the next global venue,” especially with Binance still skirting U.S. listing discussions. If OKX lands this IPO, it could reshape exchange power dynamics, giving them SEC-vetted access to the retail and institutional crowd that still can't or won’t touch offshore platforms.

Thailand’s ban highlights the geopolitical arbitrage at play. Asia cracks down, so firms pivot west. Ironically, Trump-era crypto optimism may be giving exchanges like OKX the cover they need to become “made in America”, at least on paper.

In the next 12–18 months, expect more crypto IPOs and more “regulatory refugees” planting flags in public U.S. markets. If OKX pulls it off, it won’t just be an exchange stock. It’ll be a proxy bet on global crypto liquidity flow.

🔮 Polymarket Hits 94% Accuracy on Predictions

Prediction market Polymarket is quietly becoming one of the most accurate forecasting tools in crypto and beyond. According to analyst Alex McCullough, Polymarket predictions are 94% accurate four hours before an event, 90% accurate at the 12-hour mark, and still 88.5% accurate a full day out. Even one month ahead, the market's accuracy trends above 90%, making it a serious contender for real-world forecasting.

The platform shines especially in “long-shot” markets with under 5% probabilities, which are typically correct and help push up overall accuracy. The only weak point? Sports betting, where tighter odds and randomness dilute the edge. Polymarket also shows a slight bias toward “yes” outcomes, likely a mix of herd behavior, acquiescence bias, and thin liquidity in some contracts.

Thoughts

Polymarket isn’t just a prediction market, it’s becoming a sentiment oracle. With this level of accuracy, it’s outperforming traditional polls, think tanks, and analyst consensus in real time. Why? Because it aligns incentive with insight: bet wrong, lose money.

For crypto, the implications are massive. Want to gauge Trump’s odds, ETF approvals, or bill passage chances? Polymarket might now be your sharpest tool especially as TradFi and crypto-native treasuries increasingly use it to model outcomes. It’s no longer just gambling, it’s price discovery for reality.

In a world where political volatility and regulatory uncertainty can swing billions, a live market with 90%+ accuracy is alpha. It won’t be long before even hedge funds and policymakers are watching Polymarket dashboards like they do bond yields.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and is purely informative.