There is no collaboration with the projects mentioned in this edition.

GM frens,

🌞 Welcome to crypto summer, and this time, it’s actually starting to feel like one.

Bitcoin just hit another all-time high, climbing to $118K. It’s not a big news that caused it but a massive $1.1B short squeeze, one of the biggest in the past four years. And it’s still going, as a fair share of traders are still shorting.

The map and the setup looks strong ; Funding is calm, open interest is rising, and the candles show clean momentum. Just steady pressure upwards, and for once no panic selling.

ETF flows just printed some of the biggest numbers we’ve seen all year: $1.175B into BTC and $383M into ETH… in a single day. Combine that with 315K BTC pulled off exchanges in the last four months, and you’ve got the makings of a true supply crunch.

ETH is pushing too, back to $3K, staking just launched on Robinhood, and inflows are strong. Solana’s still quiet, and altcoins are getting there, but if ETH keeps moving, the rest might follow soon.

The chart for Total3 (altcoins without BTC and ETH) looks ready, we need this breakout to hold.

For now, the market looks strong, the move is real, and this weekly close could lock in a very bullish summer.

That doesn’t confirm anything, but it does mean the momentum is shifting, and the plays that are winning right now? They’re printing real numbers.

Right now, it’s with protocols that actually make money. Pump.fun, Hyperliquid, Aave… these aren’t just pumping, they’re generating real, onchain revenue and rewarding tokenholders directly.

Fundamentals are back and revenue meta is here.

We’ve talked about this shift over the last few weeks. Hyperliquid eating CEX volume. Pump.fun reshaping Solana. Both powered by fees.

And this week, we go even deeper into the stack, because it’s not just trading apps that are printing. Lending protocols are quietly leading the revenue charge.

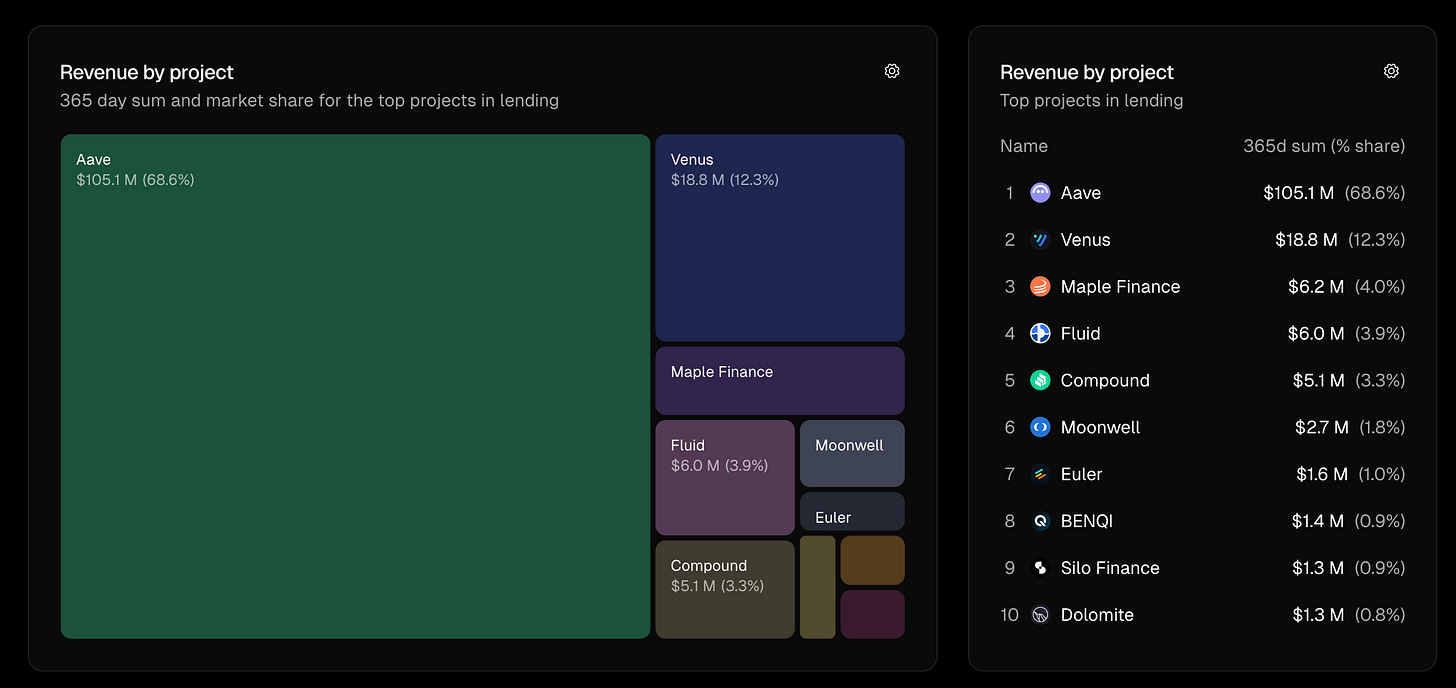

In fact, here’s what the lending landscape looks like today in revenue : 👇

Aave did $105M in revenue this year, more then 68% of the shared pie. Euler’s reborn. Morpho is onboarding protocols. Lending is the foundation of DeFi, and right now, that foundation is coming back to life.

So instead of waiting for some mythical “altseason,” we’re going to zoom in on what’s real.

Today’s deep dive is all about the battle for DeFi’s credit crown:

Euler vs Morpho vs Aave, who wins the next era of onchain lending?

Let’s get into it 👇

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!If you missed my Latest Post:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on Lending Protocols – Euler Reborn, Morpho Ascending, Aave Scaling

X Alpha.

1/ 👑 Deep Dive on Lending Protocols: Euler Reborn, Morpho Ascending, Aave Scaling - Who Wins DeFi’s Lending Crown?

Lending is the spine of DeFi. Break the spine and nothing moves.

Fix it, and everything else can run again.

That’s the frame for 2025. Credit rails are re-inflating, TVL is crawling back to pre-bear highs, and today we will talk about three lending protocols:

Euler – the modular phoenix that learned to isolate risk and still farm two yields per dollar.

Morpho Blue – the lightest peer-to-peer engine on-chain, built for pure rate efficiency.

Aave – the industrial giant turning every chain it touches into one deep money reservoir.

Quick note on prices: Some figures in this deep dive, especially token prices, might feel slightly outdated. That’s because the July 11 pump lit a fire under the whole market and pushed most charts up fast (Euler, AAVE, Morpho all caught a bid); but zoom out: the point stands.

Below is the full deep dive 👇

🌍 Macro — Credit wakes up in 2025

Let’s start with the big picture.

For most of 2024, interest rates stayed high. That made it hard for DeFi to grow people preferred holding stablecoins or parking money in real-world bonds.

But things changed in 2025.

The U.S. 10-year slid about half a point, from 4.7 % in mid-January to 4.2 % in late June. Even that modest drop was enough to push stable-coin cash back into on-chain lending. As soon as rates fell, people started looking for better returns and DeFi became attractive again.

DeFi’s global TVL slightly dipped, from $117.7B on Jan 1 to ≈$115B by now.

But lending protocols surged from $48.1B → $55B, pulling in nearly $7B while other sectors stalled or declined.

That’s reallocations. Rates, airdrops, and protocol trust shifted flows from passive LPs and DeFi infra… back into lending.

Why this matters now:

Big names like BlackRock and Franklin Templeton have over $1B in tokenized T-Bills

Europe passed MiCA, and the U.S. is moving toward clearer DeFi rules

As more blockchains go live, liquidity gets split, so protocols that can move or copy assets across chains suddenly matter a lot more.

In short: Rates dipped, rules improved, capital rotated, and lending protocols that actually deliver are now riding the front of the wave

💥 2023 — The crash that rewrote Euler

Euler used to be one of the most promising lending platforms on Ethereum.

Unlike Aave that pooled assets together, Euler let you isolate risk, each asset had its own “room” (called a Volt), where it earned interest without affecting the rest of the protocol. That made it safer for long-tail tokens and new markets. It also made it a magnet for DeFi power users looking for better rates and more control.

But on March 13th, 2023, everything stopped.

A flash-loan exploit drained around $197M from multiple lending pools. In minutes, Euler’s TVL went to zero. On CT, it looked like the end of the story.

Then something rare happened: The attacker gave the money back.

Over the next three weeks, Euler Labs negotiated successfully and recovered roughly $240 million, thanks partly to ETH’s price rebound during that period

This recovery wasn’t just luck, it reflected a deeply strategic, rounds‑of‑negotiation effort from Euler’s resilient team, navigating false leads (including potential ties to Lazarus Group) and dealing with front‑running bots.

The lessons were crystal clear:

Even isolated pools need bullet‑proof architecture, because one faulty function can collapse the whole protocol.

Trust can be rebuilt, but only through sustained, transparent action, like recovering user funds and sharing the process behind the scenes.

This episode set the stage for Euler’s 2024 rebuild and the launch of the new modular V2. It also underpins why Euler’s current design stands apart from other protocols, it's built on genuine resilience.

🛠 2024 — Rebuilding, wall by wall

Euler’s team didn’t just patch the bug. They rebuilt the entire system from the ground up, keeping the isolated design but adding new defenses at every layer.

Here’s what changed:

Volts: every asset sits in its own isolated room ; if one fails, the rest stay safe

Smart rate curve: interest ramps up fast when funds exit, blocking flash-loan drains

Guardian switch: a one-click safety tool to freeze any single Volt without halting the full protocol

Frontier: a clean zone just for top-tier stables, optimized for low risk

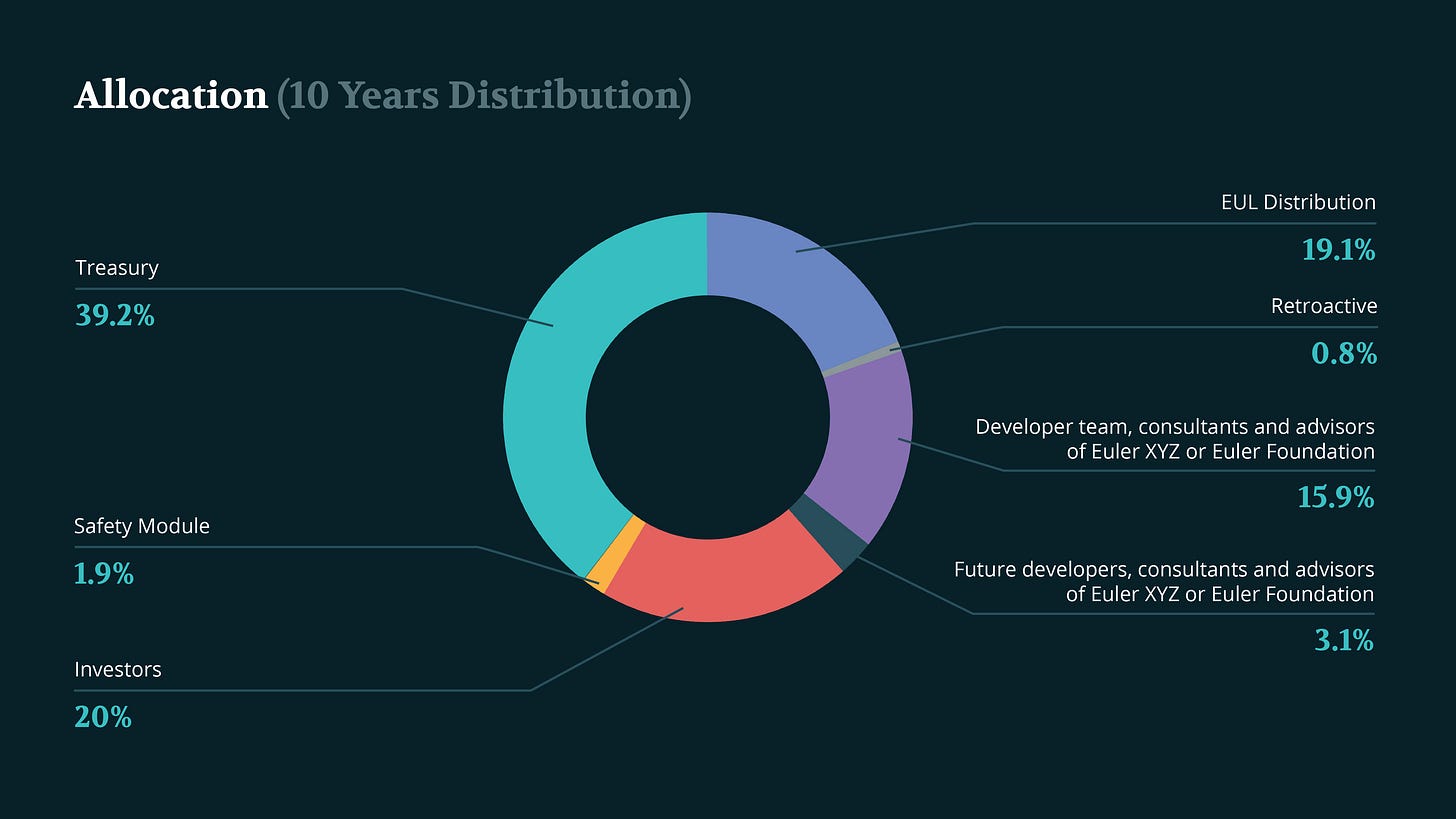

Fee-Flow auctions: protocol earns interest → auctions it for $EUL → burns or stakes the tokens

Security stack: five audits (Halborn, Trail of Bits, SigmaPrime, Spearbit, ChainSecurity) + formal proofs

After the exploit, Euler’s TVL was near 0 for all 2023 and early 2024.

With Euler v2’s September launch in 2024, TVL went back gradually into the low-$100 millions by year-end.

🚀 2025 — Euler reborn, month to month

Why these points matter

June’s billion-dollar milestone – Crossing $1B in TVL on 5 June showed treasuries and market-makers that Euler’s “isolated-room” architecture can handle serious capital without leaks. (Crazy prediction BTW)

Token follow-through: $EUL climbed around +66%, from $7.40 in April to about $12.30 today, now trading back at its 2022 high. That is something huge in today’s market.

Dual-income kicker: With EulerSwap live, every deposited dollar now collects two revenue streams. That extra flow will feed into the Fee-Flow auctions that buy and burn EUL, creating a clear link between protocol usage and token demand (Already 1B volume).

Euler has moved from “fixed but fragile” in January to “front-runner with growing fee power” by July, not to mention the number of users that has exploded.

The timeline shows deposits stabilizing above one billion, code shipping on schedule, and the token re-rating alongside real cash flow.

But there’s still upside: only 33% of the fee revenue is currently used for $EUL buybacks. The rest goes to the treasury for audits, grants, or future reserves.

As Euler matures and its cash flows grow, that fee switch could be raised by governance to 100%, turning every dollar of protocol revenue into stronger buy pressure… that change alone would directly lift token value, without touching emissions or altering vault mechanics.

🪶 2025 — Morpho finds its flow

If Euler rebuilt DeFi’s risk engine and Aave scaled the deepest liquidity lake, Morpho zeroed-in on speed.

While most lending protocols pool capital into one giant bucket, Morpho took a different route: peer-to-peer by default.

Every lender gets matched directly with a borrower and if no match is available, funds earn fallback yield until one appears. That small shift, cutting out the pool, is what makes the whole system faster, leaner, and more efficient.

And in 2025, that model started to scale 👇

How the engine actually works

Morpho keeps two live lists in sync:

Lenders who just dropped liquidity in.

Borrowers who want that liquidity right now.

When fresh funds land, the engine scans the borrower list and pairs the deposit with the best-fit loan request. If a piece of that deposit still waits for a match, Morpho parks it in a tiny reserve that mirrors Aave’s rate until a borrower appears. The cycle runs every block, so cash rarely sits idle and the gap between lend and borrow rates stays tight.

Borrowers can bolt on pre-liquidation guards (think auto stop-loss) and builders can spin up custom vaults with their own risk curves.

End result: capital keeps earning, borrowers keep paying fair rates, and the spread stays razor-thin compared with pool-style giants like Aave or Compound.

Where it stands today → and how it got here in six months

Three levers could explain the jump in deposits and borrows:

Coinbase ignition (Jan). Native BTC-backed USDC loans on Base funnelled > $300 M into Morpho vaults within weeks, proving a CEX can bolt DeFi rails under the hood.

Wallet-first UX (Q1→Q2). Bundler3 let any EOA deposit-borrow-swap in one click; Trust Wallet added a “Deposit to Morpho” button, converting mobile savers directly into DeFi lenders.

Protocols pile in (May–Jul). Compound Blue (Polygon) and Seamless 2.0 (Base) migrated to Morpho vaults, treating Morpho as back-end infra. Borrowed outstanding spiked 40 % the month those vaults went live.

Pendle integration (June) : Pendle LP tokens became valid collateral on Morpho, letting users bring fixed‑rate yield assets into lending or borrowing loops. This opened Morpho to a wave of yield-structured capital from Pendle users, diversifying deposit sources and attracting more sophisticated liquidity

What to watch next

Morpho V2. Fixed-rate, fixed-term loans plus intent-based routing will push the engine into corporate-grade credit.

Cross-chain settlement. Borrow on Base, post collateral on Ethereum, a direct shot at fragmentation pain.

RWA vaults. Tokenized T-Bills and freight invoices already in testnet, giving treasuries a home inside Morpho.

Fee switch. DAO vote expected Q3; even a 2 bp clip on matched notional turns current volumes into seven-figure annual revenue flowing through $MORPHO.

My take:

Aave is the biggest, Euler owns the “sealed-room” narrative but Morpho’s edge is pace.

Capital gets matched instantly, unused funds don’t sit idle, and new vaults can go live across chains in a matter of hours.

It’s been growing without handing out rewards, pulling in retail flow through Coinbase, and quietly becoming the backend for other protocols. If 2025’s game is capital velocity, Morpho is a really nice play.

🏗 | Aave — Upgrades since Oct ’24

(Recall: We talked about AAVE in Oct 24, we covered flash-loans, collateral choice, and the Safety Module. Below is only what has appeared or shifted since then.)

What’s rolled out or moved forward :

• Aave V4 testnet – Internal testing is underway for the Liquidity Hub and first Spoke pools. Once audits wrap up, a public beta will launch on Sepolia.

• Cross-Chain Liquidity Layer – still in closed testing; main-net target remains Q4 2025, letting users supply on one chain and borrow on another in one click.

• Umbrella – live since July 2025. Lenders can tick an “Insure” toggle and earn an extra ≈ 3-5 % APY while their aTokens backstop protocol risks.

• Fee switch – DAO now spends up to $1 M per week buying AAVE on-market; roughly 25 k AAVE (≈ 0.17 % of supply) has been bought and sent to the Ecosystem Reserve since April.

• Aave Network (validium L2) – confirmed as a future step; roadmap pins launch sometime in 2026-27 after V4 and CCLL reach main-net.

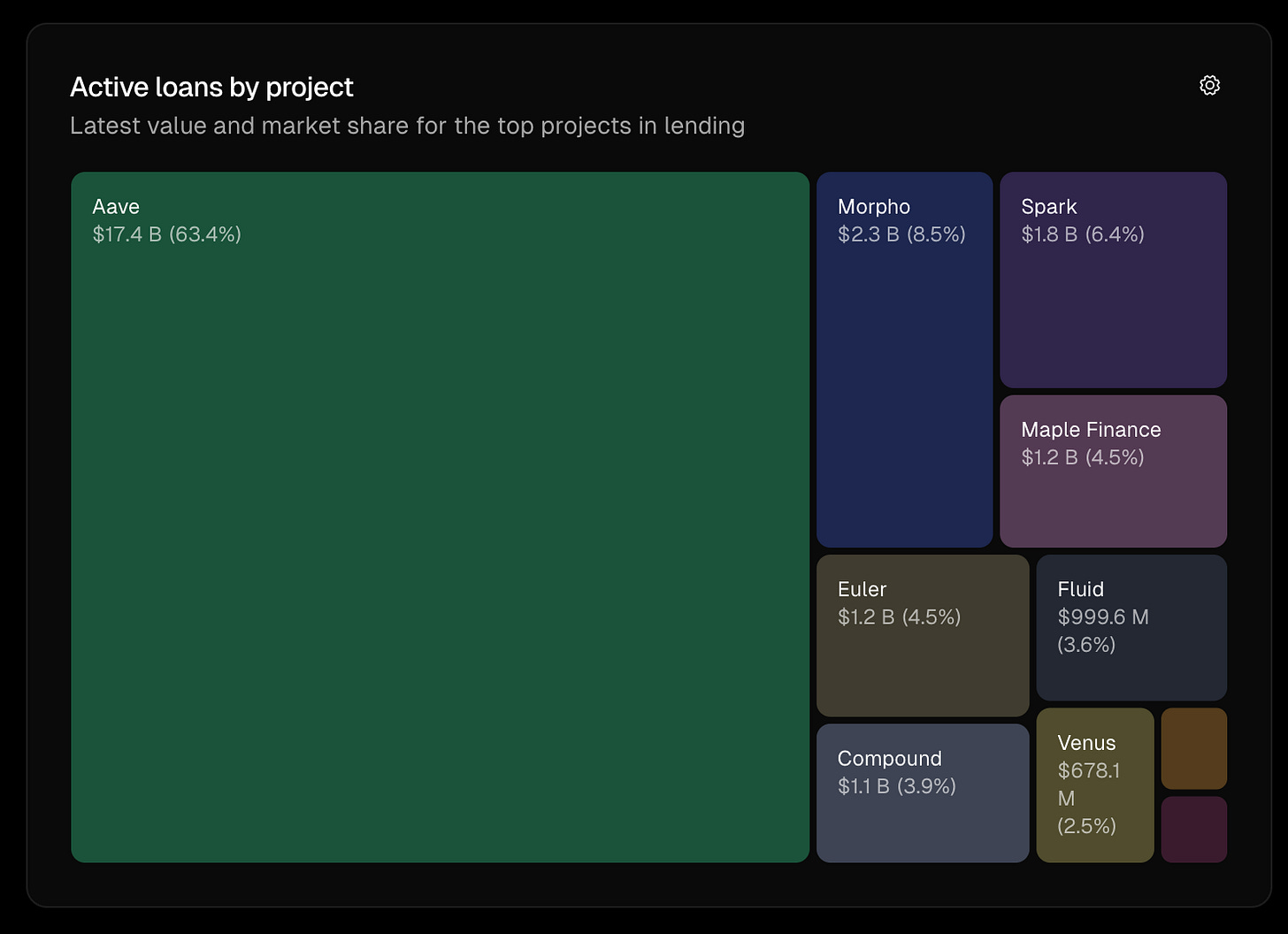

TVL across all chains has climbed from ≈ $22B ( 15 Oct 2024) to ≈ $47B now (+100%) and it’s still growing 👇

AAVE price at the last case study was $162.74 (15 Oct 2024) and today it trades near $311 (+91 %).

$GHO ( AAVE stablecoin) supply grew by over 120% in supply over the same time, rising from ≈$136M to ≈$302M.

Why it matters right now

Last October these upgrades were still PowerPoint promises and today they’re live in beta, moving real money.

Since that October case study, $AAVE has jumped from $162 to $311, but even at these levels, the risk-to-upside ratio feels solid for anyone looking for strength and staying power in the space.

And it’s far from done.. the full mainnet rollout is still ahead, the Aave Network L2 is just getting started and that whole vision of turning Aave into a unified, cross-chain liquidity engine is still loading with V4.

AAVE is eating the competition, and is one of the most profitable protocol in crypto.

🪞 Three lending styles, side by side

Each design hits a different target:

Euler is the “sleep-well” choice ; tight risk walls plus a handy yield boost.

Morpho is the “squeeze every penny” option ; lean, fast, and laser-focused on the best rates.

Aave is the “bring the suitcase” venue ; deep liquidity and cross-chain reach for anyone moving real size

If you want to compare Morpho / Aave even further 👈 They are not in the same league tbh.

🎯 Why the mix matters + how I use it

The point of lining these three up isn’t to crown a single winner; it’s to show we finally have real choice in DeFi lending.

Euler is where I leave stablecoins when I want strong safety walls and some extra fees on top.

Morpho is where I go when I’m chasing the best rates. If the APR is even slightly better than Aave, I’ll borrow there and move fast.

Aave is still my go-to for big moves. If I need size, cross-chain support, or access to fresh GHO liquidity, it’s the reliable option.

We didn’t have that range two years ago ; one mega-pool ran the show. Now the spectrum runs from locked rooms, to direct handshakes, to a chain-spanning hub all live, audited, and holding billions.

Why the deep dive matters

Design diversity survived the bear. 2023 killed bad code fast; 2024-25 prove good ideas adapt and thrive.

RWA runway. Treasuries, invoices and tokenised bonds will slot into whichever design best matches their risk and size. Knowing the differences today lets us front-run that shift.

No single rail fits every job. You don’t store rent money and day-trade cash in the same pocket; treat lending rails the same way.

For the tokens 👉 I stay overweight $EUL for its balanced risk and fee bid, keep a tactical stack in $MORPHO for quick trades, and hold a bag of $AAVE because “slow, deep, everywhere” still wins the biggest inflows.

Your own mix will depend on what you value most, but the key is you now get to choose.

That alone makes 2025 a good year for on-chain credit.

2/ X Alpha 🫡

Phantom x Hyperliquid: Phantom adding Hyperliquid perps is massive. 15M users now seeing onchain perps front and center. If even 10% try it, that’s 1.5M new wallets in the Hyper flow. This is how you scale perps without playing the chain wars.

Upcoming TGE: If you’re farming, this list is gold. Big names, big funding, some still under the radar. Don’t wait for CT to catch on, because these are the kind of plays that print when no one’s looking.

2026?: 2025 is setting the stage, stablecoins, ETFs, tokenized everything, and DeFi built for suits. But 2026? If this post hits, we’re just getting started.

I need you 🫵: Good original post. Some people must think it’s alpha or bots that make it long-term, but it could really be just relationships. The biggest wins always start with 'I knew someone.' If you’re only here to extract, you’ll miss everything that actually matters. Give value, build trust, and the right circles will open up.

After death ?: Wasn’t expecting this post fr. Crazy how we farm all day but forget the final unlock: not letting our bags die with us. Some people will not care but doesn’t cost anything to set up the inheritance play.

Exiting rn: Just some development news… megaETH, zkVMs, SOL ETF, CLOB wars, AI infra, ETH sentiment shift. A lot moving and it’s worth keeping an eye on.

17 memes: Liked this one, bit of laughter never hurts (and actually a good rewind of the year so far tbh).

More $HYPE: Just some development alpha by my fren Eli5Defi, HyperEVM’s shaping into one of the most active DeFi stacks out there. Feels early once again.

Check this project: Didn’t plan to yap, but INFINIT caught my eye. DeFi + AI with real infra behind it, feels worth the noise.

Prediction markets = Free money?: Really good thread on prediction markets, with a focus not only on Polymarket. Might be the subject of a future newsletter..

Crypto Cards: Tokenless for now, but the trading card x crypto crossover could be a real unlock.

Yarm: I agree with FastLife here. Yarm feels like the next evolution of KOL rounds, except now you're working for exposure and paying to play. It’s clever, but let’s not pretend it’s a win for creators by default.

A new trend ?: Getting 98% of a token dropped in your wallet is insane. Burning it + buying USELESS was the cleanest way out. Smart move. But yeah… if this becomes a trend, it’s only a matter of time before someone gets wrecked

303M$ Unlock: With that many majors on the list : APT, IMX, SOL, TAO, AVAX, it’s definitely time to be selective. If you’re holding, know what’s unlocking and when. Exit liquidity season always finds someone.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and is purely informative.