This Week's Project Research - LPDfi, Capital Efficiency, RWA, SocialFi, Cross Chain, Bot, Perp DEX Narratives With: HMX, Limitless, Rollbit, Polytrade, And More

The Best Research curated to save you time

GM frens.

Find this edition as a thread:

Gathering & Curating the best Research of the week, in the Latest Narratives.

Anyway, let’s get straight to the alpha! 👇

I’m posting daily Live Alpha in my Instagram Story, and in my Alpha Telegram Channel ☟

My Linktree to have access to all my Content & Alpha on Twitter (X), Instagram, Telegram, and More: https://linktr.ee/cryptoshiro

Today you will find Research & Alpha on:

LPDfi

Capital Efficiency

RWA

SocialFi

Cross Chain

Yield

Bot

Perp DEX

Base

And much more!

Your Alpha, gathered in the following categories:

1/ Layer1 & App Chain

2/ Scaling Solution

3/ DEX & Perp DEX

4/ LPDfi

5/ Vault & Yield

6/ Money Market

7/ GambleFi

8/ RWA

9/ GameFi

10/ SocialFi

11/ Bot

12/ Others

Find your alpha! 👇

The categories are just informative, projects can fit multiple categories.

Everything is NFA, I don't vet the projects here.

I've read & selected the threads but I did not do deep research on every project.

DYOR.

1/ Layer1 & App Chain

Kaspa Overview (wacy_time1)

🔹 PoW DAG Chain

🔹 GHOSTDAG → Scalability, Security, 400 tx per block

🔹 RWA Potential

🔹 BTC-like Principles: Decentralization, Anti-inflationary, PoW

🔹 P2P E-money System

🔹 Fair Launch

Vega, Infrastructure allowing anyone to create products & markets (ViktorDefi)

🔹 App-chain DPoS optimized for Trading → Low Latency, High throughput Rates

🔹 Gas-less Trading

🔹 On-chain Incentives

🔹 Permissionless Market Creation

🔹 Backed by Leading Investors

Axelar, PoS Network built using the Cosmos SDK (exliquidity)

🔹 Infrastructure, Blockchain, Bridge

🔹 Cross-chain Narrative

🔹 Token → Validation, Governance, Incentives

🔹 Constant Buyback

Sommelier, App Chain & Intelligent Vaults (Flowslikeosmo)

🔹 Dynamic & Decentralized Vaults

🔹 Intelligent Vaults → Predict, React, Optimize, Evolve

🔹 TVL up 2500% YTD & Not slowing down

🔹 High Yield for Blue Chips

🔹 Token → Limited Supply, Rewards for Stakers

2/ Scaling Solution

Mantle, Mass Adoption of Decentralized & Token-Governed Tech (TheDeFiPlug)

🔹 Layer2, OP Stack, Modular Narrative

🔹 > 40M TVL & Backed by the largest DAO in DeFi → $2B Treasury

🔹 Scalable, Secure, Cost Saving, Fast

🔹 Token: Gas, Governance

3/ DEX & Perp DEX

Citadel, Base hyperfunctional DEX & Launchpad (stacy_muur)

🔹 Base Narrative

🔹 Launchpad

🔹 Concentrated Liquidity → Capital Efficiency

🔹 Incentivized LPs

🔹 Revenue for Buying back & Burning

🔸 Big competition on Base, every week there is a new DEX

More on Citadel (arndxt_xo)

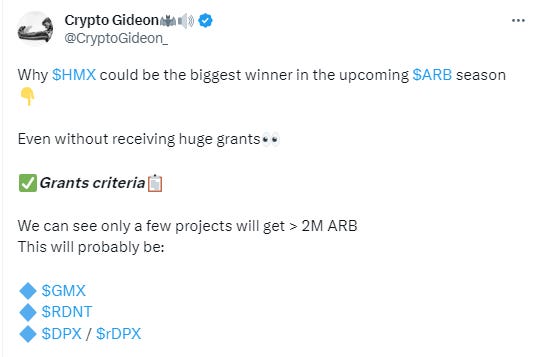

HMX, Next-gen Perp DEX on Arbitrum (CryptoGideon_)

🔹 Crypto, Forex & Commodity

🔹 $HMX Fees > $GNS Fees with 1/10 Mcap

🔹 Volume/TVL Higher than competition

🔹 Potential ARB Grant

🔹 6-month cliff for previous sales

🔹 Available on Mobile

🔹 Account Abstraction

Gains, On-chain Leveraged Trading (LadyofCrypto1)

🔹 Upcoming Catalysts

🔹 Trade Crypto, Forex, Commodities

🔹 1-click Orders

🔹 Fiat On-Ramp

🔹 Better Staking Rewards & Earnings

4/ LPDfi

Limitless, Democratizing Leverage for any Digital Asset (Defi0xJeff)

🔹 2000x Leverage

🔹 No Forced Liquidation

🔹 Capital Efficiency

🔹 Early, still in closed Testnet

5/ Vault & Yield

NOYA, Omnichain DeFi Strategies (Flowslikeosmo)

🔹 Smart Liquidity → Machine Learning models to control Liquidity On-chain

🔹 Omnichain Yield Optimizer

🔹 ZKP & AI Narrative

🔹 Early, still in Testnet

6/ Money Market

Synonym, Cross-chain Money Market (ViktorDefi)

🔹 Wormhole Architecture, Proof-of-Authority

🔹 Liquid & Flexible Liquidity across Chains

🔹 Take a loan on a chain, Pay on another

🔹 Synonym merged with NewOrderDAO → Big Treasury

🔹 50% Fees to Users

7/ GambleFi

Rollbit, Crypto Innovative Casino (DistilledCrypto)

🔹 $1M+ Daily Revenue

🔹 Cash Flow → P/E Ratio better than most protocols

🔹 Deflationary

🔹 YTD: 10%+ Monthly Growth in Revenue

🔹 Holders: Lower Trading Fees, Rakebacks, Lottery

🔹 Fairly Launched

8/ RWA

Polytrade, Bringing Sustainable RWA Yields to DeFi (TheDefiDog)

🔹 Joining Mastercard's Blockchain & Digital Assets Program

🔹 Assets backed by real Underlying Economics,

🔹 Factional & Self-Ownership

🔹 Transparency

🔹 NFT Market for RWA

Arcton, Marketplace for Startup IPOs (0xSalazar)

🔹 Startups investing: Illiquidity Issue and Long Lockup period issue

🔹 → Tokenizing Startup Shares/Equities → Marketplace

🔹 Legal Clarity for Securities on Blockchain

🔹 Camelot Partnership: Secondary Marketplace

More on Arcton (Defi0xJeff)

Goldfinch, Decentralized Credit Protocol (hmalviya9)

🔹 Real-World Businesses to borrow from Crypto Investors without Crypto Collateral

🔹 $700k Fees every Month & $100M worth of Active Loans

🔹 Secondary Market soon

🔹 Supply Unlocks in 2026

🔸 High Inflation for now

Centrifuge, Institutional Platform for On-chain Credit (iambullsworth)

🔹 RWA More Accessible & Liquid for Investors & Borrowers

🔹 Expansion to Arbitrum & Base

🔹🔸 Bottomed Chart, Price below ICO Price

🔹 Many Partnerships

9/ GameFi

NakamotoGames, Web3 Gaming Hub (BenjiGanar)

🔹 Devs can publish Games & Monetize

🔹 Play2Earn, NFTs, Metaverse, Lands

🔹 3 Years Runway

🔹 $40M Mcap, Uptrend

🔸 No more Vesting, 105M $NAKA Free to be sold

🔸 Low DAU & Activity

🔸 Many Features Missing

10/ SocialFi

FriendTech Overview & Strategies (drakeondigital)

🔹 Decentralized Social Network

🔹 Airdrop Farming

🔹 Day Trading

🔹 Swing Trading

PostTech, Web3 Social Network on Arbitrum (CryptoGideon_)

🔹 Good UI, X-like UI

🔹 5% Trading Volume earned on held Shares

🔹 Airdrop Farming

🔹 High Volume & Users in a short amount of time

🔸 Agressive Marketing Strategy & Airdrop Strategy

More on PostTech (TheDeFiPlug & belizardd)

11/ Bot

Maestro, DeFi Focused Tools & Bots (matrixthesun)

🔹 Sniping Telegram Bot

🔹 No Token yet

🔹 1.2k Daily Active Users → 36% of the Telegram Bots Sector

🔹 Very Profitable, High Revenue, $630k Weekly Fees

12/ Others

Brave, Web3 Private Browser (hmalviya9)

🔹 23M Daily Users

🔹 Deflationary Token

🔹 Buybacks

🔹 Super-App for Privacy, Web3, VPN, Firewall, News Feed, and more

🔹 Founded by Mozilla Co-founder

🔹 ZKP Technology

Chainlink, Decentralized Oracle Network (hmalviya9)

🔹 Accessing External Data Feeds to provide these data to Apps on Blockchains

🔹 Total Value Secured: $11.48B

🔹 2500 Clients & Partners

🔹 Partnership with Google, SWIFT, Binance & more

🔹 Token: Primary Fees Token, Staking

That’s it for today frens!

Thank you for sticking around, your future self will thank you.

Don’t forget to follow the people who provide us this content. They are big brains sharing their knowledge.

You can also follow me on Twitter @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro

If you liked this edition and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.