This Week's Newsletter - Deep Dive on Chain Abstraction through Particle, Socket and LayerZero, & Main News of the Week

Weekly Alpha

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

We’re seeing green again — and this time, it feels real.

Bitcoin just smashed through $94K, and the money coming in isn’t just retail chasing candles.

Over the past three days, BTC ETFs pulled in $912M, $917M, and $107M+ (and that’s only partial data). These are some of the biggest daily inflows ever — clear proof that institutions are not just watching anymore, they’re buying hard.

Meanwhile, BTC supply on exchanges is at its lowest since 2018.

Supply is drying up, and long-term holders aren’t selling. (Micro)Strategy is still stacking, and U.S. banks just got a greenlight from the Fed to invest more freely in crypto.

That’s huge — it removes one of the biggest walls stopping traditional finance from getting in.

So, are we back?

Not yet. But we’re getting close enough to start asking the question.

ETH whales are waking up too. Around 500K ETH got scooped at the recent bottom, which helped kickstart a solid bounce.

Alts? Most are recovering from March’s crash, and people are still unsure if it’s safe to rotate back in.

So for now, BTC dominance is climbing again, while most altcoins are just trying to hold the floor, even if there is exceptions.

Macro-wise, things are still choppy. Inflation’s sticky, the Fed’s not cutting yet, and broader markets are cautious.

But here’s the thing: if the Fed signals a pivot, or even hints at easing, this market could rip fast — and catch a lot of people off guard.

So what’s next?

Forget L1 vs L2. The real shift is happening at the infrastructure level. It’s not about which chain is faster or cheaper — it’s about making chains invisible to users. No more bridges, no more guessing which chain your funds are on.

That’s where chain abstraction comes in — and today we’re diving into it.

We’ll break down what it means, why it matters, and how projects like Particle, Socket, and LayerZero are working to make using crypto feel as easy as using any app on your phone.

Let’s get into it.

Before we dive in this Week’s Newsletter

I also curate CT Content on X.

Find new projects early. Don’t miss anything!Also, if you missed my Latest Post:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on Chain Abstraction: How Particle, Socket & LayerZero are building the invisible crypto UX.

Main News of the Week.

Today's Newsletter is brought to you by Mantle

🎯 The Big News: Securitize x Mantle

We’ve discussed Mantle Index Four (MI4) already, a tokenized, institutional-grade crypto index fund backed by $400M.

Well, things are going fast already.

MI4 has chosen Securitize, the leading real-world asset tokenization platform that has tokenized and issued over $3B on-chain as of April 21, 2025, in partnership with top-tier institutional asset managers like Apollo, BlackRock, KKR and Hamilton Lane.

By leveraging Securitize’s tokenization infrastructure, MI4 investors can tokenize their fund interests.

We’ll dive deeper into MI4 — and what it means for bridging DeFi and TradFi — in the Main News of the Week.

📈 The Bullish Catalyst: MNT x Coinbase

On top of it all, $MNT was just added to the Coinbase roadmap — putting Mantle directly on the radar for even broader exposure in the coming weeks.

Most CEX listing nowadays aren't as bullish as they were last cycle, but Coinbase is still an exception usually. They don’t list that many assets, and when they do, it usually matters.

Sure, they’ve had a few questionable listings lately, but the majority are still top quality — and $MNT is clearly among them.

$MNT available to more people, that’s all we want.

Key Initiative: Gasless Cross-Chain Swaps & Deep Rewards — New Mantle x Bungee Campaign

A new day, a new opportunity to earn on Mantle.

Mantle Network and Bungee have launched a new 1-week campaign offering zero-fee swaps and 3,000 $MNT in rewards — live from April 24 to May 1.

Swapping into Mantle assets has never been easier (or cheaper):

No bridging, no gas fees, no headaches — just pure chain-abstracted liquidity.

📦 Campaign Details

How it works:

Swap any token from any chain into Mantle-native tokens ($MNT, $mETH, $cmETH, $FBTC, $EURe, $COOK) on Bungee Exchange

Zero swap fees — cross-chain only (same-chain swaps don't count)

Campaign timeline: April 24 to May 1, 2025

As always with Mantle, many more events are ongoing, don’t miss them!

1/ Deep Dive on Chain Abstraction – Through Particle, Socket & LayerZero

🧭 Quick Recap: Chain Abstraction vs. “Multichain UX”

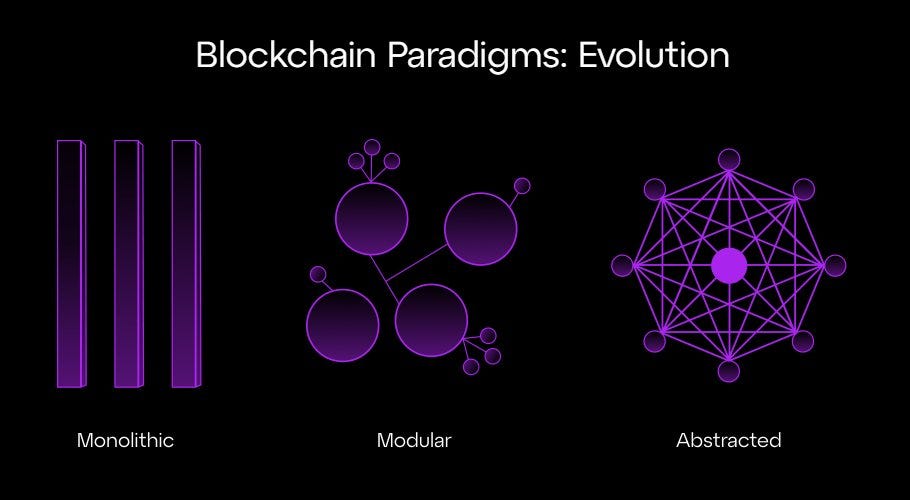

Over the last three years, we built roll-ups like we were stacking LEGO.

Every L1 spun up a new L2. App-chains, zkVMs, Cosmos zones—you name it.

But with every launch, the UX got worse. Switching RPCs. Bridging funds. Buying native gas for one transaction. Multichain was supposed to be composable; instead, it became a border checkpoint.

Chain abstraction flips the paradigm. Instead of manually selecting chains, users declare an intent (e.g., “Swap ETH on Base for SOL on Solana”), and the stack routes, settles, and funds it—automatically. No bridging. No signing multiple txs. No opening five tabs.

In essence:

🛣️ Multichain = Many highways, manual toll booths

🚄 Chain abstraction = One transport layer, tolls paid automatically, like a cake.

If multichain UX is a paper map, chain abstraction is Google Maps. You pick the destination, not the road.

So who’s laying the tracks?

Particle Network – Universal Accounts & Universal Gas

Socket Protocol – Modular Order-Flow Auctions (MOFA)

LayerZero – Omnichain messaging via OApps

Let’s zoom in 👇

🧩 From Fragmentation to One-Click: Why Chain Abstraction Matters

Let’s spell it out. Here's what sucked in 2024—and how chain abstraction fixes it:

🔦 Project Spotlights

1️⃣ Particle Network – “One Account, One Balance, Any Chain”

The pitch: Particle abstracts identity, balances, and gas into one UX. It’s the closest thing crypto has to a chain-agnostic PayPal.

Key Products:

Universal Accounts: Aggregate your EVM + Solana addresses into a single smart account with unified balance and nonce.

Universal Gas: Pay transaction fees with USDC, DAI, or any ERC-20—across all supported chains.

UniversalX: Their consumer-facing trading platform. Onchain, self-custodial, but feels like a CEX. 1.5M+ trades, $4.3M+ in revenue.

How it works:

Wallet state is managed through a Master Keystore Hub

Execution is routed via Particle Chain—their custom L1 coordinating liquidity + gas funding

Built on ERC-4337, with EIP-7702 support + Bitcoin Account Abstraction (BTC Connect) coming in 2025

Live since March 25, 2025 (Binance HODLer airdrop)

Powers gas fees, staking, governance, and is burned on usage

Market cap ~$44M, with real traction and PMF in hand

Why it hits: This isn’t a speculative product—it’s shipping. Users trade on UniversalX today. Every tx consumes $PARTI. This isn’t just abstraction—it’s monetized abstraction.

Here is my post on this project.

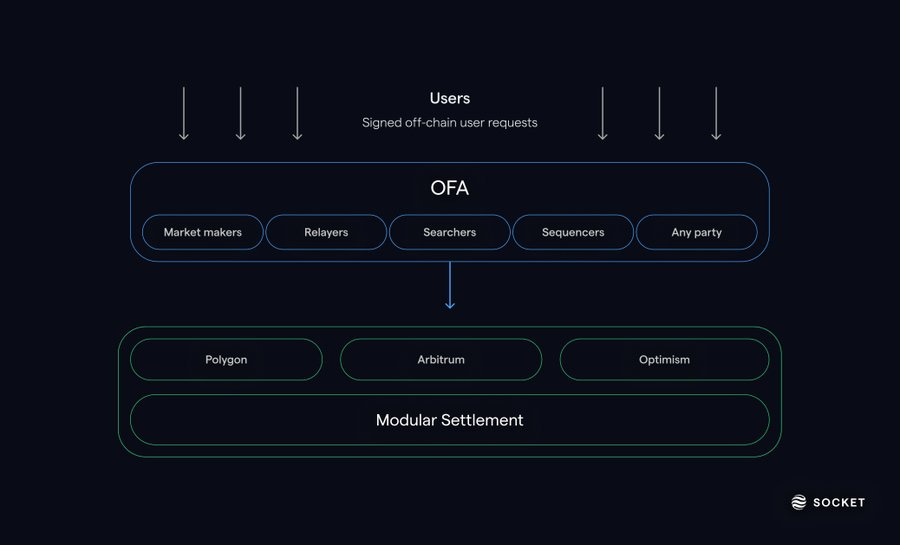

2️⃣ Socket Protocol – Liquidity & Execution Layer

The pitch: Socket abstracts execution into a competitive market. Instead of relying on fixed bridges, devs call one API, and the network decides who fills the order.

Key Product: MOFA (Modular Order-Flow Auctions)

Transmitters bid in real time to fulfill intents (bridge, swap, pay gas)

Cheapest + safest route wins

Developers don’t pick a path—they just define an intent

Live Integrations:

300+ networks supported (EVM, Solana, Cosmos)

Polygon’s AggLayer (launched Feb 2025) runs on MOFA—first true “chain-abstracted” L2

Magic Accounts unify gas + balances across chains (e.g., 10 USDC on ARB = 10 on Base = 10 on OP)

Token: $SOCKET

Not live yet, but Pioneer Quest and Huntable airdrop campaigns are underway

Backed by Coinbase Ventures, OpenSea Ventures, Framework, and others

Real stats:

14M+ transactions processed

$15B+ in cross-chain volume

$200M in total locked value

Integrated in MetaMask, Coinbase Wallet, Aevo, Derive, Kinto, BungeeExchange

Why it hits: Socket doesn’t try to be the bridge. It replaces it with a market for execution. That’s scalable. That’s secure. That’s web3 infra with price discovery built in.

Here is my thread on Socket Protocol.

3️⃣ LayerZero v2 – The Messaging Backbone (Now with vApps)

The pitch: LayerZero doesn’t bridge assets—it bridges messages. It’s the interop layer that allows smart contracts to communicate across 80+ chains like they live in the same execution environment.

Core products:

OApps – Contracts deployed across chains, synced via LayerZero messages

ZRO Token – Launched June 2024; stakers secure the Oracle/Relayer stack

vApps – Just launched: Verifiable Applications at internet scale

📦 Enter vApps

Built by LayerZero + Succinct Labs, vApps are a Rust-based framework that lets developers build verifiable apps with Web2-like performance—but on crypto rails.

Key breakthroughs:

Up to 832× fewer cycles than EVM interpreters

95.7% reduction in proving cycles

30× throughput with GPU acceleration

346MB → 1.5MB proof compression via recursion

Why it matters:

vApps abstract away proof systems, letting developers focus on logic—not cryptography

Supports single-chain, multi-chain, and Web2–Web3 hybrid apps

One universal SDK → build once, generate onchain + offchain artifacts

Think: verifiable APIs, attestations, IoT integrations—all without blockchain overhead.

Network Reach:

80+ supported chains

1.7M cumulative messages

4.1M messages in Q4 2024 alone (+51% QoQ)

Who’s building on it:

Stargate, Radiant, PolynomialFi, PancakeSwap

Now expanding with vApps to unlock composable, verifiable Web2–Web3 hybrids

Why it hits: LayerZero is positioning itself as the transport and verification layer for the entire crypto stack. It’s not just about passing messages anymore—it’s about enabling verifiable computation, seamless state syncing, and global deployment.

🧰 How They Interlock – A Day-in-the-Life Flow

User Intent:

“Swap 1 ETH on Base for a meme coin on Solana.”

What Happens:

Particle: UA signs once. No switching networks. One balance.

Socket: MOFA auctions off the best execution path. ETH → SOL. Solana gas funded from Base USDC.

LayerZero: Delivers settlement message + receipt back to the original wallet.

🔁 Result: One click. No bridges. No UI friction. Just one intent, fully abstracted.

📊 Quick Comparison

⚡ Real-World Progress

🧱 Challenges Ahead

Socket: Auctions need to settle <1s to match Web2 latency

LayerZero: Oracle/Relayer governance—who chooses the default stack?

Standards: ERC-4337 vs. Particle’s UAs vs. EIP-7702—will wallets converge or fragment further?

Tokenomics: Can relayers earn sustainable yield without inflation?

Regulation: Paying gas with stablecoins? Might trigger money-transmitter compliance.

🔭 Vision: From Narrative to Infrastructure

Chain abstraction started as a meme. Now it’s becoming the UX layer for the entire internet of blockchains.

The winners will be the ones building infra for apps—not apps per chain.

"No one asks which SMTP server sent their email. Soon, no one will ask what chain they’re on."

For Builders:

Plug Socket for programmable intent flows + cross-chain liquidity

Integrate Particle SDK for seamless onboarding, no gas alerts

Deploy as LayerZero OApps to live everywhere by default

For Investors + Power Users:

Farm $PARTI and $SOCKET quests while early

Watch LayerZero’s message volume on Dune for ecosystem health

Don’t buy chains—buy the layer abstracting them

✅ Conclusion

Chain abstraction isn’t about making crypto “simpler”—it’s about making it invisible.

Particle, Socket, and LayerZero are turning blockchain into backend plumbing. Users don’t care if it’s Base, Solana, or Arbitrum—they just want their trade to settle.

And in 2025, for the first time, that’s actually possible.

The future is abstracted.

2/ Crypto & DeFi News

🎯 Citigroup Says Blockchain's "ChatGPT Moment" Is Coming in 2025

Citigroup says 2025 might be blockchain’s breakout year—its “ChatGPT moment”—sparked by regulatory clarity, U.S. policy shifts, and institutional adoption.

According to their April 23 report, the stablecoin market could hit a staggering $3.7 trillion by 2030, or a more “conservative” $1.6T base case. Key drivers? U.S. regulation (think: the GENIUS Act), rising treasury-backed stablecoins, and non-U.S. markets doubling down on CBDCs.

Citi also predicts stablecoin issuers could surpass entire countries in their U.S. Treasury holdings by the end of the decade—basically turning Circle and Tether into sovereign bond whales.

Thoughts

This is about way more than adoption curves. If stablecoins truly become the backbone of a new digital dollar economy, it could upend the global financial hierarchy. The U.S. could extend dollar dominance through crypto rails, while China and the EU race to defend their monetary turf via CBDCs. It’s geopolitical fintech warfare.

But with 1,900+ depegging incidents last year, the road to stability is, well... unstable. A big depeg could spark contagion across CeFi, DeFi, and TradFi.

Still, if policymakers can thread the needle, and players like BlackRock or PayPal step in with compliant stablecoin offerings, 2025 could be the year stablecoins graduate from crypto sidebar to systemically relevant assets.

🧩 Ethereum’s L2 Strategy vs. the Monoliths: Avail Enters the chat

Avail co-founder Anurag Arjun is hyping Ethereum’s L2-centric architecture as its not-so-secret weapon. Instead of one high-speed base chain, Ethereum enables a galaxy of rollups—each with different block times and design goals.

Critics say this splinters liquidity and confuses users. But Arjun frames it differently: “The under-appreciated beauty of rollups is diversity.” Rollups as sandbox cities instead of one megacity.

Meanwhile, ETH gas fees just hit a five-year low, and daily L1 activity is down. Institutions are quietly slashing allocations, as retail engagement dips.

Thoughts

If you missed last week’s newsletter on modular madness.

Ethereum’s multichain thesis is elegant in theory, but messy in practice. While it empowers experimentation, it also fractures user experience and liquidity. For normies and institutions, hopping across 12 rollups to do one thing feels like a UX nightmare.

Until there’s seamless interoperability between rollups, the modular thesis risks being too abstract for real adoption.

ETH might still be king in dev mindshare, but unless it can tie the room together—like a crypto version of TCP/IP—it risks losing market cap relevance to faster, more coherent chains like Solana or newer modular L1s.

💰 Securitize & Mantle Launch Institutional Crypto Index

Securitize and Mantle just dropped the Mantle Index Four (MI4) Fund — an institutional-grade crypto index product designed to offer diversified exposure and sustainable on-chain yield.

The fund bundles BTC (50%), ETH (28%), SOL (7%), and USD stablecoins (15%), while incorporating liquid staking strategies through assets like mETH, bbSOL, and sUSDe, targeting an estimated 3–4% APR.

Structured as a BVI Limited Partnership, MI4 provides compliant onboarding, quarterly rebalancing, professional fund administration, and secure self-custody via Fireblocks.

Fund interests are tokenized through Securitize, enabling real-time on-chain liquidity on Mantle Network — offering investors composability, transparency, and flexibility never seen before at the institutional level.

The fund positions itself as the “S&P 500 of crypto”, and it’s launching right as institutional interest in tokenized assets hits new highs. Securitize, already managing $2.5B+ through initiatives like BlackRock’s BUILD fund, brings the heavyweight infrastructure needed to support MI4’s ambitious goals.

Thoughts

This is the professionalization of DeFi, brought to scale.

Liquid staking meets institutional fund structures, wrapped inside a trusted, compliant framework — MI4 bridges the gap between traditional finance expectations and DeFi-native opportunities.

The fund combines several key innovations:

Crypto beta exposure without active portfolio management

Built-in staking yield via trusted Defi protocols

Real-time tokenization of fund shares for liquidity and secondary market possibilities

Institutional-grade security and compliance to unlock larger capital flows

Securitize’s dominance in real-world asset tokenization (71% market share) and Mantle’s $4B+ ecosystem foundation create a potent combination — one built to usher billions of dollars into the next generation of on-chain finance.

With MI4, crypto-native yield strategies are no longer niche or experimental.

They’re becoming part of the global financial system, structured, regulated, and ready for prime time.

DeFi isn’t just here to stay — it’s setting the new standard for what modern finance can be.

🧢 Trump Hosting a TRUMP Memecoin Dinner for Top 220 Holders

Trump is throwing a dinner at his Washington, D.C. golf club—exclusively for the top 220 holders of his TRUMP memecoin. Yes, really.

The coin, launched before he took office in January, has seen wild swings—peaking at $15B market cap before crashing 50%. Post-dinner announcement, it pumped 52%. Meanwhile, Melania’s memecoin (of course she has one) is down 90% from ATH.

To attend, holders must pass a background check and hail from a non-KYC-watchlisted country. No plus ones.

Thoughts

We’ve officially entered the timeline where memecoins and U.S. politics are indistinguishable. TRUMP token is part performance art, part campaign stunt, part regulatory headache. With 80% of supply in team-controlled wallets, this looks less like community coin and more like controlled chaos.

But if you zoom out, it’s a glimpse at how politicians might use memecoins as proto-SuperPACs—fundraising tools with no need for disclosures. The SEC isn’t ready for this. Neither is the electorate.

If TRUMP token sets precedent, every 2028 candidate might launch a token.

🧊 SEC Delays Polkadot ETF, Again

The SEC just kicked the can down the road on Grayscale’s Polkadot ETF, now delaying a final decision until June 11. The ETF joins 70+ other altcoin-based funds waiting in line—everything from XRP to Doge to Melania 2x.

Grayscale is also eyeing Solana, ADA, and Litecoin ETFs, while 21Shares is pushing its own DOT product. Polkadot, launched in 2020, has ~$6.6B in market cap, but still struggles with user traction compared to Cosmos or Avalanche.

Thoughts

ETF-ization is becoming the final boss for altcoin legitimacy.

The problem? Not all tokens are created equal. Bitcoin and ETH have institutional narratives. DOT, not so much. While the tech is cool—interoperability, parachains, Gavin Wood pedigree—the vibe just hasn’t hit.

Getting listed won’t guarantee flows. But it does get these tokens into brokerage accounts, which matters for boomers and funds.

If the altcoin ETF wave hits in 2025, expect a short-term pump. Long term? Only the ones with real demand and sticky users will survive. DOT needs more than ETFs—it needs culture.

The New MicroStrategy

Twenty One is a new Bitcoin-native company backed by:

Tether (USDT issuer with massive BTC holdings)

Bitfinex (a crypto OG exchange)

SoftBank (big surprise — TradFi + tech power)

Cantor Fitzgerald (Investment Firm with a $5B Portfolio, already exposed to Crypto, AI, and tech, via MSTR, NVDA, TSLA)

Jack Mallers (Strike CEO, vocal Bitcoin maximalist)

Learn more

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.

Good newsletter, but I was hoping to hear about some of the smaller, less obvious chain abstraction protocols. Still, very valuable content! Thank you