This Week's Newsletter - Deep Dive on RWA-Fi through Maple Finance and Plume, & Main News of the Week

Weekly Alpha

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

The market is slowly coming back to life. Altcoins are showing signs of strength, surprisingly even new token launches are performing well, and institutions are quietly accumulating.

Last week, we talked about stablecoins—arguably the most successful example of Real World Assets (RWAs) in crypto.

This week, we’re diving deeper into RWA-FI, one of the most promising narratives in the space.

But first, let’s address the elephant in the room: Trump’s latest crypto stance. Many expected a more forward-thinking approach, but his recent statements were disappointing. Instead of embracing innovation, his focus remains on the US dollar’s dominance. Rather than fostering crypto’s growth, stablecoins are being positioned as tools to reinforce traditional finance.

Yet, despite this, the market is moving. Altcoins are gaining momentum, and institutional players are stepping in while retail exits. We’ve seen this pattern before—quiet accumulation before major moves. On-chain activity is low, social engagement is muted, but the fundamentals are strengthening.

Real World Assets are no longer just a concept—they’re becoming a reality. Sergey Nazarov (Chainlink) recently highlighted the urgency for the US to establish dominance in secure, tokenized RWAs before global competitors take the lead. We’re talking about a market projected to reach $100T, spanning tokenized credit, real estate, and institutional finance.

Tokenization is transforming illiquid assets into liquid opportunities. From private credit ($12.2B tokenized) to real estate developments in Turkey and the UAE, the shift is accelerating. The question isn’t whether RWAs will take off—it’s which platforms will lead the way.

Maple Finance has been a strong player in institutional DeFi lending, facilitating over $6.5B in loans. While Maple serves institutional lenders with overcollateralized loans, Syrup opens the doors to permissionless DeFi, allowing anyone to participate. With a TVL of $700M+, strong partnerships (Coinbase, Bitwise, Ethena Labs), and innovative BTC yield products, Maple is positioning itself at the forefront of RWA lending.

While Maple focuses on institutions, Plume Network is taking a different route—bringing RWAs to the masses. Initially an RWA-focused Layer2, Plume has now evolved into a full-fledged Layer1 blockchain designed for real-world asset tokenization. Plume is setting the foundation for RWAFi (RWA + DeFi).

With $5B+ in committed assets and major backers (ex-Binance Labs, Galaxy Ventures), Plume is making waves. The market has already noticed—$PLUME has outperformed competitors like Ondo on the monthly, and with potential CEX listings on the horizon, this could be just the beginning.

We’re at an inflection point. RWAs are surging, institutions are positioning, and narratives are evolving. Whether it’s Maple’s institutional lending or Plume’s retail-focused RWAFi ecosystem, the pieces are falling into place.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on RWA-Fi: How Maple Finance & Plume Network Are Reshaping Real-World Asset Finance.

Main News of the Week.

Today's Newsletter is brought to you by Mantle

The Everest Upgrade & EigenDA Integration

For over a year, Mantle has operated seamlessly with Mantle Tectonic, but now it's time for a major leap forward. The Everest Upgrade strengthens Mantle’s infrastructure while ensuring full compatibility with Ethereum’s Pectra Upgrade.

A key part of this evolution is EigenDA, now fully integrated into Mantle’s mainnet. This move brings enterprise-grade data availability, positioning Mantle as a scalable and cost-efficient solution.

With EigenDA securing $1.3B in value, Mantle benefits from:

Ethereum-backed security with 4.3M restaked ETH + 391.6M restaked EIGEN

High throughput (15MB/s vs. EthereumDA’s 0.0625MB/s)

Fixed pricing for predictable transaction fees

Decentralization boost: From 10 to 200+ operators

Product Innovations

1. EigenDA – Scaling the Future of Onchain Finance

Mantle’s migration to EigenDA isn’t just an upgrade—it’s a fundamental shift in how the network handles data availability.

Key improvements:

✅ Higher scalability: EigenDA enables 15MB/s throughput, eliminating bottlenecks.

✅ Fixed pricing model: Unlike EthereumDA’s fluctuating blob fees, EigenDA allows Mantle to lock in costs.

✅ Stronger censorship resistance: MantleDA had 10 operators, while EigenDA scales to 200+ operators.

With these advancements, Mantle Network ensures cost-efficient, high-speed transactions.

2. Ethereum Pectra Compatibility – Future-Proofing Mantle

Ethereum’s Pectra Upgrade is set to introduce major changes, and Mantle is already ahead of the curve.

🔹 EIP-7685: Supports the RequestsHash field in block headers

🔹 EIP-7702: Implements the SetCodeTx transaction type

🔹 Seamless adaptation: Mantle ensures full Ethereum L2 compatibility from day one

These upgrades make Mantle a plug-and-play solution for developers, ensuring long-term network stability and innovation.

Treasury/Financial Overview

EigenDA is now the world’s largest alternative DA provider, with billions in secured value. This move cements Mantle’s position as a leader in scalability and financial infrastructure.

This transition positions Mantle to scale DeFi, enterprise solutions, and institutional adoption without facing the congestion issues that plague other L2s.

Conclusion: Why This Matters

Crypto infrastructure is entering a new phase where scalability, security, and cost-efficiency define the winners. Mantle’s Everest Upgrade, with EigenDA at its core, is setting a new standard for Ethereum L2s.

✅ Enterprise-grade scalability with EigenDA’s high throughput

✅ Future-proof compatibility with Ethereum’s Pectra upgrade

✅ Decentralization boost with over 200 EigenDA operators

As Ethereum scales and institutional adoption grows, Mantle is positioning itself as the most efficient blockcain for onchain finance—bridging the gap between DeFi and mainstream adoption.

And you can profit from it as always with Mantle Ecosystem Yield & Rewards.

1/ Deep Dive: Maple Finance, Syrup, and Plume Network in the Expanding RWA-Fi Sector

We've previously discussed RWAs in this newsletter, as an introduction here (October 2024), here via Pendle & Story Protocol (December 2024), and here via Mantra (February 2025).

I must continue discussing RWAs because it's one of the few narratives currently fueling global adoption and gaining momentum.

Today, we'll delve into RWA-FI 👇

The RWA-Fi Narrative: A Bridge Between TradFi and DeFi

Real-world asset finance (RWA-Fi) is a transformative narrative in blockchain, merging traditional financial products with decentralized finance (DeFi). This sector is experiencing significant growth as institutions embrace the tokenization of real-world assets—ranging from equities and bonds to real estate and private credit—unlocking efficiency, transparency, and liquidity on-chain.

BlackRock and the Institutional Shift Toward RWA Tokenization

One of the most significant endorsements of RWA-Fi comes from BlackRock, the world’s largest asset manager with $11.6 trillion in assets. BlackRock has pioneered RWA tokenization through its BUIDL fund (BlackRock USD Institutional Digital Liquidity Fund), launched in March 2024 on Ethereum.

BlackRock's BUIDL is a tokenized investment vehicle designed to provide qualified investors with exposure to U.S. dollar yields through blockchain technology.

By early 2025, BUIDL has tokenized over $1 billion in U.S. Treasury Bonds, reflecting rapid adoption. Given that the U.S. Treasury issues approximately $2 trillion in bills monthly, a mere 0.1% market share translates to $2 billion in tokenized assets per month. With BlackRock’s expansive network, BUIDL could potentially scale toward $100 billion in total value locked (TVL) by 2026, though this depends on regulatory and market dynamics.

While BlackRock’s involvement validates RWA-Fi, DeFi-native projects like Maple Finance and Plume Network are driving innovation with scalable, decentralized solutions tailored to this ecosystem.

Democratization of Institutional Investment Products

RWAs are broadening access to TradFi investment products by eliminating intermediaries and lowering entry barriers. Tokenization enables participation in financial instruments once exclusive to high-net-worth individuals and institutions, reshaping capital markets.

Institutional Private Credit

Traditionally, private credit markets have been inaccessible due to regulatory hurdles, high capital requirements, and reliance on centralized intermediaries, limiting retail investor participation. On-chain platforms like Maple Finance bring private credit markets to the blockchain, reducing minimum investment sizes and enhancing accessibility.

Data Insights:

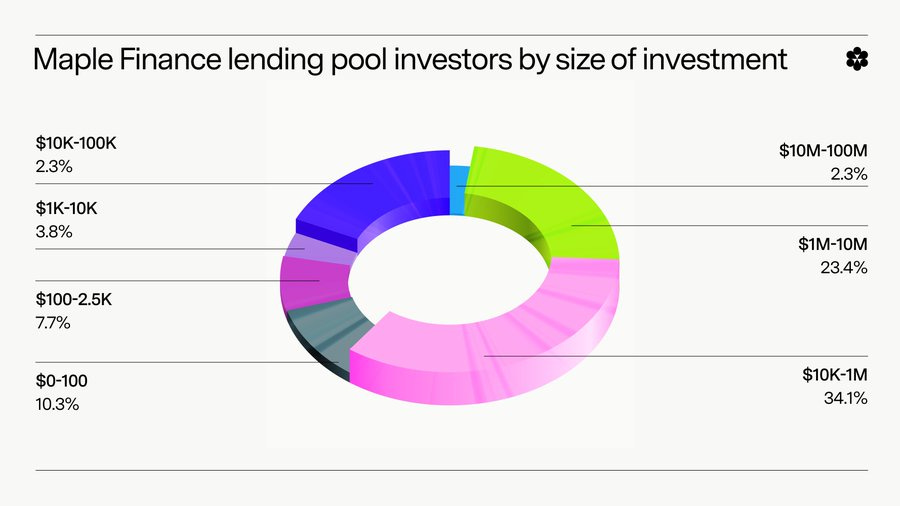

Over 70% of lenders on Maple Finance invest below the $1M minimum required for Blackstone’s Private Credit Fund (BCRED), with a median investment size of $220,000.

This contrasts sharply with BCRED’s institutional focus, where minimums typically start at $1M for direct access.

By fractionalizing private credit, RWAs bridge the gap between institutional-grade financial products and accredited investors, though full retail access remains jurisdictionally constrained.

Maple Finance: Institutional Lending with a DeFi Edge

Maple operates as a capital-efficient credit marketplace for institutions, offering structured loans with on-chain transparency. Borrowers submit loan requests to pool delegates, who assess credit and approve loans. The liquidity comes from institutional lenders who must pass strict KYC procedures. In return, they earn interest and $SYRUP rewards. Maple also has a built-in coverage mechanism to protect against defaults.

One of the biggest recent developments is Bitwise joining as a lender, a significant validation for Maple's model.

The TVL for Maple Finance stands at $700M.

The protocol aims to scale further, with a target of $4B in loans.

Key Features of Maple Finance:

Credit Pools: Borrowers request capital from pools managed by Delegates, who determine loan terms, interest rates, and collateral requirements based on the borrower’s creditworthiness.

Pool Delegates: These are experienced asset managers responsible for due diligence, ensuring risk mitigation through active monitoring of borrower activity.

Lender Participation: Lenders contribute to the pools, earning yields based on loan repayments and interest accrued from borrowers.

Default Management: If a borrower defaults, Maple enforces structured liquidation and recovery processes, ensuring stability in capital allocation.

Institutional Lending:

Maple caters primarily to crypto-native firms, trading desks, and market makers who require liquidity. Its lending structure allows these firms to deploy capital more effectively, maintaining operational efficiency while reducing costs.

Revenue Model:

Maple generates revenue through various streams, including:

Loan Origination Fees: Charged to borrowers when securing funding.

Interest Spreads: A portion of the interest paid by borrowers is allocated to the protocol.

Protocol Fees: Maple collects fees from lenders and borrowers, contributing to its sustainability.

Since its inception, Maple has facilitated over $2 billion in loan originations, with continued expansion into structured credit for RWAs. It bridges institutional capital with DeFi, enabling hedge funds and market makers to leverage blockchain-based credit infrastructure.

A few days ago, Converge, a new EVM-compatible Layer1 blockchain was launched, by Ethena Labs and Securitize, as a settlement network designed to integrate traditional finance (TradFi) with decentralized finance (DeFi), focusing on digital dollars and tokenized assets.

Maple Finance is collaborating with Converge to build verifiable on-chain institutional yield and credit products using USDe and real-world assets, enhancing the blockchain’s goal of onboarding institutional capital into crypto-native solutions. This initiative, part of Converge’s broader 2025 launch, aims to create a permissioned and permissionless financial ecosystem, with Maple contributing to institutional-grade DeFi products on the network.

Keep an eye on it 👀

Syrup: Enhancing Capital Efficiency

Syrup, Maple’s latest innovation launched in late 2024, optimizes lender returns and borrower efficiency within the RWA-Fi ecosystem.

How Syrup Works

Broader Lender Access: Syrup expands participation beyond Maple’s permissioned pools, though some accreditation or compliance checks may apply, balancing institutional and wider investor access.

Overcollateralized Loans: Leverages Maple’s current model, requiring collateral exceeding loan values, with risk managed via senior-junior tranches.

Liquidity Deposits: Users can deposit liquidity (USDC, USDT) via Ethereum wallets.

Yields & "Drips": Depositors earn APY and receive daily "drips" (1 drip per USD deposited). These drips can be multiplied by locking funds for longer periods (e.g., 1.5x for 3 months, 3x for 6 months).

Conversion to SYRUP Tokens: Drips convert into SYRUP tokens at the end of each season (monthly), with varying conversion rates.

SYRUP Staking: SYRUP tokens can be staked for additional yield (~4% APY).

TVL: Syrup’s TVL stands at $283 million, contributing to the overall Maple ecosystem’s TVL.

Mechanism:

Yield Enhancements: Lenders provide liquidity to a structured credit vault, earning fees from borrowers plus Maple’s $SYRUP staking incentives.

Risk Tranching: A senior-junior tranche model offers stable returns for senior lenders (lower risk) and higher yields for junior lenders (higher risk).

Automated Credit Underwriting: On-chain risk metrics streamline credit assessments, boosting transparency and efficiency.

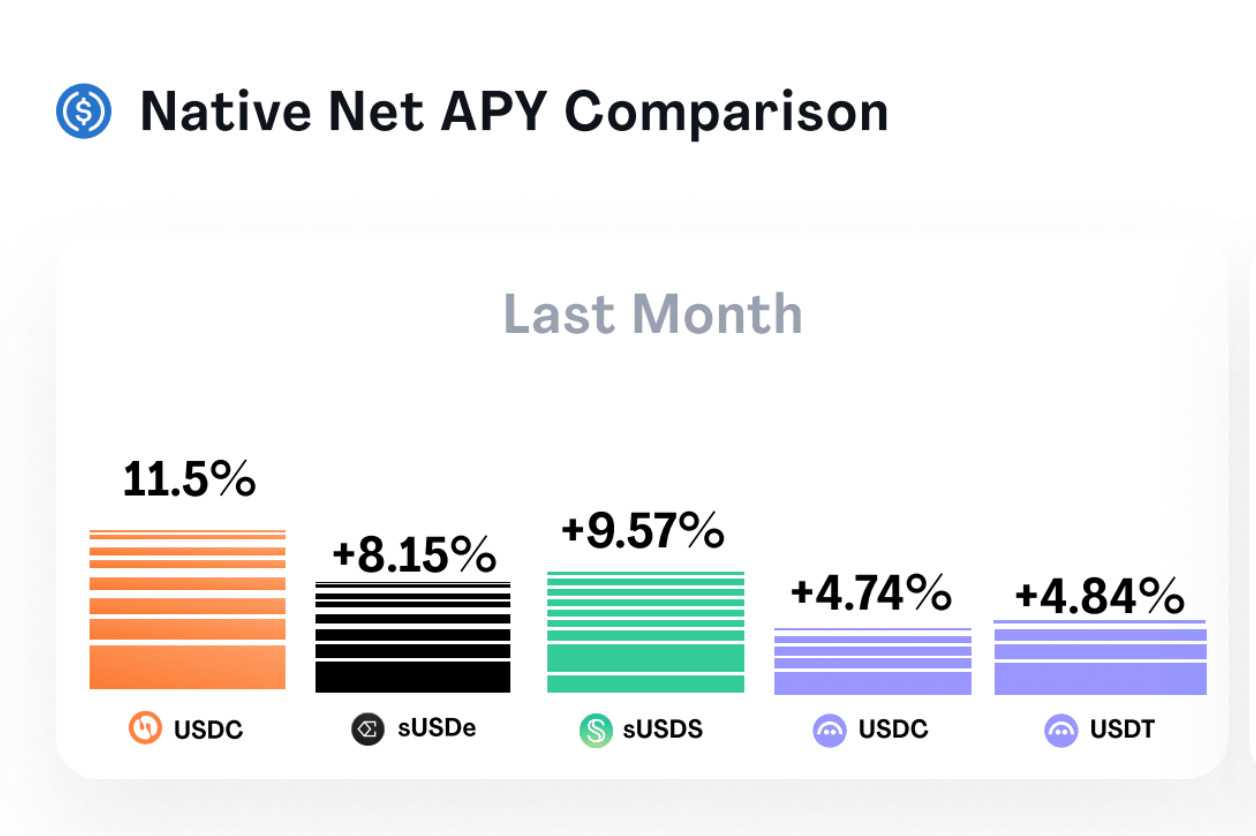

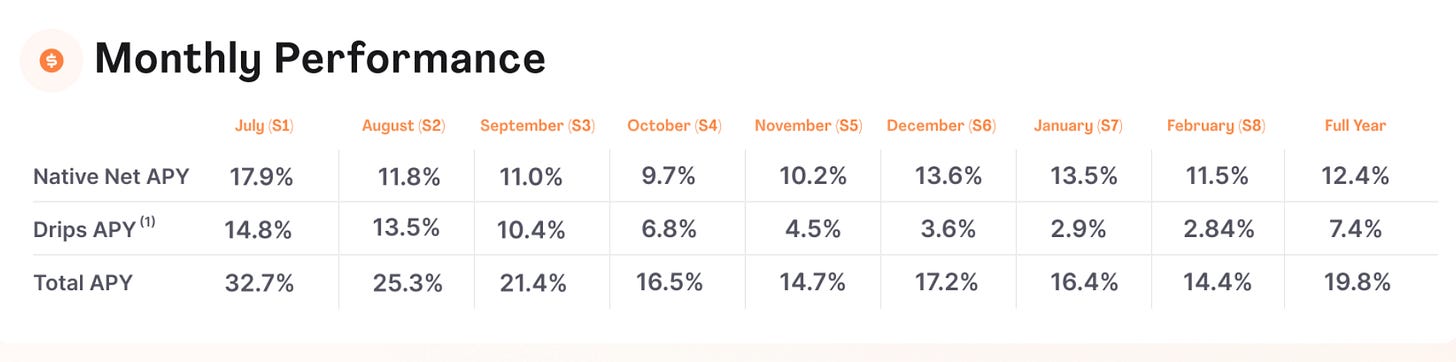

Key Metrics & Recent Performance:

Total Loans Issued (2023-2024): Over $500M across Maple, with Syrup contributing a growing share.

Active Loan Book: $150M.

Yield Range: 8-15% APY, varying by tranche risk.

Top Borrowers: Institutional trading desks and crypto-native funds.

Syrup was also recently listed on Coinbase, showing interest and boosting adoption.

Key Differences Between Maple Finance & Syrup:

Syrup enhances Maple’s ecosystem as an on-chain prime brokerage, blending DeFi liquidity with TradFi credit mechanisms to support institutional borrowers.

Target Audience: Maple Finance is institution-focused (permissioned, KYC required), while Syrup enables broader lender participation (permissionless, no KYC for depositors).

Loan Access: Maple loans are for accredited entities; Syrup allows open deposits from all, leveraging Maple’s institutional borrowers.

Rewards Mechanism: Maple initially rewarded with MPL (later converted to $SYRUP), while Syrup used convertible “Drips” pre-launch, now transitioning to $SYRUP staking rewards.

If you want to see the last monthly update of both protocols.

Plume Network: A Blockchain Purpose-Built for RWAs

Plume Network is a Layer1 blockchain built with the Cosmos SDK, designed exclusively for RWA tokenization and institutional DeFi.

Its modular interoperability via Inter-Blockchain Communication (IBC) supports seamless integration with other ecosystems.

Plume is a project I find particularly interesting due to its unique positioning in the RWA ecosystem. Initially designed as a Layer2, it has evolved into a Layer1 specializing in the tokenization of real-world assets and DeFi around these assets. What stands out to me is its differentiated approach—while many projects focus on bringing institutions into tokenization, Plume is taking the "buy side" perspective, targeting the broader community and retail investors interested in RWAs.

Features like Arc, which promises ultra-fast tokenization of various RWA products (real estate, treasury bonds, renewable energy), and Plume SkyLink, which connects to 17 other blockchains via LayerZero, could be major catalysts for adoption.

One aspect that requires attention is PLUME’s tokenomics.

Only 20% of the total supply is circulating, with a major unlock set to begin in July 2025. Early backers and contributors hold 41% of the supply, and as their tokens unlock progressively until 2028, there could be significant sell pressure—especially if this happens at the tail end of a bull run. Personally, I’d be cautious around this period.

From a broader perspective, Plume could benefit from the "Made in the USA" narrative, especially if regulatory conditions become more favorable under a Trump administration. Its market cap is smaller than Ondo’s, which means it has more upside potential if the RWA narrative gains traction. That said, much of Plume’s success depends on how well it delivers on its promises—especially in onboarding large-scale tokenized assets and integrating them into DeFi.

For now, I see Plume as an early-stage project with an ambitious vision. It could become an interesting proxy for the growth of RWAs in crypto, but I’ll be watching closely how things unfold, particularly around mid-2025.

Key Features & Innovations:

Institutional-Grade Compliance: Plume embeds KYC/AML verification at the application layer, ensuring regulatory adherence for issuers and investors.

Cross-Chain Liquidity Bridges: IBC enables RWAs to flow across Ethereum, Solana, and Cosmos-based chains.

Native RWA Asset Issuance: Built-in token standards support fixed-income instruments, real estate-backed tokens, and private credit assets, simplifying deployment.

Plume targets institutional asset managers, private credit funds, and tokenized securities platforms. Early adopters include real estate firms and treasury bill issuers seeking scalable on-chain solutions.

Key Metrics & Growth:

Total Value Locked (TVL): $50M+ in early-stage growth (pending mainnet confirmation).

Active Validators: 30+ (estimated based on network scale).

Notable Partners: Institutional asset issuers and DeFi liquidity providers.

Target Market Size: Over $10 trillion in tokenized RWAs by 2030, per industry forecasts.

Claims of $4B in assets tokenized at launch reflect $4.5B in commitments, but execution remains unproven—caution is advised.

The token $PLUME has gained significant momentum post-mainnet launch in Q1 2025.

Plume is also now the official RWA Channel of the YZi Labs Ecosystem, formerly known as Binance Labs. This groundbreaking move marks YZi Labs' debut investment in an RWAfi chain, showcasing their strong vote of confidence in Plume.

Plume vs. Ondo

Unlike Ondo, which is seen as the leader in onboarding institutions to tokenize assets, Plume complements it rather than competing directly. If Ondo is Wall Street 2.0, providing assets, Plume acts more like Robin Hood 2.0, facilitating access and attracting liquidity. This positioning makes a lot of sense, as institutional adoption alone isn’t enough—there needs to be a strong market of buyers and efficient tools to integrate these assets into DeFi.

Ondo Chain:

Focus: Tokenizing U.S. Treasuries and bonds for asset managers and institutional investors.

Key Features:

Compliance-first blockchain tailored for regulated entities.

Interoperable with traditional finance systems.

Enables issuance and settlement of tokenized fixed-income products.

Primary Users: Institutions seeking low-risk, yield-bearing assets.

Example Product: USDY (Ondo’s tokenized short-term U.S. Treasuries).

Plume:

Focus: Building a full-stack RWA-Fi ecosystem for issuance, trading, compliance, and liquidity.

Key Features:

Supports diverse RWAs beyond Treasuries.

Includes built-in compliance modules for on-chain institutional finance.

Optimized for DeFi liquidity, reducing cross-chain fragmentation.

Offers flexibility for issuers, investors, and DeFi applications.

Primary Users: RWA issuers needing compliant tokenization infrastructure; institutional and retail investors in RWA-Fi markets.

Ondo Chain focuses narrowly on U.S. Treasuries and fixed-income assets with regulatory clarity for TradFi, while Plume integrates a broader range of RWAs into a dynamic, DeFi-native financial ecosystem.

BlackRock, Ondo, and Broader Institutional RWA Adoption

The RWA sector is gaining traction with institutional giants:

BlackRock: BUIDL marks a major step in blending blockchain assets with TradFi portfolios.

Ondo Finance: Facilitates tokenized Treasuries and private credit, linking traditional assets to DeFi yields.

Franklin Templeton: Deploys blockchain-based strategies, reinforcing tokenized assets’ legitimacy.

These players drive liquidity into tokenized finance, amplifying demand for infrastructures like Plume Network and Maple Finance to support institutional adoption.

Why These Projects Matter for RWA-Fi?

As RWA-Fi evolves, Maple/Syrup and Plume Network address critical needs:

Maple Finance & Syrup: Deliver institutional credit and scalable lending, primarily via an overcollateralized model.

Plume Network: Provides blockchain infrastructure for RWA adoption, with compliance and liquidity bridges.

With trillions in real-world assets poised to migrate on-chain by 2030, these platforms are pivotal to institutional DeFi and capital market transformation.

Who Will Benefit Most from RWA Growth?

BlackRock’s ecosystem (BUIDL investors and partners).

Layer1s supporting institutional RWA compliance (Plume, Ondo Chain).

RWA-Fi protocols solving liquidity fragmentation and scaling.

Blockchains onboarding major RWA issuers and integrating institutional finance at scale.

Challenges Ahead:

Settlement inefficiencies.

Fragmented KYC/AML processes.

Low secondary market liquidity.

If you want to learn about another great project on RWA, with an upcoming TGE.

2/ Crypto & DeFi News

📈 Pump.fun Launches Own DEX, Drops Raydium

Pump.fun has launched PumpSwap, its own decentralized exchange (DEX), shifting away from Raydium as the primary trading venue for Solana memecoins. Starting March 20, memecoins that successfully bootstrap liquidity on Pump.fun will migrate directly to PumpSwap instead of Raydium.

PumpSwap is designed to function similarly to Raydium V4 and Uniswap V2 but aims to streamline trading by removing friction in liquidity migration. Previously, bonded Pump.fun tokens had to migrate to Raydium, a process that slowed momentum and added complexity for users. PumpSwap enables instant, free migrations, potentially improving trading efficiency.

The move intensifies competition between Pump.fun and Raydium, which recently announced its own memecoin launchpad, LaunchLab, to rival Pump.fun. Other projects like Daos.fun, GoFundMeme, and Pumpkin are also entering the memecoin sector on Solana. PumpSwap plans to introduce revenue sharing with memecoin creators, a feature popularized by GoFundMeme, aiming to align incentives and encourage higher-quality token launches.

Memecoin trading activity has declined significantly from its January peak, impacting both Pump.fun and Raydium. Pump.fun’s daily fee revenue has dropped from over $4 million in January to around $1 million in mid-March. Despite this downturn, Solana’s total value locked (TVL) surged from $1.4 billion to over $9 billion in 2024, with Raydium benefiting from increased trading volumes.

Thoughts

Pump.fun’s launch of PumpSwap is a strategic play to capture more value within its ecosystem by reducing reliance on Raydium. By eliminating the need for token migrations and introducing revenue-sharing incentives, Pump.fun is positioning itself as a more creator-friendly platform. This move could attract memecoin projects looking for a seamless and financially rewarding launch experience.

However, this shift also risks fragmenting liquidity within Solana’s DeFi ecosystem. Raydium’s strength lies in its deep liquidity pools and integration across Solana’s trading infrastructure. If liquidity spreads too thinly between PumpSwap, Raydium, and other emerging platforms, it could lead to higher slippage and reduced trading efficiency for memecoins.

The timing of this launch is also crucial. Memecoin activity has dropped significantly since January, and Pump.fun’s revenue has declined alongside it. The success of PumpSwap will depend on whether it can reignite retail interest in memecoins, especially in a market where scandals and volatility have shaken trader confidence.

If PumpSwap’s revenue-sharing model proves effective, it could set a new standard for memecoin launches, but competition from Raydium’s upcoming LaunchLab will make this an uphill battle.

We talked about Raydium and Solana Ecosystem in a precedent edition.

🇫🇷 Toncoin Open Interest Soars as Pavel Durov Departs France

Toncoin’s open interest (OI) surged by 67%, reaching $169 million on March 15, following reports that Telegram founder Pavel Durov has been released, and left France. This marks the highest level of OI in 42 days, surpassing levels last seen on Feb. 1.

TON, the native cryptocurrency of The Open Network (TON), serves as the backbone of Telegram’s Mini App ecosystem. The sharp increase in OI suggests heightened trading activity and speculation surrounding the news of Durov’s departure. Over the same 24-hour period, TON’s price rose by 17% to $3.45.

Market analysts suggest that TON is entering a long-term accumulation phase, with traders closely watching key support levels. However, if the rally is short-lived and TON drops back toward $3, approximately $18.8 million in long positions could face liquidation.

Durov was previously arrested in France in August 2024, accused of running a platform that facilitated illicit transactions. His case has sparked concerns about broader regulatory scrutiny on privacy-focused platforms. Interestingly, TON’s OI also spiked by 32% following his arrest, though its price declined by nearly 12%. With reports now indicating that Durov has moved to Dubai—a jurisdiction with no extradition agreements with many countries—uncertainty remains regarding the long-term impact on TON’s market dynamics.

Thoughts

The sharp rise in Toncoin’s open interest highlights how closely the market links TON’s price action to Telegram and its founder. Unlike traditional cryptocurrencies that rely on fundamental network metrics, TON’s market movements are largely driven by external events, particularly those concerning Durov and regulatory pressures.

Traders are likely speculating on whether Durov’s departure to Dubai signals a reduced regulatory threat to Telegram and TON. However, the sustainability of this rally depends on whether new developments emerge or if the market sees this as a temporary reaction. The risk of a pullback remains significant, especially if regulatory scrutiny intensifies or if investor sentiment shifts.

From a broader perspective, TON’s reliance on Telegram creates both opportunities and vulnerabilities. If Telegram continues integrating TON into its ecosystem, adoption could rise. However, regulatory uncertainty surrounding privacy-focused platforms remains a key risk factor, making TON highly reactive to legal and geopolitical developments.

✊ Solana Futures ETF to Grow Institutional Adoption, Despite Limited Inflows

The launch of the first Solana futures ETFs—Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT)—marks a significant step in institutionalizing Solana as an investment vehicle. Scheduled to debut on March 20, these ETFs could set the stage for a future Solana spot ETF, which industry watchers view as the “next logical step.”

According to Ryan Lee, chief analyst at Bitget Research, the ETF launch could strengthen Solana’s market position by increasing demand and liquidity for SOL, helping it compete more closely with Ethereum. However, despite its potential to attract institutional interest, concerns remain about investor enthusiasm. Historical trends suggest that altcoin ETFs, like the Ether spot ETF, have struggled to generate substantial inflows compared to Bitcoin ETFs.

While the futures ETF may not drive immediate capital inflows, it plays a role in legitimizing Solana within regulated markets. Solana's inclusion in former U.S. President Donald Trump’s proposed crypto strategic reserve—alongside Cardano (ADA) and XRP—further reinforces its growing significance.

Industry participants believe that a Solana spot ETF would be more impactful than a futures ETF. A JPMorgan report estimates that a Solana spot ETF could attract between $3 billion and $6 billion in net assets within six months, outpacing the adoption of Ethereum ETFs. However, regulatory hurdles could push approval timelines into 2026, given the SEC’s historically lengthy review periods of 240–260 days.

Thoughts

The launch of Solana futures ETFs represents an incremental but important step in broadening SOL’s institutional appeal. While short-term excitement may be muted due to limited inflows, the regulatory approval of futures ETFs creates a clearer pathway for a spot ETF—where real capital deployment happens.

The key takeaway here is that institutional recognition of Solana is growing. Its inclusion in high-level policy discussions and ETF markets signals a shift in perception—from a high-performance blockchain to a legitimate investment asset. However, the challenge remains: Will Solana sustain long-term adoption in regulated markets, or will it struggle with the same liquidity and demand issues seen in other altcoin ETFs?

For now, the Solana ecosystem continues to gain traction, but its ability to convert institutional interest into tangible capital inflows remains uncertain.

🧢 Coinbase Becomes Ethereum’s Largest Node Operator with 11% Stake

A Coinbase report confirmed that the crypto exchange is now Ethereum’s largest node operator, controlling 11.42% of the total staked ETH. As of March 3, Coinbase had 3.84 million ETH—worth approximately $6.8 billion—staked across its validators, surpassing all other individual operators.

According to Ethereum researcher Anthony Sassano, Coinbase’s dominance makes it the “single largest node operator” on the network. While staking collective Lido remains larger overall, its individual node operators control much smaller portions of staked ETH.

Coinbase also shared strong validator performance metrics, reporting an average uptime of 99.75%, exceeding its 99% target. The exchange attributes this to a 2024 upgrade that enabled validator operations to continue uninterrupted during beacon node maintenance. Additionally, Coinbase validators achieved a 99.75% participation rate—higher than the network average of 99.52%—and recorded a 99.76% success rate in submitting MEV relay blocks, surpassing the Ethereum-wide average of 99.38%.

Despite being a centralized exchange, Coinbase emphasized its commitment to Ethereum’s decentralization, stating that its validators are distributed across Japan, Singapore, Ireland, Germany, and Hong Kong.

Following the report, Ether prices surged above $2,000, with daily trading volume reaching $17.4 billion on March 19. ETH accumulation addresses also increased their holdings, signaling renewed market confidence, despite earlier bearish sentiment predicting a potential price drop.

Thoughts

Coinbase's position as Ethereum's leading node operator is a mixed blessing. Its strong validator uptime and regional distribution enhance Ethereum's security and attract capital with institutional-grade staking. However, with an 11.42% stake, concerns about centralization and censorship risk arise. Unlike Lido's distributed model, Coinbase is a centralized entity vulnerable to U.S. regulatory pressure, which could lead to transaction censorship and threaten Ethereum's neutrality.

The report also highlights how institutional involvement in Ethereum staking is increasing, reinforcing ETH’s position as a yield-generating asset. As more institutions look to participate, the question becomes whether Ethereum’s staking model will remain sufficiently decentralized or if large operators like Coinbase will become systemic risks.

Going forward, Ethereum’s validator set may need additional mechanisms, such as stake-weighted governance caps or protocol-level decentralization incentives, to prevent any single entity from gaining outsized influence. While Coinbase’s infrastructure benefits Ethereum today, the long-term impact of centralized staking power remains a critical issue for the network’s resilience and censorship resistance.

🎉 Ripple Celebrates SEC’s Dropped Appeal, but Crypto Rules Still Not Set

The U.S. Securities and Exchange Commission (SEC) has decided not to pursue an appeal against Ripple, marking what many in the crypto industry see as a victory. Ripple CEO Brad Garlinghouse stated that while the case is effectively over, there are still unresolved matters with the SEC. The ruling strengthens Ripple’s position but does not provide broader regulatory clarity for the industry.

Legal experts highlight that this decision does not create a binding precedent. Brian Grace, general counsel at the Metaplex DAO, noted that the ruling was made by a single district court judge and does not set a legal framework for other crypto firms. Meanwhile, legislative efforts to establish a comprehensive crypto regulatory structure in the U.S. remain stalled, with Congress, not the SEC, being responsible for long-term industry reforms.

Despite the SEC’s retreat, Ripple may continue legal battles. Garlinghouse has suggested that Ripple might pursue a cross-appeal to challenge the $125 million fine imposed for institutional XRP sales. Meanwhile, lawmakers are still working on key crypto legislation, including the stablecoin bill and the FIT 21 crypto framework bill, which some expect to pass later this year.

Thoughts

Ripple’s legal victory is significant, but it does not resolve the broader regulatory uncertainty in the U.S. While it confirms that XRP’s retail sales do not constitute securities transactions, it does not establish a legal precedent that other crypto projects can rely on. This means that companies facing similar SEC enforcement actions are still at risk of unpredictable legal interpretations. Without a clear regulatory framework, crypto firms remain vulnerable to ongoing litigation, and market participants lack the stability needed to make long-term strategic decisions.

The case also highlights a shift in the SEC’s approach, potentially signaling a reduced appetite for aggressive enforcement under new leadership. However, this does not equate to regulatory clarity, as the SEC’s stance could change again depending on political factors and future leadership. Real progress will come from Congress, where crypto legislation is still slow-moving.

Until comprehensive laws are passed, the crypto industry remains in a legal gray zone, with enforcement actions continuing to shape, rather than define, regulatory policy.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.