This Week's Newsletter - Case Study on Berachain, Main News of the Week, & Zoom on Cosmos

Weekly Alpha

Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

The market is as unpredictable as ever, with constant swings, new scenarios of “it’s so over” and “we’re so back” every week. Macroeconomic factors continue to weigh on crypto, making it both a challenging and exciting space to navigate.

It was impossible to miss Berachain’s launch—it’s been one of the most hyped projects since 2022. However the airdrop left some users frustrated, sparking FUD. Berachain is a Layer 1 built on Cosmos, using a unique "Proof of Liquidity" model where users provide liquidity instead of traditional staking. It’s EVM-compatible, integrates IBC for seamless interoperability, and aims for high transaction throughput.

Launching in a tough market, Berachain still sits outside the top 100, but don’t let that fool you. With over three years of development and 300+ active dApps spanning DeFi, NFTs, gaming, and AI, it’s far from just another ghost chain.

Cosmos and IBC has been the go-to infrastructure for major projects for a while.

Maybe not so much nowadays. However many great projects are part of the Cosmos ecosystem, and more are launching.

dYdX, one of the biggest decentralized trading platforms, made the jump a while ago from Starkware to Cosmos for greater sovereignty, scalability, and efficiency. Since the transition transactions have sped up massively, and trading fees have dropped by 99.9%.

Ondo Finance, a leader in RWAs, is also building its own Layer 1 using the Cosmos SDK. This move highlights Cosmos’ strengths in interoperability, modularity, and sovereignty. Ondo’s goal is to bridge TradFi and DeFi with features like gas fees in stable assets and front-running protection, making it an attractive choice for institutional adoption.

We could mention more great projects using Cosmos IBC & Cosmos Hub, such as Mantra, Celestia, Ankr,…

With dYdX and Ondo leading the way, Cosmos is proving to be one of the most valuable ecosystems in crypto. More projects are catching on, and we might see even bigger moves.

Last week, we covered Mantra, a key player in the RWA space within Cosmos. This week, we’re diving deeper into why major projects are choosing this ecosystem over other alternatives.

But don’t get me wrong, Cosmos is a great ecosystem to onboard projects and to build on it, but it doesn’t mean ATOM token is gaining any value from that. ATOM definitely hasn’t been a good token to hold for the past 3 years.

Good tech isn’t always good money.

Before we dive in this Week’s Newsletter

I must remind you that I curate CT Content on X. Find new projects early.

Don’t miss anything.Learn about the Latest News, Narratives, Market Updates & More!

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into :

Case Study on Berachain: Berachain’s launch stirred Web3, but its airdrop sparked FUD. Despite this, its Proof of Liquidity model and strong ecosystem could make it a key DeFi player.

Main News of the Week.

Zoom on Cosmos: Why major projects like dYdX and Ondo Finance are choosing Cosmos for its interoperability and scalability.

Today's Newsletter is brought to you by Mantle :

Key Partnership: Mantle Joins Chainlink Scale

Mantle Network has officially joined Chainlink Scale, bringing decentralized Chainlink Data Feeds and Data Streams to its ecosystem. By covering specific operational costs for Chainlink oracle nodes, Mantle ensures low-cost, reliable access to crucial on-chain data, reinforcing its commitment to long-term ecosystem growth.

Why It Matters:

Reliable Oracle Services: Chainlink Price Feeds aggregate data from multiple premium sources, ensuring high accuracy and resilience against manipulation.

Decentralized Security: Independent, security-reviewed oracle nodes eliminate central points of failure.

High-Frequency Market Data: Chainlink Data Streams deliver sub-second price updates, enabling faster and more efficient DeFi applications on Mantle.

Product Innovations: Bitcoin Financialization with Function & ƒBTC ($FBTC)

Mantle is also playing a key role in Bitcoin’s financial evolution through Function (formerly Ignition FBTC). This rebranding introduces ƒBTC ($FBTC) as a new institutional Bitcoin yield asset, unlocking BTC’s potential in DeFi.

ƒBTC’s Key Features:

1:1 Bitcoin-backed: Maintains BTC’s security while enabling structured yield generation.

Omnichain Yield Strategies: Seamless integration across Ethereum, Mantle, Arbitrum, and Base.

Liquidity & Capital Efficiency: Optimized for lending, staking, and structured yield products.

Mantle is leveraging zero-knowledge proofs (ZK) and a modular blockchain design, providing an optimal environment for scalable and capital-efficient BTC yield generation.

Treasury & Financial Incentives: Earn with $mETH & $cmETH on ApeX Omni

Mantle is launching a cross-collateral rewards campaign in partnership with ApeX Omni, offering $10K USDT + $10K MNT in rewards for users who deposit $mETH or $cmETH from Feb 11 - Feb 25, 2025.

Key Details:

Deposit $mETH or $cmETH as collateral for perpetual trading.

Rewards split: 50% as ApeX Omni Bonus, 50% in $MNT tokens.

Users can earn up to 500 USDT based on their effective deposit.

Existing depositors automatically enrolled (minimum 100 USDT net deposit required).

$cmETH holders should note that Powder points and restaking rewards will stop accruing after Season 2: Methamorphosis.

Why This Matters

Mantle’s rapid expansion highlights its commitment to scalable DeFi infrastructure.

By integrating secure oracles, institutional BTC yield products, and new DeFi incentives, Mantle is positioning itself as a leading financial hub for DeFi innovation. This continued momentum strengthens its ecosystem, attracting developers, institutional players, and yield-seeking users alike.

Stay tuned for further updates as Mantle continues reshaping DeFi.

1/ Case Study: Berachain → Hype vs Reality

Introduction

Berachain, a Layer 1 blockchain leveraging a unique "Proof of Liquidity" consensus mechanism, has been one of the most anticipated projects in the crypto space.

Berachain Mainnet officially launched on February 6th and despite years of anticipation and a strong community, Berachain struggled to maintain a $500M market cap post-launch.

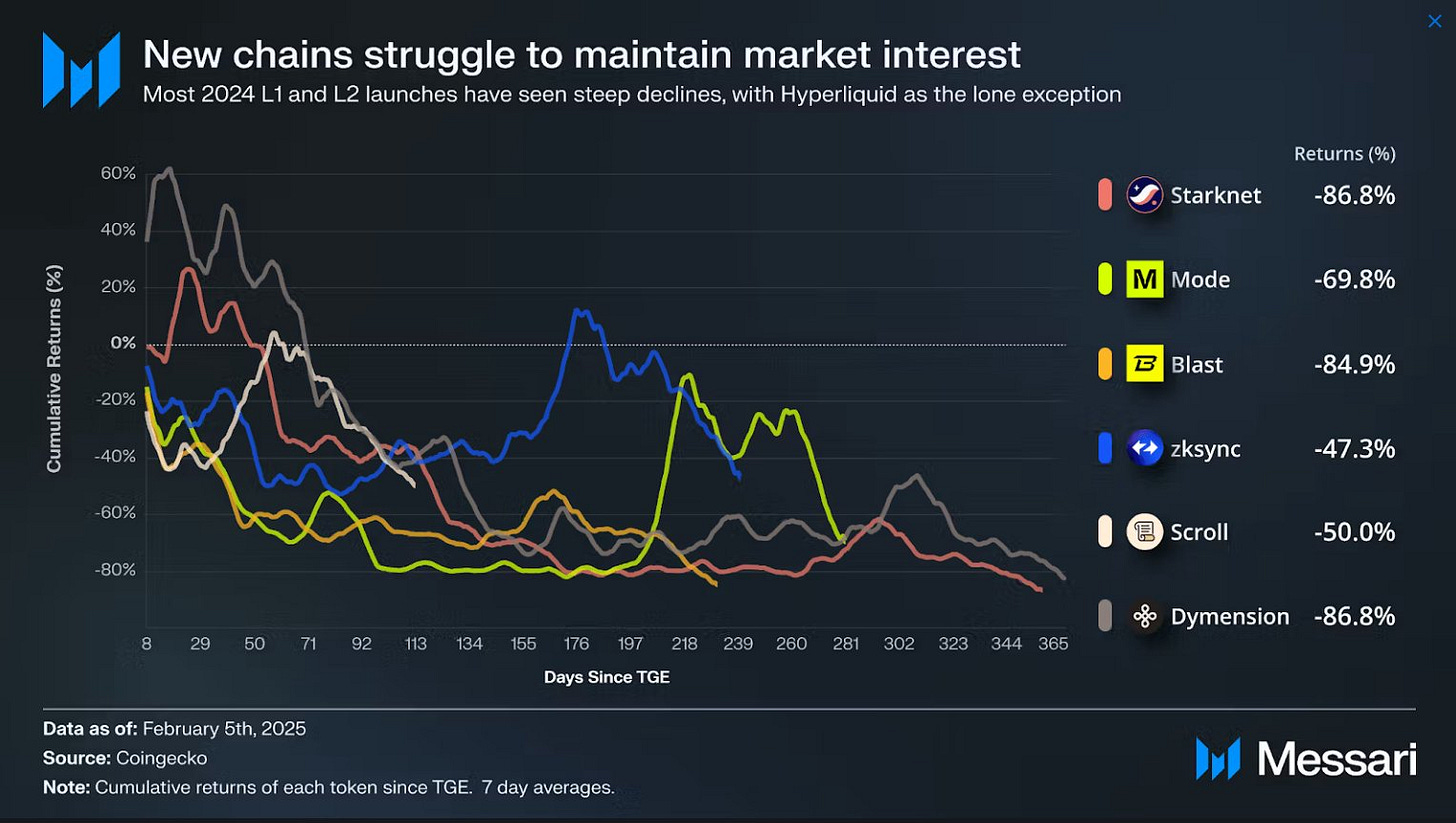

Berachain is not an isolated case, since their TGEs, major new chains projects have faced sharp declines: Starknet and Dymension down 87%, Blast 85%, Mode 70%, Berachain 59%, Scroll 50%, and zkSync 47%. Hyperliquid, however, up to 1100%.

This case study explores Berachain’s fundamentals, challenges, and potential for a rebound in a recovering market 👇

Origins and Funding

Founded by NFT creators Smoky the Bera, Dev Bear, and Hom Ber.

Originated from the Bong Bears NFT collection (August 2021), which saw over $20M in trading volume.

Secured $42M in funding in 2023 from Polychain Capital, AK VCI, Shima Capital, and other prominent investors.

Innovation: Proof of Liquidity

Unlike Proof of Stake (PoS), Berachain’s Proof of Liquidity (PoL) mechanism rewards not just token staking but also liquidity provision.

Aims to create a sustainable ecosystem where validators and protocols cooperate for liquidity efficiency.

Features "bribes" to incentivize validators to support protocols, strengthening overall network stability.

Integrated DEX (BEX) designed to capitalize on PoL.

Built-in oracle allowing validators to select price sources, creating a self-sufficient ecosystem.

Technology and Ecosystem

Cosmos SDK-based Layer 1 blockchain, EVM-compatible, with a customized virtual machine for performance.

Uses IBC for cross-chain interoperability.

Supports up to 350 transactions per second.

Challenges include a lack of attractive applications at launch and a lack of speculative excitement around native tokens.

Airdrop Controversy & Community Frustration

One of the most significant events in Berachain’s early phase was its airdrop campaign, which initially aimed to reward early supporters and contributors. However, the execution of the airdrop led to considerable backlash from the community due to several key issues:

Unclear Eligibility Criteria – Many users felt that the criteria for receiving the airdrop were not communicated transparently, leading to confusion and disappointment when some participants did not receive the expected rewards.

Overestimated Rewards – Early expectations of generous airdrop allocations were met with much lower distributions than anticipated, leading to accusations of misleading promotional tactics.

Bot and Sybil Attacks – As with many airdrop campaigns, some users exploited loopholes to farm multiple allocations, potentially reducing the rewards for genuine community members. Berachain’s response involved filtering out suspected Sybil accounts, but this led to further dissatisfaction among those who were mistakenly flagged.

Early Testnet Users received nothing – Since there were many testnet participants, rewarding all of them would have significantly diluted the airdrop, resulting in negligible rewards per user. As a result, the testnet phase wasn’t very rewarding, and many users received nothing despite interacting with multiple protocols, conducting hundreds of transactions, and participating for months.

Unexpected Distribution Changes – Last-minute adjustments to the airdrop mechanics, such as changes in the distribution breakdown, led to frustration among users who had initially participated under different expectations.

The backlash was evident across social media, with many early supporters voicing concerns over transparency and fairness. This controversy put pressure on Berachain’s team to regain trust and reaffirm its commitment to equitable reward distribution. While the airdrop issue created a short-term reputational challenge, the team’s response and ongoing developments in the ecosystem will determine whether they can maintain long-term credibility and engagement.

Post-Launch Challenges

Despite a strong narrative and initial traction, Berachain faces significant challenges post-launch:

Sustainability of PoL – While rewarding liquidity providers is appealing, ensuring continued incentives without inflationary pressure is a key concern.

Adoption and Developer Interest – Competing with established DeFi chains means attracting developers and users through innovative applications and partnerships.

Market Conditions – As with any new blockchain, external factors like macroeconomic trends and regulatory developments will impact Berachain’s adoption and price action.

Tokenomics and Market Struggles

Initial Fully Diluted Valuation (FDV) at launch: $2.5B.

Private investors entered at a $50M FDV, maintaining a 50x gain despite price corrections.

Post-Token Generation Event (TGE), $BERA dropped 70% within four days, from $15 to $5.

Inflation concerns:

10% BGT inflation annually (~50M tokens in Year 1).

Initial circulating supply: ~21.5% (110M tokens) + 2% from Boyco unlocks in 30–90 days.

Estimated 170M circulating tokens by Year 1, with supply ballooning to ~418M by Year 2.

150% inflation in Year 2, driven by private investor vesting schedules.

Concerns Around Private Investors & Staking Mechanisms

Almost 35% of token supply allocated to private investors, with rounds sold at $50M, $420M, and $1.5B FDV.

Creates constant sell pressure due to long vesting schedules.

Private investors allowed to stake $BERA and earn liquid rewards, exacerbating sell pressure.

Staking APY estimated between 2.8–3.2%, significantly lower than comparable projects like Celestia.

Community frustration over lack of transparency on staking details pre-launch.

Delayed Proof of Liquidity Implementation

Berachain’s primary selling point, Proof of Liquidity, is not yet operational.

As of now, Berachain functions as a standard Proof of Stake blockchain, diminishing its value proposition.

Uncertainty around PoL activation timeline has impacted confidence.

Comparison to Other Layer 1s

Berachain’s inflation outpaces most L1 projects, which typically experience price struggles due to high initial emissions.

Similar concerns exist regarding heavy VC influence and long-term token sell pressure.

Some fear Berachain may become another Cosmos-like technical project without mass retail appeal.

Path Forward: Can Berachain Rebound?

Market Recovery Could Spark a Rebound

Berachain’s price action is partly dictated by broader market conditions.

If the crypto market resumes a bull cycle, Berachain’s innovative approach could regain traction.

Successful Proof of Liquidity Rollout

If Berachain can effectively implement PoL and showcase tangible benefits, it may regain market confidence.

Stronger Ecosystem Development

More applications and use cases are necessary to attract liquidity and active users.

Strategic partnerships with DeFi protocols could boost adoption.

Community Trust and Fairer Distribution

Addressing past airdrop frustrations and ensuring future incentives are distributed equitably will be crucial.

Improving transparency around staking rewards and token allocations can restore faith in the project.

Conclusion

Berachain emerges as a technically remarkable venture, distinguished by its unique liquidity-driven consensus. Yet, its initial market success faltered due to execution errors, rampant inflation, sell-offs by private investors, and unmet expectations. Despite a strong following and anticipation since 2022, the project’s Airdrop did not satisfy everyone, sparking some discontent and skepticism.

Its debut coincided with a challenging market climate, and perhaps it hasn't yet received the recognition it deserves, considering its position outside the top 100. Interestingly, despite a recent social airdrop, the anticipated massive sell-off did not materialize, indicating many beneficiaries have already parted ways with their tokens. However, there's more to Berachain than meets the eye.

With over three years of development, a multitude of dApps are being created on the platform, forging a vibrant community. Unlike many new chains, it's far from deserted. It already boasts over 300 dApps, spanning DeFi, NFTs, gaming, AI, and beyond. Its DeFi offerings promise enticing yields and the NFT mints are generating considerable buzz.

The potential launch of memecoins on the chain could align with its community's focus on meme-NFTs. Currently, with a market cap shy of $500M, a successful rollout of Proof of Liquidity coupled with better market conditions could trigger a significant recovery. For Berachain to fulfill its early promise, it must adeptly navigate these challenges, cultivate a thriving ecosystem, and rebuild trust within its community.

2/ Crypto & DeFi News

💎 TON Expands USDt Interoperability with LayerZero Integration

The Open Network (TON) has strengthened its crosschain capabilities by integrating with LayerZero, a major interoperability protocol. Announced on Feb. 11, this integration connects TON to at least 100 chains, including Ethereum, Tron, and Solana, enhancing its ability to interact with Tether’s USDt stablecoin ecosystem.

This development enables seamless bridging of assets to TON using LayerZero’s messaging protocol, with key partners including Tether, Ethena, and Stargate. The integration allows users to transfer USDt directly from Ethereum and Tron to TON via the Stargate platform, marking a significant milestone in TON’s multichain expansion.

TON has been actively pursuing crosschain interoperability, with prior initiatives like the TON Application Chain bridging Ethereum’s developer ecosystem. The integration with LayerZero, however, is a major step forward in connecting TON directly to the largest stablecoin ecosystem.

With $136 billion in USDt circulating on Ethereum and Tron—representing 96% of the total supply—TON’s integration positions it to capture liquidity from the dominant stablecoin networks. TON has already seen rapid growth in USDt adoption, surpassing $1.4 billion in circulating supply since its launch in April 2024, making it the fourth-largest blockchain for USDt.

Thoughts

TON’s integration with LayerZero is a major step toward making it a key player in the stablecoin infrastructure race. By linking directly to Ethereum and Tron, TON gains access to the most liquid USDt markets, solidifying its role as a bridge between major blockchain ecosystems.

This move also aligns with TON’s broader strategy to become a key layer in the multichain economy. With Telegram’s vast user base, TON has the potential to drive mass adoption of blockchain-based payments, positioning itself as a competitor to Solana in the stablecoin transfer and remittance space.

Furthermore, the LayerZero integration is likely to bring more DeFi activity to TON, as seamless crosschain transfers reduce friction for liquidity providers and traders. If TON continues to scale its USDt adoption at this pace, it could challenge Solana’s position as the third-largest USDt network, reshaping the hierarchy of stablecoin-dominated blockchains.

🐂 Tether Selects Arbitrum for Crosschain Stablecoin Infrastructure

Tether has chosen Arbitrum as the infrastructure provider for USDT0, its new crosschain U.S. dollar stablecoin. According to a Feb. 11 announcement, Arbitrum One will serve as the main hub connecting USDt deployments on Ethereum, Tron, TON, and Celo to USDT0. This will be facilitated through Arbitrum’s Legacy Mesh technology, which enables seamless transfers of USDt across major chains.

Steven Goldfeder, CEO of Arbitrum developer Offchain Labs, stated that Legacy Mesh would ensure deep liquidity across multiple blockchains, making USDt transfers more efficient and scalable. The move is expected to strengthen Tether’s dominance in the stablecoin market, where it already accounts for 61% of the total $230 billion market capitalization, dwarfing its nearest competitor, Circle’s USDC, which holds $59 billion.

Tether first launched USDT0 in partnership with LayerZero on Jan. 16, with its initial deployment on Ink, Kraken’s scaling solution. Despite ongoing regulatory scrutiny, Tether continues to report massive profits, with $13 billion in earnings in 2024, largely fueled by interest from its $113 billion U.S. Treasury portfolio.

Thoughts

Tether’s move to integrate Arbitrum for crosschain liquidity is a major step toward consolidating USDt’s position as the dominant stablecoin. By leveraging Arbitrum’s technology, Tether ensures that USDt remains the most liquid and widely accessible stablecoin across multiple blockchains, reducing fragmentation and making it more attractive for institutional and retail users alike.

This also signals an aggressive expansion strategy from Tether. Despite regulatory concerns, particularly in the European Union, Tether is doubling down on its infrastructure play. The use of Arbitrum’s Legacy Mesh highlights the growing importance of L2 solutions in improving stablecoin usability, making crosschain settlements faster and more efficient.

From a broader perspective, this move could reinforce Tether’s grip on remittance markets. The ability to seamlessly move USDt across multiple chains without friction is a game-changer for cross-border payments, where stablecoins already provide a 60% cheaper alternative to traditional remittance services. With stablecoins playing an increasing role in global finance, Tether is positioning itself as the go-to bridge between crypto and traditional financial systems, while also making it harder for competitors to catch up.

💰 Fed Chair Powell Confirms No Plans for a Digital Dollar

Federal Reserve Chair Jerome Powell assured U.S. lawmakers that the central bank would not issue a central bank digital currency (CBDC) during his tenure, which ends in May 2026. Speaking at a Senate Banking Committee meeting on Feb. 11, Powell explicitly stated that as long as he remains in charge, the Fed would not introduce a digital dollar.

This statement aligns with the broader stance of the Republican-controlled government, which has made preventing a U.S. CBDC a policy priority. In January, President Donald Trump signed an executive order prohibiting the establishment and issuance of a digital dollar, though legal experts question its enforceability. Additionally, an anti-CBDC bill introduced by Representative Tom Emmer passed the House in May 2024 and is now under Senate review.

Powell also addressed concerns about financial institutions debanking crypto firms, stating that the Fed would take a “fresh look” at related policies. His comments follow growing scrutiny over whether government entities pressured banks to cut off services to crypto businesses.

Thoughts

Powell’s outright rejection of a CBDC represents a shift from his previous, more cautious stance. While he had previously stated that the U.S. was “nowhere near” adopting a CBDC, this is the first time he has guaranteed that it will not happen under his leadership. This marks a clear political positioning that aligns with Republican efforts to block a digital dollar, reinforcing the party’s broader pro-crypto and anti-CBDC agenda.

For the crypto industry, this is a double-edged sword. On one hand, the rejection of a CBDC ensures that stablecoins remain the dominant form of digital dollars. On the other hand, Powell’s stance doesn’t necessarily translate into clearer regulatory support for crypto. The Fed remains cautious about crypto banking, and despite Powell’s comments on reviewing debanking policies, there is no clear commitment to reversing restrictions on crypto firms.

This also raises questions about the long-term trajectory of the U.S. dollar in a digitized financial system. While countries like China are actively rolling out CBDCs, the U.S. is opting for private-sector solutions like stablecoins. Whether this approach strengthens or weakens the dollar’s global dominance will depend on how effectively the government can regulate and integrate stablecoins into the financial system without stifling innovation.

🦄 Uniswap Launches Unichain Mainnet, Expanding into the Ethereum L2 Market

Uniswap Labs has officially launched the mainnet for Unichain, its Ethereum layer-2 (L2) blockchain, after months of testing. Unichain aims to provide faster transactions with one-second block times, along with DeFi-native features such as swap liquidity, borrowing, and interest-earning capabilities. The move positions Uniswap as a direct competitor in the already crowded Ethereum L2 ecosystem.

The chain is part of Optimism’s Superchain, a collective of L2 networks designed to scale Ethereum. According to Uniswap, Unichain could redirect nearly $500 million annually in fees that would have otherwise gone to Ethereum validators, potentially benefiting UNI tokenholders.

Unichain will compete with major L2s like Arbitrum, Base, Blast, Mantle, and Polygon, all vying for dominance in Ethereum's $56.6 billion DeFi market. Uniswap is also playing a role in shaping the future of L2 interoperability through its work on EIP-7683, a proposed intent standard to simplify cross-chain swaps and liquidity sharing.

Thoughts

Uniswap’s entry into the L2 market is a natural evolution for the protocol, but it also raises key questions about the long-term economics of Ethereum scaling. By launching its own chain, Uniswap is not just optimizing for lower fees—it’s actively reshaping the incentives of Ethereum’s rollup ecosystem. The potential $500M in recaptured fees highlights the growing trend of major DeFi protocols seeking greater control over their infrastructure rather than relying solely on third-party L2s.

However, Unichain is entering a highly competitive space. Base, Arbitrum, and Polygon already have significant adoption, and liquidity fragmentation remains a major challenge across rollups. Uniswap's involvement in EIP-7683 suggests a long-term play towards solving these inefficiencies, but its success will depend on how seamlessly it can integrate with the broader Ethereum ecosystem.

Ultimately, Unichain signals that the next phase of DeFi is not just about providing liquidity but about owning the rails on which liquidity moves. If Uniswap succeeds in making Unichain a hub for cross-chain activity, it could cement its dominance in DeFi beyond just being the largest decentralized exchange.

🚀 Story Protocol to Launch Public Mainnet on Feb. 13, Introducing IP Token

Web3 intellectual property (IP) protocol Story Protocol has confirmed that its mainnet will go live on Feb. 13, introducing its native token, IP. The protocol aims to establish an open marketplace for programmable IP, enabling creators to register, license, and monetize their digital content on-chain.

The IP token will be used for transactions, governance, and creator payments, with an initial staking phase called "Singularity." Rewards from staking will be distributed starting March 2. Several major exchanges, including Coinbase, OKX, KuCoin, Bybit, Bithumb, and Bitget, have already announced plans to list the token.

Built on the Cosmos ecosystem, Story Protocol provides tools for creators to secure their digital works, set up automated licensing agreements, and receive direct payments without intermediaries. The platform already has over 50 applications running on it, including Magma, a collaborative digital art platform with 2.5 million users. In addition to enabling traditional IP monetization, Story Protocol is advancing AI-powered content exchange. It recently introduced an on-chain framework allowing AI agents to interact and trade digital assets autonomously. Backed by Andreessen Horowitz, Polychain Capital, Hashed, and Samsung Next, the protocol has raised over $134 million in funding across multiple rounds.

Thoughts

We already talked about Story Protocol in a precedent edition.

Story Protocol is positioning itself as a key player in the tokenization of IP rights, which is estimated to be a $61 trillion market. By launching on Cosmos, it benefits from interoperability, allowing cross-chain IP registration and licensing. This is significant because the current Web3 landscape lacks a standardized way to authenticate and manage creative works across chains.

The impact of this protocol extends beyond NFTs—it introduces a new economic model for content creators, where AI and Web3 intersect. The ability to program IP rights into smart contracts and integrate AI-driven transactions opens up possibilities for automated licensing, remixing, and distribution. This could fundamentally reshape industries like publishing, gaming, and digital media, where ownership and royalties have long been disputed.

As stablecoins brought fiat liquidity on-chain, Story Protocol aims to do the same for creative rights, making them programmable, transferable, and enforceable in a decentralized manner. If successful, it could become the backbone for digital content ownership in Web3, fueling a more sustainable creator economy.

3/ The power of Cosmos : dYdX & Ondo

Cosmos is more than just a blockchain—it's an interconnected network designed to solve some of the biggest challenges in the crypto space: scalability, interoperability, and sovereignty. Traditional blockchain ecosystems, like Ethereum, are constrained by network congestion and high fees, forcing developers to work within a rigid framework. Cosmos, however, introduces a fundamentally different approach, enabling projects to launch their own blockchains (appchains) while maintaining seamless connectivity with other networks.

The Cosmos ecosystem is built on three key innovations:

Cosmos SDK: A modular framework that allows developers to create highly customizable and sovereign blockchains with ease. Unlike general-purpose chains like Ethereum, Cosmos SDK enables developers to tailor their blockchain to specific use cases, optimizing performance and functionality.

Inter-Blockchain Communication (IBC) Protocol: A breakthrough in blockchain interoperability, IBC facilitates secure and permissionless asset and data transfers between different blockchains, eliminating reliance on centralized bridges that pose security risks.

Tendermint Consensus: A high-performance, Byzantine Fault Tolerant (BFT) consensus mechanism that ensures fast finality and scalability, making Cosmos chains highly efficient compared to traditional Proof-of-Work (PoW) blockchains.

By leveraging these technologies, Cosmos has become a hub for blockchain innovation, attracting projects looking for enhanced control, reduced costs, and true interoperability.

Cosmos is building across multiple verticals: DeFi, DePIN, AI, Gaming. But RWA’s hold the true edge.

Competitive Edge: Cosmos vs. The Competition

Today, we're skipping $ATOM, the Cosmos token. It’s been underperforming the whole market for 3 years straight now, it has not been a good investment until now, and struggles to find a true Product-market Fit, a reason to be bought & held.

Instead we’ll be diving into why innovative projects like Ondo and DYDX are choosing Cosmos over other options👇

Tendermint BFT vs. EVM

6s finality vs. 12-minute optimistic rollup delays

10,000 TPS vs. Ethereum’s 15 TPS (even post-Danksharding)

Native MEV resistance vs. auction-based chaos

IBC vs. Axelar/LayerZero

Cost: $0.0001 per cross-chain transaction vs. $15+

Security: Validator-set trust vs. 9-of-12 multisigs

Speed: 6s vs. 30+ minutes

Cosmos SDK vs. Solana’s Monolithic Design

Customizability: Swap consensus, add modules, fork freely

Upgrades: On-chain governance vs. hard forks

Composability: Native IBC vs. fragile bridging solutions

Ondo Finance and Its Adoption of Cosmos

Ondo Finance has positioned itself as a key player in the tokenization of real-world assets (RWA). Originally built on Ethereum, Ondo recognized the limitations of high gas fees and congestion and made a strategic move to Cosmos to leverage its modularity and interoperability.

They just launched their very own L1 blockchain built on Cosmos.

Why Ondo Chose Cosmos

Customizability: Ondo needed a blockchain infrastructure that allowed fine-tuned control over transaction processing and governance.

IBC Integration: The ability to move tokenized RWAs seamlessly across different ecosystems without relying on third-party bridges was a major draw.

Lower Costs & Higher Scalability: With Cosmos’ architecture, Ondo benefits from faster finality and significantly reduced fees compared to Ethereum’s congested network.

How Ondo Leverages Cosmos

Tokenized Securities: Ondo issues tokenized bonds and treasury products, which can be freely transferred across IBC-enabled chains.

Liquidity Expansion: By integrating with other Cosmos-based DeFi platforms, Ondo enhances liquidity for its tokenized assets.

Composability: Ondo’s Cosmos-based solution allows RWAs to be easily used in DeFi applications like lending protocols and automated market makers.

Impact on the Ecosystem

Ondo’s move to Cosmos enhances the credibility of the ecosystem as a hub for institutional-grade tokenization projects.

The presence of RWAs within Cosmos unlocks new DeFi use cases, bridging traditional finance with decentralized finance.

Institutions now have a scalable, low-cost infrastructure for engaging with RWAs without Ethereum’s bottlenecks.

dYdX’s Transition to Cosmos

dYdX, one of the largest decentralized perpetual exchanges, made a bold move back in 2022 by transitioning from an Ethereum-based rollup solution to launching its own Cosmos-based chain. The decision was driven by the need for greater scalability, sovereignty, and enhanced user experience.

Why dYdX Left Ethereum

High Gas Fees: Even with rollups, dYdX users faced increasing transaction costs on Ethereum.

Limited Control: Relying on StarkWare’s L2 solution meant dYdX had to operate within the constraints of another protocol.

Scalability Issues: Ethereum’s L1 and L2 solutions still faced network congestion, affecting order execution speeds.

How dYdX Benefits from Cosmos

Sovereign Chain: Running on its own Cosmos-based blockchain allows dYdX to optimize the chain specifically for high-frequency trading and order book execution.

Near-Zero Fees: Unlike Ethereum, where gas fees fluctuate unpredictably, dYdX’s custom Cosmos chain significantly reduces transaction costs for traders.

Decentralized Order Book: The new chain supports a fully on-chain order book, a significant technical feat that ensures transparency and decentralization without sacrificing performance.

IBC-Enabled Liquidity: Traders can move assets seamlessly between dYdX and other Cosmos chains, fostering a more interconnected DeFi ecosystem.

The Impact on dYdX’s Growth

Increased Trading Volume: Since moving to Cosmos, dYdX has seen increased trader activity due to lower costs and improved efficiency.

Enhanced Decentralization: The move reduces reliance on Ethereum L2 providers, giving dYdX full autonomy over its blockchain.

Attracting Institutional Traders: With improved performance and cost-efficiency, institutional traders are more inclined to use dYdX over centralized exchanges.

Cosmos Ecosystem Growth & Value Accumulation

The adoption of Cosmos by projects like Ondo and dYdX underscores its growing dominance as an interoperability powerhouse. The network's value proposition continues to attract major players, leading to significant capital inflow and ecosystem expansion.

Key Metrics Indicating Growth

Total Value Locked (TVL): Cosmos chains have seen a steady increase in TVL as more DeFi protocols migrate.

IBC Transaction Volume: A surge in cross-chain transfers highlights the effectiveness of Cosmos' interoperability features.

Developer Activity: With multiple new projects launching custom appchains, Cosmos remains one of the most active blockchain ecosystems.

Why Cosmos could be the Future of Blockchain Interoperability

Cosmos claims already the 4th spot among blockchain giants, trailing only Ethereum, Solana, and Polkadot in active developers.

Custom Blockchain Economies: Projects can build their own tailored ecosystems without being constrained by a monolithic L1 like Ethereum.

True Cross-Chain Connectivity: Unlike bridges that introduce security risks, IBC-native projects benefit from trustless interoperability.

Scalability Without Sacrificing Security: The modularity of Cosmos SDK allows optimized performance for different use cases.

Final Thoughts

The next trillion-dollar crypto narrative could be Real World Assets (RWAs). As institutional capital prepares to flood into the market, it demands solutions that are reliable, cost-effective, and swift. Cosmos, with its Inter-Blockchain Communication (IBC), modular sovereignty, and robust institutional-grade infrastructure, stands at the forefront of this transformative wave.

The strategic adoption of Cosmos by high-profile projects such as Ondo Finance and dYdX underscores its stature as a premier blockchain framework tailored for unparalleled scalability and seamless interoperability.

As the blockchain ecosystem matures, more projects are beginning to embrace the benefits of sovereign chains and seamless cross-chain transactions, recognizing the significant advantages they offer. This positions Cosmos to be a pivotal player in the ongoing evolution of Web3.

The future of blockchain is not just modular, interconnected, and efficient—but Cosmos is the beating heart of this dynamic revolution, driving innovation and growth in the digital frontier.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.