Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

We just saw two textbook examples of “how to instantly kill trust on-chain.”

On one side, $OM (Mantra) — a Top 25 token — collapsed by nearly 95% in a few hours. The kind of violent selloff that breaks markets, nukes books, and raises every red flag imaginable. And no, OKX wasn’t the origin. The whole thing smells like forced liquidation meets strategic exit. We’ll get into more in the main news of the week.

Then there’s Base, which somehow managed to rug its own community from its official account. A “contentcoin” called “Base is for Everyone” pumped to $20M+ MC, then cratered 99% as the top wallets unloaded. No safeguards. No structure. Just vibes — and now, total backlash. More on that in the news section too.

Meanwhile, macro is still in chaos mode.

Trump’s back on the offensive — floating unsourced “deals” with China (denied), threatening the EU with tariffs, and throwing Powell under the bus. He’s signaling unilateral moves, and markets are paying attention.

Bitcoin? Still stuck between $83K–$85K, six weeks deep. That kind of compression usually ends in one of two ways: a slow bleed into apathy, or a violent expansion. Current setup says the latter. Funding’s negative, longs are exiting, and open interest is drifting — but liquidity is stacked, and options data points to a blowout around April 25.

Alts are trying to find footing. AI names like TAO and Render are slowly waking up. But overall, dominance is drifting back to BTC, and most altcoins are still coping from March’s wipeouts.

So what are people actually paying attention to right now?

After months of L2 vs L1 debates, the focus is shifting. It’s not about settlement. It’s not even about execution. It’s about who owns the trust layer for modular chains — and two names are at the front: Celestia and Avail.

Celestia has first-mover advantage, and is widely integrated across the rollup stack. Blobstream, EigenDA compatibility, OP Stack alignment — they’ve built the infrastructure narrative everyone’s plugged into. But they’re slow to expand beyond Cosmos-native circles, and most usage is still early-stage.

Then came Avail — spun out of Polygon, now going full modular with its own rollup-friendly DA layer and a shared security model built for multi-chain coordination. It’s faster to onboard, aligned with EVM tooling, and aggressively recruiting ecosystems. Also? They have plans — including Avail Nexus, which could become the IBC of rollups.

In short: this isn’t L1 vs L2 anymore. It’s who becomes the trust layer of the internet.

Let’s dig into the modular madness.

Before we dive in this Week’s Newsletter

In case you missed it, the Shiro Instagram is back!

You will get visuals of current market/project situations with short descriptions that sum up what you need to know.

And Alpha shared in stories.A simple and light way to stay connected with crypto daily—without spending hours or reading walls of text.

I’m also posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on Modular Madness: How Celestia and Avail are shaping the new onchain meta.

Main News of the Week.

Today's Newsletter is brought to you by Mantle

🔦 Key Initiative: Slashing Is Live — mETH Protocol’s Q2 Is All About Yield, Access, and Alignment

As EigenLayer flips the slashing switch, Q2 marks a seismic shift for the restaking landscape — and mETHProtocol is entering the spotlight with full firepower.

The thesis is simple: More AVSs = More Security Demand = Higher Yield. But capturing that yield now depends on what you hold and how you use it.

Let’s break down how mETH is positioning to thrive — and why this might be a breakout quarter.

🧠 Active vs Passive Restaking – Pick Your Path to Yield

Restaking isn't a set-and-forget game anymore. You have two clear paths:

Actively restake $mETH → Delegate to AVS operators, optimize for incentives, and earn higher, operator-specific rewards.

Hold $cmETH → Get passive exposure via a vault-based strategy designed for broad, risk-adjusted yield. Think ETF but on EigenLayer.

With slashing now live, AVSs are competing for restaked ETH by offering stronger, verifiable rewards. That means bigger upside — if you’re positioned.

🌊 Liquidity Pools & Powder Season 3

For those who’d rather earn passively:

$cmETH pools offer platform fees + ecosystem incentives

Bonus Powder rewards are now live across supported chains

Season 3: Methamorphosis adds HyperEVM-native protocol rewards on top

Liquidity isn’t just for traders — it’s a major source of yield when paired with restaked collateral.

🏛 Institutional Flow Is Picking Up

Institutions want three things: predictability, scalability, and security.

mETH delivers on all three:

Fixed Yield Vault: 6.38% APY (incl. 2% fixed layer), capped at 30K $cmETH

$55M+ already deposited by institutions seeking clean ETH exposure

Bybit integration: up to 9.5% APR + collateral access for loans/margin

Included as the ETH strategy in Mantle’s $400M MI4 Index Fund

This isn’t just yield farming — it’s becoming the institutional standard for ETH restaking.

📅 What to Expect in Q2

mETHProtocol is dialing things up this quarter:

Expanding institutional partnerships

Deeper integrations across HyperEVM and Mantle

A packed events schedule to drive global community momentum

More Powder, more utility, and maybe some new product alpha 👀

Slashing may raise the bar — but for mETH holders, it just raised the ceiling.

One-click staking. Passive yield. Institutional-grade rails. Q2 is about restaking going real.

My latest post on Mantle, and what to expect from Q2.

1/ Deep Dive on Modular Madness: Celestia vs Avail

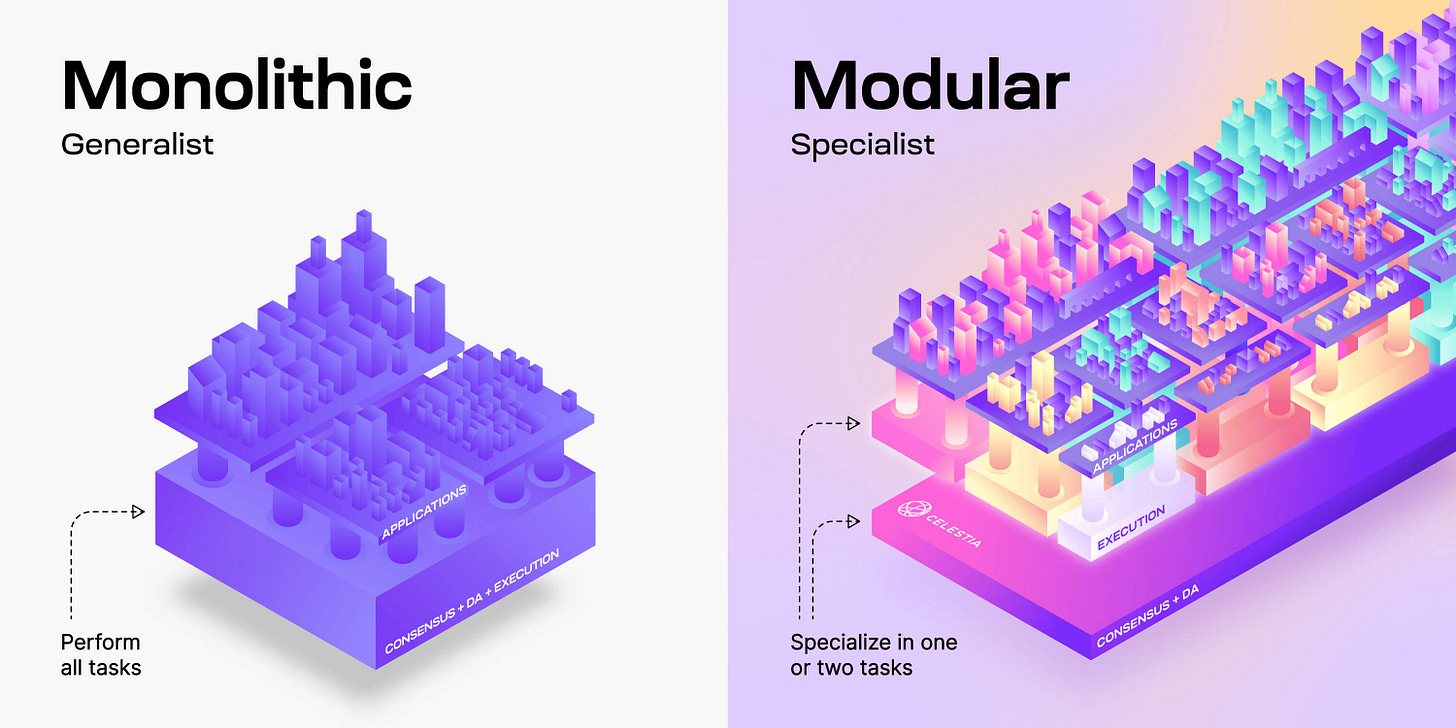

Modular blockchains have moved from side‑quest to center‑stage. As monolithic L1s creak under scaling pressure, the modular thesis says: un‑bundle every layer, specialize it, then recombine like Lego.

The decisive fight is over data availability (DA) because whoever owns DA sets the toll for every rollup and captures modular liquidity.

🌐 The Problem: Data Bottlenecks Are Breaking Crypto

To understand why DA is a big deal, look at how crypto apps differ from Web2.

Web apps rely on giant cloud infrastructures to store and serve petabytes of content. Blockchains, in contrast, publish every transaction onchain — but the way that data is stored and accessed has become the #1 constraint for rollups and L2s.

DA defines whether users can independently verify what’s happening onchain. It also defines how expensive it is to run a rollup. And today, ~95% of rollup operating costs are tied to DA.

Most L2s currently use Ethereum for DA, which works but is expensive.

EIP-4844 brought temporary relief, but long-term scaling requires a different path. This is where DA layers — modular chains focused only on making data available — come in.

Celestia pioneered this category.

Avail is now aggressively entering with fresh tech, Polygon DNA, and giga-block ambitions.

Let’s break down both 👇

Celestia – DA at Web3 Scale

Celestia’s been shipping since late 2023, and it’s quietly captured the rollup mindshare. Its value prop? Cheap, neutral, verifiable DA for anyone building off-chain execution.

Its killer app is Data Availability Sampling (DAS)—letting even a phone verify DA without running a full node. That’s huge for decentralization. No trust assumptions, no reliance on validators. Just probabilistic guarantees backed by cryptographic proofs.

📊 Celestia in Numbers:

🔐 Security & Decentralization

100‑slot Tendermint PoS validator set

DAS → light clients on phones

Fraud‑proof window ⇒ DA finality ≈ 10 min

🔧 Infra Highlights:

Vacuum!: insane data propagation engine (bye-bye gossip bottlenecks)

Lazybridging: rollups can trustlessly reference each other via shared DA

ZK working groups, light client DAS, and browser-based nodes

💰 $TIA Tokenomics

Utility: staking, governance, gas for publishing blobs

$55 M Series B (Bain Capital Crypto, Oct 2022) → treasury > $155 M

Unlocks drip until 2027

🔭 Alpha

Celestia began as “neutral infra,” but with DAS + shared DA it’s turning into a coordination layer:

DYM, Eclipse and Berachain are already piloting DA‑native deployments.

Converge has just announced its blockchain, integrating the Celestia DA layer to enhance scalability with a goal of 30K+ transactions per second. This collaboration benefits both networks, showcasing Celestia’s modular design in a high-demand environment, boosting adoption and strengthening its position in the blockchain ecosystem. If Ethereum is the base chain, Celestia aims to be crypto’s data cloud—cheap, trustless, scalable.

Here is the full roadmap.

Avail – The Giga-Block Challenger

Avail isn’t playing catch-up. It’s going bigger, faster, deeper.

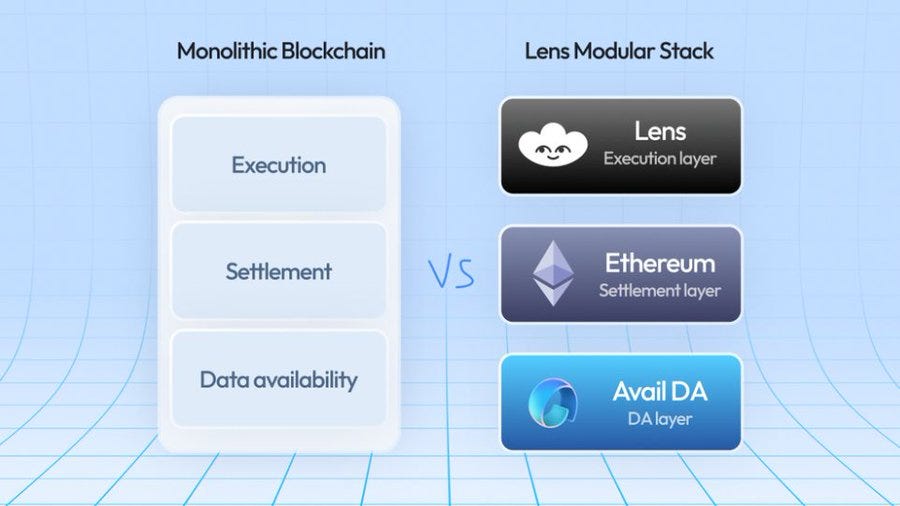

Spawned from Polygon devs, it comes with production-ready blood in its veins. It’s not just another DA chain—it’s a whole coordination and interoperability layer.

📈 Numbers That Pop

⚙️ Stack Overview

Avail DA — high‑throughput blob storage

Nexus — ZK aggregation rollup unifying proofs across chains

Fusion — restaking security (BTC, ETH, others)

Essentially: AWS + ZK Router + Restaking‑as‑a‑Service rolled into one.

🔭 Early Alpha

Lens Protocol already stores social graphs on Avail.

MachineFi narratives (Silencio, YOM, Charge) rumored but unconfirmed.

If 10 GB blocks and Nexus ship, Avail could become the hub of multi‑chain state.

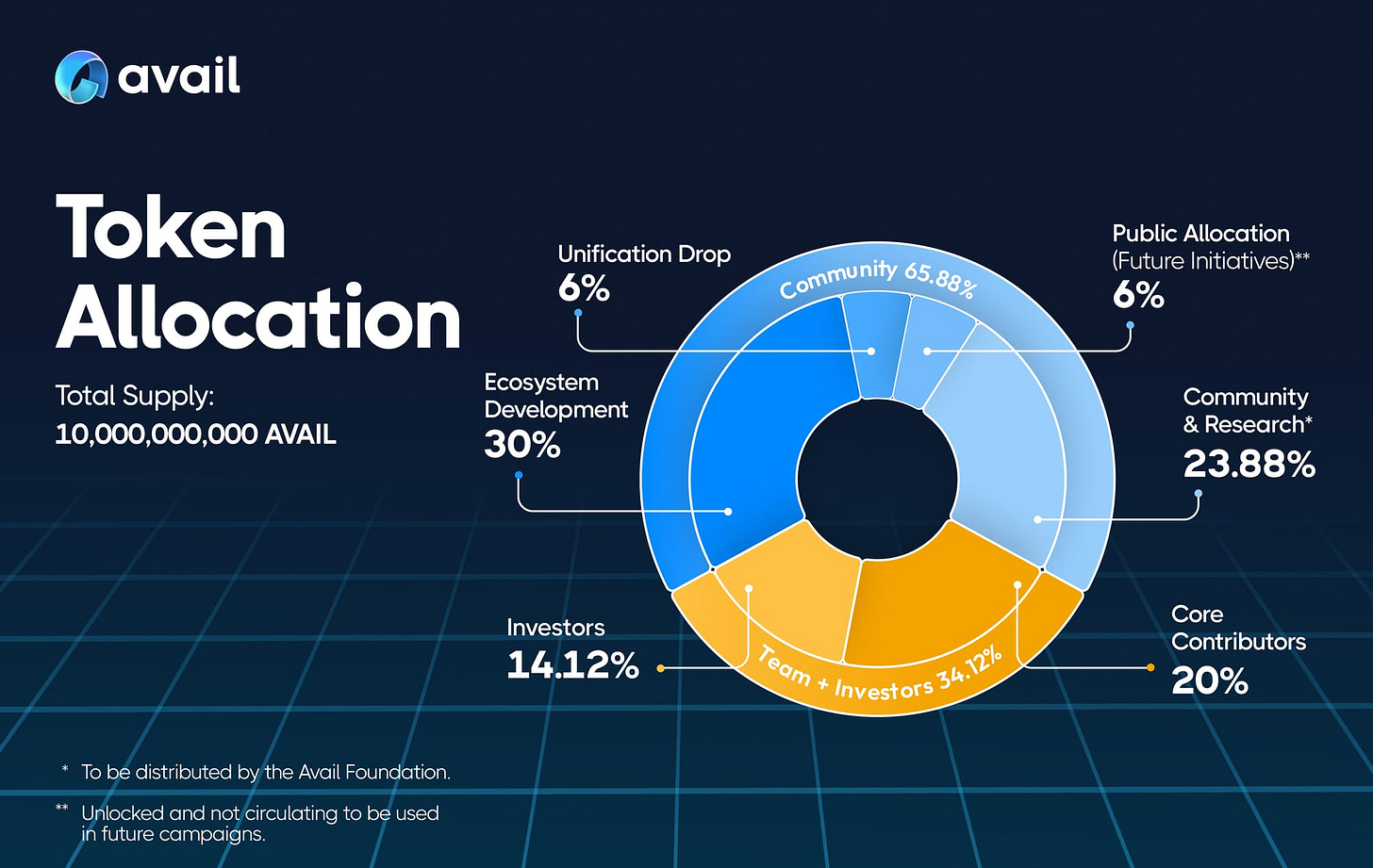

💸 Tokenomics

Major unlocks only in July 2025 → limited float until then

High staking (~ 50 %) = strong alignment

🧠 Narrative Split

This is not just a Celestia copy. Avail is building the OS layer for modular blockchains.

⚔️ Modular Showdown: Who’s Winning the DA Wars?

Cost king: Celestia SuperBlobs.

Speed king: Avail’s < 1‑minute finality.

Scale race: Celestia’s 1 GB DAS vs Avail’s 10 GB light‑client design.

🐆 Wildcards

Ethereum dank‑sharding (64 blobs/slot) could shrink third‑party DA demand.

Solana’s monolithic TPS might lure devs away from DA layers.

🧱 The Real Modular War

Modularity isn’t a meme—it’s an arms race. The DA victor gains:

Every rollup’s data fees.

Right to coordinate cross‑chain state.

Dominance over modular liquidity flows.

Celestia = lean, neutral, already embedded.

Avail = coordinated, faster, betting on scale + UX.

🔭 What to Watch Next

Celestia — first public 1 GB DAS light‑client demo.

Avail — inaugural Nexus mega‑proof on Ethereum (< 400 k gas target).

Liquidity migration — which DA layer secures the next breakout rollup?

Restaking arms race — Fusion’s multi‑asset model vs native PoS.

Modular DA is the power layer. Whoever nails it isn’t just infrastructure—they’re the new L1.

We’re still early.

2/ Crypto & DeFi News

🎯 Trump-linked World Liberty Financial Gets $25M Investment from DWF Labs

DWF Labs has just dropped $25 million into World Liberty Financial (WLFI), a DeFi project backed by the Trump family.

This investment is part of a broader strategy to expand into the U.S. market with a new office in New York. WLFI has its sights set on becoming a key player in the U.S. crypto market, focusing on USD-pegged stablecoins like USD1.

What’s particularly intriguing here is the political connection—Trump has been vocal about leaving behind “slow and outdated big banks,” positioning his family’s brand as part of the crypto revolution. The partnership with DWF Labs adds a layer of legitimacy, but also plenty of questions.

Thoughts

This deal isn’t just about dollars and tokens—it’s about leveraging a well-known political name in a rapidly growing industry. DWF’s stake in WLFI and their ability to influence the platform’s governance could provide some interesting tension between traditional finance and decentralized finance.

But with Trump’s involvement, it’s hard to ignore the potential for political implications. Is this the beginning of more political figures entering the crypto space, or will it simply become a fleeting gimmick?

If WLFI can deliver on its promise of a USD-pegged stablecoin while staying out of the political crossfire, it could be a strong player. But if it’s seen as another Trump-backed stunt, expect it to face serious headwinds.

Here is a really good post about USD1 red flags.

💥 Coinbase Distances Base from Memecoin That Dumped $15M

Coinbase blockchain, Base, got tangled up in a memecoin fiasco this week.

A coin named “Base is for Everyone” launched after a promotional post from Base’s official X account. The coin shot up to a $17 million market cap before nosediving by almost 90%.

Coinbase quickly distanced itself from the token, claiming Base didn’t officially launch it, but the damage to its reputation was already done. The crypto community wasn’t thrilled with the optics, and Base’s credibility took a significant hit.

Thoughts

This isn’t just a marketing blunder—it’s a cautionary tale for any new blockchain looking to make its mark in the crowded crypto space. Base tried to ride the wave of social media tokenization, but in doing so, it failed to anticipate the market’s reaction.

While Coinbase was quick to clarify that this was not an official Base token, the whole situation raises questions about what happens when marketing oversteps its bounds.

If Coinbase wants Base to succeed, it can’t afford any more slip-ups like this one. Otherwise, it risks being seen as a project more focused on hype than on building real, long-term value.

🚨 Mantra OM Token Crash Exposes ‘Critical’ Liquidity Issues in Crypto

Mantra’s OM token saw a catastrophic 90% crash in value this weekend, revealing the deep liquidity issues that plague the crypto market.

The crash, which occurred amidst allegations of insider dumping and large wallet transfers, highlights a systemic problem in the industry. Liquidity levels during off-hours—especially weekends—are perilously low, and sudden market movements can trigger extreme volatility.

According to Bitget’s CEO, this isn't just an OM issue—it’s an industry-wide challenge.

Thoughts

The OM token’s fall isn’t just a single project’s misfortune—it’s a glaring symptom of a broader, more concerning issue in crypto: liquidity risk. It’s easy to forget how fragile the market is when big players can move millions of dollars in tokens, causing massive fluctuations.

For smaller tokens, this can lead to disastrous consequences. And in a market that’s already fraught with skepticism, events like this don’t just hurt one project—they hurt the whole space. As more institutional players look to get involved, this issue will need to be addressed. Otherwise, crypto could face more regulation and oversight that stifles its growth.

They started with an excessive number of tokens and are now conducting staged burns to create the illusion of momentum.

In my opinion, projects should stop launching with inflated token supplies just to burn them later for the sake of appearing active. If your tokenomics only seem reasonable after reducing the supply, then they probably never made sense in the first place.

If you want to know the full story, here’s a very good post.

🔒 Babylon Total Value Locked Drops 32% as Wallets Unstake $1.2B in Bitcoin

We already talked about Babylon in a precedent edition.

Babylon’s Bitcoin staking protocol took a serious hit this week, with over $1.26 billion in Bitcoin unstaked, causing its total value locked (TVL) to drop by 32%.

The movement of these assets followed a tweet from Lombard Finance, which hinted at a transition to new finality providers. While this move was framed as a strategic transition, the massive unstaking has left the crypto community questioning Babylon's stability.

The real question: Who’s behind these large withdrawals, and what does this mean for the future of Bitcoin DeFi?

Thoughts

Babylon’s massive Bitcoin unstaking raises serious questions about how decentralized finance platforms manage liquidity and trust. Whether it’s a routine transition or something more concerning remains to be seen, but the fact that $1.26 billion in Bitcoin left the protocol in such a short time is a red flag. The speculation about who might be behind the withdrawals—be it institutional investors or insiders—only adds to the mystery.

This is a situation that will need to be closely monitored, especially as the larger DeFi ecosystem grapples with liquidity risks. If Babylon can recover from this, it’ll set an important precedent for DeFi projects handling large sums of capital. But if it can’t, it could be a cautionary tale for the rest of the space.

💰 Semler Scientific Reports $42M Paper Loss on Bitcoin, Floats $500M Stock Sale

Semler Scientific, a healthcare technology firm, posted a $42 million paper loss from its Bitcoin holdings in the first quarter of the year.

Despite the downturn in the crypto market, Semler isn’t backing down. In fact, they’ve announced a $500 million securities sale, part of which will fund more Bitcoin purchases.

While their stock has taken a hit, Semler continues to double down on its strategy of acquiring and holding Bitcoin.

Thoughts

This move shows that Semler is playing the long game, but it also highlights the volatility that comes with Bitcoin. In the world of corporate crypto investments, this is a big bet. Semler might be facing a paper loss now, but its willingness to continue buying Bitcoin signals faith in its long-term potential. However, this strategy could backfire if Bitcoin continues to underperform.

The $500 million stock sale is a bold move, but it could either make Semler a big winner in the future of digital assets or lead to more headaches if crypto prices don’t rebound. For now, it’s a case of “hold strong” and see what happens.

Here’s my take on $BTC bought by institutions.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.