This Week's Newsletter - Case Study on Virtuals Protocol, Main News of the Week, & Moon or Dust on $OLAS

Weekly Alpha

There is no collaboration with the projects mentioned in this edition.

GM frens,

It finally happened. The shift we’ve been waiting for — the real one — isn’t just coming. It’s here and the map is greeeeeen 👇

Bitcoin has closed above $100K — and stayed there. Twice this week, with barely a sign of rejection. It tagged $103k before consolidating, and this time the move isn’t driven by froth or memes — it’s policy-level capital rotation. We’re watching a structural change unfold in real-time.

The signals are everywhere. U.S. federal regulators now allow regulated banks to hold, buy, and sell crypto assets. That’s not a headline — that’s an unlock.

At the same time, Washington and London signed a bilateral trade agreement that coincided (conveniently?) with BTC’s breakout, with broader whispers of coordinated deals to come. Even geopolitical rivals like China are showing signs of softening their stance. It’s not about adoption anymore — it’s about integration. The rails are going mainstream.

And the market is reacting with force.

Ethereum is back.

After being sidelined for nearly a year, ETH has exploded past $2.4K — its sharpest rally in four years — powered by the Pectra upgrade and a long-overdue shift in sentiment. The ripple effect was instant: altcoins caught a bid, Total3 broke through key resistance, and liquidity is visibly rotating. BTC dominance slipped from 65.5% to 64%, and suddenly CT’s “only BTC matters” narrative is looking stale.

Still — we’re early.

The Altcoin Season Index is only at 31.

That’s far from full send territory (75+), but that’s exactly what makes this moment interesting. The foundation is forming: macro tailwinds, policy alignment, retail interest rebooting, and early-stage capital rotating into the right narratives. What’s next will be defined by what infrastructure actually scales with this new wave.

That brings us to today’s focus — two radically different, but equally important coordination primitives.

First, we’re diving into Virtuals Protocol. After a stealth x4–x5 run, it’s entering Genesis — a high-stakes phase for a project that’s part game, part economic OS, part composable identity layer. It’s weird, modular, and potentially foundational for how on-chain “virtual agents” emerge and coordinate.

Then there’s OLAS — the sleeper DeFi x AI project building the incentive scaffolding for agent-based networks. While others drop vague AI buzzwords, OLAS is quietly deploying actual coordination tech, with real traction, real use cases, and a design that might outlast the hype cycle entirely.

Crypto’s past was speculation. Its present is integration. And its future? Coordination.

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!Also, if you missed one of my Latest Posts:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Case Study on Virtuals Protocol – How Genesis, game loops, and on-chain agents could redefine coordination.

Main News of the Week.

Moon or Dust on $OLAS – Can DeFi-native AI coordination outlive the hype?

1/ 🔍 Case Study – Virtuals Genesis Launch & the Rise of AI Agent IPOs

We already covered Virtuals Protocol in a previous edition among others AI Agents projects — and lately, the ecosystem is seeing a real revival.

The protocol has evolved a lot since January 2025.

Today we are seeing how Virtuals Protocol just turned every AI agent into a pre-market IPO—and why degen finance might never be the same 👇

🧩 Context – From Speculation-First to Contribution-Gated Token Launches

Virtuals has always flirted with the narrative of “AI meets token incentives,” but its newest mechanism—Genesis—marks a legitimate shift. Not just in product. In coordination theory.

Forget bonding curves, Dutch auctions, sniper bots. Genesis flips the script:

The more measurable work you do for the ecosystem, the bigger your slice of the next token launch.

Not just fair in vibes—fair in verifiables.

And it didn’t roll out quietly.

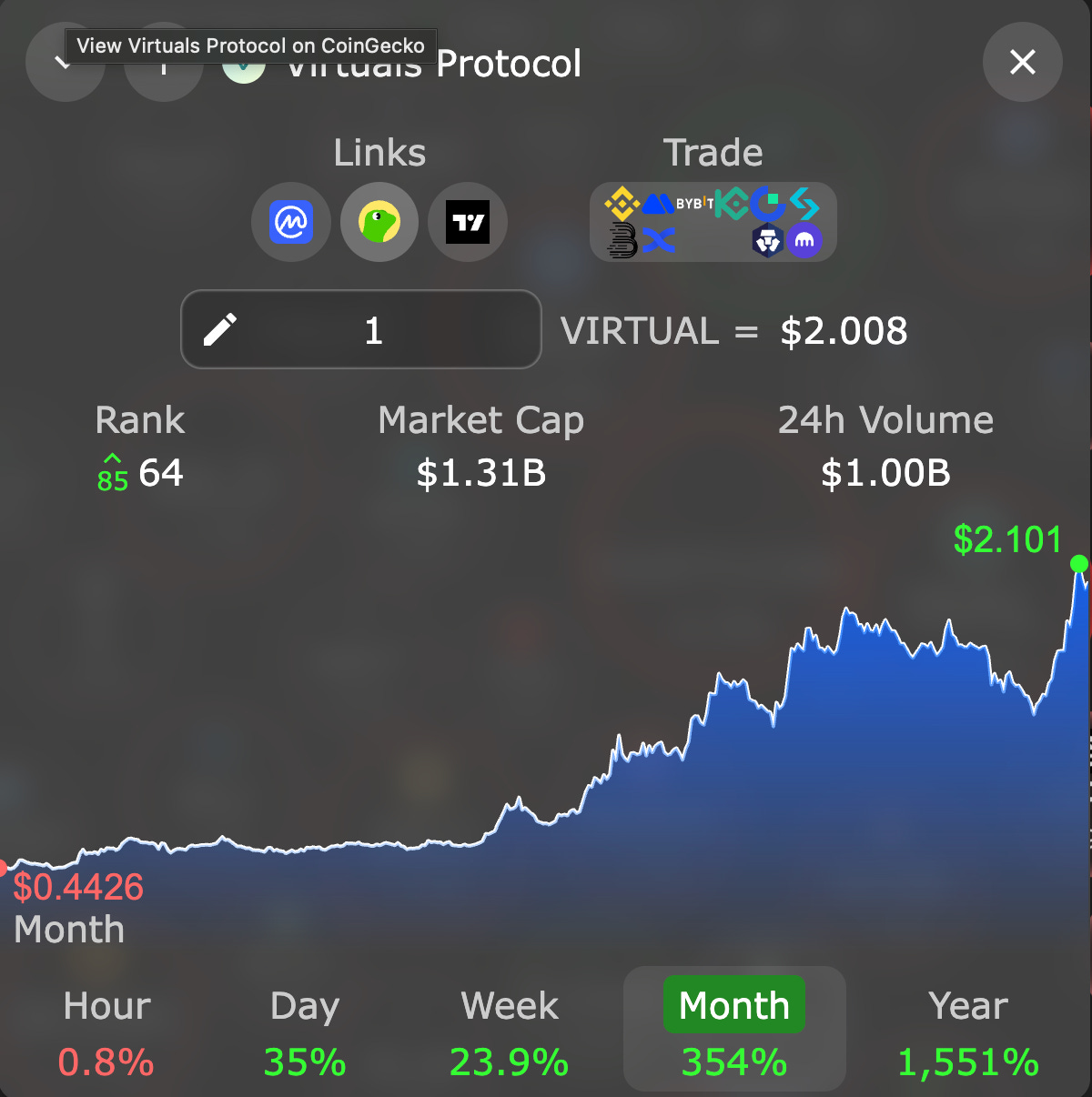

→ $VIRTUAL up 354% month-over-month

→ Genesis pools 600–2100% oversubscribed

→ Top agents IPO’d with ~$180K caps, hitting $4–20M FDV within days—with vesting and cooldowns embedded from day one.

The alpha? This isn’t airdrop speculation. This is contributor-weighted public sale access.

🛠️ The Rise of AI Agents – IPOs with Locked Floats and Sybil Armor

Each Genesis event mints a new token around a specific AI agent. 37.5% of the total supply is allocated over a fixed 24-hour window.

But here's the kicker: you can't just ape in.

You need Virgen Points—non-transferrable, decaying contribution credits earned through:

Holding or staking $VIRTUAL

Building with approved agents

Linking social accounts and publishing content

These points determine your allocation cap. But $VIRTUAL still covers the actual purchase.

Unused points and unspent tokens? Auto-refunded.

No rugs. No gatekeeping. No cabals.

It’s a fair-launch machine—with smart contract enforcement baked in.

🔧 New Design Levers (May 2025 Upgrades)

The ecosystem just got sharper:

All of this runs onchain, not vibes. You can inspect every rule.

🔎 Concrete Examples

The first agents dropped quietly—and exploded:

👩💻 HOLLY

A personal AI assistant with context chaining.

→ IPO’d at $187K FDV

→ Hit $4M+ FDV in 72 hours

→ Oversubscribed +2100%

🧠 BasisOS

Cognitive infra and memory framework for agents.

→ Launch cap: $187K FDV

→ Currently trading near $12.2M FDV, peaked around $20M

→ Oversubscribed +537%

🪙 Gloria AI

Emotive assistant prototype—core narrative tied to interactive UX.

→ Sold out in under 4 hours

→ Oversubscribed: +686%

→ Locked over $120K in $VIRTUAL on Day 1

Each of these launched with the same cap: 112,000 $VIRTUAL (~$180–190K FDV).

Compare that to Solana memecoins, which often list 10x higher on Day 1—and dump faster.

🔄 The Genesis Flywheel

This isn’t just about launches. It’s about flywheel design. Every new drop compounds pressure:

Points expire in 14 days → no passive hoarding

Each pledge locks $VIRTUAL, reducing circulating float

Top contributors can now stake their points, but only if agent tokens are DAO-approved

The result? A compounding loop of contribution → allocation → supply choke → price pressure.

And it’s moving fast.

⚙️ What Makes Genesis Different?

Everyone’s using points. Only Genesis weaponizes them.

Only ~1,100 people joined Genesis — and they already pumped $VIRTUAL 3x to a $2B cap

While others use points to delay rewards, Genesis uses them to gate real-time IPO access.

You’re not waiting for an airdrop—you’re bidding for a live token launch.

Points decay fast → no idle farming

Smart-contract cooldowns → punish flip wallets

Refund system → no sunk capital

IPO caps ~200k FDV → whales can’t front-run

Merit = access → not just capital or clout

Genesis is the only launch system where measurable work, not money, determines what you can buy.

It’s not just a points meta. It’s a real-time, rotating contributor economy.

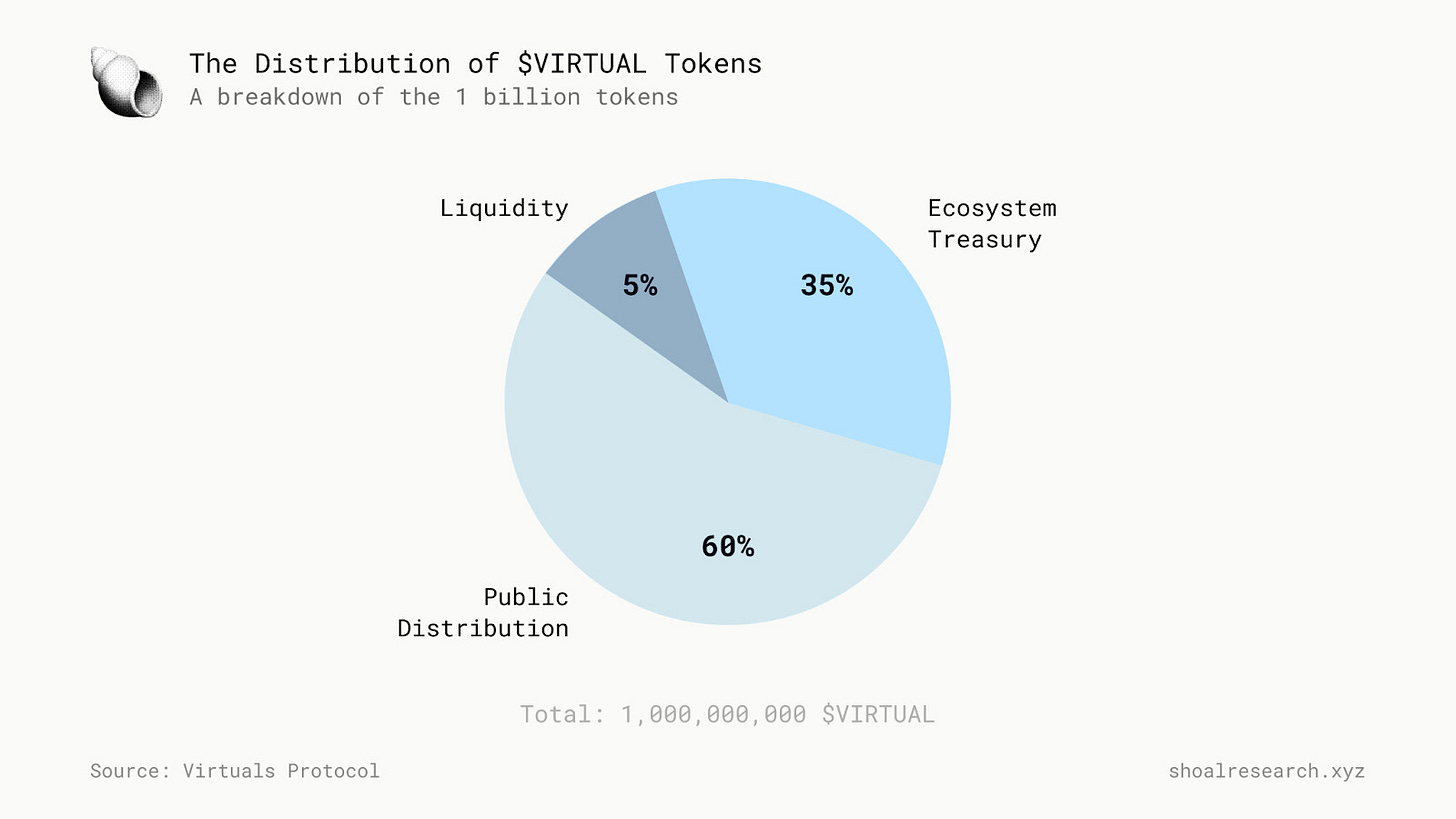

💸 $VIRTUAL Tokenomics Snapshot

Launch Price: $0.22

Current Price: ~$2

FDV: ~$1.47B

Circulating Supply: ~652M

No VC Allocations. No pre-mine.

Most upcoming token unlocks are tied directly to Genesis pledge mechanics.

You want more exposure? You help the system grow.

The float is increasingly locked up, block by block, pledge by pledge.

🧨 Hidden Alpha – Under-the-Radar Upgrades

These aren't just gimmicks—they're coordination primitives:

On-chain vesting locks – Team cliffs can't be shortened post-deploy

Diamond-Hand Bonus – Top 5% of holders now farm more than 1.5x normal points daily

Cooldown tracking – Attempt to exit and re-enter the same meta? You’ll get delayed

Genesis IPO caps – Still hard-fixed around $194K FDV. Most retail tokens start 10x higher—and collapse

These mechanics weren’t built for hype—they were built for resilience.

⚠️ Key Risks

Unpredictable Points Meta

→ Already changed twice in 30 days; expect rapid iteration 👇

Agent Saturation

→ 19 projects in the queue; not all deserve tokens

→ DAO review may not scale wellSpeculation Cycles

→ Top agent tokens still dump 40–60% post-hype

→ Managing expectations is keyNo Token for Points

→ No guaranteed conversion route; some degens won’t stick without direct upside

🧠 Personal Take – Genesis as a Fair Launch OS

Genesis isn’t a tool for launching coins. It’s a coordination engine.

A new framework for public funding where attention = access

—and where measurable contribution, not memes, earns allocation.

It forces fairness:

Points decay

Allocations cap

Vesting is exposed

Wallet churn gets punished

This is the opposite of the blackbox VC meta.

It feels native. It feels earned.

Virtuals isn’t just launching tokens.

They’re shipping a live, adaptive economic engine—updated weekly, sometimes daily.

Expect:

2–4 new agent IPOs per week

Rotating meta for point-maxxing

Dashboards, bots, and aggregators to rise

New games, new exploits, new ways to prove contribution

Genesis made token launches interesting again.

The only question now?

How long until someone games the system better than it can defend itself?

2/ Crypto & DeFi News

🎯 Coinbase Drops $2.9B on Deribit to Conquer Crypto Derivatives

In a landmark move, Coinbase is acquiring Deribit—the world’s leading crypto options exchange—for $2.9B, making it the largest M&A deal in crypto to date. With this acquisition, Coinbase will control the lion’s share of crypto derivatives open interest, eclipsing competitors like Kraken and Robinhood.

Deribit does ~$1.2T in annual volume and holds ~$30B in open interest. Coinbase is already pushing $10B in daily perp volume. This deal locks in global dominance across futures, options, and perps—just in time for the next wave of institutional inflows. Deribit’s team exits post-deal, and Coinbase gains the edge it needs in a market still dwarfed by TradFi's derivatives giants.

Thoughts

This is Coinbase’s biggest swing yet—and it might be the first one that actually lands. Unlike NFTs or Base or Layer-2 adventures, this move gives Coinbase hard financial infrastructure. Derivatives are where the real money is, and Deribit already owns that space globally. Buying them isn’t just a growth play—it’s a moat-builder.

Binance still owns spot. Coinbase just claimed the options and perps crown without needing to beat Binance head-on. And that matters: regulators trust Coinbase more, institutions need clarity, and the Deribit integration means Coinbase can offer a one-stop shop for futures, options, and spot wrapped in compliance and fiat ramps.

Also: timing. ETFs are live, BTC is six digits, and TradFi whales are finally sniffing around structured crypto exposure.

Here is 5 reasons why it’s huge.

Options are the future of institutional crypto strategy—and Coinbase now owns the toolbox. Kraken’s NinjaTrader buy? That’s Little League by comparison.

⛓️💥 BNB Chain Hits $600+ as DeFi & Trump-Stablecoin Momentum Return

BNB Chain is surging again. Following a sleepy 2023, DeFi inflows have more than doubled in 2024—TVL is up from $3.5B to $6B. BNB itself blasted past $600 and is now flirting with previous all-time highs, outperforming most L1s even as the broader market corrects.

Driving it all? Institutional tailwinds, Binance's still-massive trading volumes (~$76T in 2024), and the launch of Trump-backed stablecoin USD1—which lives almost entirely on BNB Chain. VanEck even filed for a BNB ETF in the U.S., and Standard Chartered sees a 4x upside by 2028.

Thoughts

Everyone wrote BNB off after 2022. Too centralized, too regulatory-risky, too tied to CZ. But here we are—BNB’s pumping, TVL is climbing, and the chain is doing what few others can: staying relevant to both institutions and degens.

While Solana drowns in memecoins and Ethereum deals with L2 fragmentation, BNB Chain is making a quiet comeback. Its DeFi stack may be basic—DEXs, lending, staking—but it’s stable, familiar, and fast. And now it has a geopolitical weapon: USD1, the Trump-backed stablecoin, minted almost exclusively on BNB Chain.

When regulators and presidents are directly boosting your token issuance and ETF filings are landing in D.C., you’re not “shadowy super coders” anymore—you’re part of the future monetary system.

It’s not flashy, but BNB’s boring, centralized resilience might actually be its killer feature.

💪 Bybit Recovers $1.5B Hack Blow in Just 30 Days

Bybit, the world’s #2 exchange by volume, is officially back on its feet. After suffering a $1.5B hack in February, Kaiko reports that liquidity levels—especially for BTC—are fully restored. Altcoins are at ~80% recovery, and withdrawals remained open through the entire crisis.

The hack was traced back to a compromised SafeWallet dev’s device. But the fallout? Surprisingly muted. Bybit covered user funds, bridged liquidity, and kept its books solid. Trading volume is still bouncing back, but the market views the incident as a macro blip, not an existential failure.

Thoughts

This was the biggest hack in crypto since Ronin—and it barely made a dent in Bybit’s long-term standing. That’s a testament to two things: (1) the maturity of Bybit’s crisis response, and (2) how desensitized the market is to billion-dollar exploits.

Let’s be clear: $1.5B is no small number. But Bybit kept withdrawals open, communicated clearly, and most importantly—proved it had the reserves to cover the loss. That’s rare in this space. Most platforms would’ve soft-rugged or pulled a “maintenance upgrade” for weeks. Instead, Bybit leaned into transparency, and competitors even stepped up with liquidity support.

The real story is that Bitcoin liquidity is back to pre-hack levels already. Altcoins lag, but that’s more about macro risk-off flows than trust in Bybit.

As institutions keep inching into crypto, exchanges that can absorb black swan events and bounce back fast are going to win market share. Bybit might come out stronger.

💳 Meta Eyes Stablecoin Payouts as Stripe, Visa, Trump All Go Onchain

Meta is reportedly exploring stablecoin integrations—its first foray back into crypto payments since the Libra/DM debacle. Sources say they’re considering support for USDT, USDC, and others in a “multi-token” model, with no firm rollout yet.

Meanwhile, Stripe launched stablecoin wallets in 100+ countries, Visa backed BVNK, and Trump’s USD1 is now part of the U.S. political economy. Stablecoins are no longer just stable—they’re strategic.

Thoughts

This isn’t just a tech pivot—it’s a global monetary shift. Meta, Visa, Stripe, and Trump are all converging on the same idea: if dollars are going digital, you want to be the pipe. And stablecoins are the pipe.

Meta’s cautious return is telling. They got burned on Libra, but the market is now 10x bigger, institutional-grade, and seen as a geopolitical tool. Stablecoins have hit $230B+ in market cap, and usage is growing outside of crypto Twitter—in remittances, commerce, and private banking.

As Stripe and Visa build infrastructure and Meta re-enters the arena, the stage is being set for a full-on fintech + DeFi fusion. Forget PayPal. The new USD rail won’t be legacy—it’ll be programmable, liquid, and sovereign-aligned.

🇺🇸 Trump-Backed USD1 Rockets to $2.2B Market Cap in Just Weeks

Trump-affiliated USD1 has exploded in market cap—from $128M in March to over $2.2B by early May—making it the 7th-largest stablecoin globally. Over 99% of its supply is issued on BNB Chain. The growth spike came just before Eric Trump announced a $2B investment partnership between Abu Dhabi’s MGX and Binance via USD1.

WLFI, the group behind the coin, is currently holding a community vote to airdrop USD1 to all token holders—with 99.97% voting yes.

Thoughts

USD1 isn’t just growing—it’s being deployed. The coin's rise wasn’t driven by organic demand, but by a coordinated political-economic machine pushing a new model: state-aligned stablecoins with no public audits, no reserve attestations, and no real oversight.

This is the anti-USDC strategy—less about transparency, more about influence. WLFI is using USD1 as a tool to embed itself in DeFi rails, absorb attention, and rewrite what legitimacy looks like in the age of crypto geopolitics. And with BNB Chain as its base layer, it’s also anchoring stablecoin scale to an ecosystem that welcomes opacity if it means velocity.

The airdrop is the next phase: a high-impact distribution blitz designed to create ubiquity before regulators can react.

It’s less about rewarding holders and more about forcing the market to acknowledge USD1’s presence. We’re not watching a token launch—we’re watching the start of a monetary campaign.

What happens when the issuer is the state?

3/🌙 Moon or Dust: $OLAS (Autonolas)

We already talked about DeFAI in a precedent edition,

Here’s an interesting post about DeFAI ecosystem.

I’ve been tracking $OLAS since back when “agent-to-agent” sounded like a Discord scam, not a transaction class.

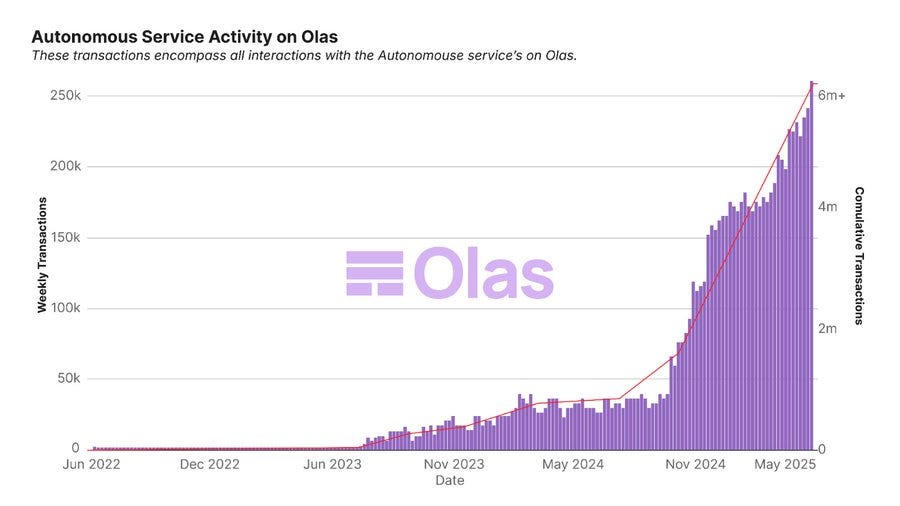

Fast forward to now: OLAS bots are live across 11 chains, handling 6M+ transactions, with a staking model that rewards live performance and slashes lazy agents.

OLAS is also top 6 in top DeFAI projects by market cap.

And with the DeFAI narrative heating up, it’s time to ask: is OLAS the infra play that glues logic, compute, and incentives together… or just a complex token with no traction beyond Dune charts?

🧠 The Core Concept

Autonolas is building the foundational layer for co-owned, on-chain AI agents. The architecture leans fully into autonomy, cross-chain coordination, and yield incentives — all wrapped in a token economy that’s live today.

Here’s what’s in the stack:

Mech Marketplace – bots execute, schedule, and trade with each other (3.8M+ peer-to-peer agent txs logged)

PoAA (Proof-of-Active-Agent) – token rewards flow to bots with verified on-chain activity; PoAA v2 introduces slashing for idle bots

Pearl – a consumer-facing “agent app store,” launched publicly in April; mobile version is in TestFlight now with embedded point-farming

In short: OLAS agents live on-chain, get paid to perform, and plug into retail UX and scalable compute. Most “AgentFi” projects talk about the future. OLAS is just quietly building it.

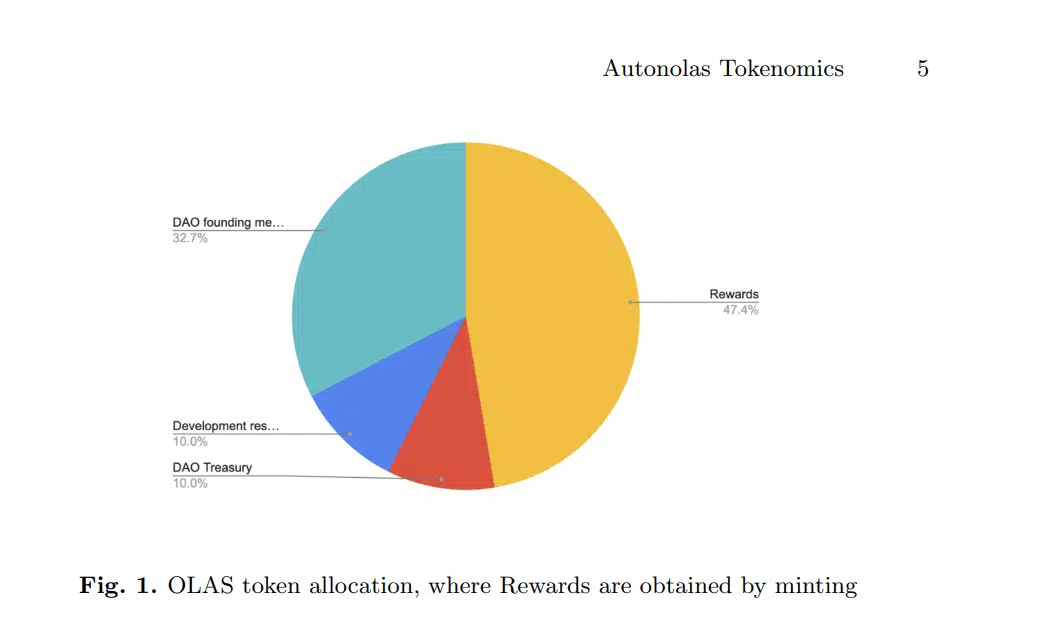

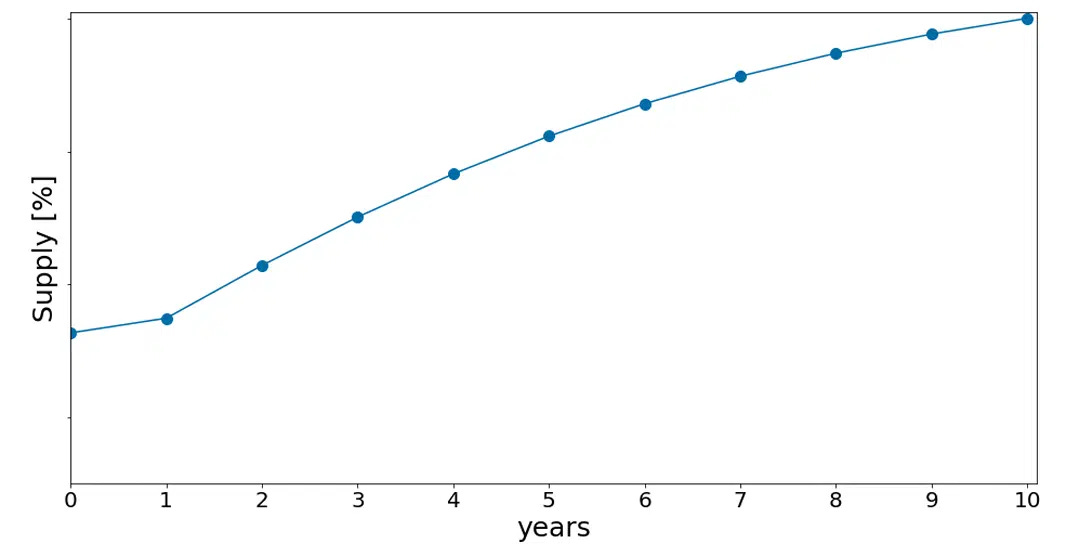

📊 Token & Treasury Highlights

Price: $0.25 (down 7.6% on the week)

Market Cap / FDV: $44M / $118M

Token Burn: 77.9M unvested OLAS incinerated in March → lower long-term inflation

Staking Yields (PoAA): 20–45% base APR; top-performing agent pools clearing 100%+

Liquidity: ~$400k daily volume across 7 CEXs + CowSwap — tradable, but shallow

Holder Concentration: Top 10 wallets control 78% of supply → high-trust, high-volatility dynamic

Runway: $13.8M raised (Feb, led by 1kx) → funds Pearl, grants, and DAO ops for ~24 months

🚀 Why OLAS Could Moon

Real-Time Agent Traction

6M+ agent transactions. ~500 active bots per day. That’s more operational AI autonomy on-chain than almost any project in crypto — full stop.DeFAI Narrative Alignment

Unlike centralized API-wrapper models like FET or TAO, OLAS is natively decentralized. The logic layer (agents), incentive layer (PoAA), and compute layer are all open, composable, and already interoperating.Pearl = Distribution Engine

Desktop launch was quiet but effective — 7k installs already. Mobile is in TestFlight with early point-farming. If Pearl nails UX, it could become the Steam of agent apps, and the gateway for normies into DEFAI.PoAA v2 = Tokenomics With Teeth

June’s DAO vote brings slashing mechanics and higher rewards for top-KPI pools. This upgrade makes the staking economy reflexive and performance-based — think EigenLayer, but for logic instead of restaking ETH.

⚠️ Why OLAS Could Dust

Whale Risk

With 78% of supply in the top 10 wallets, any rage-quit or strategic exit could nuke price and morale in one swipe.Token Still 97% Below ATH

The chart is ugly. OLAS printed highs in Jan 2024 and never recovered. Any pump might just be an exit ramp for early buyers.Liquidity Is Shallow

<$0.5M in daily volume means that even small fund-size positions could slip 3–5% on entry or exit.UX Still Raw

Pearl’s early traction is promising, but it’s not plug-and-play. If mobile doesn’t land cleanly, retail adoption could stall.Regulatory Uncertainty Around Autonomous Agents

DEFAI may be the narrative of the year—but if one rogue agent exploits a dApp or gets slashed unfairly, it opens the door to legal, reputational, and trust risks.

🔮 Final Verdict: AgentFi That Actually Works — and Plugs Directly Into DeFAI

OLAS is one of the few live plays in the emerging DeFAI stack: an economic engine for agent-based coordination, powered by usage, not speculation. Between Pearl’s rollout, PoAA v2, and rising on-chain KPIs, there’s a real shot at breakout.

But whale concentration, UX risk, and shallow liquidity mean the window to scale adoption before a dump or distraction is narrow.

Verdict: Moon Bias for DeFAI Maxis, Execution-Dependent.

Track the June PoAA vote, monitor Pearl mobile metrics, and treat any deep CEX listing as a trigger. It’s live infra in a meta just waking up — but don’t size irresponsibly.

NFA, DYOR 🫡

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and is purely informative.