Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

After a vertical +30K run since April 7th, BTC is cooling off in textbook fashion: small pullbacks, tight ranges, barely a -0.2% move down. That’s not weakness — that’s a reset. A necessary one. Zoom out and the structure’s clean, healthy, and coiled for more.

But here’s the twist: Ethereum is stealing the show.

ETH has rallied +65% over the past month— and it’s not done. ETH has broken out of key levels, printed a clean stair-step structure.. The move looks stronger than BTC, and the setup for a full ATH breakout is forming fast.

This isn’t just about price action — the fundamentals are snapping into place.

Ethereum is quietly becoming the global settlement layer for digital finance. It’s the backbone of stablecoin velocity, processing nearly $900B in flows — and that’s not a typo. Whether it's USDT, USDC, or new omnichain stables, most serious issuance still lives on ETH.

The buildout of RWA infrastructure is accelerating — and Ethereum is the default environment. Projects tokenizing treasuries, real estate, and invoice markets are settling on ETH because that’s where liquidity, security, and composability live.

Beyond that, Ethereum continues to dominate DeFi TVL, hosts the densest ecosystem of dApps, and leads in developer activity. With EIP-4844 live, L2 costs have dropped dramatically, enabling the next wave of user-friendly apps to flourish without leaving Ethereum’s security umbrella.

Combine that with the complete absence of retail and the result is a stealthy, institutional-led rotation that’s just beginning to show on-chain.

Meanwhile, altcoins are alive. Total3 is holding structure, rotation is ticking up, and DePIN — yes, DePIN — is leading 24H mindshare. Not memecoins. Not L1s. Infra. Something is shifting.

VCs are also back in force, but with new rules. No more 80x revenue dreams. No more slide decks with vibes only. They want cashflow, velocity, and models that can scale.

And that’s exactly where today’s story comes in :

Hyperliquid isn’t just keeping up — it’s pulling away.

60% of all perp DEX volume now flows through Hyperliquid. That’s more than the next five combined. It's got CEX-grade speed, native EVM infra, validator staking, and the most aggressive buy-back loop in the game — 97% of all revenue gets market-bought into $HYPE and burned.

The farming season has started.

The flywheel is spinning.

And the window to front-run it? Still open. Barely.

Let’s get into how Hyperliquid is designing the most complete, reflexive reward system in crypto — and why the rest of the market hasn’t caught up yet.

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!Also, if you missed one of my Latest Posts:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on Hyperliquid : How Hyperliquid is building the most aggressive, vertically integrated token economy in crypto.

Main News of the Week.

Today's Newsletter is brought to you by Reown

🔔 Key Development: Reown Drops the UX Report of the Year – 1,000 Users, Endless Pain Points

Reown just released The State of Onchain UX 2025 — and it’s the clearest snapshot yet of how people actually navigate the onchain world.

They went deep: 1,000+ active users surveyed (beginners to 4+ year veterans), behavior over vibes, and extra firepower from @nansen_ai’s onchain data.

The takeaway? UX is still holding crypto back — badly. Wallet sprawl is increasing, security is a coin flip, and chains feel more siloed than ever. But the data doesn’t just diagnose the problem — it highlights where the real opportunities are.

🔍 Highlights:

🧩 Wallet fragmentation is real

48% of users juggle wallets across chains

44% add wallets purely for safety

Nearly half switch wallets based on the dApp

💸 Stablecoins are winning by utility

Adoption jumped from 20% → 37% in one year

Users are shifting from speculation to spending, saving, and remittance

🔐 Feeling safer ≠ being safer

69% say they feel safe onchain — up big from last year

Still, 21% got phished

🔗 Interoperability is now mandatory

95% say seamless cross-chain access is “very important”

Only 5% said it doesn’t matter. That’s not optional — that’s a product requirement.

💡 Social and payments are the future — but trading still dominates behavior

The belief-behavior gap is huge. That’s where the builders come in.

The report isn’t just research — it’s a roadmap. If you’re building wallets, apps, or infra, this is where the UX bar is headed.

🛠️ Reown Is Shipping to Match the Moment

The UX issues flagged in the report aren’t theoretical — and Reown’s not waiting around.

Their new Reown Dashboard centralizes wallet UX, multichain flows, and real-time usage data in one clean interface. Builders get faster paths from idea → integration, without duct-taped logic across 10 chains.

Recent updates:

Farcaster usernames in Embedded Wallets – More context, less drop-off

AppKit Core revamp – Leaner QR flows, better scaling

wallet_changeNetwork upgrade – Easier network switching

Solana support in WalletKit – One integration, all chains

And if you’re a wallet provider, the WalletGuide + WalletCertified revamp makes it easier to get listed, get trusted, and get discovered — with fewer steps and more visibility across the WalletConnect Network.

🔮 What’s Next from Reown?

They’re doubling down on flexible onboarding, deeper insights, and cross-chain simplicity. Plus, WalletGuide community curation is coming — so users help define what trusted UX looks like.

1/ 🧠 Deep Dive on Hyperliquid – From Perp DEX to Full-Stack Airdrop Machine

We already talked about Hyperliquid in a precedent edition.

Hyperliquid is thriving since TGE.

What began as a sleek on-chain perps venue is now a juggernaut with CEX-grade UX, a native EVM stack, validator staking and the most aggressive buyback engine in crypto.

At press time $HYPE = $26.63, Mcap ≈ $8.89 B (333.9 M circulating / 1 B max).

And Top 15 crypto by market cap :

60 % of all perpetual-DEX volume now routes through Hyperliquid — more than the next five DEXes combined.

Throughput & UX: HyperCore + HyperBFT process ~200 k orders / s with ~0.2 s median finality, fully on-chain.

Revenues: trailing 12-week run-rate implies ≈ $595 M revenue / yr; 97 % is auto-swept into daily $HYPE buy-backs and burns.

Supply on the table: 31 % distributed in the record 2024 airdrop; 42 % ring-fenced for future community rewards.

That’s ETF-grade demand pressure on a token 35× smaller than ETH — and the bought tokens are burned.

⚙️ HyperInfra — CEX Speed, Chain-Native Execution

No bridges. No multi-sig sequencer. Every perp, spot or contract call settles in the same block — exactly why farming here is so capital-efficient.

🔁 Reflexive Tokenomics — $HYPE Buy-Back & Burn

97 % of revenue → Assistance Fund → market-buy $HYPE → burn/hold

233 k HYPE burned so far (≈ $5.81 M) 👇

AF wallet now holds ≈ 22.46 M $HYPE (≈ 6.7 % of circ.) for future burns 👇

Staking tier fee discounts launched 5 May 2025 — stake 10 → 500 k HYPE for 5 % → 40 % trading-fee rebates.

With 42 % of supply still unreleased, the loop is only warming up.

🧱 HyperEVM — Your Airdrop Playground

Mainnet live 18 Feb 2025

USDT0 went live 9 May 2025, the first omnichain stable on Hyperliquid

TVL just punched through $1 B — up 7× since April.

Only ~94 k addresses have ever touched HyperEVM — competition is still tiny .

Why farmers care: every gas-burning EVM tx is a point signal, and the chain is exploding with fresh DeFi primitives.

🎯 Season-2 Farming — Already Underway

Hyper Foundation hints: Season-2 point accrual started the day HyperEVM launched.

42 % supply unallocated, and the team historically gives only 24h notice ahead of a snapshot.

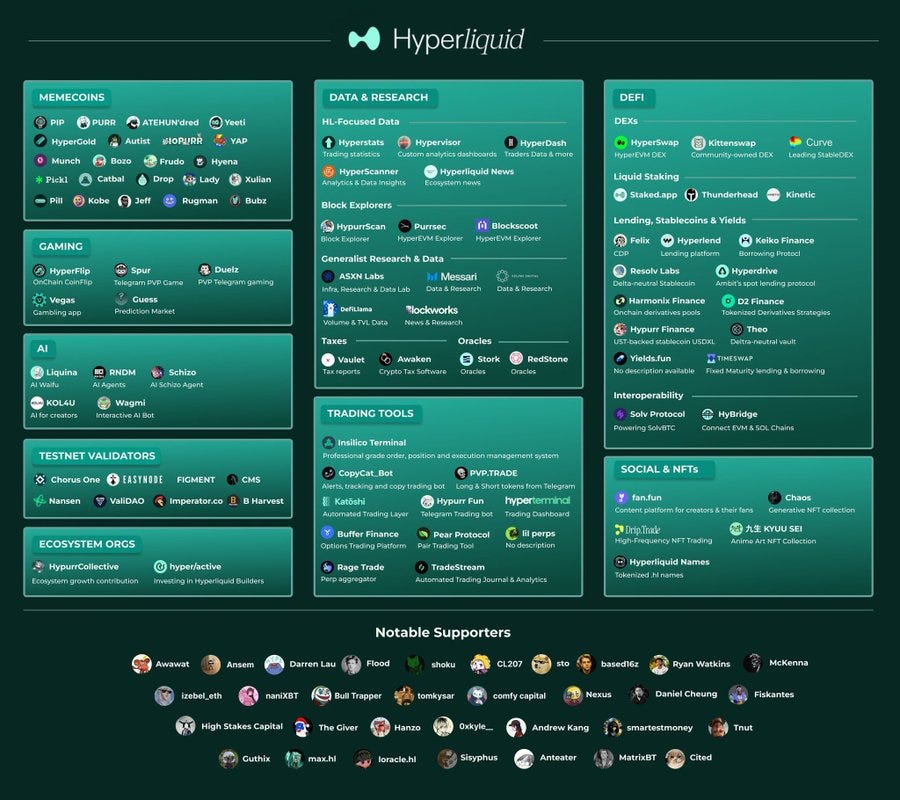

🌐 Ecosystem Snapshot (May 2025)

Over 30 live protocols in total (options, prediction markets, AI agents, NFT infra, etc.).

🧃 Capital-Efficient Daily Rotation (~10 clicks)

Bridge USDC (Arbitrum → HyperCore).

Buy & stake HYPE, mint LHYPE on HyperEVM.

Collateralize LHYPE on HyperLend, borrow USDXL.

LP LHYPE-USDXL on HyperSwap or KittenSwap.

Mint feUSD / KEI, stake Stability Pool, LP stables.

Bridge BTC/ETH via HyperUnit → park in Mizu.

Daily: claim XP, tiny swap; Weekly: refresh LP ranges.

Delegate HYPE to third-party validators (Phase-2 now scaling to 21 nodes) .

Stacks: Season-2 points + dApp points + real yield.

Gas ≈ $1/day.

🧨 TL;DR — Hyperliquid Is the Fly-Wheel That Prints

≈ $595M annual revenue, already above Arbitrum or Optimism.

97 % flows straight into buy-backs and burns.

42 % of supply still for the community.

< 100 k on-chain users farming right now.

Hyperliquid delivers CEX-speed trading, fully on-chain settlement and the most aggressive real-yield mechanics in DeFi.

If you’re staking $HYPE and routing capital through HyperEVM today, you’re front-running one of 2025’s fattest reward curves.

Early edge is fading — but it isn’t gone yet.

2/ Crypto & DeFi News

🕵️♂️ Coinbase Drops 7% After Breach and SEC Probe Into User Numbers

Coinbase stock took a 7% hit this week after a brutal one-two punch: a customer data breach and a resurfacing SEC investigation into its 2021 user claims.

The SEC is probing whether Coinbase overstated its “100+ million verified users” during its IPO period—a metric the company quietly stopped reporting in 2022. Coinbase insists this is an outdated investigation and points to its newer metric: monthly transacting users. Meanwhile, they’ve lawyered up with Davis Polk & Wardwell to handle the heat.

Oh, and the breach? Cybercriminals allegedly recruited overseas support agents to leak customer data, then demanded a $20M ransom. Coinbase refused to pay, but the remediation could cost them up to $400M.

Thoughts

It’s a rough week to be bullish COIN. The SEC probe isn’t necessarily new, but it drags Coinbase back into regulatory quicksand at the worst possible time. Even if the investigation fizzles out, the optics of “misleading user numbers” during an IPO are never good.

The breach, however, is more immediate—and more damaging. A compromised support system, a $20M ransom attempt, and hundreds of millions in possible payouts? That’s a fundamental trust hit. Coinbase is positioning itself as crypto’s most institutional-friendly player. It can’t afford Web2-level security failures or regulatory skeletons.

Long-term? Probably fine. Short-term? Pain.

💸 Tron Flips Ethereum on USDT Supply with $1B Fresh Mint

Tether just minted another $1 billion USDT on Tron, tipping the scales in Tron’s favor in the battle for stablecoin dominance.

With this new mint, Tron’s authorized USDT supply surpasses Ethereum’s, clocking in at $74.7B versus Ethereum’s $74.5B. Even on circulating supply, Tron is ahead: $73.6B vs. $71.8B. This marks another chapter in the ongoing tug-of-war between the two chains over who owns the stablecoin throne.

While Ethereum briefly reclaimed the lead in early 2025 after an $18B surge, Tron’s steady pace (and now this monster mint) puts it back on top. Tether says this is part of “inventory replenishment,” meaning they're preparing to meet future demand—but the optics are clear: Tron is back in the driver’s seat.

Thoughts

This isn’t just a flex—it’s a narrative win for Tron. In a market where stablecoin liquidity is power, having the majority of USDT circulation is a big deal. It boosts Tron’s relevance in the DeFi and remittance ecosystems, especially in Asia where Tron’s adoption is strong.

For Ethereum, this isn’t exactly an existential crisis, but it does signal that cheaper, faster chains are winning the stablecoin UX war. And for Tether? It’s more dominance—USDT now makes up 61% of all USD stablecoins in circulation, with $150B total. That's not just market share, that's empire status.

Tron may still carry a “centralized” stigma, but users clearly don’t care. They want speed, low fees, and access.

And right now, Tron’s giving them all three—plus a fresh $1B reason to keep choosing it over Ethereum.

🛡️ Ethereum Foundation Launches “Trillion Dollar Security Initiative” to Ditch Legacy Risk

The Ethereum Foundation just dropped a bold new effort: the Trillion Dollar Security Initiative, aiming to modernize and harden Ethereum’s security stack from top to bottom.

Led by Fredrik Svantes and Josh Stark, with support from heavyweights like samczsun, the initiative will tackle UX, wallet infra, smart contracts, and protocol-level risks. The goal? Make Ethereum robust enough for billions of users to safely hold thousands onchain—adding up to trillions in trustless capital.

With nearly $80B TVL on Ethereum today, the stakes are sky-high. The Foundation is pushing to ensure that as Ethereum scales, its security keeps up—not just for devs, but for mainstream adoption.

Thoughts

This is Ethereum saying the quiet part out loud: legacy security models aren’t cutting it. And if this chain is going to be the base layer for global digital assets, it needs Fort Knox–level confidence.

The name might sound like a meme—“Trillion Dollar Security”—but the intent is dead serious. As Ethereum fights to maintain relevance amid faster L1s and slicker UXs, it knows security is where it can win hearts (and capital). It’s also a clever narrative move to reframe Ethereum as the safe and battle-tested choice for institutions, not just degens.

Pair this with the momentum from the Pectra upgrade and ETH’s recent 43% price pump? We might be witnessing Ethereum’s comeback arc.

But security has to go from GitHub docs to real-world defense fast—before the next multi-million dollar bug makes headlines.

🌏 Asia’s Rich Ditching the Dollar for Gold, Crypto, and China – UBS Says Quiet Part Out Loud

According to UBS, Asia’s ultra-wealthy are pulling out of the US dollar and rotating into gold, crypto, and Chinese markets.

Amy Lo, UBS’s co-head of wealth management for Asia, said at Bloomberg’s New Voices event that “volatility is here to stay”, pushing clients to rebalance into hard assets and new-growth regions. Gold demand is spiking, interest in crypto is heating back up, and China—after years in the penalty box—is finally seeing inflows again.

The rotation is driven by geopolitical jitters and USD fatigue. Bank of America also reports the biggest underweight on the dollar by fund managers in nearly 20 years. Add in a fresh US-China tariff truce and a resurgent Hong Kong stock index, and you’ve got a perfect storm for a macro-level pivot.

Thoughts

This shift is a huge signal. When Asia’s richest start moving off the dollar, it’s not just about performance—it’s about hedging a broken global order. The dollar’s dominance is starting to crack at the edges, and the new capital destinations tell a bigger story: Bitcoin as digital gold, China as a growth engine reborn, and gold itself as the OG safe haven.

Crypto’s inclusion in the rotation is especially noteworthy. These aren’t Reddit degen flows—this is structured private wealth shifting into BTC and digital assets as a real reserve alternative. That’s not bullish... it’s secularly bullish.

The US still leads tech and capital markets, but when the world’s second-largest wealth region rethinks its allocation, everyone else watches—and eventually follows.

🕰️ SEC Hits Snooze on Solana ETF as XRP, Polkadot Decisions Loom

The SEC just delayed its ruling on Grayscale’s proposed Solana (SOL) spot ETF, pushing the next decision deadline out to October 2025. This comes hot on the heels of another ETF delay—for Litecoin—and sets the stage for more regulatory kicking-the-can as Polkadot, XRP, and DOGE ETFs approach June deadlines.

Despite the holdup, sentiment remains surprisingly bullish. On Polymarket, over 82% of traders still bet that a SOL ETF will be approved by the end of 2025, with similar odds for Litecoin. Meanwhile, industry watchers are eyeing June 11 (Polkadot), June 17 (XRP and DOGE), and June 24 (another Polkadot filing) for what could be the SEC’s next moves—or next delays.

Thoughts

The SEC doing SEC things—delaying, posturing, and squeezing the clock on anything that isn’t Bitcoin or Ethereum. But make no mistake: the ETF floodgates are cracking open.

Spot ETFs bring structure, liquidity, and legitimacy to crypto, and Solana is next in line for institutional dressing. Even if it doesn’t bring BTC-level inflows, a SOL ETF would supercharge adoption and offer TradFi a clean, regulated route into the Solana ecosystem.

And here’s the alpha: the delay isn’t denial. It’s strategy. The SEC has 240 days to drag its feet, and it will use every single one. But with increasing political pressure, a growing number of approved BTC and ETH products, and Polymarket odds this high, it’s only a matter of time before SOL, XRP, and even DOGE get their ticker tape moment.

Just don’t expect it this summer—this is a slow-play game. But the pieces are moving.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and is purely informative.