This Week's Newsletter - Deep Dive on InfoFi Season (Kaito, Loud, Noise, Ethos, Cookie) & Main News of the Week

Weekly Alpha

There is no collaboration with the projects mentioned in this edition.

GM frens,

Ok, the market is experiencing a small dip right now. But before that, something big happened.

Bitcoin hit another all-time high of $111,891 on May 22. You’d think that would be front-page news everywhere. But no.

There’s no retail FOMO, no search spikes, no app store action. Google searches for “Bitcoin” are still near five-year lows. Coinbase isn’t trending. No friend texting you to ask how to buy crypto. It feels nothing like the 2017 or 2021 bull runs. BTC is mooning, but retail’s asleep.

What’s actually happening is a massive shift in who’s buying. Institutions are loading up, quietly and aggressively. ETFs are now buying six times more BTC than miners can produce, with over $65 billion flowing in just this year. Big names like BlackRock, Goldman, and even countries like El Salvador and Brazil (and now Pakistan) are on the bid.

Meanwhile, retail is selling. More than 247,000 BTC — almost $23 billion — has been offloaded by small holders in 2025. It’s a quiet exit, powered by old fears, high interest rates, and the memory of getting rekt in the last cycle. Most are waiting for the next parabolic move — but by the time it comes, it might already be too late.

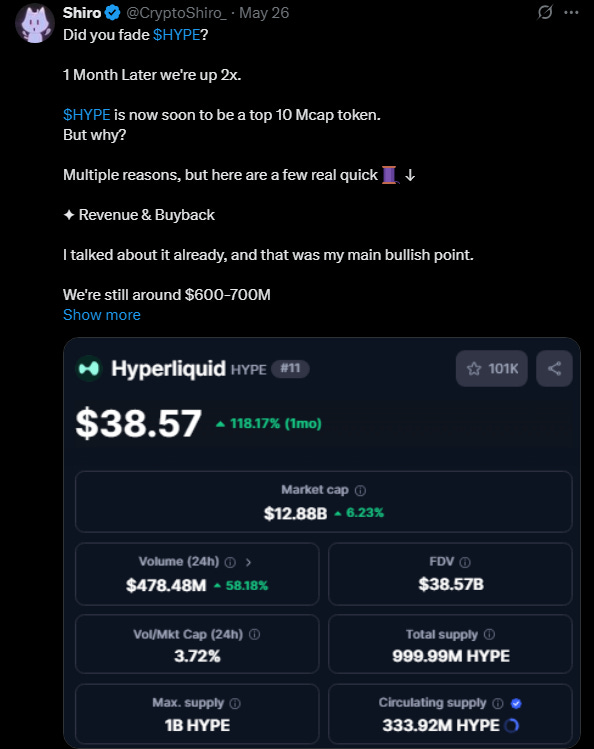

Ethereum is still trying to find its place. It’s upgrading (EIP-7702), but not leading like it used to. Solana and Hyperliquid are gaining momentum. Altcoins? Scattered and noisy. The cycle feels… different.

But here’s what matters: attention hasn’t disappeared — it’s just changing shape.

If the last cycle was about who could launch the fastest, this one is about who can capture and convert attention into economic power. We’re entering a new market phase where signal is everything. Not just clicks or clout — but measurable, programmable, tradable attention. A new stack is forming to handle it.

Welcome to InfoFi Season — the era where mindshare becomes capital.

It’s not about who shouts the loudest, but who builds trust, sustains engagement, and turns presence into protocol-level value. While price grinds sideways and retail waits for a catalyst, a new wave of infra is laying the groundwork for what comes next.

This week, we’re diving into that stack. Loud, where onchain PvP rewards yappers. Ethos, the trust layer filtering signal from spam. Cookie, the creator engine powering protocol-native campaigns. The tools are here, the rails are live, and attention is finally measurable.

Let’s get into it.

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!Also, if you missed one of my Latest Post:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on InfoFi Season: Where Mindshare Becomes Capital, and Attention Is the New Liquidity

Main News of the Week.

1/ 📡 Deep Dive: InfoFi Season — Who Wins the Mindshare War?

In a previous edition, we dove into KAITO — the protocol that turned information into a financial primitive.

But $KAITO didn’t just define the category. It opened the gates.

What followed was an explosion of onchain attention markets. Projects that don’t just reward clicks or comments—but measure influence, reputation, and trust with surgical precision.

Now, we’re entering InfoFi Season. The thesis is simple: attention is capital, and the new economy is built on signal, not noise.

This week, we break it down across 3 battlegrounds:

Kaito-powered social experiment: Loud

Onchain identity and reputation: Ethos Network

The data-rich content engine: Cookie.fun

Let’s dive in 👇

🔊 PART I — Loud: The Perpetual Attention Engine

📣 What’s the Idea

Loud is a new kind of token launch built around one simple question: what if talking online was enough to earn you a bag?

It’s the first real experiment of an Initial Attention Offering (IAO), powered by Kaito’s mindshare tech. Instead of rewarding capital, Loud rewards participation. It turns your posts, replies, and engagement into points—measured on a leaderboard that decides who gets the most $LOUD.

This flips the script. It’s not about buying your way in. It’s about being visible, early, and loud.

🎯 Why It Matters

At first, it was all about being in the top 25. But then Loud gave everyone a chance:

Top 1,000 yappers get guaranteed access to the presale

The rest of the whitelist opens to 120,000 Kaito users with a linked wallet and 10+ smart followers

The snapshot for both IAO phases was taken yesterday (May 30th).

A checker is now live at stayloud.io—just enter your wallet to see if you made the cut.

Phase 1 gives guaranteed access to the top 1,000 yappers. If you’re in, congrats—you locked in a 0.2 SOL allocation.

Phase 2 opens to 120,000 Kaito-linked wallets with 10+ smart followers. It’ll be first-come, first-serve with a dynamic refund system if oversubscribed.

Everyone gets a piece. No VC round. No private raise. Just yap-to-earn.

💰 Why I’m Watching It

0.2 SOL (~$33) gives you exposure to what could be a 100x–1000x play, depending on how the market reacts. If it hits a $15M cap, that’s a 100x from entry.

There’s risk, of course — but it’s an asymmetric bet. And you’re not just betting on a token. You’re participating in a new type of launch.

Loud also runs on a flywheel dynamic: the more you talk, the more you earn visibility — and the more you earn, the more you talk. That loop creates powerful short-term hype, but it may need new incentives later to sustain long-term traction.

But the flywheel can’t spin forever. The team knows that. That’s why more nuanced reward systems are likely coming — rewarding not just volume, but also types of contributors (researchers, meme lords, analysts, etc).

🚨 Why the IAO Format Is a Big Deal

This is a new primitive: Initial Attention Offering. It’s launching May 31st on the Holoworld launchpad (HoloLaunch), with clear rules and real-time impact.

45% of supply distributed

45% added to liquidity

10% for MM and community rewards

That’s one of the most transparent, community-first launches we’ve seen.

🧩 Final Thoughts

Loud is loud for a reason. The IAO could change how early access and token launches are done in Web3.

You don’t have to agree with the noise. But if you’re active on CT, you should at least understand the game. And maybe — play it smart.

This isn’t hype for hype’s sake. It’s an experiment worth watching.

💥 What About Noise?

While Loud rewards you for farming attention, Noise lets you trade it.

Noise is not powered by Kaito, but it leverages Kaito's public data feeds as a reference—particularly its mindshare indexes and trend data. This makes Noise a fascinating parallel: independent in infrastructure, yet adjacent in vision.

Built on MegaETH, Noise creates real-time markets for narrative speculation. You go long or short attention trends—similar to perps, but for culture.

They partnering with Kaito to turn mindshare into tradable trends.

In practice, Kaito provides the signal, but Noise builds the rails. This is a collaboration—not a full integration.

Loud asks: “Can you generate the hype?”

Noise asks: “Can you predict the trend?”

Both test the same thesis: attention is a tradable asset. But their execution differs radically.

Loud is winning now—because it pays you for showing up, but is more of a one time experiment (that will probably happen again, as they announced in a Space).

Noise is for those betting early on where attention flows next, and is a more long term platform, with many upcoming opportunities to trade trends.

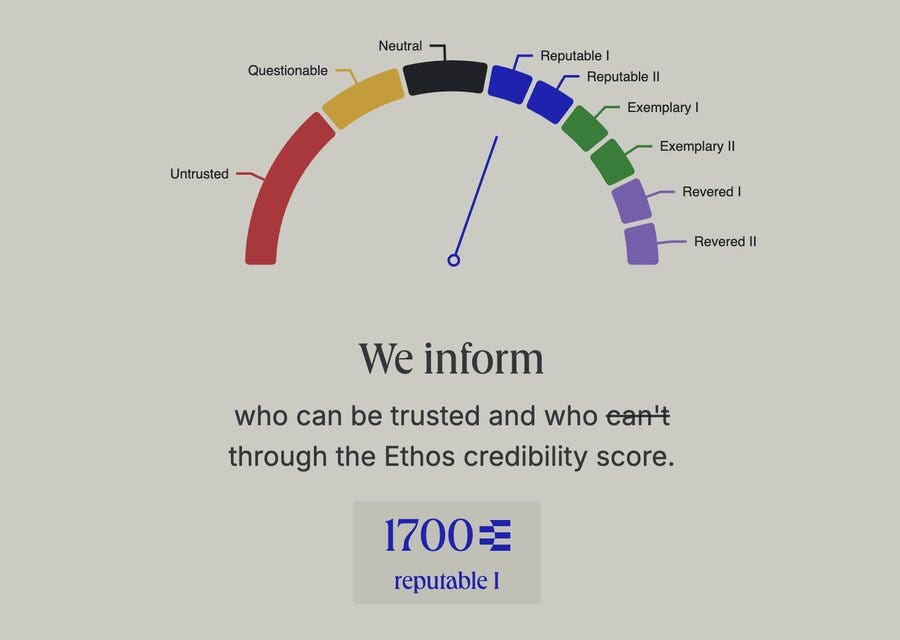

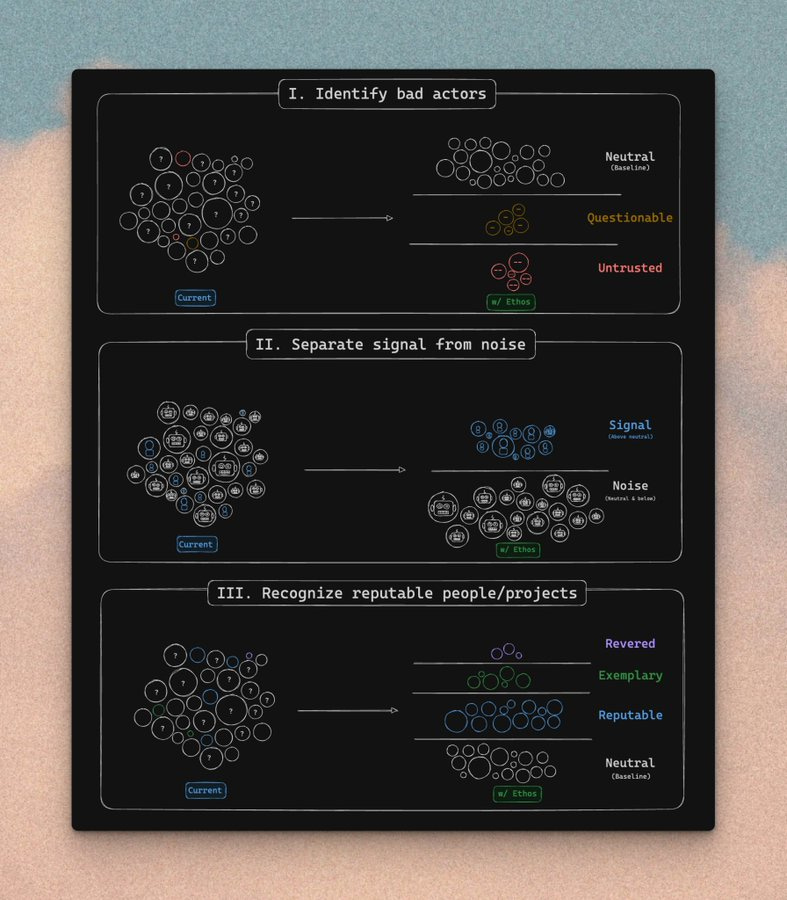

🤝 PART II — Ethos Network : The Trust Layer

Ethos is different from the rest. While most InfoFi projects chase volume and hype, Ethos is here to clean things up. It's not about being loud — it's about being real.

Explanation in real simple terms 👈

🛠 What It Does

Ethos gives every wallet and social account a trust score. It helps projects see who’s legit and who’s just farming points.

You build your score through:

Reviews — thumbs up/neutral/down from other users that impact your rep over time

Vouches — staking ETH on someone boosts their trust score (and links it to yours)

Slashes — flagging bad actors (you risk ETH if you’re wrong)

Invites — you’re judged by who you bring in

All of this creates a Credibility Score, kind of like an Elo ranking for trust. It already shows up on places like OpenSea, Kaito, and X thanks to their Chrome extension.

You can see the score below the profile on X 👇

🚪 Why It Matters

Reputation is becoming key in Web3:

DAOs can filter who gets to vote

Protocols can stop bots from gaming airdrops

Users can know who they’re really dealing with

Ethos isn't chasing noise. It’s building a long-term trust layer for everything.

And the best part? It’s invite-only for now. That exclusivity keeps the quality high and gives early users a real edge.

✅ How to Win with Ethos

Give honest reviews and build slowly

Only vouch for people you trust

Be careful who you invite — their actions affect your score

Use the Chrome extension to see scores and connect with high-trust users

Ethos feels like a passport for the next phase of Web3. A high score could unlock access, drops, or even roles others won’t see. If you're early and credible, you're already ahead.

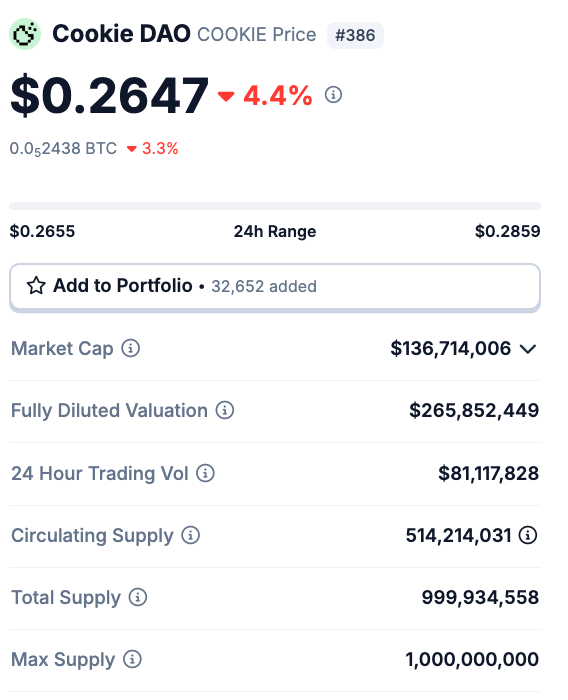

🍪 PART III — Cookie : The InfoFi Farmer’s Command Center

Cookie joined the InfoFi race in May 2025, when Kaito is dominating mindshare. But Cookie didn’t aim to copy Kaito—it aimed to fill the gaps.

Instead of building for analysts and dashboards, Cookie built for creators, those who want to act fast, farm smarter, and get rewarded in real time.

🧠 Why Cookie is Different from Kaito

Where Kaito focuses on data aggregation and institutional reach, Cookie builds creator tooling and campaign precision.

Kaito is the Bloomberg Terminal. Cookie is the content engine. It rewards smart content that aligns with protocol narratives and engages real users.

Kaito powers the data.

Cookie gamifies distribution.

You don’t need deep analysis—you need to match your message to the moment.

The token is :

Listed on major exchanges: Binance, Coinbase, Bybit

~$265M FDV vs Kaito’s ~$2.1B — still early

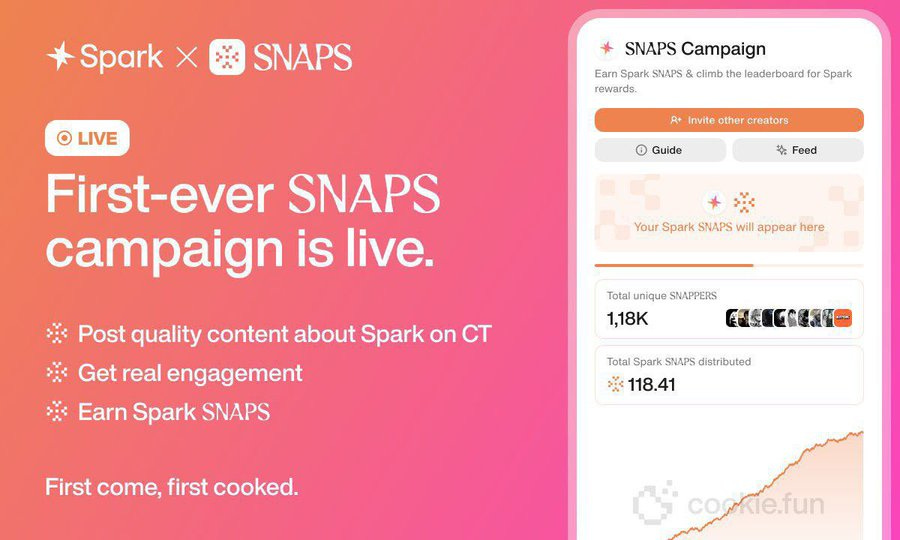

🔥 The Spark Campaign: Cookie's Real Arrival

Cookie’s first Snap campaign launched with Spark Protocol, pushing their fixed 9.252% PT APY USDS product.

It’s the proof that InfoFi could drive real capital via creator content.

What happened:

10,000+ users onboarded in hours

Snap point values peaked near $100 per post

Spark saw actual inflows—not just noise

By making the Snap process simple—project, message, post, reward—Cookie proved that good content isn’t just viral, it’s valuable.

🧰 What You Can Actually Do with Cookie

Snaps — post aligned content during active campaigns, score points, and earn eligibility

Dashboards — track token flows, project overlap, agent activity

Alpha Feed — a curated, real-time snapshot of onchain and offchain signals

Airdrop Farming — register/stake and access campaigns across ETH, BNB, and Base

They’ve even teased a Reward SDK that’ll let any protocol launch its own Snap bounty—making Cookie the creator hub for the whole ecosystem.

💸 Why I’m Farming

Cookie made InfoFi feel accessible. I don’t need a dashboard overload or 10 platforms to keep up. I can see trends, track campaigns, and post with a clear goal—and get rewarded for doing it well.

The Spark campaign showed that Cookie isn’t just hype—it drives real traction.

Here’s a good article for farming on Cookie.

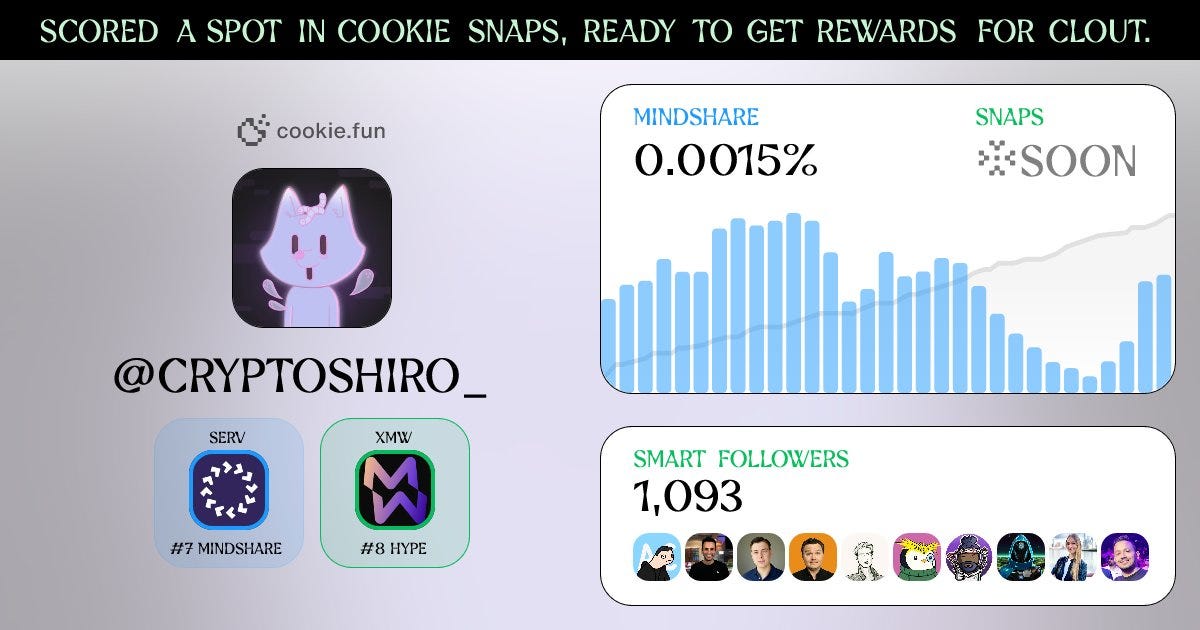

(I did join Snaps too.) 👇

📊 TL;DR — The InfoFi Stack

Together, they form a composable, monetizable InfoFi infrastructure:

Loud = The yapper’s playground, an experiment that may happen again

Noise = The trend trading platform

Cookie = The creator’s analytics engine

Ethos = The trust and identity layer

🔭 Final Thoughts: InfoFi Season Is Real

Kaito lit the flame, Loud turned it into an experiment, Noise made the trend tradable, Cookie is bringing competition and Ethos is securing it.

The new market isn’t about who shouts the loudest. It’s about who earns trust, drives volume, and builds signal loops.

InfoFi isn’t a niche anymore. It’s infrastructure.

If you’re not farming these primitives — you’re already behind.

🔥 InfoFi Season has begun.

2/ Crypto & DeFi News

🏦 Metaplanet Issues $21M in Zero-Interest Bonds to Buy More BTC, Chasing 10K Target

Metaplanet just can’t stop stacking sats. The Japanese investment firm issued $21 million in zero-interest bonds to Evo Fund—just one day after raising $50 million in a separate debt round. That brings their 2025 war chest to $135.2 million, all aimed at funding an aggressive Bitcoin acquisition strategy.

The bonds mature in November 2025, offer no interest, require no collateral, and can be redeemed early. Translation: cheap capital, fast deployment. Metaplanet now holds 7,800 BTC, worth around $840 million, with an average buy-in of $91,340 per BTC. Their goal? 10,000 BTC by year’s end.

They're not just buying spot either—cash-secured puts and options premiums have become a regular tool in their strategy. Oh, and they’ve launched a U.S. subsidiary in Florida, aiming to raise another $250 million via American capital markets.

Thoughts

This isn’t a sideshow anymore—Metaplanet is building MicroStrategy 2.0, but with a distinctly global twist. The playbook is familiar: use debt to buy Bitcoin, lean into the digital gold thesis, and ride macro liquidity. But the no-interest bond strategy? That’s next-level game theory.

And there’s more to the story: with Eric Trump on the advisory board and GameStop now holding 4,710 BTC, corporate Bitcoin accumulation is clearly evolving into a multinational trend, not just a U.S. tech bro hobby.

What makes this even more impressive is the timing. Metaplanet is buying heavily above $100K BTC, with full conviction that the top is nowhere close. They’re betting on global M2 expansion, U.S. liquidity taps, and a Bitcoin supply squeeze doing the rest.

At this rate, Metaplanet’s 10K BTC target looks less like a moonshot and more like an inevitability. This is how conviction gets capitalized.

💻 Nvidia Beats on Revenue, Misses on Profit — Warns of $8B Hit from U.S. Chip Curbs

Nvidia posted a mixed Q1, crushing revenue expectations with $44.1B (up 69% YoY), but missing on earnings per share at $0.81 vs. $0.85 expected. Still, the market cheered — shares jumped nearly 5% after-hours, driven by another strong quarter of AI-fueled demand.

CEO Jensen Huang called AI “essential infrastructure,” pointing to a 10x surge in inference token generation over the past year. Data center revenue led the charge, reaching $39.1B, making up the lion’s share of total sales.

But there’s a caveat: Nvidia warned of a potential $8B revenue hit from U.S. export curbs on its H20 chips to China. The company has already booked a $4.5B charge and plans to release a lower-cost, export-friendly AI chip for China in June.

Thoughts

Nvidia is in beast mode, but it's not bulletproof. The $44.1B revenue headline is huge, but the $8B China-shaped hole in their future guidance is the real story. Washington’s export controls are finally catching up to the AI arms race, and Nvidia is the first casualty with a trillion-dollar target on its back.

Still, the after-hours pop shows that Wall Street is betting on the long game: AI infrastructure is now as critical as power grids and internet cables, and Nvidia owns that stack.

What’s more interesting? Bitcoin miners getting in on the AI compute game. As mining margins compress and AI demand surges, the overlap between decentralized infrastructure and AI could get very weird and very profitable.

TL;DR: Nvidia is still the king, but geopolitics is the dragon. The chip war is real, and it’s just getting started.

🇵🇰 Pakistan Announces Bitcoin Strategic Reserve in Surprise Pro-Crypto Pivot

In a stunning reversal, Pakistan has announced the formation of a government-led Bitcoin Strategic Reserve, signaling a massive policy U-turn from its prior anti-crypto stance.

Bilal Bin Saqib, head of Pakistan’s crypto council, made the announcement at Bitcoin 2025 in Las Vegas, crediting the U.S. government’s embrace of Bitcoin under President Trump as the inspiration. Just last year, Pakistan declared crypto would never be legalized—now it's building a BTC treasury.

The move follows the country’s broader 2025 crypto strategy: a National Crypto Council, 2,000 MW of energy allocated for BTC mining, and even Binance’s CZ advising the government. Trump-affiliated WLFI is also involved, with plans to help Pakistan tokenize real-world assets and develop DeFi infrastructure.

Thoughts

This is not just a crypto story—it’s geopolitical. Pakistan is officially entering the Bitcoin-as-sovereign-asset game, following a trend kicked off by the U.S. and echoed by El Salvador and other emerging economies. The Bitcoin reserve isn’t just a treasury play—it’s a hedge against financial exclusion and a giant narrative shift for a nation previously allergic to crypto.

Also: this isn't a small-time pilot. With dedicated energy allocation for mining and CZ advising at a government level, Pakistan is positioning itself as a crypto-forward nation in a region still largely skeptical.

It’s also another feather in the cap for Trump’s WLFI—which now has direct ties to a national economy.

Between the Bitcoin reserve, DeFi ambitions, and tokenized infrastructure plans, Pakistan just became a surprise contender in the global crypto arms race. Don’t sleep on it.

🏦 BlackRock Eyes 10% Stake in Circle’s IPO, ARK Also Joining the Party

BlackRock is reportedly looking to scoop up 10% of Circle’s $624M IPO, signaling big-league TradFi interest in stablecoins and public crypto infrastructure. According to Bloomberg, Cathie Wood’s ARK Invest is also eyeing $150M worth of shares in the deal.

Circle, the issuer of USDC, began its IPO rollout on May 27 with 24 million shares—both new and from insiders like CEO Jeremy Allaire. Demand is already sky-high, with orders said to exceed the offering by multiple times.

The company posted $1.67B in revenue in 2024 (+16% YoY), but net income dropped nearly 42% to $155.7M, per its S-1 filing. Circle currently commands 24.6% of the stablecoin market with a $60.9B cap, behind only Tether.

Thoughts

This is a milestone moment for stablecoins. BlackRock throwing weight behind Circle isn’t just a vote of confidence—it’s a full TradFi endorsement of regulated, transparent stablecoin infrastructure.

While Tether dominates on volume, it remains private, opaque, and largely offshore. Circle, by contrast, is going full public playbook: U.S. regulated, IPO-bound, with transparent financials and big-name backers.

The buy-in from BlackRock and ARK signals that USDC is the stablecoin TradFi wants to bet on—not necessarily for dominance now, but for alignment with future regulation, ETF rails, and digital dollar infrastructure.

Circle may not have the memecoin flash, but in terms of institutional relevance and strategic positioning, it’s quietly becoming the most important crypto company nobody’s hyping.

💸 Elon Musk Confirms X Money Beta Testing Ahead of 2025 Launch

Elon Musk has officially confirmed that “X Money,” his long-teased payments and banking app, is now in beta testing—marking the next step in transforming X into the everything app.

The test is currently limited-access, with Musk posting on X that "extreme care must be taken when people’s savings are involved." The platform is targeting a full launch in 2025, with 41 U.S. money transmitter licenses already secured and more on the way.

X Money has been in the works since Musk’s $44B Twitter acquisition in 2022, which he famously called an “accelerant” to building X. Plans include unlimited interactivity, integrated media, and financial services baked directly into the social layer. The app is now part of Musk’s growing political footprint, as he also leads Trump’s newly formed Department of Government Efficiency (DOGE).

Thoughts

This isn’t just Musk doing Musk things—X Money is a direct shot at PayPal, Cash App, and even banks. And coming from the guy who co-founded PayPal? It’s personal.

The beta may be small now, but the ambition is massive. We’re talking about a fully integrated social-financial OS, run by one of the most polarizing and powerful figures in tech and politics. And let’s not ignore the crypto angle—X Money is still heavily speculated to support Bitcoin and digital assets, despite regulatory heat from folks like Senator Warren.

Musk doesn’t want to just play in fintech—he wants to own the rails of how value moves in a post-bank, post-social, post-trust world. Whether you love or hate him, you can’t ignore what he’s building.

If he pulls it off? X becomes a financial super app—and that changes everything.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and is purely informative.