This Week's Newsletter - Moon or Dust on Agent Virtual Machine ($AVM), And Main News of the Week

Weekly Alpha

There is no collaboration with the projects mentioned in this edition.

GM frens,

The CT is quite boring, with mostly yappers & AI-generated posts.

But in the meantime, things are finally starting to feel a little better in the market.

There’s some green on the screen and people are starting to feel a bit more confident. But let’s be honest, it’s not quite it yet. Retail’s still nowhere to be seen, and most people couldn’t care less about crypto right now. Feels like it’s just institutions and a few holders.

On the other hand, Bitcoin looks solid. It rebounded off key levels, reclaimed support, and is sitting just below ATH. Every dip is getting bought, and ETF flows are still strong with hundreds of millions coming in.

ETH is finally starting to look stronger after months of falling behind, going up 5% against BTC this week. But if you zoom out, it’s still far from where people hoped it would be. This bounce might be the start of a comeback, or just a short break before more weakness.

Altcoins are trying to bounce, especially the low caps, but let’s be real, they’ve been bleeding for months. Most of this green is just a reaction to how much they crashed.

I think everyone’s waiting for something new, some fresh narrative that brings back real momentum. Right now, all the attention is on DeFi names with actual revenue and real tokenholder incentives, stuff like $SYRUP, $AERO, and $HYPE.

Meanwhile, the macro backdrop is leaning more bullish. Powell said he’s ready to cut rates soon, likely in September. Trump’s calling for even lower rates (1–2%). If those cuts happen, risk assets will rip, but if the Fed stalls or delays, things could get rough real quick, because the market is already pricing those cuts in.

Still, none of this matters if retail stays asleep. Until we see FOMO, meme cycles, and TikToks about “the next 100x,” we’re just watching institutions play ping-pong with each other..

So maybe it’s time to look somewhere else. Not at what’s already pumped, but what’s quietly getting built while no one’s paying attention. One corner that’s actually showing life is the AI agent space. A few real projects, a growing dev base, and some serious infra shipping under the radar.

That’s where $AVM comes in. It’s a microcap trying to do one very specific job, help AI agents not just think, but actually act. If this stack works, it could be the missing link between GPT-like models and real onchain automation.

Let’s dive into it 👇

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!If you missed my Latest Post:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Moon or Dust on AVM – Can This AI Infra Microcap Power the Agent Economy?

X Alpha.

Main News of the Week.

1/ Moon or Dust: $AVM (Agent Virtual Machine)

It’s been a bit slow lately. Market’s quiet, CT feels boring.

This is usually when it makes sense to start digging for the next pump’s winners. Over the past few weeks, I’ve been spending more time looking at the whole AI Agents wave.

After $SERV and $OLAS, $AVM has caught my attention.

At first, I wasn’t sure what to make of it because I feel like every project is slapping “AI Agent Infra” on their deck these days, but the more I dug, the more $AVM started to stand out.

AVM focuses on one job: taking whatever code an AI agent writes… and making sure it runs safely, scalably, and without human babysitting.

🧠 What’s The Big Idea Behind AVM?

Every LLM can think, plan, and spit out Python scripts, but turning that output into real action still needs backend infrastructure.

Most teams still run their agents on AWS or Google Cloud, but that setup comes with problems:

– Slowdowns when too many people use it

– Random price changes

– One company controls everything

– If one region goes down, your agent goes offline too

AVM handles things in a simpler way. Agents send their code, and AVM runs it inside a clean, isolated box, called a sandbox.

Here’s how it works:

– Agent writes a task (like “check ETH price” or “buy this token”)

– Sends it to AVM

– AVM runs the job, saves the logs, and shuts the box after it’s done

Code goes in → result comes out. Clean and automatic.

Feels like AWS Lambda for agents… but crypto-native (For context: AWS Lambda generates over $7B in annualized revenue for Amazon, just from this execution layer slot.).

AVM’s tech backbone is something called MCP (Model Context Protocol), basically a universal translator that lets OpenAI, Claude, or open-source agents submit jobs with almost no setup.

If MCP adoption grows, AVM could become the default action layer for every agent that wants to execute tasks onchain.

📊 Tokenomics Snapshot: Small Cap, Front-Loaded, Built for Flow

This part feels like one of the cleanest setups I’ve seen in recent microcaps.

Total supply sits at 100 million tokens.

About 52 million already circulate (as of July 1st).

Instead of stretching vesting over years, most investor unlocks finish by September 2025. 30% unlocked at TGE and the rest drips out over three months.

There’s also a 4% DEX tax live today, tied to a clear target: it vanishes once the project treasury reaches $5 million.

That gives them short-term runway without locking the token into permanent friction.

By Q4, most of the supply will already sit in circulation, leaving much less structural overhang than what wrecks most microcaps early.

🚀 Why $AVM Could Moon From Here

1. Agent Meta

The AgentFi narrative feels stronger every day on CT.

$SERV helps build agents.

$VIRTUALS focuses on agent data feeds.

AVM takes care of the final mile: running the agent’s code onchain.

As more teams shift from chatbot demos to real automation flows, the need for scalable, trustless execution layers keeps growing.

And AVM already has real usage today.

Their Phase 1 is nearly done: The MVP dashboard, beta SDK, and early virtual machines (Python and TypeScript) are already live and running production jobs.

2. Lightweight, Dev-Friendly Infra

MCP (Model Context Protocol) makes it easy for devs to plug into AVM.

Agents built on OpenAI, Anthropic, or open models can start sending jobs with barely any setup.

Devs don’t touch servers.

Scaling tools stay on the shelf.

Backend headaches don’t show up.

Agent sends code → AVM runs it → logs come back, ready to use.

It’s the same kind of unlock that Stripe gave payments or Twilio gave messaging.

AVM is aiming for that slot, just built for agents instead of humans.

3. Sandboxes Marketplace Incoming

Q4 2025 marks the start of AVM’s Phase 2: Expansion.

The biggest near-term unlock is the launch of the Sandboxes Marketplace.

External developers will get the chance to build and monetize custom sandbox environments for AVM.

More sandboxes → more use cases → more $AVM burned.

The marketplace introduces modular revenue loops into the token economy.

Phase 2 also brings ecosystem grants, real-time analytics dashboards, and multi-modality support (meaning agents will be able to generate things like images or video, not just text responses).

4. Decentralization and DAO

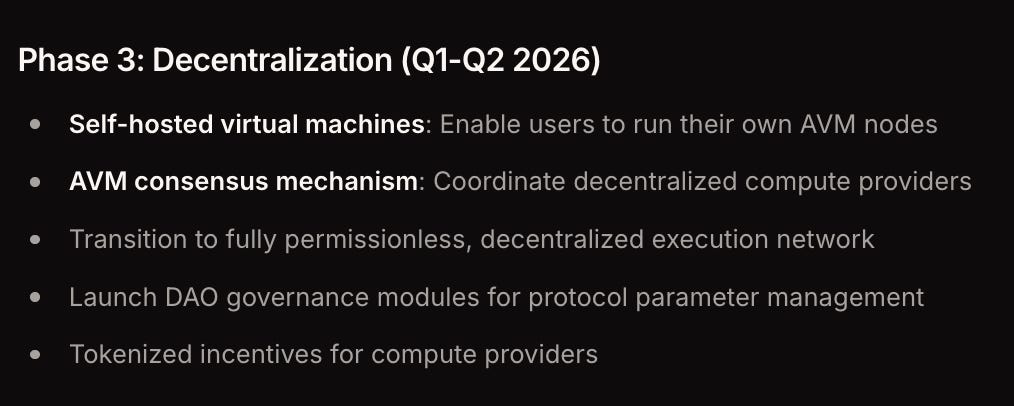

Early 2026 kicks off Phase 3: Decentralization.

AVM plans to open up node operations, letting external compute providers run AVM nodes and earn $AVM for processing jobs.

DAO governance will also come online, giving token holders a role in protocol decisions and upgrades.

This is where the shift from semi-centralized to permissionless infra happens. For a network handling agent execution at scale, that matters.

5. Already Trading with Liquidity

$AVM has been live on BitMart, Ourbit, and XT.com for about three weeks now.

Daily trading volume sits around $1.7 million, which is a healthy start for a project at this cap level.

With a FDV around $21 million, there’s plenty of space for upside if the product continues to ship and the AgentFi narrative keeps heating up.

⚠️ Where This Could Go Sideways

1. Early Infra Risk

The mainnet is live, and jobs are already running on AVM. But right now, the network still relies on a semi-centralized setup. Most execution flows are processed by internal or partnered nodes.

Full decentralization is scheduled for early 2026 (Phase 3), but until then, operational trust still sits with the core team and selected partners.

2. Competitive Pressure From Bigger Players

Big names like Render, io.net, and Akash are all chasing the decentralized compute narrative.

Render focuses on GPU-heavy jobs.

Io.net is racing for inference and training workloads.

Akash leans toward generalized cloud infrastructure.

AVM plays in a different lane, short, low-latency, agent-triggered jobs, but most retail CT won’t separate those narratives cleanly.

Narrative compression stays a risk until AVM builds more distinctive mindshare.

By late 2026, AVM plans to roll out distributed storage so agents can retain long-term memory between jobs.

Full-scale marketing and global node expansion are also on the table, alongside GPU support and advanced load balancing for performance optimization.

If the AgentFi wave keeps growing, this kind of low-latency execution backbone could become a core layer in the AI agent stack.

3. Audit and Security Stage

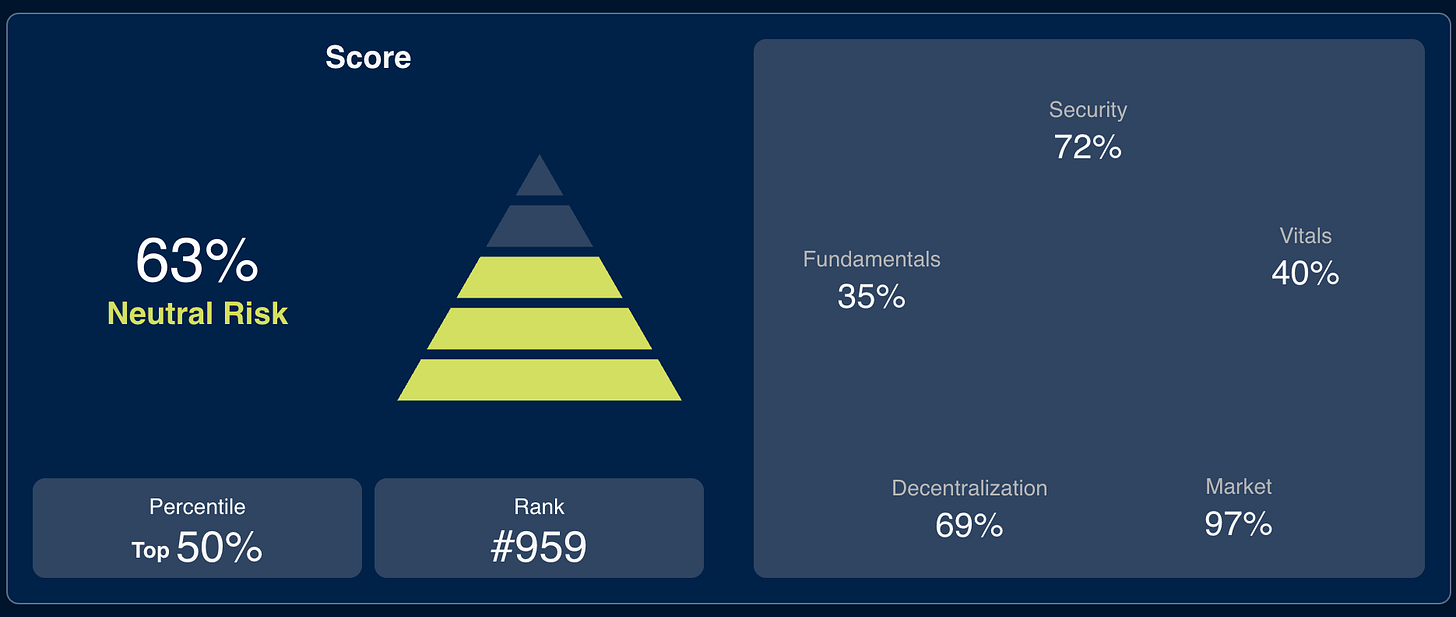

AVM has already completed a Cyberscope review (scoring 63%, “Neutral”).

A top-tier Certik audit is scheduled for late Q4 2025 and for a platform that runs arbitrary, agent-submitted code, extra security validation feels critical.

The team has already renounced token contract ownership and locked liquidity for a year, which helps build baseline trust.

4. Token Liquidity and Market Depth

With a market cap sitting just above $11 million and daily DEX volume around $1 million, $AVM is still thinly traded.

For small wallets, that’s not a huge issue, but for anyone trying to take larger positions, even a $50K buy or sell could move the price noticeably.

That creates both an opportunity and a challenge: small caps like this can move fast when they catch attention… but they’re also vulnerable to sharp pullbacks on low liquidity days.

🔍 My Personal Read: Why I’m Taking The Bet

I keep a mental checklist for early-stage infrastructure bets:

Right lane, right time ; the tech lines up with a hot narrative.

Product already in the wild ; people can touch it, even if it’s v1.

Token flow ties straight to usage ; demand grows whenever the core service runs.

Plenty of projects/token have followed that playbook and exploded:

$HYPE jumped on the “CEX-speed on-chain trading” wave and turned trading fees into a perpetual buy-back engine.

$PENDLE put simple wrappers around yield, and the mix of real TVL plus points farming pulled in both whales and grinders.

$RENDER locked down the decentralized GPU memo early and now sits above $2 B FDV because AI builders actually need those cards.

$IO (io.net) showed that even a pre-TGE network with live jobs and clear token sinks can attract hundreds of millions in TVL before its first listing.

Each one did the same three things: grab a lane people care about, ship a working service, and push every bit of value through its native token.. and there is many others exemples.

AVM feels like the next stop on that road. Its lane is agent execution : the moment when GPT-like models move from “thinking” to “doing.”

Web2 already proved how huge that slot can become: AWS Lambda and Google Cloud Functions quietly rack up billions because every app needs a place to run quick jobs without managing servers.

Crypto’s agent stack has room for a similar backbone. AVM wants to fill it, and it already processes live code in sandboxes today. Each run burns a bit of $AVM, so usage feeds price by design.

And longer term?

The final phase, what they’re calling “Ascension”, aims to make AVM the default execution layer for autonomous agents at global scale. Think persistent desktop-style environments where agents don’t just execute tasks… they operate continuously, across sessions, with long-term state and full computing environments.

With an FDV around $20M, the math looks friendly:

A move to even one-tenth of Render’s valuation = 10×.

A single mid-tier CEX listing often adds fresh depth and visibility.

Mainnet decentralization and the Sandboxes Marketplace could turn one-off jobs into a burn loop.

I’m sizing the position small because this is still a microcap. But the convexity is hard to ignore and if agents truly eat the front end of crypto, the network that lets them act could become the silent workhorse everyone plugs into.

🔮 Final Verdict: Microcap AI Infra With Asymmetric Optionality

If you like early-stage AI narratives with real infra and a defined product-market fit…

If you like backing low-cap projects with obvious narratives and visible milestones…

If you’re okay with volatility, low liquidity, and execution risk...

Then AVM feels like one of the better asymmetric AI agent plays on the market right now.

But let’s be clear: This is not Hyperliquid or Render yet.

It’s still a small project that could 10x or rug on a bug, and there is only +1300 holders.

For me personally? I’ve taken a starter position and will size in further only if:

Certik audit comes back clean

Q3 roadmap milestones hit on time

Sandboxes Marketplace shows early dev traction

Until then? It’s a narrative-compliant, high-risk microcap that fits my AI-agent thesis but I’m size-controlled.

Verdict: Moon Bias… but conditional on execution.

Watch: upcoming roadmap progress, Certik audit, and any Tier-1 CEX listings.

2/ X Alpha 🫡

The Kaito effect: Sonic is the perfect example of how real the Kaito effect is on mindshare and CT visibility. Went from background noise to top 5 in a week. When CT decides to care… it moves fast.

12 laws of liquidity: Super interesting breakdown. People love talking narratives, but end of the day… it’s always about liquidity. If you want to catch the next bull run, look at those 12 laws.

Defi is exiting: One of the best posts I’ve read this week. Between Fluid V2, Aave V4, and Boros coming soon… feels like DeFi’s finally entering its next real wave of innovation. More capital efficiency, more composability, and actual new primitives that could bring volume back onchain. Been waiting for this kind of momentum for a while

Quiet before the storm?: Very bullish Bittensor post. The scale of capital circling TAO sounds unreal… and the whole 'it won’t be retail-driven' angle makes sense when you see how funds and subnet teams are positioning. Supply shock + AI narrative + QE backdrop… feels like the setup for something violent. I will look at this closely.

Binance alpha: Honestly… seeing these numbers laid out hits different. Tiny airdrops, brutal FDV dumps, and this whole ‘spend $300 for a $25 airdrop’ meta… Binance Alpha’s starting to feel more like a $100M extraction machine than a real opportunity. Seeing a token listed there doesn’t mean much anymore.

TAO’s growing pains: I had to highlight this one too… One of the most honest and well-rounded takes on Bittensor I’ve read. The vision is massive, the supply dynamics are crazy bullish long-term, and yeah… the growing pains are real. Feels like we’re still deep in the ‘confusion = opportunity’ phase.

Defi’s potentiel: Posts like this are a good reminder that DeFi’s still cooking under the surface. Between RWAs, ETH infra upgrades, and on-chain metrics hitting ATHs…

Only 3 above 1B: Wild how 80% of these 2025 listings launched straight into $50M–$1B FDV… while VCs are still fully locked and just waiting for cliff unlocks to dump on retail. Some of these are already trading below seed round prices and the real exit flood hasn’t even started yet. Careful who you’re exit liquidity for.

Retail is out: Classic disbelief phase and by the time most people care again, it’s gonna be $150K+

More Hyperliquid Farming: Dropped a full Hyperliquid farming guide in the newsletter not long ago, but the meta’s moving fast. I lowkey love this kind of content right now. Quiet market = perfect time to stack points and position early. Hyperliquid ecosystem keeps serving plays for the grinders… if you’re still active, there’s free money on the table everywhere

Market feels tired: Robinhood x Arbitrum? Nothing. Sol ETF? Almost no reaction. In 2021, those would've sent prices flying. Now it’s like TradFi’s winning and tokens are stuck. Alt market cap is still just $1.3T with way more tokens than before.

3/ Crypto & DeFi News

📈 First Solana Staking ETF Hits $12M Inflows on Day One

The REX-Osprey Solana Staking ETF (ticker: SSK) just launched in the U.S. and made a solid debut: $12 million in inflows and $33 million traded on its first day. It gives investors exposure to Solana and staking rewards ; a first for a U.S.-based crypto ETF.

While the SEC had pushed back on it, REX-Osprey worked around the rules by investing in other non-U.S. crypto funds to stay compliant. Some say it's not a true “spot Solana ETF,” but it’s the closest legal option available right now.

Analysts called it a “healthy start.” It traded more on day one than Solana or XRP futures ETFs did at launch, though still much less than the massive Bitcoin and Ether ETF launches.

Thoughts

The launch of SSK, the first Solana staking ETF, might seem like just another fund but it’s actually a signal that the ETF narrative is expanding beyond Bitcoin and Ethereum. For years, the crypto ETF conversation was stuck on BTC and ETH spot approval. Now we’re entering a new phase: altcoins, yield, and DeFi exposure wrapped in TradFi clothes.

This matters because ETFs are how institutional money gets comfortable with crypto. They offer regulatory clarity, tax-friendly wrappers, and low operational friction. That’s why spot BTC ETFs unlocked billions in inflows overnight, retail and advisors can now buy crypto in the same interface they use for Apple and Tesla.

Now imagine that applied to Solana, XRP, or even something like Chainlink or Avalanche. Once staking and rewards can be accessed through ETFs, it becomes a yield play, not just a speculative asset. You’re not just betting on price, you’re collecting passive returns through a legal, regulated vehicle.

Mainstream capital will finally have the green light to go beyond Bitcoin. If the SEC keeps the approval train rolling into 2025, we might look back at SSK’s $12M day one as the start of the next ETF-driven cycle, built on altcoins, yield, and real on-chain activity.

📢 SEC Chair Atkins Declares End of "Regulation Through Enforcement.

In a recent CNBC interview, SEC Chair Paul Atkins signaled a major shift in approach: “That day is over” when the SEC relied on vague enforcement to stifle crypto. He urged the agency to champion tokenization as true innovation, setting transparent regulatory rules so businesses can confidently develop new blockchain-based products.

Atkins' remarks mark a stark departure from the stricter tone of the Gensler era. He pledged to empower crypto entrepreneurs, stating the SEC’s goal is to offer a “firm foundation upon which to innovate” in markets involving digital assets.

Thoughts

This is more than talk. The SEC under Atkins is signaling a pro-active shift by:

Welcoming tokenized real-world assets (RWA) – With over $24 billion in tokenized RWAs already in circulation, from private credit to Treasurys, the SEC is embracing a booming trad-to-crypto bridge.

Backing staking ETFs – The approval of the first Solana staking ETF underlines the SEC’s new openness to meaningful crypto financial products that deliver real yield.

Offering regulatory clarity – New guidance on how tokens should be reported shows the SEC is setting the rules, not breaking them via surprise enforcement raids.

What could this bring?

Institutional momentum: Expect major banks (JPMorgan tokenizing carbon credits, others exploring tokenized equities or Treasurys) to gain confidence and launch tokenized products.

Emerging innovation: Startups building real-world-asset platforms, asset-backed stablecoins, or even tokenized equity could now move forward with legal certainty.

Crypto mainstreaming: With a defined rulebook, DeFi and tokenized securities might finally enter portfolios of pension funds, endowments, and asset managers.

If momentum builds, this could be the start of a new crypto golden era, one led not by enforcement but by informed, regulated innovation.

🍳 PancakeSwap Hits $530B Q2 Volume as Upgrades & Solana Push Supercharge Growth

PancakeSwap just served up a monster quarter. The BNB Chain-native DEX clocked in a record $325B in June alone, doubling its Q2 volume to $530B from Q1’s $211B. The growth came on the back of Infinity v3 upgrades, seamless crosschain swaps (no bridges!), and an aggressive Solana expansion.

Its v3 launch brought lower gas fees, customizable pools with “Hooks,” and advanced liquidity tools like CLAMM and LBAMM. Liquidity providers can now allocate capital more precisely and minimize impermanent loss, while developers get to ship faster without smart contract redeploys. Crosschain swaps between BNB, Ethereum, and Arbitrum arrived in June, and Solana integration went live July 1.

Thoughts

PancakeSwap just reminded everyone it’s not just a BNB Chain thing, it wants multichain dominance. Sure, 97% of its Q2 volume came from BNB Chain, but it’s been quietly gaining on Ethereum, Arbitrum, and Base. With crosschain swaps, a sleek UX, and Solana onboarding in full swing, it’s starting to feel like a serious contender to Uniswap.

What’s the big narrative? DEXs are evolving from clunky DeFi frontends into modular, crosschain trading superapps. PancakeSwap’s Infinity v3 is a clear leap in that direction, more capital efficiency, better developer tooling, and a plug-and-play liquidity engine.

But here’s the alpha: volume leads to mindshare, and mindshare leads to sticky liquidity. If PancakeSwap can keep innovating while expanding its multichain reach, especially on Solana, it could claw real market share away from Ethereum-native incumbents.

We're watching a DEX power shift in real time.

🛠️ Coinbase Acquires Liquifi to Turbocharge Token Launch Infrastructure

Coinbase is going all-in on tokenization. The exchange just acquired Liquifi, a startup focused on making token management,think cap tables, vesting schedules, and compliance, smoother for early-stage projects. The goal? Simplify and scale the token launch process so onchain builders can go to market without tripping over legal spaghetti.

This marks Coinbase’s fourth acquisition of 2025, following big buys like Deribit and privacy startup Iron Fish. Liquifi’s tooling will be folded into Coinbase Prime, bringing token issuance closer to traditional fintech-grade workflows.

Thoughts

Coinbase is assembling a full-stack launchpad for the next wave of tokenized assets. If 2021 was the “token summer,” 2025 is shaping up to be the token infra era, and Coinbase wants to own every layer, from custody and liquidity to issuance and compliance.

This is bullish for two reasons:

RWA & tokenization narratives are hot. Everyone from JPMorgan to startups is racing to tokenize everything, equity, real estate, credit, carbon. Coinbase wants to be the backend for it all.

Token launch pain points : vesting cliffs, cap tables, legal filings are a mess. By absorbing Liquifi, Coinbase is betting it can turn it into SaaS.

Watch this space. A clean, compliant token launch pipeline opens the door for more institutional and startup tokens and gives Coinbase a front-row seat (and fee cut) from day one.

🇺🇸 Trump’s Crypto Plays Add $620M to His Net Worth

Donald Trump just clocked in an extra $620 million this year ; not from towers or Truth Social, but from crypto. A Bloomberg deep dive reveals that nearly 9% of the president’s $6 billion fortune now stems from digital assets, thanks to a trio of ventures: his memecoin ($TRUMP), the family-run World Liberty Financial (WLF), and an indirect stake in mining firm American Bitcoin.

The $550M token sale for WLF earned the Trumps a tidy $390M, and they’re sitting on another $2B+ in governance tokens. Meanwhile, $TRUMP, complete with tokenholder dinners and VIP tours, is currently valued at ~$150M. Add in a $100M stablecoin deal via Abu Dhabi’s MGX and a planned public listing for American Bitcoin, and Trump’s crypto empire is now officially a power player.

Thoughts

Trump isn’t just crypto-friendly, he’s crypto-rich. His net worth surge from WLF, $TRUMP, and mining plays shows he’s not promoting Web3 for clout or campaign donations. He’s all-in, and Congress is not thrilled.

Multiple bills have been floated to ban elected officials from holding or promoting digital assets, but with Republicans in control, they’re mostly symbolic.

But make no mistake: this is the president of the United States personally profiting from tokenomics. It’s uncharted territory, raising serious questions about regulation, favoritism, and transparency. It also adds fuel to the “crypto = establishment” backlash some corners of DeFi are starting to feel.

Still, if the world’s most powerful office is now a crypto bagholder seat, the narrative has changed forever : Welcome to the tokenized presidency.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Financial Advice and is purely informative.