Unless explicitly mentioned, there is no collaboration with the projects mentioned in this edition.

GM frens,

We just lived through the most bullish CPI print of the year.

The U.S. inflation numbers came in better than expected — CPI at 2.4% YoY (vs 2.8% previously), core CPI at 2.8% (down from 3%). By all metrics, this was a clean win. Inflation’s slowing. The Fed should be happy. But somehow, Wall Street still went red while Europe pumped hard.

🔻 S&P -3.36%, Nasdaq -4.07% — despite the best macro print in months.

Although a couple days later the TradFi Market seems to have priced in these numbers and finally starts to recover.

Meanwhile, crypto went green. A rare, beautiful moment where BTC outperformed both indices. Altcoins saw huge volumes. Whales are back. We’re so back.

But that’s only half the story.

Let’s talk about the “market manipulation of the century” — at least, that’s what several Democrat groups are calling it :

The Trump Tweets + Wall Street Pump (aka: “Insider Trading: Presidential Edition”)

April 2nd, 15:30 – Wall Street opens. Trump tweets: “Everything’s going to be great. America will be better than ever.”

15:37 – “Now is the time to buy.”

Later that day – he announces a 90-day pause on tariffs, causing a massive market rally.

All this happened before the CPI numbers dropped. Suspicious? A bit.

Especially when you realize that his inner circle likely bought the dip right before the pump. Timing-wise, it’s giving “textbook insider trading.” But hey — if anyone can redefine financial crime, it’s Trump.

Now, while equities couldn’t hold the rally, crypto’s been thriving. Altcoins are flying, volumes are exploding, and the market feels alive again.

Tokens with actual momentum are pumping — and not just on vibes this time. In a market this deranged, what truly matters? I'm beginning to question it myself.

Meanwhile, remember those Trump-linked tokens?

Trump Token pumped to $80 post-election hype. Now? Trading under $5.

Melania Token launched at $50. Currently chilling at $0.50.

That’s -99% if you’re keeping track.WLFI Token — pitched as an “American DeFi revolution” — raised $550M in a public sale almost 6 months ago, hasn’t launched yet. This is still an ongoing situation, wait and see what happens.

Combined with that “buy now” tweet, people are speculating that this whole Trump-token-news-market cycle is one big orchestrated game. And there’s real talk that legal probes could drop if someone decides to connect the dots.

Now back to macro:

🧾 March CPI was good, but…

These inflation stats don’t include Trump’s tariff madness, which started April 2nd.

The 10% tariff on all imports is still in place.

The 125% China tariff? Not resolved.

April's inflation report (dropping in May) will be key — and might be brutal.

When liquidity dries up and fake headlines stop working, capital starts looking for real-world utility. Not vaporware. Not vibes. But things that do something.

This is the moment where DePAI (Decentralized Physical AI) and other IRL-aligned protocols could start to shine.

You know the drill — crypto narratives come and go, but the ones that bridge into actual usage? Those are the ones that stick around when the lights flicker. DePAI is building tooling that connects decentralized compute to real-world devices, infrastructure, and agents. Think: smart cities, logistics, robotics — but open-source and onchain.

In short: when markets are shaky, speculation dies and functionality thrives.

That’s why this new wave of IRL-integrated projects — whether it’s DePAI, RWAs, DePIN, or whatever acronym we’re cooking up next — isn’t just a side quest. It might be the main mission.

This is a rotation moment. Capital is moving away from hype cycles and into use-case gravity wells. The protocols that survive 2025 will be the ones that can answer a simple question:

“Why does this need to exist in the real world?”

Markets are ugly. But the signal is showing. The meme is fading. The build phase is beginning — again.

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!Learn about the Latest News, Narratives, Market Updates & More!

Also, in case you missed it, the Shiro Instagram is back.

You will get visuals of current market/project situations with short descriptions that sum up what you need to know.

And Alpha shared in stories.A simple and light way to stay connected with crypto daily—without spending hours or reading walls of text.

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on DePAI through peaq: How Decentralized AI Coordination Is Emerging as the New Onchain Meta

Main News of the Week

1/ Deep Dive on DePAI through peaq

🧭 Quick Recap: DePAI vs. DePIN

Before diving into DePAI, it’s worth briefly clarifying how it relates to DePIN.

DePIN (Decentralized Physical Infrastructure Networks) refers to community-owned networks that provide decentralized alternatives to traditional infrastructure—think compute, storage, connectivity, and sensors.

We’ve previously explored this in our newsletter with case studies on Render, io.net, and Helium—each showing how Web3 can build foundational systems for the physical world.

DePAI, on the other hand, builds on top of this infrastructure. It introduces agentic AI and robotics into the mix—machines that think, act, and transact autonomously, powered by data from DePINs and coordinated via blockchain.

In essence:

DePIN powers the infrastructure layer

DePAI activates the intelligence layer

If DePIN is the highway, DePAI is the fleet of autonomous vehicles driving on it.

Today, we zoom in on DePAI, and specifically, how peaq is helping lay the rails for this machine-driven, decentralized future.

From Physical AI to DePAI: Decentralization Meets Intelligence

DePAI, or Decentralized Physical AI, is more than a narrative—it’s a new technological frontier. By merging AI, Web3, Robotics, and DePIN, it creates a complete system for autonomous, intelligent machines to operate for people rather than over them.

It’s not just about automation. It’s about ownership, privacy, transparency, and building an AI-powered world that belongs to the many, not the few. And DePAI directly addresses three core problems with today’s AI:

Centralized control and opaque governance by big tech

Resource scarcity (especially compute and real-world data)

User data exploitation without compensation or transparency

DePAI solves these by decentralizing infrastructure, crowdsourcing high-quality data, and rewarding users through blockchain-based incentives. It transforms everyday people into AI stakeholders—as owners, contributors, and participants.

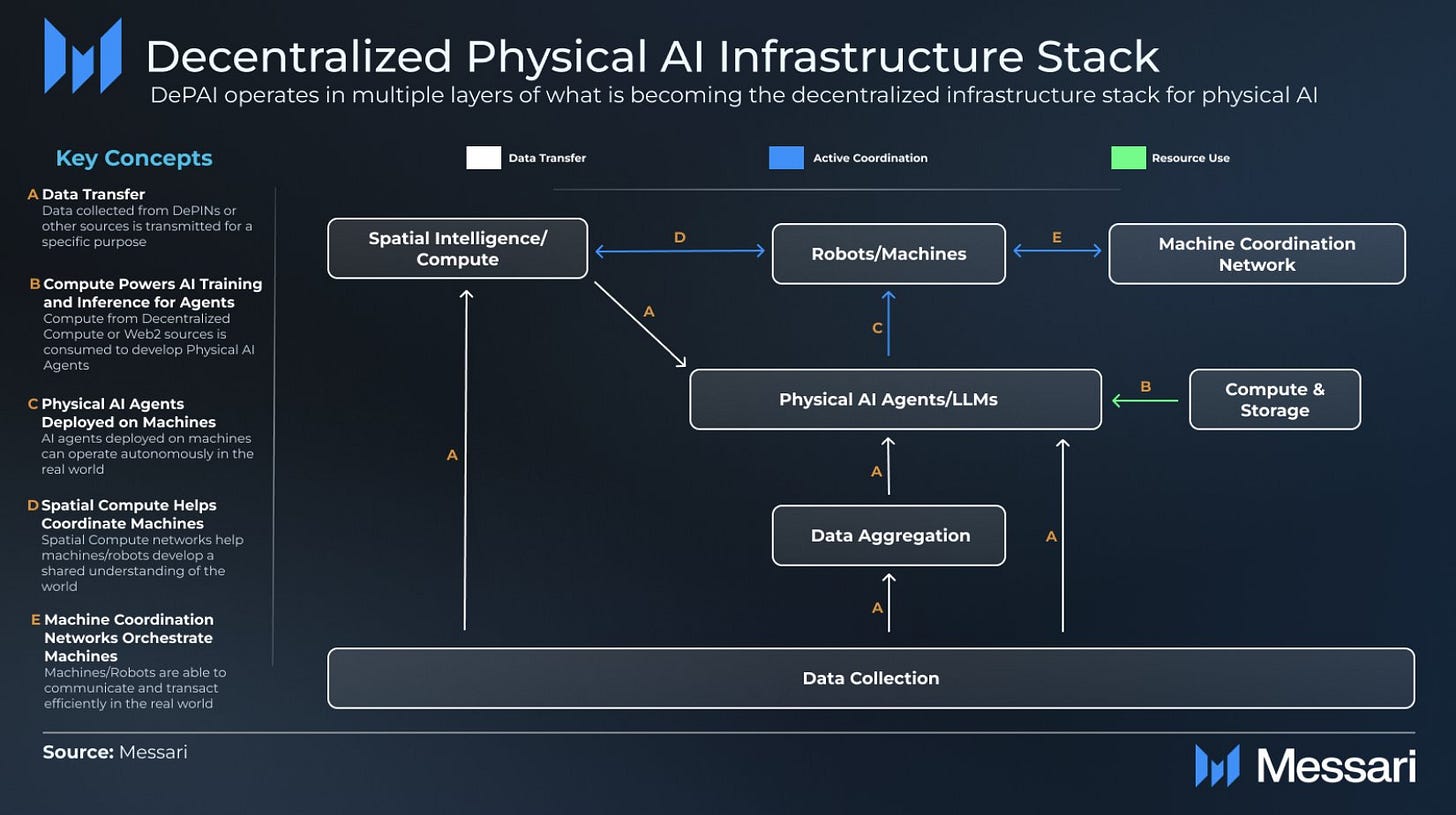

What Makes DePAI Unique

At its core, DePAI combines three megatrends:

Artificial Intelligence (AI): Agentic, real-world-capable intelligence

Blockchain & Web3: Transparent, permissionless ownership + economic rails

DePINs: Community-powered infrastructure for compute, storage, and connectivity

What makes it truly revolutionary is how it binds these layers together into a functional Machine Economy. From training AI on real-time crowd-collected data, to letting a robot transact autonomously on-chain, every layer of DePAI works in sync.

Through decentralized data marketplaces, people can supply anonymized data (videos, sensor inputs, etc.) to help train models. In return, they’re compensated via tokens. Decentralized compute and storage DePINs replace AWS or Google Cloud with peer-powered infrastructure. And through Machine DeFi, the hardware itself—robots, drones, sensors—can be fractionalized and owned by DAOs.

In short: DePAI takes the brains (AI), the body (robots), the fuel (data + compute), and the economy (blockchain incentives), and turns it into a self-sustaining loop that works for everyone.

Here’s a full breakdown of DePAI projects.

🕹️ peaq’s Role in Enabling DePAI

peaq is one of the few Layer-1s built specifically for the Machine Economy—where machines, agents, and humans transact seamlessly.

It offers:

High throughput (up to 67,000 TPS)

Rust + EVM compatibility for easy development

Universal Machine Time (UMT) for precise coordination

peaq IDs for decentralized machine identity

Smart contracts tailored for machine automation

These tools aim to solve core DePAI challenges like trust, automation, and transparent payments.

So far, peaq supports:

3.5M wallets

1.7M machines

Over 9M transactions (7M in Q1 2025)

DePAI apps are being tested, and wider usage will depend on ecosystem growth and real-world traction.

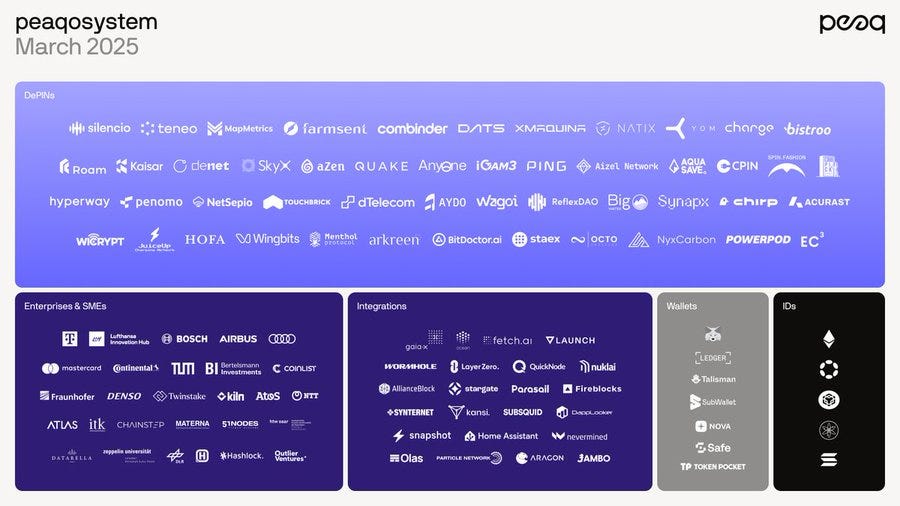

🌍 DePINs on peaq: Building the Infrastructure of DePAI

peaq’s DePIN ecosystem is one of its most promising features:

Silencio: Uses smartphone audio data to map noise pollution. One of the most used apps in the ecosystem, with a successful token sale ($113M demand).

ROM Network: Mapping mobile network quality with plans for decentralized SIM integration.

YOM (Your Open Metaverse): A decentralized edge cloud for gaming, streaming, and low-latency AI inference.

Charge: Decentralized map and monetization layer for EV chargers. Aims to serve both people and machines.

Farm Cent: Aggregates environmental data (temperature, humidity) for precision agriculture and supply chain optimization.

These DePINs serve as the data and resource backbone for DePAI applications—powering autonomous decision-making with real-world inputs.

📈 Machine DeFi: Real Yield from Real Machines

peaq goes beyond robots—it’s laying down the financial stack for machines to transact, earn, and be collateralized.

Machine DeFi includes:

Tokenizing Machine RWAs: Own a robot, or a share of its earnings

Collateralized Lending: Borrow against productive robotic infrastructure

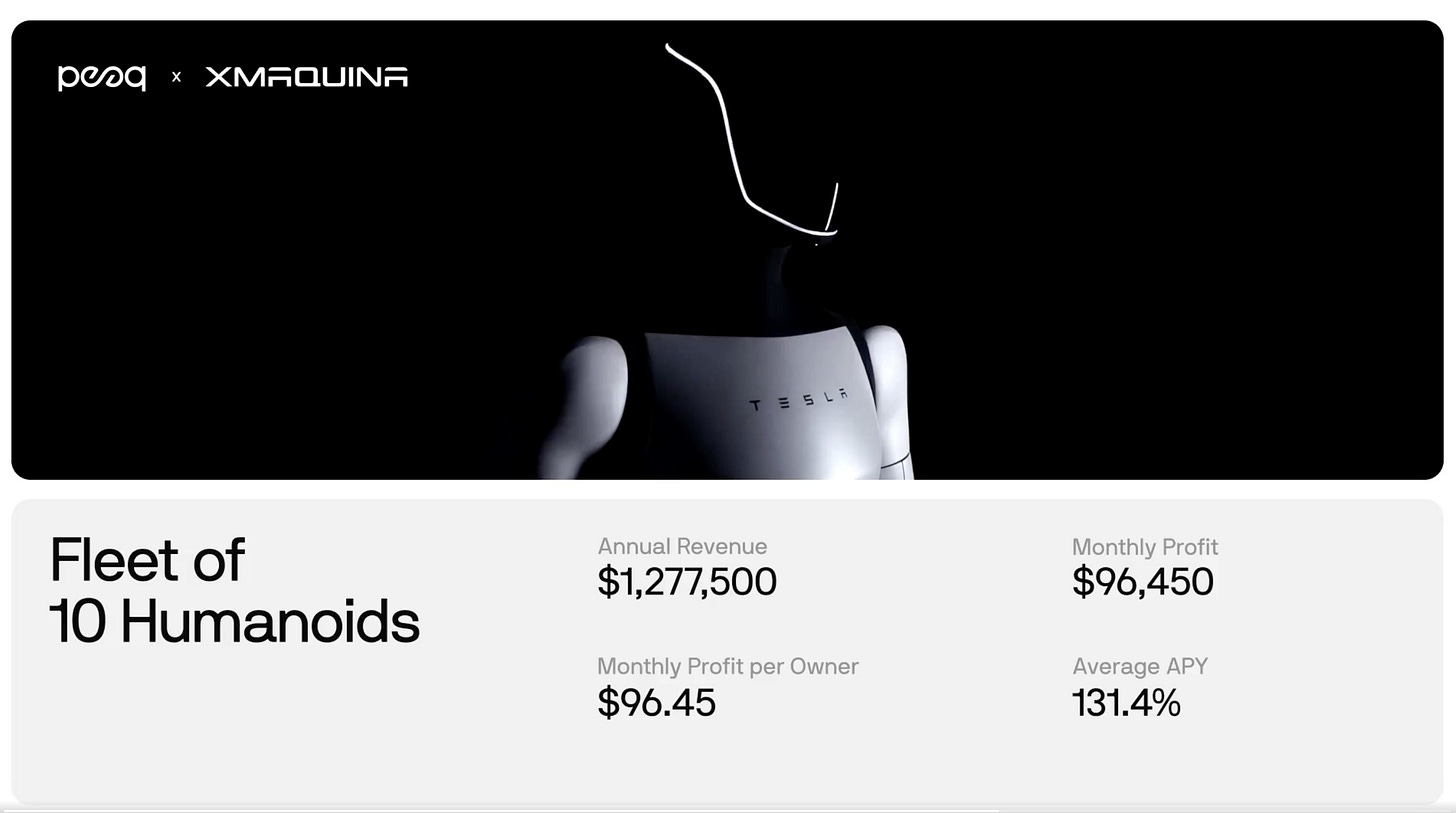

Revenue Sharing DAOs: Stake in fleets of autonomous machines (like XMAQUINA DAO)

Programmable Payment Rails: Robot-to-robot microtransactions (yes, M2M DeFi)

Example: A robo-taxi owned collectively by multiple token holders. Each ride generates income that’s automatically distributed between owners, service providers, and ecosystem contributors. It’s a more inclusive and transparent model—enabled by peaq—where the value created by machines flows back to the people who support them… DePAI apps are being tested, and wider usage will depend on ecosystem growth and real-world traction.

What differentiates Machine DeFi is its grounding in real-world services—coffee bots, pollution sensors, autonomous logistics—not synthetic TVL games.

This is the next evolution of RWAs—Machine RWAs. Unlike gold or real estate, robots produce yield every second they operate.

⚡ Real-World Progress & Token Model

peaq saw meaningful traction in Q1 2025:

Wallets grew 235%

7M+ transactions in 90 days

High-profile migrations (AquaSaveCrypto from Solana)

New launches like XMaquina.

Token distribution includes:

40% for staking and validator incentives

34% in private allocations

Ongoing efforts to reduce inflation from 3.5% to 1% via staking

While demand for ecosystem tokens (like Silencio) is rising, $PEAQ itself remains volatile and closely tied to broader altcoin market sentiment for the past 3 months.

Yet, it’s performing better than most alts on the monthly.

🧱 Challenges Ahead

While DePAI and peaq’s role in it are promising, there are still several major hurdles to address:

1. Infrastructure maturity: Many DePINs are still in beta or limited rollout stages. Reliability, redundancy, and uptime must improve for large-scale AI coordination.

2. Standardization: A universal language for AI agents, machines, and DePIN networks is still lacking. peaq IDs and UMT help, but broader adoption is needed across ecosystems.

3. Interoperability: Coordination between different Layer-1s, chains, and physical protocols (e.g., robotics APIs, data standards) remains fragmented.

4. Economic sustainability: Token incentives need to remain effective long-term. Many DePIN projects rely on token emissions, which must eventually give way to real-world utility demand.

5. Governance & legal risks: Who’s liable when an autonomous bot causes harm? How are AI decisions audited on-chain? These questions remain unresolved.

peaq has proposed frameworks (via XMAQUINA and DAO tooling) but implementation and regulatory clarity are still works in progress.

🔭 Vision: From Narrative to Infrastructure

DePAI is no longer just a concept—it’s an evolving framework for how AI and physical devices can coordinate, transact, and be governed by communities.

peaq offers a Layer-1 stack that directly supports this future: machine-native tooling, real-world infrastructure, and early traction in DePIN adoption.

But success will depend on whether:

DePINs achieve reliability at scale

Machine DeFi generates sustainable real-world yield

Governance keeps up with automation risks

peaq is well-positioned, but the race is far from over.

Decentralized AI is in motion. Its infrastructure is still under construction.

2/ Crypto & DeFi News

😶🌫️ Tokenized Gold Volume Breaks $1B — Tariffs Bring Back the Safe-Haven Trade

Tokenized gold just had its biggest week in over two years, with trading volume crossing $1 billion for the first time since the 2023 banking crisis. The trigger? President Trump’s aggressive tariff policy — specifically, a 125% hike on Chinese imports — which has rekindled fears of a global trade war. In response, investors rotated into traditional safe-havens, but this time, it’s the onchain version of gold leading the charge.

Paxos Gold (PAXG) saw its volume spike over 900% since Trump’s first January tariff announcement. Tether Gold (XAUT) jumped 300%, while Kinesis Gold (KAU) completely melted faces with an absurd 83,000%+ surge in activity. Gold-backed tokens also benefitted from a simultaneous all-time high in physical gold prices, which cleared $3,100/oz at month-end.

Meanwhile, tokenized RWAs as a sector have seen consistent momentum. Gold isn’t acting as a Bitcoin competitor — yet — but it’s becoming a legit hedge in crypto-native portfolios that are suddenly macro-aware again.

Thoughts

This is a real inflection point for the RWA narrative. What was once a sleepy corner of DeFi is now a liquidity magnet during times of stress. Tokenized gold works because it blends conviction (gold is gold) with accessibility (you don’t need a vault). In many ways, it’s what stablecoins were in 2020 — a simple bridge from TradFi trust into crypto rails.

If macro conditions worsen and inflation picks up again, expect this “gold onchain” trade to turn from narrative to necessity.

Also, keep an eye on how this spills into tokenized credit and real estate. The demand for yield with safety is only going to grow — and that’s the kind of energy that could push RWAs toward the projected $50B mark before year-end.

🎈 SEC Drops Helium Lawsuit — New Regime, New Rules?

In a surprising about-face, the SEC has officially dropped its lawsuit against Helium’s developers (Nova Labs). The case alleged that HNT and other associated tokens were unregistered securities — a classic Gensler-era move. But with Trump’s new appointee, Paul Atkins, now chairing the commission, that era seems to be closing fast.

The dismissal came with prejudice, meaning Helium can’t be charged again on the same claims. According to the company, this ruling confirms that selling hardware and distributing tokens to incentivize network growth does not automatically qualify as a securities violation.

Helium, which runs a decentralized wireless network, once topped $5B in market cap but now sits closer to $480M. Still, this ruling wipes a major legal overhang off the board — and it sets a precedent.

Thoughts

This is way more than just a win for Helium. It’s a precedent-setter. For years, the SEC blurred the line between utility and security, going after anything with a token. But this ruling hints at a shift: if tokens are earned through meaningful activity — not sold in a pre-sale — they might escape the securities net.

In plain English: incentivized token distribution could be back on the menu.

This could have downstream effects on networks like Filecoin, Render, and even newer L1s planning bootstraps. The Web3 hardware economy might actually get room to breathe again.

💥 Trump’s Tariff Escalation Rattles Global Markets, Fuels RWA Boom

President Trump isn’t slowing down. After briefly pausing reciprocal tariffs for 90 days, he turned around and hit Chinese imports with a fresh 125% tariff escalation — the highest yet. The move has spooked markets, revived de-dollarization narratives, and intensified interest in decentralized and non-sovereign financial products.

The immediate impact? Investors are seeking safety, again. Tokenized gold is up. Onchain RWAs topped $20B in total market cap for the first time ever. Private credit now leads the sector, holding $12.7B of that total. And according to several analysts, RWAs could hit $50B+ before 2025 ends, especially if traditional assets keep losing yield appeal in inflation-prone fiat environments.

Thoughts

This is macro chaos 101 — and crypto is finally playing the hedge role it always promised. The timing couldn’t be better for RWAs: TradFi is shaky, inflation tools are everywhere, and sovereign games are back in play. If governments keep weaponizing currencies and tariffs, expect capital to continue rotating into anything off-grid but onchain.

Also worth noting: if RWAs are the trade of the year, then protocols like Centrifuge, Maple, Goldfinch, and Plume could be the infrastructure winners. This moment isn’t just about headlines — it’s about permanent behavioral shifts in how capital seeks refuge.

🔥 XRP Pops 13% on ETF Launch and Trump Tariff Pause — But It’s Complicated

XRP rallied 13% to $2 following two major events: the launch of the XRP ETF on NYSE Arca and President Trump’s 90-day pause on most reciprocal tariffs.

Combined, these gave markets a temporary sigh of relief and fueled XRP’s biggest single-day move in months.

But the chart’s not as clean as it looks. XRP has been trapped in a descending triangle since December 2024 — a bearish structure — and recent price action suggests a potential breakdown toward $1.20, or even lower, per technical analysts. So while the ETF debut brought $5M in volume (solid, not spectacular), some traders are already bracing for a reversal.

Thoughts

This is one of those "news vs. chart" moments. Structurally, XRP is still in a precarious spot — and no ETF alone can undo the kind of technical damage it’s suffered. But symbolically? This ETF matters. It cements XRP as TradFi-worthy and gives the token more institutional legitimacy, especially at a time when US policy is rapidly shifting toward crypto-friendliness.

Still, for real momentum, Ripple will need more than just optics, that’s why they are building a real ecosystem.

Expect price to stay volatile unless there's follow-through — either from capital inflows or a new use case unlock. Until then, ETF hype is just a band-aid on a messy setup.

✍🏻 Trump Signs Resolution to Kill IRS DeFi Broker Rule — First Crypto Bill Ever Signed into Law

In a major policy win for DeFi and crypto broadly, President Trump has officially signed a resolution repealing the controversial IRS “DeFi Broker Rule.” Originally introduced under the Biden administration, the rule would have required DeFi platforms to report gross proceeds from crypto sales and collect taxpayer data — effectively treating them like traditional financial brokers.

The rule was set to take effect in 2027 but drew sharp criticism from across the crypto space. Opponents called it overly broad, privacy-invasive, and technologically impractical. Even the IRS was allegedly unprepared to handle the anticipated flood of filings. After quick movement through the House and Senate, Trump signed the repeal into law on April 10 — marking the first time a crypto bill has ever been signed into law in the US.

Representative Mike Carey, who co-sponsored the resolution, called the rule a direct threat to innovation and privacy. Kristin Smith of the Blockchain Association echoed the sentiment, saying the repeal allows crypto developers and builders to "breathe again," arguing that the rule would have "ended" the U.S. crypto industry.

Thoughts

This isn’t just a regulatory rollback — it’s a signal that the U.S. is entering a new chapter in crypto policy. The Trump administration is clearly positioning itself as crypto-friendly, not just with rhetoric but with real legislative action. And make no mistake: killing this IRS rule is a big one. It would’ve essentially forced DeFi apps to become KYC-enforcement arms of the government, a role they’re technically and philosophically unequipped to handle.

By axing it, the U.S. avoids a dangerous precedent — and maybe even dodges a future where crypto devs are treated like financial institutions. More importantly, it shows that crypto’s political capital is growing. With more wins like this, the sector could shift from defense to offense, advocating for frameworks that make sense instead of just fighting bad rules.

What’s next? Probably a wave of proposed crypto legislation — but this time, from a place of momentum, not desperation.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and purely informative.

another great write up. cheers!