This Week's Newsletter - Deep Dive on The Rise of Perp DEX Incentives with Extended, Ethereal & Ostium, & Main News of the Week

Weekly Alpha

There is no collaboration with the projects mentioned in this edition.

GM frens,

Things got tense — and fast.

Donald Trump and Elon Musk clashed publicly on X. Musk criticized Trump’s new budget plan, calling it out directly. Trump didn’t take it lightly: he fired back, saying he was “very disappointed” and even threatened to cut all government contracts with Musk’s companies, including SpaceX and Tesla.

Musk answered with a heavy accusation — linking Trump to the Epstein case and questioning why Trump never released the full files. The situation escalated quickly. One of Trump’s advisors even went as far as calling for Musk’s deportation. Old immigration claims from the early 2000s resurfaced, and suddenly, this wasn't just internet drama — it was front-page political warfare.

The fallout hit markets instantly:

Tesla lost 17%, wiping out $150 billion in value overnight.

Trump Media dropped 8%, and the NASDAQ slipped around 2%.

Crypto wasn’t spared either. Bitcoin fell hard, driven mostly by $900 million in long liquidations.

Over $400M of that was from BTC, wiping out late entries and overleveraged traders in one sweep. BTC hit $100K — a level with major liquidity sitting just below — and managed a good bounce from there.

But the market still feels fragile. There are signs of deeper liquidity waiting around $95K–$90K, so if more bad news hits, we could revisit lower levels. On the upside, having reclaimed $104K–$106K might flip sentiment back quickly.

On the macro side, all eyes are on U.S. job numbers. Unemployment claims came in higher than expected, hinting that the job market might be slowing down. That could push the Fed to lower interest rates sooner, but not for the reasons we want — more like trying to avoid recession.

Meanwhile, Ethereum is showing “stronger” fundamentals than BTC. ETF inflows continue, especially from BlackRock, and ETH is playing a central role in stablecoin activity and RWA infrastructure. Even while altcoins bled hard this week, some now look ready for a short squeeze — especially ones that have been heavily shorted (ADA, AVAX, SOL, etc.).

While the rest of the market reacts to headlines and liquidations, the best opportunities are happening where few are looking.

Something is quietly exploding: Perp DEXs.

After Hyperliquid changed the game — full CEX-level performance, completely on-chain, and the biggest airdrop of the year — new players are lining up to follow that model. But instead of rushing token launches, they’re using smart point systems to attract early users before any token drops.

And it’s working.

Projects like Extended, Ethereal, and Ostium are pulling in hundreds of millions in TVL and volume, just from incentives alone. No token. No emissions. Just points. It’s a new way to build — clean, efficient, and designed to reward first-movers.

Why focus on this now?

Because we’ve seen this movie before. Hyperliquid started quietly — then made millionaires.

The next wave is live, and the window’s even smaller.

Let’s get into it 👇

Before we dive in this Week’s Newsletter

I curate CT Content on X.

Find new projects early. Don’t miss anything!If you missed one of my Latest Post:

I’m posting daily Live Alpha on my Telegram Channel 👇

My Linktree to have access to all my Content & Alpha on X, Instagram & Telegram: https://linktr.ee/cryptoshiro

This Week’s Newsletter dives deep into:

Deep Dive on The Rise of Perp DEX Incentives — Focus on: Extended, Ethereal & Ostium

Main News of the Week.

1/ 💎 Deep Dive: The Rise of Perp DEX Incentives — Focus on: Extended, Ethereal & Ostium

In a previous edition, we broke down how Hyperliquid became the blueprint for modern perps: CEX-grade UX, fully on-chain, and a points system that turned early traders into multi-million dollar airdrop recipients.

But Hyperliquid didn’t just raise the bar — it opened the floodgates for a new kind of points meta.

Now, a new wave of perp DEXs is rethinking what it means to bootstrap liquidity. Not through tokens. Not through mercenary emissions. But through carefully engineered point systems designed to attract early capital, reward behavior, and eventually convert it all into shareable upside.

Three names are leading this new cycle:

→ Extended, with its TradFi-meets-DeFi hybrid stack and low-cap farming surface

→ Ostium, a synthetic RWA powerhouse for macro traders

→ Ethereal, a perp DEX in construction, already attracting 9-figure liquidity just through deposit incentives

Only two of them have live trading. But all three are competing in the same arena: pre-token liquidity war, where every early move could translate to long-term upside.

Together, they hold ≈$825M in TVL and clear $75–140M in volume per day — without a token. TVL is dominated by Ethereal deposits, but all three are attracting sticky capital ahead of a token

Let’s break them down 👇

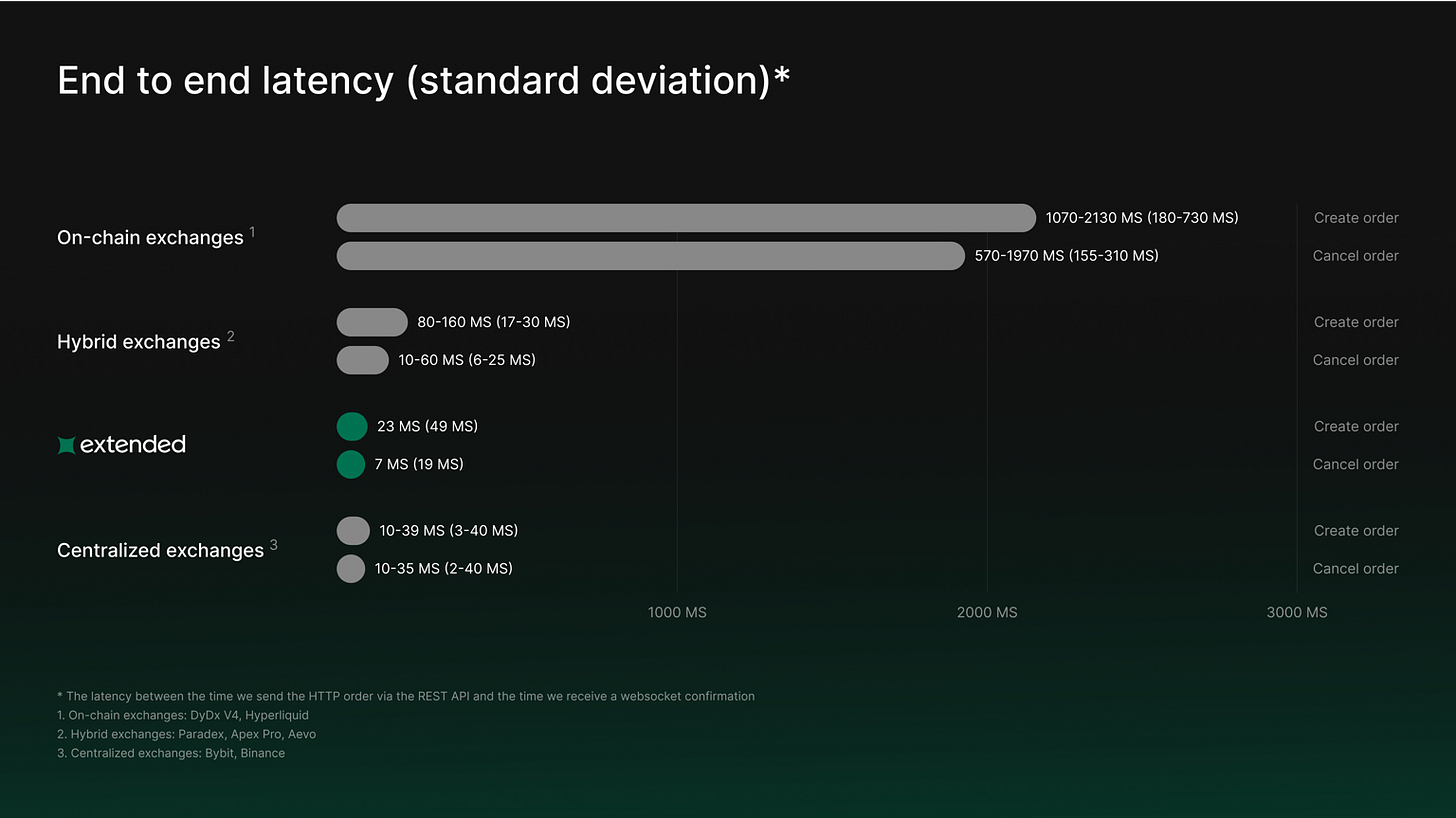

🔁 Extended — A Clean-Slate Hyperliquid with TradFi Ambitions

🧠 What It Is

Extended feels like a second shot at farming Hyperliquid before it blew up.

It’s a hybrid perp DEX built by ex-Revolut crypto engineers, blending high leverage (up to 100x), cross-market exposure (crypto, gold, SPX, FX), and a clean CEX-like interface — all without KYC or custodial risk.

The project isn’t a quick follower. It’s been in motion since 2023, raised $6.5M before Hyperliquid’s TGE, and shipped its mainnet in late 2024. The team’s been clear on the mission: a serious, scalable alternative to centralized derivatives — especially after the collapse of FTX exposed how fragile the old model was.

🔭 Why I’m Watching It

Extended is the closest thing we’ve got to a CEX-killer in DeFi perps and checks all the boxes for a prime airdrop farm — but it also goes beyond.

The points campaign kicked off in late April with clear emissions and multiple farming paths. Volume is still light (~$30–45M daily), and the user count is small — meaning early participation actually matters.

More importantly, the roadmap’s legit:

Starknet migration is underway

Spot markets and unified cross-margin are next

Vault shares will soon become tokenized ERC-20s

Lending and validator rollout to follow

It’s not just a points farm — it’s a full-stack build in motion. If the token lands anything like $HYPE, the upside for early contributors could be significant.

🧑🌾 Farming Playbook — Extended

Extended offers three main ways to farm points:

Trade actively, ideally with organic or hedged volume. Don’t loop fake size — the system tracks behavior

Deposit into the vault (when caps reopen). It earns through liquidations, MM, and 50% of exchange fees. Last reported APR: ~27%

Refer users after $10K in trading volume — earn 5% of their points. Extra perks if you hit ambassador status

Advanced loopers farm by placing maker orders on thin books (like gold or forex) to trigger multipliers, or hedging exposure across accounts or platforms.

Points are distributed weekly on Tuesdays, 00:00 UTC. No token confirmed yet — but all signs suggest they’re following the Hyperliquid playbook.

⚠️ Vault is frequently capped — announcements happen in Discord.

⚠️ Use risk-controlled setups if farming — leverage is high and early-stage liquidity can shift fast.

💸 Ethereal — A Yield Machine Disguised as a DEX

🧠 What It Is

While trading isn’t live, Ethereal already behaves like a DEX liquidity layer — routing USDe into yield-bearing positions and reward programs — and it already locked in over $747M in TVL.

Why? Because Ethereal isn’t built for degens to leverage farm altcoins. It’s designed for capital to work before the platform goes live. Think of it more like a stablecoin engine, where USDe flows into carefully integrated DeFi strategies — and every dollar deposited starts stacking future airdrop points.

It’s built as a Layer 3 on Converge, a new Ethereum L2 launched by Ethena and Securitize, with native support for RWAs and yield-bearing stablecoin flows. On the backend, it leverages 1-block batch auctions and plugs directly into Pendle, Aave, Morpho, and Horizons — giving it instant hooks into DeFi’s most efficient protocols.

Not a fork, a full-stack flywheel built from scratch.

Season Zero is now live, and the only thing users can do is deposit — yet Ethereal still managed to cross $1B in TVL ( at peak). That should tell you how strong the incentives — and expectations — are.

🎯 Why I’m Watching It

Ethereal’s whole strategy is designed to do one thing: bootstrap deep, sticky liquidity before the exchange even exists.

You’re not just depositing and hoping. You’re:

Farming a likely airdrop via a transparent points system

Earning real yield via Aave and Pendle integrations

Getting multiplier boosts depending on where and how you route your USDe

Competing for leaderboard ranks — which may determine the size of your eventual allocation

This is one of the most well-structured pre-launch loops I’ve seen in years. It combines DeFi efficiency, clear reward mechanics, and converging incentive layers in a way that feels sustainable — not degen-fueled.

Ethereal says it’s designing for 1M orders/sec — 5× higher than Hyperliquid’s current ceiling. If they pull that off, this isn’t just another airdrop play. It’s the backbone of a new DeFi execution layer.

🧑🌾 Farming Playbook — Ethereal

Here’s how early users are maximizing exposure:

Base deposit into Ethereal → direct USDe staking still gives a 30× multiplier

Route USDe through Pendle → buy Principal Tokens (PT-eUSDe) for extra boost and future APY

Supply USDe to Aave via Ethereal’s interface → current yields: 5–10%, still earns points

Make 1 trade/week (>$10) → activates “volume streak” bonus (low effort, still impactful)

→ All points accumulate under Season Zero, and your rank determines potential airdrop share

→ New boost strategies are emerging via Morpho and Horizons — worth tracking

⚠️ Note: Positive perp funding rates can weaken the USDe peg. Stay nimble if deploying large size.

⚠️ Vaults can require approvals, ETH for gas, and may route through multiple contracts — make sure to monitor deposits via portfolio tab.

🌍 Ostium Labs — Where Macro Meets Onchain

🧠 What It Is

Ostium isn’t just another perp DEX — it’s a synthetic playground built for macro traders. Think: S&P500, gold, EUR/USD, and even MAG7 stocks — all tradeable with up to 200× leverage, directly on-chain.

Built on Arbitrum, Ostium simulates real-world markets using a synthetic perp model, backed by dual-layer liquidity: a Liquidity Buffer for regular PnL settlements and a Market Making Vault (OLP) as a deeper risk pool. Pricing is handled via Chainlink and Stork oracles, while automation is driven by Gelato bots — giving it a unique infrastructure optimized for exotic markets.

It’s not a clone of GMX or Hyperliquid. Ostium was designed from the ground up to make non-crypto assets tradable in DeFi, while rewarding usage through a points-based airdrop system.

And it’s working:

• TVL grew from $2M → $62M in under 2 months

• Over $5.5B in volume processed in that same window

• Daily active traders: 600–1,200

• Points season live — 500K points distributed weekly

🎯 Why I’m Watching It

Ostium is one of the few platforms taking the “real-world market access” thesis seriously — and executing well.

It lets you long Nasdaq, short gold, speculate on EUR/USD, or farm points with delta-neutral strategies — all while staying in crypto-native infrastructure. The UI is smooth, the order execution is crisp, and the team is shipping consistently: new assets, better fees, dashboard revamps, and feature requests rolled out weekly.

But more than that, Ostium has momentum. Growth in users, TVL, and trader engagement is all trending up. And with trading focused on synthetic RWAs, it fills a niche that Hyperliquid hasn’t captured yet.

There are still some rough edges — fees on non-crypto pairs are higher, and synthetic depth is harder to scale than order books — but for anyone bullish on “macro DeFi,” this is already the best option out there.

🧑🌾 Farming Playbook — Ostium

There are multiple ways to stack points:

Market Making Vault (OLP) → 35% of capital goes here; earns from fees and volatility

High-Notional Trading → trade ≥$5–10K per week, ideally on high-vol pairs like MAG7 or FX

Delta-Neutral Plays → 20% into balanced long/short combos (e.g. long SPX, short via perps)

Reserve margin → 10% dry powder for topping up or catching volatility dips

Leaderboard resets every Sunday at 00:00 UTC — close positions in time to lock rank

🧠 Bonus Tips:

Thin asset books = bigger point multipliers

Use trailing stops on weekends — synthetic pricing can gap hard

Vaults use USDC — rewards scale with volume and volatility, not just TVL

⚠️ LPs only get paid when traders lose or generate volume — scaling rewards long-term could be a challenge

⚠️ Non-crypto assets incur rollover fees even in flat markets — be aware before going delta-neutral

🧬 TL;DR — One Narrative, Three Designs

Three different designs.

One shared thesis: early users > mercenary incentives.

🚀 Final Thoughts: The Pre-Token Window Won’t Stay Open Long

None of these projects have launched a token — but all three have structured points programs and growing traction.

If you’re still farming with the old playbook, you’re behind.

Extended, Ethereal, and Ostium aren’t just spec farms — they’re functional, capital-efficient trading engines rewarding the earliest users before things get crowded.

If you missed Hyperliquid… this might be your second shot.

Of course, there is a 99% chance none of these projects will grow as big as Hyperliquid. But competition is healthy, we need more volume on Perp DEX, less on CEX.

Even if Hyperliquid is the biggest right now, it was not the first mover per se. So we never know who can become the new king in the long run.

Either way, even if one of them get half as much volume as Hyperliquid, it would be a good idea to farm points for a potential airdrop.

2/ Crypto & DeFi News

🚗 Uber Exploring Stablecoins to Slash Global Payment Costs, Says CEO

Uber CEO Dara Khosrowshahi has confirmed the company is actively studying stablecoins as a way to cut costs on international money transfers—hinting at what could be one of the biggest real-world use cases for crypto to date.

Speaking at the Bloomberg Tech Summit, Khosrowshahi said stablecoins are “super interesting to us” and could provide a cheaper, more efficient way for Uber to move funds globally. While still in the “study phase,” he emphasized that stablecoins offer “practical benefits beyond crypto as a store of value.”

This interest follows a broader trend: 90% of institutional players are exploring stablecoin adoption, according to a May report from Fireblocks. With $27.6 trillion in 2024 stablecoin volume, these instruments have already surpassed Visa and Mastercard combined.

Thoughts

This is huge. If Uber—a $130B+ global juggernaut with operations in over 70 countries—starts using stablecoins for payments, we’re talking about mainstream infrastructure-level adoption.

Unlike buzzwords like “tokenized assets” or “web3 loyalty,” this is clear: stablecoins make Uber’s financial pipes cheaper and faster. That’s crypto utility in its rawest, most scalable form.

It also signals a larger trend: corporate treasury teams and CFOs are waking up. When Stripe, banks, and now Uber all explore stablecoins, you know something’s shifting. Fiat rails are bloated. SWIFT is ancient. Crypto is starting to win not on hype—but on cost-efficiency.

If Uber moves from “study phase” to rollout, don’t be surprised if other gig economy giants (DoorDash, Lyft, even Airbnb) follow. Stablecoins might not be sexy, but they’re quietly becoming the backbone of next-gen finance.

🌉 Maple Finance Expands to Solana, Launches Yield-Bearing Stablecoin via Chainlink CCIP

I already talked about Maple Finance in this Newsletter, at this time its TVL was $447 million and $SYRUP traded at $0.1255; since then, TVL has surged to $1.3 billion (+191 %) and $SYRUP has climbed to $0.3785 (+202 %).

Maple Finance is officially live on Solana, bringing its Ethereum-native yield-bearing stablecoin, syrupUSD, to new venues like Kamino and Orca. The move is backed by $30M in initial liquidity, aiming to strengthen lending and collateral markets on Solana.

The cross-chain bridge was powered by Chainlink’s CCIP, which recently went live on Solana, enabling seamless data transfer between EVM and SVM environments. This marks one of the first high-profile use cases of CCIP for scaling Ethereum-native protocols across chains.

Maple’s co-founder Sid Powell says Solana offers a “high-speed, high-capacity environment” to tap into a wider user base—from institutions to advanced DeFi degens. Maple currently boasts $1.3B TVL, and its Solana push puts it in direct competition with protocols like Save, margin.fi, and Rain.fi.

Thoughts

Maple’s move is another big win for Solana’s comeback arc. The network’s TVL is up 500% in 18 months, and Ethereum-native DeFi apps are now deploying in search of faster, cheaper throughput—and new user bases.

The use of Chainlink’s CCIP is also a major narrative unlock: we’re finally seeing serious cross-chain infrastructure enabling real product expansion, not just wrapped tokens. For Maple, it means faster scaling without abandoning Ethereum. For Solana, it means more liquidity, more yield, more flywheel.

This also tells us that stablecoins aren’t just about payments—they’re becoming modular yield engines. syrupUSD on Solana could tap into new staking routes, LP positions, and composable strategies unique to the ecosystem.

Maple is bridging capital, not just tokens—and that’s what DeFi 2.0 was always supposed to be.

📈 Circle Stock Soars 167% on NYSE Debut as TradFi and Crypto Collide

Circle (CRCL) made a monster debut on the New York Stock Exchange, with shares jumping 167% on Day 1, closing at $82 after opening at $31. At one point, the stock surged as high as 235% intraday, marking one of the most explosive IPOs of the year—and a major win for the stablecoin narrative.

The hype was fueled by BlackRock’s reported plans to acquire a 10% stake, plus a $150M bid from Cathie Wood’s ARK Invest. Investor demand was so strong that Circle boosted the IPO size to $1.05B across 34M shares.

Circle, the issuer of USDC, delayed its IPO last year due to macro headwinds but clearly picked the right moment to pounce. USDC currently holds a $60.9B market cap, second only to Tether in the stablecoin race.

Thoughts

This isn’t just a strong IPO—it’s a milestone for crypto-native infrastructure going fully TradFi. Circle isn’t selling a token, a layer-1, or a meme—it’s offering a real business wrapped around dollar-backed rails, and Wall Street ate it up.

The performance sends a clear message: stablecoins are maturing into one of crypto’s most investable narratives, especially as governments, institutions, and fintechs look for dollar-native settlement tools.

Of course, it wouldn’t be crypto without some drama: Arca’s CIO went full rage-post, blasting Circle for a “throwaway” allocation despite being an early backer. His now-deleted rant called Circle “TradFi clowns” and ended with a brutal burn: “you’ve come full Circle.”

Petty? Maybe. But also a reminder: as crypto enters public markets, the politics of access, allocation, and who gets the bag are only going to get messier.

Still—Circle just proved stablecoins are more than plumbing. They’re public market gold, and the demand is just getting started.

💥 James Wynn Liquidated for $25M in BTC – Blames Market Manipulation, Begs for Donations

James Wynn—the high-profile degenerate behind the $1B+ Bitcoin long on Hyperliquid—just got nuked. After manually adjusting his position to delay disaster, Wynn was finally liquidated for 240 BTC (~$25M) as Bitcoin dipped below his liquidation threshold.

He’s still sitting on 770 BTC (~$80.5M) with more than $1M in unrealized losses on his 40x leveraged long. Wynn, who’s quickly become crypto’s most watched wallet, claims the market is being manipulated against him—and is now asking for donations to “expose” the system.

Wynn’s rollercoaster:

🔻 Lost $29M on May 23

🎢 YOLOed $1.25B long on May 24

💨 Switched to a $110M short

😵 Lost $100M over the week

🤷♂️ Still aping with new $100M long

Meanwhile, CZ floated the idea of a dark pool perp DEX, arguing that too much transparency on DEXs enables front-running and liquidation hunting—especially when whales like Wynn make trades visible to the entire market.

Thoughts

This is what happens when your trading strategy is “main character syndrome + max leverage.” Wynn is now the poster child for transparent liquidation bait—and his meltdown is fueling serious conversations about whether public onchain trading helps or hurts market fairness.

Here’s the irony: Wynn made himself a spectacle. Every position, every move, broadcast live. And now that it’s backfiring? He’s blaming manipulation. But when you open a $1.25B trade on a public ledger, you’re not just trading—you’re giving every algo and sniper a target.

CZ’s call for dark pool-style perp DEXs is getting traction, and he’s not wrong—some transparency is too much transparency, especially in high-leverage environments. But let's be clear: this isn’t just market structure. It’s reckless overexposure from a trader who flew too close to the sun.

Wynn wanted to make $1B. Now he’s down over $100M and begging X for sympathy. In the words of the market: rekt.

(That could be all an act and he’d have been hedging on CEX this whole time though).

📉 Ethereum Foundation Tightens Treasury Policy, Calls Next 18 Months ‘Pivotal’

The Ethereum Foundation (EF) is restructuring its treasury strategy as it stares down what it calls a “pivotal” 18-month stretch for the Ethereum ecosystem.

In a June 4 announcement, EF director Hsiao-Wei Wang revealed that the foundation has only 2.5 years of runway left, prompting a new policy that aligns operational spending with ETH reserves and ensures better long-term planning. The move follows community backlash over the Foundation’s recent, poorly-communicated ETH sales, which some saw as a trust breach.

The EF will now issue quarterly and annual reports on asset holdings and investment performance. As of Oct. 2024, the treasury sat at $970.2M—with over 81% held in ETH.

Thoughts

Ethereum’s getting its financial house in order, and it’s about time. The new treasury policy feels like a reaction to two key pressures: fading community trust after stealth ETH dumps, and the realization that Ethereum is entering a make-or-break phase as L2s, DeFi, and alt-L1s race ahead.

The real alpha here is that the EF is finally stepping into DeFi—allocating capital into Aave, Spark, Compound, and more. That $120M chunk of ETH being actively deployed signals a shift from neutrality to “Defipunk-aligned capital efficiency.” And it’s a subtle rebuttal to critics like Kain Warwick, who’ve called the EF “anti-DeFi.”

Still, it’s a fine line. Ethereum’s credibility comes from its neutral base-layer ethos. Start playing kingmaker in DeFi and the ecosystem politics get spicy—fast.

But the bigger picture? Ethereum is gearing up for its next act. Whether that’s full proto-danksharding, L2 finality, or economic abstraction, the Foundation knows the clock is ticking—and it’s finally acting like it.

That’s it for today frens!

Thank you for sticking around, your future self will thank you. You can follow me on X @CryptoShiro_.

Find more Alpha on my Telegram & Instagram here: linktr.ee/cryptoshiro.

If you liked this format and love to learn and share knowledge about crypto, you can share this post with your crypto frens!

Everything here is NOT Finance Advice and is purely informative.